Current Report Filing (8-k)

August 17 2016 - 10:17AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant

to Section 13 or 15(d)

of the Securities Exchange Act of 1934

August 17, 2016 (August 15, 2016)

Date of Report (Date of earliest event reported)

Caesars

Entertainment Corporation

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

Delaware

|

|

001-10410

|

|

62-1411755

|

|

(State of Incorporation)

|

|

(Commission

File Number)

|

|

(IRS Employer

Identification Number)

|

One Caesars Palace Drive

Las Vegas, Nevada 89109

(Address of principal executive offices) (Zip Code)

(702) 407-6000

(Registrant’s telephone number, including area code)

N/A

(Former Name or

Former Address, if Changed Since Last Report)

Check the appropriate box below

if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

¨

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

¨

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

¨

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

¨

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Item 8.01 Other Events.

On August 15, 2016, Caesars Entertainment Corporation (“

CEC

”), Caesars Entertainment Operating Company, Inc., a majority owned

subsidiary of CEC (“

CEOC

” and, with its debtor subsidiaries, the “

Debtors

” and, together with CEC, the “

Caesars Parties

”), and Frederick Barton Danner (“

Danner

”), a holder of

CEOC’s 6.50% Senior Notes due 2016 (the “

2016 Notes

”) and the plaintiff in

Frederick Barton Danner v. Caesars Entertainment Corporation and Caesars Entertainment Operating Company, Inc.

, No. 14-cv-7973 (S.D.N.Y.) (the

“

Danner Lawsuit

”), entered into a Settlement and Forbearance Agreement (the “

Agreement

”) with respect to claims that Danner has or may have against the Caesars Parties.

Danner has agreed to, among other things, (a) support the restructuring of CEOC’s indebtedness (the “

Restructuring

”) and

vote in favor of the Debtors’ Second Amended Joint Plan of Reorganization (the “

CEOC Plan

”) and, if applicable, a chapter 11 plan of reorganization for CEC (the “

CEC Plan

” and, together with the CEOC Plan, the

“

Plans

”), (b) support the mutual release and exculpation provisions provided in the Plans, (c) support CEOC’s motion to enjoin certain litigation against CEC, (d) not later than three business days after the date upon which all

conditions precedent to the effectiveness of the Plans have been satisfied (the “

Effective Date

”), seek to dismiss with prejudice the Danner Lawsuit and (e) forbear from exercising any default-related rights and remedies under the

indenture governing the 2016 Notes.

CEOC has agreed to, among other things, amend the CEOC Plan so as to require Danner’s consent to

modify the CEOC Plan in a manner that is materially inconsistent with respect to the treatment of recovery of the 2016 Notes under the CEOC Plan and the Agreement and add Danner to the definition of a “Released Party” in the CEOC

Plan. CEC has agreed to, among other things, pay, if Class H votes to accept the CEOC Plan, on the Effective Date a fee in cash equal to 6.38% of the face amount of 2016 Notes held by certain holders who complete the applicable form and subject

to certain other conditions set forth in the Agreement. In addition, CEC and Danner have agreed to seek to mutually stay the prosecution of the Danner Lawsuit no later than August 28, 2016.

The foregoing description of the Agreement does not purport to be complete and is qualified in its entirety by reference to the Agreement,

which is filed as Exhibit 99.1 hereto and incorporated herein by reference.

Item 9.01 Financial Statements and Exhibits.

|

|

(d)

|

Exhibits

. The following exhibit is being filed herewith:

|

|

|

|

|

|

Exhibit

No.

|

|

Description

|

|

|

|

|

99.1

|

|

Settlement and Forbearance Agreement, dated as of August 15, 2016, among Caesars Entertainment Operating Company, Inc., on behalf of itself and each of the debtors in the Chapter 11 Cases, Caesars Entertainment Corporation and

Frederick Barton Danner.

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the Registrant has duly caused this report to be signed on

its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CAESARS ENTERTAINMENT CORPORATION

|

|

|

|

|

|

|

Date: August 17, 2016

|

|

|

|

By:

|

|

/s/ S

COTT

E. W

IEGAND

|

|

|

|

|

|

|

|

Name:

|

|

Scott E. Wiegand

|

|

|

|

|

|

|

|

Title:

|

|

Senior Vice President, Deputy General Counsel and Corporate Secretary

|

EXHIBIT INDEX

|

|

|

|

|

Exhibit

No.

|

|

Description

|

|

|

|

|

99.1

|

|

Settlement and Forbearance Agreement, dated as of August 15, 2016, among Caesars Entertainment Operating Company, Inc., on behalf of itself and each of the debtors in the Chapter 11 Cases, Caesars Entertainment Corporation and

Frederick Barton Danner.

|

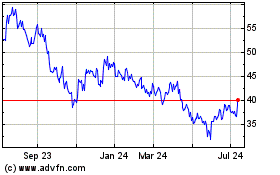

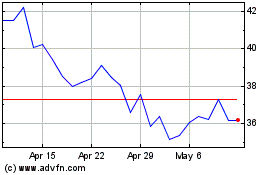

Caesars Entertainment (NASDAQ:CZR)

Historical Stock Chart

From Mar 2024 to Apr 2024

Caesars Entertainment (NASDAQ:CZR)

Historical Stock Chart

From Apr 2023 to Apr 2024