Current Report Filing (8-k)

October 03 2016 - 4:09PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT

TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported): October 1, 2016

Marchex, Inc.

(Exact

name of Registrant as Specified in its Charter)

|

|

|

|

|

|

|

Delaware

|

|

000-50658

|

|

35-2194038

|

|

(State or other jurisdiction

of incorporation)

|

|

(Commission

File Number)

|

|

(I.R.S. Employer

Identification No.)

|

520 Pike Street

Suite 2000

Seattle,

Washington 98101

(Address of Principal Executive Offices)

(206) 331-3300

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any

of the following provisions (see General Instruction A.2. below):

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

|

Item 1.01

|

Entry into a Material Definitive Agreement.

|

The information set forth under

Item 5.02 of this Current Report on Form 8-K is incorporated herein by reference.

|

Item 5.02

|

Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements for Certain Officers.

|

Board and Officer Changes.

Effective on October 1, 2016, Clark Kokich (“

Kokich

”) resigned as Executive Chairman of the Board of Directors of

Marchex, Inc. (the “

Company

”) and as a member of the Board of Directors (the “

Board

”). Mr. Kokich’s decision to resign was not as a result of any disagreement with the Company.

Effective on October 3, 2016 (the “

Effective Date

”), by mutual agreement, Peter Christothoulou resigned as Chief

Executive Officer of the Company and on the Effective Date, the Board appointed Anne Devereux-Mills as Chairman of the Board.

Also

on the Effective Date, the Board established an Interim Office of the CEO subject to oversight by Anne Devereux-Mills as Chairman. The Interim Office of the CEO consists of Michael Arends, Chief Financial Officer of the Company; Ethan Caldwell,

Chief Administrative Officer, General Counsel and Secretary of the Company; Gary Nafus, Chief Revenue Officer of the Company; and Russell C. Horowitz, currently a consultant to the Company and previously Chief Executive Officer and Chairman of the

Board. The Interim Office of the CEO will perform the duties and responsibilities of the chief executive officer on an interim basis while a search for a permanent chief executive officer is conducted by the Nominating & Governance

Committee of the Board. During the period in which the Interim Office of the CEO is active, Ethan Caldwell will act as the principal executive officer for Securities and Exchange Commission (“

SEC

”) reporting

purposes. Further information regarding Ms. Devereux-Mills, Mr. Arends, Mr. Caldwell, Mr. Nafus and Mr. Horowitz is set forth in the Company’s Definitive Proxy Statement filed with the SEC on April 4, 2016.

Separation Agreement (Christothoulou).

In connection with his resignation, on the Effective Date Mr. Christothoulou entered into a separation agreement and release with the

Company (the “

Christothoulou Separation Agreement

”), which supersedes and replaces any employment and retention related agreements with Christothoulou. Notwithstanding the foregoing, Christothoulou shall remain an employee of the

Company through October 31, 2016. The Christothoulou Separation Agreement provides for the following:

|

|

•

|

|

a cash payment equal to $285,000 payable on the Effective Date and a second cash payment equal to $285,000 payable on April 3, 2017 subject to performance of transition services in cooperation with the Company

through such date;

|

|

|

•

|

|

payment by the Company of its share of medical, dental and vision insurance premiums under COBRA for Christothoulou and Christothoulou’s dependents for up to twelve (12) months following the termination date; and

|

|

|

•

|

|

an additional vesting of 190,187 shares of restricted stock and an additional vesting of 288,877 options held by Christothoulou as of the termination date.

|

Additionally, the Christothoulou Separation Agreement contains a release of claims, as well as an acknowledgement of

Mr. Christothoulou’s existing non-competition and non-solicitation obligations pursuant to his Amended and Restated Employment Agreement with the Company dated April 21, 2016.

The above summary is qualified in its entirety by reference to the Christothoulou Separation

Agreement, a copy of which will be filed as an exhibit to the Company’s next applicable periodic report or registration statement.

The Company issued a press release regarding the Board and officer changes described above on October 3, 2016. A copy of the press

release is being filed as Exhibit 99.1 to this Current Report on Form 8-K.

|

Item 9.01

|

Financial Statements and Exhibits.

|

|

|

|

|

|

Exhibit No.

|

|

Description

|

|

|

|

|

99.1

|

|

Press Release of the Company, dated October 3, 2016.

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Company has duly caused this Current Report to be signed on its

behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

Date: October 3, 2016

|

|

|

|

MARCHEX, INC.

|

|

|

|

|

|

|

|

|

|

|

By:

|

|

/s/ M

ICHAEL

A. A

RENDS

|

|

|

|

|

|

Name:

|

|

Michael A. Arends

|

|

|

|

|

|

Title:

|

|

Chief Financial Officer

|

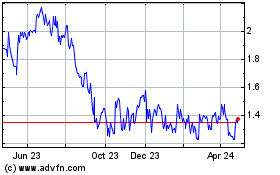

Marchex (NASDAQ:MCHX)

Historical Stock Chart

From Mar 2024 to Apr 2024

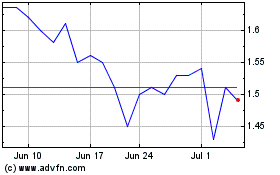

Marchex (NASDAQ:MCHX)

Historical Stock Chart

From Apr 2023 to Apr 2024