Current Report Filing (8-k)

October 13 2016 - 1:13PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report

(Date of earliest event reported)

October 13, 2016

DEVRY EDUCATION GROUP INC.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

Delaware

|

|

1-13988

|

|

36-3150143

|

|

(State of incorporation)

|

|

(Commission File Number)

|

|

(IRS Employer Identification No.)

|

|

|

|

|

|

3005 Highland Parkway

Downers Grove, Illinois

|

|

60515

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

(630) 515-7700

(Registrant’s telephone number, including area code)

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

|

Item 1.01

|

Entry into a Material Definitive Agreement

|

On October 13, 2016, DeVry Group announced that DeVry University (“DeVry”) entered into a Settlement Agreement (the “Settlement Agreement”) with the United States Department of Education (“ED”) resolving matters that were the subject of a previously disclosed Notice of Intent to Limit received on January 27, 2016 from the M

ulti-Regional and Foreign School Participation Division of the Federal Student Aid office of ED (the “January 2016 Notice”).

Under the terms of the Settlement Agreement, among other things, without admitting wrongdoing, DeVry (1) may no longer make representations regarding the graduate employment outcomes of DeVry graduates from 1975 to October 1980, including advertising regarding the graduate employment outcomes since 1975 (the “Since 1975 Representation”), (2) will maintain or undertake certain recordkeeping and compliance practices to support future representations regarding graduate employment rates and (3) will post a notice on its website and in its enrollment agreements regarding the Since 1975 Representation. The Settlement Agreement also provides that, except for Heightened Cash Monitoring 1 status, ED will not impose conditions on the timing of, or documentation requirements for, disbursement of aid due to the matters relating to the Since 1975 Representation. As a result of the

Settlement Agreement

, DeVry will participate in the Title IV programs under provisional certification and will be required to post a letter of credit equal to the greater of 10% of DeVry’s annual Title IV disbursements or $68.4 million for a five-year period.

The foregoing description of certain terms contained in the Settlement Agreement does not purport to be complete and is qualified in its entirety by reference to the copy of the Settlement Agreement filed as Exhibits 10.1to this Current Report on Form 8-K and incorporated herein by reference.

|

Item 7.01

|

Regulation FD Disclosure

|

On October 13, 2016, DeVry issued a statement regarding the signing of the Settlement Agreement, a copy of which is attached hereto as Exhibit 99.1.

Forward-Looking Statements

Certain statements contained in this Form 8-K and related press release, including those that affect the expectations or plans of DeVry University or DeVry Education Group (“DeVry Group”), may constitute forward-looking statements subject to the Safe Harbor Provision of the Private Securities Litigation Reform Act of 1995. These forward-looking statements generally can be identified by phrases such as DeVry, DeVry Group or their management “anticipates,” “believes,” “estimates,” “expects,” “forecasts,” “foresees,” “intends,” “plans” or other words or phrases of similar import. Because these forward-looking statements involve risks and uncertainties, there are important factors that could cause DeVry Group’s actual results to differ materially from those projected or implied by these forward-looking statements. Potential risks, uncertainties and other factors that could cause results to differ are described more fully in Item 1A, "Risk Factors," in DeVry Group’s Annual Report on Form 10-K for the fiscal year ended June 30, 2016. These forward-looking statements are based on information as of October 13, 2016, and DeVry Group assumes no obligation to publicly update or revise its forward-looking statements even if experience or future changes make it clear that any projected results expressed or implied therein will not be realized.

|

Item 9.01

|

Financial Statements and Exhibits

|

|

|

|

|

10.1

|

Settlement Agreement, dated October 13, 2016, by and between DeVry University and the United States Department of Education

|

|

99.1

|

Statement of DeVry University dated October 13, 2016.

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

DEVRY EDUCATION GROUP INC.

|

|

|

|

(Registrant)

|

|

|

|

|

|

Date: October 13, 2016

|

|

By:

|

|

/s/ Patrick J. Unzicker

|

|

|

|

|

|

Patrick J. Unzicker

|

|

|

|

|

|

Senior Vice President, Chief Financial Officer and Treasurer

|

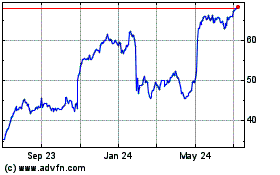

Adtalem Global Education (NYSE:ATGE)

Historical Stock Chart

From Mar 2024 to Apr 2024

Adtalem Global Education (NYSE:ATGE)

Historical Stock Chart

From Apr 2023 to Apr 2024