UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported) March 3, 2016

KOPIN CORPORATION

(Exact Name of Registrant as Specified in Charter)

|

|

|

|

|

| DELAWARE |

|

000-19882 |

|

04-2833935 |

| (State or Other Jurisdiction

of Incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

125 North Drive, Westborough, MA 01581

(Address of Principal Executive

Offices) (Zip Code)

Registrant’s telephone number, including area code (508) 870-5959

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the

following provisions (see General Instruction A.2 below):

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Item 2.02. Results of Operations and Financial Condition.

Kopin Corporation issued a press release on March 3, 2016, a copy of which is attached as Exhibit 99.1 to this report and incorporated

herein by this reference, in which the Company announced financial results for the fourth quarter and year ended December 26, 2015. This information shall not be deemed to be “filed” for the purposes of Section 18 of the

Securities Exchange Act of 1934, as amended, and shall not be deemed to be incorporated by reference in any filing under the Securities Act of 1933, as amended.

Item 9.01. Financial Statements and Exhibits.

| 99.1 |

Press Release dated March 3, 2016, entitled, “Kopin Corporation Provides Business Update and Fourth Quarter and Full Year 2015 Operating Results”. |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

KOPIN CORPORATION |

|

|

|

|

| Dated: March 3, 2016 |

|

|

|

By: |

|

/s/ Richard A. Sneider |

|

|

|

|

|

|

|

|

Richard A. Sneider Treasurer and Chief

Financial Officer (Principal Financial and Accounting Officer) |

EXHIBIT INDEX

|

|

|

| Exhibit |

|

Description |

|

|

| 99.1 |

|

Press Release dated March 3, 2016, entitled, “Kopin Corporation Provides Business Update and Fourth Quarter and Full Year 2015 Operating Results” |

Exhibit 99.1

KOPIN PROVIDES BUSINESS UPDATE AND FOURTH

QUARTER AND FULL YEAR 2015 OPERATING RESULTS

| |

• |

|

Company Enjoys Very Successful CES Event With 15 Companies Displaying Products with Kopin Components |

| |

• |

|

Tier One Company Launches Health & Fitness Product with Kopin Wearable technology at 2016 CES |

| |

• |

|

Solos™ Smart Eyewear and Whisper Chip™ on Track for Summer Release |

| |

• |

|

Wearables Revenue doubled in 2015 |

| |

• |

|

Company Maintains Very Strong Financial Position |

WESTBOROUGH, Mass.—March 3,

2016—(BUSINESS WIRE)—Kopin Corporation (NASDAQ: KOPN), a leading developer of innovative wearable computing technologies and solutions, today provided an update on its business initiatives and reported financial results for the fourth

quarter and full year ended December 26, 2015.

“We made solid progress in 2015 in executing our wearables strategy, with technology

development, customer acquisition and product launches,” said Dr. John C.C. Fan, President and CEO of Kopin. “We ended the year with the leading headset manufacturers across enterprise, consumer and military all offering wearable

products based on our technology. Our customers range from Rockwell Collins for military avionic helmets, to Fujitsu for enterprise applications, and to Intel/Recon for consumer applications. The headset products target second screen applications,

as in the case of Fujitsu’s repair and maintenance product, to augmented reality (AR) applications, such as the F-35 fighter pilot helmet, and virtual reality (VR) applications, such as First Person Viewers (FPVs) used with drones. These FPVs

are relatively new to the market but give a hint of where virtual reality is going, as they provide the drone user with a first person view.”

“We maintained our strong momentum into 2016 with a successful Consumer Electronics Show (CES), highlighted by 15 customers demonstrating products

featuring Kopin wearable components. We also displayed our own Solos product, an AR headset designed for competitive cyclists to monitor their activities and enhance performance. Solos smart eyewear provides the user with a see-through image of data

being transmitted from sensors, on or near the athlete or from the cloud. Solos also demonstrates the vast progress we have made over the last few years. When we introduced the Golden-i® in

2011, our first wearable headset for enterprise applications, it weighed over 600 grams. Today Solos, with similar functionality but designed for consumers, weighs approximately 60 grams and

looks like a fashionable pair of sunglasses.”

“CES was also the first time we gave public demonstrations of the Whisper™ technology, our speech enhancement technology. Since CES we have been very actively engaging with Tier One companies on the Whisper technology and our new Whisper Chip. This will be a very

differentiable product and would be used with many wearable devices as a well as other applications. We believe voice will be the next touch and Whisper technology will play a key role.”

“In 2015, our revenues from sale of products for the wearable market doubled over 2014 to approximately $12 million. As more companies adopt Kopin’s

view that the headset is the next smartphone and voice will someday replace touch, we expect more new customers and industries to develop. We have been very active in new design-in activities, including a product for public safety which our customer

is expected to debut in the second quarter of this year. Furthermore Solos and Whisper Chips are on track for a summer release to provide additional revenue growth, which until now has been based on our display and display modules. Now our heavy

lifting of technology and product development is finishing as planned and we are entering the marketing and sales phases. With our extensive patent portfolio, design wins with Tier One customers and our strong balance sheet, we are very well

positioned to take advantage of the growing and potentially huge wearable market,” concluded Dr. Fan.

Fourth Quarter Financial Results

Total revenues for the fourth quarter ended December 26, 2015, were $4.6 million, compared with $10.6 million for the fourth quarter of 2014.

Net loss for the fourth quarter of 2015 was $7.0 million, or $0.11 per share, compared with net loss of $5.3 million, or $0.08 per share, for the same

period of 2014.

Full Year Financial Results

Total

revenues for the 12 months ended December 26, 2015, were $32.1 million, compared with $31.8 million for the fiscal year 2014.

Research and development expenses for 2015 were $17.6 million compared with $20.7 million for 2014.

Selling, general and administrative expenses were $18.1 million for 2015 as compared with approximately $19.9 million for 2014.

Net loss for the 12 months ended 2015 was $14.7 million, or $0.23 per share, compared with net loss of $28.2 million, or $0.45 per share, for 2014. Included

in the 2015 results of operations was a $9.2 million gain on the sale of investments. Included in the 2014 results of operations was a $1.3 million write-down of investments.

We have maintained our strong financial position. Kopin’s cash and equivalents and marketable securities was $80.7 million at December 26,

2015 as compared to $90.9 million at December 27, 2014. In addition, on January 15, 2016 we received $15 million as the final installment of the sale of our III-V operation and investment in Kopin Taiwan Corporation. Kopin has no

long-term debt.

All amounts above are estimates and readers should refer to our Form 10-K for the year ended December 26, 2015, for final

disposition.

Financial Results Conference Call

In

conjunction with its year end 2015 financial results, Kopin will host a teleconference call for investors and analysts at 5:00 a.m. ET today. To participate, please dial (877) 709-8150 (U.S. and Canada) or

(201) 689-8354 (International). The call will also be available as a live and archived audio webcast on the “Investors” section of the Kopin website, www.kopin.com.

About Kopin

Kopin Corporation is a leading

developer and provider of innovative wearable technologies and solutions for integration into head-worn computing and display systems to military, industrial and consumer customers. Kopin’s technology portfolio includes ultra-small displays,

optics, speech enhancement technology, system and hands-free control software, low-power ASICs, and ergonomically designed smart headset reference systems. Kopin’s proprietary components and technology are protected by more than 300 global

patents and patents pending. For more information, please visit Kopin’s website at www.kopin.com.

Kopin, Whisper, Solos and Golden-i are trademarks of Kopin Corporation.

Contact:

Kopin Corporation

Richard Sneider, 508-870-5959

Treasurer and Chief

Financial Officer

Richard_Sneider@kopin.com

or

Market Street Partners

Joann

Horne, 415-445-3233

JHorne@marketstreetpartners.com

Forward-Looking Statements

Statements in this press

release may be considered “forward-looking” statements under the “Safe Harbor” provisions of the Private Securities Litigation Reform Act of 1995. These include, without limitation, statements relating to our statement that FPVs

give a hint of where virtual reality is going; our expectation that Solos smart eyewear and Whisper chip on track for a summer release; our belief that the Whisper Chip will be a very differentiable product and used by many wearable devices as a

well as other applications; our expectation that as more companies adopt Kopin’s view that the headset is the next smartphone and voice will someday replace touch, we expect new customers and industries to develop including public safety

applications which are expected to debut in the second quarter of this year; our belief that Solos and Whisper technology products will be in the market by this summer to provide revenue growth which for now has been based on our display and display

modules; and our belief we are very well positioned to take advantage of the growing wearable market . These statements involve a number of risks and uncertainties that could cause actual results to differ materially from those expressed in the

forward-looking statements. These risks and uncertainties include, but are not limited to, the following: Solos smart eyewear and Whisper chip may not be ready for launch by the summer; the headset wearable market may take longer to develop than we

expect or it may not develop at all; we may not obtain new customers; the public safety application may not be

available in the second quarter; and the final amounts in the Company’s Form 10-K for the period ended December 26, 2015 may differ from the amounts included in the release above; it

may take longer than the Company estimates to develop products; the Company’s products may not be accepted by the market place; there may be issues that prevent the adoption or further development of the Company’s wearable computing

technologies; manufacturing, marketing or other issues may prevent either the adoption or acceptance of products; the Company might be adversely affected by competitive products and pricing; new product initiatives and other research and

development efforts may be unsuccessful; the Company could experience the loss of significant customers; costs to produce the Company’s products might increase significantly, or yields could decline; the Company’s customers might be

unable to ramp production volumes of their products, or the Company’s product forecasts could turn out to be wrong; manufacturing delays, technical issues, economic conditions or external factors may prevent the Company from achieving its

goals; and other risk factors and cautionary statements listed in the Company’s periodic reports and registration statements filed with the Securities and Exchange Commission, including the Annual Report on Form 10-K for the 12 months

ended December 27, 2014, and the Company’s subsequent filings with the Securities and Exchange Commission. You should not place undue reliance on any forward-looking statements, which are based only on information currently available

to the Company and only as of the date on which they are made. The Company undertakes no obligation to update any of these forward-looking statements to reflect events or circumstances occurring after the date of this release.

Kopin Corporation

Supplemental Information

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended |

|

|

Twelve Months Ended |

|

| |

|

December 26,

2015 |

|

|

December 27,

2014 |

|

|

December 26,

2015 |

|

|

December 27,

2014 |

|

| Display Revenues by Category (in millions) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Military Applications |

|

$ |

1.2 |

|

|

$ |

6.0 |

|

|

$ |

10.2 |

|

|

$ |

14.3 |

|

| Wearable Applications |

|

|

1.7 |

|

|

|

1.4 |

|

|

|

12.3 |

|

|

|

6.2 |

|

| Industrial Applications |

|

|

1.1 |

|

|

|

0.9 |

|

|

|

4.0 |

|

|

|

3.7 |

|

| Consumer Electronics Applications |

|

|

0.4 |

|

|

|

0.4 |

|

|

|

1.7 |

|

|

|

2.8 |

|

| Research and Development |

|

|

0.2 |

|

|

|

1.9 |

|

|

|

3.9 |

|

|

|

4.8 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total |

|

$ |

4.6 |

|

|

$ |

10.6 |

|

|

$ |

32.1 |

|

|

$ |

31.8 |

|

|

|

|

|

|

| Stock-Based Compensation Expense |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Continuing Operations |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cost of component revenues |

|

$ |

109,000 |

|

|

$ |

186,000 |

|

|

$ |

730,000 |

|

|

$ |

777,000 |

|

| Research and development |

|

|

107,000 |

|

|

|

194,000 |

|

|

|

777,000 |

|

|

|

967,000 |

|

| Selling, general and administrative |

|

|

142,000 |

|

|

|

892,000 |

|

|

|

1,639,000 |

|

|

|

3,084,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

358,000 |

|

|

$ |

1,272,000 |

|

|

$ |

3,146,000 |

|

|

$ |

4,828,000 |

|

|

|

|

|

|

| Other Financial Information |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Depreciation and amortization |

|

$ |

279,000 |

|

|

$ |

414,000 |

|

|

$ |

2,139,000 |

|

|

$ |

3,002,000 |

|

Kopin Corporation

Condensed Consolidated Statements of Operations

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended |

|

|

Twelve Months Ended |

|

| |

|

December 26,

2015 |

|

|

December 27,

2014 |

|

|

December 26,

2015 |

|

|

December 27,

2014 |

|

| Revenues: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Component revenues |

|

$ |

4,428,880 |

|

|

$ |

8,756,290 |

|

|

$ |

28,163,118 |

|

|

$ |

26,956,741 |

|

| Research and development revenues |

|

|

183,015 |

|

|

|

1,881,095 |

|

|

|

3,891,301 |

|

|

|

4,850,724 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4,611,895 |

|

|

|

10,637,385 |

|

|

|

32,054,419 |

|

|

|

31,807,465 |

|

| Expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cost of component revenues |

|

|

4,609,096 |

|

|

|

6,054,836 |

|

|

|

21,609,826 |

|

|

|

19,638,149 |

|

| Research and development |

|

|

3,878,820 |

|

|

|

5,680,298 |

|

|

|

17,631,413 |

|

|

|

20,736,021 |

|

| Selling, general and administrative |

|

|

4,081,531 |

|

|

|

4,974,597 |

|

|

|

18,134,580 |

|

|

|

19,908,020 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

12,569,447 |

|

|

|

16,709,731 |

|

|

|

57,375,819 |

|

|

|

60,282,190 |

|

|

|

|

|

|

| Loss from operations |

|

|

(7,957,552 |

) |

|

|

(6,072,346 |

) |

|

|

(25,321,400 |

) |

|

|

(28,474,725 |

) |

|

|

|

|

|

| Other income (expense), net |

|

|

895,439 |

|

|

|

635,267 |

|

|

|

10,500,776 |

|

|

|

10,378 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Loss before (provision) benefit for income taxes, equity loss in unconsolidated affiliate and net loss from noncontrolling

interest |

|

|

(7,062,113 |

) |

|

|

(5,437,079 |

) |

|

|

(14,820,624 |

) |

|

|

(28,464,347 |

) |

|

|

|

|

|

| (Provision) benefit for income taxes |

|

|

(12,500 |

) |

|

|

118,000 |

|

|

|

25,000 |

|

|

|

180,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Loss before equity loss in unconsolidated affiliate and net loss from noncontrolling interest |

|

|

(7,074,613 |

) |

|

|

(5,319,079 |

) |

|

|

(14,795,624 |

) |

|

|

(28,284,347 |

) |

|

|

|

|

|

| Equity loss in unconsolidated affiliate |

|

|

— |

|

|

|

(126,568 |

) |

|

|

(47,443 |

) |

|

|

(386,442 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net loss before (income) loss attributable to noncontrolling interest |

|

|

(7,074,613 |

) |

|

|

(5,445,647 |

) |

|

|

(14,843,067 |

) |

|

|

(28,670,789 |

) |

|

|

|

|

|

| Net loss attributable to noncontrolling interest |

|

|

113,557 |

|

|

|

143,401 |

|

|

|

149,651 |

|

|

|

458,745 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net loss |

|

$ |

(6,961,056 |

) |

|

$ |

(5,302,246 |

) |

|

$ |

(14,693,416 |

) |

|

$ |

(28,212,044 |

) |

|

|

|

|

|

| Net loss per share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic |

|

$ |

(0.11 |

) |

|

$ |

(0.08 |

) |

|

$ |

(0.23 |

) |

|

$ |

(0.45 |

) |

| Diluted |

|

$ |

(0.11 |

) |

|

$ |

(0.08 |

) |

|

$ |

(0.23 |

) |

|

$ |

(0.45 |

) |

|

|

|

|

|

| Weighted average number of common shares outstanding: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic |

|

|

63,607,538 |

|

|

|

62,734,237 |

|

|

|

63,465,797 |

|

|

|

62,638,675 |

|

| Diluted |

|

|

63,607,538 |

|

|

|

62,734,237 |

|

|

|

63,465,797 |

|

|

|

62,638,675 |

|

Kopin Corporation

Condensed Consolidated Balance Sheets

(Unaudited)

|

|

|

|

|

|

|

|

|

| |

|

December 26,

2015 |

|

|

December 27,

2014 |

|

| ASSETS |

|

|

|

|

|

|

|

|

| Current assets: |

|

|

|

|

|

|

|

|

| Cash and marketable securities |

|

$ |

80,710,780 |

|

|

$ |

90,858,936 |

|

| Accounts receivable, net |

|

|

1,574,973 |

|

|

|

3,802,324 |

|

| Inventory |

|

|

2,512,473 |

|

|

|

4,081,886 |

|

| Prepaid and other current assets |

|

|

1,357,996 |

|

|

|

1,181,474 |

|

| Note receivable |

|

|

15,000,000 |

|

|

|

— |

|

|

|

|

|

|

|

|

|

|

| Total current assets |

|

|

101,156,222 |

|

|

|

99,924,620 |

|

|

|

|

| Land, equipment and improvements, net |

|

|

2,677,103 |

|

|

|

4,589,421 |

|

| Goodwill and intangible assets |

|

|

946,082 |

|

|

|

1,593,210 |

|

| Property and plant, held for sale |

|

|

819,263 |

|

|

|

— |

|

| Other assets |

|

|

461,416 |

|

|

|

1,900,828 |

|

| Note receivable |

|

|

— |

|

|

|

14,933,335 |

|

|

|

|

|

|

|

|

|

|

| Total assets |

|

$ |

106,060,086 |

|

|

$ |

122,941,414 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| LIABILITIES AND STOCKHOLDERS' EQUITY |

|

|

|

|

|

|

|

|

| Current liabilities: |

|

|

|

|

|

|

|

|

| Accounts payable |

|

$ |

3,959,704 |

|

|

$ |

5,503,734 |

|

| Accrued expenses |

|

|

4,702,574 |

|

|

|

5,870,719 |

|

| Deferred income taxes |

|

|

1,207,000 |

|

|

|

1,282,000 |

|

| Billings in excess of revenue earned |

|

|

1,407,566 |

|

|

|

586,471 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total current liabilities |

|

|

11,276,844 |

|

|

|

13,242,924 |

|

|

|

|

| Lease commitments |

|

|

298,463 |

|

|

|

311,187 |

|

|

|

|

| Total Kopin Corporation stockholders' equity |

|

|

94,740,875 |

|

|

|

109,846,959 |

|

| Noncontrolling interest |

|

|

(256,096 |

) |

|

|

(459,656 |

) |

|

|

|

|

|

|

|

|

|

| Total stockholders' equity |

|

|

94,484,779 |

|

|

|

109,387,303 |

|

|

|

|

|

|

|

|

|

|

| Total liabilities and stockholders' equity |

|

$ |

106,060,086 |

|

|

$ |

122,941,414 |

|

|

|

|

|

|

|

|

|

|

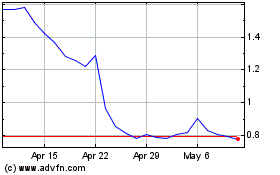

Kopin (NASDAQ:KOPN)

Historical Stock Chart

From Mar 2024 to Apr 2024

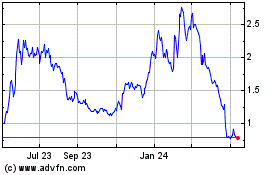

Kopin (NASDAQ:KOPN)

Historical Stock Chart

From Apr 2023 to Apr 2024