UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT

TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report: January 11, 2016

(Date of earliest event reported)

APOGEE

ENTERPRISES, INC.

(Exact name of registrant as specified in its charter)

Commission File Number: 0-6365

|

|

|

| Minnesota |

|

41-0919654 |

| (State or other jurisdiction

of incorporation) |

|

(IRS Employer

Identification No.) |

4400 West 78th Street – Suite 520

Minneapolis, Minnesota 55435

(Address of principal executive offices, including zip code)

(952) 835-1874

(Registrant’s telephone number, including area code)

Not Applicable

(Former

name or former address, if changed since last report)

Check the

appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| Item 5.02 |

Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers. |

On January 11, 2016, the Board of Directors (the “Board”) of Apogee Enterprises, Inc. (the “Company”) took the following actions,

effective on that date: (a) increased the size of the Board by one member; and (b) to fill the vacancy created by the increase in the size of the Board, elected Patricia K. Wagner, 53, to serve as a Class I Director for a term expiring at

the Company’s Annual Meeting of Shareholders in 2017.

Ms. Wagner has been employed by Sempra Energy, a Fortune 500 energy services holding

company, since 1995 and has served as president and chief executive officer of Sempra U.S. Gas & Power, a subsidiary of Sempra Energy, since 2014. Sempra U.S. Gas & Power, a leading developer and generator of renewable energy and

natural gas solutions and operator of power plants, natural gas storage facilities, pipelines and distribution utilities, had 2014 reported revenues of approximately $1 billion. Prior to 2014, Ms. Wagner served in several leadership positions

for the Sempra Energy family of companies. Prior to joining Sempra Energy, Ms. Wagner was employed by Fluor Daniel, McGaw Laboratories and Allergan Pharmaceuticals. Ms. Wagner will serve on the Audit Committee of the Board.

There is no arrangement or understanding between Ms. Wagner and any other person pursuant to which Ms. Wagner was elected as a director. For her

service as a non-employee member of the Board, Ms. Wagner will participate in the non-employee director compensation arrangements in effect during her period of service. The arrangements currently in effect are described under the heading

“Non-Employee Director Compensation” in the Company’s proxy statement delivered in connection with its 2015 Annual Meeting of Shareholders (the “Annual Meeting”), as filed with the Securities and Exchange Commission on

May 12, 2015. On January 13, 2016, in connection with Ms. Wagner’s election to the Board, Ms. Wagner received a time-based restricted stock award of 1,039 shares of the Company’s common stock, which vests in three equal

annual installments on the first three anniversaries of the date of grant. The closing price of the Company’s common stock on the NASDAQ Global Select Market on January 13, 2016, the date of grant, was $38.49. There are no related person

transactions involving Ms. Wagner that are reportable under Item 404(a) of Regulation S-K. Ms. Wagner does not have any familial relationship with any director or other executive officer of the Company or any person nominated or

chosen by the Company to become a director or executive officer.

A copy of the press release announcing Ms. Wagner’s election is attached

hereto as Exhibit 99.1.

On January 13, 2016, the Company announced that its Board of Directors had increased

its share repurchase authorization by 1,000,000 to bring the total available share repurchase program to approximately 1.4 million shares. A copy of the press release announcing the increase in share repurchase authorization is filed as Exhibit

99.2 to this Current Report on Form 8-K and is incorporated by reference herein.

| Item 9.01 |

Financial Statements and Exhibits. |

|

|

|

| 99.1 |

|

Press Release issued by Apogee Enterprises, Inc. dated January 12, 2016. |

|

|

| 99.2 |

|

Press Release issued by Apogee Enterprises, Inc. dated January 13, 2016. |

2

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned

hereunto duly authorized.

|

|

|

|

|

| APOGEE ENTERPRISES, INC. |

|

|

|

|

|

By: |

|

/s/ Patricia A. Beithon |

|

|

|

|

Patricia A. Beithon General Counsel and

Secretary |

Date: January 15, 2016

3

EXHIBIT INDEX

|

|

|

| Exhibit

Number |

|

Description |

|

|

| 99.1 |

|

Press Release issued by Apogee Enterprises, Inc. dated January 12, 2016. |

|

|

| 99.2 |

|

Press Release issued by Apogee Enterprises, Inc. dated January 13, 2016. |

4

Exhibit 99.1

APOGEE ELECTS NEW DIRECTOR

MINNEAPOLIS, MN (January 12, 2016) – Apogee Enterprises, Inc. (Nasdaq:APOG), which provides distinctive solutions for enclosing commercial buildings and

framing art, today announced election of a new director, Patricia K. Wagner, 53, president and chief executive officer of Sempra U.S. Gas & Power, a subsidiary of Sempra Energy, a Fortune 500 energy services holding company.

“Patti is a proven leader who successfully drives results and effects change at Sempra U.S. Gas & Power, which had 2014 reported revenues of

approximately $1 billion. She also brings expertise in operations, accounting and finance, audit and information technology,” said Bernard P. Aldrich, Apogee chairman. “Her knowledge and experience will be invaluable as Apogee executes its

strategies focused on growing the company to $1.3 billion with an operating margin of at least 12 percent in our fiscal 2018.”

In 1995, Wagner

joined Sempra Energy and since 2014 has led Sempra U.S. Gas & Power, a leading developer and generator of renewable energy and natural gas solutions, and operator of power plants, natural gas storage facilities, pipelines and distribution

utilities. Previously Wagner served in several leadership positions for the Sempra Energy family of companies. Prior to joining Sempra Energy in 1995, Wagner held management positions at Fluor Daniel, one of the world’s largest, publicly owned

engineering, procurement, construction and maintenance services companies. She also worked for McGaw Laboratories and Allergan Pharmaceuticals.

She will

serve on the Apogee board of directors audit committee and is a Class I director who will stand for reelection at the 2017 annual meeting. With the addition of Wagner, the Apogee board currently has 10 members.

Apogee Enterprises, Inc. (www.apog.com), headquartered in Minneapolis, is a leader in technologies involving the design and development of value-added glass

products, services and systems for the architectural and picture framing industries.

|

|

|

| Contact: |

|

Mary Ann Jackson |

|

|

Investor Relations |

|

|

952-487-7538 |

|

|

mjackson@apog.com |

Exhibit 99.2

APOGEE RAISES QUARTERLY CASH

DIVIDEND 14 PERCENT TO $0.125 PER SHARE

MINNEAPOLIS, MN (Wednesday, January 13, 2016) – The Board of Directors of Apogee Enterprises, Inc.

(Nasdaq:APOG) announced it has declared a quarterly cash dividend of $0.125 per share, payable on February 17, 2016, to shareholders of record on February 2, 2016. The dividend of $0.125 per share represents an increase of 14 percent from

the previous quarterly dividend of $0.11 per share. The company has approximately 28.9 million shares outstanding.

The Board of Directors also

increased its existing share repurchase authorization by 1 million shares, bringing the total available share repurchase program to approximately 1.4 million shares.

“Increasing our dividend underscores our confidence in our ability to continue to grow revenues, earnings and cash flow over our strategic plan

horizon,” said Joseph F. Puishys, Apogee chief executive officer. “The increase in share repurchase authorization positions us to continue to occasionally buy back stock to offset dilution from our stock compensation programs.”

Apogee Enterprises, Inc., headquartered in Minneapolis, provides distinctive solutions for enclosing buildings and framing art. The company is organized in

four segments, with three of the segments serving the commercial construction market:

| • |

|

Architectural Glass segment consists of the leading fabricator of coated, high-performance architectural glass for global markets. |

| • |

|

Architectural Services segment consists of one of the largest U.S. full-service building glass installation and renovation companies. |

| • |

|

Architectural Framing Systems segment companies design, engineer, fabricate and finish the aluminum frames for window, curtainwall and storefront systems that comprise the outside skin of buildings. |

| • |

|

Large-Scale Optical segment consists of a value-added glass and acrylic manufacturer primarily for the custom picture framing market. |

FORWARD-LOOKING STATEMENTS

The

discussion above contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. These statements reflect Apogee management’s expectations or beliefs as of the date of this release.

The company undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. All forward-looking statements are qualified by factors that may affect the

operating results of the company, including the following: (A) the cyclical nature and market conditions of the North American and Latin American commercial construction industries, which impact our three architectural segments, and consumer

confidence

and the conditions of the U.S. economy, which impact our large-scale optical segment; (B) fluctuations in foreign currency exchange rates; (C) actions of new and existing competitors;

(D) ability to efficiently utilize and increase production capacity; (E) product performance, reliability and quality issues; (F) project management and installation issues that could result in losses on individual contracts;

(G) ability to fully realize government incentives; (H) changes in consumer and customer preference, or architectural trends and building codes; (I) dependence on a relatively small number of customers in certain business segments;

(J) volatile revenue and operating results that could differ from market expectations; (K) self-insurance risk related to a material product liability or other event for which the company is liable; (L) dependence on information

technology systems and information security threats; (M) cost of compliance with and changes in environmental regulations; and (N) potential impact on financial results if one or more key employees were no longer active with the company.

The company cautions investors that actual future results could differ materially from those described in the forward-looking statements, and that other factors may in the future prove to be important in affecting the company’s results of

operations. New factors emerge from time to time and it is not possible for management to predict all such factors, nor can it assess the impact of each such factor on the business or the extent to which any factor, or a combination of factors, may

cause actual results to differ materially from those contained in any forward-looking statements. For a more detailed explanation of the foregoing and other risks and uncertainties, see Item 1A of the company’s Annual Report on Form 10-K

for the fiscal year ended February 28, 2015.

-30-

|

|

|

| Contact: |

|

Mary Ann Jackson |

|

|

Investor Relations |

|

|

952-487-7538 |

|

|

mjackson@apog.com |

2

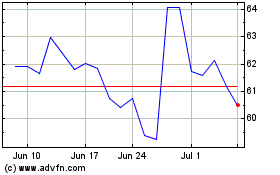

Apogee Enterprises (NASDAQ:APOG)

Historical Stock Chart

From Mar 2024 to Apr 2024

Apogee Enterprises (NASDAQ:APOG)

Historical Stock Chart

From Apr 2023 to Apr 2024