Current Report Filing (8-k)

June 15 2016 - 5:05PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant

to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): June 9, 2016

ACACIA RESEARCH CORPORATION

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

Delaware

|

|

001-37721

|

|

95-4405754

|

|

(State or other jurisdiction

of incorporation)

|

|

(Commission

File Number)

|

|

(IRS Employer

Identification No.)

|

|

|

|

|

|

|

|

520 Newport Center Drive,

Newport Beach, California

|

|

92660

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

Registrant’s telephone number, including area code: (949) 480-8300

Not applicable

(Former

name or former address, if changed since last report.)

Check the appropriate box below

if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (

see

General Instruction A.2. below):

|

¨

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

¨

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

¨

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

¨

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain

Officers; Compensatory Arrangements of Certain Officers.

(e) On June 9, 2016, the stockholders of Acacia Research Corporation (the

“Company”) approved the 2016 Acacia Research Corporation Stock Incentive Plan (the “Plan”). The Board of Directors (the “Board”) of the Company adopted the Plan on April 26, 2016, subject to stockholder approval.

The purposes of the Plan are (a) to enhance the Company’s ability to attract and retain the services of qualified employees, officers, directors, consultants and other service providers upon whose judgment, initiative and efforts the

successful conduct and development of the Company’s business largely depends, and (b) to provide additional incentives to such persons or entities to devote their utmost effort and skill to the advancement and betterment of the Company, by

providing them an opportunity to participate in the ownership of the Company and thereby have an interest in the success and increased value of the Company. The Plan provides for grants of stock options, restricted stock units and direct stock

awards.

The maximum number of shares of common stock that could be issued pursuant to awards under the Plan is 5,125,390 shares of common

stock, which consist of 4,500,000 shares of common stock initially reserved for issuance under the Plan, plus 625,390 shares of common stock remaining available for issuance and not subject to awards granted under the Company’s 2013 Acacia

Research Corporation Stock Incentive Plan as of the effective date of the Plan. The maximum number of shares of common stock that may be issued under the Plan pursuant to the exercise of incentive stock options is equal to the number of shares of

common stock authorized for issuance under the Plan. No individual participating in the Plan may receive stock options, restricted stock units or direct stock awards for more than 750,000 shares of common stock in the aggregate per calendar year.

The Plan will be administered by either the entire Board or a committee of the Board, which shall consist of at least two members of the

Board, each of whom must qualify as a “non-employee director” under Rule 16b-3 under the Securities Exchange Act of 1934, as amended, an “outside director” under Section 162(m) of the Internal Revenue Code and an

“independent director” under the Nasdaq Listing Rules. The Plan administrator has the authority to determine the terms and conditions of awards, and to interpret and administer the Plan.

The Plan may be amended or modified by the Plan administrator, except to the extent that any law, regulation or rule of a securities exchange

requires stockholder approval for any amendment, which shall not then be effective without such approval. No amendment or modification may adversely affect a participant’s rights and obligations with respect to awards previously granted under

the Plan without the written consent of the participant. The Plan will terminate on the earliest of (i) April 26, 2026, (ii) the date on which all shares available for issuance under the Plan have been issued as fully-vested shares or

(iii) the termination of all outstanding awards in connection with a change of control (as defined under the Plan), and no further awards may be granted thereafter.

The foregoing description of the Plan does not purport to be complete and is qualified in its entirety by reference to the

text of the Plan, a copy of which is included as Annex A to the Company’s Definitive Proxy Statement filed with the Securities and Exchange Commission on April 28, 2016, and is incorporated herein by reference as Exhibit 10.1 to this

Current Report on Form 8-K.

|

Item 5.07

|

Submission of Matters to a Vote of Security Holders.

|

The Company held its 2016 annual

meeting of stockholders (the “Annual Meeting”) on Thursday, June 9, 2016, at the Company’s corporate headquarters located at 520 Newport Center Drive, 7th Floor, Newport Beach, California. As of April 12, 2016, the record

date for the Annual

2

Meeting, the Company had 50,431,503 shares of its common stock outstanding and entitled to vote. At the Annual Meeting, 46,032,686 shares of the Company’s common stock were present in person

or represented by proxy and entitled to vote, constituting a quorum for the conduct of business at the Annual Meeting.

The following sets

forth detailed information regarding the voting results at the Annual Meeting:

Proposal No. 1

: The Company’s

stockholders elected the Class I director nominee named below to serve on the Company’s Board of Directors for a three-year term expiring at the Company’s 2019 annual meeting of stockholders and until his successor is duly elected and

qualified, or until his earlier resignation or removal.

|

|

|

|

|

|

|

|

|

|

|

Class I Nominee

|

|

Votes For

|

|

Votes Against

|

|

Votes Abstaining

|

|

Broker Non-votes

|

|

Fred deBoom

|

|

19,532,544

|

|

17,694,054

|

|

34,946

|

|

8,771,142

|

Proposal No. 2

: The Company’s stockholders ratified the appointment of Grant Thornton LLP as

the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2016.

|

|

|

|

|

|

|

|

|

Votes For

|

|

Votes Against

|

|

Votes Abstaining

|

|

Broker Non-Votes

|

|

44,085,416

|

|

1,840,609

|

|

106,661

|

|

0

|

Proposal No. 3

: The Company’s stockholders approved, by advisory vote, the compensation of

the Company’s named executive officers detailed in the proxy statement for the Annual Meeting.

|

|

|

|

|

|

|

|

|

Votes For

|

|

Votes Against

|

|

Votes Abstaining

|

|

Broker Non-Votes

|

|

34,953,913

|

|

1,771,332

|

|

536,299

|

|

8,771,142

|

Proposal No. 4

: The Company’s stockholders approved the Company’s 2016 Acacia Research

Corporation Stock Incentive Plan.

|

|

|

|

|

|

|

|

|

Votes For

|

|

Votes Against

|

|

Votes Abstaining

|

|

Broker Non-Votes

|

|

30,813,617

|

|

6,357,385

|

|

90,542

|

|

8,771,142

|

|

Item 9.01

|

Financial Statements and Exhibits.

|

The following exhibits are attached to this Current Report on Form 8-K:

|

|

|

|

|

Exhibit

No.

|

|

Description

|

|

|

|

|

10.1

|

|

2016 Acacia Research Corporation Stock Incentive Plan (incorporated by reference to Annex A of the Company’s Definitive Proxy Statement filed with the Securities and Exchange Commission on April 28, 2016).

|

3

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned, thereunto duly authorized.

|

|

|

|

|

|

|

|

|

Date: June 15, 2016

|

|

|

|

ACACIA RESEARCH CORPORATION

|

|

|

|

|

|

|

|

|

|

|

By:

|

|

/s/ Marvin Key

|

|

|

|

|

|

|

|

Marvin Key

|

|

|

|

|

|

|

|

Interim Chief Executive Officer

|

4

EXHIBIT INDEX

|

|

|

|

|

Exhibit

No.

|

|

Description

|

|

|

|

|

10.1

|

|

2016 Acacia Research Corporation Stock Incentive Plan (incorporated by reference to Annex A of the Company’s Definitive Proxy Statement filed with the Securities and Exchange Commission on April 28, 2016).

|

5

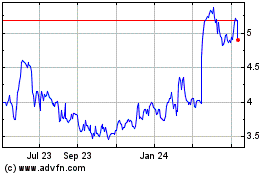

Acacia Research Technolo... (NASDAQ:ACTG)

Historical Stock Chart

From Mar 2024 to Apr 2024

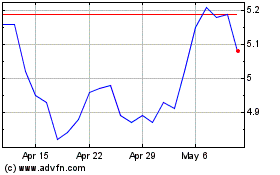

Acacia Research Technolo... (NASDAQ:ACTG)

Historical Stock Chart

From Apr 2023 to Apr 2024