UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT

REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): January 26, 2016

MICROSTRATEGY INCORPORATED

(Exact name of registrant as specified in its charter)

|

|

|

|

|

| Delaware |

|

0-24435 |

|

51-0323571 |

| (State or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(I.R.S. Employer

Identification No.) |

|

|

|

| 1850 Towers Crescent Plaza

Tysons Corner, Virginia |

|

22182 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code: (703) 848-8600

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the

following provisions (see General Instruction A.2. below):

| |

¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| Item 2.02. |

Results of Operations and Financial Condition. |

On January 27, 2016, MicroStrategy Incorporated

(the “Company”) issued a press release announcing the Company’s financial results for the quarter ended December 31, 2015. A copy of this press release is attached as Exhibit 99.1 to this Current Report on Form 8-K.

The information disclosed pursuant to Item 2.02 in this Form 8-K (including Exhibit 99.1) shall not be deemed “filed” for purposes of

Section 18 of the Securities Exchange Act of 1934 (the “Exchange Act”) or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933 or the

Exchange Act except as expressly set forth by specific reference in such a filing.

| Item 5.02. |

Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers. |

Salary Determination and Annual Cash Bonus Target for Chief Technology Officer

On January 26, 2016, the Chief Executive Officer (the “CEO”) of the Company approved an increase to the annual salary of Timothy E. Lang, the

Company’s Senior Executive Vice President & Chief Technology Officer, resulting in an annual salary of $400,000 effective January 1, 2016.

Also on January 26, 2016, the CEO established an annual cash bonus target for Mr. Lang in the amount of $400,000, effective January 1, 2016.

Any award pursuant to the foregoing cash bonus target will be determined by the CEO annually based on the CEO’s subjective evaluation of Mr. Lang’s performance in the context of general economic and industry conditions and Company

performance during the applicable year.

| Item 9.01. |

Financial Statements and Exhibits. |

|

|

|

| Exhibit No. |

|

Description |

|

|

| 99.1 |

|

Press release, dated January 27, 2016, regarding the Company’s financial results for the quarter ended December 31, 2015 |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

| Date: January 27, 2016 |

|

|

|

MicroStrategy Incorporated |

|

|

|

|

|

|

(Registrant) |

|

|

|

|

|

|

|

|

By: |

|

/s/ Phong Le |

|

|

|

|

Name: |

|

Phong Le |

|

|

|

|

Title: |

|

Senior Executive Vice President & Chief Financial Officer |

EXHIBIT INDEX

|

|

|

| Exhibit No. |

|

Description |

|

|

| 99.1 |

|

Press release, dated January 27, 2016, regarding the Company’s financial results for the quarter ended December 31, 2015 |

Exhibit 99.1

Contact:

MicroStrategy Incorporated

Investor Relations

ir@microstrategy.com

(703) 848-8600

MicroStrategy Announces

Fourth Quarter 2015 Financial Results

TYSONS CORNER, Va., January 27, 2016 - MicroStrategy® Incorporated (Nasdaq:

MSTR), a leading worldwide provider of enterprise software platforms, today announced financial results for the three-month period ended December 31, 2015 (the fourth quarter of its 2015 fiscal year).

Fourth quarter 2015 revenues were $143.5 million versus $148.9 million for the fourth quarter of 2014, a 4% decrease. Product licenses and

subscription services revenues for the fourth quarter of 2015 were $49.1 million versus $40.7 million for the fourth quarter of 2014, a 20% increase. Product support revenues for the fourth quarter of 2015 were $70.3 million versus $74.6 million for

the fourth quarter of 2014, a 6% decrease. Other services revenues for the fourth quarter of 2015 were $24.2 million versus $33.5 million for the fourth quarter of 2014, a 28% decrease. Foreign currency headwinds continued to have a negative impact

on revenues for the fourth quarter of 2015.

Operating expenses for the fourth quarter of 2015 were $74.2 million versus $84.1 million for

the fourth quarter of 2014, a 12% decrease. Fourth quarter 2015 operating expenses included less than $0.1 million in restructuring costs, as compared to $3.2 million in restructuring costs in the fourth quarter of 2014. In addition, MicroStrategy

did not capitalize any software development costs during the fourth quarter of 2015, as compared to $6.1 million in software development costs capitalized during the fourth quarter of 2014.

Income from operations for the fourth quarter of 2015 was $45.9 million, as compared to income from operations of $33.2 million for the fourth

quarter of 2014. Net income for the fourth quarter of 2015 was $39.1 million, or $3.38 per share on a diluted basis, as compared to net income of $22.7 million, or $1.99 per share on a diluted basis, for the fourth quarter of 2014.

Non-GAAP income from operations, which excludes share-based compensation expense and restructuring costs, was $50.7 million for the fourth

quarter of 2015 versus $39.6 million for the fourth quarter of 2014.

As of December 31, 2015, MicroStrategy had cash and cash

equivalents and short-term investments of $485.7 million, as compared to $345.5 million as of December 31, 2014, an increase of $140.2 million. As of December 31, 2015, MicroStrategy had 9.4 million shares of class A common stock and

2.0 million shares of class B common stock outstanding.

The tables at the end of this press release include a reconciliation of

income from operations to non-GAAP income from operations for the three and twelve months ended December 31, 2015 and 2014. An explanation of this non-GAAP measure is also included under the heading “Non-GAAP Financial Measure” below.

Conference Call

MicroStrategy will be discussing its fourth quarter 2015 financial results on a conference call today beginning at approximately 5:00 p.m. EST. To access the

conference call, dial (844) 824-7425 (domestically) or (716) 220-9429 (internationally) and use conference ID 24967509. A live webcast and replay of the conference call will be available under the “Events &

Presentations” section on MicroStrategy’s investor relations website at http://ir.microstrategy.com/events.cfm. The replay will be available beginning approximately two hours after the call concludes until February 1, 2016 at

(855) 859-2056 (domestically) or (404) 537-3406 (internationally) using the passcode 24967509. An archived webcast will also be available under the “Events & Presentations” section

on MicroStrategy’s investor relations website at http://ir.microstrategy.com/events.cfm.

Management Reorganization

As announced on January 8, 2016, the Company implemented a reorganization of its management team, which is intended to further streamline the

business. The reorganization enabled the Company to eliminate a layer of management and is designed to better position the business for profitable growth in the year ahead. This streamlining resulted in the departures of former President,

Paul N. Zolfaghari, and former President and Chief Legal Officer, Jonathan F. Klein. “Paul and Jonathan both made valuable contributions to the Company during their tenures. MicroStrategy is grateful for their service and wishes them

well,” said Michael J. Saylor, Chairman and Chief Executive Officer of MicroStrategy.

MicroStrategy Unveiled MicroStrategy 10.2™

MicroStrategy unveiled MicroStrategy 10.2, the latest release of its groundbreaking enterprise analytics platform, which became generally available on

December 23, 2015. Version 10.2 delivers a collection of enhancements across the entire platform, with a focus on making application development faster.

With the latest release, MicroStrategy 10 Secure Enterprise™ makes it easier for users to build apps and dashboards, find answers, and complete tasks

faster. The new features in version 10.2 include simpler D3 visualization workflows and novel collaboration options that allow business analysts to easily add annotations or comments while sharing dashboards via MicroStrategy Desktop™. The

release also features customizable home screens with MicroStrategy Web™, reusable themes for documents, replaceable datasets, auto partitioning of in-memory cubes, and more. Features new to MicroStrategy Mobile™ include enhanced drilling,

offline prompt support, mobile subscriptions for iOS, and improvements to the native MicroStrategy Mobile app that is also available for Android. To learn more about these new features, visit: www.microstrategy.com/analytics. To register for

the “What’s New in MicroStrategy 10.2” webcast, visit: https://info2.microstrategy.com/WhatsNewin102.

With its cadence of new

product releases rolled out approximately every three months, MicroStrategy has been able to offer new features and enhancements to its global customer base on a regular basis. MicroStrategy 10.2 provides a number of key improvements, all of

which will be highlighted on the “What’s New in MicroStrategy 10.2” webcast. MicroStrategy 10.2 will be featured at MicroStrategy World 2016, the company’s annual user conference taking place February 8-10, 2016 in Miami,

FL. To register for MicroStrategy World 2016, visit: http://www.microstrategy.com/us/learn/world-2016.

MicroStrategy Released Usher™ 3.0

Enterprise Security Platform

In October 2015, MicroStrategy announced the release of Usher 3.0. Usher is a powerful enterprise security

platform that provides advanced security for both logical and physical access, deep identity analytics for business productivity and security, and the ability to locate and communicate with users. Usher 3.0 features a new and intuitive badge design

that delivers remarkable ease-of-use together with substantial new capabilities.

Usher replaces physical badges, passwords, and keys. The platform also allows people to move through the

enterprise based on their roles and context using digital security badges available as an app on their mobile devices. Highlights of the new Usher 3.0 release include:

| |

• |

|

Seamless Badge Navigation: Users can scroll through all their badges by swiping left or right, making badges easy to use and intuitive. |

| |

• |

|

Functionality with a Tap: All core Usher functions are now on the bottom toolbar of the app, enabling users to easily access their favorite keys, open the QR code scanner, and adjust settings with a simple tap.

|

| |

• |

|

Badge Dossier: By tapping on the badge, users can now access all the extended details of their badges. This new page lists badge credentials, badge security settings, user validation, and additional information

configurable by organizations. |

| |

• |

|

Location Aware Keys: Usher will be able to display the digital key most relevant for where you happen to be. This makes it even easier to use the key you need when you need it. |

| |

• |

|

Multi-Server Support: The app will be able to register multiple instances of the Usher Security Server and enable power users to switch between servers with ease. For example, users who have Usher badges both for

work and for personal use would be able to access both sets of badges in the same app on the same phone. |

| |

• |

|

Enhanced Privacy Controls: This new version gives more granular privacy controls to users while still complying with an organization’s digital security badge controls and configurations. This gives the user

the ability to modify the user’s location access settings with Usher. It also allows administrators to require Bluetooth and location services be turned on in order to use a particular badge. |

Available on-premise and in the cloud, the Usher platform also offers a robust Software Development Kit (SDK), enabling developers to build Usher security,

analytics and productivity capabilities into their existing mobile applications, web applications, and enterprise software packages.

Usher 3.0 for iPhone

is now available for download in the iTunes app store and Google Play store. To get started with Usher and set up Usher identities for your organization, please visit http://usher.com.

MicroStrategy Announced Teradata Support for Governed Data Discovery

In October 2015, MicroStrategy announced that its joint customers with Teradata Corporation (NYSE: TDC) will be able to benefit from governed data discovery

and sub-second response rates. With the new release, in addition to benefitting from the new enhancements and features available with MicroStrategy 10.2, joint customers will be able to leverage the relatively new native and optimized Teradata

connector that was previously introduced with version 10.1.

“Companies in every industry possess astounding amounts of data, with those data volumes

expected to grow exponentially in the foreseeable future,” said Sean Slack, Vice President Global Alliances and Strategic Partnerships, Teradata. “When customers use MicroStrategy together with Teradata, they are positioned to scale to the

rising data requirements tied to the future of enterprise software and Big Data analytics. MicroStrategy is a dedicated partner that understands how crucial it is for our joint customers to transform their Big Data into useful insights so they can

make meaningful decisions about their customers, products, competitors, and markets. With MicroStrategy 10 and the Teradata Database, leading companies can harness our combined technologies to run more efficiently, innovate more rapidly, and serve

customers more effectively.”

Governed data discovery with enterprise sources like Teradata’s is one of the many key improvements

delivered in the latest release, making it easy for business users to discover, analyze, and distribute valid analytics throughout an organization. With MicroStrategy 10, Teradata customers can deploy self-service analytics to the entire

organization, giving business users the ability to promote data mashups or dashboards to a centralized environment. Business users also have the ability to swap out localized data with trusted and modeled Teradata enterprise data to ensure

consistent KPIs across the deployment. From there, business users can easily share their findings in a personalized manner using powerful dashboard and report delivery options available with MicroStrategy.

In addition to governed data discovery, MicroStrategy users will benefit from sub-second response rates while accessing relational data with optimized and

native Teradata connectors, and also leverage the processing power of Teradata to the fullest extent by intelligently pushing data joins and complex calculations to the Teradata database when possible. In this way, customers of MicroStrategy and

Teradata gain the speed and flexibility of data discovery without sacrificing the scalability, security, and trust of a governed enterprise analytics environment.

Successful Deployment of MicroStrategy Mobile Demonstrates Mobile Technology Best Practices

In December 2015, MicroStrategy announced that its customer Houghton Mifflin Harcourt (HMH) won the 2015 Ventana Research Leadership award in the Mobile

Technology category. Houghton Mifflin Harcourt is a Boston-based learning company serving more than 50 million students in over 150 countries worldwide. The 2015 Leadership award recognizes the work of HMH’s Trade Publishing group, best

known for award-winning novels, non-fiction, reference, children’s titles and characters, including Curious George®, The Hobbit and Better Homes and Gardens.

Houghton Mifflin Harcourt Trade Publishing’s mobile reporting app, INsight, provides employees in the editorial, sales and finance groups with critical

information to optimize business decisions and sales force productivity. Employees have a 360-degree view of customer, product, author and sales territory information. For instance, a sales rep can pull up a daily sales dashboard on an iPad

device, and with a swipe or tap, track title inventory status, customer sales activity and orders in the pipeline. Financial analysts can measure product line performance against prior year actuals and current year budgets, and HMH’s senior

vice president of sales can monitor the sales performance of the most recent best seller across all customers.

“With a mission to empower our sales

organization, we created mobile apps using MicroStrategy Mobile to give our sales reps customized dashboards specific to their territory,” said Vince Benenati, Vice President of Business Operations, HMH Trade Publishing. “Our sales reps

now have an agile and intuitive tool to manage their accounts, check the status of an order and quickly identify relevant titles for a specific customer. At a moment’s notice, our mobile users can pull up title information and divisional

performance, anytime, anywhere.”

Building on INsight’s success in 2015, Benenati and his group added a forecasting model to the app that

projects sales patterns, giving the sales organization intelligence on how a given title might perform based on the sales history of a comparative title. According to Benenati, such insight is also useful for inventory planners to conservatively

estimate a title’s print run.

Weiler Corporation Turns Up Efficiencies and Sales Performance with MicroStrategy Analytics™

In October 2015, MicroStrategy announced that Weiler Corporation, a global manufacturer based in Cresco, PA, successfully deployed MicroStrategy Analytics

across its business to improve operational efficiencies and sales performance. Weiler Corporation is a world-class industry leader and global manufacturer of surface conditioning solutions.

Employees across Sales, Marketing, Supply Chain, Operations, HR, and Finance use MicroStrategy Analytics to pull up actionable reports and dashboards. Weiler

employees are able to run an overall

equipment effectiveness report to see how well their machines are performing and based on the data, automate staffing for Weiler’s machinery. With MicroStrategy’s new data wrangling

feature, users can see and analyze pipeline data that’s embedded in Salesforce.com, in the warehouse, or in another system, without having to exit that application and run another separate report. With greater insight, Weiler is able to engage

with its channel partners and share meaningful, interactive data about trends in the business.

“The ability to combine all of our data in our

dashboards and reports embedded within Salesforce.com and not have to move data and combine it into one report provides a lot of value for our users,” said Bill Dwyre, Vice President Strategic Marketing at Weiler Corporation. “Our

salespeople use MicroStrategy daily to see their personal dashboards within the opportunity pipeline. They can drill into any dips or spikes across their accounts, products, markets or territories, and react quickly to close gaps.”

Non-GAAP Financial Measure

MicroStrategy is providing a

supplemental financial measure for income from continuing operations that excludes the impact of share-based compensation arrangements and restructuring activities. This financial measure is not a measurement of financial performance under generally

accepted accounting principles in the United States (“GAAP”) and, as a result, this financial measure may not be comparable to similarly titled measures of other companies. Management uses this non-GAAP financial measure internally to help

understand, manage, and evaluate business performance and to help make operating decisions. MicroStrategy believes that this non-GAAP financial measure is also useful to investors and analysts in comparing its performance across reporting periods on

a consistent basis because it excludes a significant non-cash share-based compensation expense that MicroStrategy believes is not reflective of its general business performance and significant restructuring charges that we believe are not reflective

of ongoing operating results. In addition, accounting for share-based compensation arrangements requires significant management judgment and the resulting expense could vary significantly in comparison to other companies. Therefore, MicroStrategy

believes the use of this non-GAAP financial measure can also facilitate comparison of MicroStrategy’s operating results to those of its competitors.

About MicroStrategy Incorporated

Founded in 1989,

MicroStrategy (Nasdaq: MSTR) is a leading worldwide provider of enterprise software platforms. The Company’s mission is to provide enterprise analytics, mobility, and security platforms that are flexible, powerful, scalable, and

user-friendly. To learn more, visit MicroStrategy online, and follow us on Facebook and Twitter.

MicroStrategy, MicroStrategy 10,

MicroStrategy 10 Secure Enterprise, MicroStrategy 10.1, MicroStrategy 10.2, MicroStrategy Mobile, MicroStrategy Analytics, MicroStrategy Desktop, MicroStrategy Web, Usher and Usher 3.0 are either trademarks or registered trademarks of MicroStrategy

Incorporated in the United States and certain other countries. Other product and company names mentioned herein may be the trademarks of their respective owners.

This press release may include statements that may constitute “forward-looking statements,” including estimates of future business prospects or

financial results and statements containing the words “believe,” “estimate,” “project,” “expect,” or similar expressions. Forward-looking statements inherently involve risks and uncertainties that could cause

actual results of MicroStrategy Incorporated and its subsidiaries (collectively, the “Company”) to differ materially from the forward-looking statements. Factors that could contribute to such differences include: the extent and timing of

market acceptance of MicroStrategy’s new offerings, including MicroStrategy 10.2; the impact on our business of the restructuring plan we adopted in the third quarter of 2014; the Company’s ability to recognize revenue or deferred revenue

through delivery of products or satisfactory performance of services; continued acceptance of the Company’s other products in the marketplace; fluctuations in tax benefits or provisions; the timing of significant orders; delays in or the

inability of the Company to develop or ship new products; competitive factors; general economic conditions, including economic uncertainty in the retail industry, in which the Company has a significant number of customers; currency fluctuations; and

other risks detailed in the Company’s registration statements and periodic reports filed with the Securities and Exchange Commission. By making these forward-looking statements, the Company undertakes no obligation to update these statements

for revisions or changes after the date of this release.

MSTR-F

MICROSTRATEGY INCORPORATED

CONSOLIDATED STATEMENTS OF OPERATIONS

(in thousands, except per share data)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended |

|

|

Twelve Months Ended |

|

| |

|

December 31, |

|

|

December 31, |

|

| |

|

2015 |

|

|

2014 |

|

|

2015 |

|

|

2014 |

|

| |

|

(unaudited) |

|

|

(unaudited) |

|

|

(unaudited) |

|

|

(unaudited) |

|

| Revenues |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Product licenses |

|

$ |

41,509 |

|

|

$ |

34,744 |

|

|

$ |

119,143 |

|

|

$ |

125,952 |

|

| Subscription services |

|

|

7,554 |

|

|

|

6,005 |

|

|

|

27,839 |

|

|

|

22,322 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total product licenses and subscription services |

|

|

49,063 |

|

|

|

40,749 |

|

|

|

146,982 |

|

|

|

148,274 |

|

| Product support |

|

|

70,296 |

|

|

|

74,634 |

|

|

|

281,740 |

|

|

|

295,703 |

|

| Other services |

|

|

24,163 |

|

|

|

33,488 |

|

|

|

101,147 |

|

|

|

135,853 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total revenues |

|

|

143,522 |

|

|

|

148,871 |

|

|

|

529,869 |

|

|

|

579,830 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cost of revenues |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Product licenses |

|

|

2,223 |

|

|

|

1,501 |

|

|

|

8,118 |

|

|

|

6,957 |

|

| Subscription services |

|

|

3,251 |

|

|

|

3,731 |

|

|

|

13,051 |

|

|

|

17,560 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total product licenses and subscription services |

|

|

5,474 |

|

|

|

5,232 |

|

|

|

21,169 |

|

|

|

24,517 |

|

| Product support |

|

|

3,014 |

|

|

|

3,528 |

|

|

|

12,748 |

|

|

|

14,241 |

|

| Other services |

|

|

14,926 |

|

|

|

22,875 |

|

|

|

67,191 |

|

|

|

96,452 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total cost of revenues |

|

|

23,414 |

|

|

|

31,635 |

|

|

|

101,108 |

|

|

|

135,210 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Gross profit |

|

|

120,108 |

|

|

|

117,236 |

|

|

|

428,761 |

|

|

|

444,620 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating expenses |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Sales and marketing |

|

|

39,380 |

|

|

|

47,058 |

|

|

|

148,522 |

|

|

|

225,086 |

|

| Research and development |

|

|

17,155 |

|

|

|

13,886 |

|

|

|

65,206 |

|

|

|

103,355 |

|

| General and administrative |

|

|

17,661 |

|

|

|

19,967 |

|

|

|

80,732 |

|

|

|

96,343 |

|

| Restructuring costs |

|

|

18 |

|

|

|

3,154 |

|

|

|

279 |

|

|

|

14,732 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total operating expenses |

|

|

74,214 |

|

|

|

84,065 |

|

|

|

294,739 |

|

|

|

439,516 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Income from operations |

|

|

45,894 |

|

|

|

33,171 |

|

|

|

134,022 |

|

|

|

5,104 |

|

| Interest income, net |

|

|

155 |

|

|

|

29 |

|

|

|

284 |

|

|

|

162 |

|

| Other income, net |

|

|

957 |

|

|

|

2,449 |

|

|

|

3,558 |

|

|

|

5,785 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Income before income taxes |

|

|

47,006 |

|

|

|

35,649 |

|

|

|

137,864 |

|

|

|

11,051 |

|

| Provision for income taxes |

|

|

7,895 |

|

|

|

12,950 |

|

|

|

31,933 |

|

|

|

6,016 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income |

|

$ |

39,111 |

|

|

$ |

22,699 |

|

|

$ |

105,931 |

|

|

$ |

5,035 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic earnings per share (1): |

|

$ |

3.44 |

|

|

$ |

2.01 |

|

|

$ |

9.33 |

|

|

$ |

0.45 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Weighted average shares outstanding used in computing basic earnings per share |

|

|

11,386 |

|

|

|

11,302 |

|

|

|

11,355 |

|

|

|

11,301 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Diluted earnings per share (1): |

|

$ |

3.38 |

|

|

$ |

1.99 |

|

|

$ |

9.18 |

|

|

$ |

0.44 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Weighted average shares outstanding used in computing diluted earnings per share |

|

|

11,577 |

|

|

|

11,409 |

|

|

|

11,539 |

|

|

|

11,356 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (1) |

Basic and fully diluted earnings per share for class A and class B common stock are the same. |

MICROSTRATEGY INCORPORATED

CONSOLIDATED BALANCE SHEETS

(in thousands, except per share data)

|

|

|

|

|

|

|

|

|

| |

|

December 31, |

|

|

December 31, |

|

| |

|

2015 |

|

|

2014* |

|

| |

|

(unaudited) |

|

|

|

|

| Assets |

|

|

|

|

|

|

|

|

| Current assets |

|

|

|

|

|

|

|

|

| Cash and cash equivalents |

|

$ |

292,341 |

|

|

$ |

146,919 |

|

| Restricted cash |

|

|

618 |

|

|

|

661 |

|

| Short-term investments |

|

|

193,320 |

|

|

|

198,547 |

|

| Accounts receivable, net |

|

|

68,154 |

|

|

|

78,633 |

|

| Prepaid expenses and other current assets |

|

|

10,881 |

|

|

|

17,669 |

|

| Deferred tax assets, net |

|

|

— |

|

|

|

19,936 |

|

|

|

|

|

|

|

|

|

|

| Total current assets |

|

|

565,314 |

|

|

|

462,365 |

|

|

|

|

| Property and equipment, net |

|

|

65,664 |

|

|

|

77,852 |

|

| Capitalized software development costs, net |

|

|

15,855 |

|

|

|

13,469 |

|

| Deposits and other assets |

|

|

2,072 |

|

|

|

3,951 |

|

| Deferred tax assets, net |

|

|

7,989 |

|

|

|

1,160 |

|

|

|

|

|

|

|

|

|

|

| Total Assets |

|

$ |

656,894 |

|

|

$ |

558,797 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Liabilities and Stockholders’ Equity |

|

|

|

|

|

|

|

|

| Current liabilities |

|

|

|

|

|

|

|

|

| Accounts payable and accrued expenses |

|

$ |

31,840 |

|

|

$ |

35,458 |

|

| Accrued compensation and employee benefits |

|

|

40,067 |

|

|

|

50,588 |

|

| Accrued restructuring costs |

|

|

56 |

|

|

|

2,284 |

|

| Deferred revenue and advance payments |

|

|

100,695 |

|

|

|

108,413 |

|

| Deferred tax liabilities |

|

|

— |

|

|

|

557 |

|

|

|

|

|

|

|

|

|

|

| Total current liabilities |

|

|

172,658 |

|

|

|

197,300 |

|

|

|

|

| Deferred revenue and advance payments |

|

|

8,995 |

|

|

|

10,818 |

|

| Other long-term liabilities |

|

|

19,943 |

|

|

|

22,679 |

|

| Deferred tax liabilities |

|

|

17 |

|

|

|

3,529 |

|

|

|

|

|

|

|

|

|

|

| Total Liabilities |

|

|

201,613 |

|

|

|

234,326 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Stockholders’ Equity |

|

|

|

|

|

|

|

|

| Preferred stock undesignated, $0.001 par value; 5,000 shares authorized; no shares issued or outstanding |

|

|

— |

|

|

|

— |

|

| Class A common stock, $0.001 par value; 330,000 shares authorized; 15,771 shares issued and 9,366 shares outstanding, and 15,660

shares issued and 9,255 shares outstanding, respectively |

|

|

16 |

|

|

|

16 |

|

| Class B convertible common stock, $0.001 par value; 165,000 shares authorized; 2,035 shares issued and outstanding, and 2,055 shares

issued and outstanding, respectively |

|

|

2 |

|

|

|

2 |

|

| Additional paid-in capital |

|

|

534,651 |

|

|

|

506,727 |

|

| Treasury stock, at cost; 6,405 shares |

|

|

(475,184 |

) |

|

|

(475,184 |

) |

| Accumulated other comprehensive loss |

|

|

(7,408 |

) |

|

|

(4,363 |

) |

| Retained earnings |

|

|

403,204 |

|

|

|

297,273 |

|

|

|

|

|

|

|

|

|

|

| Total Stockholders’ Equity |

|

|

455,281 |

|

|

|

324,471 |

|

|

|

|

|

|

|

|

|

|

| Total Liabilities and Stockholders’ Equity |

|

$ |

656,894 |

|

|

$ |

558,797 |

|

|

|

|

|

|

|

|

|

|

| * |

Derived from audited financial statements. |

MICROSTRATEGY INCORPORATED

CONSOLIDATED STATEMENTS OF CASH FLOWS

(in thousands)

|

|

|

|

|

|

|

|

|

| |

|

Twelve Months Ended |

|

| |

|

December 31, |

|

| |

|

2015 |

|

|

2014 |

|

| |

|

(unaudited) |

|

|

(unaudited) |

|

| Operating activities: |

|

|

|

|

|

|

|

|

| Net income |

|

$ |

105,931 |

|

|

$ |

5,035 |

|

| Adjustments to reconcile net income to net cash provided by operating activities: |

|

|

|

|

|

|

|

|

| Depreciation and amortization |

|

|

21,214 |

|

|

|

25,295 |

|

| Bad debt expense |

|

|

884 |

|

|

|

2,969 |

|

| Unrealized net loss (gain) on foreign currency forward contracts |

|

|

1,641 |

|

|

|

(1,682 |

) |

| Non-cash restructuring costs and adjustments |

|

|

(136 |

) |

|

|

199 |

|

| Deferred taxes |

|

|

9,666 |

|

|

|

(1,526 |

) |

| Release of liabilities for unrecognized tax benefits |

|

|

(899 |

) |

|

|

— |

|

| Share-based compensation expense |

|

|

17,299 |

|

|

|

11,786 |

|

| Excess tax benefits from share-based compensation arrangements |

|

|

(1,096 |

) |

|

|

— |

|

| Reclassification of foreign currency translation adjustment from other comprehensive income |

|

|

(280 |

) |

|

|

— |

|

| Changes in operating assets and liabilities: |

|

|

|

|

|

|

|

|

| Accounts receivable |

|

|

5,003 |

|

|

|

(276 |

) |

| Prepaid expenses and other current assets |

|

|

4,446 |

|

|

|

(2,713 |

) |

| Deposits and other assets |

|

|

1,631 |

|

|

|

909 |

|

| Accounts payable and accrued expenses |

|

|

1,904 |

|

|

|

(1,701 |

) |

| Accrued compensation and employee benefits |

|

|

(8,387 |

) |

|

|

(26,875 |

) |

| Accrued restructuring costs |

|

|

(1,922 |

) |

|

|

2,379 |

|

| Deferred revenue and advance payments |

|

|

(4,176 |

) |

|

|

731 |

|

| Other long-term liabilities |

|

|

(3,024 |

) |

|

|

70 |

|

|

|

|

|

|

|

|

|

|

| Net cash provided by operating activities |

|

|

149,699 |

|

|

|

14,600 |

|

|

|

|

| Investing activities: |

|

|

|

|

|

|

|

|

| Proceeds from redemption of short-term investments |

|

|

479,200 |

|

|

|

308,900 |

|

| Purchases of property and equipment |

|

|

(3,484 |

) |

|

|

(12,400 |

) |

| Purchases of short-term investments |

|

|

(473,779 |

) |

|

|

(370,050 |

) |

| Capitalized software development costs |

|

|

(9,598 |

) |

|

|

(8,396 |

) |

| Increase in restricted cash |

|

|

(20 |

) |

|

|

(164 |

) |

|

|

|

|

|

|

|

|

|

| Net cash used in investing activities |

|

|

(7,681 |

) |

|

|

(82,110 |

) |

|

|

|

| Financing activities: |

|

|

|

|

|

|

|

|

| Proceeds from sale of class A common stock under exercise of employee stock options |

|

|

9,529 |

|

|

|

856 |

|

| Excess tax benefits from share-based compensation arrangements |

|

|

1,096 |

|

|

|

— |

|

| Payments on capital lease obligations and other financing arrangements |

|

|

(1,447 |

) |

|

|

(2,326 |

) |

|

|

|

|

|

|

|

|

|

| Net cash provided by (used in) financing activities |

|

|

9,178 |

|

|

|

(1,470 |

) |

|

|

|

| Effect of foreign exchange rate changes on cash and cash equivalents |

|

|

(5,774 |

) |

|

|

(4,272 |

) |

|

|

|

|

|

|

|

|

|

| Net increase (decrease) in cash and cash equivalents |

|

|

145,422 |

|

|

|

(73,252 |

) |

| Cash and cash equivalents, beginning of period |

|

|

146,919 |

|

|

|

220,171 |

|

|

|

|

|

|

|

|

|

|

| Cash and cash equivalents, end of period |

|

$ |

292,341 |

|

|

$ |

146,919 |

|

|

|

|

|

|

|

|

|

|

MICROSTRATEGY INCORPORATED

REVENUE AND COST OF REVENUE DETAIL

(in thousands)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended |

|

|

Twelve Months Ended |

|

| |

|

December 31, |

|

|

December 31, |

|

| |

|

2015 |

|

|

2014 |

|

|

2015 |

|

|

2014 |

|

| |

|

(unaudited) |

|

|

(unaudited) |

|

|

(unaudited) |

|

|

(unaudited) |

|

| Revenues |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Product licenses and subscription services: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Product licenses |

|

$ |

41,509 |

|

|

$ |

34,744 |

|

|

$ |

119,143 |

|

|

$ |

125,952 |

|

| Subscription services |

|

|

7,554 |

|

|

|

6,005 |

|

|

|

27,839 |

|

|

|

22,322 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total product licenses and subscription services |

|

|

49,063 |

|

|

|

40,749 |

|

|

|

146,982 |

|

|

|

148,274 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Product support |

|

|

70,296 |

|

|

|

74,634 |

|

|

|

281,740 |

|

|

|

295,703 |

|

| Other services: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Consulting |

|

|

21,590 |

|

|

|

30,448 |

|

|

|

92,065 |

|

|

|

121,958 |

|

| Education |

|

|

2,573 |

|

|

|

3,040 |

|

|

|

9,082 |

|

|

|

13,895 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total other services |

|

|

24,163 |

|

|

|

33,488 |

|

|

|

101,147 |

|

|

|

135,853 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total revenues |

|

|

143,522 |

|

|

|

148,871 |

|

|

|

529,869 |

|

|

|

579,830 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cost of revenues |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Product licenses and subscription services: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Product licenses |

|

|

2,223 |

|

|

|

1,501 |

|

|

|

8,118 |

|

|

|

6,957 |

|

| Subscription services |

|

|

3,251 |

|

|

|

3,731 |

|

|

|

13,051 |

|

|

|

17,560 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total product licenses and subscription services |

|

|

5,474 |

|

|

|

5,232 |

|

|

|

21,169 |

|

|

|

24,517 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Product support |

|

|

3,014 |

|

|

|

3,528 |

|

|

|

12,748 |

|

|

|

14,241 |

|

| Other services: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Consulting |

|

|

13,818 |

|

|

|

21,950 |

|

|

|

63,344 |

|

|

|

90,780 |

|

| Education |

|

|

1,108 |

|

|

|

925 |

|

|

|

3,847 |

|

|

|

5,672 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total other services |

|

|

14,926 |

|

|

|

22,875 |

|

|

|

67,191 |

|

|

|

96,452 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total cost of revenues |

|

|

23,414 |

|

|

|

31,635 |

|

|

|

101,108 |

|

|

|

135,210 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Gross profit |

|

$ |

120,108 |

|

|

$ |

117,236 |

|

|

$ |

428,761 |

|

|

$ |

444,620 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

MICROSTRATEGY INCORPORATED

DEFERRED REVENUE DETAIL

(in thousands)

|

|

|

|

|

|

|

|

|

| |

|

December 31, |

|

|

December 31, |

|

| |

|

2015 |

|

|

2014* |

|

| |

|

(unaudited) |

|

|

|

|

| Current: |

|

|

|

|

|

|

|

|

| Deferred product licenses revenue |

|

$ |

13,506 |

|

|

$ |

10,927 |

|

| Deferred subscription services revenue |

|

|

15,763 |

|

|

|

16,018 |

|

| Deferred product support revenue |

|

|

158,738 |

|

|

|

168,833 |

|

| Deferred other services revenue |

|

|

9,149 |

|

|

|

10,564 |

|

|

|

|

|

|

|

|

|

|

| Gross current deferred revenue and advance payments |

|

|

197,156 |

|

|

|

206,342 |

|

| Less: unpaid deferred revenue |

|

|

(96,461 |

) |

|

|

(97,929 |

) |

|

|

|

|

|

|

|

|

|

| Net current deferred revenue and advance payments |

|

$ |

100,695 |

|

|

$ |

108,413 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Non-current: |

|

|

|

|

|

|

|

|

| Deferred product licenses revenue |

|

$ |

5,397 |

|

|

$ |

8,012 |

|

| Deferred subscription services revenue |

|

|

2,138 |

|

|

|

750 |

|

| Deferred product support revenue |

|

|

7,607 |

|

|

|

7,505 |

|

| Deferred other services revenue |

|

|

795 |

|

|

|

1,047 |

|

|

|

|

|

|

|

|

|

|

| Gross non-current deferred revenue and advance payments |

|

|

15,937 |

|

|

|

17,314 |

|

| Less: unpaid deferred revenue |

|

|

(6,942 |

) |

|

|

(6,496 |

) |

|

|

|

|

|

|

|

|

|

| Net non-current deferred revenue and advance payments |

|

$ |

8,995 |

|

|

$ |

10,818 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total current and non-current: |

|

|

|

|

|

|

|

|

| Deferred product licenses revenue |

|

$ |

18,903 |

|

|

$ |

18,939 |

|

| Deferred subscription services revenue |

|

|

17,901 |

|

|

|

16,768 |

|

| Deferred product support revenue |

|

|

166,345 |

|

|

|

176,338 |

|

| Deferred other services revenue |

|

|

9,944 |

|

|

|

11,611 |

|

|

|

|

|

|

|

|

|

|

| Gross current and non-current deferred revenue and advance payments |

|

|

213,093 |

|

|

|

223,656 |

|

| Less: unpaid deferred revenue |

|

|

(103,403 |

) |

|

|

(104,425 |

) |

|

|

|

|

|

|

|

|

|

| Net current and non-current deferred revenue and advance payments |

|

$ |

109,690 |

|

|

$ |

119,231 |

|

|

|

|

|

|

|

|

|

|

| * |

Derived from audited financial statements. |

MICROSTRATEGY INCORPORATED

RECONCILIATION OF GAAP TO NON-GAAP MEASURES

(in thousands)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended |

|

|

Twelve Months Ended |

|

| |

|

December 31, |

|

|

December 31, |

|

| |

|

2015 |

|

|

2014 |

|

|

2015 |

|

|

2014 |

|

| |

|

(unaudited) |

|

|

(unaudited) |

|

|

(unaudited) |

|

|

(unaudited) |

|

|

|

|

|

|

| Reconciliation of non-GAAP income from operations: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Income from operations |

|

$ |

45,894 |

|

|

$ |

33,171 |

|

|

$ |

134,022 |

|

|

$ |

5,104 |

|

| Share-based compensation expense |

|

|

4,796 |

|

|

|

3,225 |

|

|

|

17,299 |

|

|

|

11,786 |

|

| Restructuring costs |

|

|

18 |

|

|

|

3,154 |

|

|

|

279 |

|

|

|

14,732 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Non-GAAP income from operations |

|

$ |

50,708 |

|

|

$ |

39,550 |

|

|

$ |

151,600 |

|

|

$ |

31,622 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

MICROSTRATEGY INCORPORATED

WORLDWIDE EMPLOYEE HEADCOUNT

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

December 31, |

|

|

March 31, |

|

|

June 30, |

|

|

September 30, |

|

|

December 31, |

|

| |

|

2014 |

|

|

2015 |

|

|

2015 |

|

|

2015 |

|

|

2015 |

|

|

|

|

|

|

|

| Subscription services |

|

|

57 |

|

|

|

43 |

|

|

|

37 |

|

|

|

33 |

|

|

|

37 |

|

| Product support |

|

|

138 |

|

|

|

138 |

|

|

|

130 |

|

|

|

127 |

|

|

|

131 |

|

| Consulting |

|

|

600 |

|

|

|

554 |

|

|

|

508 |

|

|

|

480 |

|

|

|

467 |

|

| Education |

|

|

24 |

|

|

|

19 |

|

|

|

25 |

|

|

|

27 |

|

|

|

28 |

|

| Sales and marketing |

|

|

662 |

|

|

|

577 |

|

|

|

515 |

|

|

|

507 |

|

|

|

513 |

|

| Research and development |

|

|

645 |

|

|

|

580 |

|

|

|

508 |

|

|

|

464 |

|

|

|

461 |

|

| General and administrative |

|

|

344 |

|

|

|

321 |

|

|

|

303 |

|

|

|

301 |

|

|

|

310 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total headcount |

|

|

2,470 |

|

|

|

2,232 |

|

|

|

2,026 |

|

|

|

1,939 |

|

|

|

1,947 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

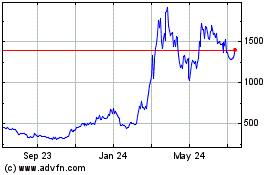

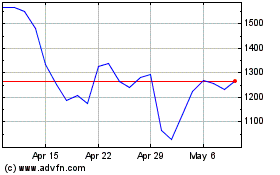

MicroStrategy (NASDAQ:MSTR)

Historical Stock Chart

From Mar 2024 to Apr 2024

MicroStrategy (NASDAQ:MSTR)

Historical Stock Chart

From Apr 2023 to Apr 2024