UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT

TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): November 4, 2015

OraSure Technologies, Inc.

(Exact Name of Registrant as Specified in Charter)

|

|

|

|

|

| Delaware |

|

001-16537 |

|

36-4370966 |

| (State or Other Jurisdiction

of Incorporation) |

|

(Commission

File Number) |

|

(I.R.S. Employer

Identification No.) |

|

|

|

| 220 East First Street

Bethlehem, Pennsylvania |

|

18015-1360 |

| (Address of Principal Executive Offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code: 610-882-1820

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the Registrant under any of the

following provisions:

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Item 2.02 – Results of Operations and Financial Condition.

On November 4, 2015, OraSure Technologies, Inc. (the “Company”) issued a press release announcing its consolidated financial results for the

quarter ended September 30, 2015, and providing financial guidance for the fourth quarter of 2015. A copy of the press release is attached as Exhibit 99.1 to this Form 8-K and is incorporated herein by reference.

The information in this Item and attached Exhibit shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934

or otherwise subject to the liabilities of that section, nor shall such information and Exhibit be deemed incorporated by reference in any filing under the Securities Act of 1933, except as shall be expressly set forth by specific reference in such

a filing. The fact that the information and Exhibit are being furnished should not be deemed an admission as to the materiality of any information contained therein. The Company undertakes no duty or obligation to publicly update or revise the

information contained in this Current Report or attached Exhibit.

Item 7.01 – Regulation FD Disclosure.

On November 4, 2015, the Company held a webcast conference call with analysts and investors, during which Douglas A. Michels, the Company’s President

and Chief Executive Officer, and Ronald H. Spair, the Company’s Chief Financial Officer and Chief Operating Officer, discussed the Company’s consolidated financial results for the quarter ended September 30, 2015, provided financial

guidance for the fourth quarter of 2015 and described certain business developments. A copy of the prepared remarks of Messrs. Michels and Spair is attached as Exhibit 99.2 to this Form 8-K and is incorporated herein by reference.

The information in this Item and attached Exhibit shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934

or otherwise subject to the liabilities of that section, nor shall such information and Exhibit be deemed incorporated by reference in any filing under the Securities Act of 1933, except as shall be expressly set forth by specific reference in such

a filing. The fact that the information and Exhibit are being furnished should not be deemed an admission as to the materiality of any information contained therein. The Company undertakes no duty or obligation to publicly update or revise the

information contained in this Current Report or attached Exhibit.

Item 9.01 – Financial Statements and Exhibits.

(d) Exhibits

|

|

|

| Exhibit

Number |

|

Description |

|

|

| 99.1 |

|

Press Release, dated November 4, 2015, announcing consolidated financial results of OraSure Technologies, Inc. for the quarter ended September 30, 2015, and providing financial guidance for the fourth quarter of

2015. |

|

|

| 99.2 |

|

Prepared Remarks of Douglas A. Michels and Ronald H. Spair for OraSure Technologies, Inc. Third Quarter 2015 Analyst/ Investor Conference Call Held November 4, 2015. |

Signatures

Pursuant to the requirements of the Securities and Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf

by the undersigned, hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

ORASURE TECHNOLOGIES, INC. |

|

|

|

|

| Date: November 4, 2015 |

|

|

|

By: |

|

/s/ Jack E. Jerrett |

|

|

|

|

|

|

Jack E. Jerrett |

|

|

|

|

|

|

Senior Vice President, General Counsel and Secretary |

Index to Exhibits

|

|

|

| Exhibit

No. |

|

Description |

|

|

| 99.1 |

|

Press Release, dated November 4, 2015, announcing consolidated financial results of OraSure Technologies, Inc. for the quarter ended September 30, 2015, and providing financial guidance for the fourth quarter of 2015. |

|

|

| 99.2 |

|

Prepared Remarks of Douglas A. Michels and Ronald H. Spair for OraSure Technologies, Inc. Third Quarter 2015 Analyst/Investor Conference Call Held November 4, 2015. |

Exhibit 99.1

Company Contact:

Ronald H.

Spair

Chief Financial Officer

610-882-1820

Investorinfo@orasure.com

www.orasure.com

OraSure Announces 2015 Third Quarter Financial Results

BETHLEHEM, PA – November 4, 2015 – (Globe Newswire) – OraSure Technologies, Inc. (NASDAQ: OSUR), a leader in point-of-care

diagnostic tests and specimen collection devices, today announced its consolidated financial results for the three and nine months ended September 30, 2015.

Financial Highlights

| |

• |

|

Consolidated net revenues for the third quarter of 2015 were $29.9 million, a 7% increase from the comparable quarter of 2014. Consolidated net revenues for the nine months ended September 30, 2015 were $87.3

million, a 12% increase from the comparable period of 2014. |

| |

• |

|

The Company’s molecular collection systems subsidiary, DNA Genotek (“DNAG”), contributed $7.3 million in net revenues during the third quarter of 2015, which represents a 7% increase over the third

quarter of 2014. Net revenues from this segment for the nine months ended September 30, 2015 were $22.1 million, a 26% increase from the comparable period in 2014. |

| |

• |

|

Net domestic revenues from sales of the Company’s OraQuick® rapid HCV test were $1.9 million for the third quarter of 2015, representing a 47% increase over

the third quarter of 2014 and 13% sequential growth from the second quarter of 2015. Net domestic product revenues for this product were $4.8 million for the nine months ended September 30, 2015, a 51% increase from the comparable period in

2014. Total HCV-related revenues, including exclusivity payments recognized under the HCV co-promotion agreement with AbbVie, were $6.3 million and $17.5 million for the third quarter and nine months of 2015, respectively, as compared to $5.2

million and $9.7 million for the third quarter and nine months of 2014, respectively. |

| |

• |

|

Consolidated net income for the third quarter of 2015 was $1.5 million, or $0.03 per share on a fully-diluted basis, which compares to consolidated net income of $1.1 million, or $0.02 per share on a fully-diluted

basis, for the third quarter of 2014. Consolidated net income for the nine months ended September 30, 2015 was $3.6 million, or $0.06 per share on a fully-diluted basis, which compares to a consolidated net loss of $2.0 million, or $0.04 per

share, for the comparable period of 2014. The Company’s bottom line results for the nine months of 2014 included a $5.5 million payment received as a result of the termination of the Company’s drug assay collaboration with Roche

Diagnostics, which was recorded as an offset to expenses in the second quarter of 2014. |

| |

• |

|

Cash and short-term investments totaled $108.2 million and working capital amounted to $112.1 million at September 30, 2015. |

“We are pleased with the Company’s financial results for the third quarter,” said Douglas A. Michels, President and CEO of OraSure

Technologies. “Our molecular collection systems segment continued its solid performance with a second consecutive quarter of more than $7 million in revenues. In addition, our HCV business once again generated strong quarterly growth on both a

year-over-year basis and sequentially when compared to the second quarter of this year. We expect these businesses will continue to be the primary growth drivers for our Company.”

Financial Results

Consolidated net product revenues for

the third quarter and first nine months of 2015 increased 5% and 3% over the comparable periods of 2014, respectively, primarily as a result of higher sales of the Company’s molecular collection systems, OraQuick® HCV and Intercept® products. These increases were partially offset by lower

OraQuick® professional HIV product sales in both periods and lower cryosurgical systems sales during the nine-month period.

Consolidated other revenues for the third quarter and first nine months of 2015 were $4.1 million and $11.5 million, respectively. Other revenues in the

current quarter included $3.4 million of exclusivity payments recognized under the Company’s HCV co-promotion agreement with AbbVie and $750,000 of Ebola-related funding received from the U.S. Department of Health and Human Services Office of

the Assistant Secretary for Preparedness and Response’s Biomedical Advanced Research and Development Authority (“BARDA”). Other revenue in the first nine months of 2015 included $10.0 million of AbbVie exclusivity payments and $1.5

million in BARDA funding. Other revenues in the third quarter and first nine months of 2014 included $3.4 million and $4.2 million of AbbVie exclusivity payments, respectively.

Consolidated gross margin for the three and nine months ended September 30, 2015 was 69% and 67%, respectively. Consolidated gross margin for the three

and

2

nine months ended September 30, 2014 was 67% and 63%, respectively. Gross margin for the current quarter increased primarily due to a reduction in royalty expense and the increase in other

revenues, partially offset by the impact of a less favorable product mix. Gross margin for the nine-month period improved largely due to the $7.4 million increase in other revenues and a reduction in royalty expense. Other revenues contributed

approximately 500 and 200 basis points to gross margin for the nine months ended September 30, 2015 and 2014, respectively.

Consolidated operating

expenses increased to $19.1 million during the third quarter of 2015 compared to $17.8 million in the comparable period of 2014. This increase was largely due to costs associated with the AbbVie co-promotion agreement along with higher legal costs,

partially offset by lower research and development expenses and a favorable change in the exchange rate between the Canadian and U.S. dollar.

For the

nine months ended September 30, 2015, consolidated operating expenses were $54.4 million, an increase from the $50.9 million reported for the nine months ended September 30, 2014. This increase was largely due to the absence of the $5.5

million Roche termination payment received in 2014, higher legal costs, increased research and development expenses, and costs associated with the AbbVie co-promotion agreement, partially offset by lower promotional expenses for the Company’s

OraQuick® In-Home HIV test and the impact of a favorable change in exchange rates. Promotional expenses for the OraQuick® In-Home HIV

test were $1.3 million and $7.7 million for the first nine months of 2015 and 2014, respectively.

The Company’s cash and short-term investment

balance totaled $108.2 million at September 30, 2015 compared to $97.9 million at December 31, 2014. Working capital was $112.1 million at September 30, 2015 compared to $104.8 million at December 31, 2014. For the nine months

ended September 30, 2015, the Company generated $15.1 million in cash from operations.

Fourth Quarter 2015 Outlook

The Company expects consolidated net revenues to range from $29.5 to $30.0 million and is projecting a consolidated net income of between $0.03 and $0.04 per

share.

3

Financial Data

Condensed Consolidated Financial Data

(In thousands, except per-share data)

Unaudited

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three months ended |

|

|

Nine months ended |

|

| |

September 30, |

|

|

September 30, |

|

| |

|

2015 |

|

|

2014 |

|

|

2015 |

|

|

2014 |

|

| Results of Operations |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net revenues |

|

$ |

29,861 |

|

|

$ |

27,845 |

|

|

$ |

87,337 |

|

|

$ |

77,783 |

|

| Cost of products sold |

|

|

9,192 |

|

|

|

9,140 |

|

|

|

28,974 |

|

|

|

29,135 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Gross profit |

|

|

20,669 |

|

|

|

18,705 |

|

|

|

58,363 |

|

|

|

48,648 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Research and development |

|

|

2,525 |

|

|

|

2,990 |

|

|

|

8,961 |

|

|

|

8,242 |

|

| Sales and marketing |

|

|

9,677 |

|

|

|

9,216 |

|

|

|

26,465 |

|

|

|

30,828 |

|

| General and administrative |

|

|

6,931 |

|

|

|

5,617 |

|

|

|

18,971 |

|

|

|

17,317 |

|

| Gain on contract termination |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(5,500 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total operating expenses |

|

|

19,133 |

|

|

|

17,823 |

|

|

|

54,397 |

|

|

|

50,887 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating income (loss) |

|

|

1,536 |

|

|

|

882 |

|

|

|

3,966 |

|

|

|

(2,239 |

) |

| Other income |

|

|

81 |

|

|

|

268 |

|

|

|

395 |

|

|

|

244 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Income (loss) before income taxes |

|

|

1,617 |

|

|

|

1,150 |

|

|

|

4,361 |

|

|

|

(1,995 |

) |

| Income tax expense (benefit) |

|

|

147 |

|

|

|

10 |

|

|

|

810 |

|

|

|

(33 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income (loss) |

|

$ |

1,470 |

|

|

$ |

1,140 |

|

|

$ |

3,551 |

|

|

$ |

(1,962 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Earnings (loss) per share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic |

|

$ |

0.03 |

|

|

$ |

0.02 |

|

|

$ |

0.06 |

|

|

$ |

(0.04 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Diluted |

|

$ |

0.03 |

|

|

$ |

0.02 |

|

|

$ |

0.06 |

|

|

$ |

(0.04 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Weighted average shares: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic |

|

|

56,482 |

|

|

|

56,018 |

|

|

|

56,427 |

|

|

|

55,897 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Diluted |

|

|

56,692 |

|

|

|

56,666 |

|

|

|

56,900 |

|

|

|

55,897 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4

Summary of Net Revenues by Market and Product (Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended September 30, |

|

| |

|

Dollars |

|

|

|

|

|

Percentage of

Total Net

Revenues |

|

| Market |

|

2015 |

|

|

2014 |

|

|

%

Change |

|

|

2015 |

|

|

2014 |

|

|

|

|

|

|

|

| Infectious disease testing |

|

$ |

11,297 |

|

|

$ |

11,183 |

|

|

|

1 |

% |

|

|

38 |

% |

|

|

40 |

% |

| Substance abuse testing |

|

|

2,955 |

|

|

|

2,149 |

|

|

|

38 |

|

|

|

10 |

|

|

|

8 |

|

| Cryosurgical systems |

|

|

3,458 |

|

|

|

3,241 |

|

|

|

7 |

|

|

|

11 |

|

|

|

11 |

|

| Molecular collection systems |

|

|

7,329 |

|

|

|

6,867 |

|

|

|

7 |

|

|

|

25 |

|

|

|

25 |

|

| Insurance risk assessment |

|

|

675 |

|

|

|

1,007 |

|

|

|

(33 |

) |

|

|

2 |

|

|

|

4 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net product revenues |

|

|

25,714 |

|

|

|

24,447 |

|

|

|

5 |

|

|

|

86 |

|

|

|

88 |

|

| Other |

|

|

4,147 |

|

|

|

3,398 |

|

|

|

22 |

|

|

|

14 |

|

|

|

12 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net revenues |

|

$ |

29,861 |

|

|

$ |

27,845 |

|

|

|

7 |

% |

|

|

100 |

% |

|

|

100 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Nine Months Ended September 30, |

|

| |

|

Dollars |

|

|

|

|

|

Percentage of

Total Net

Revenues |

|

| Market |

|

2015 |

|

|

2014 |

|

|

%

Change |

|

|

2015 |

|

|

2014 |

|

|

|

|

|

|

|

| Infectious disease testing |

|

$ |

34,585 |

|

|

$ |

34,914 |

|

|

|

(1 |

)% |

|

|

40 |

% |

|

|

45 |

% |

| Substance abuse testing |

|

|

7,584 |

|

|

|

6,187 |

|

|

|

23 |

|

|

|

9 |

|

|

|

8 |

|

| Cryosurgical systems |

|

|

8,956 |

|

|

|

12,128 |

|

|

|

(26 |

) |

|

|

10 |

|

|

|

15 |

|

| Molecular collection systems |

|

|

22,148 |

|

|

|

17,523 |

|

|

|

26 |

|

|

|

25 |

|

|

|

23 |

|

| Insurance risk assessment |

|

|

2,519 |

|

|

|

2,858 |

|

|

|

(12 |

) |

|

|

3 |

|

|

|

4 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net product revenues |

|

|

75,792 |

|

|

|

73,610 |

|

|

|

3 |

|

|

|

87 |

|

|

|

95 |

|

| Other |

|

|

11,545 |

|

|

|

4,173 |

|

|

|

177 |

|

|

|

13 |

|

|

|

5 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net revenues |

|

$ |

87,337 |

|

|

$ |

77,783 |

|

|

|

12 |

% |

|

|

100 |

% |

|

|

100 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended |

|

|

Nine Months Ended |

|

| |

|

September 30, |

|

|

September 30, |

|

| HIV Revenues |

|

2015 |

|

|

2014 |

|

|

%

Change |

|

|

2015 |

|

|

2014 |

|

|

%

Change |

|

|

|

|

|

|

|

|

| Domestic |

|

$ |

5,548 |

|

|

$ |

7,231 |

|

|

|

(23 |

)% |

|

$ |

18,147 |

|

|

$ |

21,568 |

|

|

|

(16 |

)% |

| International |

|

|

450 |

|

|

|

491 |

|

|

|

(8 |

) |

|

|

1,995 |

|

|

|

1,897 |

|

|

|

5 |

|

| Domestic OTC |

|

|

1,642 |

|

|

|

1,368 |

|

|

|

20 |

|

|

|

4,923 |

|

|

|

4,991 |

|

|

|

(1 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net product revenues |

|

$ |

7,640 |

|

|

$ |

9,090 |

|

|

|

(16 |

)% |

|

$ |

25,065 |

|

|

$ |

28,456 |

|

|

|

(12 |

)% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended |

|

|

Nine Months Ended |

|

| |

|

September 30, |

|

|

September 30, |

|

| HCV Revenues |

|

2015 |

|

|

2014 |

|

|

%

Change |

|

|

2015 |

|

|

2014 |

|

|

%

Change |

|

|

|

|

|

|

|

|

| Domestic |

|

$ |

1,914 |

|

|

$ |

1,301 |

|

|

|

47 |

% |

|

$ |

4,803 |

|

|

$ |

3,183 |

|

|

|

51 |

% |

| International |

|

|

957 |

|

|

|

470 |

|

|

|

104 |

|

|

|

2,577 |

|

|

|

2,341 |

|

|

|

10 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net product revenues |

|

|

2,871 |

|

|

|

1,771 |

|

|

|

62 |

|

|

|

7,380 |

|

|

|

5,524 |

|

|

|

34 |

|

| Amortization of exclusivity payments |

|

|

3,397 |

|

|

|

3,398 |

|

|

|

— |

|

|

|

10,081 |

|

|

|

4,173 |

|

|

|

142 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net HCV-related revenues |

|

$ |

6,268 |

|

|

$ |

5,169 |

|

|

|

21 |

% |

|

$ |

17,461 |

|

|

$ |

9,697 |

|

|

|

80 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended |

|

|

Nine Months Ended |

|

| |

|

September 30, |

|

|

September 30, |

|

| Intercept® Revenues |

|

2015 |

|

|

2014 |

|

|

%

Change |

|

|

2015 |

|

|

2014 |

|

|

%

Change |

|

|

|

|

|

|

|

|

| Net Intercept® revenues |

|

$ |

2,251 |

|

|

$ |

1,606 |

|

|

|

40 |

% |

|

$ |

5,764 |

|

|

$ |

4,473 |

|

|

|

29 |

% |

|

|

|

| |

|

Three Months Ended |

|

|

Nine Months Ended |

|

| |

|

September 30, |

|

|

September 30, |

|

| Cryosurgical Systems Revenues |

|

2015 |

|

|

2014 |

|

|

%

Change |

|

|

2015 |

|

|

2014 |

|

|

%

Change |

|

|

|

|

|

|

|

|

| Domestic professional |

|

$ |

1,600 |

|

|

$ |

1,590 |

|

|

|

1 |

% |

|

$ |

3,268 |

|

|

$ |

4,601 |

|

|

|

(29 |

)% |

| International professional |

|

|

258 |

|

|

|

43 |

|

|

|

|

* |

|

|

757 |

|

|

|

581 |

|

|

|

30 |

|

| Domestic over-the-counter |

|

|

137 |

|

|

|

— |

|

|

|

|

* |

|

|

300 |

|

|

|

— |

|

|

|

|

* |

| International over-the-counter |

|

|

1,463 |

|

|

|

1,608 |

|

|

|

(9 |

) |

|

|

4,631 |

|

|

|

6,946 |

|

|

|

(33 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net cryosurgical systems revenues |

|

$ |

3,458 |

|

|

$ |

3,241 |

|

|

|

7 |

% |

|

$ |

8,956 |

|

|

$ |

12,128 |

|

|

|

(26 |

)% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| * |

Calculation is not considered meaningful |

6

Condensed Consolidated Balance Sheets (Unaudited)

|

|

|

|

|

|

|

|

|

| |

|

September 30, 2015 |

|

|

December 31, 2014 |

|

| Assets |

|

|

|

|

|

|

|

|

|

|

|

| Cash |

|

$ |

100,677 |

|

|

$ |

92,867 |

|

| Short-term investments |

|

|

7,512 |

|

|

|

5,000 |

|

| Accounts receivable, net |

|

|

17,089 |

|

|

|

16,138 |

|

| Inventories |

|

|

14,985 |

|

|

|

15,763 |

|

| Other current assets |

|

|

1,559 |

|

|

|

1,446 |

|

| Property and equipment, net |

|

|

17,800 |

|

|

|

17,934 |

|

| Intangible assets, net |

|

|

13,661 |

|

|

|

17,505 |

|

| Goodwill |

|

|

18,974 |

|

|

|

21,734 |

|

| Other non-current assets |

|

|

1,589 |

|

|

|

1,246 |

|

|

|

|

|

|

|

|

|

|

| Total assets |

|

$ |

193,846 |

|

|

$ |

189,633 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Liabilities and Stockholders’ Equity |

|

|

|

|

|

|

|

|

| Accounts payable |

|

$ |

6,964 |

|

|

$ |

7,148 |

|

| Deferred revenue |

|

|

13,302 |

|

|

|

8,043 |

|

| Other current liabilities |

|

|

9,429 |

|

|

|

11,271 |

|

| Other non-current liabilities |

|

|

1,142 |

|

|

|

1,234 |

|

| Deferred income taxes |

|

|

3,010 |

|

|

|

3,236 |

|

| Stockholders’ equity |

|

|

159,999 |

|

|

|

158,701 |

|

|

|

|

|

|

|

|

|

|

| Total liabilities and stockholders’ equity |

|

$ |

193,846 |

|

|

$ |

189,633 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Nine months ended |

|

| |

September 30, |

|

| Additional Financial Data (Unaudited) |

|

2015 |

|

|

2014 |

|

|

|

|

| Capital expenditures |

|

$ |

1,885 |

|

|

$ |

2,353 |

|

| Depreciation and amortization |

|

$ |

4,259 |

|

|

$ |

4,732 |

|

| Stock-based compensation |

|

$ |

4,543 |

|

|

$ |

4,284 |

|

| Cash provided by operating activities |

|

$ |

15,105 |

|

|

$ |

8,384 |

|

Conference Call

The

Company will host a conference call and audio webcast to discuss the Company’s 2015 third quarter financial results, certain business developments and financial guidance for the fourth quarter of 2015, beginning today at 5:00 p.m. Eastern Time

(2:00 p.m. Pacific Time). On the call will be Douglas A. Michels, President and Chief Executive Officer, and Ronald H. Spair, Chief Financial Officer and Chief Operating Officer. The call will include prepared remarks by management and a question

and answer session.

7

In order to listen to the conference call, please either dial 844-831-3030 (Domestic) or 315-625-6887

(International) and reference Conference ID #52009076 or go to OraSure Technologies’ web site, www.orasure.com, and click on the Investor Relations page. Please click on the webcast link and follow the prompts for registration and access

10 minutes prior to the call. A replay of the call will be archived on OraSure Technologies’ web site shortly after the call has ended and will be available for seven days. A replay of the call can also be accessed until November 11, 2015,

by dialing 855-859-2056 (Domestic) or 404-537-3406 (International) and entering the Conference ID #52009076.

About OraSure Technologies

OraSure Technologies is a leader in the development, manufacture and distribution of point-of-care diagnostic and collection devices and other technologies

designed to detect or diagnose critical medical conditions. Its first-to-market, innovative products include rapid tests for the detection of antibodies to HIV and HCV on the OraQuick®

platform, oral fluid sample collection, stabilization and preparation products for molecular diagnostic applications, and oral fluid laboratory tests for detecting various drugs of abuse. OraSure’s portfolio of products is sold globally to

various clinical laboratories, hospitals, clinics, community-based organizations and other public health organizations, research and academic institutions, distributors, government agencies, physicians’ offices, commercial and industrial

entities and consumers. The Company’s products enable healthcare providers to deliver critical information to patients, empowering them to make decisions to improve and protect their health.

Important Information

This press release contains

certain forward-looking statements, including with respect to expected revenues and earnings/loss per share. Forward-looking statements are not guarantees of future performance or results. Known and unknown factors that could cause actual

performance or results to be materially different from those expressed or implied in these statements include, but are not limited to: ability to market and sell products, whether through our internal, direct sales force or third parties; ability to

manufacture products in accordance with applicable specifications, performance standards and quality requirements; ability to obtain, and timing and cost of obtaining, necessary regulatory approvals for new products or new indications or

applications for existing products; ability to comply with applicable regulatory requirements; ability to effectively resolve warning letters, audit observations and other findings or comments from the FDA or other regulators; changes in

relationships, including disputes or disagreements, with strategic partners or other parties and reliance on strategic partners for the performance of critical activities under collaborative arrangements; our ability to achieve financial and

performance objectives under the HCV co-promotion

8

agreement with AbbVie; failure of distributors or other customers to meet purchase forecasts, historic purchase levels or minimum purchase requirements for our products; impact of replacing

distributors; inventory levels at distributors and other customers; ability of DNAG to achieve its financial and strategic objectives and continue to increase its revenues; ability to identify, complete, integrate and realize the full benefits of

future acquisitions; impact of competitors, competing products and technology changes; impact of negative economic conditions, high unemployment and poor credit conditions; reduction or deferral of public funding available to customers; competition

from new or better technology or lower cost products; ability to develop, commercialize and market new products; market acceptance of oral fluid testing or other products; changes in market acceptance of products based on product performance or

other factors, including changes in CDC or other testing guidelines, algorithms or other recommendations; ability to fund research and development and other products and operations; ability to obtain and maintain new or existing product distribution

channels; reliance on sole supply sources for critical products and components; availability of related products produced by third parties or products required for use of our products; history of losses and ability to achieve sustained

profitability; ability to utilize net operating loss carry forwards or other deferred tax assets; volatility of OraSure’s stock price; uncertainty relating to patent protection and potential patent infringement claims; uncertainty and costs of

litigation relating to patents and other intellectual property; availability of licenses to patents or other technology; ability to enter into international manufacturing agreements; obstacles to international marketing and manufacturing of

products; ability to sell products internationally, including the impact of changes in international funding sources and testing algorithms; adverse movements in foreign currency exchange rates; loss or impairment of sources of capital; ability to

attract and retain qualified personnel; exposure to product liability and other types of litigation; changes in international, federal or state laws and regulations; customer consolidations and inventory practices; equipment failures and ability to

obtain needed raw materials and components; the impact of terrorist attacks and civil unrest; and general political, business and economic conditions. These and other factors are discussed more fully in the Company’s Securities and Exchange

Commission filings, including its registration statements, Annual Report on Form 10-K for the year ended December 31, 2014, Quarterly Reports on Form 10-Q, and other filings with the SEC. Although forward-looking statements help to provide

information about future prospects, readers should keep in mind that forward-looking statements may not be reliable. The forward-looking statements are made as of the date of this press release and OraSure Technologies undertakes no duty to update

these statements.

# # #

9

Exhibit 99.2

OraSure Technologies, Inc.

2015 Third Quarter

Analyst/Investor Conference Call

November 4, 2015

Prepared Remarks of Douglas A. Michels and Ronald H. Spair

Please see “Important Information” at the conclusion of the following prepared remarks.

Introduction – Doug Michels

Thanks

Rena. Good afternoon everyone and welcome to our call.

The third quarter continued our strong performance in 2015.

| |

• |

|

Consolidated net revenues were $29.9 million and came in at the high end of our guidance for the quarter. |

| |

• |

|

The drivers for this performance were our molecular collections systems business and continued momentum for our rapid HCV test. |

| |

• |

|

Molecular collection systems revenues increased 7% over the prior year period. |

| |

• |

|

Q3 sales of our OraQuick® rapid HCV test increased 62% over the third quarter of 2014 and 23% sequentially from Q2 of this year. Together with the exclusivity

payments recognized under our HCV co-promotion agreement with AbbVie, total HCV-related revenues were $6.3 million for the third quarter. |

| |

• |

|

Revenue growth, combined with favorable margins, generated a $1.5 million net profit for the third quarter. This is the third consecutive quarter of profitable performance for the Company. |

Later in the call I will provide additional highlights regarding our business. But before I do that, Ron will provide more detail on our Q3 performance and

our expectations for the fourth quarter.

So with that, I will turn the call over to Ron.

Third Quarter 2015 Financial Results – Ron Spair

Thanks Doug, and good afternoon everyone.

Revenues

– Ron Spair

Our third quarter 2015 consolidated net revenues increased 7% to $29.9 million, compared to $27.8 million reported in 2014.

Our consolidated net product revenues of $25.7 million increased 5%, largely as a result of higher sales of our OraQuick® HCV,

Intercept®, and molecular collection systems products, partially offset by lower sales of our OraQuick® HIV product.

Other revenues were $4.1 million in the current quarter, of which $3.4 million represents the recognition of exclusivity payments under the AbbVie agreement

and $750,000 represents revenue associated with Ebola-related funding we received from The Biomedical Advanced Research and Development Authority, or BARDA. Other revenues in the third quarter of 2014 included $3.4 million of AbbVie exclusivity

payments.

Total HCV-related revenues, including the AbbVie exclusivity payments, increased 21% to $6.3 million in the third quarter of 2015 compared to

$5.2 million in the third quarter of 2014. HCV product revenues increased 62% to $2.9 million in Q3 from $1.8 million in the prior year. Sales of our OraQuick® HCV professional product in the

domestic market increased 47% in the third quarter of 2015 to $1.9 million from $1.3 million in the prior year. This increase is largely due to the addition of new HCV customers and higher sales to current customers who have expanded their HCV

testing programs. International sales of our HCV test in the third quarter of 2015 increased 104% to $957,000 from $470,000 in the same period last year, primarily due to the timing of purchases by a multi-national humanitarian organization. Also

contributing to the higher international sales was the expansion of our HCV business in Asia.

Domestic sales of our professional HIV product decreased

23% to $5.5 million in the third quarter of 2015, compared to $7.2 million in the third quarter of 2014. This

2

decrease was the result of customers continuing to move some of their testing to 4th generation automated HIV immunoassays or to competitive

point-of-care HIV tests that are perceived to be more sensitive. We expect continued pressure on our professional HIV business for the foreseeable future.

Sales of our OraQuick® In-Home test increased 20% to $1.6 million in the current period from $1.4

million the third quarter of 2014 largely due to the timing of orders placed by our retail trade customers.

Our molecular collection systems revenues,

primarily representing sales of the Oragene® product line in the genomics market, increased 7% to $7.3 million in the third quarter of 2015 compared to $6.9 million in the third quarter of

2014. Commercial sales increased 20% primarily as a result of higher sales to existing U.S. based customers. Sales to academic customers decreased 11%, largely due the fulfillment of an order in 2014 for a large academic research project that did

not repeat in 2015.

Substance abuse testing revenues rose 38% to $3.0 million in the third quarter of 2015 compared to $2.1 million in 2014. This

increase is largely due to higher sales of our Intercept® device as a result of the recovery of customers previously lost to competition, improved domestic employment conditions and an

increase in oral fluid testing due to certain customers recognizing the advantage of its ability to detect recent drug use.

Third quarter 2015

cryosurgical revenues increased 7% to $3.5 million from $3.2 million in the third quarter of 2014. Domestic sales of our professional product remained largely unchanged at $1.6 million. International sales of our professional product increased to

$258,000 in the third quarter of 2015 compared to $43,000 due to the reintroduction of our product into the Asian marketplace. Sales of our OTC products in the international markets decreased 9% to $1.5 million in the third quarter of 2015 compared

to $1.6 million in the third quarter of 2014 primarily due to distributor ordering patterns.

3

Gross Margin – Ron Spair

Gross margin for the third quarter of 2015 was 69% compared to 67% reported for the third quarter of 2014. Margin for the current quarter benefited from a

reduction in royalty expense and the increase in other revenues, partially offset by the impact of a less favorable product mix.

Operating

Expenses – Ron Spair

Our consolidated operating expenses for the third quarter of 2015 were $19.1 million compared to $17.8 million in

the comparable period of 2014. During the current quarter, higher detailing costs associated with our HCV co-promotion agreement with AbbVie and increased legal expenses were partially offset by lower research and development spending and a

favorable change in the exchange rate between the Canadian and U.S. dollar.

Net Income – Ron Spair

From a bottom line perspective, we reported net income of $1.5 million, or $0.03 per share on a fully diluted basis, for the third quarter of 2015, compared to

$1.1 million, or $0.02 per share, for the same period of 2014.

Cash Flow from Operations and Liquidity – Ron Spair

Turning briefly to our balance sheet and cash flow, we continue to maintain a solid cash and liquidity position. Our cash and short-term investment balance at

September 30, 2015 was $108.2 million compared to $97.9 million at December 31, 2014. Cash generated by operating activities in the third quarter of 2015 was $18.5 million compared to $18.8 million generated in the third quarter of 2014.

Fourth Quarter 2015 Consolidated Financial Guidance – Ron Spair

Turning to guidance for the fourth quarter of 2015, we are projecting consolidated net revenues of approximately $29.5 to $30.0 million. We are also projecting

consolidated net income of approximately $0.03 to $0.04 per share. Our current expectations for Q4 exclude a $1.1M order for OraQuick® HIV and HCV devices that has been received from

4

a public health jurisdiction that normally orders at the end of their fiscal year. Given certain constraints surrounding the warehousing of inventory by this customer, we were not comfortable in

assuming that they will take delivery of the product before year-end, which would be required to recognize the revenue.

As we look further ahead to Q1 of

2016, it is important to remember that the first quarter of the calendar year is historically our softest quarter for revenues. We expect this pattern to continue in 2016.

An additional item to note is that our existing universal shelf registration statement that became effective in 2012 is set to expire during the fourth

quarter of 2015. We intend to file a new universal shelf consistent with our previously communicated practice of always having a shelf registration statement in effect.

And with that, I will now turn the call back over to Doug.

Business Update – Doug Michels

Thanks, Ron.

Molecular Collection Systems – Doug

Michels

As noted earlier in the call, DNA Genotek had another strong quarter. The $7.3 million in current quarter revenues represents the

second highest quarterly revenue total in DNA Genotek’s history. Through the end of September 2015, DNA Genotek generated more than $22 million of revenue, which represents growth of over 25% compared to the first nine months of 2014.

The revenue split for Q3 was largely consistent with prior quarters, with commercial customers representing 60% of the total and academic customers

contributing the remaining 40%. Commercial revenues were up 20% year-over-year in Q3.

5

The largest contributor to the growth of our commercial revenues was 23andMe, which delivered $1.7 million of

revenue for the quarter. This represents more than 200% growth over Q3 2014 when 23andMe was dealing with certain regulatory issues.

You will note that

third quarter revenues were down sequentially from Q2, as expected, primarily as a result of the ordering pattern of a large breast cancer genetic testing company. This customer made its initial purchase in Q2 to deploy our Oragene® DNA sample collection product into its large network of collection centers. This initial purchase contributed to DNA Genotek’s record revenue performance in Q2. Although this customer

purchased additional product in Q3, the amount purchased was naturally down from the initial stocking order in Q2. Overall, Q3 performance across a number of commercial customers was strong and we are very pleased with the advances we have made in

this market.

On our last call, we discussed DNA Genotek’s new product initiatives in microbiome and tuberculosis. I am pleased to report that these

initiatives are progressing as expected. We continue to acquire new customers in the microbiome space. We are also continuing to execute the trials and validation studies — through partners and prospective customers — to demonstrate the

capabilities and value of our tuberculosis products.

Infectious Disease Testing – Doug Michels

Turning to infectious disease testing — revenues from this part of the business were up 1% compared to the third quarter of 2014. Lower sales resulting

from the continued challenges impacting our professional HIV business were largely offset by continued growth in revenues from our OraQuick® HCV test. We expect both of these trends to

continue for the foreseeable future.

With respect to HCV, this part of our business continues to show promising growth. As previously mentioned, total

HCV revenues were up 62% during the third quarter compared to 2014 and were up 23% sequentially from the second quarter of this year. These results were driven by strong growth in both the domestic and international markets. We expect continued

growth and also anticipate sequential growth in the fourth quarter.

6

As noted during our last several calls, a major focus continues to be our co-promotion agreement with AbbVie. Our

efforts in the physician office market have included refreshed training for both the AbbVie and OraSure field sales teams, improved messaging for customers and increased detailing by AbbVie. In the retail market, the pilot program mentioned on prior

calls has continued in order to help assess the effectiveness of using our test to identify positive patients and link them to care. We will continue to look for ways to maximize the benefit of this collaboration on our HCV business.

Rapid Ebola Test – Doug Michels

A

final area I will address is our ongoing efforts to commercialize the OraQuick® Rapid Ebola Antigen test.

In the quarter, we announced significant progress toward the commercialization of this product. In September, BARDA exercised an option to provide an

additional $7.2 million in funding, primarily for clinical and regulatory activities required to obtain U.S. FDA 510(k) clearance. This option is part of the $10.4 million aggregate funding contract between OraSure and BARDA that was announced in

June 2015. The Company also announced that the CDC will purchase approximately $1.5 million of the Company’s OraQuick® Ebola Test. The CDC purchase is expected to be fulfilled by the end

of 2015, with approximately $500K in revenue recognized in Q3 and the remainder expected in Q4. The CDC is purchasing the OraQuick® Ebola Test for field testing in West Africa. This is the

second such purchase of this product for field testing made by the CDC.

We will continue to focus on the completion of regulatory activities and on

securing sustainable purchase commitments for this product.

7

Conclusion

So in conclusion, our financial performance for the third quarter was strong, with solid revenues and another quarter of profitability. Our molecular

collection systems and HCV businesses continue to be the growth drivers for the Company and we expect that to continue for the foreseeable future. We are also making good progress on the commercialization of our OraQuick® Ebola test. We look forward to wrapping up a record 2015 with a solid fourth quarter and we look forward to continued growth in 2016.

With that, I will now open the floor to your questions. Operator, please proceed.

* * * *

[Q&A session]

Final Conclusion

– Doug Michels

Thank you for participating on today’s call and for your continued interest in OraSure. Have a good afternoon and

evening.

Important Information

This document

contains certain forward-looking statements, including with respect to expected revenues and earnings/loss per share. Forward-looking statements are not guarantees of future performance or results. Known and unknown factors that could cause actual

performance or results to be materially different from those expressed or implied in these statements include, but are not limited to ability to market and sell products, whether through our internal, direct sales force or third parties; ability to

manufacture products in accordance with applicable specifications, performance standards and quality requirements; ability to obtain, and timing and cost of obtaining, necessary regulatory approvals for new products or new indications or

applications for existing products; ability to comply with applicable regulatory requirements; ability to effectively resolve warning letters, audit observations and other findings or comments from the FDA or other regulators; changes in

relationships, including disputes or disagreements, with strategic

8

partners or other parties and reliance on strategic partners for the performance of critical activities under collaborative arrangements; our ability to achieve financial and performance

objectives under the HCV co-promotion agreement with AbbVie; failure of distributors or other customers to meet purchase forecasts, historic purchase levels or minimum purchase requirements for our products; impact of replacing distributors;

inventory levels at distributors and other customers; ability of DNA Genotek to achieve its financial and strategic objectives and continue to increase its revenues; ability to identify, complete, integrate and realize the full benefits of future

acquisitions; impact of competitors, competing products and technology changes; impact of negative economic conditions, high unemployment and poor credit conditions; reduction or deferral of public funding available to customers; competition from

new or better technology or lower cost products; ability to develop, commercialize and market new products; market acceptance of oral fluid testing or other products; changes in market acceptance of products based on product performance or other

factors, including changes in CDC or other testing guidelines, algorithms or other recommendations; ability to fund research and development and other products and operations; ability to obtain and maintain new or existing product distribution

channels; reliance on sole supply sources for critical products and components; availability of related products produced by third parties or products required for use of our products; history of losses and ability to achieve sustained

profitability; ability to utilize net operating loss carry forwards or other deferred tax assets; volatility of OraSure’s stock price; uncertainty relating to patent protection and potential patent infringement claims; uncertainty and costs of

litigation relating to patents and other intellectual property; availability of licenses to patents or other technology; ability to enter into international manufacturing agreements; obstacles to international marketing and manufacturing of

products; ability to sell products internationally, including the impact of changes in international funding sources and testing algorithms; adverse movements in foreign currency exchange rates; loss or impairment of sources of capital; ability to

attract and retain qualified personnel; exposure to product liability and other types of litigation; changes in international, federal or state laws and regulations; customer consolidations and inventory practices; equipment failures and ability to

obtain needed raw materials and components; the impact of terrorist attacks and civil unrest; and general political, business and economic conditions. These and other factors are discussed

9

more fully in the Company’s Securities and Exchange Commission filings, including its registration statements, Annual Report on Form 10-K for the year ended December 31, 2014, Quarterly

Reports on Form 10-Q, and other filings with the SEC. Although forward-looking statements help to provide information about future prospects, readers should keep in mind that forward-looking statements may not be reliable. The forward-looking

statements are made as of the date of this call, and we undertake no duty to update these statements.

10

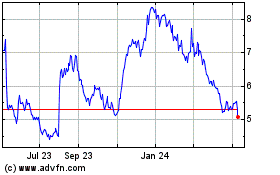

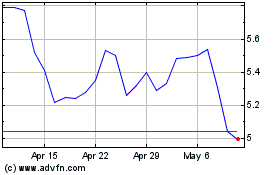

OraSure Technologies (NASDAQ:OSUR)

Historical Stock Chart

From Mar 2024 to Apr 2024

OraSure Technologies (NASDAQ:OSUR)

Historical Stock Chart

From Apr 2023 to Apr 2024