UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): November 9, 2015

ORGANOVO HOLDINGS, INC.

(Exact name of registrant as specified in its charter)

Commission File Number: 001-35996

|

Delaware |

|

27-1488943 |

|

(State or other jurisdiction

of incorporation) |

|

(I.R.S. Employer

Identification No.) |

6275 Nancy Ridge Dr.,

San Diego, California 92121

(Address of principal executive offices, including zip code)

(858) 224-1000

(Registrant’s telephone number, including area code)

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

o |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

|

o |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

|

o |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

|

o |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Item 2.02 Results of Operations and Financial Condition

On November 9, 2015, Organovo Holdings, Inc. (the “Company”) issued a press release announcing financial results for the second quarter of its fiscal year, which period ended September 30, 2015. A copy of the press release is attached hereto as Exhibit 99.1.

The information furnished in this Item 2.02 is being furnished and shall not be deemed “filed” for purposes of Section 18 of the Exchange Act of 1934 or otherwise subject to the liabilities of that Section. The information in this Item 2.02 shall not be incorporated by reference into any registration statement or other document filed with the Securities and Exchange Commission (the “SEC”).

Item 9.01 Financial Statements and Exhibits

|

(d) |

|

Exhibits |

|

99.1 |

|

Press Release, dated November 9, 2015. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this Report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

ORGANOVO HOLDINGS, INC. |

|

|

|

|

Date: November 9, 2015 |

/s/ Keith Murphy |

|

|

Keith Murphy |

|

|

Chief Executive Officer and President |

|

|

|

Exhibit Index

|

Exhibit

No. |

|

Description |

|

|

|

|

|

99.1 |

|

Press Release, dated November 9, 2015. |

Exhibit 99.1

|

Investor Contact: |

Press Contact: |

|

|

|

|

Steve Kunszabo |

Jessica Yingling |

|

Organovo Holdings, Inc. |

Little Dog Communications |

|

+1 (858) 224-1092 |

+1 (858) 480-2411 |

|

skunszabo@organovo.com |

jessica@litldog.com |

ORGANOVO ANNOUNCES FISCAL SECOND-QUARTER RESULTS; COMPANY AFFIRMS FULL-YEAR FISCAL 2016 AND LONG-RANGE OUTLOOK

SAN DIEGO, Ca. – November 9, 2015 – Organovo Holdings, Inc. (NYSE MKT:ONVO) (“Organovo”), a three-dimensional biology company focused on delivering scientific and medical breakthroughs using its 3D bioprinting technology, today reported financial results for the fiscal second quarter of 2016 and affirmed its full-year fiscal 2016 and long-range outlook. Net loss was $11.3 million, or $0.12 per share, for the fiscal second quarter of 2016, as compared to $8.9 million, or $0.11 per share, for the fiscal second quarter of 2015.

Organovo reported fiscal second-quarter total revenue of $0.3 million, which consisted of $0.2 million of products and services revenue and $0.1 million of collaborations and grants revenue. Total revenue increased 502 percent versus the comparable period of fiscal 2015. Products and services revenue, which primarily represents revenue from the exVive3DTM Human Liver Tissue research service and product, increased by $0.2 million from the year-ago period. The Company commercially released the exVive3D Human Liver Tissue in November 2014.

The Company also achieved its next milestone for its kidney program ahead of schedule. Functional validation of its kidney tissue, due to be achieved in December 2015, was completed in October 2015. The Company is preparing the data, which includes functional measurement of tissue performance, as well as characteristic toxic behavior of known molecules, for submission to a peer-reviewed journal. Organovo remains on schedule to initiate contracting for this product in the calendar third quarter of 2016.

“We affirmed our fiscal 2016 and long-range outlook across the board today and are pleased with our momentum through the fiscal second quarter,” said Keith Murphy, CEO, Organovo. “We participate in attractive and growing markets with critical unmet needs, benefit from favorable competitive dynamics that come with a first mover advantage, and own a leading technology with a strong IP portfolio. Taking all this together, we expect solid revenue growth through an expanding product and service platform.”

Murphy continued, “We’ve made progress in key strategic areas, by both aligning our sales, marketing and R&D functions to optimize our commercial execution and continuing to build the scientific data that supports the predictive power of our solutions in addressing the major gaps in pharmaceutical discovery. Our commercial in vitro tissue business has an expanded footprint,

with dedicated business development resources in the U.S. and Europe driving these complex solutions sales. We’re also investing significantly in developing additional data sets to grow the preclinical safety market and increase customer penetration.”

Murphy concluded, “As we look to the second half of fiscal 2016, we’re focused on a few key targets including accelerated liver tissue revenue growth, ongoing development of our kidney tissue now that we’ve achieved functional validation, and business development initiatives in the drug discovery and therapeutic tissue spaces.”

Organovo Business Highlights

Revenue

|

|

· |

Products and services revenue was $0.2 million, up from $0.0 million in the prior-year period, primarily driven by customer contracts for the Company’s exVive3D Human Liver Tissue research services. |

|

|

· |

Collaborations and grants revenue totaled $0.1 million, largely supported by existing partnerships and research funded by grants. |

Operating Expenses

|

|

· |

Selling, general and administrative expenses grew 19 percent year-over-year to $6.8 million, reflecting increased employee costs related to sales and administrative staffing. |

|

|

· |

Research and development expenses increased 47 percent from the prior-year period to $4.7 million, primarily due to increased employee related costs and lab supplies. |

Liquidity & Capital Resources

|

|

· |

The Company ended the fiscal second quarter with a cash and cash equivalents balance of $76.9 million. Organovo’s net cash utilization(1) during the period was $9.1 million. The Company’s net cash utilization for the six months ended September 30, 2015 was $16.5 million. |

|

|

· |

Working capital was $72.3 million to end the fiscal second quarter compared to $52.0 million in the prior-year quarter. |

Fiscal-Year 2016 Outlook

The Company affirmed its full-year fiscal 2016 outlook for revenue recognized from previously disclosed contract bookings for its commercial liver tissue product and net cash utilization. The Company continues to expect:

|

|

· |

In fiscal 2016, to recognize between $1.2 million and $1.4 million of its previously reported approximately $2 million in contract bookings for its exVive3D Human Liver Tissue for the period from April 1, 2014 to June 9, 2015. The Company had already recognized approximately $0.3 million from these contract bookings in fiscal 2015. Organovo anticipates that additional revenue from these contract bookings will be recognized in fiscal 2017. In addition, revenue from new contracts signed after June 9, 2015, as well as revenue from grants and collaborations, may also be recognized during the remainder of fiscal 2016. |

|

|

· |

Net cash utilization of between $32 million and $36 million for fiscal-year 2016. The Company had a cash and cash equivalents balance of $76.9 million for its fiscal second quarter ended September 30, 2015. |

|

|

Fiscal-Year 2016 Outlook

(September 2015) |

Fiscal-Year 2016 Outlook

(November 2015) |

|

Total Revenue Recognized From Previously Reported Contract Bookings |

$1.2 million - $1.4 million |

Affirmed |

|

Net Cash Utilization |

$32 million - $36 million |

Affirmed |

Long-Range Outlook

The Company affirmed its long-range outlook for potential revenue from its liver tissue product and initiation of commercial contracting for its kidney tissue product. The Company continues to expect:

|

|

· |

As it penetrates the toxicology market, Organovo’s exVive3D Human Liver Tissue and service will grow into the tens of millions in annual revenue, and has $100 million+ revenue potential in the future (inside of a total addressable market of over $1 billion). |

|

|

· |

Initiation of commercial contracting for its kidney tissue product in the calendar third quarter of 2016. |

Net Cash Utilization Definition

|

(1) |

In addition to disclosing financial results that are determined in accordance with U.S. GAAP, the Company provides net cash utilization as a supplemental measure to help investors evaluate the Company’s fundamental operational performance. The Company defines net cash utilization as the change in the amount of cash and cash equivalents at the beginning of the reporting period as compared to the end of the reporting period, excluding financing activities (which would include proceeds from the sale of common stock and the exercise of warrants and stock options). Net cash utilization is an operational measure that should be considered in addition to our results prepared in accordance with U.S. GAAP. This operational measure should not be considered as a substitute for, or superior to, U.S. GAAP |

|

results. The Company believes net cash utilization is a relevant and useful operational measure because it provides information regarding our cash utilization rate. Management uses net cash utilization to manage the business, including in preparing its annual operating budget, financial projections and compensation plans. The Company believes that net cash utilization is also useful to investors because similar measures are frequently used by securities analysts, investors and other interested parties in their evaluation of companies in similar industries. However, there is no standardized measurement of net cash utilization, and net cash utilization as the Company presents it may not be comparable with similarly titled operational measures used by other companies. Due to these limitations, the Company’s management does not view net cash utilization in isolation but also uses other measurements, such as cash used in operating activities and revenues to measure operating performance. |

Conference Call Information

As previously announced, the Company will host a conference call to discuss its results at 5:00 p.m. ET on Monday, November 9, 2015. Callers should dial (888) 317-6003 (U.S. only) or (412) 317-6061 (from outside the U.S.) to access the call. The conference call ID is 9182401. The conference call will also be simultaneously webcast on Organovo’s Investor Relations webpage at www.organovo.com. A replay of the conference call will be available beginning Monday, November 9, 2015 through Monday, November 16, 2015 at Organovo’s Investor Relations webpage. Callers can also dial (877) 344-7529 (U.S. only) or (412) 317-0088, Access Code 9182401, for an audio replay of the conference call.

About Organovo Holdings Inc.

Organovo designs and creates functional, three-dimensional human tissues for use in medical research and therapeutic applications. The Company develops 3D human disease models through internal development and in collaboration with pharmaceutical and academic partners. Organovo's 3D human tissues have the potential to accelerate the drug discovery process, enabling treatments to be developed faster and at lower cost. The Company recently launched its initial product of the planned exVive3D portfolio offering, the exVive3D Human Liver Tissue for use in toxicology and other preclinical drug testing. Additional products are in development, with the anticipated release of the exVive3D Human Kidney Tissue scheduled for the third quarter of calendar year 2016. The Company also actively conducts early research on specific tissues for therapeutic use in direct surgical applications. In addition to numerous scientific publications, the Company's technology has been featured in The Wall Street Journal, Time Magazine, The Economist, and numerous other media outlets. Organovo is changing the shape of medical research and practice. Learn more at www.organovo.com.

Forward-Looking Statements

Any statements contained in this press release that do not describe historical facts constitute forward-looking statements as that term is defined in the Private Securities Litigation Reform Act of 1995. Any forward-looking statements contained herein are based on current expectations, but are subject to a number of risks and uncertainties. The factors that could cause the Company's actual future results to differ materially from current expectations include, but are not limited to, risks and uncertainties relating to the Company's ability to develop, market and sell products and services based on its technology; the expected benefits and efficacy of the Company's products, services and technology; the market acceptance of the Company's products and services; the Company's business, research, product development, regulatory approval, marketing and distribution plans and strategies; and the Company's ability to successfully complete the contracts and recognize the revenue represented by the contracts included in its previously reported total contract bookings. These and other factors are identified and described in more detail in the Company's filings with the SEC, including its Annual Report on Form 10-K filed with the SEC on June 9, 2015 and its Quarterly Report on Form 10-Q filed with the SEC on November 9, 2015. You should not place undue reliance on these forward-looking statements, which speak only as of the date that they were made. These cautionary statements should be considered with any written or oral forward-looking statements that the Company may issue in the future. Except as required by applicable law, including the securities laws of the United States, the Company does not intend to update any of the forward-looking statements to conform these statements to reflect actual results, later events or circumstances or to reflect the occurrence of unanticipated events.

Organovo Holdings, Inc.

Condensed Consolidated Balance Sheets

(in thousands)

|

|

|

September 30, 2015 |

|

|

March 31, 2015 |

|

|

|

|

Unaudited |

|

|

Audited |

|

|

Assets |

|

|

|

|

|

|

|

|

|

Current Assets |

|

|

|

|

|

|

|

|

|

Cash and cash equivalents |

|

|

76,863 |

|

|

|

50,142 |

|

|

Accounts receivable |

|

|

180 |

|

|

|

— |

|

|

Inventory |

|

|

68 |

|

|

|

66 |

|

|

Prepaid expenses and other current assets |

|

|

714 |

|

|

|

1,054 |

|

|

Total current assets |

|

|

77,825 |

|

|

|

51,262 |

|

|

Fixed assets, net |

|

|

3,633 |

|

|

|

2,042 |

|

|

Restricted cash |

|

|

79 |

|

|

|

79 |

|

|

Other assets, net |

|

|

139 |

|

|

|

106 |

|

|

Total assets |

|

$ |

81,676 |

|

|

$ |

53,489 |

|

|

Liabilities and Stockholders’ Equity |

|

|

|

|

|

|

|

|

|

Current Liabilities |

|

|

|

|

|

|

|

|

|

Accounts payable |

|

$ |

567 |

|

|

$ |

1,387 |

|

|

Accrued expenses |

|

|

2,421 |

|

|

|

2,257 |

|

|

Deferred rent |

|

|

1,112 |

|

|

|

759 |

|

|

Deferred revenue |

|

|

1,402 |

|

|

|

227 |

|

|

Current portion of capital lease |

|

|

— |

|

|

|

5 |

|

|

Warrant liabilities |

|

|

16 |

|

|

|

126 |

|

|

Total current liabilities |

|

|

5,518 |

|

|

|

4,761 |

|

|

Deferred revenue, net of current portion |

|

|

7 |

|

|

|

32 |

|

|

Total liabilities |

|

$ |

5,525 |

|

|

$ |

4,793 |

|

|

Commitments and Contingencies |

|

|

|

|

|

|

|

|

|

Stockholders’ Equity |

|

|

|

|

|

|

|

|

|

Common stock |

|

|

92 |

|

|

|

82 |

|

|

Additional paid-in capital |

|

|

218,102 |

|

|

|

170,909 |

|

|

Accumulated deficit |

|

|

(142,043 |

) |

|

|

(122,295 |

) |

|

Total stockholders’ equity |

|

|

76,151 |

|

|

|

48,696 |

|

|

Total Liabilities and Stockholders’ Equity |

|

$ |

81,676 |

|

|

$ |

53,489 |

|

Organovo Holdings, Inc.

Unaudited Condensed Consolidated Statements of Operations

(in thousands)

|

|

|

Three Months

Ended |

|

|

Three Months

Ended |

|

|

Six Months

Ended |

|

|

Six Months

Ended |

|

|

|

|

September 30,

2015 |

|

|

September 30,

2014 |

|

|

September 30,

2015 |

|

|

September 30,

2014 |

|

|

Revenues |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Products and services |

|

$ |

187 |

|

|

$ |

— |

|

|

$ |

396 |

|

|

$ |

— |

|

|

Collaborations |

|

|

19 |

|

|

|

45 |

|

|

|

33 |

|

|

|

114 |

|

|

Grants |

|

|

95 |

|

|

|

5 |

|

|

|

178 |

|

|

|

35 |

|

|

Total Revenues |

|

|

301 |

|

|

|

50 |

|

|

|

607 |

|

|

|

149 |

|

|

Selling, general, and administrative expenses |

|

|

6,846 |

|

|

|

5,777 |

|

|

|

11,468 |

|

|

|

9,472 |

|

|

Research and development expenses |

|

|

4,739 |

|

|

|

3,229 |

|

|

|

8,881 |

|

|

|

6,043 |

|

|

Operating Expenses |

|

|

11,585 |

|

|

|

9,006 |

|

|

|

20,349 |

|

|

|

15,515 |

|

|

Loss from Operations |

|

|

(11,284 |

) |

|

|

(8,956 |

) |

|

|

(19,742 |

) |

|

|

(15,366 |

) |

|

Other Income (Expense) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Change in fair value of warrant liabilities |

|

|

9 |

|

|

|

94 |

|

|

|

(28 |

) |

|

|

64 |

|

|

Loss on disposals of fixed assets |

|

|

— |

|

|

|

(3 |

) |

|

|

— |

|

|

|

(3 |

) |

|

Interest income |

|

|

18 |

|

|

|

7 |

|

|

|

25 |

|

|

|

14 |

|

|

Total Other Income (Expense) |

|

|

27 |

|

|

|

98 |

|

|

|

(3 |

) |

|

|

75 |

|

|

Income Tax Expense |

|

|

— |

|

|

|

— |

|

|

|

(3 |

) |

|

|

— |

|

|

Net Loss |

|

$ |

(11,257 |

) |

|

$ |

(8,858 |

) |

|

$ |

(19,748 |

) |

|

$ |

(15,291 |

) |

Organovo Holdings, Inc.

Unaudited Condensed Consolidated Statements of Cash Flows

(in thousands)

|

|

|

Six Months Ended |

|

|

Six Months Ended |

|

|

|

|

September 30, 2015 |

|

|

September 30, 2014 |

|

|

Cash Flows From Operating Activities |

|

|

|

|

|

|

|

|

|

Net loss |

|

$ |

(19,748 |

) |

|

$ |

(15,291 |

) |

|

Adjustments to reconcile net loss to net cash

used in operating activities: |

|

|

|

|

|

|

|

|

|

Amortization of deferred financing costs |

|

|

— |

|

|

|

— |

|

|

Loss on disposal of fixed assets |

|

|

|

|

|

|

3 |

|

|

Depreciation and amortization |

|

|

324 |

|

|

|

208 |

|

|

Change in fair value of warrant liabilities |

|

|

28 |

|

|

|

(64 |

) |

|

Stock-based compensation |

|

|

3,952 |

|

|

|

3,634 |

|

|

Amortization of warrants issued for services |

|

|

(105 |

) |

|

|

469 |

|

|

Increase (decrease) in cash resulting from changes in: |

|

|

|

|

|

|

|

|

|

Accounts receivable |

|

|

(180 |

) |

|

|

(30 |

) |

|

Inventory |

|

|

(2 |

) |

|

|

(7 |

) |

|

Prepaid expenses and other assets |

|

|

337 |

|

|

|

113 |

|

|

Accounts payable |

|

|

(820 |

) |

|

|

204 |

|

|

Accrued expenses |

|

|

164 |

|

|

|

737 |

|

|

Deferred rent |

|

|

(21 |

) |

|

|

223 |

|

|

Deferred revenue |

|

|

1,150 |

|

|

|

124 |

|

|

Accrued interest payable |

|

|

— |

|

|

|

— |

|

|

Net cash used in operating activities |

|

|

(14,921 |

) |

|

|

(9,677 |

) |

|

Cash Flows From Investing Activities |

|

|

|

|

|

|

|

|

|

Restricted cash deposits |

|

|

— |

|

|

|

— |

|

|

Purchases of fixed assets |

|

|

(1,550 |

) |

|

|

(576 |

) |

|

Proceeds from disposals of fixed assets |

|

|

14 |

|

|

|

— |

|

|

Purchases of intangible assets |

|

|

(35 |

) |

|

|

— |

|

|

Net cash used in investing activities |

|

|

(1,571 |

) |

|

|

(576 |

) |

|

Cash Flows From Financing Activities |

|

|

|

|

|

|

|

|

|

Proceeds from issuance of common stock and exercise of warrants, net |

|

|

43,137 |

|

|

|

16,291 |

|

|

Proceeds from exercise of stock options |

|

|

81 |

|

|

|

188 |

|

|

Principal payments on capital lease obligations |

|

|

(5 |

) |

|

|

(4 |

) |

|

Deferred financing costs |

|

|

— |

|

|

|

— |

|

|

Net cash provided by financing activities |

|

|

43,213 |

|

|

|

16,475 |

|

|

Net Increase (Decrease) in Cash and Cash Equivalents |

|

|

26,721 |

|

|

|

6,222 |

|

|

Cash and Cash Equivalents at Beginning of Period |

|

|

50,142 |

|

|

|

48,167 |

|

|

Cash and Cash Equivalents at End of Period |

|

$ |

76,863 |

|

|

$ |

54,389 |

|

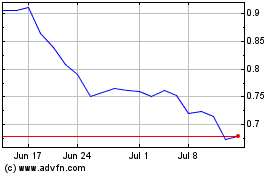

Organovo (NASDAQ:ONVO)

Historical Stock Chart

From Mar 2024 to Apr 2024

Organovo (NASDAQ:ONVO)

Historical Stock Chart

From Apr 2023 to Apr 2024