Current Report Filing (8-k)

January 22 2016 - 4:42PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE

COMMISSION

WASHINGTON, D.C. 20549

FORM

8-K

CURRENT REPORT

PURSUANT TO SECTION

13 OR 15(d) OF THE

SECURITIES EXCHANGE

ACT OF 1934

Date of Report (Date

of earliest event reported): January 20, 2016

| AMREP

CORPORATION |

| (Exact

name of Registrant as specified in its charter) |

| Oklahoma |

1-4702 |

59-0936128 |

| (State or other

jurisdiction of |

(Commission

File |

(IRS Employer |

| incorporation) |

Number) |

Identification

No.) |

| 300

Alexander Park, Suite 204, Princeton, New Jersey |

08540 |

| (Address of

principal executive offices) |

(Zip Code) |

Registrant's telephone number, including

area code: (609) 716-8200

| Not

Applicable |

| (Former name

or former address, if changed since last report) |

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the Registrant under any of the following provisions (see General Instruction

A.2. below):

| ¨ |

Written communications pursuant to Rule 425 under the Securities

Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange

Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under

the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under

the Exchange Act (17 CFR 240.13e-4(c)) |

Item 1.01 Entry into a Material Definitive Agreement.

Reference is made to the sale on February 9, 2015 of AMREP

Corporation’s Newsstand Distribution Services business and Product Packaging and Fulfillment Services business and the relationship

of Michael P. Duloc to AMREP Corporation, each of which is described in Item 1 of Part I of AMREP Corporation’s Form 10-K

for the year ended April 30, 2015, which was filed with the Securities and Exchange Commission on July 29, 2015.

On January 20, 2016, American Investment Republic Co. (“Lender”),

a subsidiary of AMREP Corporation, entered into a letter agreement with each of DFI Holdings, LLC, KPS Holdco, LLC and their respective

subsidiaries (collectively, “Borrowers”), which resolved certain events of default of the Borrowers. Among other things,

the letter agreement provided the following:

| · | Payment

to Lender of approximately $1.6 million, representing the full amount of principal and

interest outstanding under the promissory note executed by DFI Holdings, LLC and KPS

Holdco, LLC in favor of Lender; |

| · | Termination

of the line of credit promissory note provided by Lender to certain Borrowers. No amount

of principal was outstanding under the line of credit promissory note as of the termination

date; |

| · | Termination

of the security agreement provided by Borrowers in favor of Lender pursuant to which

Borrowers had pledged and granted a security interest in substantially all of their personal

property to Lender in order to secure the obligations of Borrowers; and |

| · | A

release and indemnity in favor of Lender and its affiliates with respect to the events

of default and the resolution thereof. |

The foregoing description of the letter agreement is a

summary only and is qualified in all respects by the provisions of such document.

Item 1.02 Termination of a Material Definitive Agreement.

The information in Item 1.01 of this Current Report on

Form 8-K is incorporated by reference into this Item 1.02.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

|

|

|

|

|

|

| |

|

|

|

AMREP

Corporation |

| |

|

|

|

| Date: January 22,

2016 |

|

|

|

By: |

|

/s/ Christopher

V. Vitale |

| |

|

|

|

|

|

Name: Christopher

V. Vitale |

| |

|

|

|

|

|

Title: Executive

Vice President |

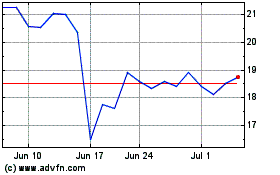

AMREP (NYSE:AXR)

Historical Stock Chart

From Mar 2024 to Apr 2024

AMREP (NYSE:AXR)

Historical Stock Chart

From Apr 2023 to Apr 2024