Current Report Filing (8-k)

September 23 2016 - 12:45PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported):

September 22, 2016

AAR CORP.

(Exact name of registrant as specified in its charter)

|

Delaware

|

|

1-6263

|

|

36-2334820

|

|

(State of Incorporation)

|

|

(Commission File Number)

|

|

(IRS Employer Identification No.)

|

|

One AAR Place

|

|

|

1100 N. Wood Dale Road

|

|

|

Wood Dale, Illinois 60191

|

|

|

(Address and Zip Code of Principal Executive Offices)

|

|

Registrant’s telephone number, including area code:

(630) 227-2000

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

o

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 5.02. Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On September 22, 2016, AAR CORP. (the “Company”) amended the Severance and Change in Control Agreement it has with Timothy J. Romenesko, its Vice Chairman and Chief Financial Officer.

The amendment eliminates certain provisions of the Agreement:

(i)

The amendment eliminates the ability of Mr. Romenesko to terminate his employment during the 19

th

month following a change in control of the Company and still receive severance benefits. As amended, severance is only payable if a change in control occurs and within 18 months following the change in control, either the Company terminates Mr. Romenesko’s employment for reasons other than Cause or Disability, or Mr. Romenesko terminates his employment for Good Reason (as such terms are defined in the Agreement).

(ii)

The amendment eliminates the “280G” excise tax gross up that would have been paid if the excise tax provisions of §280G of the Internal Revenue Code were triggered by the amount of severance paid to Mr. Romenesko following a change in control. The amendment provides that if the excise tax is triggered, Mr. Romenesko can elect to either (a) receive the full amount of severance benefits and be responsible for paying the excise tax or (b) receive severance benefits up to the maximum amount that can be paid without triggering the excise tax.

(iii)

The amendment eliminates the income tax gross up that would have been paid with respect to the portion of Mr. Romenesko’s severance that consists of three additional years’ of employer contributions under the Company’s retirement plans. (He will be entitled to this portion of severance if he incurs a qualifying termination of employment within 18 months following a change in control.)

For a description of Mr. Romenesko’s Severance and Change in Control Agreement as in effect prior to this amendment, see “Executive Compensation — Potential Payments Upon a Termination of Employment or a Change in Control of the Company — Severance and Change in Control Agreements” on pages 60-61 of the Company’s definitive proxy statement dated August 31, 2016.

Item 9.01. Financial Statements and Exhibits.

(d)

Exhibits

.

|

Exhibit No.

|

|

Description

|

|

10

|

|

Fourth Amendment to Severance and Change in Control Agreement of Timothy J. Romenesko.

|

2

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

Date: September 23, 2016

|

|

|

|

AAR CORP.

|

|

|

|

|

|

|

|

|

|

By:

|

/s/

ROBERT J. REGAN

|

|

|

|

Name: Robert J. Regan

|

|

|

|

Vice President, General Counsel and Secretary

|

3

EXHIBIT INDEX

|

Exhibit No.

|

|

Description

|

|

10

|

|

Fourth Amendment to Severance and Change in Control Agreement of Timothy J. Romenesko.

|

4

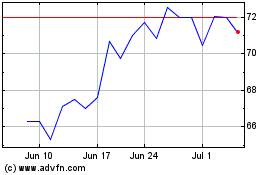

AAR (NYSE:AIR)

Historical Stock Chart

From Mar 2024 to Apr 2024

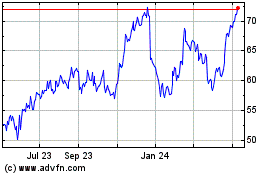

AAR (NYSE:AIR)

Historical Stock Chart

From Apr 2023 to Apr 2024