UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15 (d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): January 15, 2016

VOXX INTERNATIONAL CORPORATION

(Exact name of registrant as specified in its charter)

|

| |

Delaware (State or other jurisdiction of incorporation or organization) | 0-28839 (Commission File Number) |

13-1964841 (IRS Employer Identification No.) |

180 Marcus Blvd., Hauppauge, New York (Address of principal executive offices) | 11788 (Zip Code) |

Registrant's telephone number, including area code (631) 231-7750

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of file following provisions:

[ ] Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

[ ] Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

[ ] Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

[ ] Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(e))

Item 1.01 Entry into a Material Definitive Agreement.

VOXX International Corporation (the “Company”) entered into the Sixth Amendment to Amended and Restated Credit Agreement, dated as of January15, 2016 (the “Sixth Amendment”), by and among the Company, the Borrowers, the Guarantors, the Lenders party thereto and Wells Fargo Bank, National Association, as administrative agent on behalf of the Lenders (the “Credit Agreement”).

The Sixth Amendment provides for a reduction in the amount of the Revolving Committed Amount from $200 million to $125 million, with a $15.625 million sublimit for Letters of Credit and a $6.25 million sublimit for Swingline Loans. The amended facility is due on January 9, 2019 however it is subject to acceleration upon the occurrence of an Event of Default (as defined in the Credit Agreement).

The Sixth Amendment also adds definitions to Section 1.1 of the Credit Agreement which allow for the Extension of Credit based on a Borrowing Base Certificate and amended Sections 5.9(a)(i) and 5.9(b) to allow for the Total Leverage Ratio for the quarter ended November 30, 2015 to be less than or equal to 4.25 to 1.00, and the Consolidated EBIT to Consolidated Interest Expense Ratio for the quarter ended November 30, 2015 to be no greater than or equal to 1.75 to 1.00, respectively, effectively waiving the breach of these covenants for the quarter ended November 30, 2015.

The above description of the Sixth Amendment does not purport to be a complete statement of the parties’ rights and obligations under the Sixth Amendment and is qualified in its entirety by reference to the Sixth Amendment which is filed herewith as Exhibit 10.1.

| |

Item 2.03 | Creation of a Direct Financial Obligation or an Obligation Under an Off-Balance Sheet Arrangement of a Registrant. |

The disclosures required by this Item 2.03 are contained in Item 1.01 above and are incorporated as if fully restated herein.

EXHIBIT INDEX

|

| |

Exhibit No. | Description |

| |

10.1 | Sixth Amendment to the Amended and Restated Credit Agreement, dated as of January 15, 2016, by and among VOXX International Corporation, the other Borrowers, the Guarantors, the Lenders and Wells Fargo Bank, National Association, as administrative agent on behalf of the Lenders. |

| |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

VOXX International Corporation (Registrant)

Date: January 22, 2016

BY: /s/ Charles M. Stoehr

Charles M. Stoehr

Senior Vice President and

Chief Financial Officer

SIXTH AMENDMENT TO AMENDED AND RESTATED

CREDIT AGREEMENT

THIS SIXTH AMENDMENT TO AMENDED AND RESTATED CREDIT AGREEMENT (this “Amendment”), dated as of January 15, 2016, is by and among VOXX INTERNATIONAL CORPORATION, a Delaware corporation (the “Company”), VOXX ACCESSORIES CORP., a Delaware corporation (“VAC”), VOXX ELECTRONICS CORP. (formerly known as Audiovox Electronics Corporation), a Delaware corporation (“VEC”), AUDIOVOX CONSUMER ELECTRONICS, INC., a Delaware corporation (“ACEI”), AUDIOVOX ATLANTA CORP. (formerly known as American Radio Corp.), a Georgia corporation (“AAC”), CODE SYSTEMS, INC., a Delaware corporation (“CSI”), INVISION AUTOMOTIVE SYSTEMS INC., a Delaware corporation (“IAS”), KLIPSCH GROUP, INC., an Indiana corporation (“Klipsch”, and together with the Company, VAC, VEC, ACEI, AAC, CSI and IAS, each a “Borrower” and collectively the “Borrowers”), the Subsidiaries of the Company party hereto (collectively, the “Guarantors”), the Lenders (defined below) and WELLS FARGO BANK, NATIONAL ASSOCIATION, as administrative agent on behalf of the Lenders under the Credit Agreement (as hereinafter defined) (in such capacity, the “Administrative Agent”). Capitalized terms used herein and not otherwise defined herein shall have the meanings ascribed thereto in the Credit Agreement.

W I T N E S S E T H

WHEREAS, the Borrowers, the Guarantors, certain banks and financial institutions from time to time party thereto (the “Lenders”) and the Administrative Agent are parties to that certain Amended and Restated Credit Agreement dated as of March 14, 2012 (as amended by that certain First Amendment to Amended and Restated Credit Agreement dated as of November 29, 2012, that certain Second Amendment to Amended and Restated Credit Agreement dated as of May 14, 2013, that certain Third Amendment to Amended and Restated Credit Agreement and Waiver dated as of January 9, 2014, and that certain Fourth Amendment to Amended and Restated Credit Agreement dated as of November 24, 2014, that certain Fifth Amendment to Amended and Restated Credit Agreement and Consent dated as of July 17, 2015 and as further amended, modified, extended, restated, replaced, or supplemented from time to time, the “Credit Agreement”);

WHEREAS, the Credit Parties have informed the Administrative Agent that they wish to permanently reduce (a) the Revolving Committed Amount from $200,000,000 to $125,000,000 pursuant to Section 2.6(a) of the Credit Agreement, (b) the LOC Committed Amount from $25,000,000 to $15,625,000 and (c) the Swingline Committed Amount from $10,000,000 to $6,250,000 (collectively, the “Specified Commitment Reduction”);

WHEREAS, the Credit Parties have requested that the Required Lenders (a) amend certain provisions of the Credit Agreement and (b) waive the five (5) Business Day notice requirement contained in Section 2.6(a) of the Credit Agreement (the “Commitment Reduction Notice Requirement”) in connection with the Specified Commitment Reduction ; and

WHEREAS, the Required Lenders are willing to waive the Commitment Reduction Notice Requirement and make such amendments to the Credit Agreement, in accordance with and subject to the terms and conditions set forth herein.

NOW, THEREFORE, in consideration of the agreements hereinafter set forth, and for other good and valuable consideration, the receipt and adequacy of which are hereby acknowledged, the parties hereto agree as follows:

ARTICLE I

COMMITMENT REDUCTION

1.1 Waiver of Notice. Notwithstanding the provisions of Section 2.6(a) to the contrary, the Required Lenders hereby waive, on a one time basis and solely in connection with the Specified Commitment Reduction, the Commitment Reduction Notice Requirement.

1.2 Reduction of Commitments. By execution of this Amendment, the parties hereto acknowledge that the Specified Commitment Reduction shall become effective on the Amendment Effective Date, and, in connection therewith, the Revolving Committed Amount referred to in Section 2.1(a) shall be amended to read “ONE HUNDRED TWENTY-FIVE MILLION DOLLARS ($125,000,000)”. The Specified Commitment Reduction shall be subject to Section 2.7(b) of the Credit Agreement. After giving effect to the Specified Commitment Reduction, the Revolving Commitments and Revolving Commitment Percentages of the Lenders shall be as set forth on Exhibit A to this Amendment.

ARTICLE II

AMENDMENTS

2.1 Additional Definitions. Section 1.1 of the Credit Agreement is hereby amended by adding the following definitions to such Section in the appropriate alphabetical order:

“Borrowing Base” shall mean, as of any date of determination, the amount equal to (a) 85% (or (i) such lower percentage as determined by the Administrative Agent in its sole discretion or (ii) such higher percentage as determined by the Required Lenders) of Eligible Accounts Receivable plus (b) 50% (or (i) such lower percentage as determined by the Administrative Agent in its sole discretion or (ii) such higher percentage as determined by the Required Lenders) of Eligible Inventory, in each case (1) based on the most recently delivered Borrowing Base Certificate delivered by the Company pursuant to Section 5.2(h) and (2) net of any reserves established from time to time by Administrative Agent in its sole discretion and following not less than five (5) days prior written notice to Company.

“Borrowing Base Certificate” shall mean a certificate substantially in the form of Exhibit 5.2(h) hereto executed by Authorized Officers of the Borrowers, delivered to the Administrative Agent and calculating the Borrowing Base.

“Eligible Inventory” shall mean domestic inventory of the Company and its Domestic Subsidiaries subject to the first-priority Lien in favor of the Administrative Agent pursuant to the Security Documents, valued at the lower of cost or market determined in accordance with GAAP, but excluding any inventory deemed ineligible by the Administrative Agent in its sole discretion.

“Eligible Accounts Receivable” shall mean and consist solely of domestic accounts receivable created in the ordinary course of the Company or any Domestic Subsidiary’s business, upon which such Person’s right to receive payment is absolute and not contingent upon the fulfillment of any condition whatsoever, and which is subject to the first-priority Lien in favor of the Administrative Agent pursuant to the Security Documents, but shall not include any account, or portion thereof, deemed ineligible by the Administrative Agent in its sole discretion.

2.2 Amendment to Section 2.1(a). The proviso appearing in Section 2.1(a) of the Credit Agreement is hereby amended and restated in its entirety to read as follows:

provided, however, that after giving effect to such Revolving Loans, (A) with regard to each Revolving Lender individually, such Revolving Lender’s Revolving Credit Exposure shall not exceed such Revolving Lender’s Revolving Commitment, (B) with regard to the Revolving Lenders collectively, the Aggregate Revolving Credit Exposure outstanding shall not exceed (1) the Revolving Committed Amount then in effect or (2) the Borrowing Base and (C) the aggregate principal Dollar Equivalent of outstanding Foreign Currency Revolving Loans made to the Borrowers shall not exceed the Foreign Currency Sublimit.

2.3 Amendment to Section 2.3(a). The first proviso appearing in Section 2.3(a) of the Credit Agreement is hereby amended and restated in its entirety to read as follows:

provided, however, that (i) the aggregate amount of LOC Obligations shall not at any time exceed FIFTEEN MILLION SIX HUNDRED TWENTY-FIVE THOUSAND DOLLARS ($15,625,000) (the “LOC Committed Amount”), (ii) the Aggregate Revolving Exposure shall not exceed (A) the Revolving Committed Amount or (B) the Borrowing Base and (iii) Letters of Credit shall be issued for any lawful corporate purposes and shall be issued as standby or commercial letters of credit.

2.4 Amendment to Section 2.4(a). The proviso appearing in Section 2.4(a) of the Credit Agreement is hereby amended and restated in its entirety to read as follows:

provided, however, (i) the aggregate principal amount of Swingline Loans outstanding at any time shall not exceed SIX MILLION TWO HUNDRED FIFTY THOUSAND DOLLARS ($6,250,000) (the “Swingline Committed Amount”), and (ii) the Aggregate Revolving Exposure shall not exceed (A) the Revolving Committed Amount or (B) the Borrowing Base.

2.5 Amendment to Section 2.6(a). The proviso appearing in Section 2.6(a) of the Credit Agreement is hereby amended and restated in its entirety to read as follows:

provided that no such reduction or termination shall be permitted if after giving effect thereto, and to any prepayments of the Revolving Loans made on the effective date thereof, (i) the Aggregate Revolving Exposure would exceed the (A) Revolving Committed Amount or (B) the Borrowing Base or (ii) the aggregate principal outstanding Dollar Equivalent of Foreign Currency Revolving Loans would exceed the Foreign Currency Sublimit, as reduced.

2.5 Amendment to Section 2.7(b). Subclause (A) appearing in clause (i) of Section 2.7(b) of the Credit Agreement is hereby amended and restated in its entirety to read as follows:

(A) at any time, the Aggregate Revolving Exposure shall exceed (1) the Revolving Committed Amount or (2) the Borrowing Base, the Borrowers shall immediately repay the Revolving Loans and Swingline Loans and (after all Revolving Loans and Swingline Loans have been repaid) Cash Collateralize the LOC Obligations in an amount sufficient to eliminate such excess (such repayment to be applied as set forth in clause (ii) below) and

2.6 Amendment to Section 4.2. Clause (c) appearing in Section 4.2 of the Credit Agreement is hereby amended and restated in its entirety to read as follows:

(c) Compliance with Commitments. Immediately after giving effect to the making of any such Extension of Credit (and the application of the proceeds thereof), (i) the sum of the aggregate principal amount of outstanding Revolving Loans plus outstanding Swingline Loans plus outstanding LOC Obligations shall not exceed (A) the Revolving Committed Amount then in effect or (B) the Borrowing Base, (ii) the aggregate principal amount of outstanding Foreign Currency Revolving Loans shall not exceed the Foreign Currency Sublimit, (iii) the outstanding LOC Obligations shall not exceed the LOC Committed Amount, and (iv) the outstanding Swingline Loans shall not exceed the Swingline Committed Amount.

2.7 Amendment to Section 5.2. Section 5.2 of the Credit Agreement is hereby amended by adding a new clause (h) to the end of such section to read as follows:

(h) Borrowing Base Certificate. Concurrently with or prior to the delivery of the financial statements referred to in Sections 5.1(a) and 5.1(b) above (or at more frequent intervals, as determined by the Administrative Agent), a Borrowing Base Certificate, in form and substance substantially similar to Exhibit 5.2(h).

2.8 Amendment to Section 5.9(a). Clause (i) contained in Section 5.9(a) of the Credit Agreement is hereby amended and restated in its entirety to read as follows:

(i)Prior to the occurrence of a Financial Covenant Election, the Total Leverage Ratio, calculated as of the last day of each fiscal quarter, shall be less than or equal to (A) for each fiscal quarter ended prior to a Qualified Equity Issuance (other than the fiscal quarter ended November 30, 2015), 3.00 to 1.00, (B) for each fiscal quarter ended following a Qualified Equity Issuance, 3.25 to 1.00 and (C) for the fiscal quarter ended November 30, 2015, 4.25 to 1.00; or

2.9 Amendment to Section 5.9(b). Clause (b) contained in Section 5.9 of the Credit Agreement is hereby amended and restated in its entirety to read as follows:

(b) Consolidated EBIT to Consolidated Interest Expense Ratio. The Consolidated EBIT to Consolidated Interest Expense Ratio, calculated (i) as of the last day of each fiscal quarter (other than the fiscal quarter ended November 30, 2015), shall be greater than or equal to 3.00 to 1.00 and (ii) as of the last day of the fiscal quarter ended November 30, 2015, shall be greater than or equal to 1.75 to 1.00.

2.10 Borrowing Base Certificate. A new Exhibit 5.2(h) in the form attached as Exhibit B to this Amendment shall be added to the Credit Agreement.

ARTICLE III

CONDITIONS TO EFFECTIVENESS

3.1 Closing Conditions. This Amendment shall become effective as of the day and year set forth above (the “Amendment Effective Date”) upon satisfaction of the following conditions (in each case, in form and substance reasonably acceptable to the Administrative Agent):

(a) Executed Amendment. The Administrative Agent shall have received a copy of this Amendment duly executed by each of the Credit Parties, the Administrative Agent and the Required Lenders.

(b) Borrowing Base. The Administrative Agent shall have received a Borrowing Base Certificate satisfactory thereto calculating the Borrowing Base as of the most recent quarter end prior to the Amendment Effective Date for which financial statements are available on a Pro Forma Basis after giving effect to the Amendment.

(c) Fees and Expenses.

(i)The Administrative Agent shall have received from the Borrower, for the account of each Lender that executes and delivers a copy of this Amendment to the Administrative Agent by 12:00 PM (EST) on January 15, 2015 (each such Lender, a “Consenting Lender”, and collectively, the “Consenting Lenders”), an amendment fee in an aggregate amount equal to $125,000 to be distributed to the Consenting Lenders on a pro rata basis based on the aggregate Revolving Commitments of such Consenting Lender (prior to giving effect to this Amendment).

(ii)The Administrative Agent shall have received from the Company all out-of-pocket fees and expenses reasonably incurred by the Administrative Agent in connection with this Amendment.

(d) Miscellaneous. All other documents and legal matters in connection with the transactions contemplated by this Amendment shall be reasonably satisfactory in form and substance to the Administrative Agent and its counsel.

ARTICLE IV

MISCELLANEOUS

4.1 Representations and Warranties of Credit Parties. Each of the Credit Parties represents and warrants as follows:

(a) It has taken all necessary action to authorize the execution, delivery and performance of this Amendment.

(b) This Amendment has been duly executed and delivered by such Person and constitutes such Person’s legal, valid and binding obligation, enforceable in accordance with its terms, except as such

enforceability may be subject to (i) bankruptcy, insolvency, reorganization, fraudulent conveyance or transfer, moratorium or similar laws affecting creditors’ rights generally and (ii) general principles of equity (regardless of whether such enforceability is considered in a proceeding at law or in equity).

(c) No consent, approval, authorization or order of, or filing, registration or qualification with, any court or governmental authority or third party is required in connection with the execution, delivery or performance by such Person of this Amendment.

(d) The representations and warranties set forth in Article III of the Credit Agreement are true and correct in (i) all material respects with respect to those representations and warranties that are not qualified by materiality and (ii) all respects with respect to all other representations and warranties, in each case as of the date hereof (except for those which expressly relate to an earlier date).

(e) After giving effect to this Amendment, no event has occurred and is continuing which constitutes a Default or an Event of Default.

(f) The Security Documents continue to create a valid security interest in, and Lien upon, the Collateral, in favor of the Administrative Agent, for the benefit of the Lenders, which security interests and Liens are perfected in accordance with the terms of the Security Documents and prior to all Liens other than Permitted Liens.

(g) The Credit Party Obligations are not reduced or modified by this Amendment and are not subject to any offsets, defenses or counterclaims.

4.2 Reaffirmation of Credit Party Obligations. Each Credit Party hereby ratifies each of the Credit Documents and acknowledges and reaffirms (a) that it is bound by all terms of the Credit Documents applicable to it and (b) that it is responsible for the observance and full performance of its respective Credit Party Obligations.

4.3 Credit Document. This Amendment shall constitute a Credit Document under the terms of the Credit Agreement.

4.4 Expenses. The Company agrees to pay all reasonable out-of-pocket costs and expenses of the Administrative Agent in connection with the preparation, execution and delivery of this Amendment, including without limitation the reasonable fees and expenses of the Administrative Agent’s legal counsel.

4.5 Further Assurances. The Credit Parties agree to promptly take such action, upon the reasonable request of the Administrative Agent, as is necessary to carry out the intent of this Amendment.

4.6 Entirety. This Amendment and the other Credit Documents embody the entire agreement among the parties hereto and supersede all prior agreements and understandings, oral or written, if any, relating to the subject matter hereof.

4.7 Counterparts; Telecopy. This Amendment may be executed in any number of counterparts, each of which when so executed and delivered shall be an original, but all of which shall constitute one and the same instrument. Delivery of an executed counterpart to this Amendment by telecopy or other electronic means shall be effective as an original and shall constitute a representation or covenant that an original will be delivered.

4.8 No Actions, Claims, Etc. As of the date hereof, each of the Credit Parties hereby acknowledges and confirms that it has no knowledge of any actions, causes of action, claims, demands, damages and liabilities of whatever kind or nature, in law or in equity, against the Administrative Agent, the Lenders, or the Administrative Agent’s or the Lenders’ respective officers, employees, representatives, agents, counsel or directors, arising from any action by such Persons, or failure of such Persons to act, under the Credit Agreement on or prior to the date hereof.

4.9 GOVERNING LAW. THIS CONSENT SHALL BE GOVERNED BY, AND SHALL BE CONSTRUED AND ENFORCED IN ACCORDANCE WITH THE LAWS OF THE STATE OF NEW YORK (INCLUDING SECTIONS 5-1401 AND 5-1402 OF THE NEW YORK GENERAL OBLIGATIONS LAW).

4.10 Successors and Assigns. This Amendment shall be binding upon and inure to the benefit of the parties hereto and their respective successors and assigns.

4.11 Consent to Jurisdiction; Service of Process; Waiver of Jury Trial. The jurisdiction, service of process and waiver of jury trial provisions set forth in Sections 9.13 and 9.16 of the Credit Agreement are hereby incorporated by reference, mutatis mutandis.

[REMAINDER OF PAGE INTENTIONALLY LEFT BLANK]

IN WITNESS WHEREOF the parties hereto have caused this Amendment to be duly executed on the date first above written.

BORROWERS: VOXX International corporation,

a Delaware corporation, as the Company

By: /s/ Charles M. Stoehr

Name: Charles M. Stoehr

Title: CFO/Senior Vice President

VOXX ACCESSORIES CORP., a Delaware corporation, as a Borrower

By: /s/ Loriann Shelton

Name: Loriann Shelton

Title: CFO/Vice President/Secretary/Treasurer

VOXX ELECTRONICS CORP. (formerly known as Audiovox Electronics Corporation), a Delaware corporation, as a Borrower

By: /s/ Loriann Shelton

Name: Loriann Shelton

Title: CFO/Secretary/Treasurer

AUDIOVOX CONSUMER ELECTRONICS, INC., a Delaware corporation, as a Borrower

By: /s/ Loriann Shelton

Name: Loriann Shelton

Title: CFO/Secretary/Treasurer

AUDIOVOX ATLANTA CORP. (formerly known as American Radio Corp.), a Georgia corporation, as a Borrower

By: /s/ Charles M. Stoehr

Name: Charles M. Stoehr

Title: Vice President

CODE SYSTEMS, INC., a Delaware corporation, as a Borrower

By: /s/ Charles M. Stoehr

Name: Charles M. Stoehr

Title: Chief Financial Officer

INVISION AUTOMOTIVE SYSTEMS INC., a Delaware corporation, as a Borrower

By: /s/ Charles M. Stoehr

Name: Charles M. Stoehr

Title: Vice President

KLIPSCH GROUP, INC., an Indiana corporation, as a Borrower

By: /s/ Charles M. Stoehr

Name: Charles M. Stoehr

Title: Vice President

GUARANTORS: ELECTRONICS TRADEMARK HOLDING

COMPANY, LLC, a Delaware corporation

By: /s/ Chris Lis Johnson

Name: Chris Lis Johnson

Title: Secretary

TECHNUITY, INC., an Indiana corporation

By: /s/ Loriann Shelton

Name: Loriann Shelton

Title: Secretary

OMEGA RESEARCH AND DEVELOPMENT TECHNOLOGY LLC, a Delaware limited liability company

By: /s/ Loriann Shelton

Name: Loriann Shelton

Title: Secretary

LATIN AMERICA EXPORTS CORP., a Delaware corporation

By: /s/ Charles M. Stoehr

Name: Charles M. Stoehr

Title: Treasurer

KLIPSCH HOLDING LLC, a Delaware limited liability company

By: /s/ Charles M. Stoehr

Name: Charles M. Stoehr

Title: Vice President/Secretary

AUDIOVOX WEBSALES LLC, a Delaware limited liability company

By: /s/ Loriann Shelton

Name: Loriann Shelton

Title: Vice President/Secretary

AUDIOVOX LATIN AMERICA LTD., a Delaware corporation

By: /s/ Charles M. Stoehr

Name: Charles M. Stoehr

Title: Vice President

AUDIOVOX INTERNATIONAL CORP., a Delaware corporation

By: /s/ Charles M. Stoehr

Name: Charles M. Stoehr

Title: Vice President

AUDIOVOX COMMUNICATIONS CORP., a Delaware corporation

By: /s/ Charles M. Stoehr

Name: Charles M. Stoehr

Title: Vice President/Treasurer

AUDIOVOX GERMAN CORPORATION, a Delaware corporation

By: /s/ Charles M. Stoehr

Name: Charles M. Stoehr

Title: CFO/Vice President

VOXX ASIA INC. (formerly known as Audiovox Asia Inc.), a Delaware corporation

By: /s/ Charles M. Stoehr

Name: Charles M. Stoehr

Title: Vice President/Secretary/Treasurer

Audiovox Advanced Accessories Group LLC, a Delaware limited liability company

By: /s/ Loriann Shelton

Name: Loriann Shelton

Title: Vice President/Secretary/Treasurer

VOXX WOODVIEW TRACE LLC, a Delaware limited liability company

By: /s/ Loriann Shelton

Name: Loriann Shelton

Title: Vice President/Secretary/Treasurer

VoxxHirschmann Corporation, a Delaware corporation

By: /s/ Charles M. Stoehr

Name: Charles M. Stoehr

Title: Vice President

Klipsch Group Europe, B.V., a private company with limited liability with its corporate seat in Leiden, the Netherlands

By: /s/ T. Paul Jacobs

Name: T. Paul Jacobs

Title: Managing Director

Audio Products International Corp., a corporation formed under the laws of Province of Ontario

By: /s/ T. Paul Jacobs

Name: T. Paul Jacobs

Title: President

Audiovox canada limited, a corporation formed under the laws of Province of Ontario

By: /s/ Charles M. Stoehr

Name: Charles M. Stoehr

Title: Vice President

| |

ADMINISTRATIVE AGENT: | WELLS FARGO BANK, NATIONAL ASSOCIATION, |

as a Lender and as Administrative Agent

By: /s/ Michael Zick

Name: Michael Zick

Title: Vice President

| |

LENDERS: | People’s United Bank, National Association |

as a Lender

By: /s/ Matthew Harrison

Name: Matthew Harrison

Title: Vice President

| |

LENDERS: | HSBC Bank USA, National Association, |

as a Lender

By: /s/ William Conlan

Name: William Conlan

Title: Senior Vice President

| |

LENDERS: | Citizens Bank, N.A., |

as a Lender

By: /s/ Michael Makaitis

Name: Michael Makaitis

Title: Vice President

as a Lender

By: /s/ Stuart N. Berman

Name: Stuart N. Berman

Title: Authorized Signatory

| |

LENDERS: | Capital One. National Association, |

as a Lender

By: /s/ Jed Pomerantz

Name: Jed Pomerantz

Title: Senior Vice President

EXHIBIT A

Schedule 2.1(a)

Schedule of Lenders and Commitments

|

| | |

| Revolving Commitment | Revolving Commitment Percentage |

Lender | | |

Wells Fargo Bank, National Association | $34,375,000.00 | 27.500000000% |

HSBC Bank USA, N.A. | $14,687,500.00 | 11.750000000% |

Citizens Bank, N.A. | $14,687,500.00 | 11.750000000% |

Citibank, N.A. | $14,687,500.00 | 11.750000000% |

Fifth Third Bank | $14,687,500.00 | 11.750000000% |

Capital One, National Association | $10,625,000.00 | 8.500000000% |

People's United Bank | $10,625,000.00 | 8.500000000% |

Sovereign Bank, N.A. | $10,625,000.00 | 8.500000000% |

| | |

Total | $125,000,000.00 | 100.000000000% |

EXHIBIT B

Exhibit 5.2(h)

BORROWING BASE CERTIFICATE

TO: Wells Fargo Bank, National Association, as Administrative Agent

| |

RE: | Amended and Restated Credit Agreement, dated as of March 14, 2012, by and among VOXX International Corporation, a Delaware corporation (the “Company”), the other Borrowers party to the Credit Agreement, the Guarantors, the Lenders and Wells Fargo Bank, National Association, as Administrative Agent for the Lenders (as amended, modified, extended, restated, replaced, or supplemented from time to time, the “Credit Agreement”; capitalized terms used herein and not otherwise defined shall have the meanings set forth in the Credit Agreement) |

DATE: [________], 20[__]

Pursuant to the terms of Section 5.2(h) of the Credit Agreement, the undersigned officer of the Borrowers, hereby certifies on behalf of the Credit Parties and not in any individual capacity that, as of the date hereof, the statements below are accurate and complete in all respects:

(a) Attached hereto on Schedule A are the calculations in reasonable detail setting forth the Borrowing Base, and supporting information in connection therewith, together with any additional reports with respect to the Borrowing Base as the Administrative Agent may reasonably request pursuant to the terms of the Credit Agreement, and all such information is true, correct in all material respects and based on information in each Borrowers’ own financial accounting records.

This Borrowing Base Certificate may, upon execution, be delivered by facsimile or electronic mail, which shall be deemed for all purposes to be an original signature.

[REMAINDER OF PAGE INTENTIONALLY LEFT BLANK]

BORROWERS: VOXX International corporation,

a Delaware corporation, as the Company

By:

Name: Charles M. Stoehr

Title: CFO/Senior Vice President

VOXX ACCESSORIES CORP., a Delaware corporation, as a Borrower

By:

Name: Loriann Shelton

Title: CFO/Vice President/Secretary/Treasurer

VOXX ELECTRONICS CORP. (formerly known as Audiovox Electronics Corporation), a Delaware corporation, as a Borrower

By:

Name: Loriann Shelton

Title: CFO/Secretary/Treasurer

AUDIOVOX CONSUMER ELECTRONICS, INC., a Delaware corporation, as a Borrower

By:

Name: Loriann Shelton

Title: CFO/Secretary/Treasurer

AUDIOVOX ATLANTA CORP. (formerly known as American Radio Corp.), a Georgia corporation, as a Borrower

By:

Name: Charles M. Stoehr

Title: Vice President

CODE SYSTEMS, INC., a Delaware corporation, as a Borrower

By:

Name: Charles M. Stoehr

Title: Chief Financial Officer

INVISION AUTOMOTIVE SYSTEMS INC., a Delaware corporation, as a Borrower

By:

Name: Charles M. Stoehr

Title: Vice President

KLIPSCH GROUP, INC., an Indiana corporation, as a Borrower

By:

Name: Charles M. Stoehr

Title: Vice President

Schedule A

Borrowing Base Calculations

As of: [_____]

I. (a) Eligible Accounts Receivable $_____________

(b) Advance Rate [85]%

(c) Product of I(a) * I(b) $______________

II. (a) Eligible Inventory $_____________

(b) Advance Rate [50]%

(c) Product of II(a) * II(b) $______________

III. (a) Revolving Loans outstanding $________________

(b) Letter of Credit outstanding $________________

(c) Swingline Loans outstanding $________________

(d) Sum of III(a) + III(b) + III(c) $________________

IV. Availability equals I(c) plus II(c) less III(d) $________________

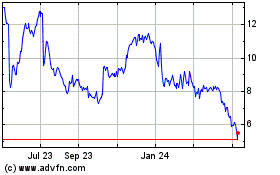

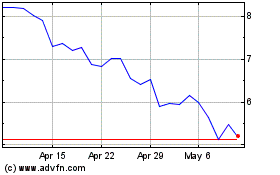

VOXX (NASDAQ:VOXX)

Historical Stock Chart

From Mar 2024 to Apr 2024

VOXX (NASDAQ:VOXX)

Historical Stock Chart

From Apr 2023 to Apr 2024