Current Report Filing (8-k)

March 02 2016 - 5:17PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): March 2, 2016

KAR Auction Services, Inc.

(Exact name of Registrant as specified in its charter)

|

| | | | |

Delaware | | 001-34568 | | 20-8744739 |

(State of Incorporation) | | (Commission File Number) | | (I.R.S. Employer Identification No.) |

13085 Hamilton Crossing Boulevard

Carmel, Indiana 46032

(Address of principal executive offices) (Zip Code)

(800) 923-3725

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

| |

¨ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

|

| |

¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

|

| |

¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

|

| |

¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Item 1.01 Entry into a Material Definitive Agreement.

On March 2, 2016, Automotive Finance Corporation ("AFC"), a subsidiary of KAR Auction Services, Inc. (the "Company"), and AFC Funding Corporation ("AFC Funding"), a wholly owned, bankruptcy remote, consolidated, special purpose subsidiary of AFC, entered into Amendment No. 1 (the "Amendment") to its Sixth Amended and Restated Receivables Purchase Agreement, dated as of June 16, 2015, by and among AFC, AFC Funding, Fairway Finance Company, LLC ("Fairway Finance"), Deutsche Bank AG, New York Branch ("Deutsche Bank"), Fifth Third Bank ("Fifth Third"), Chariot Funding LLC ("Chariot Funding"), BMO Capital Markets Corp. ("BMO"), JPMorgan Chase Bank, N.A. and Bank of Montreal, pursuant to which AFC Funding sells an undivided ownership interest in the receivables and related rights it purchases from AFC to Fairway Finance, Deutsche Bank, Fifth Third, and Chariot Funding (collectively, the "Purchasers"). The Purchasers' investment in the receivables and related rights, together with a return thereon, is paid from collections of the finance receivables held by AFC Funding.

The finance receivables sold and a cash reserve serve as security for the obligations to the Purchasers. The amount of the cash reserve depends on circumstances which are set forth in the Receivables Purchase Agreement. After the occurrence of a termination event, as defined in the Receivables Purchase Agreement, the Purchasers may, and could, cause the stock of AFC Funding to be transferred to the agent under the Receivables Purchase Agreement for the benefit of the Purchasers, though as a practical matter the Purchasers would look to the liquidation of the receivables under the transaction documents as their primary remedy. Termination events, as defined in the Receivables Purchase Agreement, include, among other things, breaches of representations and warranties; failures to perform covenants and other obligations as seller or servicer; violations of financial covenants related to AFC, AFC Funding or the Company (including, among others, limits on the amount of debt AFC can incur, minimum levels of tangible net worth of AFC and AFC Funding, and certain financial covenants contained in the Company’s senior secured credit agreement); defaults in payment of other indebtedness of the Company, AFC or AFC Funding; violation of certain covenants related to the performance of the receivables portfolio; the occurrence of a material adverse change in the collectability of the receivables owned by AFC Funding or the business, operations, property or financial condition of AFC or AFC Funding; certain changes in control of AFC or AFC Funding; and certain bankruptcy events with respect to AFC, AFC Funding or the Company.

As a result of the Amendment, the aggregate maximum commitment of the Purchasers was increased from $1.15 billion to $1.25 billion.

Certain of the Purchasers and agents and their respective affiliates have, from time to time, performed, and may in the future perform, various financial advisory and investment banking, commercial banking and other services for the Company and its affiliates, for which they received or will receive customary fees and expenses. JPMorgan Chase Bank, N.A. is the administrative agent and a lender and Fifth Third and Deutsche Bank are lenders under a credit agreement with the Company, the ultimate parent of AFC and AFC Funding.

The above description of the changes effected by the Amendment is not complete and is qualified in its entirety by reference to the full text of the Amendment, a copy of which will be filed as an exhibit to the Company's Quarterly Report on Form 10-Q for the quarter ended March 31, 2016.

Item 2.03. Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

The information set forth in Item 1 of this Current Report on Form 8-K is incorporated by reference in response to this item.

1

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

| | |

Dated: March 2, 2016 | | KAR Auction Services, Inc. |

| | |

| | By: /s/ Eric M. Loughmiller |

| | Eric M. Loughmiller |

| | Executive Vice President and Chief Financial Officer |

2

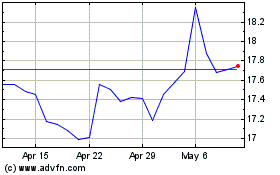

OPENLANE (NYSE:KAR)

Historical Stock Chart

From Mar 2024 to Apr 2024

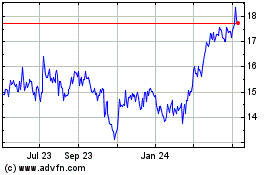

OPENLANE (NYSE:KAR)

Historical Stock Chart

From Apr 2023 to Apr 2024