UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): November 4, 2015

Alamo Group Inc.

(Exact name of registrant as specified in its charter)

|

| | |

State of Delaware | 0-21220 | 74-1621248 |

(State or other jurisdiction of incorporation) | (Commission File No.) | (IRS Employer Identification No.) |

1627 E. Walnut Seguin, Texas 78155

(Address of Principal executive offices)

|

| |

Registrant's telephone number, including area code: | (830) 379-1480 |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 2.02 Results of Operations and Financial Condition

On November 4, 2015, Alamo Group Inc. issued a press release announcing, among other things, financial results for the quarter ended September 30, 2015. A copy of the press release is filed as Exhibit 99.1 to this Current Report on Form 8-K. The foregoing description is qualified by reference to such exhibit.

The information furnished in this report, including the exhibit, shall not be deemed to be incorporated by reference into any of Alamo Group filings with the SEC under the Securities Act of 1933, except as shall be expressly set forth by specific reference in any such filing, and shall not be deemed to be "filed" with the SEC under the Securities Exchange Act of 1934.

Item 9.01 Financial Statements and Exhibits

Exhibit 99.1 - Press Release dated November 4, 2015.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

| |

November 4, 2015 | By: /s/ Robert H. George |

| Robert H. George, |

| Vice President-Administration |

EXHIBIT INDEX

|

| |

Exhibit No. | Description |

99.1 | Press release |

PAGE 1

ALAMO GROUP ANNOUNCES RECORD 2015 THIRD QUARTER RESULTS

|

| | |

| For: | Alamo Group Inc. |

| | |

| Contact: | Robert H. George |

| | Vice President |

| | 830-372-9621 |

For Immediate Release | | |

| | Financial Relations Board |

| | Marilynn Meek |

| | 212-827-3773 |

ALAMO GROUP ANNOUNCES

2015 THIRD QUARTER RESULTS

SEGUIN, Texas, November 4, 2015 -- Alamo Group Inc. (NYSE: ALG) today reported results for the third quarter ended September 30, 2015.

Highlights for the Quarter

| |

• | Record net income of $14.8 million |

| |

• | Record net earnings per diluted share of $1.28 |

| |

• | Operating profit margins over 10% for the quarter |

| |

• | Net sales down 1.4% due to currency translation |

- Agricultural and Industrial sales up despite market headwinds

- European sales down due to exchange rates

| |

• | Record nine month sales of $655.1 million |

| |

• | Record nine month net income of $31.8 million |

| |

• | Backlog increases to a record $175.0 million |

Net sales for the third quarter of 2015 were $231.6 million compared with net sales of $234.8 million for the third quarter of 2014, a decrease of 1.4%. Net income for the quarter was a record $14.8 million, or $1.28 per diluted share, versus net income of $13.4 million, or $1.10 per diluted share, for the comparable period in 2014. The sales for the quarter were negatively impacted by $9.8 million in currency translation effects as a result of the stronger U.S. dollar compared to other currencies in which the Company conducts business(1). The results for the quarter also include the effects of the acquisition of Herder in Brazil which occurred in March, 2015. This accounted for $0.6 million in net sales and $0.04 million in net earnings for the quarter(1). Also, impacting the earnings per share were the effects of a stock repurchase of 7.0% of the Company’s outstanding shares completed in September, 2014.

PAGE 2

ALAMO GROUP ANNOUNCES RECORD 2015 THIRD QUARTER RESULTS

For the first nine months of 2015, net sales were a record $655.1 million compared to $615.1 million in the previous year, an increase of 6.5%. Net income for the nine month period was a record $31.8 million, or $2.77 per diluted share, compared to $29.8 million, or $2.43 per diluted share, in 2014, an increase of 6.8% in net income and 14.0% in earnings per share. The results for the nine months include the effects of the acquisition of Herder described above, plus the acquisition of the units of Specialized Industries, which was completed in May, 2014, the acquisition of Fieldquip in Australia in April, 2014 and the acquisition of Kelland’s in the U.K. in April, 2014(1). For the Company’s nine month results, these acquisitions contributed $83.0 million in net sales and $2.2 million in net earnings for 2015 and $19.0 million in net sales and $1.6 million in net earnings for 2014(1) during the partial time the acquisitions were with Alamo Group.

Also impacting the nine month earnings per share results was the effect of the 2014 stock repurchase mentioned previously, and, as with the quarter, the nine month sales were negatively impacted by $27.8 million in currency translation(1). A summary outlining the effects the acquisitions, share repurchase and currency translation had on the third quarter and first nine months of 2015 is included as an attachment to this report.

Sales by Division

Alamo Group’s Industrial Division net sales in the third quarter of 2015 were $127.4 million compared to $126.4 million in 2014, an increase of 0.8%. The majority of the sales in this Division are to governmental end users for infrastructure maintenance which held up well during the quarter, whereas sales to other end users by this Division remained soft. For the first nine months of 2015, net sales in the Division were $362.8 million versus $309.5 million in 2014, an increase of 17.2%. The majority of this increase related to the acquisition of the units of Specialized described previously. Excluding the effects of the Specialized acquisition, net sales for the first nine months were $284.4 million compared to $290.6 million in the previous year(1).

The Company’s Agricultural Division reported net sales of $58.92 million in the third quarter, a slight increase compared to the $58.87 million achieved in 2014. For the first nine months, the Division’s net sales were $160.4 million in 2015 versus $163.3 million for the comparable period in 2014, a decrease of 1.8%. Excluding the effects of the acquisition of Herder, net sales in the Division were $58.3 million in the third quarter of 2015 and $158.2 million for the first nine months of the year(1). Sales in the Agricultural Division held up well despite continued weakness in the agricultural market.

PAGE 3

ALAMO GROUP ANNOUNCES RECORD 2015 THIRD QUARTER RESULTS

Alamo’s European Division net sales in the third quarter of 2015 were $45.3 million versus $49.6 million in the prior year, a decrease of 8.6%. The decrease was primarily related to currency changes as sales in local currency were up 3.0%(1). For the first nine months of 2015, net sales were $132.0 million versus $142.3 million in the prior year, a decrease of 7.2%, though again, in local currency net sales were up 6.0%(1). Excluding the effects of the acquisition of Kellands, net sales in the Division were $129.5 million for the first nine months compared to $142.3 million in the previous year period(1). Despite continued weakness in the overall European economies, the Division continued to show positive improvement in local currency.

Ron Robinson, Alamo Group’s President and CEO commented, “We were pleased with our third quarter results that included record earnings and continued improvement in operating margins, even though several of our markets remain soft. The third quarter results also provided a good indication of Alamo’s potential since there was a minimal impact of the non-operating issues that sometimes affect results. For the quarter, there were only minor effects due to acquisitions, inventory step up costs, acquisition costs, etc., which helped reveal the Company’s margin potential. These operating improvements were achieved even with slightly lower sales as we continue to face a variety of headwinds such as weak agricultural market conditions, a soft overall European economic situation and the currency translation declines due to the strong U.S. dollar.

“In light of these market conditions, we are pleased with the sales level we were able to achieve in the quarter as well. Though our sales were down 1.4% for the quarter, without the change in rates in currency translation compared to last year, our sales for the year would have been up 11.0%(1). This reflects the ongoing strength of our brands and stability of our core markets. In local currency our European sales are up despite the lingering softness in that market. And, while the agricultural sector continues to show double digit decreases, the fact that we were able to maintain sales at the same level as last year reflects both the broader applicability of our product range across all types of farming and ranching as well as the effectiveness of our marketing initiatives.

“Lastly, the increase in our backlog provides a positive indication of our ongoing ability to perform even with market conditions that remain less than ideal. We appreciate the determination and dedication of all of our people who continue to drive Alamo Group forward.”

PAGE 4

ALAMO GROUP ANNOUNCES RECORD 2015 THIRD QUARTER RESULTS

Earnings Conference Call

Alamo Group will host a conference call to discuss the third quarter results on Thursday, November 5, 2015 at 11:00 a.m. Eastern (10:00 a.m. Central, 9:00 a.m. Mountain and 8:00 a.m. Pacific). Hosting the call will be members of senior management.

Individuals wishing to participate in the conference call should dial 800-768-6563 (domestic) or 785-830-7991 (internationally). For interested individuals unable to join the call, a replay will be available until Thursday, November 12, 2015 by dialing 888-203-1112 (domestic) or 719-457-0820 (internationally), passcode 986453.

The live broadcast of Alamo Group Inc.’s quarterly conference call will be available online at the Company's website, www.alamo-group.com (under “Investor Relations/Events & Presentations”) on Thursday, November 5, 2015, beginning at 11:00 a.m. ET. The online replay will follow shortly after the call ends and will be archived on the Company’s website for 60 days.

About Alamo Group

Alamo Group is a leader in the design, manufacture, distribution and service of high quality equipment for infrastructure maintenance, agriculture and other applications. Our products include truck and tractor mounted mowing and other vegetation maintenance equipment, street sweepers, snow removal equipment, excavators, vacuum trucks, other industrial equipment, agricultural implements and related after-market parts and services. The Company, founded in 1969, has approximately 3,100 employees and operates 25 plants in North America, Europe, Australia and Brazil as of September 30, 2015. The corporate offices of Alamo Group Inc. are located in Seguin, Texas and the headquarters for the Company’s European operations are located in Salford Priors, England.

PAGE 5

ALAMO GROUP ANNOUNCES RECORD 2015 THIRD QUARTER RESULTS

Forward Looking Statements

This release contains forward-looking statements that are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Forward-looking statements involve known and unknown risks and uncertainties, which may cause the Company’s actual results in future periods to differ materially from forecasted results. Among those factors which could cause actual results to differ materially are the following: market demand, competition, weather, seasonality, currency-related issues, and other risk factors listed from time to time in the Company’s SEC reports. The Company does not undertake any obligation to update the information contained herein, which speaks only as of this date.

(Tables Follow)

###

(1) In this earnings release, Alamo Group reports net sales excluding the impact of the acquisitions and excluding the impact of currency translation which are both non-GAAP financial measures. The Company considers this information useful to investors to allow better comparability of period-to-period operating performance. Attachments 1, 2 and 3 to this earnings release contains a revenue reconciliation of the non-GAAP financial measure to the comparable GAAP financial measure.

Alamo Group Inc. and Subsidiaries

Condensed Consolidated Balance Sheets

(in thousands)

(Unaudited) |

| | | | | | | | | | |

| September 30,

2015 | September 30,

2014 |

ASSETS | | |

| | | | |

Current assets: | | | | | | |

Cash and cash equivalents | | $ | 42,657 |

| | | $ | 38,644 |

| |

Accounts receivable, net | | 175,940 |

| | | 178,072 |

| |

Inventories | | 174,423 |

| | | 183,797 |

| |

Other current assets | | 11,187 |

| | | 13,761 |

| |

Total current assets | | 404,207 |

| | | 414,274 |

| |

| | | | | | |

Rental equipment, net | | 42,214 |

| | | 28,927 |

| |

| | | | | | |

Property, plant and equipment | | 67,117 |

| | | 72,416 |

| |

| | | | | | |

Goodwill | | 76,082 |

| | | 71,996 |

| |

Intangible assets | | 53,908 |

| | | 62,028 |

| |

Other non-current assets | | 1,394 |

| | | 4,699 |

| |

| | | | | | |

Total assets | | $ | 644,922 |

| | | $ | 654,340 |

| |

| | | | | | |

LIABILITIES AND STOCKHOLDERS’ EQUITY | | | | | |

| |

Current liabilities: | | | | | |

| |

Trade accounts payable | | $ | 60,952 |

| | | $ | 68,701 |

| |

Income taxes payable | | 1,131 |

| | | 3,111 |

| |

Accrued liabilities | | 37,413 |

| | | 44,391 |

| |

Current maturities of long-term debt and capital lease obligations | | 473 |

| | | 852 |

| |

Other current liabilities | | 302 |

| | | 884 |

| |

Total current liabilities | | 100,271 |

| | | 117,939 |

| |

| | | | | | |

Long-term debt, net of current maturities | | 175,005 |

| | | 190,005 |

| |

Deferred pension liability | | 4,337 |

| | | 1,264 |

| |

Other long-term liabilities | | 6,084 |

| | | 3,843 |

| |

Deferred income taxes | | 5,125 |

| | | 3,825 |

| |

| | | | | | |

Total stockholders’ equity | | 354,100 |

| | | 337,464 |

| |

| | | | | | |

Total liabilities and stockholders’ equity | | $ | 644,922 |

| | | $ | 654,340 |

| |

Alamo Group Inc. and Subsidiaries

Condensed Consolidated Statements of Income

(in thousands, except per share amounts)

(Unaudited)

|

| | | | | | | | | | | | | | | |

| Third Quarter Ended | | Nine Months Ended |

| 9/30/2015 | | 9/30/2014 | | 9/30/2015 | | 9/30/2014 |

| | | | | | | |

Industrial | $ | 127,385 |

| | $ | 126,356 |

| | $ | 362,818 |

| | $ | 309,543 |

|

Agricultural | 58,919 |

| | 58,872 |

| | 160,357 |

| | 163,315 |

|

European | 45,310 |

| | 49,555 |

| | 131,971 |

| | 142,286 |

|

Total net sales | 231,614 |

| | 234,783 |

| | 655,146 |

| | 615,144 |

|

| | | | | | | |

Cost of sales | 174,105 |

| | 179,343 |

| | 501,435 |

| | 474,288 |

|

Gross margin | 57,509 |

| | 55,440 |

| | 153,711 |

| | 140,856 |

|

| 24.8 | % | | 23.6 | % | | 23.5 | % | | 22.9 | % |

| | | | | | | |

Operating expenses | 33,939 |

| | 33,914 |

| | 101,578 |

| | 93,903 |

|

Income from operations | 23,570 |

| | 21,526 |

| | 52,133 |

| | 46,953 |

|

| 10.2 | % | | 9.2 | % | | 8.0 | % | | 7.6 | % |

| | | | | | | |

Interest expense | (1,671 | ) | | (1,497 | ) | | (5,142 | ) | | (2,780 | ) |

Interest income | 27 |

| | 41 |

| | 120 |

| | 137 |

|

Other income (expense) | 895 |

| | 421 |

| | 2,243 |

| | 1,048 |

|

| | | | | | | |

Income before income taxes | 22,821 |

| | 20,491 |

| | 49,354 |

| | 45,358 |

|

Provision for income taxes | 8,065 |

| | 7,124 |

| | 17,529 |

| | 15,558 |

|

| | | | | | | |

Net Income | $ | 14,756 |

| | $ | 13,367 |

| | $ | 31,825 |

| | $ | 29,800 |

|

| | | | | | | |

Net income per common share: | | | | | | | |

| | | | | | | |

Basic | $ | 1.30 |

| | $ | 1.11 |

| | $ | 2.81 |

| | $ | 2.47 |

|

| | | | | | | |

Diluted | $ | 1.28 |

| | $ | 1.10 |

| | $ | 2.77 |

| | $ | 2.43 |

|

| | | | | | | |

Average common shares: | | | | | | | |

Basic | 11,380 |

| | 12,050 |

| | 11,337 |

| | 12,077 |

|

| | | | | | | |

Diluted | 11,496 |

| | 12,206 |

| | 11,477 |

| | 12,251 |

|

| | | | | | | |

Alamo Group Inc.

Non-GAAP Financial Measures Reconciliation

From time to time, Alamo Group Inc. may disclose certain “non-GAAP financial measures” in the course of its earnings releases, earnings conference calls, financial presentations and otherwise. For these purposes, “GAAP” refers to generally accepted accounting principles in the United States. The Securities and Exchange Commission (SEC) defines a “non-GAAP financial measure” as a numerical measure of historical or future financial performance, financial positions, or cash flows that is subject to adjustments that effectively exclude or include amounts from the most directly comparable measure calculated and presented in accordance with GAAP. Non-GAAP financial measures disclosed by Alamo Group are provided as additional information to investors in order to provide them with greater transparency about, or an alternative method for assessing, our financial condition and operating results. These measures are not in accordance with, or a substitute for, GAAP and may be different from, or inconsistent with, non-GAAP financial measures used by other companies. Whenever we refer to a non-GAAP financial measure, we will also generally present the most directly comparable financial measure calculated and presented in accordance with GAAP, along with a reconciliation of the differences between the non-GAAP financial measure we reference and such comparable GAAP financial measure.

In this earnings release, Alamo Group reports each of net sales, operating income and net income excluding the impact of acquisitions which are non-GAAP financial measures. The Company considers this information useful to investors to allow better comparability of period-to-period operating performance. Attachment 1 to this earnings release contains a revenue reconciliation of these non-GAAP financial measures to the comparable GAAP financial measure. Attachment 2 discloses Adjusted Operating Income, Adjusted Net Income, Adjusted Diluted EPS each adjusted to exclude the impact of inventory step up charge and transaction costs connected to the acquisitions and additional stock expense related to the accelerated vesting options to retirement eligible recipients, all of which are non-GAAP financial measures. The Company believes that providing Operating Income and Net Income exclusive of these adjustments, is useful to investors to allow better comparability of period-to-period operating preference. Attachment 2 sets forth a reconciliation of each such non-GAAP financial measure to its most directly comparable GAAP measure.

Alamo Group Inc.

Non-GAAP Financial Reconciliation

(in thousands)

(Unaudited)

|

| | | | | | | | | | | | | | | | |

| | Three Months Ended | | Nine Months Ended |

| | September 30, | | September 30, |

| | 2015 | | 2014 | | 2015 | | 2014 |

| | | | | | | | |

Net Sales (consolidated) - GAAP | | $ | 231,614 |

| | $ | 234,783 |

| | $ | 655,146 |

| | $ | 615,144 |

|

(less: net sales attributable to acquisitions) | | (583 | ) | | — |

| | (83,036 | ) | | (18,976 | ) |

Net Sales less acquisitions (consolidated) - non-GAAP | | $ | 231,031 |

| | $ | 234,783 |

| | $ | 572,110 |

| | $ | 596,168 |

|

| | | | | | | | |

Net Sales (Industrial Division) - GAAP | | $ | 127,385 |

| | $ | 126,356 |

| | $ | 362,818 |

| | $ | 309,543 |

|

(less: net sales attributable to acquisition) | | — |

| | — |

| | (78,425 | ) | | (18,976 | ) |

Net Sales less acquisitions (N.A. Industrial Division) - non-GAAP | | $ | 127,385 |

| | $ | 126,356 |

| | $ | 284,393 |

| | $ | 290,567 |

|

| | | | | | | | |

Net Sales (Agricultural Division) - GAAP | | $ | 58,919 |

| | $ | 58,872 |

| | $ | 160,357 |

| | $ | 163,315 |

|

(less: net sales attributable to acquisitions) | | (583 | ) | | — |

| | (2,157 | ) | | — |

|

Net Sales less acquisitions (N.A. Agricultural Division) - non-GAAP | | $ | 58,336 |

| | $ | 58,872 |

| | $ | 158,200 |

| | $ | 163,315 |

|

| | | | | | | | |

Net Sales (European Division) - GAAP | | $ | 45,310 |

| | $ | 49,555 |

| | $ | 131,971 |

| | $ | 142,286 |

|

(less: net sales attributable to acquisition) | | — |

| | — |

| | (2,454 | ) | | — |

|

Net Sales less acquisitions (European Division) - non-GAAP | | $ | 45,310 |

| | $ | 49,555 |

| | $ | 129,517 |

| | $ | 142,286 |

|

| | | | | | | | |

| | | | | | | | |

Operating Income (consolidated) - GAAP | | $ | 23,570 |

| | $ | 21,526 |

| | $ | 52,133 |

| | $ | 46,953 |

|

(less: operating income attributable to acquisitions) | | (37 | ) | | — |

| | (5,851 | ) | | (2,553 | ) |

Operating Income less acquisitions (consolidated) - non-GAAP | | $ | 23,533 |

| | $ | 21,526 |

| | $ | 46,282 |

| | $ | 44,400 |

|

| | | | | | | | |

Net Income (consolidated) - GAAP | | $ | 14,756 |

| | $ | 13,367 |

| | $ | 31,825 |

| | $ | 29,800 |

|

(less: net income attributable to acquisitions) | | (40 | ) | | — |

| | (2,167 | ) | | (1,601 | ) |

Net Income less acquisitions (consolidated) - non-GAAP | | $ | 14,716 |

| | $ | 13,367 |

| | $ | 29,658 |

| | $ | 28,199 |

|

Alamo Group Inc.

Non-GAAP Financial Reconciliation

(in thousands, except per share numbers)

(Unaudited)

|

| | | | | | | | | | | | | | | | |

| | Three Months Ended | | Nine Months Ended |

| | September 30, | | September 30, |

| | 2015 | | 2014 | | 2015 | | 2014 |

| | | | | | | | |

Operating Income - GAAP | | $ | 23,570 |

| | $ | 21,526 |

| | $ | 52,133 |

| | $ | 46,953 |

|

(add: inventory step charge) | | 209 |

| | 1,139 |

| | 2,740 |

| | 1,139 |

|

(add: expenses relating to system conversion) | | 341 |

| | — |

| | 1,011 |

| | — |

|

(add: transaction cost relating to acquisitions) | | — |

| | 131 |

| | — |

| | 1,839 |

|

Adjusted Operating Income - non-GAAP | | $ | 24,120 |

| | $ | 22,796 |

| | $ | 55,884 |

| | $ | 49,931 |

|

| | | | | | | | |

Net Income - GAAP | | $ | 14,756 |

| | $ | 13,367 |

| | $ | 31,825 |

| | $ | 29,800 |

|

Adjustments (after tax): | | | | | | | | |

(add: inventory step charge) | | 135 |

| | 724 |

| | 1,763 |

| | 724 |

|

(add: expenses relating to system conversion) | | 220 |

| | — |

| | 651 |

| | — |

|

(add: transaction cost relating to acquisitions) | | — |

| | 83 |

| | — |

| | 1,169 |

|

Adjusted Net Income - non-GAAP | | $ | 15,111 |

| | $ | 14,174 |

| | $ | 34,239 |

| | $ | 31,693 |

|

| | | | | | | | |

Diluted EPS - GAAP | | $ | 1.28 |

| | $ | 1.10 |

| | $ | 2.77 |

| | $ | 2.43 |

|

(add: inventory step charge) | | 0.01 |

| | 0.06 |

| | 0.15 |

| | 0.06 |

|

(add: expenses relating to system conversion) | | 0.02 |

| | — |

| | 0.06 |

| | — |

|

(add: transaction cost relating to acquisitions) | | — |

| | — |

| | — |

| | 0.10 |

|

Adjusted Diluted EPS - non-GAAP | | $ | 1.31 |

| | $ | 1.16 |

| | $ | 2.98 |

| | $ | 2.59 |

|

Alamo Group Inc.

Non-GAAP Financial Reconciliation

(in thousands)

(Unaudited)

|

| | | | | | | | | | | | | | | | | |

| Three Months Ended

September 30, | | | | Change due to currency translation |

| 2015 | | 2014 | | % change from 2014 | | $ | | % |

| | | | | | | | | |

| | | | | | | | | |

Industrial | $ | 127,385 |

| | $ | 126,356 |

| | 0.8 | % | | $ | (2,868 | ) | | (2.3 | )% |

Agricultural | 58,919 |

| | 58,872 |

| | 0.1 | % | | (1,158 | ) | | (2.0 | )% |

European | 45,310 |

| | 49,555 |

| | (8.6 | )% | | (5,761 | ) | | (11.6 | )% |

| $ | 231,614 |

| | $ | 234,783 |

| | (1.3 | )% | | $ | (9,787 | ) | | (4.2 | )% |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| Nine Months Ended

September 30, | | | | Change due to currency translation |

| 2015 | | 2014 | | % change from 2014 | | $ | | % |

| | | | | | | | | |

| | | | | | | | | |

Industrial | $ | 362,818 |

| | $ | 309,543 |

| | 17.2 | % | | $ | (5,815 | ) | | (1.9 | )% |

Agricultural | 160,357 |

| | 163,315 |

| | (1.8 | )% | | (2,481 | ) | | (1.5 | )% |

European | 131,971 |

| | 142,286 |

| | (7.2 | )% | | (19,470 | ) | | (13.7 | )% |

| $ | 655,146 |

| | $ | 615,144 |

| | 6.5 | % | | $ | (27,766 | ) | | (4.5 | )% |

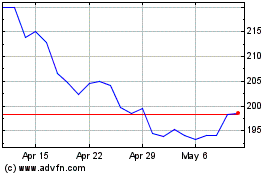

Alamo (NYSE:ALG)

Historical Stock Chart

From Mar 2024 to Apr 2024

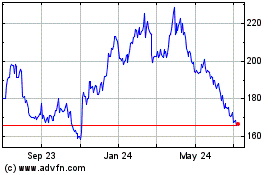

Alamo (NYSE:ALG)

Historical Stock Chart

From Apr 2023 to Apr 2024