Current Report Filing (8-k)

January 28 2016 - 5:07PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

January 25, 2016

Date of Report (Date of earliest event reported)

AptarGroup, Inc.

(Exact name of registrant as specified in its charter)

|

Delaware |

|

1-11846 |

|

36-3853103 |

|

(State or other jurisdiction of

incorporation) |

|

(Commission File Number) |

|

(IRS Employer Identification No.) |

475 West Terra Cotta Avenue, Suite E, Crystal Lake, Illinois 60014

(Address of principal executive offices)

Registrant’s telephone number, including area code: 815-477-0424.

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 1.01. Entry into a Material Definitive Agreement.

On January 25, 2016, AptarGroup, Inc. (“AptarGroup”), and two indirect subsidiaries, AptarGroup International Holding S.a.r.l., a société à responsibilité limitée (limited liability company) organized under the laws of Luxembourg, and Aptargroup Holding SAS, a société par actions simplifiée (simplified limited liability company) organized under the laws of France (collectively, “Aptar”), entered into a Share Purchase Agreement (the “Share Purchase Agreement”) with the shareholders (the “Sellers”) of (i) MEGAPLAST GmbH, a Gesellschaft mit beschränkter Haftung (limited liability company) organized under the laws of Germany, (ii) Megaplast France S.a.r.l., a société à responsibilité limitée (limited liability company) organized under the laws of France, and (iii) MEGA Pumps L.P., a Delaware limited partnership (collectively, the “Companies” and together with their direct and indirect subsidiaries, “Mega Airless”). Pursuant to the terms of the Share Purchase Agreement, Aptar has agreed to purchase all of the shares in the Companies for a purchase price of €202,400,000 in cash (the “Acquisition”), subject to customary cash, debt and working capital adjustments, plus interest from and after January 1, 2016. In addition, the purchase price is subject to reduction to the extent that the 2015 consolidated EBITDA (earnings before interest, taxes, depreciation and amortization), of Mega Airless is less than €18,000,000.

Completion of the Acquisition is subject to regulatory approvals and certain other closing conditions. Under the terms of the Share Purchase Agreement, completion of the Acquisition will occur within five business days after the regulatory approvals have been obtained and the other closing conditions have been fulfilled. The Share Purchase Agreement provides for termination rights of the parties, including in the event that the regulatory approvals are not obtained by July 25, 2016 (the “Drop Dead Date”). If either the Sellers or Aptar terminate the Share Purchase Agreement because the regulatory approvals have not been obtained by the Drop Dead Date, Aptar has agreed to pay a termination fee to the Sellers in the amount of €10,000,000.

Under the Share Purchase Agreement, each of the Sellers and Aptar have made certain representations, warranties and covenants, including a covenant by each of the Sellers, for a period of two years following the closing of the Acquisition, not to (i) compete with the business of Mega Airless in certain relevant countries or (ii) solicit any of the employees of Mega Airless.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

|

|

AptarGroup, Inc. |

|

|

|

|

|

|

|

|

|

|

|

Date: January 28, 2016 |

|

By: |

/s/ Robert W. Kuhn |

|

|

|

|

Robert W. Kuhn

Executive Vice President,

Chief Financial Officer and Secretary |

2

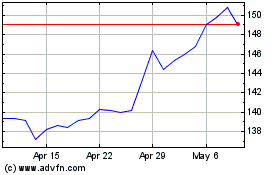

AptarGroup (NYSE:ATR)

Historical Stock Chart

From Mar 2024 to Apr 2024

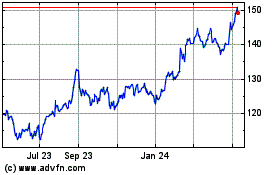

AptarGroup (NYSE:ATR)

Historical Stock Chart

From Apr 2023 to Apr 2024