Current Report Filing (8-k)

July 28 2016 - 4:36PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported):

July 28, 2016

AGREE REALTY CORPORATION

(Exact name of registrant as specified in its

charter)

Maryland

(State of other jurisdiction of incorporation)

|

1-12928

(Commission file number)

|

38-3148187

(I.R.S. Employer Identification No.)

|

|

|

|

|

70 E. Long Lake Road

Bloomfield Hills, MI

(Address of principal executive offices)

|

48304

(Zip code)

|

(Registrant’s telephone number, including

area code)

(248) 737-4190

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

¨

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

¨

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

¨

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

¨

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

|

Item 1.01

|

Entry into a Material Definitive Agreement

|

On July 28, 2016, Agree

Limited Partnership (the “Operating Partnership”), the majority-owned operating partnership of Agree Realty Corporation

(the “Company”), entered into a Note Purchase Agreement (the “Agreement”) with the institutional investors

named therein (the “Purchasers”) in connection with a private placement of senior unsecured notes of the Operating

Partnership. Pursuant to the Agreement, the Operating Partnership issued to the Purchasers $60 million aggregate principal amount

of its 4.42% senior unsecured notes due July 28, 2028 (the “Notes”). The Notes are guaranteed by the Company.

The Notes bear interest

at an annual fixed rate of 4.42% and mature on July 28, 2028. Interest is payable semi-annually on January 28

th

and

July 28

th

of each year, beginning on January 28, 2017.

The Operating Partnership

may at any time prepay the Notes, in whole or in part, at a price equal to 100% of the principal amount thereof plus accrued and

unpaid interest plus a “make-whole” prepayment premium. In the event of a Change in Control (as defined in the Agreement)

of the Company, the Company may be required to offer to prepay the Notes at a price equal to 100% of the principal amount thereof,

plus accrued and unpaid interest.

The Agreement contains

customary affirmative and negative covenants for agreements of this type including, among others, limitations on the Company, Operating

Partnership and its subsidiaries with respect to incurrence of indebtedness, disposition of assets, mergers and transactions with

affiliates. The Agreement contains customary events of default with customary grace periods, as applicable. The Operating Partnership

may use the proceeds from the sale of the Notes to repay amounts outstanding on an existing credit facility and for general corporate

purposes.

The Notes are being sold

in reliance on the exemption from registration provided by Section 4(a)(2) of the Securities Act of 1933, as amended (the “Securities

Act”). The Notes have not been and will not be registered under the Securities Act or any state or other jurisdiction's securities

laws and may not be offered or sold in the United States absent registration or an applicable exemption from the registration requirements

of the Securities Act and applicable state or other jurisdictions' securities laws.

The foregoing description

of the Agreement does not purport to be complete and is qualified in its entirety by reference to the full text of the Agreement,

which is filed as Exhibit 10.1 to this report and is incorporated in this Item 1.01 by reference.

|

Item 2.03

|

Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant

|

The information set forth in Item 1.01 is

incorporated herein by reference.

|

Item 9.01.

|

Financial Statements and Exhibits.

|

|

Exhibit

|

|

Description

|

|

10.1

|

|

Note Purchase Agreement, dated as of July 28, 2016 by and among Agree Limited Partnership, Agree Realty Corporation and each of the Purchasers thereto.

|

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned

hereunto duly authorized.

|

|

AGREE REALTY CORPORATION

|

|

|

|

|

|

By:

|

/s/ Matthew M. Partridge

|

|

|

|

Name:

|

Matthew M. Partridge

|

|

|

|

Title:

|

Executive Vice President, Chief Financial Officer and Secretary

|

Date: July 28, 2016

EXHIBIT INDEX

|

Exhibit

|

|

Description

|

|

|

|

|

|

10.1

|

|

Note Purchase Agreement, dated as of July 28, 2016 by and among Agree Limited Partnership, Agree Realty Corporation and each of the Purchasers thereto.

|

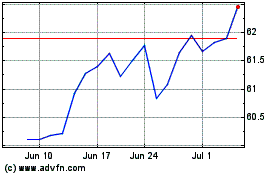

Agree Realty (NYSE:ADC)

Historical Stock Chart

From Mar 2024 to Apr 2024

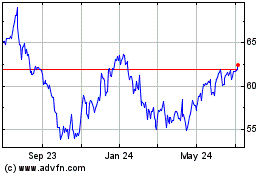

Agree Realty (NYSE:ADC)

Historical Stock Chart

From Apr 2023 to Apr 2024