Current Report Filing (8-k)

January 17 2017 - 7:16AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

|

|

|

|

|

|

|

|

|

|

Date of Report (Date of Earliest Event Reported):

|

|

January 15, 2017

|

The Andersons, Inc.

__________________________________________

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

|

|

Ohio

|

000-20557

|

34-1562374

|

|

_____________________

(State or other jurisdiction

|

_____________

(Commission

|

______________

(I.R.S. Employer

|

|

of incorporation)

|

File Number)

|

Identification No.)

|

|

|

|

|

|

1947 Briarfield Boulevard,

Maumee, Ohio

|

|

43537

|

|

_________________________________

(Address of principal executive offices)

|

|

___________

(Zip Code)

|

|

|

|

|

|

|

|

Registrant’s telephone number, including area code:

|

|

419-893-5050

|

Not Applicable

______________________________________________

Former name or former address, if changed since last report

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

[ ] Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

[ ] Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

[ ] Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

[ ] Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 2.05 Costs Associated with Exit or Disposal Activities.

The Andersons, Inc. (the "Company") issued a press release on January 15, 2017 announcing its plans to exit the retail business and close its remaining four retail stores in the second quarter of 2017.

The full financial impact of this closure has not been determined. A pre-tax charge in the range of $9 to $14 million is expected in the first half of 2017 for severance costs and other costs associated with the closure. The Company also anticipates the full carrying value of its inventory may not be recoverable during the store liquidation process. Gains or losses are anticipated on individual properties upon sale, however the Company is uncertain of the timing and amount of those sales.

In connection with this closure, the Company will recognize pre-tax asset impairment charges of approximately $6.5 million in the fourth quarter of 2016.

This press release is attached as exhibit 99.1 to this filing.

Item 9.01 Financial Statements and Exhibits.

(d) The following exhibit is filed with this Current Report on Form 8-K:

|

|

|

|

|

|

|

Exhibit No.

|

|

Description

|

|

|

|

|

|

99.1

|

|

Press Release dated January 15, 2017

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The Andersons, Inc.

|

|

|

|

|

|

|

|

|

|

January 17, 2017

|

|

By:

|

|

/s/ Naran U. Burchinow

|

|

|

|

|

|

|

|

|

|

|

|

Name: Naran U. Burchinow

|

|

|

|

|

|

Title: General Counsel & Secretary

|

|

|

|

|

|

|

Exhibit Index

|

|

|

|

|

|

|

Exhibit No.

|

|

Description

|

|

|

|

|

|

99.1

|

|

Press Release dated January 15, 2017

|

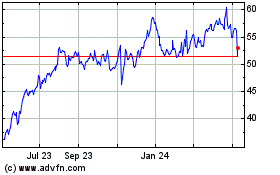

Andersons (NASDAQ:ANDE)

Historical Stock Chart

From Mar 2024 to Apr 2024

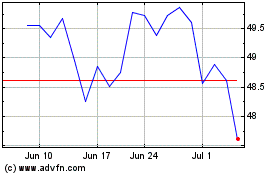

Andersons (NASDAQ:ANDE)

Historical Stock Chart

From Apr 2023 to Apr 2024