Current Report Filing (8-k)

February 09 2017 - 6:10AM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

DC 20549

FORM 8-K

CURRENT

REPORT PURSUANT TO

SECTION

13 OR 15(d) OF THE

SECURITIES

EXCHANGE ACT OF 1934

Date

of Report (Date of earliest event reported):

December 14, 2016

|

Liberty

Star Uranium & Metals Corp.

|

|

(Exact

Name of Registrant as Specified in its Charter)

|

|

|

|

Nevada

|

|

(State

or Other Jurisdiction of Incorporation)

|

|

000-50071

|

|

90-0175540

|

|

(Commission

File Number)

|

|

(IRS

Employer Identification No.)

|

|

|

|

|

|

5610

E. Sutler Lane, Tucson, AZ

|

|

85712

|

|

(Address

of Principal Executive Offices)

|

|

(Zip

Code)

|

(Registrant’s

telephone number, including area code):

(520) 731-8786

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant

under any of the following provisions (see General Instruction A.2.)

|

[ ]

|

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

[ ]

|

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

[ ]

|

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

[ ]

|

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

|

Item

1.01.

|

Entry

into a Material Definitive Agreement.

|

On December 14, 2016, Liberty Star Uranium & Metals Corp. (the

“Company”) issued a convertible promissory note (the “Note”) to Tangiers Investment Group, LLC (“Tangiers”)

in the principal amount of $110,000, which includes a 10% original issue discount (“OID”) on any consideration paid.

Tangiers made an initial payment to the Company under the Note of $33,000, which includes a 10% OID. The Company may accept additional

funding under the Note from Tangiers if and when both parties agree. The Company is only required to repay the amount funded under

the Note, and not any unfunded amounts.

The Note bears interest at 12% and matures one year from the effective

date of each payment. Each payment is convertible by Tangiers after 180 days at a price equal to 62.5% of the average volume weighted

average prices of the Company’s common stock during the five trading days prior to the conversion date.

There is no prepayment penalty for payments made under 150 days

from the effective date of a funding. Between the 151

st

and 180

th

days after a funding, the Company may prepay

the Note, in whole or in part, by paying 130% of the principal amount.

On February 2, 2017, the Company and Tangiers entered into Amendment

#1 to the Note (“Amendment #1”). Amendment #1 provides that, on or before February 2, 2017, Tangiers would make a payment

to the Company of $77,000, which includes a 10% OID.

Also on February 2, 2017, the Company and

Tangiers entered into Amendment #2 to the Note (“Amendment #2”). Amendment #2 provides that the conversion price under

the Note is equal to 60% of the lowest trading price of the Company’s common stock during the 20 consecutive trading days

prior to Tangier’s conversion election. The default percentages of 5% and 10% of the discount of conversion price point

remained the same other than reflecting the amended discount price. In addition, the provision in the Note relating to a right

of first refusal was removed by Amendment #2.

The foregoing descriptions of the Note, Amendment #1 and Amendment

#2 are not complete descriptions of all of the parties’ rights and obligations under the agreements and are qualified in

their entireties by reference to the Note, Amendment #1 and Amendment #2, copies of which are filed as Exhibits 10.1, 10.2 and

10.3, respectively, to this Current Report on Form 8-K, and each of which is incorporated herein by reference.

Item

2.03. Creation of a Direct Financial Obligation or an Obligation Under an Off-Balance Sheet Arrangement of a

Registrant.

The

information set forth above in Item 1.01 of this Current Report on Form 8-K is incorporated herein by reference.

Item 9.01. Financial Statements and Exhibits.

The exhibits listed in the following Exhibit

Index are furnished as part of this Current Report on Form 8-K.

|

Exhibit No.

|

|

Description

|

|

10.1

|

|

Promissory Note issued to Tangiers Investment Group, LLC dated December 14, 2016.

|

|

|

|

|

|

10.2

|

|

Amendment #1 dated February 2, 2017 by and between Liberty Star Uranium & Metals Corp. and Tangiers Investment Group, LLC.

|

|

|

|

|

|

10.3

|

|

Amendment #2 dated February 2, 2017 by and between Liberty Star Uranium & Metals Corp. and Tangiers Investment Group, LLC.

|

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf

by the undersigned hereunto duly authorized.

|

|

LIBERTY

STAR URANIUM & METALS CORP.

|

|

|

|

|

Dated:

February 8, 2017

|

/s/

James Briscoe

|

|

|

James

Briscoe

|

|

|

Chief

Executive Officer, Chief Financial Officer & President

|

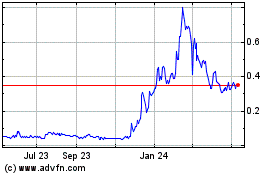

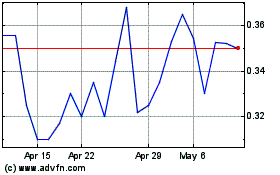

Liberty Star Uranium and... (QB) (USOTC:LBSR)

Historical Stock Chart

From Mar 2024 to Apr 2024

Liberty Star Uranium and... (QB) (USOTC:LBSR)

Historical Stock Chart

From Apr 2023 to Apr 2024