UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of The Securities Exchange Act of 1934

| Date of report (Date of earliest event reported): November 12, 2015 |

| |

| AMERICAN SHARED HOSPITAL SERVICES |

(Exact name of registrant

as specified in charter) |

| California |

1-08789 |

94-2918118 |

| (State or other jurisdiction of incorporation) |

(Commission File Number) |

(IRS Employer Identification No.) |

Four Embarcadero Center, Suite 3700,

San Francisco, CA 94111

(Address of principal executive offices)

Registrant’s telephone number, including

area code 415-788-5300

(Former name or former address, if changed

since last report)

Check the appropriate box below if the

Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Item 2.02 Results of Operations and Financial

Conditions

On November 12, 2015, the Company issued

a press release announcing its financial results for the third quarter of 2015. The full text of the press release is furnished

as Exhibit 99.1 to this report. The Company does not intend for this exhibit to be incorporated by reference into future filings

under the Securities Exchange Act of 1934.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

Exhibit 99.1 — Earnings press

release dated November 12, 2015

The information in this report is summary

information that is intended to be considered in the context of our SEC filings and other public announcements that we may make,

by press release or otherwise, from time to time. We disclaim any current intention to revise or update the information contained

in this report, although we may do so from time to time as our management believes is warranted. Any such updating may be made

through the filing of other documents or reports with the SEC, through press releases or through other public disclosures.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

|

American Shared Hospital Services |

| |

|

|

| Date: |

November 12, 2015 |

|

By: |

/s/ Ernest A. Bates, M.D. |

| |

|

|

|

Name: |

Ernest A. Bates, M.D. |

| |

|

|

|

Title: |

Chairman and CEO |

Exhibit 99.1

AMERICAN SHARED HOSPITAL SERVICES

REPORTS THIRD QUARTER RESULTS

San Francisco, CA – November

12, 2015 -- AMERICAN SHARED HOSPITAL SERVICES (NYSE MKT:AMS), a leading provider of turnkey technology solutions for advanced

radiosurgical and radiation therapy services, today announced financial results for the third quarter and first nine months of

2015.

Third Quarter Results

For the three months ended September 30,

2015, medical services revenue decreased 2.7% to $3,875,000 compared to medical services revenue of $3,982,000 for the third quarter

of 2014. The decrease in revenue for this year's third quarter was due, in part, to scheduled downtime at a customer site in order

to perform a Cobalt-60 reload.

Net income for this year's third quarter

increased to $43,000, or $0.01 per share. This compares to net income of $13,000, or $0.00 per share, for the third quarter of

2014.

The total number of procedures performed

in AMS' U.S. Gamma Knife business decreased 3.0% for the third quarter compared to the same period of 2014, reflecting

downtime for the Cobalt reload.

Medical services gross margin for the third

quarter of 2015 decreased to 37.5%, compared to medical services gross margin of 40.3% for the third quarter of 2014, primarily

the result of lower treatment volume and a change in the mix of treatments by location.

Operating income increased 15.0% to $315,000

for the third quarter of 2015 compared to operating income of $274,000 for the same period a year earlier. Pre-tax income, net

of income attributable to non-controlling interest, increased to $135,000 for the third quarter of 2015 compared to pre-tax income,

net of income attributable to non-controlling interest, of $42,000 for the third quarter of 2014.

Selling and administrative expenses for

the third quarter of 2015 decreased to $904,000 compared to SG&A expenses of $933,000 for the third quarter of 2014, primarily

reflecting lower consulting fees. Interest expense decreased to $235,000 compared to interest expense of $396,000 for the third

of 2014, the result of the closure of the Company's line of credit on January 2, 2015, the pay-down of the AMS's existing debt

obligation for its IGRT device, and a one-time benefit for a lease modification recorded in this year's third quarter.

Nine Months Results

For the nine months ended September 30,

2015, medical services revenue increased 8.4% to $12,386,000 compared to medical services revenue of $11,425,000 for the first

nine months of 2014. Excluding prior year's revenue in Turkey, medical services revenue increased 13.7% for this year's first nine

months compared to the first nine months of 2014.

For the nine months ended September 30,

2015, the Company incurred a net loss of $1,799,000, or $0.33 per share. The loss was solely attributable to a non-cash charge

of $2,114,000, or $0.39 per share, related to AMS' strategic equity investment in Mevion Medical Systems. Excluding this charge,

the Company would have reported net income of $315,000, or $0.06 per share, for the first nine months of 2015. This compares to

a net loss for the first nine months of 2014 of $1,010,000, or $0.21 per share, which included a pre-tax loss on the sale of the

Turkey subsidiary of $572,000 and a pre-tax gain on foreign currency transactions of $161,000 due to the strengthening of the Turkish

Lira against the U.S. Dollar.

The total number of procedures performed

in AMS' U.S. Gamma Knife business increased 9.9% for the first nine months of 2015 compared to the same period of 2014, excluding

procedures performed in Turkey.

Operating income for the first nine months

of 2015 increased to $1,249,000 compared to an operating loss of $431,000 for last year's first nine months.

Interest expense decreased for this year's

first nine months to $900,000 compared to $1,376,000 for the same period a year earlier. Excluding interest expense in Turkey,

this decrease was due to the closure of the Company’s line of credit on January 2, 2015, the pay-down of the Company’s

existing debt obligation for its IGRT device at the end of 2014 and an existing lease obligation for a Gamma Knife site at the

end of the first quarter 2014, and a one-time benefit for a lease modification, recorded in this year's third quarter.

Balance Sheet Highlights

At September 30, 2015, cash and cash equivalents

were $2,184,000 compared to $1,059,000 at December 31, 2014. As of December 31, 2014, AMS had a $9,000,000 renewable line of credit

with a bank secured by a certificate of deposit. This line was paid in full on January 2, 2015 using the proceeds from the certificate

of deposit. As a result, current liabilities decreased to $9,015,000 at September 30, 2015 compared to $16,251,000 at December

31, 2014. Shareholders' equity at September 30, 2015 was $24,766,000, or $4.62 per outstanding share. This compares to shareholders'

equity at December 31, 2014 of $26,154,000, or $4.88 per outstanding share.

CEO Comments

Chairman and Chief Executive Officer Ernest

A. Bates, M.D., said, "Procedure volume remained solid in the third quarter, albeit down marginally compared to last year's

exceptionally strong third quarter volume primarily as a result of a Cobalt reload at one of our sites this year. Operating income

nevertheless increased, the result of lower interest expense, as explained above, and reduced SG&A, as we remained focused

on tightly controlling our operating costs. Net income attributable to AMS shareholders also increased. We believe our Gamma Knife

business is well positioned for continued success.

"The Centers for Medicare and Medicaid

Services (CMS) has posted its Medicare hospital outpatient prospective payment rates for calendar year 2016. The CMS comprehensive

reimbursement rate for both Gamma Knife and LINAC one session cranial radiosurgery of approximately $7,300 will be inclusive of

the delivery and certain ancillary codes but exclusive of co-insurance payments or other adjustments. Effective in 2016, treatment

planning and MRI treatment imaging codes will be reimbursed separately. The average 2016 CMS reimbursement rate for delivery and

separately reimbursable ancillary codes (exclusive of co-insurance and other adjustments) is estimated at $8,781 compared to the

current rate of $9,768, a decrease of 10.1%. To put this in perspective, we estimate that CMS’s Gamma Knife rate reduction

would have reduced AMS' annualized 2015 revenue by approximately 2%.

"CMS' 2016 proton therapy delivery

code rates per daily session are $506, a 0.4% decrease ($508 in 2015) for a simple treatment without compensation; $1,151, a 7.4%

increase ($1,072 in 2015), for a simple treatment with compensation; and $1,151, a 7.4% increase ($1,072 in 2015), for an intermediate

or complex treatment.

"AMS' first proton therapy center

is now under construction at UF Health Cancer Center at Orlando Health in Florida. This center, which will employ the MEVION S250

proton therapy system, is expected to begin treating patients in the first quarter of 2016. We expect to finalize and announce

a permanent financing package for this project soon.

"We believe proton therapy represents

an extraordinary growth opportunity for AMS. Hospitals around the country have expressed interest in partnering with AMS to develop

proton centers of their own, also employing the MEVION S250 proton therapy system being installed in Orlando. Clinical results

from the MEVION S250 systems already treating patients at cancer centers in St. Louis, Jacksonville and New Brunswick, New Jersey

have demonstrated the device's reliability and rapid patient throughput, as well as its ability to treat a diverse and complex

array of cancers in both children and adults. We believe that the clinical advantages of proton therapy in the treatment of a wide

range of cancers will support rapid growth in the application of this advanced therapeutic technology."

Earnings Conference Call

American Shared has scheduled a conference

call at 12:00 p.m. PDT (3:00 p.m. EDT) today. To participate in the live call, dial (800) 351-9852 at least 5 minutes prior to

the scheduled start time. A simultaneous WebCast of the call may be accessed through the Company's website, www.ashs.com,

or through CCBN, www.earnings.com (individual investors) or www.streetevents.com (institutional investors). A replay

will be available for 30 days at these same internet addresses, or by calling (888) 843-7419, pass code 4119 8398#.

About AMS

American Shared Hospital Services provides

turnkey technology solutions for advanced radiosurgical and radiation therapy services. AMS is the world leader in providing Gamma

Knife radiosurgery equipment, a non-invasive treatment for malignant and benign brain tumors, vascular malformations and trigeminal

neuralgia (facial pain). The Company also offers the latest IGRT and IMRT systems, as well as its proprietary Operating Room for

the 21st CenturySM concept. AMS owns a common stock investment in Mevion Medical Systems, Inc., developer of the compact

MEVION S250 Proton Therapy System.

Safe Harbor Statement

This press release may be deemed to

contain certain forward-looking statements with respect to the financial condition, results of operations and future plans of American

Shared Hospital Services, which involve risks and uncertainties including, but not limited to, the risks of the Gamma Knife and

radiation therapy businesses, the risks of developing The Operating Room for the 21st Century program, the risks of investing in

a development-stage company, Mevion Medical Systems, Inc., and the risks of the timing, financing, and operations of the Company’s

proton therapy business. Further information on potential factors that could affect the financial condition, results of operations

and future plans of American Shared Hospital Services is included in the filings of the Company with the Securities and Exchange

Commission, including the Company's Annual Report on Form 10-K for the year ended December 31, 2014, its quarterly reports on Form

10-Q for the three months ended March 31, 2015 and June 30, 2015, and the definitive Proxy Statement for the Annual Meeting of

Shareholders held on June 16, 2015.

| Contacts: | American Shared Hospital Services |

Ernest A. Bates, M.D.,

(415) 788-5300

Chairman and Chief Executive

Officer

eabates@ashs.com

Berkman Associates

Neil Berkman, (310) 477-3118

President

info@berkmanassociates.com

| AMERICAN SHARED HOSPITAL SERVICES |

| |

|

| |

|

| PRESS RELEASE |

November 12, 2015 |

| Page 4 of 4 |

Third Quarter 2015 Financial Results |

| |

| Selected Financial Data |

| (unaudited) |

| | |

Summary of Operations Data | |

| | |

| | |

| | |

| | |

| |

| | |

Three months ended | | |

Nine months ended | |

| | |

September 30, | | |

September 30, | |

| | |

2015 | | |

2014 | | |

2015 | | |

2014 | |

| | |

| | |

| | |

| | |

| |

| Medical services revenue | |

$ | 3,875,000 | | |

$ | 3,982,000 | | |

$ | 12,386,000 | | |

$ | 11,425,000 | |

| Costs of revenue | |

| 2,421,000 | | |

| 2,379,000 | | |

| 7,533,000 | | |

| 7,688,000 | |

| Gross margin | |

| 1,454,000 | | |

| 1,603,000 | | |

| 4,853,000 | | |

| 3,737,000 | |

| Selling & administrative expense | |

| 904,000 | | |

| 933,000 | | |

| 2,704,000 | | |

| 2,792,000 | |

| Interest expense | |

| 235,000 | | |

| 396,000 | | |

| 900,000 | | |

| 1,376,000 | |

| Operating income (loss) | |

| 315,000 | | |

| 274,000 | | |

| 1,249,000 | | |

| (431,000 | ) |

| (Loss) on write down | |

| | | |

| | | |

| | | |

| | |

| investment in equity securities | |

| -- | | |

| -- | | |

| (2,114,000 | ) | |

| -- | |

| (Loss) on sale of subsidiary | |

| -- | | |

| -- | | |

| -- | | |

| (572,000 | ) |

| Gain on foreign currency transaction | |

| -- | | |

| -- | | |

| -- | | |

| 161,000 | |

| Other income | |

| 3,000 | | |

| 7,000 | | |

| 14,000 | | |

| 22,000 | |

| Income (loss) before income taxes | |

| 318,000 | | |

| 281,000 | | |

| (851,000 | ) | |

| (820,000 | ) |

| Income tax expense | |

| 92,000 | | |

| 29,000 | | |

| 328,000 | | |

| 33,000 | |

| Net income (loss) | |

$ | 226,000 | | |

$ | 252,000 | | |

$ | (1,179,000 | ) | |

$ | (853,000 | ) |

| Less: Net (income) attributable | |

| | | |

| | | |

| | | |

| | |

| to non-controlling interest | |

| (183,000 | ) | |

| (239,000 | ) | |

| (620,000 | ) | |

| (157,000 | ) |

| Net income (loss) attributable to | |

| | | |

| | | |

| | | |

| | |

| American Shared Hospital Services | |

$ | 43,000 | | |

$ | 13,000 | | |

$ | (1,799,000 | ) | |

$ | (1,010,000 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Earnings (loss) per common share: | |

| | | |

| | | |

| | | |

| | |

| Basic | |

$ | 0.01 | | |

$ | 0.00 | | |

$ | (0.33 | ) | |

$ | (0.21 | ) |

| Assuming dilution | |

$ | 0.01 | | |

$ | 0.00 | | |

$ | (0.33 | ) | |

$ | (0.21 | ) |

| | |

Balance Sheet Data | |

|

| | |

Sep. 30, | | |

Dec. 31, | |

|

| | |

2015 | | |

2014 | |

|

| | |

| | |

| |

|

| Cash and cash equivalents | |

$ | 2,184,000 | | |

$ | 1,059,000 | |

|

| Certificate of deposit | |

$ | -- | | |

$ | 9,000,000 | |

|

| Current assets | |

$ | 6,588,000 | | |

$ | 14,247,000 | |

|

| Investment in equity securities | |

$ | 605,000 | | |

$ | 2,709,000 | |

|

| Total assets | |

$ | 55,886,000 | | |

$ | 67,528,000 | |

|

| | |

| | | |

| | |

|

| Current liabilities | |

$ | 9,015,000 | | |

$ | 16,251,000 | |

|

| Shareholders' equity | |

$ | 24,766,000 | | |

$ | 26,154,000 | |

|

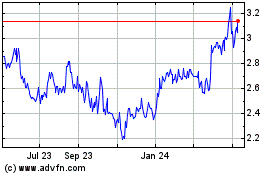

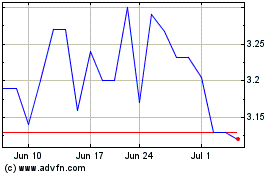

American Shared Hospital... (AMEX:AMS)

Historical Stock Chart

From Mar 2024 to Apr 2024

American Shared Hospital... (AMEX:AMS)

Historical Stock Chart

From Apr 2023 to Apr 2024