UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

The Securities Exchange Act of 1934

November 23, 2015

Date of Report (Date of earliest event reported)

OWENS-ILLINOIS, INC.

(Exact name of registrant as specified in its charter)

|

Delaware

(State or other jurisdiction

of incorporation or organization) |

|

1-9576

(Commission

File Number) |

|

22-2781933

(I.R.S. Employer

Identification Number) |

|

One Michael Owens Way

Perrysburg, Ohio

(Address of principal executive offices) |

|

43551-2999

(Zip Code) |

(567) 336-5000

(Registrant’s telephone number, including area code)

(Former name or former address, if changed since last report)

Check the appropriate box if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

ITEM 5.02. DEPARTURE OF DIRECTORS OR CERTAIN OFFICERS; ELECTION OF DIRECTORS; APPOINTMENT OF CERTAIN OFFICERS; COMPENSATORY ARRANGEMENTS OF CERTAIN OFFICERS.

On November 23, 2015, Owens-Illinois, Inc. (“O-I”) announced the appointment of Jan Bertsch, age 58, as Senior Vice President and Chief Financial Officer of O-I, effective immediately. Prior to joining O-I, Ms. Bertsch served as Executive Vice President and Chief Financial Officer for Sigma-Aldrich Corporation, recently acquired by Merck KGaA. Prior to joining Sigma-Aldrich in 2012, Ms. Bertsch was Vice President, Controller and Principal Accounting Officer at BorgWarner Inc. She also spent nearly 30 years at Chrysler LLC and Ford Motor Company in various roles in Finance, Treasury and Information Technology. She also serves on the board of directors of BWX Technologies, Inc.

Ms. Bertsch will receive an annual base salary of $650,000, a target annual incentive of 80% of her annual base salary and be eligible for long-term equity grants under O-I’s Long-Term Incentive Program targeted at $1.3 million. Ms. Bertsch will also receive a special award of restricted stock units valued at $2.5 million with three-year cliff vesting. She will be eligible to participate in the other components of O-I’s executive compensation program, including the Executive Deferred Compensation Plan, severance, health and welfare programs and other benefits, which are described in O-I’s Definitive Proxy Statement filed on April 2, 2015, as well as, the Current Report on Form 8-K filed on March 12, 2015. A copy of Ms. Bertsch’s employment offer letter is attached hereto as Exhibit 10.1.

Ms. Bertsch succeeds John Haudrich, who has resigned his title as Acting Chief Financial Officer, effective immediately. As previously announced on November 20, 2015, Mr. Haudrich will continue as O-I’s Senior Vice President and Chief Strategy and Integration Officer.

O-I’s related press release is attached hereto as Exhibit 99.1 and is incorporated herein by reference.

ITEM 9.01. FINANCIAL STATEMENTS AND EXHIBITS.

(d) Exhibits.

|

Exhibit |

|

|

|

No. |

|

Description |

|

10.1 |

|

Employment Offer Letter signed November 20, 2015 and effective November 23, 2015 |

|

99.1 |

|

Press Release dated November 23, 2015 |

2

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

OWENS-ILLINOIS, INC. |

|

|

|

|

|

|

|

|

|

Date: November 23, 2015 |

By: |

/s/ James W. Baehren |

|

|

Name: |

James W. Baehren |

|

|

Title: |

Senior Vice President and |

|

|

|

General Counsel |

3

EXHIBIT INDEX

|

Exhibit |

|

|

|

No. |

|

Description |

|

10.1 |

|

Employment Offer Letter signed November 20, 2015 and effective November 23, 2015 |

|

99.1 |

|

Press Release dated November 23, 2015 |

4

Exhibit 10.1

|

|

Paul A. Jarrell |

|

Senior Vice President |

|

Chief Administrative Officer |

|

One Michael Owens Way, Plaza 1 |

|

Perrysburg OH 43551-2999 |

|

+1 567 336-2000 tel |

|

+1 567 336-5410 fax |

October 30, 2015

Ms. Jan Bertsch

Dear Jan,

On behalf of O-I, AI, Andres and I are pleased to offer you the position of Chief Financial Officer, based in Perrysburg, Ohio, as per the key terms and conditions summarized below. A more complete overview of the benefits programs will be provided at the beginning of your employment.

Base Salary

Your base salary will be $650,000 per year. Payments will be made on a monthly basis.

Short Term Incentive

You will participate in O-I’s Senior Management Incentive Program (“SMIP”) with a target incentive of 80% of annual earned base salary. Actual incentive earned may range from 30% to 200% of the target incentive based on company and personal performance. Once a pool is created based on the Company’s performance against the established financial metrics, 20% of your final award will be discretionary and based on your personal contributions and leadership. For 2015, your SMIP award will be prorated based on your date of hire.

Long Term Incentive

You will be eligible to participate in O-I’s Long-Term Incentive Program (“LTI”). The target award for the CFO role is $1.3M in 2015 and is reviewed annually. Actual LTI awards may vary based upon the performance of the Company and the participant. Equity grants are made in March of each year to certain eligible employees following the review and approval of the Compensation Committee of the Company’s Board of Directors.

On your first day of employment or the first legally allowable date, you will receive a long-term incentive award valued at $1,300,000. The award will consist of performance share units (50%), stock options (25%), and restricted stock units (25%), as per the Company’s current equity program rules and regulations. The

options will be valued based on a Black-Scholes valuation and the restricted stock units and performance share units will be valued at fair market value (FMV) on the date of grant. The performance share units vest over a three-year cycle beginning in 2015. The final award of performance shares may range from 0% to 200% of the target award based on company performance for EPS, ROIC and organic revenue growth. The stock options and restricted stock units will vest in 25% increments on each anniversary of the grant date.

Long Term Incentive – Special Award

Upon commencement of employment or on the first legally allowable date, a special award of restricted stock units valued at $2.5M with three-year cliff vesting will be issued. Further description of the award and details of the award agreement will be provided prior to issuance.

Benefits / Other

a. Medical, Dental, Drug, Vision. You will participate in the same plans as other U.S. salaried employees.

b. Retirement. You will participate in the salaried employee defined contribution retirement plan which includes a 401K plan with a 50% match on the first 8% contributed and an additional 2% company contribution into your account. You are also eligible to participate in the Executive Deferred Savings Plan (non-qualified 401(k) plan).

c. Vacation. Your annual vacation entitlement is five (5) weeks.

d. Relocation. A lump-sum relocation allowance of $50,000.

Executive Benefits

a. Executive Life. You will participate in the executive life insurance program providing term life insurance of 3x your base salary at no cost to you. However, any imputed income will be taxable income to you.

b. Tax and Financial Planning. You will be eligible for reimbursement of these expenses, not to exceed $15,000 per year. Note that this is taxable income.

c. Executive Physical Program. You will be eligible to participate via the preferred provider in Toledo.

d. Executive Severance. In accordance with the Executive Severance Policy, in the event you are involuntarily terminated, other than for cause, you will be eligible for a lump sum severance payment equal to two years of your total cash compensation (base salary plus target short-term incentive). In addition, you will continue to have medical/drug/dental coverage (same rates paid by active employees) and executive life insurance coverage for two years.

Outplacement support will also be provided. In exchange, you will be required to sign a waiver, release, and non-compete/non-solicitation agreement.

Stock Ownership

You will be required to accumulate and hold O-I stock valued at 2.5x your base salary within five years of your date of hire.

Contingencies

The offer is contingent on the standard O-I employment requirements:

a. Verification of your right to work in the U.S.

b. The successful results of a background and reference check and drug test.

c. The signing of a Confidentiality / Non-Compete Agreement.

d. Your verification that you have no contractual obligations with your former employer(s) or other third parties that will restrict your right to accept and perform the job being offered.

Jan, we look forward to your joining the O-I team and know you will find this opportunity to be challenging and rewarding. This offer of employment remains in effect until December 1, 2015. Please sign below indicating your acceptance of our offer and confirming your start date. It is our understanding that you will do so immediately following the closing (sale) of your current business.

Sincerely,

|

/s/ Paul A. Jarrell |

|

|

Paul A. Jarrell |

|

|

Senior Vice President |

|

|

Chief Administrative Officer |

|

|

cc: |

A. Stroucken |

|

|

A. Lopez |

I accept this offer and agree to begin my employment with O-I on 11-23, 2015.

|

/s/ Jan Bertsch |

|

11-20-15 |

|

Jan Bertsch |

|

Date |

Exhibit 99.1

FOR IMMEDIATE RELEASE

For more information, contact:

Kristin Kelley

Vice President, Global and Corporate Communications

567-336-2395

kristin.kelley@o-i.com

Jan Bertsch Joins O-I as Chief Financial Officer

Perrysburg, Ohio (Nov. 23, 2015) - Owens-Illinois (NYSE: OI) announced today the appointment of Jan Bertsch as Senior Vice President and Chief Financial Officer, effective Nov. 23, 2015. In addition to assuming responsibility for the company’s Financial function, Bertsch will lead O-I’s Information Technology organization. She will report to CEO-elect Andres Lopez.

Most recently, Bertsch served as Executive Vice President and Chief Financial Officer for Sigma-Aldrich, a $2.8 billion life science and technology company. Sigma-Aldrich was recently acquired by Merck KGaA. Prior to joining Sigma-Aldrich in 2012, Bertsch was Vice President, Controller and Principal Accounting Officer at BorgWarner. She also spent nearly 30 years at Chrysler LLC and Ford Motor Company in various roles of increasing responsibility in Finance, Treasury and Information Technology. She also serves on the BWX Technologies, Inc. Board of Directors.

“Having served as a senior financial leader in several global manufacturing companies, Jan brings a great wealth of experience to O-I. She is a CFO with a solid track record of operational and cost improvement, value creation and asset optimization,” said Lopez. “Her impressive credentials, combined with her leadership style and approach will strengthen our Global Leadership Team and makes her an ideal fit for our organization.”

Jan succeeds John Haudrich, who had served as Acting CFO since April 2015 and was recently named Senior Vice President and Chief Strategy and Integration Officer.

“I look forward to joining the O-I team and having an opportunity to leverage my prior experience facing many similar challenges and opportunities to make a positive difference for the company,” said Bertsch.

# # #

About O-I

Owens-Illinois, Inc. (NYSE: OI) is the world’s largest glass container manufacturer and preferred partner for many of the world’s leading food and beverage brands. The Company had revenues of $6.8 billion in 2014. Following the acquisition of Vitro’s food and beverage business, the company now employs approximately 27,000 people at 81 plants in 23 countries. With global headquarters in Perrysburg, Ohio, U.S., O-I delivers safe, sustainable, pure, iconic, brand-building glass packaging to a growing global marketplace. For more information, visit o-i.com.

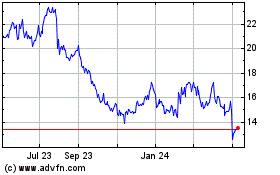

OI Glass (NYSE:OI)

Historical Stock Chart

From Mar 2024 to Apr 2024

OI Glass (NYSE:OI)

Historical Stock Chart

From Apr 2023 to Apr 2024