Current Report Filing (8-k)

January 04 2017 - 5:30PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

8-K

CURRENT

REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): January 4, 2017 (December 30, 2016)

ALCOA CORPORATION

(Exact name of Registrant as specified in its charter)

|

|

|

|

|

|

|

Delaware

|

|

1-37816

|

|

81-1789115

|

|

(State or Other Jurisdiction

of Incorporation)

|

|

(Commission

File Number)

|

|

(I.R.S. Employer

Identification Number)

|

|

|

|

|

390 Park Avenue, New York, New York

|

|

10022-4608

|

|

(Address of Principal Executive Offices)

|

|

(Zip Code)

|

212-518-5400

(Registrant’s telephone number, including area code)

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form

8-K

filing is intended to simultaneously satisfy the filing obligation of

the registrant under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule

14a-12

under the Exchange Act (17 CFR

240.14a-12)

|

|

☐

|

Pre-commencement

communications pursuant to Rule

14d-2(b)

under the Exchange Act (17 CFR

240.14d-2(b))

|

|

☐

|

Pre-commencement

communications pursuant to Rule

13e-4(c)

under the Exchange Act (17 CFR

240.13e-4(c))

|

|

Item 2.02

|

Results of Operation and Financial Condition.

|

On January 3, 2017, Alcoa

Corporation (“Alcoa”) issued a press release announcing the permanent closure of the Suralco refinery and other actions that will impact fourth quarter 2016 results. A copy of the press release is attached as Exhibit 99 and is incorporated

herein by reference. The information contained in this Item 2.02, including Exhibit 99, is being furnished in accordance with the provisions of General Instruction B.2 of Form

8-K.

|

Item 2.05

|

Costs Associated with Exit or Disposal Activities.

|

On December 30, 2016,

management of Alcoa approved the permanent closure of the Suralco refinery (capacity of 2,207,000

metric-tons-per-year)

in Suriname effective immediately. The Suralco

refinery has been fully curtailed since November 2015. Management of Alcoa’s former parent company, Alcoa Inc. (ParentCo), decided to curtail the remaining operating capacity of the Suralco refinery during 2015 in an effort to improve the

position of ParentCo’s refining operations on the global alumina cost curve. Since that time, management of ParentCo (through October 31, 2016) and then separately management of Alcoa (from November 1, 2016 through the end of 2016)

had been in discussions with the Government of the Republic of Suriname to determine the best long-term solution for Suralco due to limited bauxite reserves and the absence of a long-term energy alternative. The decision to permanently close the

Suralco refinery was based on the ultimate conclusion of those discussions. Demolition and remediation activities related to this action will begin in 2017 and are expected to be completed by the end of 2021. The related bauxite mines in Suriname

will also be permanently closed while the hydroelectric facility that supplied power to the Suralco refinery, known as Afobaka, will continue to operate and supply power to the Government of the Republic of Suriname.

As a result of this decision, Alcoa expects to record restructuring-related charges of $132 million ($90 million

after-tax

and noncontrolling interest, or $0.49 per diluted share) in the fourth quarter of 2016. These charges include $116 million for asset retirement obligations and environmental remediation resulting from

the decision to permanently close and demolish this facility and related infrastructure and $16 million for asset impairments to write off the remaining book value of various assets. In 2015, ParentCo recorded significant restructuring-related

charges as a result of the curtailment of the Suralco refinery for accelerated depreciation and asset impairments, layoff costs, contract terminations, and asset retirement obligations. Additionally, Alcoa expects to record demolition expenses and

holding costs of $49 million ($30 million

after-tax

and noncontrolling interest) as incurred during the subsequent five-year timeframe (2017 through 2022).

Expected future cash outlays related to the closure of the refining and mining operations in Suriname total $224 million (Alcoa’s

share is estimated to be $151 million), including $36 million in 2017 (Alcoa’s share is estimated to be $24 million). The $224 million is comprised of the $116 million in 2016 fourth quarter charges for asset retirement

obligations and environmental remediation, $59 million related to previously accrued asset retirement obligations and environmental remediation liabilities, and the $49 million in estimated future demolition expenses and holding costs.

Amounts related to this action are still being finalized. Additional details will be provided in Alcoa’s Form

10-K

for the year ended December 31, 2016. Also, it is possible that charges in addition to those described above may be recognized in future periods.

The Suralco operations are owned by legal entities that are part of the Alcoa World Alumina and Chemicals (AWAC) group of companies owned 60%

by Alcoa and 40% by Alumina Limited of Australia.

2

|

Item 2.06

|

Material Impairments.

|

Also on December 30, 2016, management of Alcoa concluded

that an interest in certain gas exploration assets in Western Australia has been impaired. Alcoa’s majority-owned subsidiary, Alcoa of Australia (AofA), which is part of AWAC, owns an interest in a gas exploration project that was initially

entered into in 2007 as a potential source of

low-cost

gas to supply AofA’s refineries in Western Australia. This interest, now at 43%, relates to four separate gas wells and, prior to management’s

conclusion, had a carrying value of $74 million. In the fourth quarter of 2016, AofA received the results of a technical analysis performed earlier in the year for two of the wells and an updated analysis for a third well that concluded that

the cost of gas recovery would be significantly higher than the market price of gas. For the fourth well, the results of a technical analysis performed prior to 2016 indicated that the cost of gas recovery would be lower than the market price of gas

and, therefore, would require additional investment to move to the next phase of commercial evaluation, which management previously supported. In the fourth quarter of 2016, management

re-evaluated

its options

related to the fourth well and decided it is not economical to make such a commitment for the foreseeable future. As a result, AofA fully impaired its $74 million interest resulting in Alcoa recording a $31 million

non-cash

charge

(after-tax

and noncontrolling interest), or $0.17 per diluted share, in the fourth quarter of 2016.

As previously disclosed in Alcoa’s Quarterly Report on Form

10-Q

for the period ended September 30, 2016, Alcoa’s Portland smelter in Australia experienced a power outage on December 1, 2016, resulting in a production stoppage on one of the potlines and a

reduction in full operating capacity of the other potline. The financial impact of this event was unknown at that time; however, management has since been able to assess this matter and has determined that the financial impact is not expected to be

significant in the fourth quarter of 2016.

|

Item 9.01

|

Financial Statements and Exhibits.

|

The following is furnished as an exhibit to this report:

|

|

|

|

|

99

|

|

Alcoa Corporation press release dated January 3, 2017

|

3

Forward-Looking Statements

This Current Report on Form

8-K

contains statements that relate to future events and expectations and as such

constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements include those containing such words as “anticipates,” “believes,” “could,”

“estimates,” “expects,” “forecasts,” “intends,” “may,” “outlook,” “plans,” “projects,” “seeks,” “sees,” “should,” “targets,”

“will,” “would,” or other words of similar meaning. All statements that reflect the Company’s expectations, assumptions or projections about the future, other than statements of historical fact, are forward-looking

statements. Forward-looking statements are not guarantees of future performance and are subject to risks, uncertainties, and changes in circumstances that are difficult to predict. Although the Company believes that the expectations reflected in any

forward-looking statements are based on reasonable assumptions, it can give no assurance that these expectations will be attained and it is possible that actual results may differ materially from those indicated by these forward-looking statements

due to a variety of risks and uncertainties. Such risks and uncertainties include, but are not limited to: (a) the inability to complete the closure, demolition and/or remediation activities as planned or within the time periods anticipated, whether

due to changes in regulations, technology or other factors; (b) changes in preliminary accounting estimates due to the significant judgments and assumptions required; and (c) the other risk factors disclosed in Alcoa’s registration statement on

Form 10 and other reports filed with the Securities and Exchange Commission. The Company disclaims any obligation to update publicly any forward-looking statements, whether in response to new information, future events or otherwise, except as

required by applicable law.

4

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

|

|

|

|

|

ALCOA CORPORATION

|

|

|

|

|

By:

|

|

/s/ Molly S. Beerman

|

|

|

|

Molly S. Beerman

|

|

|

|

Vice President and Controller

|

Date: January 4, 2017

5

EXHIBIT INDEX

|

|

|

|

|

Exhibit

No.

|

|

Description

|

|

|

|

|

99

|

|

Alcoa Corporation press release dated January 3, 2017

|

6

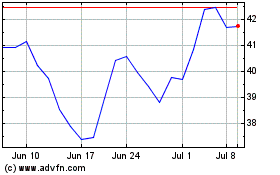

Alcoa (NYSE:AA)

Historical Stock Chart

From Mar 2024 to Apr 2024

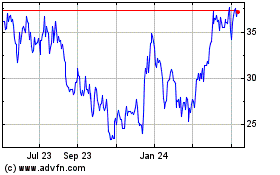

Alcoa (NYSE:AA)

Historical Stock Chart

From Apr 2023 to Apr 2024