Current Report Filing (8-k)

December 09 2015 - 5:02PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant

to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): December 3, 2015

XOMA CORPORATION

(Exact

name of registrant as specified in its charter)

|

|

|

|

|

| DELAWARE |

|

001-14710 |

|

52-2154066 |

| (State of

incorporation) |

|

(Commission

File No.) |

|

(IRS Employer

Identification No.) |

XOMA Corporation

2910 Seventh Street

Berkeley, CA 94710

(Address of principal executive offices and zip code)

Registrant’s telephone number, including area code: (510) 204-7200

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the

following provisions (see General Instruction A.2. below):

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| ITEM 1.01 |

ENTRY INTO A MATERIAL DEFINITIVE AGREEMENT. |

On December 3, 2015, XOMA (US) LLC (the

“Company” or “XOMA”), as a successor-in-interest of XOMA Ireland Limited and Pfizer Inc. (“Pfizer”), entered into a settlement and amended license agreement (the “Agreement”), pursuant to which XOMA granted a

fully-paid, royalty-free, worldwide, irrevocable, non-exclusive license rights to XOMA’s patented bacterial cell expression (BCE) technology for phage display and other research, development and manufacturing of antibody products for an

upfront, non-dilutive cash payment by Pfizer of $3.8 million in full satisfaction of all obligations to XOMA under the 2007 Agreement (defined below), including but not limited to potential milestone, royalty and other fees under the 2007

Agreement.

Under the terms of the original License Agreement, effective as of August 27, 2007, by and between XOMA Ireland Limited and Pfizer Inc.

(the “2007 Agreement”), XOMA received an upfront, non-dilutive cash payment of $30 million and was eligible for potential milestone, royalty and other fees on future sales of all products subject to this license, including products

currently in late-stage clinical development.

The description of the Agreement contained herein does not purport to be complete and is qualified in its

entirety by reference to the complete text of the Agreement, a copy of which will be filed as an exhibit to the Company’s Annual Report on Form 10-K for the period ending December 31, 2015.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned

hereunto duly authorized.

|

|

|

|

|

|

|

| Date: December 9, 2015 |

|

|

|

XOMA Corporation |

|

|

|

|

|

|

|

|

By: |

|

/s/ Russell J. Wood |

|

|

|

|

|

|

Russell J. Wood |

|

|

|

|

|

|

Sr. Corporate Counsel and Corporate Secretary |

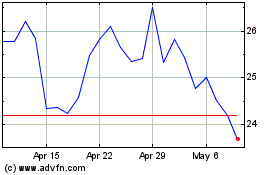

XOMA (NASDAQ:XOMA)

Historical Stock Chart

From Mar 2024 to Apr 2024

XOMA (NASDAQ:XOMA)

Historical Stock Chart

From Apr 2023 to Apr 2024