UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

| | |

| | |

Date of Report (Date of Earliest Event Reported): | | November 4, 2015 |

The Andersons, Inc.

__________________________________________

(Exact name of registrant as specified in its charter)

|

| | |

| | |

Ohio | 000-20557 | 34-1562374 |

_____________________ (State or other jurisdiction | _____________ (Commission | ______________ (I.R.S. Employer |

of incorporation) | File Number) | Identification No.) |

| | |

480 West Dussel Drive, Maumee, Ohio | | 43537 |

_________________________________ (Address of principal executive offices) | | ___________ (Zip Code) |

|

| | |

Registrant’s telephone number, including area code: | | 419-893-5050 |

Not Applicable

______________________________________________

Former name or former address, if changed since last report

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

[ ] Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

[ ] Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

[ ] Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

[ ] Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 2.02 Results of Operations and Financial Condition.

The Andersons, Inc. issued a press release today announcing its third quarter 2015 earnings. This press release is attached as exhibit 99.1 to this filing.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

| | | | |

| | | | |

| | The Andersons, Inc. | | |

| | | | |

November 4, 2015 | | By: | | /s/ John Granato |

| | | | |

| | | | Name: John Granato |

| | | | Title: Chief Financial Officer |

| | | | (Principal Financial Officer) |

Exhibit Index

|

| | |

Exhibit No. | | Description |

| | |

99.1 | | Third Quarter 2015 Earnings Release |

NEWS RELEASE

NEWS RELEASE

THE ANDERSONS, INC. REPORTS THIRD QUARTER RESULTS

Third Quarter Loss of $0.04 per Diluted Share; Dividend increased for First Quarter 2016

MAUMEE, OHIO, NOVEMBER 4, 2015 The Andersons, Inc. (NASDAQ: ANDE) announces financial results for the third quarter ended September 30, 2015.

Highlights

| |

• | Rail Group has continued strong performance |

| |

• | Quarterly dividend to be increased 11 percent |

| |

• | Grain Group performance down due to significant decline in equity earnings and lower core grain business results |

| |

• | Plant Nutrient Group results adversely impacted by ongoing and one-time costs associated with recent acquisitions, lower demand, and a cob business impairment |

“The Rail Group had a great quarter as they continued to benefit from their focus on asset management, which has led to higher lease and utilization rates. The Ethanol Group also had good results, despite margins being down, as they continued to increase throughput due to various process improvements they have made,” said Chairman Mike Anderson. “Overall, however, this was a disappointing quarter primarily due to the results of our Grain and Plant Nutrient groups.

“We are confident in our future earning potential and we have again raised our dividend. It has increased from 14 cents to 15 1/2 cents per share; this will be effective with the next planned dividend to be paid on January 25, 2016 to holders of record as of January 4, 2016,” concluded Anderson.

Key Highlights

The loss during the third quarter of 2015 attributable to the Company was $1.2 million, or $0.04 per diluted share. Last year, third quarter net income was $16.8 million, or $0.59 per diluted share. Net income through September this year was $34.0 million, or $1.19 per diluted share. Adjusted net income through September of 2014 was $73.2 million, or $2.57 per diluted share. (See the Reconciliation to Adjusted Net Income Table attached for further explanation.) Third quarter 2015 revenues were $936 million compared to $953 million in the prior year.

| |

• | The Rail Group achieved pre-tax income of $11.9 million this quarter led by strong base leasing business results and continuing improvement in the railcar repair business. The utilization rate ended the third quarter at 92.2 percent. |

| |

• | Despite ethanol margins being down significantly, the Ethanol Group had a good quarter due to strong operational execution. The group achieved record third quarter ethanol production volumes. |

| |

• | The Grain Group’s performance was down year over year by $12.3 million due to a significant decrease in equity earnings from affiliates and lower results in the core grain business. |

| |

• | The Plant Nutrient Group’s performance included a $4.5 million negative impact related to recent acquisitions, which were not expected to be accretive this quarter. The legacy portion of the business continued to see a reduction of nutrient purchasing this quarter. The group’s results were further impacted by a $2.0 million goodwill impairment charge in the Cob business. |

Conference Call

The Company will host a webcast on Thursday, November 5, 2015 at 11:00 A.M. ET, to discuss its performance. To dial-in to the call, the number is 866-439-8514 (participant passcode is 60752097. It is recommended that you call 10 minutes before the conference call begins.

To access the webcast: Click on the link: http://edge.media-server.com/m/p/dybuefmq/lan/en Log on. Click on the phone icon at the bottom of the "webcast window" on the left side of the screen. Then, you will be provided with the conference call number and passcode. Click the gear set icon (left of the telephone icon) and select 'Live Phone' to synchronize the presentation with the audio on your phone. A replay of the call can also be accessed under the heading "Investor" on the Company website at www.andersonsinc.com.

Forward Looking Statements

This release contains forward-looking statements. These statements involve risks and uncertainties that could cause actual results to differ materially. Without limitation, these risks include economic, weather and regulatory conditions, competition, and the risk factors set forth from time to time in the Company’s filings with the Securities and Exchange Commission. Although the Company believes that the assumptions upon which the financial information and its forward-looking statements are based are reasonable, it can give no assurance that these assumptions will prove to be correct.

Company Description

Founded in Maumee, Ohio, in 1947, The Andersons is a diversified Company rooted in agriculture conducting business across North America in the grain, ethanol, plant nutrient and rail sectors. The Company also has a consumer retailing presence. For more information, visit The Andersons online at www.andersonsinc.com.

Investor Relations Contact

Jim Burmeister

Phone: 419-891-5848

E-mail: Jim_Burmeister@andersonsinc.com

The Andersons, Inc.

Condensed Consolidated Statements of Income

(unaudited)

|

| | | | | | | | | | | | | | | |

(in thousands, except per share data) | Three months ended

September 30, | | Nine months ended

September 30, |

| 2015 | | 2014 | | 2015 | | 2014 |

Sales and merchandising revenues | $ | 935,774 |

| | $ | 952,927 |

| | $ | 3,094,355 |

| | $ | 3,268,303 |

|

Cost of sales and merchandising revenues | 850,584 |

| | 868,009 |

| | 2,817,681 |

| | 2,985,115 |

|

Gross profit | 85,190 |

| | 84,918 |

| | 276,674 |

| | 283,188 |

|

| | | | | | | |

Operating, administrative and general expenses | 88,698 |

| | 76,737 |

| | 251,044 |

| | 223,997 |

|

Interest expense | 6,147 |

| | 4,253 |

| | 16,210 |

| | 16,401 |

|

Other income: | | | | | | | |

Equity in earnings of affiliates, net | 3,845 |

| | 23,917 |

| | 23,295 |

| | 76,631 |

|

Other income, net | 3,355 |

| | 1,685 |

| | 20,235 |

| | 25,094 |

|

Income before income taxes | (2,455 | ) | | 29,530 |

| | 52,950 |

| | 144,515 |

|

Income tax provision | (1,505 | ) | | 10,251 |

| | 17,556 |

| | 49,837 |

|

Net income | (950 | ) | | 19,279 |

| | 35,394 |

| | 94,678 |

|

Net income attributable to the noncontrolling interests | 277 |

| | 2,454 |

| | 1,433 |

| | 10,844 |

|

Net income attributable to The Andersons, Inc. | $ | (1,227 | ) | | $ | 16,825 |

| | $ | 33,961 |

| | $ | 83,834 |

|

| | | | | | | |

Per common share: | | | | | | | |

Basic earnings attributable to The Andersons, Inc. common shareholders | $ | (0.04 | ) | | $ | 0.59 |

| | $ | 1.19 |

| | $ | 2.95 |

|

Diluted earnings attributable to The Andersons, Inc. common shareholders | $ | (0.04 | ) | | $ | 0.59 |

| | $ | 1.19 |

| | $ | 2.95 |

|

Dividends declared | $ | 0.14 |

| | $ | 0.11 |

| | $ | 0.42 |

| | $ | 0.33 |

|

The Andersons, Inc.

Reconciliation to Adjusted Net Income (unaudited)

|

| | | | | | | | | | | | | | | |

(in thousands, except per share data) | Three months ended

September 30, | | Nine months ended

September 30, |

| 2015 | | 2014 | | 2015 | | 2014 |

Net income attributable to The Andersons, Inc. | $ | (1,227 | ) | | $ | 16,825 |

| | $ | 35,189 |

| | $ | 67,009 |

|

Items impacting other income, net: | | | | | | | |

Partial redemption of investment in Lansing Trade Group | — |

| | — |

| | — |

| | (10,656 | ) |

Total adjusting items | — |

| | — |

| | — |

| | (10,656 | ) |

Adjusted net income attributable to The Andersons, Inc. | $ | (1,227 | ) | | $ | 16,825 |

| | $ | 99,070 |

| | $ | 56,353 |

|

| | | | | | | |

Diluted earnings attributable to The Andersons, Inc. common shareholders | $ | (0.04 | ) | | $ | 0.59 |

| | $ | 1.19 |

| | $ | 2.95 |

|

| | | | | | | |

Impact on diluted earnings per share | — |

| | — |

| | — |

| | (0.38 | ) |

Adjusted diluted earnings per share | $ | (0.04 | ) | | $ | 0.59 |

| | $ | 1.19 |

| | $ | 2.57 |

|

The Andersons, Inc.

Condensed Consolidated Balance Sheets

(unaudited)

|

| | | | | | | | | | | |

(in thousands) | September 30, 2015 | | December 31, 2014 | | September 30, 2014 |

Assets | | | | | |

Current assets: | | | | | |

Cash and cash equivalents | $ | 40,658 |

| | $ | 114,704 |

| | $ | 326,946 |

|

Restricted cash | 181 |

| | 429 |

| | 173 |

|

Accounts receivable, net | 201,664 |

| | 183,059 |

| | 162,270 |

|

Inventories | 527,789 |

| | 795,655 |

| | 396,464 |

|

Commodity derivative assets - current | 60,965 |

| | 92,771 |

| | 126,396 |

|

Deferred income taxes | 6,735 |

| | 7,337 |

| | 148 |

|

Other current assets | 66,411 |

| | 60,492 |

| | 36,518 |

|

Total current assets | 904,403 |

| | 1,254,447 |

| | 1,048,915 |

|

| | | | | |

Other assets: | | | | | |

Commodity derivative assets - noncurrent | 1,584 |

| | 507 |

| | 2,383 |

|

Other assets, net | 220,355 |

| | 131,527 |

| | 113,141 |

|

Pension asset | — |

| | — |

| | 13,738 |

|

Equity method investments | 223,207 |

| | 226,857 |

| | 257,166 |

|

| 445,146 |

| | 358,891 |

| | 386,428 |

|

Railcar assets leased to others, net | 347,100 |

| | 297,747 |

| | 245,849 |

|

Property, plant and equipment, net | 495,045 |

| | 453,607 |

| | 401,800 |

|

Total assets | $ | 2,191,694 |

| | $ | 2,364,692 |

| | $ | 2,082,992 |

|

| | | | | |

Liabilities and equity | | | | | |

Current liabilities: | | | | | |

Short-term debt | $ | 82,801 |

| | $ | 2,166 |

| | $ | 451 |

|

Trade and other payables | 466,428 |

| | 706,823 |

| | 387,311 |

|

Customer prepayments and deferred revenue | 23,581 |

| | 99,617 |

| | 27,246 |

|

Commodity derivative liabilities – current | 49,911 |

| | 64,075 |

| | 229,265 |

|

Accrued expenses and other current liabilities | 71,593 |

| | 78,610 |

| | 70,598 |

|

Current maturities of long-term debt | 26,989 |

| | 76,415 |

| | 76,757 |

|

Total current liabilities | 721,303 |

| | 1,027,706 |

| | 791,628 |

|

| | | | | |

Other long-term liabilities | 16,510 |

| | 15,507 |

| | 13,902 |

|

Commodity derivative liabilities – noncurrent | 2,912 |

| | 3,318 |

| | 26,203 |

|

Employee benefit plan obligations | 58,123 |

| | 59,308 |

| | 39,606 |

|

Long-term debt, less current maturities | 413,561 |

| | 298,638 |

| | 289,448 |

|

Deferred income taxes | 179,591 |

| | 136,166 |

| | 120,628 |

|

Total liabilities | 1,392,000 |

| | 1,540,643 |

| | 1,281,415 |

|

Total equity | 799,694 |

| | 824,049 |

| | 801,577 |

|

Total liabilities and equity | $ | 2,191,694 |

| | $ | 2,364,692 |

| | $ | 2,082,992 |

|

The Andersons, Inc.

Segment Data

(Unaudited)

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

(in thousands) | Grain | | Ethanol | | Plant Nutrient | | Rail | | Retail | | Other | | Total |

Three months ended

September 30, 2015 | | | | | | | | | | | | | |

Revenues from external customers | $ | 570,626 |

| | $ | 139,140 |

| | $ | 149,303 |

| | $ | 44,758 |

| | $ | 31,947 |

| | $ | — |

| | $ | 935,774 |

|

Gross profit | 29,926 |

| | 6,265 |

| | 22,320 |

| | 17,491 |

| | 9,188 |

| | — |

| | 85,190 |

|

Equity in earnings of affiliates | 1,340 |

| | 2,505 |

| | — |

| | — |

| | — |

| | — |

| | 3,845 |

|

Other income, net | 618 |

| | 36 |

| | 947 |

| | 2,093 |

| | 92 |

| | (431 | ) | | 3,355 |

|

Income (loss) before income taxes | 129 |

| | 6,167 |

| | (11,114 | ) | | 11,913 |

| | (769 | ) | | (8,781 | ) | | (2,455 | ) |

Income (loss) attributable to the noncontrolling interests | (2 | ) | | 279 |

| | — |

| | — |

| | — |

| | — |

| | 277 |

|

Income (loss) before income taxes attributable to The Andersons, Inc. (a) | $ | 131 |

| | $ | 5,888 |

| | $ | (11,114 | ) | | $ | 11,913 |

| | $ | (769 | ) | | $ | (8,781 | ) | | $ | (2,732 | ) |

Three months ended

September 30, 2014 | | | | | | | | | | | | | |

Revenues from external customers | $ | 575,354 |

| | $ | 179,405 |

| | $ | 133,440 |

| | $ | 32,022 |

| | $ | 32,706 |

| | $ | — |

| | $ | 952,927 |

|

Gross profit | 32,748 |

| | 12,770 |

| | 19,240 |

| | 10,841 |

| | 9,319 |

| | — |

| | 84,918 |

|

Equity in earnings of affiliates | 10,190 |

| | 13,727 |

| | — |

| | — |

| | — |

| | — |

| | 23,917 |

|

Other income, net | (2,354 | ) | | 71 |

| | 2,861 |

| | 792 |

| | 418 |

| | (103 | ) | | 1,685 |

|

Income (loss) before income taxes | 12,447 |

| | 23,709 |

| | (3,014 | ) | | 4,160 |

| | (968 | ) | | (6,804 | ) | | 29,530 |

|

Income (loss) attributable to the noncontrolling interest | (2 | ) | | 2,456 |

| | — |

| | — |

| | — |

| | — |

| | 2,454 |

|

Income (loss) before income taxes attributable to The Andersons, Inc. (a) | $ | 12,449 |

| | $ | 21,253 |

| | $ | (3,014 | ) | | $ | 4,160 |

| | $ | (968 | ) | | $ | (6,804 | ) | | $ | 27,076 |

|

| Grain | | Ethanol | | Plant Nutrient | | Rail | | Retail | | Other | | Total |

Nine months ended

September 30, 2015 | | | | | | | | | | | | | |

Revenues from external customers | $ | 1,781,104 |

| | $ | 416,752 |

| | $ | 660,440 |

| | $ | 134,497 |

| | $ | 101,562 |

| | $ | — |

| | $ | 3,094,355 |

|

Gross profit | 84,656 |

| | 18,394 |

| | 90,984 |

| | 53,062 |

| | 29,578 |

| | — |

| | 276,674 |

|

Equity in earnings of affiliates | 10,764 |

| | 12,531 |

| | — |

| | — |

| | — |

| | — |

| | 23,295 |

|

Other income, net | 2,682 |

| | 83 |

| | 2,441 |

| | 14,766 |

| | 284 |

| | (21 | ) | | 20,235 |

|

Income (loss) before income taxes | 4,016 |

| | 22,274 |

| | 8,183 |

| | 43,915 |

| | (1,483 | ) | | (23,955 | ) | | 52,950 |

|

Income (loss) attributable to the noncontrolling interests | (8 | ) | | 1,441 |

| | — |

| | — |

| | — |

| | — |

| | 1,433 |

|

Income (loss) before income taxes attributable to The Andersons, Inc. (a) | $ | 4,024 |

| | $ | 20,833 |

| | $ | 8,183 |

| | $ | 43,915 |

| | $ | (1,483 | ) | | $ | (23,955 | ) | | $ | 51,517 |

|

Nine months ended

September 30, 2014 | | | | | | | | | | | | | |

Revenues from external customers | $ | 1,814,517 |

| | $ | 594,613 |

| | $ | 639,603 |

| | $ | 117,733 |

| | $ | 101,837 |

| | $ | — |

| | $ | 3,268,303 |

|

Gross profit | 77,665 |

| | 38,773 |

| | 90,328 |

| | 46,569 |

| | 29,853 |

| | — |

| | 283,188 |

|

Equity in earnings of affiliates | 20,541 |

| | 56,090 |

| | — |

| | — |

| | — |

| | — |

| | 76,631 |

|

Other income, net | 16,967 |

| | 201 |

| | 4,211 |

| | 2,289 |

| | 720 |

| | 706 |

| | 25,094 |

|

Income (loss) before income taxes | 34,102 |

| | 85,833 |

| | 23,952 |

| | 25,889 |

| | (1,666 | ) | | (23,595 | ) | | 144,515 |

|

Income attributable to the noncontrolling interest | (8 | ) | | 10,852 |

| | — |

| | — |

| | — |

| | — |

| | 10,844 |

|

Income (loss) before income taxes attributable to The Andersons, Inc. (a) | $ | 34,110 |

| | $ | 74,981 |

| | $ | 23,952 |

| | $ | 25,889 |

| | $ | (1,666 | ) | | $ | (23,595 | ) | | $ | 133,671 |

|

(a) Income (loss) before income taxes attributable to The Andersons, Inc. for each Group is defined as net sales and merchandising revenues plus identifiable other income less all identifiable operating expenses, including interest expense for carrying working capital and long-term assets and is reported net of the noncontrolling interest share of income (loss).

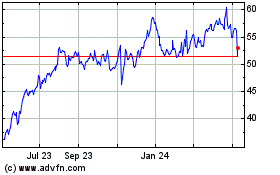

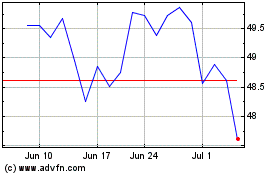

Andersons (NASDAQ:ANDE)

Historical Stock Chart

From Mar 2024 to Apr 2024

Andersons (NASDAQ:ANDE)

Historical Stock Chart

From Apr 2023 to Apr 2024