UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): March 3, 2016

Alamo Group Inc.

(Exact name of registrant as specified in its charter)

|

| | |

State of Delaware | 0-21220 | 74-1621248 |

(State or other jurisdiction of incorporation) | (Commission File No.) | (IRS Employer Identification No.) |

1627 E. Walnut Seguin, Texas 78155

(Address of Principal executive offices)

|

| |

Registrant's telephone number, including area code: | (830) 379-1480 |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 2.02 Results of Operations and Financial Condition

On March 3, 2016, Alamo Group Inc. issued a press release announcing, among other things, financial results for the fourth quarter and year ended December 31, 2015. A copy of the press release is filed as Exhibit 99.1 to this Current Report on Form 8-K. The foregoing description is qualified by reference to such exhibit.

The information furnished in this report, including the exhibit, shall not be deemed to be incorporated by reference into any of Alamo Group filings with the SEC under the Securities Act of 1933, except as shall be expressly set forth by specific reference in any such filing, and shall not be deemed to be "filed" with the SEC under the Securities Exchange Act of 1934.

Item 9.01 Financial Statements and Exhibits

Exhibit 99.1 - Press Release dated March 3, 2016.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

| |

March 3, 2016 | By: /s/ Robert H. George |

| Robert H. George, |

| Vice President-Administration |

EXHIBIT INDEX

|

| |

Exhibit No. | Description |

99.1 | Press release |

|

| | |

| For: | Alamo Group Inc. |

| | |

| Contact: | Robert H. George |

| | Vice President |

| | 830-372-9621 |

For Immediate Release | | |

| | Financial Relations Board |

| | Marilynn Meek |

| | 212-827-3773 |

ALAMO GROUP ANNOUNCES 2015

FOURTH QUARTER AND YEAR END RESULTS

SEGUIN, Texas, March 3, 2016 - Alamo Group Inc. (NYSE: ALG) today reported results for the fourth quarter and year ended December 31, 2015.

Highlights

| |

• | Net sales for the fourth quarter of $224.4 million, slightly above prior year's record level |

| |

• | Industrial Division up 7.5% |

| |

• | Agricultural Division down (6.1)% |

| |

• | European Division down (12.6)% |

| |

• | Net income for the fourth quarter of $11.4 million, slightly above prior year's record level |

| |

• | Earnings per share for the fourth quarter of $0.99, down (1)% |

| |

• | Record net sales for full year of $879.6 million, up 5% |

| |

• | Record net income for full year of $43.2 million, up 5% |

| |

• | Record earnings per share for full year of $3.76, up 10% |

Results for the Quarter

Net sales for the fourth quarter of 2015 were $224.4 million compared to net sales of $223.9 million for the fourth quarter of 2014, an increase of 0.2%. Net income for the quarter was $11.4 million, or $0.99 per diluted share, versus net income of $11.4 million, or $1.00 per diluted share, for the comparable

PAGE 2

ALAMO GROUP ANNOUNCES 2015 FOURTH QUARTER AND YEAR END RESULTS

period in 2014. The sales for the quarter were negatively impacted by $7.3 million in currency translation effects as a result of the stronger U.S. dollar compared to other currencies in which the Company conducts business(1). The results for the quarter also include the effects of the acquisition of Herder in Brazil which occurred in March, 2015. Herder accounted for $0.4 million in net sales and a net loss of $(0.04) million for the quarter(1). In addition, there were two significant events in Alamo’s European Division which affected the results for the quarter, both of which occurred in December. The first was a sale of a portion of excess land in the U.K. which resulted in a net gain after tax of $2.5 million and the second was an after tax reserve of $1.9 million that relates to a restructuring and consolidation of the Company’s Faucheux operation in France(1). A summary outlining the effects these items had on the Company’s results is included in the attachments to this earnings release. Excluding the acquisition of Herder and the two events in Europe, net sales for the quarter were $224.0 million and net income was $10.8 million(1).

Full Year Results

For the full year 2015, net sales were $879.6 million versus $839.1 million in 2014, an increase of 5%. Net income for the year was $43.2 million, or $3.76 per diluted share, compared to $41.2 million, or $3.42 per diluted share in 2014, an increase of 5% in net earnings and 10% in earnings per share. Net sales and net income for both the fourth quarter and full year of 2015 were records for the Alamo Group. The results for the full year were affected by the previously referenced events in the fourth quarter and additionally by the acquisition of the units of Specialized Industries, which was completed in May, 2014; the acquisition of Fieldquip in Australia in April, 2014; and, the acquisition of Kelland’s in the U.K. in April, 2014. A summary of the effects these factors had on the Company’s full year results is also included in the attachments.

Sales by Division

Alamo Group’s Industrial Division net sales in the fourth quarter of 2015 were $135.9 million compared to $126.5 million in the fourth quarter of 2014, an increase of 8%. For the full year the Division’s net sales were $498.8 million in 2015 compared to $436.0 million in 2014, an increase of 14%. The acquisition of the units of Specialized was a major contributor to the full year increase, but had no effect on the fourth quarter increase which was the result of internal growth as the Division had a strong finish to the year, particularly in its snow removal, mowing and street sweeping equipment.

Alamo’s Agricultural Division recorded net sales of $47.9 million in the fourth quarter of 2015 compared to $51.0 million in the prior year, a decrease of 6%. The Division’s full year net sales were $208.3 million in 2015 versus $214.3 million in 2014, a decrease of 3%. Excluding the effects of the acquisition of Herder, sales in the Division were $47.5 million in the fourth quarter and $205.7 million for the full year(1). Despite the continuing weakness in the overall agricultural market, sales in the Division held up well and margins continued to improve as a result of our manufacturing initiatives.

Alamo Group’s European Division net sales in the fourth quarter of 2015 were $40.6 million, a decrease of 13% versus net sales of $46.4 million in the previous year. For the full year net sales in the Division were $172.6 million, 9% below the $188.7 million achieved in 2014. The decreases were primarily related to changes in exchange rates, though the overall European market remains weak and the agricultural sector, as in North America, is down.

Ron Robinson, Alamo Group’s President and CEO commented, “We are pleased with Alamo’s progress in 2015. While many of our markets are weak and we continue to be impacted by the effects of the strong U.S. dollar on international sales, we managed to improve net sales and net income over the record levels achieved in the previous year with steadily improving margins.

“In many ways it was a complicated year as we worked on integrating recent acquisitions, began a restructuring of one of our operations in France and continued to manage through the effects of the strong U.S. dollar and the weak worldwide agricultural market. Yet, we remained focused on our ongoing programs to improve our manufacturing efficiencies, raise our margins, continue to invest in new products and work to improve our asset utilization. And, although we only completed one small acquisition in 2015, we remain active in this area and are continuously evaluating new opportunities, as acquisitions remain an ongoing element of our strategy.

PAGE 3

ALAMO GROUP ANNOUNCES 2015 FOURTH QUARTER AND YEAR END RESULTS

“These developments give us confidence as we enter 2016. While the headwinds in both markets and currencies are likely to continue to affect us, we feel this should be another positive year for our Company, though we are concerned about the fragile state of the overall global economy. We started the year with a healthy backlog and feel the outlook for most of our operations remains steady. We do not see a lot of strengthening in areas such as the agricultural sector, but we do not foresee further declines like those that impacted the market in 2015. And, though we do not believe the U.S. dollar will weaken in 2016, we should have better comparables to 2015 since the major currency changes happened over a year ago. As a result, we are optimistic about the prospects for Alamo Group, feel confident about our ability to deal with short term fluctuations in our markets and remain focused on Alamo’s long term growth.”

Earnings Conference Call

Alamo Group will host a conference call to discuss fourth quarter and year end 2015 financial results on Friday, March 4, 2016 at 11:00 a.m. Eastern (10 a.m. Central, 9:00 a.m. Mountain and 8:00 a.m. Pacific). Hosting the call will be members of senior management.

Individuals wishing to participate in the conference call should dial 888-329-8893 (domestic) or 719-325-2281 (internationally). For interested individuals unable to join the call, a replay will be available until Friday, March 11, 2016 by dialing 888-203-1112 (domestic) or 719-457-0820 (internationally), passcode 3720549.

The live broadcast of Alamo Group Inc.’s quarterly conference call will be available online at the Company's website, www.alamo-group.com (under “Investor Relations/Events & Presentations”) on Friday, March 4, 2016, beginning at 11:00 a.m. ET. The online replay will follow shortly after the call ends and will be archived on the Company’s website for 60 days.

About Alamo Group

Alamo Group is a leader in the design, manufacture, distribution and service of high quality equipment for infrastructure maintenance, agriculture and other applications. Our products include truck and tractor

PAGE 4

ALAMO GROUP ANNOUNCES 2015 FOURTH QUARTER AND YEAR END RESULTS

mounted mowing and other vegetation maintenance equipment, street sweepers, snow removal equipment, excavators, vacuum trucks, other industrial equipment, agricultural implements and related after-market parts and services. The Company, founded in 1969, has approximately 3,000 employees and operates 25 plants in North America, Europe, Australia and Brazil as of December 31, 2015. The corporate offices of Alamo Group Inc. are located in Seguin, Texas and the headquarters for the Company’s European operations are located in Salford Priors, England.

Forward Looking Statements

This release contains forward-looking statements that are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Forward-looking statements involve known and unknown risks and uncertainties, which may cause the Company’s actual results in future periods to differ materially from forecasted results. Among those factors which could cause actual results to differ materially are the following: market demand, competition, weather, seasonality, currency-related issues, and other risk factors listed from time to time in the Company’s SEC reports. The Company does not undertake any obligation to update the information contained herein, which speaks only as of this date.

(Tables Follow)

# # #

(1) In this earnings release, Alamo Group reports net sales excluding the impact of the acquisitions and excluding the impact of currency translation which are both non-GAAP financial measures. The Company considers this information useful to investors to allow better comparability of period-to-period operating performance. Attachments 1, 2 and 3 to this earnings release contains a revenue reconciliation of the non-GAAP financial measure to the comparable GAAP financial measure.

Alamo Group Inc. and Subsidiaries

Condensed Consolidated Balance Sheets

(in thousands)

(Unaudited) |

| | | | | | | | | | |

| December 31,

2015 | December 31,

2014 |

ASSETS | | |

| | | | |

Current assets: | | | | | | |

Cash and cash equivalents | | $ | 26,922 |

| | | $ | 39,533 |

| |

Accounts receivable, net | | 178,305 |

| | | 175,008 |

| |

Inventories | | 150,758 |

| | | 166,088 |

| |

Other current assets | | 6,901 |

| | | 12,673 |

| |

Total current assets | | 362,886 |

| | | 393,302 |

| |

| | | | | | |

Rental equipment, net | | 37,564 |

| | | 33,631 |

| |

| | | | | | |

Property, plant and equipment | | 70,950 |

| | | 71,170 |

| |

| |

|

| | |

|

| |

Goodwill | | 75,509 |

| | | 75,691 |

| |

Intangible assets | | 52,950 |

| | | 56,984 |

| |

Other non-current assets | | 3,644 |

| | | 2,108 |

| |

| | | | | | |

Total assets | | $ | 603,503 |

| | | $ | 632,886 |

| |

| | | | | | |

LIABILITIES AND STOCKHOLDERS’ EQUITY | | | | | |

| |

Current liabilities: | | | | | |

| |

Trade accounts payable | | $ | 45,486 |

| | | $ | 47,741 |

| |

Income taxes payable | | 1,320 |

| | | 52 |

| |

Accrued liabilities | | 38,141 |

| | | 41,002 |

| |

Current maturities of long-term debt and capital lease obligations | | 77 |

| | | 551 |

| |

Other current liabilities | | — |

| | | 21 |

| |

Total current liabilities | | 85,024 |

| | | 89,367 |

| |

| | | | | | |

Long-term debt, net of current maturities | | 144,006 |

| | | 190,024 |

| |

Deferred pension liability | | 4,499 |

| | | 5,714 |

| |

Other long-term liabilities | | 5,782 |

| | | 5,656 |

| |

Deferred income taxes | | 3,723 |

| | | 4,455 |

| |

| | | | | | |

Total stockholders’ equity | | 360,469 |

| | | 337,670 |

| |

| | | | | | |

Total liabilities and stockholders’ equity | | $ | 603,503 |

| | | $ | 632,886 |

| |

Alamo Group Inc. and Subsidiaries

Condensed Consolidated Statements of Income

(in thousands, except per share amounts)

(Unaudited)

|

| | | | | | | | | | | | | | | |

| Fourth Quarter Ended | | Year Ended |

| 12/31/2015 | | 12/31/2014 | | 12/31/2015 | | 12/31/2014 |

| | | | | | | |

Industrial | $ | 135,943 |

| | $ | 126,475 |

| | $ | 498,761 |

| | $ | 436,018 |

|

Agricultural | 47,900 |

| | 51,011 |

| | 208,257 |

| | 214,326 |

|

European | 40,588 |

| | 46,425 |

| | 172,559 |

| | 188,711 |

|

Total Net Sales | 224,431 |

| | 223,911 |

| | 879,577 |

| | 839,055 |

|

| | | | | | | |

Cost of sales | 175,694 |

| | 175,539 |

| | 677,129 |

| | 649,827 |

|

Gross margin | 48,737 |

| | 48,372 |

| | 202,448 |

| | 189,228 |

|

| 21.7 | % | | 21.6 | % | | 23.0 | % | | 22.6 | % |

| | | | | | | |

Operating Expenses | 34,342 |

| | 32,661 |

| | 135,920 |

| | 126,564 |

|

Income from Operations | 14,395 |

| | 15,711 |

| | 66,528 |

| | 62,664 |

|

| 6.4 | % | | 7.0 | % | | 7.6 | % | | 7.5 | % |

| | | | | | | |

Interest Expense | (1,582 | ) | | (1,257 | ) | | (6,724 | ) | | (4,037 | ) |

Interest Income | 69 |

| | 74 |

| | 189 |

| | 211 |

|

Other Income (Expense) | 4,631 |

| | 719 |

| | 6,874 |

| | 1,767 |

|

| | | | | | | |

Income before income taxes | 17,513 |

| | 15,247 |

| | 66,867 |

| | 60,605 |

|

Provision for income taxes | 6,129 |

| | 3,896 |

| | 23,658 |

| | 19,454 |

|

| | | | | | | |

Net Income | $ | 11,384 |

| | $ | 11,351 |

| | $ | 43,209 |

| | $ | 41,151 |

|

| | | | | | | |

Net income per common share: | | | | | | | |

| | | | | | | |

Basic | $ | 1.00 |

| | $ | 1.01 |

| | $ | 3.81 |

| | $ | 3.47 |

|

| | | | | | | |

Diluted | $ | 0.99 |

| | $ | 1.00 |

| | $ | 3.76 |

| | $ | 3.42 |

|

| | | | | | | |

Average common shares: | | | | | | | |

Basic | 11,382 |

| | 11,268 |

| | 11,349 |

| | 11,875 |

|

| | | | | | | |

Diluted | 11,500 |

| | 11,403 |

| | 11,482 |

| | 12,039 |

|

| | | | | | | |

Alamo Group Inc.

Non-GAAP Financial Measures Reconciliation

From time to time, Alamo Group Inc. may disclose certain “non-GAAP financial measures” in the course of its earnings releases, earnings conference calls, financial presentations and otherwise. For these purposes, “GAAP” refers to generally accepted accounting principles in the United States. The Securities and Exchange Commission (SEC) defines a “non-GAAP financial measure” as a numerical measure of historical or future financial performance, financial positions, or cash flows that is subject to adjustments that effectively exclude or include amounts from the most directly comparable measure calculated and presented in accordance with GAAP. Non-GAAP financial measures disclosed by Alamo Group are provided as additional information to investors in order to provide them with greater transparency about, or an alternative method for assessing, our financial condition and operating results. These measures are not in accordance with, or a substitute for, GAAP and may be different from, or inconsistent with, non-GAAP financial measures used by other companies. Whenever we refer to a non-GAAP financial measure, we will also generally present the most directly comparable financial measure calculated and presented in accordance with GAAP, along with a reconciliation of the differences between the non-GAAP financial measure we reference and such comparable GAAP financial measure.

In this earnings release, Alamo Group reports each of net sales, operating income and net income excluding the impact of acquisitions, dispositions or restructuring and consolidations which are non-GAAP financial measures. The Company considers this information useful to investors to allow better comparability of period-to-period operating performance. Attachment 1 to this earnings release contains a revenue reconciliation of these non-GAAP financial measures to the comparable GAAP financial measure. Attachment 2 discloses Adjusted Operating Income, Adjusted Net Income, Adjusted Diluted EPS each adjusted to exclude the impact of inventory step up charge and transaction costs connected to the acquisitions and additional stock expense related to the accelerated vesting options to retirement eligible recipients, all of which are non-GAAP financial measures. The Company believes that providing Operating Income and Net Income exclusive of these adjustments, is useful to investors to allow better comparability of period-to-period operating performance. Attachment 2 sets forth a reconciliation of each such non-GAAP financial measure to its most directly comparable GAAP measure. Attachment 3 discloses a non-GAAP financial presentation related to the impact of currency translation on net sales by division.

Alamo Group Inc.

Non-GAAP Financial Reconciliation

(in thousands)

(Unaudited)

|

| | | | | | | | | | | | | | | | |

| | Three Months Ended | | Year Ended |

| | December 31, | | December 31, |

| | 2015 | | 2014 | | 2015 | | 2014 |

| | | | | | | | |

Net Sales (consolidated) - GAAP | | $ | 224,431 |

| | $ | 223,911 |

| | $ | 879,577 |

| | $ | 839,055 |

|

(less: net sales attributable to acquisitions) | | (446 | ) | | — |

| | (62,944 | ) | | — |

|

Net Sales less acquisitions (consolidated) - non-GAAP | | $ | 223,985 |

| | $ | 223,911 |

| | $ | 816,633 |

| | $ | 839,055 |

|

| | | | | | | | |

Net Sales (Industrial Division) - GAAP | | $ | 135,943 |

| | $ | 126,475 |

| | $ | 498,761 |

| | $ | 436,018 |

|

(less: net sales attributable to acquisition) | | — |

| | — |

| | (57,887 | ) | | — |

|

Net Sales less acquisitions (Industrial Division) - non-GAAP | | $ | 135,943 |

| | $ | 126,475 |

| | $ | 440,874 |

| | $ | 436,018 |

|

| | | | | | | | |

Net Sales (Agricultural Division) - GAAP | | $ | 47,900 |

| | $ | 51,011 |

| | $ | 208,257 |

| | $ | 214,326 |

|

(less: net sales attributable to acquisitions) | | (446 | ) | | — |

| | (2,603 | ) | | — |

|

Net Sales less acquisitions (Agricultural Division) - non-GAAP | | $ | 47,454 |

| | $ | 51,011 |

| | $ | 205,654 |

| | $ | 214,326 |

|

| | | | | | | | |

Net Sales (European Division) - GAAP | | $ | 40,588 |

| | $ | 46,425 |

| | $ | 172,559 |

| | $ | 188,711 |

|

(less: net sales attributable to acquisition) | | — |

| | — |

| | (2,454 | ) | | — |

|

Net Sales less acquisitions (European Division) - non-GAAP | | $ | 40,588 |

| | $ | 46,425 |

| | $ | 170,105 |

| | $ | 188,711 |

|

| | | | | | | | |

| | | | | | | | |

Operating Income (consolidated) - GAAP | | $ | 14,395 |

| | $ | 15,711 |

| | $ | 66,528 |

| | $ | 62,664 |

|

(less: operating income attributable to acquisitions) | | 27 |

| | — |

| | (5,090 | ) | | — |

|

Operating Income less acquisitions (consolidated) - non-GAAP | | $ | 14,422 |

| | $ | 15,711 |

| | $ | 61,438 |

| | $ | 62,664 |

|

| | | | | | | | |

Net Income (consolidated) - GAAP | | $ | 11,384 |

| | $ | 11,351 |

| | $ | 43,209 |

| | $ | 41,151 |

|

(less: net income attributable to acquisitions) | | 44 |

| | — |

| | (3,577 | ) | | — |

|

Net Income less acquisitions (consolidated) - non-GAAP | | $ | 11,428 |

| | $ | 11,351 |

| | $ | 39,632 |

| | $ | 41,151 |

|

Alamo Group Inc.

Non-GAAP Financial Reconciliation

(in thousands, except per share numbers)

(Unaudited)

|

| | | | | | | | | | | | | | | | |

| | Three Months Ended | | Year Ended |

| | December 31, | | December 31, |

| | 2015 | | 2014 | | 2015 | | 2014 |

| | | | | | | | |

Operating Income - GAAP | | $ | 14,395 |

| | $ | 15,711 |

| | $ | 66,528 |

| | $ | 62,664 |

|

(add: inventory step charge) | | — |

| | 1,439 |

| | 2,740 |

| | 2,578 |

|

(add: expenses relating to system conversion) | | — |

| | — |

| | 1,011 |

| | — |

|

(add: transaction cost relating to acquisitions) | | — |

| | 240 |

| | 425 |

| | 2,079 |

|

(add: costs related to plant closure) | | 2,941 |

| | — |

| | 2,941 |

| | — |

|

Adjusted Operating Income - non-GAAP | | $ | 17,336 |

| | $ | 17,390 |

| | $ | 73,645 |

| | $ | 67,321 |

|

| | | | | | | | |

Net Income - GAAP | | $ | 11,384 |

| | $ | 11,351 |

| | $ | 43,209 |

| | $ | 41,151 |

|

Adjustments (after tax): | | | | | | | | |

(add: inventory step charge) | | — |

| | 923 |

| | 1,771 |

| | 1,654 |

|

(add: expenses relating to system conversion) | | — |

| | — |

| | 653 |

| | — |

|

(add: transaction costs relating to acquisitions) | | — |

| | 154 |

| | 275 |

| | 1,334 |

|

(add: costs related to plant closure) | | 1,900 |

| | — |

| | 1,900 |

| | — |

|

(less: gain on sale of non operating asset) | | (2,453 | ) | | — |

| | (2,453 | ) | | — |

|

Adjusted Net Income - non-GAAP | | $ | 10,831 |

|

| $ | 12,428 |

| | $ | 45,355 |

| | $ | 44,139 |

|

| | | | | | | | |

Diluted EPS - GAAP | | $ | 0.99 |

| | $ | 1.00 |

| | $ | 3.76 |

| | $ | 3.42 |

|

(add: inventory step charge) | | — |

| | 0.08 |

| | 0.15 |

| | 0.14 |

|

(add: expenses relating to system conversion) | | — |

| | — |

| | 0.06 |

| | — |

|

(add: transaction costs relating to acquisitions) | | — |

| | 0.01 |

| | 0.02 |

| | 0.11 |

|

(add: costs related to plant closure) | | 0.17 |

| | — |

| | 0.17 |

| | — |

|

(less: gain on sale of non operating asset) | | (0.21 | ) | | — |

| | (0.21 | ) | | — |

|

Adjusted Diluted EPS - non-GAAP | | $ | 0.95 |

| | $ | 1.09 |

| | $ | 3.95 |

| | $ | 3.67 |

|

Alamo Group Inc.

Non-GAAP Financial Reconciliation

(in thousands)

(Unaudited)

|

| | | | | | | | | | | | | | | | | |

| Three Months Ended December 31, | | | | Change due to currency translation |

| 2015 | | 2014 | | % change from 2014 | | $ | | % |

| | | | | | | | | |

Industrial | $ | 135,943 |

| | $ | 126,475 |

| | 7.5 | % | | $ | (2,545 | ) | | (2.0 | )% |

Agricultural | 47,900 |

| | 51,011 |

| | (6.1 | )% | | (718 | ) | | (1.4 | )% |

European | 40,588 |

| | 46,425 |

| | (12.6 | )% | | (4,042 | ) | | (8.7 | )% |

Total Net Sales | $ | 224,431 |

| | $ | 223,911 |

| | 0.2 | % | | $ | (7,305 | ) | | (3.3 | )% |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| Twelve Months Ended December 31, | | | | Change due to currency translation |

| 2015 | | 2014 | | % change from 2014 | | $ | | % |

| | | | | | | | | |

Industrial | $ | 498,761 |

| | $ | 436,018 |

| | 14.4 | % | | $ | (8,375 | ) | | (1.9 | )% |

Agricultural | 208,257 |

| | 214,326 |

| | (2.8 | )% | | (3,152 | ) | | (1.5 | )% |

European | 172,559 |

| | 188,711 |

| | (8.6 | )% | | (23,327 | ) | | (12.4 | )% |

Total Net Sales | $ | 879,577 |

| | $ | 839,055 |

| | 4.8 | % | | $ | (34,854 | ) | | (4.2 | )% |

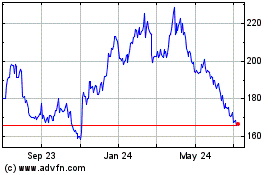

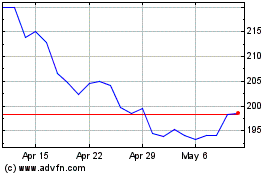

Alamo (NYSE:ALG)

Historical Stock Chart

From Mar 2024 to Apr 2024

Alamo (NYSE:ALG)

Historical Stock Chart

From Apr 2023 to Apr 2024