Current Report Filing (8-k)

April 01 2016 - 11:03AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant

to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): March 31, 2016

Autoliv, Inc.

(Exact

name of registrant as specified in its charter)

|

|

|

|

|

|

|

Delaware

|

|

001-12933

|

|

51-0378542

|

|

(State or other jurisdiction

of incorporation)

|

|

(Commission

File Number)

|

|

(IRS Employer

Identification No.)

|

Vasagatan 11, 7

th

Floor, SE-111 20

Box 70381,

SE-107 24,

Stockholm, Sweden

(Address and Zip Code of principal executive offices)

+46 8 587 20 600

(Registrant’s telephone number, including area code)

Not Applicable

(Former

name or former address, if changed since last report)

Check the appropriate box below

if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

|

¨

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

¨

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

¨

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

¨

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

On April 1, 2016, Autoliv, Inc. (the “Company”) announced

the closing on March 31, 2016 of its previously announced transaction with Nissin Kogyo to form the joint venture Autoliv Nissin Brake Systems (the “Joint Venture”). The Joint Venture combines the current brake control business of

Autoliv and a carve-out of the automotive braking business of Nissin Kogyo. Autoliv purchased 51% of the Joint Venture for JPY 29.7 billion (approximately $264 million), including pre-closing adjustments and subject to customary post-closing

adjustments. The Company will have management control for consolidation purposes under U.S. GAAP. The Joint Venture’s sales and operating margin for the nine month period April-December 2016 are expected to be slightly lower than initially

communicated, sales are now expected to be in the range of $400-$450 million for the same nine month period.

The full text of the press

release dated April 1, 2016 announcing the closing of the Joint Venture is attached as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated herein by reference.

Safe Harbor Statement

This report

contains statements that are not historical facts but rather forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Such forward-looking statements include those that address activities, events or

developments that Autoliv, Inc. or its management believes or anticipates may occur in the future. All forward-looking statements, including the anticipated revenue of the Joint Venture, the consolidation of the Joint Venture for accounting

purposes, the expansion of the Joint Venture’s business and its anticipated product offering and other estimates of future operating performance or financial results, are based upon our current expectations, various assumptions and data

available from third parties. Our expectations and assumptions are expressed in good faith and we believe there is a reasonable basis for them. However, there can be no assurance that such forward-looking statements will materialize or prove to be

correct as forward-looking statements are inherently subject to known and unknown risks, uncertainties and other factors which may cause actual future results, performance or achievements to differ materially from the future results, performance or

achievements expressed in or implied by such forward-looking statements. Numerous risks, uncertainties and other factors may cause actual results to differ materially from those set out in the forward-looking statements. The Company undertakes no

obligation to update publicly or revise any forward-looking statements in light of new information or future events. For any forward-looking statements contained in this or any other document, we claim the protection of the safe harbor for

forward-looking statements contained in the Private Securities Litigation Reform Act of 1995, and we assume no obligation to update any such statement.

|

Item 9.01

|

Financial Statements and Exhibits.

|

(d) EXHIBITS

|

|

|

|

|

|

|

|

99.1

|

|

Press Release of Autoliv, Inc. dated April 1, 2016.

|

2

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

|

|

|

|

|

AUTOLIV, INC.

|

|

|

|

|

By:

|

|

/s/ Lars A. Sjöbring

|

|

Name:

|

|

Lars A. Sjöbring

|

|

Title:

|

|

Group Vice President Legal Affairs, General Counsel and Secretary

|

Date: April 1, 2016

EXHIBIT INDEX

|

|

|

|

|

Exhibit No.

|

|

Description

|

|

|

|

|

99.1

|

|

Press Release of Autoliv, Inc. dated April 1, 2016.

|

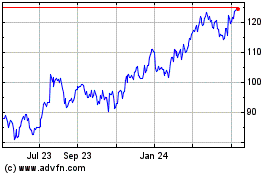

Autoliv (NYSE:ALV)

Historical Stock Chart

From Mar 2024 to Apr 2024

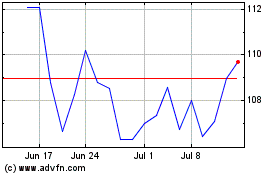

Autoliv (NYSE:ALV)

Historical Stock Chart

From Apr 2023 to Apr 2024