United

States

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

---------------

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

February 5, 2016

CHINA GREEN AGRICULTURE, INC.

---------------------------------------

(Exact name of Registrant as specified in

charter)

| Nevada |

|

001-34260 |

|

36-3526027 |

| (State or other jurisdiction |

|

(Commission File No.) |

|

(IRS Employer |

| of Incorporation) |

|

|

|

Identification No.) |

3rd floor, Borough A, Block A. No. 181,

South Taibai Road,

Xi’an, Shaanxi province, PRC 710065

(Address of principal

executive offices) (Zip Code)

Registrant's telephone number, including

area code: (515) 897-2421

Check the appropriate box below if the

Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ | Written

communications pursuant to Rule 425 under the Securities Act (17CFR230.425) |

| ¨ | Soliciting

material pursuant to Rule14a-12 under the Exchange Act (17CFR240.14a-12) |

| ¨ | Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17CFR240.14d-2(b)) |

| ¨ | Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17CFR240.13e-4(c)) |

Item 2.02 Results of Operations and Financial Condition.

On February 5, 2016,

China Green Agriculture, Inc., a corporation incorporated in the State of Nevada (the “Company”), issued a press release

announcing (i) certain financial results for the fiscal quarter ended December 31, 2015; (ii) guidance for the third quarter of

fiscal year of 2016 and reaffirming the guidance for the fiscal year of 2016; and (iii) a conference call to be held by the Company

on [Friday], February 5, 2016 at 7:00 a.m. Eastern Time to discuss the results of operations for the quarter ended December 31,

2015. A copy of the press release is attached hereto as Exhibit 99.1.

Item 9.01 Financial Statements and Exhibits.

The following is filed as an exhibit to

this report:

| Exhibit No. |

|

Description |

| |

|

|

| 99.1 |

|

Press Release, dated February 5, 2016. |

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned

hereunto duly authorized.

Date: February 5, 2016

| |

CHINA GREEN AGRICULTURE, INC. |

| |

(Registrant) |

| |

|

|

| |

By: |

/s/ Tao Li |

| |

Name: Tao Li |

| |

Title: President and Chief Executive Officer |

Exhibit 99.1

China Green Agriculture Reports the

Second Quarter Fiscal Year 2016 Financial Results

With Revenue Beating the Guidance, Net

income Meeting the Guidance

Provides Guidance on the Third Fiscal

Quarter 2016 and Confirms Guidance on Full Year Revenues and Net Incomes

XI'AN, China, February

5, 2016 /PRNewswire-Asia-FirstCall/ --

China Green Agriculture,

Inc. (NYSE: CGA; "China Green Agriculture" or the "Company"), a company mainly produces and distributes

humic acid-based compound fertilizers, varieties of compound fertilizers and agricultural products through its subsidiaries in China,

today announced its financial results for the second quarter ended December 31, 2015 and guidance on revenues and net incomes

of the Third Fiscal Quarter 2016 and Fiscal Year 2016.

Highlights:

| · | Net sales increased 5.4% to $57 million;

Net income decreased 18.2% to $4.3 million with EPS of $0.12. |

| · | Guidance for Third Quarter of Fiscal Year

2016: Revenue of $75 million to $80 million; Net Income of $5 million to $7 million; EPS of $0.14 to $0.19 based on 37 million

fully diluted shares. |

| · | Guidance for Fiscal Year 2016: Revenue

of $257.6 million to $269.4 million; Net Income of $21.1 million to $24.1 million; EPS of $0.57 to $0.65 based on 37 million fully

diluted shares. |

Financial Summary

Financial Summary

Second Quarter 2016 Results

(USD)

(Three Months ended December

31,2015)

| | |

Q2 FY2016 | | |

Q2 FY2015 | | |

CHANGE (%) | |

| Net Sales | |

| $57 million | | |

| $54.1 million | | |

| 5.4 | % |

| Gross Profit | |

| $22.6 million | | |

| $22.9 million | | |

| (1.2 | )% |

| Net Income | |

| $4.3 million | | |

| $5.2 million | | |

| (18.2 | )% |

| EPS (Diluted) | |

$ | 0.12 | | |

$ | 0.16 | | |

| (26.3 | )% |

| Weighted Average Shares Outstanding (Diluted) | |

| $36.9 million | | |

| $33.3 million | | |

| 11.0 | % |

(Six Months ended

December 31, 2015)

| | |

Q2 FY2016 | | |

Q2 FY2015 | | |

CHANGE (%) | |

| Net Sales | |

| $111.2 million | | |

| $105.4 million | | |

| 5.5 | % |

| Gross Profit | |

| $46.8 million | | |

| $47.6 million | | |

| (1.6 | )% |

| Net Income | |

| $11.5 million | | |

| $13.3 million | | |

| (13.5 | )% |

| EPS (Diluted) | |

$ | 0.32 | | |

$ | 0.41 | | |

| (22.1 | )% |

| Weighted Average Shares Outstanding (Diluted) | |

| $36.4 million | | |

| $32.8 million | | |

| 11 | % |

Mr. Tao Li, Chairman

and Chief Executive Officer of the Company, stated, “We are very pleased with our performance in business operation, generating

$4.3 million net income in the second quarter ended December 31, 2015,” he concluded, " Looking

ahead to the Fiscal Year 2016, we expect revenue of $257.6 to $269.4 million; net income of $21.1 to $24.1 million; and

EPS of $0.57 to $0.65 based on 37 million fully diluted shares. "

Second

Quarter of FY2016 Results of Operations

Total net sales for the three months ended

December 31, 2015 were $56,966,000, an increase of $2,914,826, or 5.4%, from $54,051,174 for the three months ended December 31,

2014. This increase was due to an increase in net sales from all three business segments.

For the three months ended December 31,

2015, Jinong’s net sales increased $109,868, or 0.4%, to $31,302,561 from $31,192,693 for the three months ended December

31, 2014. This slight increase was mainly attributable to Jinong’s higher priced liquid fertilizer sold despite the decrease

in Jinong’s sales volume during the three months ended December 31, 2015.

For the three months ended December 31,

2015, Gufeng’s net sales were $23,579,674, an increase of $1,800,867 or 8.3% from $21,778,807 for the three months ended

December 31, 2014. The increase was mainly attributable to Gufeng’s expanded marketing and promotion strategy.

For the three months ended December 31,

2015, Yuxing’s net sales were $2,083,765, an increase of $1,004,091 or 93.0%, from $1,079,674 during the three months

ended December 31, 2014. The increase was mainly attributable to the increase in market demand and the higher prices on Yuxing’s

top-grade flowers.

Total cost of goods sold for the three

months ended December 31, 2015 was $34,330,432, an increase of $3,189,252, or 10.2%, from $31,141,180 for the three months ended

December 31, 2014. This increase was mainly due to the 5.4% increase in net sales and an increase in cost of raw materials.

Cost of goods sold by Jinong for the three

months ended December 31, 2015 was $13,434,686, an increase of $1,120,646, or 9.1%, from $12,314,040 for the three months ended

December 31, 2014. The increase in cost of goods was primarily attributable to the higher cost in raw materials.

Cost of goods sold by Gufeng for the three

months ended December 31, 2015 was $19,712,848, an increase of $1,677,869, or 9.3%, from $18,034,979 for the three months ended

December 31, 2014. This increase was primarily attributable to an increase in the cost of raw materials and an increase in the

sales of fertilizer products.

For the three months ended December 31,

2015, cost of goods sold by Yuxing was $1,182,898, an increase of $390,737, or 49.3%, from $792,161 for the three months ended

December 31, 2014. This increase was mainly due to the increase in Yuxing’s net sales.

Total gross profit for the three months

ended December 31, 2015 decreased by $274,426 to $22,635,568, as compared to $22,909,994 for the three months ended December 31,

2014. Gross profit margin was 39.7% and 42.4% for the three months ended December 31, 2015 and 2014, respectively.

Gross profit generated by Jinong decreased

by $1,010,778, or 5.4%, to $17,867,875 for the three months ended December 31, 2015 from $18,878,653 for the three months ended

December 31, 2014. Gross profit margin from Jinong’s sales was approximately 57.1% and 60.5% for the three months ended December

31, 2015 and 2014, respectively. The decrease in gross profit margin was mainly due to the higher raw material cost and packaging

cost.

For the three months ended December 31,

2015, gross profit generated by Gufeng was $3,866,826, an increase of $122,998, or 3.3%, from $3,743,828 for the three months ended

December 31, 2014. Gross profit margin from Gufeng’s sales was approximately 16.4% and 17.2% for the three months ended December

31, 2015 and 2014, respectively. The decrease in gross profit percentage was mainly due to the increased weight for lower-margin

products sales in Gufeng’s total sales answering to market demand.

For the three months ended December 31,

2015, gross profit generated by Yuxing was $900,867, an increase of $613,354, or 213.3% from $287,513 for the three months ended

December 31, 2014. The gross profit margin was approximately 43.2% and 26.6% for the three months ended December 31, 2015

and 2014, respectively. The increase in gross profit margin was mainly due to the higher priced top grade flowers that Yuxing sold

during the three months ended December 31, 2015.

Our selling expenses consisted primarily

of salaries of sales personnel, advertising and promotion expenses, freight-out costs and related compensation. Selling expenses

were $5,285,103, or 9.3%, of net sales for the three months ended December 31, 2015, as compared to $1,981,065 or 3.7% of net sales

for the three months ended December 31, 2014, an increase of $3,304,038, or 166.8%. The selling expenses of Yuxing were $135,466

or 6.5% of Yuxing’s net sales for the three months ended December 31, 2015, as compared to $13,935, or 1.3% of Yuxing’s

net sales for the three months ended December 31, 2014. The selling expenses of Gufeng were $110,972 or 0.5% of Gufeng’s

net sales for the three months ended December 31, 2015, as compared to $228,488, or 1.0% of Gufeng’s net sales for the three

months ended December 31, 2014. The selling expenses of Jinong for the three months ended December 31, 2015 were $5,038,665 or

16.1% of Jinong’s net sales, as compared to selling expenses of $1,738,642, or 5.6% of Jinong’s net sales for the three

months ended December 31, 2014. The increase in Jinong’s selling expenses was due to Jinong’s expanded marketing efforts

and the increase in shipping costs.

Our selling expenses - amortization of

our deferred assets were $8,664,752, or 15.2%, of net sales for the three months ended December 31, 2015, as compared to $10,651,432

or 18.7% of net sales for the three months ended December 31, 2014, a decrease of $1,986,680, or 18.7%. This decrease was due to

the fact that some of the deferred assets were fully amortized and therefore no amortization was recorded on the fully amortized

assets during the three months ended December 31, 2015.

General and administrative expenses consisted

primarily of related salaries, rental expenses, business development, depreciation and travel expenses incurred by our general

and administrative departments and legal and professional expenses including expenses incurred and accrued for certain litigations.

General and administrative expenses were $2,905,982, or 5.1% of net sales for the three months ended December 31, 2015, as compared

to $3,193,979, or 5.9%, of net sales for the three months ended December 31, 2014, a decrease of $257,758, or 8.1%. The decrease

in general and administrative expenses was mainly due to the related expenses in the stock compensation awarded to the employees

which amounted to $1,786,225 for the three months ended December 31, 2015 as compared to $1,786,225 for the three months ended

December 31, 2014.

Net income for the three months ended December

31, 2015 was $4,267,535, a decrease of $947,902, or 18.2%, compared to $5,215,437 for the three months ended December 31, 2014.

The decrease was attributable to the higher coast of good sold and increase in selling expenses offset by an increase in net sales

and selling expenses. Net income as a percentage of total net sales was approximately 7.5% and 9.6% for the three months ended

December 31, 2015 and 2014, respectively.

Six

Months of FY2016 Results of Operations

Total net sales for the six months ended

December 31, 2015 were $111,150,271, an increase of $5,797,307, or 5.5%, from $105,352,964 for the six months ended December 31,

2014. This increase was due to an increase in net sales from all three business segments.

For the six months ended December 31, 2015,

Jinong’s net sales increased of $353,507, or 0.5%, to $66,010,365 from $65,656,858 for the six months ended December 31,

2014. This slightly increase was mainly attributable to Jinong’s higher priced liquid fertilizer sold despite the decrease

in Jinong’s sales volume during the six months ended December 31, 2015.

For the six months ended December 31, 2015,

Gufeng’s net sales were $41,814,506, an increase of $4,049,625 or 10.7% from $37,764,881 for the six months ended December

31, 2014. The increase was mainly attributable to Gufeng’s expanded marketing promotion strategy.

For the six months ended December 31, 2015,

Yuxing’s net sales were $3,325,400, an increase of $1,394,175 or 72.2%, from $1,931,225 during the six months ended

December 31, 2014. The increase was mainly attributable to the increase in market demand and higher prices on Yuxing’s top-grade

flowers.

Total cost of goods sold for the six months

ended December 31, 2015 was $64,326,541, an increase of $6,557,005, or 11.4%, from $57,769,536 for the six months ended December

31, 2014. This increase was mainly due to the 5.6% increase in net sales and an increase in the cost of raw materials.

Cost of goods sold by Jinong for the six

months ended December 31, 2015 was $27,975,071, an increase of $2,280,408, or 8.9%, from $25,694,663 for the six months ended December

31, 2014. The increase was primarily attributable to its higher raw material cost.

Cost of goods sold by Gufeng for the six

months ended December 31, 2015 was $34,458,522, an increase of $3,824,358, or 12.5%, from $30,634,164 for the six months ended

December 31, 2014. This increase was primarily attributable to an increase in the cost of raw materials and an increase in the

sales of fertilizer products.

For the six months ended December 31, 2015,

cost of goods sold by Yuxing was $1,892,948, an increase of $452,239, or 31.4%, from $1,440,709 for the six months ended December

31, 2014. This increase was mainly due to the increase in Yuxing’s net sales.

Total gross profit for the six months ended

December 31, 2015 decreased by $759,698 to $46,823,730, as compared to $47,583,428 for the six months ended December 31, 2014.

Gross profit margin was 42.1% and 45.2% for the six months ended December 31, 2015 and 2014, respectively.

Gross profit generated by Jinong decreased

by $1,926,901, or 4.8%, to $38,035,294 for the six months ended December 31, 2015 from $39,962,195 for the six months ended December

31, 2014. Gross profit margin from Jinong’s sales was approximately 57.6% and 60.9% for the six months ended December 31,

2015 and 2014, respectively. The decrease in gross profit margin was mainly due to higher raw material cost and higher packaging

cost.

For the six months ended December 31, 2015,

gross profit generated by Gufeng was $7,355,984, an increase of $225,267, or 3.2%, from $7,130,717 for the six months ended December

31, 2014. Gross profit margin from Gufeng’s sales was approximately 17.6% and 18.9% for the six months ended December 31,

2015 and 2014, respectively. The decrease in gross profit percentage was mainly due to the increased weight for lower-margin products

sales in Gufeng’s total sales answering to market demand.

For the six months ended December 31, 2015,

gross profit generated by Yuxing was $1,432,452, an increase of $941,936, or 31.7% from $490,516 for the six months ended December

31, 2014. The gross profit margin was approximately 43.1% and 25.4% for the six months ended December 31, 2015 and 2014,

respectively.

The increase in gross profit margin was

mainly due to the higher priced top grade flowers that Yuxing sold during the six months ended December 31, 2015.

Our selling expenses consisted primarily

of salaries of sales personnel, advertising and promotion expenses, freight-out costs and related compensation. Selling expenses

were $7,628,858, or 6.9%, of net sales for the six months ended December 31, 2015, as compared to $2,716,702 or 2.6% of net sales

for the six months ended December 31, 2014, an increase of $4,912,156, or 180.8%. The selling expenses of Yuxing were $143,171

or 4.3% of Yuxing’s net sales for the six months ended December 31, 2015, as compared to $21,073, or 1.1% of Yuxing’s

net sales for the six months ended December 31, 2014.The selling expenses of Gufeng were $263,657 or 0.6% of Gufeng’s net

sales for the six months ended December 31, 2015, as compared to $414,466, or 1.1% of Gufeng’s net sales for the six months

ended December 31, 2014. The selling expenses of Jinong for the six months ended December 31, 2015 were $7,222,030 or 10.9% of

Jinong’s net sales, as compared to selling expenses of $2,281,163, or 3.5% of Jinong’s net sales for the six months

ended December 31, 2014. The increase in Jinong’s selling expenses was due to Jinong’s expanded marketing efforts and

the increase in shipping costs.

Our selling expenses - amortization of

our deferred assets were $18,377,467, or 16.5%, of net sales for the six months ended December 31, 2015, as compared to $20,982,516

or 19.9% of net sales for the six months ended December 31, 2014, a decrease of $2,605,049, or 12.4%. This decrease was due to

the fact that some of the deferred assets were fully amortized and therefore no amortization was recorded on the fully amortized

assets during the six months ended December 31, 2015.

General and administrative expenses consisted

primarily of related salaries, rental expenses, business development, depreciation and travel expenses incurred by our general

and administrative departments and legal and professional expenses including expenses incurred and accrued for certain litigations.

General and administrative expenses were $5,659,624, or 5.1% of net sales for the six months ended December 31, 2015, as compared

to $6,313,611, or 6.0%, of net sales for the six months ended December 31, 2014, a decrease of $653,987, or 10.4%. The decrease

in general and administrative expenses was mainly due to the related expenses in the stock compensation awarded to the employees

which amounted to $3,206,945 for the six months ended December 31, 2015 as compared to $3,206,945 for the six months ended December

31, 2014.

Net Income

Net income for the six months ended December

31, 2015 was $11,513,207, a decrease of $1,801,312, or 13.5%, compared to $13,314,519 for the six months ended December 31, 2014.

The decrease was attributable to the higher cost of good sold and increase in selling expenses offset by an increase in our net

sales. Net income as a percentage of total net sales was approximately 10.4% and 12.6 % for the six months ended December 31, 2015

and 2014, respectively.

Third Quarter

Fiscal Year 2016 and Confirmed Fiscal Year 2016 Guidance

For the ongoing third

quarter ending March 31, 2016, amid the marketing efforts both online and offline, management has expectation of net

sales of $75 to $80 million, net income of $5 to $7 million, and EPS of $0.14 to $0.19 based on 37

million fully diluted shares. For the fiscal year ended June 30, 2016, management has expectation of net sales of $257.6

million to $269.4 million, net income of $21.1 million to $24.1 million, and an EPS of $0.57 to $0.65 based

on 37 million fully diluted shares.

Conference Call

The Company will

hold a conference call at 7:00 a.m. ET on Friday, February 5, 2016. Any interested participants are welcome to join

in the call by following the dial-in details as set out below. When prompted by the operator, please indicate "China Green

Agriculture's Second Quarter of Fiscal Year 2016 Financial Results" to join the call.

| Participant Dial In (Toll Free): |

1-888-346-8982 |

| Participant International Dial In: |

1-412-902-4272 |

| Hong Kong-Local Toll |

852-301-84992 |

| Beijing-Local Toll |

86-10-5357-3132 |

| China Toll Free |

86-4001-201203 |

| Hong Kong Toll Free |

852-800-905945 |

To access the replay,

please dial any of the following numbers:

| US Toll Free: |

1-877-344-7529 |

| International Toll: |

1-412-317-0088 |

| Canada Toll Free: |

1-855-669-9658 |

| Replay Access Code: |

10076134 |

The replay will be

available 1 hour after the end of the conference.

Teleconference Replay

Available Until: February 11, 2016

About China Green Agriculture, Inc.

The Company produces and distributes humic

acid-based compound fertilizers, other varieties of compound fertilizers and agricultural products through its wholly-owned subsidiaries,

i.e.: Shaanxi TechTeam Jinong Humic Acid Product Co., Ltd. ("Jinong"), Beijing Gufeng Chemical Products Co., Ltd ("Gufeng")

and a variable interest entity, Xi'an Hu County Yuxing Agriculture Technology Development Co., Ltd. ("Yuxing"). Jinong

produced and sold 129 different kinds of fertilizer products through 1,044 distributors as of December 31, 2015, all of the

products are certified by the government of the People's Republic of China (the "PRC") as Green Food Production

Materials, as stated by the China Green Food Development Center. Gufeng, and its wholly-owned subsidiary, Beijing Tianjuyuan Fertilizer

Co., Ltd., produced and sold 332 different kinds of fertilizer products, and had 290 distributors in the PRC. For more information,

visit http://www.cgagri.com. The Company routinely posts important information on its website.

Safe Harbor Statement

This press release contains forward-looking

statements within the meaning of the Private Securities Litigation Reform Act of 1995 concerning the Company's business, products

and financial results. The Company's actual results may differ materially from those anticipated in the forward-looking statements

depending on a number of risk factors including, but not limited to, the following: general economic, business and environment

conditions, development, shipment, market acceptance, additional competition from existing and new competitors, changes in technology,

the execution of its ten-year growth plan, a satisfactory conclusion of the pending securities class action litigation and various

other factors beyond the Company's control. All forward-looking statements are expressly qualified in their entirety by this Safe

Harbor Statement and the risk factors detailed in the Company's reports filed with the SEC. China Green Agriculture undertakes

no duty to revise or update any forward-looking statements to reflect events or circumstances after the date of this release, except

as required by applicable law or regulations.

For more information, please contact:

China Green Agriculture, Inc.

Ms. Ran Liu (English and Chinese)

Tel: +86-29-88266500

Email: liuran@cgagri.com

SOURCE China Green Agriculture, Inc.

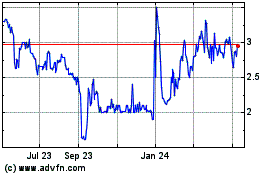

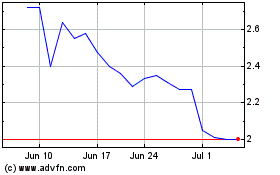

China Green Agriculture (NYSE:CGA)

Historical Stock Chart

From Mar 2024 to Apr 2024

China Green Agriculture (NYSE:CGA)

Historical Stock Chart

From Apr 2023 to Apr 2024