UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

November 5, 2015

Date of Report

(Date of earliest event reported)

AIR LEASE CORPORATION

(Exact name of registrant as specified in its charter)

|

|

|

|

|

Delaware

|

001-35121

|

27-1840403

|

|

(State or other jurisdiction of

incorporation)

|

(Commission File Number)

|

(I.R.S. Employer

Identification No.)

|

|

2000 Avenue of the Stars, Suite 1000N

Los Angeles, California

|

|

90067

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

Registrant’s telephone number, including area code: (310) 553-0555

Not Applicable

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

[ ] Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

[ ] Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

[ ] Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

[ ] Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 7.01Regulation FD Disclosure.

On November 5, 2015, Air Lease Corporation (the “Company”) held a conference call to discuss its financial results for the three and nine months ended September 30, 2015. A copy of the conference call transcript is furnished herewith and attached hereto as Exhibit 99.1.

The information in this Item 7.01 and the related information in Exhibit 99.1 attached hereto shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that Section, and shall not be incorporated by reference into any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

Item 9.01Financial Statements and Exhibits

(d) Exhibits

Exhibit 99.1Air Lease Corporation Conference Call Transcript dated November 5, 2015.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

|

|

|

|

AIR LEASE CORPORATION

|

|

|

|

|

|

|

|

Date: November 6, 2015

|

/s/ Gregory B. Willis

|

|

|

Gregory B. Willis

|

|

|

Senior Vice President and Chief Financial Officer

|

EXHIBIT INDEX

|

99.1

|

|

Air Lease Corporation Conference Call Transcript dated November 5, 2015

|

Exhibit 99.1

Air Lease Corporation

Earnings Call Transcript

November 5, 2015

4:30 p.m. ET

Q3 2015

AIR LEASE CORPORATION PARTICIPANTS

|

Ryan McKenna

|

Vice President, Strategic Planning

|

|

Steven Udvar-Házy

|

Chairman and CEO

|

|

John Plueger

|

President and COO

|

|

Greg Willis

|

Senior Vice President and CFO

|

ANALYST PARTICIPANTS

|

Jason Arnold

|

RBC Capital Markets

|

|

Helane Becker

|

Cowen and Company

|

|

Jamie Baker

|

JPMorgan

|

|

Arren Cyganovich

|

DA Davidson & Co

|

|

Mike Linenberg

|

Deutsche Bank Research

|

|

Kristine Liwag

|

Bank of America Merrill Lynch

|

|

Nathan Hong

|

Morgan Stanley

|

|

Christopher Nolan

|

FBR & Company

|

|

Moshe Orenbuch

|

Credit Suisse

|

PRESENTATION

Operator

Good day, ladies and gentlemen, and thank you for standing by. And welcome to the Air Lease Corporation's Third Quarter Earnings Conference Call. At this time, all participants are in a listen-only mode. Later, we'll conduct a question-and-answer session and instructions will follow at that time. (Operator Instructions) As a reminder, today's conference may be recorded.

It is now my pleasure to turn the floor over to Ryan McKenna, Head of Strategic Planning. Sir, the floor is yours.

Ryan McKenna – Air Lease Corporation – VP, Strategic Planning

Good afternoon, everyone, and welcome to Air Lease Corporation's third quarter 2015 earnings call. This is Ryan McKenna. And I'm joined this afternoon by Steve Házy, our Chairman and Chief Executive Officer; John Plueger, our President and Chief Operating Officer; and Greg Willis, our Senior Vice President and Chief Financial Officer.

Earlier today, we published our third quarter 2015 results. A copy of our earnings release is available on the Investors section of our website at www.airleasecorp.com. This conference call is being webcast and recorded today, Thursday, November 5, 2015, and the webcast will be available for replay on our website. At this time, all participants to this call are in listen-only mode. At the conclusion of today's conference call, instructions will be given for the question-and-answer session.

Before we begin, please note that certain statements in this conference call, including certain answers to your questions, are forward-looking statements within the meaning of the Private Securities Litigation Reform Act, including without limitation, statements regarding our future operations and performance, revenues, operating expenses, other income and expense, and stock-based compensation expense.

These statements and any projections as to the Company's future performance represent management's estimates of future results and speak only as of today, November 5, 2015. These estimates involve risks and uncertainties that could cause actual results to differ materially from expectations. Please refer to our filings with the Securities and Exchange Commission for a more detailed description of the risk factors that may affect our results. Air Lease Corporation assumes no obligation to update any forward-looking statements or information in light of new information or future events.

In addition, certain financial measures we will use during this call, such as adjusted net income and adjusted diluted earnings per share, are non-GAAP measures. A description of our reasons for utilizing these non-GAAP measures, as well as our definition of them and their reconciliation to corresponding GAAP measures can be found in the earnings release and 10-Q we issued today. This release can be found in both the Investors and Press section of our website at www.airleasecorp.com. Unauthorized recording of this conference call is not permitted.

I would now like to turn the call over to our Chairman and Chief Executive Officer, Steve Házy.

Steven Udvar-Házy – Air Lease Corporation – Chairman and CEO

Thank you, Ryan. Good afternoon and thank you for joining us today. I'm pleased to report that for the third quarter of 2015 Air Lease grew our top-line revenues to $313 million versus $262 million in the third quarter of 2014, an increase of 19.5%.

Our income before taxes increased to $120 million from $96 million in Q3 of 2014, representing a profit growth of 24.2%. Additionally our diluted EPS grew to $0.71 per share for the quarter, compared with $0.58 in the third quarter of 2014, which is an increase in our EPS of 22.4%.

And finally, we delivered another strong pretax profit margin for our Company this quarter at 38%. The financial returns and the metrics of our core leasing business were excellent, and we continue to deliver record and consistent results.

We've heard questions about the slowing GDP growth in emerging markets, potential slowdown in China, currency concerns, M&A activity, production rate concerns and increases, and residual values of current aircraft. While it is a good thing that many more people are focusing on our industry than ever before, I want to be absolutely clear that none of these topics are new issues or matters that we haven't dealt with many times before.

We have seen all of these concerns come and go over my 40-plus years in the industry. And I think there has been a great deal of overreaction recently in the media. The core of our business is passenger demand for air travel. And all other matters are a derivative of this demand picture.

Through the end of September of this year, passenger traffic globally has grown 6.7%, while capacity globally has grown at 6.2% according to data released today by the International Air Transport Association. Furthermore, load factors came in at a very strong 80.3% thus far this year. These are overwhelmingly positive figures, and indicate a very healthy picture for the core demand and supply of air travel.

We serve this demand with current aircraft in our fleet, as well as the new pipeline that is yet to deliver. And this passenger demand on a global scale has created an environment which has allowed our customers to perform well broadly.

In order to handle this increase in passenger demand, the manufacturers have continued to push production rates higher. We always want to see the OEMs slightly undersupply the market, to maintain healthy aircraft values and lease rates. And we believe broadly this is occurring, both manufacturers that overbooked their single-aisle aircraft orders. Further, let me remind you that the OEMs have never in their history have been able to hold production rates on current generation aircraft when leading into the introduction of a new program.

We have said this over and over again. And this is okay. If they're able to sell all the aircraft in this bridge period to the new aircraft program introduction that would be a great outcome. If they're not able to sell all the planes, we would expect them to adjust the productions rates, and that can also be a realistic outcome.

Let me remind you that aircraft today are being built exactly to customer order specification, rather than built on spec and then wait on a dealer's lot to be sold. We do not believe that the major OEMs have any incentive to produce wide-tail aircraft. And this very fact protects the asset values in the existing fleet, and also with future deliveries.

Capital continues to flow into our industry, both at the airline level, and through the leasing community. We view this very positively for all players. Recently there have been numerous transactions for whole businesses and for large portfolios over the past number of months, and values remain strong and robust.

This continued interest from those who are actually deploying capital speaks for itself. Aircraft values are strong, and remain highly desirable, cash-generating assets to own and manage.

Owing to the strong performance of ALC since inception, and the confidence that we have in our future continued growth, ALC's Board of Directors has just declared a 25% increase in our quarterly cash dividend to shareholders from $0.04 per quarter to $0.05 per quarter per share.

We have delivered excellent results while building the best-in-class fleet, on long-term leases with globally diversified airline customers. At this time, I would like to turn this over to John Plueger, our President and Chief Operating Officer, who will further discuss our operations and strategic positioning.

John Plueger – Air Lease Corporation – President and COO

Thanks, Steve. Our core leasing operations remain strong, and our customers are performing well. During 2015, our team has signed leases on 67 aircraft, and added 17 new customers. You know, there's no stronger signal for demand for high-quality new and used aircraft than those results indicate.

The lease rates on our current fleet are consistent and unchanged, and the four replacements are continuing at these expected levels. This past quarter we took delivery of nine aircraft from our order book. We acquired three incremental units. And we sold four aircraft. We continue to execute our business with the consistency that our airline partners and investors have come to expect.

On that note, I feel compelled to advise that the constant up and down of market prognosticators about the value of individual aircraft is entirely overdone. Aircraft values simply don't swing in value anywhere near the quantum that Delta's CEO recently indicated. Prices that he indicated simply don't exist in the market for normal aircraft that are well-maintained. These wide-body aircraft generate strong economic returns for their operators. And that doesn't change based upon public opinion of the day.

Now you can always find exceptions to the rule in every aircraft type. And within each aircraft type at any age, you'll experience periods of greater or lesser supply. But these are all normal data points within today's overall good and healthy aircraft marketplace. And owing to that overall good and healthy marketplace, we are 100% leased in 2015 and placed, 100% placed in 2016, 86% placed in 2017.

So in summary, we're right on track with how we target aircraft placements from our order book, 18 to 36 months ahead of delivery. I'll remind you that as we seize upon additional future aircraft opportunities, such as incremental aircraft we obtain from aircraft manufacturers, these placement percentages and our forward pipeline will vary slightly quarter to quarter.

The management side of our business continues to increase nicely. During the quarter we increased our managed fleet to 26 aircraft. And this business is tracking as we expected. Blackbird Capital I continues to ramp up, and we now have lined up nearly $1 billion of aircraft that are currently in the fleet that will deliver in 2016 and 2017. Our marketing team is using this pool of flexible capital as another tool for us to help us out-compete in the marketplace. As we fill up the $2 billion fund, we'll look to grow our managed business even further, with subsequent funds at the appropriate time.

As we look forward to the fourth quarter, we'll deliver six aircraft from our order book, totaling about $461 million in capital commitments. I'd like to remind you that the full revenue impact of those deliveries will not be realized until the following quarter, and will be offset by sales activity during the quarter.

Let me turn this over now to Greg Willis, our CFO, who will walk you through our financial results that we believe further differentiates ALC. Greg?

Greg Willis – Air Lease Corporation – Senior Vice President and CFO

Thanks, John. This quarter I want to focus on the cash earnings of our business. I'm going to take a few moments to introduce our revised non-GAAP measures, adjusted net income and adjusted diluted earnings per share.

For the third quarter we recorded adjusted net income of $132 million, which represented an increase by 22%, resulting in adjusted diluted earnings per share of $1.20. Our adjusted net income is GAAP net income adjusted to exclude the effects of non-cash items including deferred taxes, stock-based compensation expense, the amortization of debt discounts and issuance costs, along with our litigation settlement expense, which as previously discussed, is a one-time non-recurring charge. We view these adjustments as key to understanding and evaluating the operating performance of the Company by providing insight into the cash earnings of the business, and is how ALC's management evaluates our business.

The third quarter is typically a light quarter in terms of capital expenditures and aircraft sales. This proved to be the case this year as well, as expected.

We ended the third quarter at our target debt-to-equity ratio of 2.5 to 1. This ratio is driven by the timing of capital expenditures tied to our order book. And we expect there to be quarterly cyclicality in this ratio as we go forward. However, there is no change to our long-term target debt-to-equity ratio of 2.5 to 1.

There have been several developments on the financing side of the business. First, I'm very pleased that Standard & Poor's has recognized Air Lease's strengthening credit profile, and have changed their outlook on our corporate credit rating to positive. We continue to benefit from diversified funding sources, our low leverage unencumbered balance sheet, and the strength of our core business.

In August, we issued $500 million of senior unsecured notes due in 2018, which bear interest at 2 5/8%. We elected to tap the market in August, sidestepping the ensuing market volatility in September and October. We are looking forward to the repayment of one of our first unrated bonds in January 2016, which is when a $500 million 3-year bond is scheduled to mature, and bears interest at 4.5%. This will save the Company nearly $10 million in interest expense annually.

Also during the quarter we entered into agreements to increase the capacity of our unsecured revolving credit facility. We increased the size of the facility to $2.8 billion, and maintained the pricing at LIBOR plus 125, with no LIBOR floor. This facility provides us with a substantial amount of financial flexibility, and is a great source of liquidity for our business.

We ended the quarter with a strong liquidity balance of $2.8 billion. I'm very pleased to report that our composite cost of funds ticked down slightly to 3.6%. Our unsecured debt increased to 88% of our debt portfolio, which is a key metric in evaluating the strength of our investment-grade capital structure. And our fixed-rate debt reached 81%, further demonstrating the stability and predictability of our funding structure. Furthermore, as we have continued to execute on our financing strategy, our investment grade credit metrics have continued to improve.

This concludes my review of the results and financing activities of the Company. And I will now turn it back to Ryan.

Ryan McKenna

Thanks, Greg. That concludes management's remarks. For the question-and-answer session, each participant will be allowed one question and one follow-up. Now I'd like to hand the call over the operator. Operator?

Operator

(Operator Instructions) Jason Arnold, RBC Capital Markets

Jason Arnold – RBC Capital Markets

Hi. Good afternoon, guys. Nice results this quarter, and thanks for the color on the industry and air travel demand, very helpful.

Just to start with, maybe you can talk about the three incremental aircraft added to the fleet in the quarter. Were those opportunistic adds? And maybe you can comment on the market, and if you're seeing additional opportunities to kind of make these incremental adds going forward as well.

Steven Udvar-Házy

Yes. During the quarter, we acquired three Boeing 737NGs from one of our airline customers, as part of a larger, broader placement of new-generation aircraft, both single-line and wide-body aircraft.

We acquired these three aircraft on 4-year leases. And two of those aircraft we have subsequently sold during the fourth quarter. One of the aircraft, which is the youngest of the three, we have retained in our own portfolio.

Jason Arnold

Great. And do you see more of these relationships that you continue bringing on with new airplanes? I would imagine would offer potentially additional incremental opportunities of this type.

Steven Udvar-Házy

Yes. We have done a number of transactions, both with Boeing and Airbus, where we're picking up some incremental aircraft for deliveries in 2016 and 2017. And all of those aircraft that we have accelerated or acquired incrementally have been placed on long-term leases. So the answer to your question is yes. We are pursuing incremental opportunities, especially with the strong aircraft sales activity in 2015. We have room to acquire additional aircraft as we go forward beyond the current order pipeline that we have.

Jason Arnold

Excellent. Thank you. And then just maybe one for Greg, typical timeframe, if there is such a thing for rating moves after being on rating watch, positive. Is there additional thoughts that you'd have around that? And maybe any additional color you could think of off of incremental benefits on a funding cost perspective would be helpful. Thanks.

Greg Willis

Jason, I would refer you back to the S&P report that was published to give you further color on S&P's thoughts. I think that obviously we're hopeful that a ratings upgrade will eventually come. And I think that will benefit us on the capital raising side going forward.

Jason Arnold

Okay.

Greg Willis

Maybe another-- maybe you should look to other BBB flat-rated entities to gauge the amount of pickup there is-- there's potential for our funding cost when we issue bonds into the market.

Jason Arnold

Okay. Terrific. Thanks for the color.

Operator

Helane Becker, Cowen

Helane Becker – Cowen and Company

Thanks very much, Operator. Hi, guys. Thank you very much for the time. So this is one question I had for you. Your fleet mix shifted in the quarter around with a big increase in the Middle East and Africa, and kind of declines elsewhere around the world. Is that by design, or is that just the way that deliveries worked that quarter?

Steven Udvar-Házy

These were two Boeing 777s that we’ve actually ordered about two years ago. And they were finally delivered to the airline in that region. We do not anticipate that there will be a significant change in the overall mix. But on a quarter-to-quarter basis, a couple of 777s or a couple of wide-body aircraft, which have a value between $250 million to $300 million, can shift those decimal points a little bit here and there.

But our basic portfolio strategy is not changed in terms of the allocation of assets in Asia, greater Europe, Middle East, Africa, Australia and New Zealand, and North America-South America. So we're staying within a very narrow band in all of those regions to maintain that global diversification.

Helane Becker

Okay, okay. That's great. That makes a lot of sense.

Steven Udvar-Házy

I mean just to give you an example, this week we delivered a new 777-300ER to one of the largest European network carriers. And next week we're delivering another new 777-300ER to a large Asian scheduled airline. So as I say, on these wide-body aircraft, a singular transaction still has an impact on the overall ratios down to a few decimal points. But I wouldn't read into that as being a change in our focus in our diversification.

Helane Becker

Okay. Is that-- were those from your order book, those 777s?

Steven Udvar-Házy

Yes, yes.

Helane Becker

Nice to see that demand. My other question is really with respect to capital allocation. You guys increased the dividend versus like a share repurchase program. Is that kind of the way we should think about capital allocation is you would prefer a dividend-- the Board prefers to give a dividend?

Steven Udvar-Házy

Yes. We are obviously a capital intensive company that is generating, as I indicated earlier, 38% profit margin. We believe that those margins, it's better to deploy our capital to buy aircraft assets that are highly in demand, and continue to generate profits from those assets, rather than spend several hundred million dollars buying back shares.

What we have seen in other players in the industry is that sometimes they have these share buyback programs, but they don't really move the needle on a long-term basis. There might be a short-term blip. But we haven't seen any real meaningful long-term impact on share prices in our segment of the industry.

Helane Becker

Fair enough. Thank you very much. Have a nice day.

Operator

Jamie Baker, JPMorgan

Jamie Baker – JPMorgan

Hey, good afternoon, everybody. First question, and this one might seem a little bit off the wall. But a few hours ago, Russia suspended the certification of the 737. My question is whether aircraft leases ever have any sort of force majeure clause that would allow the airline to return the asset to the lessor in the event its certification is pulled. I know it seems like a stretch. But I'm already taking the question from clients.

Steven Udvar-Házy

Your information is not correct. I hate to correct you.

Jamie Baker

No. On this issue, I welcome the correction, Steve.

Steven Udvar-Házy

Yes. What the Russian authorities are saying is that 737 classic aircrafts that are currently on foreign registry, either Cayman Islands or Ireland or Bermuda, they would like to pull those aircraft back onto Russian registry so that the Russian equivalent of the FAA can inspect those aircraft. This is a knee-jerk reaction to the A321 accident that occurred on Saturday. And I want to tell you that what they're talking about is the re-registration of the aircraft, not withdrawing the airworthiness certificate. In other words, their talking about the domicile of registration, not the actual fly-ability of the aircraft. I just want to make that absolutely crystal clear.

Because Aeroflot itself has a fleet of 737-800s that happened to be registered in Bermuda. In fact, virtually all of Aeroflot's aircraft are registered in Bermuda, not in Russia. Only their Sukhoi SuperJet 100s are registered in Russia. Every other plane they own or lease are registered in Bermuda.

Jamie Baker

That's perfect. I appreciate you clearing that up. Back to Air Lease and relative I suppose to Helane's question, on the recent 777 placements, in light of all of the discussions about this potential wide-body glut, would you be willing to give a bit more specifics on how the lease rates for these very, very recent placements on the 300ER's compared to placements that you might have made, call it, two years ago? Just so we have some actual data around the comments that you made as part of the prepared remarks.

Steven Udvar-Házy

Right. John will comment on specifics. I just want to make a statement with regards to Boeing 777 family, which has gotten sort of a lot of attention. I want to point out that our 777 fleet is composed entirely of 777-300ERs with a fleet age of less than two years, average, with the exception of one relatively young 777-200ER that's on a long-term lease to KLM.

And so these general comments about 777 residual issues really have no impact on Air Lease whatsoever, since we have either just delivered in the last few quarters our new 777s, and we have several more to deliver in 2016. So essentially those aircraft are on 12-year leases. So we don't see any residual value impact until 2026-2027 timeframe.

John Plueger

So Jamie, let me take that a little bit further, give a little bit more specifics. Today if you cross, look across the landscape of about, I don't know, 9 or 10 different appraisers, plus the range of transactions we've seen in the marketplace specifically, you're talking about 10-year-old normal Boeing 777-200ERs, i.e. a 2005 built aircraft, values ranging anywhere from like $45 million to north of $70 million, depending upon the condition of the aircraft and the engine types.

Any 10-year-old used 777-200ER, you could buy for $10 million, which by the way we have not seen in the marketplace, would be in run-out condition, would need an engine overhauls, landing-gear overhauls, major airframe checks, interior, inflight and entertainment replacement; all that stuff could cause $30-40 million to complete.

The fact of the matter is that today with sustained lower fuel prices, the 777-200ER offers a pretty good value to the airlines. In fact, the last passenger 777-200ER aircraft was delivered to Asiana Airlines in July of 2013. And earlier that year and in 2012 to A&A and to Asiana. And by the way, if ALC could find half-life 2005 vintage 777-200ER at anywhere near $10 million, even though we are newer aircraft player, we'd probably buy them all for cash today.

Now Singapore Airlines, which was referred to in Delta's comments, they've got about 23 Boeing 777-200ERs in their fleet today, with an average age of about 12.9 years. And now the 300ER, that's 777-300ER Steve is indicating, is really the gold standard of current generation international long-haul flying by a majority of the world's largest global carriers.

Now if you go over to the A330 fleet, which was also mentioned by Delta, the A330-300 entered into service in January of 1994 with Air Inter of France. Now those early aircraft are now 21 years old, with limited gross weight of 212-214 tons. And they don't compare with current vintage A330's now offering up to 242 tons of gross weight.

In fact, we at ILFC took the first A330-200s in 1998 when we ran that company, leasing them to Canada 3000. Those early A330-200s now are about 17 years old. And they've got marketplace value and lease rates commensurate with their age. And Singapore Airlines, by the way, doesn't even operate A330-200s. They operate about 31 A330-300s, with an average age of about 3.82 years.

So ALC is not seeing, I'm quoting directly here from the Q&A session of Delta's recent earnings release. We are not seeing quote “, a huge bubble in excess wide-body airplanes around the world”. Nor do we see that “, the market appears to be for 777-200s, about 9 to 10 years old, their price is about $10 million”.

Or we also don't see “, on A330-200, the lease rate is about a fifth of what it would be new”. So look, prices of aircraft do naturally decline with age. So yes, they're going to be lower in the future than they are today. I mean there's nothing earth-shattering there. But such broad generalizations just don't hold up across these fleet types globally across the marketplace.

Neither Singapore Airlines nor any other major airline can dispose of 70 wide-bodies over a short period of time. So over the normal course of aircraft replacement, the market has demonstrated pretty well overall balance. It looks to remain so both for wide-bodies and narrow-bodies. In any specific aircraft type, as I mentioned in my remarks, there are exceptions. There are certainly times of greater supply and lesser supply. But nothing we see today, nor in the foreseeable future, indicates impending gross imbalance or gluts or bubbles.

And by the way, ALC congratulates Delta for being a co-launch customer with ALC on the A330neo, as well as their order for new A350-900 aircraft.

Jamie Baker

Guys, I appreciate that. If I could just squeeze a third one in, and a simple yes or no. On last week's Airbus call, they talked about ramping the 350 deliveries in 2016, doubling the rate, so getting to I guess that's a little over 30 units of output. I think most of us were thinking at least 45. I'm curious if the A350 ramp right now is consistent with what you've been assuming, and consistent with the delivery schedule that's in your pipeline, and hence in our earnings models.

Steven Udvar-Házy

Well, the ramp-up on a brand new wide-body new generation is tremendously challenging for both Airbus and Boeing. And we just spent a day with Airbus leadership after the Wings Club event. So I think they're doing the best they can to get the A350 production levels up to the region that they like to achieve, which is around 10 a month in the next four years. And I really would defer the details on specific deliveries in 2016 to Airbus and Rolls Royce, the engine supplier.

And whatever predictions we would make today, looking back in December of 2016, will probably be different by several aircraft units. But I can tell you that Airbus has exercised great caution in not over-promising on the A350. And they don't want to have some of the issues that Boeing had to deal with disappointing customers. So I think they're using a very pragmatic, very careful approach. Making sure that all the suppliers and all the vendors and subcontractors can support this ramp-up and deliveries.

That's kind of a long-winded answer. It doesn't say yes or no. But it's a very complex business to manufacture and deliver new wide-body aircraft. And I think Airbus is doing their very best to satisfy their customer needs.

Operator

Arren Cyganovich, DA Davidson

Arren Cyganovich – DA Davidson

Thanks. I guess staying on the production theme, Airbus had mentioned that they're looking to increase the narrow-body production to 60 per month by 2019. What are your thoughts on the market's ability to handle that, the potential for them to actually reach that, and just how you think about potential opportunities possibly from just adding that added production? Because it's, I guess, pretty big relative to what they're currently doing now. I think it's like over 200 aircraft per year, versus what they're actually putting out these days.

John Plueger

Yes. Look, I think Steve actually hit that square on the head in his remarks on our preliminary before the Q&A here. The bottom line is that there is-- continues to be very, very strong demand. And over-booking monthly by both manufacturers, actually. Certainly Airbus on the single-aisle series.

We know in fact that they went through a pretty rigorous-- and have been going through a very rigorous process to determine what is the optimal level to go to? Because, to Steve's point, they build these aircraft for every single customer. So we believe that although we as aircraft and asset owners, we always love to see a little shortage-- short supply in the marketplace.

And if you look back on 30-plus years of experience, the number of 60 a month does sound high. The fact of the matter is if you really scrub the production backlogs and even if you take out some orders that you might deem questionable or unsure of delivery. The demand is there to support those levels. I mean Boeing and Airbus is not going out there to produce white-tails.

So I think what we're going to see is simply more and more of those aircraft as they're produced, I think will generate both replacement and growth opportunities. They'll be focused in Asia and the Middle East. We don't see it necessarily as any negative impact to our business. The leasing companies have already ordered their product.

And don't forget that the manufacturers, especially Airbus in this case, does exactly look at the leasing content and who the end users are as a part of the equation to increase production rates.

Steven Udvar-Házy

By 2019, there'll be approximately 20,000 single-aisle aircraft in the 737 A320 family size category. So if Airbus builds 700 aircraft in 2019, of A319, 320, 321, neos. That would represent only 3.5% of the total fleet of single-aisle aircraft in operation in 2019.

So while the number of 60 a month or roughly 700 a year is historically looking back, a very high number, if you look at the total embedded fleet of jet aircraft in that size category in operation by 2019, it's only about 3.5% percent of that fleet.

Arren Cyganovich

That's helpful. Thanks. And then just from a modeling perspective, you mentioned two aircraft that you sold in the fourth quarter. What's your expectations for selling from the fleet in the fourth quarter?

Steven Udvar-Házy

We have an ongoing program to keep our fleet young. This year we sold already roughly $711 million worth of aircraft. So it's an ongoing effort. Every quarter we're selling some of our older airplanes.

John Plueger

But we never postulate forward specifically the number of quantities of units or the dollar value of aircraft sold. It's a highly opportunistic market. And I think we've consistently said every earnings call up to now that we've been surprised at the level of demand. We've actually-- we've sold far more aircraft than we thought we would have about-- if we go back a year from now or a year back.

So it continues to surprise us. But we just don't offer guidance as to how much we're going to sell or how many units.

Greg Willis

And we're in a pretty strong position financially. We have $2.8 billion in liquidity and we're at our debt to equity target of 2.5 to 1. So I think we're in a pretty comfortable position to let us be very selective about opportunities to sell airplanes.

Steven Udvar-Házy

And we consistently evaluate assets that are potential sales candidates, and we look at what is the earning value of those assets if we continue to lease them versus selling them at the appropriate economic value.

So we have a number of ongoing sales activities on used aircraft. And you'll continue to see us consummate sales transactions virtually every quarter.

Arren Cyganovich

Okay. Thank you.

Operator

Mike Linenberg, Deutsche Bank

Mike Linenberg – Deutsche Bank

Hey, great. Hey, everyone. I wanted-- Steve and John, I want to go back to your point about the ramp-up, Airbus I guess it's 42 a month now. And it's moving towards 60 over the next four years. And I know Boeing's moving up as well.

Look, I'm in agreement with you that I think that there's significant amount of demand out there. And I think that the market will be able to absorb 60 from one and possibly 60 from another. But isn't the real issue on the supply chain, and I wanted to sort of get your views on that. Because about two calls ago, I mean, you talked about at the current rate, you were seeing challenges at the supply chain level that you hadn't seen in all your

years of being involved with aircraft. And I think you were sort of referring to some of the interior manufacturers.

When you look at some of the commentary out there from some of the other-- some of the manufacturers involved-- how they're still running into issues. I mean if they're running into issues now when we're seeing somewhere in the mid-40s per month, I mean are we getting, on the horizon do we see relief there? Or does it get even worse as it relates seat availability and interiors, et cetera? I mean doesn't the situation get worse?

John Plueger

Mike, and by the way, the ability to produce engines at that rate. So Mike, you're 100% spot on. I'm glad you raised that. Look, our comments about the overall demand equations supporting those levels is all about that. It's about the overall demand equation.

But I will say we do have concerns about the very fact, the supply chain that you brought up. While both manufacturers are stating that they are very confident, highly confident this can happen, I can tell you at a day-to-day level and working and placing and building these aircraft, you know we order all the bits and pieces that go into the airplane separately. And we send all those bits and pieces to Airbus and to Boeing, avionics, seats, galleys, wheels, tires, brakes, APUs, you name it; plus other things, other smaller bits and pieces that go into building sub-assembly components.

We don't have the confidence that the manufacturers seem to have in that supply chain. So we think that's going to be the real challenge.

Steven Udvar-Házy

Already there are concerns amongst our airline customers. For example, on the Pratt & Whitney GTF, on the LEAP engine, on CFM both for the A320 and 737, whether they are able, and through all of the hundreds of suppliers that they depend on, the engine guys, whether they can actually meet those objectives.

Now obviously they'll try to maximize those output capabilities. But building 120 narrow-bodies a month which involve 240 engines, plus the spare engines that you need to support that, is a significant challenge, in our opinion. And I think in retrospect, we'll be proven right.

John Plueger

And so many suppliers have to invest really major sums of money to make this happen. These are very substantial issues and concerns across the supply base. So I think we would just simply pause, where we say it's not such a slam-dunk.

Mike Linenberg

Okay, great. That's helpful. And then just the second question. One of your fellow lessors recently had, I guess, a bad sort of set of results with one of their aircraft with Malaysian. And they went so far as to say that maybe this was a carrier that financial service companies, lessors, et cetera, would probably not-- would be

not likely to do business with going forward. And yet as part of their reorganization plan, I would say that you're actually an integral part. You are putting A350s into that company.

From a high level, can you give us maybe-- I realize every one of these agreement there's elements of them that are confidential. But maybe from a high level, give us maybe some comfort in how you're protecting yourself in doing business with a company like that.

Steven Udvar-Házy

Okay, let me tell you. And this is all public record. Malaysian Airline system has been separated into two legal entities, both owned and controlled by the government of Malaysia. The Malaysian airline system, which was the original airline which had these 777-200s and has the A380s, has now been sort of closed off as a separate entity, with its own sets of assets and liabilities. And a new company was formed, which has taken over all the licenses, and all of the operating rights of MAS. And that's now called Malaysian Airlines Berhad.

And that is the new entity that is the surviving company going forward. Did not assume any of the liabilities or obligations of the old MAS. And that's the entity that we leased the A350s to, which in fact will replace their A380s operating to London, primarily.

In addition, a lessor can protect itself through security deposits and cash and also ongoing overhaul reserves, maintenance reserves on a monthly basis. The Aircastle transaction that I think you're referring to, I think that was a rear-end adjustment, catchup adjustment, and in as much as this contract was with the firm that's being sort of folding up. It's unfortunate that Aircastle was caught in this situation. But our transaction is completely different. And it's with the new entity that's completely clean and well-financed.

Mike Linenberg

Great. That's really helpful, Steve. Thank you.

Operator

Kristine Liwag, Bank of America

Kristine Liwag

Hi. Good afternoon, everyone. So I guess another one of your competitors, same competitor, was saying that because of cheap oil, airlines are less willing to pay a premium for new next-generation aircraft. So from your conversations with your customers, how are airlines balancing forward expectations regarding possible higher interest rates versus a period of prolonged low crude price? And how are these expectations translating to the lease rates for aircraft that you're replacing in 2017 versus those you have placed in 2016?

Steven Udvar-Házy

Yes. This company you refer to, how many new-generation aircraft do they have on order?

Kristine Liwag

We know the answer to that.

John Plueger

So the bottom line is, you see it in our results Kristine that--

Steven Udvar-Házy

It's the number below 1. Is that the number?

Ryan McKenna

We would suggest that we have a little more expertise in that area than potentially these other competitors. So I don't think that that really seems to be their area to focus on, Kristine.

John Plueger

For our results, we've stated in our opening comments and repeatedly, our lease rates remain consistent. Demand remains consistent and strong. Our forward order book strong placements. Lease rates are consistent and holding up on an overall portfolio basis. I don't know what else we can say.

Steven Udvar-Házy

In fact, we had a Board meeting yesterday. And one of the things that our Board of Directors looks for is they want to see historical trend lines on the aircraft lease factors and financial metrics of all of our leases, and then also broken down to their various components, single-aisle aircraft, wide-body aircraft, Boeing aircraft and Airbus aircraft. And I can tell you that in the last 36 months we haven't seen really any deviation of any meaningful mathematical proportion, other than very minor to the hundredth of a decimal.

Now one of the factors that's different from us is we're not in the spot market. We place our aircraft 18 to 36, sometimes as much as 48 months before delivery. So our leases are already pinned down, contracted firm on a long horizon.

Now obviously if somebody has an aircraft today, they haven't placed it. It's not in the right configuration. They have to invest money. There's downtime. There could be issues to someone that has sort of stuck with an airplane. They'll have to deal with the economic consequences.

But our business strategy is based on ordering high quantities of aircraft with long-term placements. So we've immunized ourselves from a lot of those issues.

John Plueger

The low fuel price, as we indicated last quarter, I'll say it again this quarter, has helped us on the fringes with airlines looking to extend and approach us early for lease extensions on existing airplanes, 5, 6, 7, 8, 9-year-old aircraft. And that's a good thing. That's a good thing, a very healthy thing for everything, for everybody.

But in terms of our forward placements through today and the pipeline that we have in lease placements, we're just not seeing any measurable impact of the phenomenon that you asked about.

Steven Udvar-Házy

In fact, since the oil prices began to trend downward, we have not had a single airline that has come to ALC and say, you know that new aircraft, whether it's a Boeing or Airbus unit, that we have contracted with you for the future, we'd like to delay it or postpone it or cancel it. We've not had that phenomenon. So we have really not seen an impact on our portfolio, our types of airplanes.

There may be others that are being impacted. But we haven't seen it.

Ryan McKenna

Kristine, one thing that I think that's really important that seems to get lost a lot when those types of sort of one-note messages are portrayed by the competitors that there's a lot of reasons that airlines lease brand-new aircraft. Fuel is one component. But certainly maintenance efficiencies, range capabilities, payload, the capacity, the type of product offering for the customers. It's really not just a single decision based on a forward fuel forecast. There's a whole lot of factors that go into that.

And I think that if you've got the right aircraft types, within those sub-families, whether they're brand-new aircraft, mid-life aircraft, end-of-life aircraft; there's a good strong market for it that we're seeing across the board. And if you pick the right types, you've got the best chance to win.

John Plueger

And environmental impact is looming more and more important every single day across this planet. And only the new, the most young, current generation, state-of-the-art aircraft address that. It's not just fuel burn. Fuel burn is the biggest contributor to NOx emissions. But on the newer power plants, it's the amount of NOx emissions per pound of fuel burned. So there's many, many other factors besides fuel that drive an airline's desires for new aircraft. And some of these were mentioned by Ryan. And I would just add the environmental issues.

I think actually you and I have talked about this before-- are looming larger as we speak.

Kristine Liwag

Yes. And a follow-up question; you're 100% leased in 2016. And it looks like you have enough capital to cover your aircraft commitments in 2016 as well. Can you give us a sense of how much upside you expect to see in net interest margins in 2016?

Greg Willis

With regard to tightening of our composite rate, I would you point you to the maturity, as I mentioned in my remarks earlier, the January 16 maturity at $500 million, those 3-year notes at 4.5%. We also have another $100 million that matures in June of 2016 at 5%. So overall those will get refinanced at lower levels. And then whatever rate we're able to achieve there, given the timing of a potential upgrade. It may also impact the pricing, and as well as with an upgrade there would also be additional tightening on our bank revolver.

Kristine Liwag

So if leased rates are pretty strong for 2016 and trending as you've seen it, and then your debt costs are also coming down. So I mean your net interest margin should trend down for next year-- or trend up for next year? Is that--

Ryan McKenna

We don't think about net interest margins, Kristine. We really think about our cash earnings, if really what I think is important to focus on. Because, look, we don't think of ourselves as a bank who is operating on a floating cost of capital. We finance with fixed-rate debt.

Steven Udvar-Házy

It should improve if interest expense goes down.

Ryan McKenna

We're optimistic that margins could improve in 2016.

Kristine Liwag

Great. Thank you very much.

Operator

Nathan Hong, Morgan Stanley

Nathan Hong – Morgan Stanley

Thanks for taking the question. Kind of just piggy-backing off the debt side. Greg, I think you mentioned a few debt products that out there that's going to mature in the upcoming year. But obviously there's a much larger one in 2017. So I'm actually wondering if there's a potential to actually accelerate the debt retirement. Is that something that you guys are considering?

Greg Willis

I think given the cash flow, I don't think we're going to look to early retire that piece of debt. I mean it is at 5 5/8%. We'll pay it off at its maturity.

Nathan Hong

Okay. That's helpful. And I guess for Steve, we have actually heard that there's a US airline that's seeking to actually acquire delivery slots from lessors, not to lease the aircraft, but to own them. So I'm wondering if this is actually a strategy that Air Lease takes into consideration. And I'm kind of just curious whether or not you guys do see that as an attractive transaction.

Steven Udvar-Házy

There is one large US airline that currently wants to accelerate the retirement of certain airplanes in their fleet, which are getting older in terms of flight hours and cycles. But we have very specific contractual understandings with both Boeing and Airbus that we don't participate in selling slots or selling delivery positions.

Our mission is to market these aircraft and bring in new customers and widen the customer base, not to simply sell delivery slots that we have secured through our master purchase agreements. So Air Lease is not going to be selling our delivery positions.

John Plueger

Nathan also, I think you should know that there's a point of contract on virtually almost every single contract that I'm ever aware of, of a buyer with Airbus or Boeing. You have no right to sell a slot. That position is solely and exclusively the property of the manufacturer until the day you buy and transfer title.

Now you can try and window dress around it by going in and buying it and then doing a simultaneous try-- but let me tell you something. As a large buyer and therefore a large strategic partner with Airbus and Boeing, the biggest way you could get their ire up was to do some kind of a gimmicky transaction where you sold a bunch of positions that you have through some sort of post-sale arrangement to a big customer.

Our relationships with the manufacturers are too important. And they're too strategic. So we're not going to do that.

Nathan Hong

Great. That's very helpful. Thanks for the time.

Operator

Christopher Nolan, FBR & Company

Christopher Nolan

Hi. Strategically, CIT is in the news talking about possibly selling their aircraft leasing portfolio. Does increasing scale, is that a priority for Air Lease Corp or not?

John Plueger

Look. We're happy with our growth rate, as you go back, and I know you're new with FBR. One of the beauties with starting with a clean sheet of paper company is you're able to create and mold from day one, without any legacy issues. Any transaction that we would do, yes, size and scale has some value. But we believe that we're getting that size and scale.

But virtually any other company that we would go look to purchase or any large group of assets from such companies we would look to purchase would have the following impacts. One, our average remaining lease maturity of our portfolio would decline. Two, the average age would go up. Three, the overall composite cost of funds would go up. And four, our amount of secured debt, which we worked so hard to reduce with the Holy Grail and sacrosanct of our investment-grade rating, would go up significantly. And therefore five, we would look to possibly jeopardize our investment-grade rating, which we're never going to do.

So scale and size do matter. But at the expense of what? And we work very hard at Air Lease to try and create as pure a platform that's going to earn the highest return over time to its shareholders because of the purity of the platform.

So we'll never say never. And we always evaluate all opportunities, but up to now, this is how we see it.

Steven Udvar-Házy

We've had a lot of campaigns in the last two years where we compete vigorously against the largest lessors like GECAS and AerCap. And I can tell you that we've won more campaigns with a lot of these airlines, both on single-aisle and wide-body aircraft. And in no case did we find that our size or scale was a handicap.

Ryan McKenna

Yes, Chris. I would offer, I know we've chatted about this briefly. But with a fleet of now 235 aircraft on the book with 26 managed, with 387 on order, I can say pretty definitively we've never heard from a single customer that you don't have the inventory or the balance sheet capability, both on-balance sheet or off-balance sheet with our management vehicle, to serve the needs of the customer.

And I think in that sense we feel great about the scale and our ability to offer the solutions to the customers that we really need. So I think we feel good.

Christopher Nolan

Great. And as follow up, what was the Blackbird assets under management? I missed that. I know that it was mentioned earlier.

Ryan McKenna

It's right now north of $500 million that's in the-- that's been acquired. And close to $1 billion that is-- will total to $1 billion that's not yet delivered, but has been committed to. So those are for forward orders. So another sort of $400-plus million in aircraft assets that will deliver next year and the following year. So we're right on target with 12 months in, having about $1 billion in the hopper, and another $1 billion to go.

Christopher Nolan

Last question on China, I know Steve was giving comments on the overall macro. Can you tell me that all your Chinese airline customers are current right now?

Steven Udvar-Házy

Yes they are.

Christopher Nolan

Great. Thanks for the clarification and taking my questions.

Operator

Moshe Orenbuch, Credit Suisse

Moshe Orenbuch

Thanks. Most of my questions actually have been asked and answered, just to follow up a little bit on Blackbird. Just wondering if there's-- what the thoughts are in terms of whether either another vehicle like this or something-- anything else that you could kind of do, given that there is significant demand, it seems like from outside of the large lessor community for ways to enter this business.

John Plueger

Look, we're always looking at new opportunities. But first and foremost we want to make sure that the ventures we already have out there, specifically Blackbird Capital I, works well. As you've heard from Ryan, it's on track. But we like to get to the finish stage and make sure that that's all done, that the investors are happy. But having said that, you've heard us say several times before that we can see follow-on entities similar to Blackbird. And we look at any other potential in the marketplace for other specialized products or something similar. We're always on the look for a new way to spin the business.

And if we can find those opportunities, as we found Blackbird, we will seize upon them.

Moshe Orenbuch

Great. Thanks, John.

Operator

Thank you. And at this time I'm currently showing no additional questioners in the phone queue. I'd like to turn the program back over to management for any additional or closing remarks.

Ryan McKenna

Thank you all very much. That concludes our call for today. We look forward to speaking with you during our 10-K call in the start of 2016.

Operator

Thank you presenters, and thank you to all of our attendees for joining us. This will conclude today's call. Thank you for your participation and have a wonderful day.

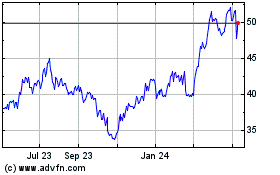

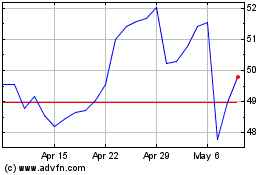

Air Lease (NYSE:AL)

Historical Stock Chart

From Mar 2024 to Apr 2024

Air Lease (NYSE:AL)

Historical Stock Chart

From Apr 2023 to Apr 2024