UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): November 4, 2015

AVALONBAY COMMUNITIES, INC.

(Exact name of registrant as specified in its charter)

Maryland

(State or Other Jurisdiction of Incorporation)

|

1-12672 |

|

77-0404318 |

|

(Commission File Number) |

|

(I.R.S. Employer Identification No.) |

|

671 N. Glebe Road, Suite 800, Arlington, Virginia |

|

22203 |

|

(Address of Principal Executive Offices) |

|

(Zip Code) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 8.01. Other Events.

On November 4, 2015, AvalonBay Communities, Inc. (the “Company”) priced a public offering (the “Offering”) of an aggregate of $300,000,000 principal amount of its 3.500% Medium Term Notes due November 15, 2025 (the “Notes”). The Offering was made pursuant to a Pricing Supplement dated November 4, 2015, a Prospectus Supplement dated May 6, 2015 and a Prospectus dated February 19, 2015 relating to the Company’s Shelf Registration Statement on Form S-3 (File No. 333-202185). The Terms Agreement, dated November 4, 2015, by and among the Company and Wells Fargo Securities, LLC, Goldman, Sachs & Co. and Barclays Capital Inc., as representatives of the agents named therein, is filed herewith as Exhibit 1.1.

The Notes were issued under an Indenture between the Company and The Bank of New York Mellon, as trustee, dated as of January 16, 1998, as supplemented by a First Supplemental Indenture dated as of January 20, 1998, a Second Supplemental Indenture dated as of July 7, 1998, an Amended and Restated Third Supplemental Indenture dated as of July 10, 2000, a Fourth Supplemental Indenture dated as of September 18, 2006, and a Fifth Supplemental Indenture dated as of November 21, 2014.

The Notes bear interest from November 16, 2015, with interest on the Notes payable semi-annually on May 15 and November 15, beginning on May 15, 2016. The Notes will mature on November 15, 2025. The Company will use the aggregate net proceeds, after underwriting discounts and other transaction-related costs, of approximately $296,572,000 from the sale of the Notes for working capital, capital expenditures and other general corporate purposes, which may include the acquisition, development and redevelopment of apartment communities and repayment and refinancing of existing indebtedness. Pending such uses, the Company may invest the net proceeds from the sale of the Notes in short-term demand deposits, short-term money market funds or investment grade securities or other similar investments. Settlement occurred on November 16, 2015.

ITEM 9.01 Financial Statements and Exhibits

(d) Exhibits.

|

Exhibit No. |

|

Description |

|

|

|

|

|

1.1* |

|

Terms Agreement, dated November 4, 2015, among the Company and the agents named therein. |

|

5.1* |

|

Legal Opinion of Goodwin Procter LLP, dated November 16, 2015. |

|

23.1 |

|

Consent of Goodwin Procter LLP (included in Exhibit 5.1). |

* Filed herewith.

2

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be filed on its behalf by the undersigned hereunto duly authorized.

|

|

AVALONBAY COMMUNITIES, INC. |

|

|

|

|

|

|

|

Dated: November 16, 2015 |

|

By: |

/S/ Kevin P. O’Shea |

|

|

|

Kevin P. O’Shea |

|

|

|

Chief Financial Officer |

3

EXHIBIT 1.1

AVALONBAY COMMUNITIES, INC.

Medium-Term Notes

Due Nine Months or More From Date of Issue

TERMS AGREEMENT

November 4, 2015

AvalonBay Communities, Inc.

Ballston Tower

671 N. Glebe Rd, Suite 800

Arlington, Virginia 22203

Reference is made to that certain Amended and Restated Distribution Agreement dated as of December 16, 2013 (including any exhibits and schedules thereto, the “Distribution Agreement”), by and among AvalonBay Communities, Inc., a Maryland corporation (the “Company” or “AvalonBay”) and the agents named therein. The entities listed on Schedule 1 hereto are collectively referred to herein as the “Agents.” Wells Fargo Securities, LLC, Goldman, Sachs & Co. and Barclays Capital Inc. have agreed to act as the representatives (the “Representatives”) of the Agents in connection with this Terms Agreement (this “Agreement”). Capitalized terms used, but not defined, in this Agreement are used in this Agreement as defined in the Distribution Agreement. This Agreement is one of the Written Terms Agreements referred to in Section 4(a) of the Distribution Agreement. The first offer of Notes for purposes of the term “Time of Sale Prospectus” under the Distribution Agreement shall be 3:29 p.m. Eastern Time.

In accordance with and subject to the terms and conditions stated in this Agreement, the Distribution Agreement and those certain Appointment Agreements dated as of the date hereof (the “Appointment Agreements”), by and between the Company and each of BB&T Capital Markets, a division of BB&T Securities, LLC, BNY Mellon Capital Markets, LLC and Mitsubishi UFJ Securities (USA), Inc., which agreements are incorporated herein in their entirety and made a part hereof, the Company agrees to sell to the Agents, and each of the Agents severally agrees to purchase, as principal, from the Company the aggregate principal amount set forth opposite its name in Schedule 1 hereto of the Company’s Notes identified on Schedule 2 hereto. If one or more of the Agents shall fail at the Settlement Date to purchase the Notes which it or they are obligated to purchase under this Agreement, the procedures set forth in Section 4(a) of the Distribution Agreement shall apply.

The obligations of the Agents to purchase Notes shall be subject, in addition to the conditions precedent listed in the Distribution Agreement, to the delivery of the following documents to the Representatives, on or before the Settlement Date:

1. the opinions and letters referred to in Sections 6(a), 6(b) and 6(c) of the Distribution Agreement, each dated the Settlement Date and otherwise in substantially the same form as was delivered in connection with the Company’s May 6, 2015 public offering of medium-term notes (the “Prior Offering”);

2. the letters of Ernst & Young LLP referred to in Section 6(d) of the Distribution Agreement, dated the date hereof and the Settlement Date and otherwise in substantially the same forms as were delivered in connection with the Prior Offering; and

3. the officers’ certificate referred to in Section 6(e) of the Distribution Agreement, dated the Settlement Date and otherwise in substantially the same form as was delivered in connection with the Prior Offering.

All such opinions, certificates, letters and other documents will be in compliance with the provisions hereof only if they are reasonably satisfactory in form and substance to the Representatives of the Agents and their counsel. The Company will furnish the Agents with such conformed copies of such opinions, certificates, letters and other documents as the Agents shall reasonably request.

This Agreement shall be governed by the laws of the State of New York. This Agreement, the Distribution Agreement and the Appointment Agreements constitute the entire agreement of the parties regarding the offering of Notes contemplated by this Agreement and supersede all prior written or oral and all contemporaneous oral agreements, understandings and negotiations with respect to the subject matter hereof. This Agreement may be executed in one or more counterparts and, if executed in more than one counterpart, the executed counterparts shall each be deemed to be an original but all such counterparts shall together constitute one and the same instrument.

[Signature pages follow.]

IN WITNESS WHEREOF, the parties have executed this Agreement as of the date first above written.

|

|

AVALONBAY COMMUNITIES, INC. |

|

|

|

|

|

|

|

|

By: |

/s/ Kevin P. O’Shea |

|

|

Name: |

Kevin P. O’Shea |

|

|

Title: |

CFO |

[Signature Page to Terms Agreement]

WELLS FARGO SECURITIES, LLC

GOLDMAN, SACHS & CO.

BARCLAYS CAPITAL INC.

For themselves and as Representatives of the Agents named on Schedule 1 hereto

|

WELLS FARGO SECURITIES, LLC |

|

|

|

|

|

|

|

|

|

By: |

/s/ Carolyn Hurley |

|

|

Name: |

Carolyn Hurley |

|

|

Title: |

Director |

|

|

|

|

|

|

|

|

|

|

GOLDMAN, SACHS & CO. |

|

|

|

|

|

|

|

|

|

|

By: |

/s/ Adam Greene |

|

|

Name: |

Adam Greene |

|

|

Title: |

Vice President |

|

|

|

|

|

|

|

|

|

|

BARCLAYS CAPITAL INC. |

|

|

|

|

|

|

|

|

|

By: |

/s/ Pamela Kendall |

|

|

Name: |

Pamela Kendall |

|

|

Title: |

Director |

|

|

|

|

|

[Signature Page to Terms Agreement]

Schedule 1

AGENTS’ ALLOCATIONS

2025 Notes

|

Agent |

|

Aggregate

Principal Amount

of 2025 Notes |

|

|

Wells Fargo Securities, LLC |

|

$ |

87,000,000 |

|

|

|

|

|

|

|

Goldman, Sachs & Co. |

|

$ |

87,000,000 |

|

|

|

|

|

|

|

Barclays Capital Inc. |

|

$ |

87,000,000 |

|

|

|

|

|

|

|

BB&T Capital Markets, a division of BB&T Securities, LLC |

|

$ |

13,000,000 |

|

|

|

|

|

|

|

BNY Mellon Capital Markets, LLC |

|

$ |

13,000,000 |

|

|

|

|

|

|

|

Mitsubishi UFJ Securities (USA), Inc. |

|

$ |

13,000,000 |

|

|

|

|

$ |

300,000,000 |

|

Schedule 2

AVALONBAY COMMUNITIES, INC.

TERMS OF THE NOTES

(See Attached.)

Exhibit 5.1

November 16, 2015

AvalonBay Communities, Inc.

Ballston Tower

671 N. Glebe Road, Suite 800

Arlington, VA 22203

Re: Legality of Securities to be Registered Under Registration Statement on Form S-3

Ladies and Gentlemen:

We have acted as counsel to you in connection with your filing of a Registration Statement on Form S-3 (File No. 333-202185) (as amended or supplemented, the “Registration Statement”) filed on February 19, 2015 with the Securities and Exchange Commission (the “Commission”) pursuant to the Securities Act of 1933, as amended (the “Securities Act”), relating to the registration of the offer by AvalonBay Communities, Inc., a Maryland corporation (the “Company”) of an unlimited amount of any combination of securities of the types specified therein. The Registration Statement became effective pursuant to the rules of the Commission upon filing on February 19, 2015. Reference is made to our opinion letter dated February 19, 2015 and included as Exhibit 5.1 to the Registration Statement. We are delivering this supplemental opinion letter in connection with the pricing supplement dated November 4, 2015 (the “Pricing Supplement”) filed on November 4, 2015 by the Company with the Commission pursuant to Rule 424 under the Securities Act. The Pricing Supplement relates to the offering by the Company of $300,000,000 principal amount of the Company’s 3.500% Notes due November 15, 2025 (the “Notes”) covered by the Registration Statement. We understand that the Notes are to be offered and sold in the manner described in the Pricing Supplement.

We have reviewed such documents and made such examination of law as we have deemed appropriate to give the opinions set forth below. We have relied, without independent verification, on certificates of public officials and, as to matters of fact material to the opinions set forth below, on certificates of officers of the Company.

We refer to (a) the Indenture, dated as of January 16, 1998, between the Company and The Bank of New York Mellon (as successor to State Street Bank and Trust Company) (the “Trustee”), (b) the First Supplemental Indenture, dated as of January 20, 1998, between the Company and the Trustee, (c) the Second Supplemental Indenture, dated as of July 7, 1998, between the Company and the Trustee, (d) the Amended and Restated Third Supplemental Indenture, dated as of July 10, 2000, between the Company and the Trustee, (e) the Fourth Supplemental Indenture, dated as of September 18, 2006, between the Company and the Trustee and (f) the Fifth Supplemental Indenture, dated as of November 21, 2014, between the Company and the Trustee, collectively as the “Indenture.”

The opinion expressed below is limited to the law of New York and the Maryland General Corporation Law.

Based on the foregoing, and subject to the additional qualifications set forth below, we are of the opinion that, upon the execution, authentication and issuance of the Notes in accordance with the terms of the Indenture, the Notes will be valid and binding obligations of the Company, enforceable against the Company in accordance with their terms.

The opinion expressed above is subject to bankruptcy, insolvency, fraudulent transfer, reorganization, moratorium and other similar laws of general application affecting the rights and remedies of creditors and to general principles of equity. We express no opinion as to the validity, binding effect or enforceability of provisions in the Notes or the Indenture relating to the choice of forum for resolving disputes.

This opinion letter and the opinion it contains shall be interpreted in accordance with the Legal Opinion Principles issued by the Committee on Legal Opinions of the American Bar Association’s Business Law Section as published in 53 Business Lawyer 831 (May 1998).

We hereby consent to the inclusion of this opinion as Exhibit 5.1 to the Registration Statement and to the references to our firm under the caption “Legal Matters” in the Registration Statement. In giving our consent, we do not admit that we are in the category of persons whose consent is required under Section 7 of the Securities Act or the rules and regulations thereunder.

|

Sincerely, |

|

|

|

|

|

|

|

|

/s/ Goodwin Procter LLP |

|

|

GOODWIN PROCTER LLP |

|

2

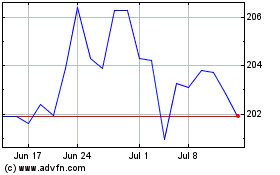

Avalonbay Communities (NYSE:AVB)

Historical Stock Chart

From Mar 2024 to Apr 2024

Avalonbay Communities (NYSE:AVB)

Historical Stock Chart

From Apr 2023 to Apr 2024