UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(D) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported): November 9, 2015

Toll Brothers, Inc.

(Exact Name of Registrant as Specified in Charter)

|

| | | | |

Delaware | | 001-09186 | | 23-2416878 |

(State or Other Jurisdiction of Incorporation) | | (Commission File Number) | | (IRS Employer Identification No.) |

| |

250 Gibraltar Road, Horsham, PA | | 19044 |

(Address of Principal Executive Offices) | | (Zip Code) |

Registrant’s telephone number, including area code: (215) 938-8000

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

| |

o | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

|

| |

o | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

|

| |

o | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

|

| |

o | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

ITEM 2.02. RESULTS OF OPERATIONS AND FINANCIAL CONDITION

On November 9, 2015, Toll Brothers, Inc. issued a press release which contained preliminary information about its contracts and home building revenues for the twelve-month and three-month periods ended October 31, 2015, as well as preliminary information about the value of its backlog at October 31, 2015. A copy of the press release is attached hereto as Exhibit 99.1.

The information hereunder shall not be deemed to be “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934 (the “Exchange Act”) or otherwise subject to the liabilities of that section, nor shall it be incorporated by reference into a filing under the Securities Act of 1933, or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

ITEM 9.01. FINANCIAL STATEMENTS AND EXHIBITS

(d). Exhibits

The following Exhibits are furnished as part of this Current Report on Form 8-K:

Exhibit

No. Item

| |

99.1* | Press release of Toll Brothers, Inc. dated November 9, 2015 announcing its preliminary results for contracts, backlog and home building revenues for the twelve-month and three-month periods ended October 31, 2015. |

* Filed electronically herewith

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

| | | | | | |

| | | | | | |

| | | | TOLL BROTHERS, INC. |

| | | |

Dated: | November 9, 2015 | | | By: | | /s/ Joseph R. Sicree |

| | | | | | Joseph R. Sicree Senior Vice President, Chief Accounting Officer |

EXHIBIT 99.1

|

| |

FOR IMMEDIATE RELEASE | CONTACT: Frederick N. Cooper (215) 938-8312 |

November 9, 2015 | fcooper@tollbrothersinc.com |

Toll Brothers Reports Preliminary 4th Quarter and FY 2015 Results

for Contracts, Backlog and Home Building Revenues

Horsham, PA, November 9, 2015 – In anticipation of its webcast presentation and related investor meetings on November 11, 2015 at the UBS Building and Building Products Annual CEO Conference in New York City, Toll Brothers, Inc. (NYSE:TOL) (www.tollbrothers.com), the nation’s leading builder of luxury homes, today announced preliminary results for contracts, backlog and home building revenues for its fourth quarter and fiscal year ended October 31, 2015. These results are preliminary and unaudited. The Company will announce final totals when it releases fourth quarter and fiscal year earnings results on December 8, 2015, followed by an 11:00 A.M. (EST) conference call that will be broadcast live on its website.

Fourth Quarter and Fiscal Year 2015 Financial Highlights (preliminary and unaudited):

| |

▪ | FY 2015’s fourth-quarter total revenues of $1.44 billion and 1,820 units increased 6% in dollars and 1% in units, compared to FY 2014’s fourth-quarter results of $1.35 billion and 1,807 units. The average price of homes delivered was $790,000, compared to $724,000 in FY 2015’s third quarter and $747,000 in FY 2014’s fourth quarter. |

| |

▪ | FY 2015’s fourth-quarter net signed contracts of $1.25 billion and 1,437 units rose 29% in dollars and 12% in units, compared to FY 2014’s fourth-quarter net signed contracts of $970.8 million and 1,282 units. The average price of net contracts signed in FY 2015’s fourth quarter was $872,000, compared to $834,000 in FY 2015’s third quarter and $757,000 in FY 2014’s fourth quarter. |

| |

▪ | The Company ended FY 2015 with a backlog of approximately $3.50 billion and 4,064 units, an increase of 29% in dollars and 10% in units, compared to FY 2014’s year-end backlog of $2.72 billion and 3,679 units. The average price of homes in FY 2015’s fourth-quarter-end backlog was $862,000 compared to $829,000 at FY 2015’s third-quarter end and $739,000 at FY 2014’s fourth-quarter end. |

| |

▪ | FY 2015’s home building revenues of $4.17 billion and 5,525 units increased 7% in dollars and 2% in units, compared to FY 2014’s results of $3.91 billion and 5,397 units. |

| |

▪ | FY 2015’s net signed contracts of $4.96 billion and 5,910 units increased 27% in dollars and 12% in units, compared to net signed contracts of $3.90 billion and 5,271 units in FY 2014. |

Douglas C. Yearley, Jr., Toll Brothers’ chief executive officer, stated: “This is the fifth consecutive quarter of year-over-year growth in contract dollars and units. Based on our strong backlog and pace of demand, we believe we will have significant growth and increased profitability in FY 2016.”

Toll Brothers, Inc., A FORTUNE 1000 Company, is the nation's leading builder of luxury homes. The Company began business in 1967 and became a public company in 1986. Its common stock is listed on the New York Stock Exchange under the symbol “TOL.” The Company serves move-up, empty-nester, active-adult, and second-home buyers and operates in 19 states: Arizona, California, Colorado, Connecticut, Delaware, Florida, Illinois, Maryland, Massachusetts, Michigan, Minnesota, Nevada, New Jersey, New York, North Carolina, Pennsylvania, Texas, Virginia, and Washington, as well as in the District of Columbia.

Toll Brothers builds an array of luxury residential single-family detached, attached home, master planned resort-style golf, and urban low-, mid-, and high-rise communities, principally on land it develops and improves. The Company operates its own architectural, engineering, mortgage, title, land development and land sale, golf course development and management, home security, and landscape subsidiaries. The Company also operates its own lumber distribution, house component assembly, and manufacturing operations. The Company purchases distressed loan and real estate asset portfolios through its wholly owned subsidiary, Gibraltar Capital and Asset Management. The Company acquires and develops commercial and apartment properties through Toll Commercial and Toll Apartment Living, and the affiliated Toll Brothers Realty Trust, and develops urban low-, mid-, and high-rise for-sale condominiums through Toll Brothers City Living.

Toll Brothers was recently named as The Most Admired Home Building Company in Fortune magazine’s survey of the World’s Most Admired Companies for 2015. Toll Brothers was also named 2015 America’s Most Trusted Home Builder™ by Lifestory Research, an award which was based on a study of 43,200 new home shoppers in the nation’s top 27 housing markets. Toll Brothers was named 2014 Builder of the Year by Builder magazine, and is honored to have been awarded Builder of the Year in 2012 by Professional Builder magazine, making it the first two-time recipient. Toll Brothers proudly supports the communities in which it builds; among other philanthropic pursuits, the Company sponsors the Toll Brothers Metropolitan Opera International Radio Network, bringing opera to neighborhoods throughout the world. For more information, visit www.tollbrothers.com.

Toll Brothers discloses information about its business and financial performance and other matters, and provides links to its securities filings, notices of investor events, and earnings and other news releases, on the Investor Relations section of its website (tollbrothers.com/investor_relations).

Forward Looking Statement

Information presented herein for the fourth quarter ended October 31, 2015 is subject to finalization of the Company's regulatory filings, related financial and accounting reporting procedures and external auditor procedures.

Certain information included in this release is forward-looking within the meaning of the Private Securities Litigation Reform Act of 1995, including, but not limited to, information related to: anticipated operating results; anticipated financial performance, resources and condition; selling communities; home deliveries; average home prices; consumer demand and confidence; contract pricing; business and investment opportunities; and market and industry trends.

Such forward-looking information involves important risks and uncertainties that could significantly affect actual results and cause them to differ materially from expectations expressed herein and in other Company reports, SEC filings, statements and presentations. These risks and uncertainties include, among others: local, regional, national and international economic conditions; fluctuating consumer demand and confidence; interest and unemployment rates; changes in sales conditions, including home prices, in the markets where we build homes; conditions in our newly entered markets and newly acquired operations; the competitive environment in which we operate; the availability and cost of land for future growth; conditions that could result in inventory write-downs or write-downs associated with investments in unconsolidated entities; the ability to recover our deferred tax assets; the availability of capital; uncertainties in the capital and securities markets; liquidity in the credit markets; changes in tax laws and their interpretation; effects of governmental legislation and regulation; the outcome of various legal proceedings; the availability of adequate insurance at reasonable cost; the impact of construction defect, product liability and home warranty claims, including the adequacy of self-insurance accruals, and the applicability and sufficiency of our insurance coverage; the ability of customers to obtain financing for the purchase of homes; the ability of home buyers to sell their existing homes; the ability of the participants in various joint ventures to honor their commitments; the availability and cost of labor and building and construction materials; the cost of raw materials; construction delays; domestic and international political events; and weather conditions. For a more detailed discussion of these factors, see the information under the captions "Risk Factors" and "Management's Discussion and Analysis of Financial Condition and Results of Operations" in our most recent annual report on Form 10-K and our subsequent quarterly reports on Form 10-Q filed with the Securities and Exchange Commission.

Any or all of the forward-looking statements included in this release are not guarantees of future performance and may turn out to be inaccurate. Forward-looking statements speak only as of the date they are made. The Company undertakes no obligation to publicly update any forward-looking statements, whether as a result of new information, future events or otherwise.

Toll Brothers operates in two segments: Traditional Home Building and Urban Infill ("City Living"). Within Traditional Home Building, Toll operates in five geographic segments:

| |

North: | Connecticut, Illinois, Massachusetts, Michigan, Minnesota, New Jersey, and New York |

| |

Mid-Atlantic: | Delaware, Maryland, Pennsylvania, and Virginia |

| |

South: | Florida, North Carolina, and Texas |

| |

West: | Arizona, Colorado, Nevada, and Washington |

The fiscal 2015 information presented below is preliminary.

|

| | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

October 31, |

| Units | | $ (Millions) | | Average Price Per Unit $ |

| 2015 |

| 2014 |

| 2015 |

| 2014 | | 2015 | | 2014 |

HOME BUILDING REVENUES | | | | | | | | | | | |

North | 391 |

| | 392 |

| | $ | 239.0 |

| | $ | 234.3 |

| | $ | 611,300 |

| | $ | 597,800 |

|

Mid-Atlantic | 413 |

| | 427 |

| | 266.2 |

| | 264.9 |

| | 644,400 |

| | 620,500 |

|

South | 351 |

| | 363 |

| | 281.0 |

| | 259.9 |

| | 800,600 |

| | 716,000 |

|

West (1) | 319 |

| | 277 |

| | 209.7 |

| | 178.9 |

| | 657,400 |

| | 645,800 |

|

California (1) | 269 |

| | 225 |

| | 310.2 |

| | 245.4 |

| | 1,153,200 |

| | 1,090,600 |

|

Traditional Home Building | 1,743 |

| | 1,684 |

| | 1,306.1 |

| | 1,183.4 |

| | 749,300 |

| | 702,700 |

|

City Living | 77 |

| | 123 |

| | 131.1 |

| | 167.3 |

| | 1,702,800 |

| | 1,360,000 |

|

Total consolidated | 1,820 |

| | 1,807 |

| | $ | 1,437.2 |

| | $ | 1,350.7 |

| | $ | 789,700 |

| | $ | 747,500 |

|

| | | | | | | | | | | |

CONTRACTS | | | | | | | | | | | |

North | 311 |

| | 286 |

| | $ | 219.7 |

| | $ | 174.0 |

| | $ | 706,400 |

| | $ | 608,400 |

|

Mid-Atlantic | 331 |

| | 287 |

| | 216.3 |

| | 185.8 |

| | 653,300 |

| | 647,300 |

|

South | 234 |

| | 293 |

| | 179.9 |

| | 223.5 |

| | 769,000 |

| | 762,900 |

|

West (1) | 291 |

| | 225 |

| | 211.5 |

| | 147.5 |

| | 726,700 |

| | 655,500 |

|

California (1) | 195 |

| | 143 |

| | 290.9 |

| | 159.0 |

| | 1,492,000 |

| | 1,112,000 |

|

Traditional Home Building | 1,362 |

| | 1,234 |

| | 1,118.3 |

| | 889.8 |

| | 821,100 |

| | 721,100 |

|

City Living | 75 |

| | 48 |

| | 134.6 |

| | 81.0 |

| | 1,794,300 |

| | 1,686,500 |

|

Total consolidated | 1,437 |

| | 1,282 |

| | $ | 1,252.9 |

| | $ | 970.8 |

| | $ | 871,900 |

| | $ | 757,200 |

|

| | | | | | | | | | | |

BACKLOG | | | | | | | | | | | |

North | 890 |

| | 878 |

| | $ | 619.2 |

| | $ | 564.6 |

| | $ | 695,800 |

| | $ | 643,100 |

|

Mid-Atlantic | 811 |

| | 830 |

| | 518.9 |

| | 519.5 |

| | 639,900 |

| | 625,900 |

|

South | 824 |

| | 963 |

| | 669.2 |

| | 723.2 |

| | 812,100 |

| | 751,000 |

|

West (1) | 816 |

| | 589 |

| | 573.5 |

| | 392.6 |

| | 702,800 |

| | 666,600 |

|

California (1) | 609 |

| | 275 |

| | 897.8 |

| | 304.6 |

| | 1,474,200 |

| | 1,107,600 |

|

Traditional Home Building | 3,950 |

| | 3,535 |

| | 3,278.6 |

| | 2,504.5 |

| | 830,000 |

| | 708,500 |

|

City Living | 114 |

| | 144 |

| | 225.4 |

| | 215.2 |

| | 1,977,200 |

| | 1,494,200 |

|

Total consolidated | 4,064 |

| | 3,679 |

| | $ | 3,504.0 |

| | $ | 2,719.7 |

| | $ | 862,200 |

| | $ | 739,200 |

|

|

| | | | | | | | | | | | | | | | | | | | | |

| Twelve Months Ended

October 31, |

| Units | | $ (Millions) | | Average Price Per Unit $ |

| 2015 | | 2014 | | 2015 | | 2014 | | 2015 | | 2014 |

HOME BUILDING REVENUES | | | | | | | | | | | |

North | 1,126 |

| | 1,110 |

| | $ | 702.2 |

| | $ | 662.7 |

| | $ | 623,600 |

| | $ | 597,000 |

|

Mid-Atlantic | 1,342 |

| | 1,292 |

| | 845.3 |

| | 817.3 |

| | 629,900 |

| | 632,600 |

|

South | 1,175 |

| | 1,204 |

| | 892.3 |

| | 836.5 |

| | 759,400 |

| | 694,800 |

|

West (1) | 994 |

| | 814 |

| | 665.3 |

| | 517.9 |

| | 669,300 |

| | 636,200 |

|

California (1) | 669 |

| | 713 |

| | 750.0 |

| | 795.8 |

| | 1,121,100 |

| | 1,116,100 |

|

Traditional Home Building | 5,306 |

| | 5,133 |

| | 3,855.1 |

| | 3,630.2 |

| | 726,600 |

| | 707,200 |

|

City Living | 219 |

| | 264 |

| | 316.1 |

| | 281.4 |

| | 1,443,400 |

| | 1,065,900 |

|

Total consolidated | 5,525 |

| | 5,397 |

| | $ | 4,171.2 |

| | $ | 3,911.6 |

| | $ | 755,000 |

| | $ | 724,800 |

|

| | | | | | | | | | | |

CONTRACTS | | | | | | | | | | | |

North | 1,138 |

| | 1,040 |

| | $ | 756.8 |

| | $ | 664.8 |

| | $ | 665,000 |

| | $ | 639,200 |

|

Mid-Atlantic | 1,323 |

| | 1,220 |

| | 844.7 |

| | 763.9 |

| | 638,500 |

| | 626,100 |

|

South | 1,036 |

| | 1,211 |

| | 838.3 |

| | 886.2 |

| | 809,200 |

| | 731,800 |

|

West (1) | 1,221 |

| | 951 |

| | 846.2 |

| | 618.2 |

| | 693,000 |

| | 650,100 |

|

California (1) | 1,003 |

| | 639 |

| | 1,343.2 |

| | 694.2 |

| | 1,339,200 |

| | 1,086,400 |

|

Traditional Home Building | 5,721 |

| | 5,061 |

| | 4,629.2 |

| | 3,627.3 |

| | 809,200 |

| | 716,700 |

|

City Living | 189 |

| | 210 |

| | 326.4 |

| | 269.2 |

| | 1,727,000 |

| | 1,281,900 |

|

Total consolidated | 5,910 |

| | 5,271 |

| | $ | 4,955.6 |

| | $ | 3,896.5 |

| | $ | 838,500 |

| | $ | 739,200 |

|

| |

(1) | Prior to October 31, 2015, California was included in the West geographic segment. Due to the increase in our assets and operations in California, it is now presented as a separate geographic segment. Prior year amounts have been reclassified to conform to the fiscal 2015 presentation. |

Unconsolidated entities:

Information related to revenues and contracts of entities in which we have an interest for the three-month and twelve-month periods ended October 31, 2015 and 2014, and for backlog at October 31, 2015 and 2014 is as follows:

|

| | | | | | | | | | | | | | | | | | | | | |

| Units | | $ (Millions) | | Average Price Per Unit $ |

| 2015 | | 2014 | | 2015 | | 2014 | | 2015 | | 2014 |

Three months ended October 31, | | | | | | | | | | | |

Revenues | 21 |

| | 21 |

| | $ | 17.2 |

| | $ | 15.3 |

| | $ | 820,000 |

| | $ | 730,400 |

|

Contracts | 40 |

| | 22 |

| | $ | 74.6 |

| | $ | 49.9 |

| | $ | 1,865,300 |

| | $ | 2,268,700 |

|

| | | | | | | | | | | |

Twelve months ended October 31, | | | | | | | | | | | |

Revenues | 96 |

| | 70 |

| | $ | 78.1 |

| | $ | 54.9 |

| | $ | 813,300 |

| | $ | 784,600 |

|

Contracts | 147 |

| | 143 |

| | $ | 260.2 |

| | $ | 293.2 |

| | $ | 1,770,100 |

| | $ | 2,050,000 |

|

| | | | | | | | | | | |

Backlog at October 31, | 186 |

| | 135 |

| | $ | 466.6 |

| | $ | 284.4 |

| | $ | 2,508,500 |

| | $ | 2,107,000 |

|

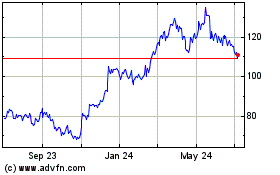

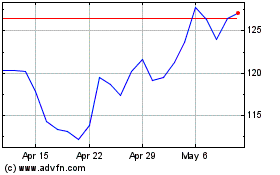

Toll Brothers (NYSE:TOL)

Historical Stock Chart

From Mar 2024 to Apr 2024

Toll Brothers (NYSE:TOL)

Historical Stock Chart

From Apr 2023 to Apr 2024