UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of

the Securities Exchange Act of 1934

Date of Report (Date of earliest event

reported): March 1, 2016

AMARANTUS BIOSCIENCE HOLDINGS, INC.

(Exact name of registrant as specified

in its charter)

| Nevada |

|

000-55016 |

|

26-0690857 |

(State or other jurisdiction of

incorporation or organization) |

|

(Commission File Number) |

|

IRS Employer

Identification No.) |

|

655 Montgomery Street, Suite 900

San Francisco, CA |

|

94111 |

| (Address of Principal Executive Offices) |

|

(Zip Code) |

(408) 737-2734

(Registrant’s telephone number,

including area code)

Check the appropriate box below if the Form 8-K filing is

intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐

Written communications pursuant to Rule 425 under the Securities Act

☐

Soliciting material pursuant to Rule 14a-12 under the Exchange Act

☐

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 1.01 Entry

Into a Material Definitive Agreement.

On March 1, 2016,

Amarantus BioScience Holdings, Inc. (the “Company”) was issued a convertible note (the “Note”) from Theranostic

Health, Inc. (“THI”) in exchange for $400,000. The Company provided the financing evidenced by the Note in order to

facilitate the proposed acquisition by Avant Diagnostics, Inc. (“Avant”) of the assets and certain liabilities of THI.

In a concurrent transaction, the Company has entered into a non-binding letter of intent to sell its wholly-owned subsidiary, Amarantus

Diagnostics, Inc. to Avant for 80 million shares of common stock of Avant.

The Note matures

on February 28, 2017 and bears interest at 8% per annum payable at maturity in cash. The Note is convertible at any time at the

option of the Company into shares of common stock of THI at a conversion price of $40.64 per share. The Note shall automatically

convert into shares of common stock of THI upon a change of control of THI. It is expected that the Note will be assumed by Avant

upon consummation of the transaction with THI. The conversion price of the Note is subject to weighted average anti-dilution price

protection if the dilutive issuances are for less than $1 million and full ratchet anti-dilution protection if the dilutive issuances

are for more than $1 million. The Note has events of default in for any default in the payment of principal or interest when due

and for bankruptcy.

The foregoing

is only a summary of the material terms of the Note. The foregoing description of the Note is qualified in its entirety by reference

to the Note, which is filed as Exhibit 10.1 to this Current Report on Form 8-K, which is incorporated herein by reference.

Item 8.01 Other

Items.

On

March 7, 2016, the Company issued a press release announcing announced that it has jointly entered into a letter of intent with

Avant and THI for Avant to acquire assets and certain liabilities of THI , adding key CLIA laboratory and intellectual property

capabilities to Avant’s previously announced non-binding letter of intent to merge with Amarantus Diagnostics, Inc. A copy

of the Company’s press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K.

Item 9.01 Financial Statements

and Exhibits.

(d) Exhibits

| Exhibit

No. |

|

Description |

| |

|

|

| 10.1 |

|

Form

of Note from Theranostics Health, Inc. |

| |

|

|

99.1 |

|

Amarantus

Bioscience Holdings, Inc. Press Release, dated March 7, 2016. |

2

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| |

AMARANTUS BIOSCIENCE HOLDINGS, INC. |

| |

|

|

| Date: March 7, 2016 |

By: |

/s/ Gerald E. Commissiong |

| |

Name: |

Gerald E. Commissiong |

| |

Title: |

Chief Executive Officer |

3

Exhibit

10.1

NEITHER

THIS SECURITY NOR THE SECURITIES INTO WHICH THIS SECURITY IS CONVERTIBLE HAVE BEEN REGISTERED WITH THE SECURITIES AND EXCHANGE

COMMISSION OR THE SECURITIES COMMISSION OF ANY STATE IN RELIANCE UPON AN EXEMPTION FROM REGISTRATION UNDER THE SECURITIES ACT

OF 1933, AS AMENDED (THE “SECURITIES ACT”), AND, ACCORDINGLY, MAY NOT BE OFFERED OR SOLD EXCEPT PURSUANT TO AN EFFECTIVE

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OR PURSUANT TO AN AVAILABLE EXEMPTION FROM, OR IN A TRANSACTION NOT SUBJECT TO,

THE REGISTRATION REQUIREMENTS OF THE SECURITIES ACT AND IN ACCORDANCE WITH APPLICABLE STATE SECURITIES LAWS AS EVIDENCED BY A

LEGAL OPINION OF COUNSEL TO THE TRANSFEROR TO SUCH EFFECT, THE SUBSTANCE OF WHICH SHALL BE REASONABLY ACCEPTABLE TO BORROWER.

Issuance

Date: February 29, 2016

Principal

Amount: $400,000

8%

CONVERTIBLE NOTE

DUE

February 28, 2017

FOR

VALUE RECEIVED, the undersigned, Theranostics Health, Inc., a Delaware corporation (the “Borrower”),

promises to pay to Amarantus Bioscience Holdings, Inc. or its assigns (the “Holder”), or shall have

paid pursuant to the terms hereunder, the principal sum of Four Hundred Thousand Dollars ($400,000) on February 28,

2017 (the “Maturity Date”) or such earlier date as this Note is required or permitted to be repaid as provided

hereunder, and to pay interest, if any, to the Holder on the aggregate unconverted and then outstanding principal amount of this

Note in accordance with the provisions hereof.

This

Note is subject to the following additional provisions:

Section

1. Definitions. For the purposes hereof, in addition to

the terms defined elsewhere in this Note, the following terms shall have the following meanings:

“Bankruptcy

Event” means any of the following events: (a) Borrower or any Subsidiary thereof commences a case or other proceeding

under any bankruptcy, reorganization, arrangement, adjustment of debt, relief of debtors, dissolution, insolvency or liquidation

or similar law of any jurisdiction relating to Borrower or any Subsidiary thereof, (b) there is commenced against Borrower or

any Subsidiary thereof any such case or proceeding that is not dismissed within 60 days after commencement, (c) Borrower or any

Subsidiary thereof is adjudicated insolvent or bankrupt or any order of relief or other order approving any such case or proceeding

is entered, (d) Borrower or any Subsidiary thereof suffers any appointment of any custodian or the like for it or any substantial

part of its property that is not discharged or stayed within 60 calendar days after such appointment, or (e) Borrower or any Subsidiary

thereof makes a general assignment for the benefit of creditors.

“Business

Day” means any day except any Saturday, any Sunday, any day which is a federal legal holiday in the United States or

any day on which banking institutions in the State of New York are authorized or required by law or other governmental action

to close.

“Change

of Control Event” means: except for the acquisition of substantially all the assets of Borrower by Avant

Diagnostics, Inc., (i) any acquisition of Borrower by means of merger, securities purchase or other form of reorganization in

which Borrower's outstanding equity interests are exchanged for securities or other consideration issued, or caused to be issued,

by the acquiring person or any one or more of its subsidiaries or affiliates, unless Borrower's security holders immediately prior

to such merger, securities purchase or reorganization hold more than 50% of the voting power of the surviving or acquiring person

immediately after such merger, securities purchase or reorganization in the same relative proportions, or (ii) the sale of all

or substantially all of the assets of Borrower.

“Common

Stock” means the voting common stock of the Borrower.

“Common

Stock Equivalents” means any securities of the Company or the Subsidiaries which would entitle the holder thereof to acquire

at any time Common Stock, including, without limitation, any debt, preferred stock, right, option, warrant or other instrument

that is at any time convertible into or exercisable or exchangeable for, or otherwise entitles the holder thereof to receive,

Common Stock

“Conversion”

shall have the meaning ascribed to such term in Section 4.

“Conversion

Date” shall have the meaning set forth in Section 4.

“Conversion

Price” means $40.64 which Conversion Price shall be adjusted as provided in Section 5.

“Conversion

Shares” means, collectively, the shares of Common Stock issuable upon conversion of this Note in accordance with the

terms hereof.

“Event

of Default” shall have the meaning set forth in Section 7(a).

“New

York Courts” shall have the meaning set forth in Section 11(d).

“Notice

of Conversion” shall have the meaning set forth in Section 4(a).

“Person”

means an individual or corporation, partnership, trust, incorporated or unincorporated association, joint venture, limited liability

company, joint stock company, government (or an agency or subdivision thereof) or other entity of any kind.

“Trading

Day” means a day on which the principal Trading Market is open for trading.

“Trading

Market” means any of the following markets or exchanges on which the Common Stock is listed or quoted for trading on

the date in question: the NYSE MKT, the Nasdaq Capital Market, the Nasdaq Global Market, the Nasdaq Global Select Market, the

New York Stock Exchange, the OTCQB, or the OTCQX (or any successors to any of the foregoing).

Section

2. Interest.

a) Interest.

The Holder shall be entitled to receive, and Borrower shall pay, simple interest on the outstanding principal amount of this Note

at the annual rate of eight (8%) percent per annum payable in cash on the Maturity Date.

b) Payment

Grace Period. The Borrower shall have a ten Business Day grace period to pay any monetary amounts due under this Note except

as specifically set forth herein.

c) Calculations.

Interest shall be calculated on the basis of a 365-day year, and shall accrue daily commencing on the date hereof until payment

in full of the outstanding principal, together with all accrued and unpaid interest and other amounts which may become due hereunder,

has been made.

d) Manner

and Place of Payment. Principal and interest on this Note and other payments in connection with this Note shall be payable

at the Borrower’s offices as designated above in lawful money of the United States of America in immediately available funds

without set-off, deduction or counterclaim. Upon assignment of the interest of Holder in this Note, Borrower shall instead make

its payment pursuant to the assignee’s instructions upon receipt of written notice thereof.

Section

3. Investment Representations. This Note has been

issued subject to certain investment representations of the original Holder set forth in the Investor Representations annexed

hereto as Exhibit A and may be transferred or exchanged only in compliance with the terms contained herein and applicable

federal and state securities laws and regulations to a successor Holder who provides the same investment representations to the

Borrower.

Section

4. Conversion.

a)

Voluntary Conversion.

i.

At Holder’s Option. This Note shall be convertible at any time, in whole and not in part, into the Conversion Shares

at the option of the Holder. The Holder shall effect conversion by delivering to Borrower written notice of Conversion (the “Notice

of Conversion”) which Notice of Conversion shall be accompanied by this Note. The Conversion Date shall be the date

that such Notice of Conversion and this Note is deemed delivered hereunder.

ii.

At Holder’s Option. At the option of the Holder at any time after March 31, 2016 if on such date Borrower is not

then subject to a legally binding obligation to sell substantially all of its assets to Avant Diagnostics, Inc., this Note shall

be convertible, in whole and not in part, into the Conversion Shares based on the then applicable Conversion Price. The Borrower

shall effect conversion by delivering to Holder written a Notice of Conversion which Notice of Conversion. Upon delivery of this

shall this Note to Borrower, Borrower shall issue to the Holder the Conversion Shares. The Conversion Date shall be the date that

such Notice of Conversion is deemed delivered hereunder

b)

Mandatory Conversion. This Note shall automatically convert into the Conversion Shares on the earliest of the date

upon the occurrence of a Change of Control Event.

c)

Mechanics of Conversion.

i. Conversion Shares Issuable Upon Conversion. The number of Conversion Shares issuable upon a conversion hereunder

shall be determined by the quotient obtained by dividing (x) the outstanding principal amount of this Note and accrued but unpaid

interest thereon to be converted by (y) the Conversion Price.

ii. Delivery

of Certificate Upon Conversion. Not later than five Trading Days after the Conversion Date (the “Share Delivery Date”),

Borrower shall deliver, or cause to be delivered, to the Holder a certificate or certificates representing the Conversion Shares.

iii. Reservation

of Shares Issuable Upon Conversion. Borrower covenants that it will at all times reserve and keep available out of its authorized

and unissued shares of Common Stock for the sole purpose of issuance upon conversion of this Note as herein provided, free from

preemptive rights or any other actual contingent purchase rights of Persons other than the Holder, not less than one hundred (100%)

percent of the aggregate number of shares of the Common Stock as shall be issuable (taking into account the adjustments and restrictions

of Section 5) upon the conversion of the then outstanding principal amount plus accrued interest of this Note at the Conversion

Price (as adjusted from time to time). Borrower covenants that all shares of Common Stock that shall be so issuable shall, upon

issue, be duly authorized, validly issued, fully paid and nonassessable.

iv. Fractional

Shares. No fractional shares or scrip representing fractional shares shall be issued upon the conversion of this Note. As

to any fraction of a share which the Holder would otherwise be entitled to purchase upon such conversion, Borrower shall at its

election, either pay a cash adjustment in respect of such final fraction in an amount equal to such fraction multiplied by the

Conversion Price or round up to the next whole share.

v. Transfer

Taxes and Expenses. The issuance of certificates for shares of the Common Stock on conversion of this Note shall be made without

charge to the Holder hereof for any documentary stamp or similar taxes that may be payable in respect of the issue or delivery

of such certificates, provided that, Borrower shall not be required to pay any tax that may be payable in respect of any transfer

involved in the issuance and delivery of any such certificate upon conversion in a name other than that of the original Holder

of this Note and Borrower shall not be required to issue or deliver such certificates to such other person unless or until such

other person shall have paid to Borrower the amount of such tax or shall have established to the satisfaction of Borrower that

such tax has been paid.

Section

5. Certain Adjustments.

a) Stock

Dividends and Stock Splits. If Borrower, at any time while this Note is outstanding: (i) pays a stock dividend or otherwise

makes a distribution or distributions payable in shares of Common Stock on shares of Common Stock o, (ii) subdivides outstanding

shares of Common Stock into a larger number of shares, (iii) combines (including by way of a reverse stock split) outstanding

shares of Common Stock into a smaller number of shares or (iv) issues, in the event of a reclassification of shares of the Common

Stock, any shares of capital stock of Borrower, then the Conversion Price shall be multiplied by a fraction of which the numerator

shall be the number of shares of Common Stock (excluding any treasury shares of Borrower) outstanding immediately before such

event, and of which the denominator shall be the number of shares of Common Stock outstanding immediately after such event. Any

adjustment made pursuant to this Section shall become effective immediately after the record date for the determination of stockholders

entitled to receive such dividend or distribution and shall become effective immediately after the effective date in the case

of a subdivision, combination or re-classification.

b)

Subsequent Equity Sales. If the Borrower or any Subsidiary thereof, as applicable, at any time while this Note is outstanding,

shall sell or grant any option to purchase, or sell or grant any right to reprice, or otherwise dispose of or issue (or announce

any offer, sale, grant or any option to purchase or other disposition) any Common Stock or Common Stock Equivalents other than

pursuant to an Exempt Issuance (as defined below), at an effective price per share less than the Conversion Price then in effect

(such lower price, the “Base Share Price” and such issuances (excluding any an Exempt Issuance),collectively,

a “Dilutive Issuance”) (it being understood and agreed that if the holder of the Common Stock or Common Stock

Equivalents so issued shall at any time, whether by operation of purchase price adjustments, reset provisions, floating conversion,

exercise or exchange prices or otherwise, or due to warrants, options or rights per share which are issued in connection with

such issuance, be entitled to receive shares of Common Stock at an effective price per share that is less than the Conversion

Price, such issuance shall be deemed to have occurred for less than the Conversion Price on such date of the Dilutive Issuance

at such effective price), then simultaneously with the consummation of each Dilutive Issuance the Conversion Price shall be reduced

and only reduced as set forth below and the number of Conversion Shares issuable hereunder shall be increased such that the aggregate

Conversion Price payable hereunder, after taking into account the decrease in the Conversion Price, shall be equal to the aggregate

Conversion Price prior to such adjustment.

(i)

If the Dilutive Issuance, together with all other Dilutive Issuances, is for consideration of less than One Million Dollars ($1,000,000),

the Conversion Price shall be adjusted to the product of (w) the sum of Six Million Dollars ($6,000,000) plus the consideration

received by the Borrower with respect to such Dilutive Issuances of Common Stock and that would be received by the Borrower upon

the exercise of any Common Stock Equivalents divided (x) by the number of shares of Common Stock outstanding after the

issuance of shares of Common Stock pursuant to a Dilutive Issuance and that would be outstanding upon the exercise of Common Stock

Equivalents that constitute a Dilutive Issuance.

(ii)

If the Dilutive Issuance, together with all other Dilutive Issuances, is for consideration of One Million Dollars ($1,000,000)

or more, the Conversion Price shall be adjusted to equal the Base Share Price.

(iii)

If the Dilutive Issuance is Common Stock that is issued to a creditor of the Borrower or any Subsidiary who has claims against

the Borrower or any Subsidiary as of the date hereof in full or partial satisfaction of the claims of such creditor, the Base

Share Price shall be the value of such shares of Common Stock as agreed upon by the Borrower or any Subsidiary and such creditor

and the consideration received by the Borrower with respect to such Dilutive Issuance shall be (y) the number of shares of Common

Stock so issued multiplied by (z) such agreed upon Base Share Price.

b) The

Borrower shall notify the Holder, in writing, no later than the Trading Day following the issuance or deemed issuance of any Common

Stock or Common Stock Equivalents subject to this Section 5(b), indicating therein the applicable issuance price, or applicable

reset price, exchange price, conversion price and other pricing terms (such notice, the “Dilutive Issuance Notice”).

For purposes of clarification, whether or not the Borrower provides a Dilutive Issuance Notice pursuant to this Section 5(b),

upon the occurrence of any Dilutive Issuance, the Holder is entitled to receive a number of Conversion Shares based upon the Conversion

Price as adjusted pursuant to this Section 5(b) regardless of whether the Holder accurately refers to the Conversion Price as

adjusted pursuant to this Section 5(b) in the Notice of Conversion. Notwithstanding the foregoing, no adjustments shall be made

to the Conversion Price or the number of Conversion Shares to be issued under this Section 5(b) in respect of an Exempt Issuance.

“Exempt Issuance” means the issuance of (a) shares of Common Stock or options to employees, officers or directors

of the Borrower pursuant to any stock or option plan duly adopted for such purpose, by a majority of the non-employee members

of the Board of Directors of the Borrower or a majority of the members of a committee of non-employee directors of the Borrower

established for such purpose, (b) securities upon the exercise or exchange of or conversion of any Notes issued hereunder and/or

other securities exercisable or exchangeable for or convertible into shares of Common Stock issued and outstanding on the date

of this Note, provided that such securities have not been amended since the date of this Note to increase the number of such securities

or to decrease the Conversion Price, exchange price or conversion price of such securities, and (c) securities issued pursuant

to acquisitions or strategic transactions approved by a majority of the disinterested directors of the Borrower, provided that

any such issuance shall only be to a Person (or to the equity holders of a Person) which is, itself or through its subsidiaries,

an operating entity or an owner of an asset in a business synergistic with the business of the Borrower and shall provide to the

Borrower additional benefits in addition to the investment of funds, but shall not include a transaction in which the Borrower

is issuing securities primarily for the purpose of raising capital or to an entity whose primary business is investing in securities.

c) Calculations.

All calculations under this Section 5 shall be made to the nearest cent or the nearest 1/100th of a share, as the case may be.

For purposes of this Section 5, the number of shares of Common Stock deemed to be issued and outstanding as of a given date shall

be the sum of the number of shares of Common Stock (excluding any treasury shares of Borrower) issued and outstanding.

d) Notice

to the Holder. Whenever the Conversion Price is adjusted pursuant to any provision of this Section 5, Borrower shall promptly

deliver to the Holder a notice setting forth the Conversion Price after such adjustment and setting forth a brief statement of

the facts requiring such adjustment.

Section

6. Prepayment. The Borrower shall have the option of paying the principal sum of this Note to Holder in advance

in full or in part at any time and from time to time without premium or penalty; provided, however, that together with such payment

in full the Borrower shall pay to the Holder all interest and all other amounts owing pursuant to this Note and remaining unpaid.

Section

7. Events of Default.

a)

“Event of Default” means, wherever used herein, any

of the following events (whatever the reason for such event and whether such event shall be voluntary or involuntary or effected

by operation of law or pursuant to any judgment, decree or order of any court, or any order, rule or regulation of any administrative

or governmental body):

i. any

default in the payment of the principal amount or interest and other amounts owing under this Note, as and when the same shall

become due and payable (whether by acceleration or otherwise) which default is not cured within ten (10) Trading Days; or

ii. the

Borrower or any Significant Subsidiary (as such term is defined in Rule 1-02(w) of Regulation S-X) shall be subject to a Bankruptcy

Event.

b)

Remedies Upon Event of Default. If any Event of Default occurs, the

outstanding principal amount of this Note, interests and other amounts owing in respect thereof through the date of acceleration,

shall become, at the Holder’s election, immediately due and payable in cash. Commencing on the Maturity Date and also five

(5) days after the occurrence of any Event of Default interest on this Note shall accrue at an interest rate of 10%. Upon the

payment in full, the Holder shall promptly surrender this Note to or as directed by Borrower. In connection with such acceleration

described herein, the Holder need not provide, and Borrower hereby waives, any presentment, demand, protest or other notice of

any kind, and the Holder may immediately and without expiration of any grace period enforce any and all of its rights and remedies

hereunder and all other remedies available to it under applicable law. Such acceleration may be rescinded and annulled by Holder

at any time prior to payment hereunder and the Holder shall have all rights as a holder of the Note until such time, if any, as

the Holder receives full payment pursuant to this Section 7(b). No such rescission or annulment shall affect any subsequent Event

of Default or impair any right consequent thereon.

Section

8. Borrower’s Representations. The Borrower is duly organized, validly existing and in good standing under

the laws of the jurisdiction of its organization with full power and authority to own, lease, license and use its properties and

assets and to carry out the business in which it proposes to engage. The Borrower has the requisite corporate power and authority

to execute, deliver and perform its obligations under this Note and to issue this Note. All necessary proceedings of the Borrower

have been duly taken to authorize the execution, delivery, and performance of this Note. When this Note is executed and delivered

by the Borrower, it will constitute the legal, valid and binding obligation of the Borrower enforceable against the Borrower in

accordance with their terms, except as such enforceability may be limited by general principles of equity or to applicable bankruptcy,

insolvency, reorganization, moratorium, liquidation and other similar laws relating to, or affecting generally, the enforcement

of applicable creditors' rights and remedies.

Section

9. Miscellaneous.

a)

Notices. All notices, demands, requests, consents, approvals, and

other communications required or permitted hereunder shall be in writing and, unless otherwise specified herein, shall be (i)

personally served, (ii) deposited in the mail, registered or certified, return receipt requested, postage prepaid, (iii) delivered

by reputable air courier service with charges prepaid, or (iv) transmitted by hand delivery, telegram, facsimile or email, addressed

as set forth below or to such other address as such party shall have specified most recently by written notice. Any notice or

other communication required or permitted to be given hereunder shall be deemed effective (a) upon hand delivery, delivery by

email or delivery by facsimile, with accurate confirmation generated by the transmitting facsimile machine, at the address or

number designated below (if delivered on a business day during normal business hours where such notice is to be received), or

the first business day following such delivery (if delivered other than on a business day during normal business hours where such

notice is to be received) or (b) on the second business day following the date of mailing by express courier service, fully prepaid,

addressed to such address, or upon actual receipt of such mailing, whichever shall first occur. The addresses for such communications

shall be: (i) if to Borrower, to: Theranostics Health, Inc., Attn: Kevin Quinn, member of the Board of Directors, ____________,

__________ MD _____, Facsimile (___) ___-____, email: kquinn@wyeriver.com, and (ii) if to the Holder, as indicated in Exhibit

A.

b)

Absolute Obligation. Except as expressly provided herein, no provision

of this Note shall alter or impair the obligation of Borrower, which is absolute and unconditional, to pay the principal of, liquidated

damages and accrued interest, as applicable, on this Note at the time, place, and rate, and in the coin or currency, herein prescribed.

This Note is a direct debt obligation of Borrower.

c)

Lost or Mutilated Note. If this Note shall be mutilated, lost, stolen

or destroyed, Borrower shall execute and deliver, in exchange and substitution for and upon cancellation of a mutilated Note,

or in lieu of or in substitution for a lost, stolen or destroyed Note, a new Note for the principal amount of this Note so mutilated,

lost, stolen or destroyed, but only upon receipt of evidence of such loss, theft or destruction of such Note, and of the ownership

hereof, reasonably satisfactory to Borrower.

d)

Governing Law. All questions concerning the construction, validity,

enforcement and interpretation of this Note shall be governed by and construed and enforced in accordance with the internal laws

of the State of New York, without regard to the principles of conflict of laws thereof. Each party agrees that all legal proceedings

concerning the interpretation, enforcement and defense of the transactions contemplated by the Note (whether brought against a

party hereto or its respective Affiliates, directors, officers, shareholders, employees or agents) shall be commenced in the state

and federal courts sitting in the City of New York, Borough of Manhattan (the “New York Courts”). Each party

hereto hereby irrevocably submits to the exclusive jurisdiction of the New York Courts for the adjudication of any dispute hereunder

or in connection herewith or with any transaction contemplated hereby or discussed herein, and hereby irrevocably waives, and

agrees not to assert in any suit, action or proceeding, any claim that it is not personally subject to the jurisdiction of such

New York Courts, or such New York Courts are improper or inconvenient venue for such proceeding. Each party hereby irrevocably

waives personal service of process and consents to process being served in any such suit, action or proceeding by mailing a copy

thereof via registered or certified mail or overnight delivery (with evidence of delivery) to such party at the address in effect

for notices to it under this Note and agrees that such service shall constitute good and sufficient service of process and notice

thereof. Nothing contained herein shall be deemed to limit in any way any right to serve process in any other manner permitted

by applicable law. Each party hereto hereby irrevocably waives, to the fullest extent permitted by applicable law, any and all

right to trial by jury in any legal proceeding arising out of or relating to this Note or the transactions contemplated hereby.

Each party shall be responsible for its own legal fees and costs in the event any party shall commence an action or proceeding

to enforce any provisions of this Note.

e)

Waiver. Any waiver by Borrower or the Holder of a breach of any provision

of this Note shall not operate as or be construed to be a waiver of any other breach of such provision or of any breach of any

other provision of this Note. The failure of Borrower or the Holder to insist upon strict adherence to any term of this Note on

one or more occasions shall not be considered a waiver or deprive that party of the right thereafter to insist upon strict adherence

to that term or any other term of this Note on any other occasion. Any waiver by Borrower or the Holder must be in writing.

f) Severability.

If any provision of this Note is invalid, illegal or unenforceable, the balance of this Note shall remain in effect, and if any

provision is inapplicable to any Person or circumstance, it shall nevertheless remain applicable to all other Persons and circumstances.

g)

Usury. If it shall be found that any interest or other amount deemed interest

due hereunder violates the applicable law governing usury, the applicable rate of interest due hereunder shall automatically be

lowered to equal the maximum rate of interest permitted under applicable law.

h)

Next Business Day. Whenever any payment or other obligation hereunder shall be

due on a day other than a Business Day, such payment shall be made on the next succeeding Business Day.

i) Headings.

The headings contained herein are for convenience only, do not constitute a part of this Note and shall not be deemed to limit

or affect any of the provisions hereof.

j) Amendment.

Unless otherwise provided for hereunder, this Note may not be modified or amended or the provisions hereof waived without the

written consent of Borrower and the Holder.

k) Facsimile

Signature. In the event that the Borrower’s signature is delivered by facsimile transmission, PDF, electronic

signature or other similar electronic means, such signature shall create a valid and binding obligation of the Borrower with

the same force and effect as if such signature page were an original thereof.

IN

WITNESS WHEREOF, Borrower has caused this Note to be signed in its name by an authorized officer as of the 29th

day of February, 2016.

| |

THERANOSTICS

HEALTH, INC. |

| |

|

|

| |

By:

|

|

| |

|

Name: |

| |

|

Title: |

Exhibit

A

Investment

Representations for Accredited Investor

The

Holder hereby acknowledges, agrees with and represents, warrants and covenants to the Borrower, as follows:

(a) Accredited

Investor. The Holder is an “accredited investor” as that term is defined in Regulation D promulgated under the

Securities Act by virtual of being (initial all applicable responses below):

| |

[__] |

an

individual (not a partnership, corporation, etc.) whose individual net worth, or joint net worth with his or her spouse, presently

exceeds $1,000,000. For purposes of calculating net worth under this paragraph, (i) the primary residence shall

not be included as an asset, (ii) to the extent that the indebtedness that is secured by the primary residence is in excess

of the fair market value of the primary residence, the excess amount shall be included as a liability, and (iii) if the amount

of outstanding indebtedness that is secured by the primary residence exceeds the amount outstanding 60 days prior to the execution

of this Subscription Agreement, other than as a result of the acquisition of the primary residence, the amount of such excess

shall be included as a liability. |

| |

[__] |

an

individual (not a partnership, corporation, etc.) who had an income in excess of $200,000 in each of the two most recent years,

or joint income with his or her spouse in excess of $300,000 in each of those years (in each case including foreign income,

tax exempt income and full amount of capital gains and losses but excluding any income of other family members and any unrealized

capital appreciation) and has a reasonable expectation of reaching the same income level in the current year |

| |

[__] |

a

bank as defined in section 3(a)(2) of the Act, or a savings and loan association or other institution as defined in section

3(a)(5)(A) of the Act whether acting in its individual or fiduciary capacity; a broker or dealer registered pursuant to section

15 of the Securities Exchange Act of 1934; an insurance company as defined in section 2(a)(13) of the Act; an investment company

registered under the Investment Company Act of 1940 or a business development company as defined in section 2(a)(48) of that

Act; a Small Business Investment Company licensed by the U.S. Small Business Administration under section 301(c) or (d) of

the Small Business Investment Act of 1958; any plan established and maintained by a state, its political subdivisions, or

any agency or instrumentality of a state or its political subdivisions, for the benefit of its employees, if such plan has

total assets in excess of $5,000,000; any employee benefit plan within the meaning of the Employee Retirement Income Security

Act of 1974 if the investment decision is made by a plan fiduciary, as defined in section 3(21) of such act, which is either

a bank, savings and loan association, insurance company, or registered investment adviser, or if the employee benefit plan

has total assets in excess of $5,000,000 or, if a self-directed plan, with investment decisions made solely by persons that

are accredited investors. |

| |

[__] |

a

private business development company as defined in section 202(a)(22) of the Investment Advisors Act of 1940. |

| |

[_X_] |

a

corporation, partnership, Massachusetts business trust, or nonprofit organization within the meaning of Section 501(c)(3)

of the Internal Revenue Code, in each case not formed for the specific purpose of acquiring the securities being offered and

with total assets in excess of $5,000,000. |

| |

[__] |

a

trust with total assets in excess of $5,000,000, not formed for the specific purpose of acquiring the Note, whose purchase

is directed by a “sophisticated investor” as defined in Regulation 506(b)(2)(ii) under the Act. |

| |

[__] |

an

entity in which all of the equity owners are “accredited investors” within one or more of the above categories. |

(b) Experience.

The Holder is sufficiently experienced in financial and business matters to be capable of evaluating the merits and risks of its

investments, and to make an informed decision relating thereto, and to protect its own interests in connection with the purchase

of the Note.

(c) Own

Account. The Holder is purchasing the Note as principal for its own account, for investment purposes only and not with an

intent or view towards further sale or distribution (as such term is used in Section 2(11) of the Securities Act) thereof, and

has not pre-arranged any sale with any other person and has no plans to enter into any such agreement or arrangement.

(d) Exemption.

The Holder understands that the offer and sale of the Note is not being registered under the Securities Act or any state securities

laws and is intended to be exempt from registration provided by Rule 506 promulgated under Regulation D and/or Section 4(a)(2)

of the Securities Act;

(e) Importance

of Representations. The Holder understands that the Note are being offered and sold to it in reliance on an exemption from

the registration requirements of the Securities Act, and that the Borrower is relying upon the truth and accuracy of the representations,

warranties, agreements, acknowledgments and understandings of the Holder set forth herein in order to determine the applicability

of such safe harbor and the suitability of the Holder to acquire the Note;

(f) No

Registration. The Note have not been registered under the Securities Act or any state securities laws and may not be transferred,

sold, assigned, hypothecated or otherwise disposed of unless registered under the Securities Act and applicable state securities

laws or unless an exemption from such registration is available (including, without limitation, under Rule 144 of the Securities

Act, as such rule may be amended, or any similar rule or regulation hereafter adopted by the Commission having substantially the

same effect (“Rule 144”)). The Holder represents and warrants and hereby agrees that all offers and sales of the Note

and the Note shall be made only pursuant to such registration or to such exemption from registration.

(g) Risk.

The Holder acknowledges that the purchase of the Note involves a high degree of risk, is aware of the risks and further acknowledges

that it can bear the economic risk of the Note, including the total loss of its investment. The Holder has adequate means of providing

for its financial needs and foreseeable contingencies and has no need for liquidity of its investment in the Note for an indefinite

period of time.

(h) Borrower

Information. The Holder and its representatives have received all the documents requested by the Holder, have carefully reviewed

them and understand the information contained therein.

(i) Independent

Investigation. The Holder, in making the decision to purchase the Note subscribed for, has relied upon independent investigations

made by it and its representatives, if any, and the Holder and such representatives, if any, have prior to any sale to it been

given access and the opportunity to examine all material contracts and documents relating to this investment and an opportunity

to ask questions of, and to receive answers from, the Borrower or any person acting on its behalf concerning the terms and conditions

of this investment. The Holder and its advisors, if any, have been furnished with access to all materials relating to the business,

finances and operation of the Borrower and materials relating to the offer and sale of the Note which have been requested. The

Holder and its advisors, if any, have received complete and satisfactory answers to any such inquiries.

(j) No

Recommendation or Endorsement. The Holder understands that no federal, state or other regulatory authority has passed on or

made any recommendation or endorsement of the Note. Any representation to the contrary is a criminal offense.

(k) No

Representation. In evaluating the suitability of an investment in the Borrower, the Holder has not relied upon any representation

or information (oral or written) other than as stated in the Note.

(l) No

Tax, Legal, Etc. Advice. The Holder is not relying on the Borrower or any of its employees or agents with respect to the legal,

tax, economic and related considerations of an investment in the Note, and the Holder has relied on the advice of, or has consulted

with, only its own advisers.

(m) No

Advertisement or General Solicitation. Holder acknowledges that it is not aware of, is in no way relying on, and did not become

aware of the offering of the Note through or as a result of any form of general solicitation or general advertising, including,

without limitation, any article, notice, advertisement or other communication published in any newspaper, magazine, or similar

media or broadcast over television or radio, or through any seminar or meeting whose attendees have been invited by any general

solicitation or general advertising.

| Amarantus Bioscience Holdings, Inc. |

|

| |

|

|

| By: |

|

|

| |

Gerald Commissiong, President & CEO |

|

Address:

655 Montgomery Street

San

Francisco, CA 94111

Email

Address: gerald.commissiong@amarantus.com

Fax:

______________________________

Tax

ID: ____________________________

__________________________________

Date

12

Exhibit 99.1

Avant

Diagnostics and Amarantus Diagnostics to Combine Operations With Theranostics Health

Companies

to hold a Conference Call to discuss the business combination today, March 7, 2015 at 4:30pm ET

SCOTTSDALE,

Arizona, SAN FRANCISCO and GAITHERSBERG, Maryland, March 7, 2016 /PRNewswire/ --

Highlights

of Business Combination

| |

● |

Amarantus

Diagnostics and Theranostics Health operations to consolidate into Avant Diagnostics (AVDX) |

| |

● |

Theranostics

Health customer list includes 7 of the top 10 pharmaceutical companies with estimated pharma services revenue of over $1.5

million in 2015 expected to grow significantly in the coming years using |

| |

● |

Combined

Company to forward rich pipeline of Oncology and Neurology diagnostics with 3 proprietary diagnostic tests for ovarian cancer

(OvaDx®), multiple sclerosis (MSPrecise®) and Alzheimer's disease (LymPro Test®) CLIA-enabling validation studies

for OvaDx® MSPrecise® and LymPro Test® expected to initiate in 2016 to support product launch in 2017 |

| |

● |

Scientific

focus is on becoming recognized leader in field of cell cycle biology research with Theralink® for oncology and LymPro

Test® for Alzheimer's |

Avant

Diagnostics, Inc. (AVDX), a biotechnology company focused on the development of oncology based diagnostics, and Amarantus

Diagnostics, Inc. ("Amarantus Diagnostics") a wholly-owned subsidiary of Amarantus BioScience Holdings, Inc.

("Amarantus BioScience") (AMBS), today announced that the companies have jointly entered into a letter of intent

for Avant to acquire assets and certain liabilities of Theranostics Health Incorporated ("THI"), adding key CLIA

laboratory and intellectual property capabilities to Avant's previously announced letter of intent to merge with Amarantus Diagnostics

(collectively, the "Transactions"). THI currently generates over $1.5M in services revenue from some of the world's

leading biopharmaceutical companies, including 7 of the top 10 pharmaceutical companies by revenue. The companies will be holding

a conference call to discuss the business combination today at 4:30 PM ET. To access the conference call please dial 215-383-1625

or toll free 800-356-8278; access code 135394.

Under

the terms of the letter of intent, Avant shall issue to THI 25 million shares of its common stock upon the closing. Amarantus

BioScience has provided a convertible note of $400,000 to THI to facilitate the transaction that will be assumed by Avant upon

closing of the transactions. As previously disclosed, Avant plans to issue 80 million shares of its common stock to Amarantus

Biosciences upon completion of its merger with Amarantus Diagnostics. The Transactions are expected to close in the first half

of 2016, and are subject to customary closing conditions.

"THI

is a leader in the area of signal transduction biology, where they have been able to attract an A-list of pharmaceutical customers

collaborating with the company to evaluate the therapeutic benefit and potential of their drug candidates using THI's proprietary

assays," said Gerald E. Commissiong, President & CEO of Amarantus. "In addition, THI has a CLIA lab where Amarantus'

Diagnostics has established operations over the course of the first quarter that will allow for CLIA validation and commercial

launch of the combined company's suite of high-value, proprietary diagnostics in the areas of oncology and neurology. THI's sales

channel into the pharmaceutical industry will provide important leverage for the combined company to market the LymPro Test®

for Alzheimer's disease. We could not have picked a better partner to bring Avant and Amarantus' Diagnostics leading-edge intellectual

property in diagnostics and biomarkers to the market."

"Key

to the business case for the merged company is THI's impressive pharma services revenue base and sales channel in the area of

cell signaling biology," said Gregg Linn, President & CEO of Avant Diagnostics. "In addition to this, THI's CLIA

laboratory provides the combined company with the infrastructure to launch OvaDx®, MSPrecise® and LymPro Test in a regulatory

compliant environment that has been vetted by some of the world's top pharmaceutical companies. THI's laboratory meets the highest

quality standards under CLIA/CAP which should give both our pharmaceutical and commercial customers great confidence in the information

generated in THI's laboratory."

THI's

core business is centered on providing pharmaceutical and biotechnical companies access to its technology for quantitatively measuring

the activation status of key proteins and signal transduction pathways that are dysregulated in multiple disease processes via

its Reverse-phase Protein Array (RPPA) platform. THI is experienced in running CAP-accredited assays in its CLIA laboratory for

predicting response to therapies in difficult to treat cancers. THI believes that, while genomic approaches may identify

potential activating mutations in diseased tissues, measuring the actual activation status of the protein drug targets and the

signal transduction pathways that they regulate, provides physicians with much-needed evidence that a particular therapeutic strategy

can provide benefits to the patient. THI has launched tests, TheraLink® Assays, for guiding therapeutic decisions

in breast and colorectal cancer. The post-merger Avant Diagnostics will further build on its recognized scientific expertise in

the area of cell cycle biology to increase its pharma services revenues and provide therapy guiding diagnostics in difficult to

treat conditions.

"After

an extensive evaluation of the diagnostics market, we believe that we have found the best potential partners in Avant and Amarantus,"

commented Glenn Hoke, PhD, Chief Executive Officer of THI. "It is clear that we will be expanding our CLIA offerings with

much needed tests such as OvaDx in cancer and MSPrecise in neurology, while also providing significant additional pharma services

business development opportunities with the LymPro Test. With platforms in microarray proteomics, ELISA, flow cytometry and 'next-gen'

sequencing, the combined company's capabilities will allow it to add cross-platform diagnostics as we grow into the future."

Post-merger

Avant CLIA Pipeline

1.

OvaDx® immuno-oncology diagnostic assay is a protein-based test, potentially representing a significant improvement

in the screening and diagnosis for ovarian cancer. OvaDx offers the possibility to make a clear improvement to the current diagnostic

standard that generates over $2B in sales annually by substantially improving the accuracy of diagnosis, and allowing for a more

effective therapeutic triaging and intervention strategy. Longer term, the assay could become a much-needed early screening tool

for all women as part of a standard screening paradigm. It is estimated that the market opportunity for OvaDx is $50M annually

as a diagnostic test for ovarian cancer, and that this opportunity could expand to over $2B annually if it were to be approved

as a generalized screening and/or monitoring tool.

2.

MSPrecise® neuroimmunology-based next-gen sequencing diagnostic assay for multiple sclerosis (MS) offers a potentially

highly accurate and actionable result that will substantially improve upon the high mis-diagnosis rate of this degenerative disease.

More specifically, MS has an approximately 40% misdiagnosis rate, meaning that improving diagnostic accuracy will be a key driver

to adopt more effective therapeutic strategies that will reduce costs for payers and improve outcomes for patients. The

potential market opportunity for MSPrecise as a diagnostic for multiple sclerosis is over $200M annually, and could increase to

over $1B if it were to be approved as a monitoring tool to measure the efficacy of drug treatment.

3.

LymPro Test® neuroimmunology-based flow cytometry assay for Alzheimer's Disease (AD), offers an early, accurate, and scalable

diagnostic result for physicians seeking to provide the best information and treatment plan for patients from the earliest stages

of this devastating disease. AD diagnosis has an approximately 30% misdiagnosis rate. AD costs the healthcare system approximately

$200 B in direct costs per year, and these costs are expected to exceed $1.2T by 2050 according to the current spending and demographics

trajectories. The estimated market opportunity for LymPro is over $3B in a commercial setting as a generalized screening test

for patients at their initial Medicare enrollment visit.

Post-merger

Avant Pharma Services Pipeline

| |

1. |

TheraLink®

Assay includes phospho-activation markers for known

drug targets of over 30 approved molecular targeted therapies for treating breast cancer patients. In addition, the TheraLink®

Assay panel includes other biomarkers that have utility in directing patients to clinical trials involving new investigational

agents. Research programs and clinical trials are underway at leading institutions to validate the TheraLink® Assay panel

for managing cancer treatment decision-making in other clinically significant areas such as colorectal, lung, pancreatic and

ovarian cancer. |

| |

|

|

| |

2. |

LymPro

Test® neuroimmunology-based flow cytometry assay

for Alzheimer's Disease (AD), offers an early, accurate, and scalable diagnostic result for physicians seeking to provide

the best information and treatment plan for patients from the earliest stages of this devastating disease. It is estimated

research and development activity spending exceeds $2B annually in Alzheimer's. It is estimated the market opportunity for

LymPro in the investigational setting could be over $100M annually. LymPro is already being made available to the AD research

and development community under an Investigational Use Only (IUO) designation via a services agreement between Amarantus and

ICON Central Laboratories. The combined company expects to maintain the relationship with ICON and expand research activities

in Alzheimer's. |

About

Theranostics Health

THI

is a leading developer of proteomic technologies for measuring the activation status of key signaling pathways that are instrumental

in the development of companion diagnostics for molecular-targeted therapies. THI has used these proteomic technologies to support

the drug development programs of most major pharmaceutical and biotechnology drug development companies. THI is also providing

these testing capabilities to clinical oncologists to advance personalized medicine through its TheraLink® Diagnostic Assays.

For more information please visit http://www.theranosticshealth.com.

About

Avant Diagnostics, Inc.

Avant

is a medical diagnostic technology company that specializes in biomarker tests that are based on querying large panels of proteins

with exquisite precision. Avant's first test, OvaDx®, is proposed for use in monitoring women diagnosed previously with ovarian

cancer. OvaDx® is a sophisticated microarray-based test that measures the activation of the immune system in blood samples

in response to ovarian tumor cell development. Pre-clinical research studies with OvaDx® indicate high sensitivity and specificity

for all types and stages of ovarian cancer including stage IA-IV borderline serous, clear cell, endometrioid, mixed epithelial,

mucinous, serous, and ovarian adenocarcinoma. Upon FDA 510(k) clearance, Avant intends to sell or license OvaDx®. Avant intends

to utilize its public company stage to expand its portfolio of diagnostic tests in the future.

About

Amarantus BioScience Holdings, Inc.

Amarantus

BioScience Holdings (AMBS) is a biotechnology company developing treatments and diagnostics for diseases in the areas of neurology,

regenerative medicine and orphan diseases. AMBS' Therapeutics division has development rights to eltoprazine, a Phase 2b-ready

small molecule indicated for Parkinson's disease levodopa-induced dyskinesia, adult ADHD and Alzheimer's aggression, and owns

the intellectual property rights to a therapeutic protein known as mesencephalic-astrocyte-derived neurotrophic factor (MANF)

and is developing MANF-based products as treatments for brain and ophthalmic disorders. More recently, AMBS acquired the rights

to the Engineered Skin Substitute program (ESS), a regenerative medicine-based approach for treating severe burns with full thickness

autologous skin grown in tissue culture. ESS is entering Phase 2 clinical studies under a CRADA agreement with the US Army. AMBS'

Diagnostics division owns the rights to MSPrecise®, a proprietary next-generation DNA sequencing (NGS) assay for

the identification of patients with relapsing-remitting multiple sclerosis (RRMS) at first clinical presentation, has an exclusive

worldwide license to the Lymphocyte Proliferation test (LymPro Test®) for Alzheimer's disease, which was developed

by Prof. Thomas Arendt, Ph.D., from the University of Leipzig, and owns intellectual property for the diagnosis of Parkinson's

disease (NuroPro). AMBS also owns the discovery of neurotrophic factors (PhenoGuard™) that led to MANF's discovery.

For

further information please visit http://www.Amarantus.com, or connect with the Company on Facebook, LinkedIn,

Twitter and Google+.

Forward-Looking

Statements

Certain

statements, other than purely historical information, including estimates, projections, statements relating to our business plans,

objectives, and expected operating results, and the assumptions upon which those statements are based, are forward-looking statements.

These forward-looking statements generally are identified by the words "believes," "project," "expects,"

"anticipates," "estimates," "intends," "strategy," "plan," "may,"

"will," "would," "will be," "will continue," "will likely result," and similar

expressions. Forward-looking statements are based on current expectations and assumptions that are subject to risks and uncertainties

which may cause actual results to differ materially from the forward-looking statements. Our ability to predict results or the

actual effect of future plans or strategies is inherently uncertain. Factors which could have a material adverse effect on our

operations and future prospects on a consolidated basis include, but are not limited to: changes in economic conditions, legislative/regulatory

changes, availability of capital, interest rates, competition, and generally accepted accounting principles. These risks and uncertainties

should also be considered in evaluating forward-looking statements and undue reliance should not be placed on such statements.

Investor

and Media Contact:

Ascendant Partners, LLC

Fred Sommer

+1-732-410-9810

fred@ascendantpartnersllc.com

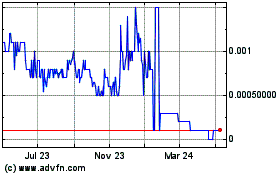

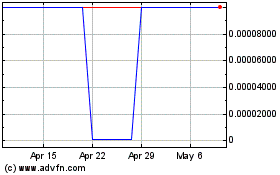

Amarantus Bioscience (CE) (USOTC:AMBS)

Historical Stock Chart

From Mar 2024 to Apr 2024

Amarantus Bioscience (CE) (USOTC:AMBS)

Historical Stock Chart

From Apr 2023 to Apr 2024