UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): November 4, 2015

AMERICAN EQUITY

INVESTMENT LIFE HOLDING COMPANY

(Exact Name of Registrant as Specified in its Charter)

|

| | |

Iowa | 001-31911 | 42-1447959 |

(State or Other Jurisdiction of Incorporation) | (Commission File Number) | (IRS Employer Indentification No.) |

|

| |

6000 Westown Parkway, West Des Moines, Iowa | 50266 |

(Address of Principal Executive Offices) | (Zip Code) |

(515) 221-0002

(Registrant's telephone number, including area code)

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 2.02 Results of Operations and Financial Condition

On November 4, 2015, the registrant issued a press release announcing its financial results for the quarter ended September 30, 2015, a copy of which is attached as Exhibit 99.1 and is incorporated herein by reference. The registrant's financial supplement for the quarter ended September 30, 2015, is attached as Exhibit 99.2 and is incorporated herein by reference.

The information, including exhibits attached hereto, furnished under this Item 2.02 shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that Section. The information in this Current Report shall not be incorporated by reference into any registration statement or other document pursuant to the Securities Act of 1933, as amended, except as otherwise expressly stated in such filing.

Item 9.01. Financial Statements and Exhibits

The following exhibits are being furnished with this Form 8-K.

|

| | |

Exhibit Number | | Description |

99.1 | | Press release dated November 4, 2015, announcing American Equity Investment Life Holding Company's financial results for the quarter ended September 30, 2015. |

99.2 | | American Equity Investment Life Holding Company's Financial Supplement for the quarter ended September 30, 2015. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Date: November 4, 2015

|

| | | |

| AMERICAN EQUITY | |

| INVESTMENT LIFE HOLDING COMPANY | |

| | | |

| | | |

| By: | /s/ John M. Matovina | |

| | John M. Matovina | |

| | Chief Executive Officer and President | |

| | | |

EXHIBIT INDEX

|

| | |

Exhibit Number | | Description |

99.1 | | Press release dated November 4, 2015, announcing American Equity Investment Life Holding Company's financial results for the quarter ended September 30, 2015. |

99.2 | | American Equity Investment Life Holding Company's Financial Supplement for the quarter ended September 30, 2015. |

Exhibit 99.1

|

| | |

| | For more information, contact: |

| |

| John M. Matovina, Chief Executive Officer |

| (515) 457-1813, jmatovina@american-equity.com |

| |

| Ted M. Johnson, Chief Financial Officer |

| (515) 457-1980, tjohnson@american-equity.com |

| | |

FOR IMMEDIATE RELEASE | | Debra J. Richardson, Chief Administrative Officer |

November 4, 2015 | | (515) 273-3551, drichardson@american-equity.com |

| | |

| | Julie L. LaFollette, Director of Investor Relations |

| | (515) 273-3602, jlafollette@american-equity.com |

American Equity Reports Third Quarter 2015 Results

WEST DES MOINES, Iowa (November 4, 2015) - American Equity Investment Life Holding Company (NYSE: AEL), a leading issuer of fixed index annuities, today reported third quarter 2015 net income of $97.3 million, or $1.19 per diluted common share, compared to a third quarter 2014 net income of $67.8 million, or $0.85 per diluted common share.

Non-GAAP operating income1 for the third quarter of 2015 decreased 28% to $45.9 million, or $0.56 per diluted common share, compared to third quarter 2014 non-GAAP operating income1 of $64.0 million, or $0.81 per diluted common share.

Highlights for the third quarter of 2015 include:

| |

▪ | Annuity sales (before coinsurance) were up 70% to $1.83 billion compared to third quarter 2014 annuity sales of $1.07 billion. |

| |

▪ | Investment spread was 2.83% compared to 2.84% for the second quarter of 2015 and 2.82% for the third quarter of 2014. |

| |

▪ | Estimated risk-based capital (RBC) ratio of 354% at September 30, 2015 compared to 372% at December 31, 2014 remained above A. M. Best’s rating threshold. |

| |

▪ | Book value per share (excluding accumulated other comprehensive income) was $21.17 at September 30, 2015 compared to $18.52 at December 31, 2014. |

| |

1 | In addition to net income, the Company has consistently utilized operating income and operating income per common share - assuming dilution, non-GAAP financial measures commonly used in the life insurance industry, as economic measures to evaluate its financial performance. See accompanying tables for reconciliations of net income to operating income and descriptions of reconciling items. See Company’s Quarterly Report on Form 10-Q for a more complete discussion of the reconciling items and their impact on net income for the periods presented. Because these items fluctuate from period to period in a manner unrelated to core operations, the Company believes measures excluding their impact are useful in analyzing operating trends. The Company believes the combined presentation and evaluation of operating income together with net income, provides information that may enhance an investor’s understanding of its underlying results and profitability. |

Third quarter 2015 net income and non-GAAP operating income1 were decreased by $1.1 million ($0.01 per diluted common share) and $8.7 million ($0.10 per diluted common share), respectively, for revisions to assumptions utilized in the determination of deferred policy acquisition costs, deferred sales inducements and the liability for future benefits to be paid under lifetime income benefit riders. Net income and non-GAAP operating income1 for the third quarter of 2014 were impacted by similar assumption revisions which increased net income by $23.0 million ($0.29 per diluted common share) and non-GAAP operating income1 by $20.2 million ($0.26 per diluted common share).

Excluding the effects of these assumption revisions, third quarter 2015 non-GAAP operating income1 per share of $0.66 increased by 20% compared to third quarter 2014 non-GAAP operating income1 per share of $0.55.

SUSTAINED SALES MOMENTUM ASSURES A RECORD YEAR

Third quarter sales of $1.8 billion, a record for any single quarter, were up 70% from the prior year third quarter and were 2% higher than second quarter 2015 sales . Commenting on sales, John Matovina, Chief Executive Officer and President, said: "We sustained our sales momentum from the second quarter bringing our year-to-date sales to $4.9 billion--just $200 million shy of the $5.1 billion full year sales record we set in 2011. With October sales comfortably exceeding $200 million, we know 2015 will be our best year ever, but have no intention of slowing down or resting on our accomplishments. Our product and service mix has never been more competitive, and we expect strong sales in the fourth quarter. Those sales may get an additional boost from impending changes to our lifetime income benefit rider. Due to mandatory changes to mortality rates used to establish regulatory reserves which become effective industry wide in 2016, benefits in the rider will be lower for policies written after 2015--an obvious incentive for agents to complete applications this year."

Turning to the outlook for sales, Matovina added: "Despite some new competition that surfaced in the third quarter, our attractive product offerings and unmatched service levels continued to produce robust sales broadly across our network of distribution partners. Looking to 2016, we intend to continue to offer competitively priced products that meet our return objectives and are confident that our consistent presence and best in class service to agents and policyholders will continue to favorably differentiate us in the fixed index annuity market."

SPREAD FLAT ON HIGHER BOND FEE AND PREPAYMENT INCOME

American Equity’s investment spread was essentially flat at 2.83% for the third quarter of 2015 compared to 2.84% for the second quarter of 2015 as a result of a one basis point increase in average yield on invested assets and a 2 basis point increase in the cost of money.

Average yield on invested assets continued to be favorably impacted by non-trendable items and unfavorably impacted by the investment of new premiums and portfolio cash flows at rates below the portfolio rate. Fee income from bond transactions and prepayment income added 0.14% to the third quarter 2015 average yield on invested assets compared to 0.07% from such items in the second quarter of 2015. Adjusting for the effect of non-trendable items, the average yield on invested assets for the quarter fell by 5 basis points from the prior quarter. The average yield on fixed income securities purchased and commercial

mortgage loans funded in the third quarter of 2015 was 3.89% compared to 3.73% and 3.84% in the second and first quarters of 2015 and average yields ranging from 4.14% - 4.39% in the prior year quarters.

The aggregate cost of money for annuity liabilities increased by 2 basis points to 1.96% in the third quarter of 2015 compared to 1.94% in the second quarter of 2015. This increase reflected continued reductions in crediting rates but the effect from the rate reductions was more than offset by a 5 basis point decrease in the benefit from over hedging the obligations for index linked interest from 0.07% in the second quarter of 2015 to 0.02% in the third quarter of 2015.

Commenting on investment spread, John Matovina, said: “The spread story in the third quarter was more of the same with our management team working diligently to mitigate the ongoing impact of a low interest rate environment. Yields on new investments were up 0.16% from the second quarter and were higher than the first quarter as well. We captured these higher yields while keeping the investment portfolio safely within our applicable risk standards. Nonetheless, the markets are still offering yields below our portfolio rate and we held more cash and short-term investments than usual this quarter, both of which put downward pressure on our investment income and average yield on invested assets. We have generated additional investment spread through bond fees, prepayment income and over hedging, but these sources are opportunistic and we do not consider them core to our investment spread strategy."

Matovina continued, "We continue to achieve a reported spread of approximately 2.80% - 2.85% with our adjusted spread at approximately 2.70% - 2.75%. We are counteracting the impact of lower investment yields by reducing the rates on our policy liabilities but the impact on the cost of money from these reductions is less than the impact on the average yield on invested assets from investment purchases by a few basis points. We continue to have flexibility to reduce our crediting rates, if necessary, and could decrease our cost of money by approximately 0.56% through further reductions in renewal rates to guaranteed minimums should the investment yields currently available to us persist. Most importantly, we intend to maintain our risk discipline in managing our investment portfolio and not chase higher yields in assets and asset classes that do not fit our risk profile.”

EQUITY OFFERING PROVIDES CAPITAL TO SUSTAIN GROWTH

The Company's August 2015 equity offering provides capital to support 2015's substantial increase in sales and the prospect that elevated sales might extend beyond this year. The Company received $104.5 million in initial net proceeds from the issuance of 4.3 million shares of its common stock. These proceeds were contributed to the Company's primary life insurance subsidiary. If needed, the Company could exercise its rights under two forward sales agreements and receive $136 million in net proceeds from the issuance of an additional 5.6 million shares of its common stock. These forward sales agreements, which have a term of 12 months ending in August 2016, allow the Company to manage its capital by matching the timing of the issuance of additional equity with any need for such capital that might be created by high levels of sales.

CAUTION REGARDING FORWARD-LOOKING STATEMENTS

This press release contains forward-looking statements within the meaning of The Private Securities Litigation Reform Act of 1995. Forward-looking statements relate to future operations, strategies, financial results or other developments, and are subject to assumptions, risks and uncertainties. Statements such as “guidance”, “expect”, “anticipate”, “believe”, “goal”, “objective”, “target”, “may”, “should”, “estimate”, “projects” or similar words as well as specific projections of future results qualify as forward-looking statements. Factors that may cause our actual results to differ materially from those contemplated by these forward looking statements can be found in the company’s Form 10-K filed with the Securities and Exchange Commission. Forward-looking statements speak only as of the date the statement was made and the company undertakes no obligation to update such forward-looking statements. There can be no assurance that other factors not currently anticipated by the company will not materially and adversely affect our results of operations. Investors are cautioned not to place undue reliance on any forward-looking statements made by us or on our behalf.

CONFERENCE CALL

American Equity will hold a conference call to discuss third quarter 2015 earnings on Thursday, November 5, 2015, at 9:00 a.m. CST. The conference call will be webcast live on the Internet. Investors and interested parties who wish to listen to the call on the Internet may do so at www.american-equity.com.

The call may also be accessed by telephone at 855-865-0606, passcode 56483898 (international callers, please dial 704-859-4382). An audio replay will be available shortly after the call on AEL’s website. An audio replay will also be available via telephone through November 12, 2015 at 855-859-2056, passcode 56483898 (international callers will need to dial 407-537-3406).

ABOUT AMERICAN EQUITY

American Equity Investment Life Holding Company, through its wholly-owned operating subsidiaries, issues fixed annuity and life insurance products, with a primary emphasis on the sale of fixed index and fixed rate annuities. American Equity Investment Life Holding Company, a New York Stock Exchange Listed company (NYSE: AEL), is headquartered in West Des Moines, Iowa. For more information, please visit www.american-equity.com.

###

American Equity Investment Life Holding Company

Consolidated Statements of Operations (Unaudited)

|

| | | | | | | | | | | | | | | |

| Three Months Ended

September 30, | | Nine Months Ended

September 30, |

| 2015 | | 2014 | | 2015 | | 2014 |

| (Dollars in thousands, except per share data) |

Revenues: | | | | | | | |

Premiums and other considerations | $ | 8,335 |

| | $ | 6,043 |

| | $ | 25,369 |

| | $ | 22,497 |

|

Annuity product charges | 37,975 |

| | 31,958 |

| | 99,066 |

| | 86,477 |

|

Net investment income | 436,085 |

| | 386,931 |

| | 1,253,930 |

| | 1,127,818 |

|

Change in fair value of derivatives | (351,360 | ) | | 39,218 |

| | (405,484 | ) | | 358,594 |

|

Net realized gains (losses) on investments, excluding other than temporary impairment ("OTTI") losses | 1,159 |

| | (3,190 | ) | | 10,362 |

| | (6,134 | ) |

OTTI losses on investments: | | | | | | | |

Total OTTI losses | (10,000 | ) | | — |

| | (10,132 | ) | | — |

|

Portion of OTTI losses recognized from other comprehensive income | 4,771 |

| | (564 | ) | | 3,943 |

| | (2,063 | ) |

Net OTTI losses recognized in operations | (5,229 | ) | | (564 | ) | | (6,189 | ) | | (2,063 | ) |

Loss on extinguishment of debt | — |

| | — |

| | — |

| | (10,551 | ) |

Total revenues | 126,965 |

| | 460,396 |

| | 977,054 |

| | 1,576,638 |

|

| | | | | | | |

Benefits and expenses: | | | | | | | |

Insurance policy benefits and change in future policy benefits | 10,959 |

| | 9,109 |

| | 32,629 |

| | 30,191 |

|

Interest sensitive and index product benefits | 213,465 |

| | 429,415 |

| | 802,431 |

| | 1,114,381 |

|

Amortization of deferred sales inducements | 65,807 |

| | 40,661 |

| | 152,278 |

| | 96,676 |

|

Change in fair value of embedded derivatives | (414,724 | ) | | (195,206 | ) | | (583,112 | ) | | (21,652 | ) |

Interest expense on notes payable | 7,283 |

| | 8,741 |

| | 21,976 |

| | 28,126 |

|

Interest expense on subordinated debentures | 3,075 |

| | 3,044 |

| | 9,138 |

| | 9,076 |

|

Amortization of deferred policy acquisition costs | 67,885 |

| | 39,671 |

| | 186,871 |

| | 113,949 |

|

Other operating costs and expenses | 24,497 |

| | 20,616 |

| | 70,487 |

| | 60,588 |

|

Total benefits and expenses | (21,753 | ) | | 356,051 |

| | 692,698 |

| | 1,431,335 |

|

Income before income taxes | 148,718 |

| | 104,345 |

| | 284,356 |

| | 145,303 |

|

Income tax expense | 51,412 |

| | 36,530 |

| | 98,302 |

| | 50,497 |

|

Net income | $ | 97,306 |

| | $ | 67,815 |

| | $ | 186,054 |

| | $ | 94,806 |

|

| | | | | | | |

Earnings per common share | $ | 1.22 |

| | $ | 0.90 |

| | $ | 2.39 |

| | $ | 1.28 |

|

Earnings per common share - assuming dilution | $ | 1.19 |

| | $ | 0.85 |

| | $ | 2.33 |

| | $ | 1.19 |

|

| | | | | | | |

Weighted average common shares outstanding (in thousands): | | | | | | | |

Earnings per common share | 79,676 |

| | 75,083 |

| | 77,995 |

| | 74,030 |

|

Earnings per common share - assuming dilution | 81,559 |

| | 79,467 |

| | 79,977 |

| | 79,477 |

|

American Equity Investment Life Holding Company

NON-GAAP FINANCIAL MEASURES

In addition to net income, the Company has consistently utilized operating income and operating income per common share - assuming dilution, non-GAAP financial measures commonly used in the life insurance industry, as economic measures to evaluate its financial performance. Operating income equals net income adjusted to eliminate the impact of net realized gains and losses on investments including net OTTI losses recognized in operations, fair value changes in derivatives and embedded derivatives, loss on extinguishment of debt and changes in litigation reserves. Because these items fluctuate from quarter to quarter in a manner unrelated to core operations, the Company believes measures excluding their impact are useful in analyzing operating trends. The Company believes the combined presentation and evaluation of operating income together with net income provides information that may enhance an investor’s understanding of our underlying results and profitability.

Reconciliation from Net Income to Operating Income (Unaudited)

|

| | | | | | | | | | | | | | | |

| Three Months Ended

September 30, | | Nine Months Ended

September 30, |

| 2015 | | 2014 | | 2015 | | 2014 |

| (Dollars in thousands, except per share data) |

Net income | $ | 97,306 |

| | $ | 67,815 |

| | $ | 186,054 |

| | $ | 94,806 |

|

Adjustments to arrive at operating income: (a) | | | | | | | |

Net realized investment (gains) losses, including OTTI | 1,639 |

| | 1,551 |

| | (1,829 | ) | | 3,476 |

|

Change in fair value of derivatives and embedded derivatives - index annuities | (54,535 | ) | | (4,957 | ) | | (40,152 | ) | | 34,636 |

|

Change in fair value of derivatives and embedded derivatives - debt | 1,506 |

| | (427 | ) | | 1,606 |

| | 29 |

|

Litigation reserve | — |

| | — |

| | — |

| | (916 | ) |

Extinguishment of debt | — |

| | — |

| | — |

| | 7,912 |

|

Operating income (a non-GAAP financial measure) | $ | 45,916 |

| | $ | 63,982 |

| | $ | 145,679 |

| | $ | 139,943 |

|

| | | | | | | |

Per common share - assuming dilution: | | | | | | | |

Net income | $ | 1.19 |

| | $ | 0.85 |

| | $ | 2.33 |

| | $ | 1.19 |

|

Adjustments to arrive at operating income: | | | | | | | |

Net realized investment (gains) losses, including OTTI | 0.02 |

| | 0.02 |

| | (0.03 | ) | | 0.04 |

|

Change in fair value of derivatives and embedded derivatives - index annuities | (0.67 | ) | | (0.06 | ) | | (0.50 | ) | | 0.44 |

|

Change in fair value of derivatives and embedded derivatives - debt | 0.02 |

| | — |

| | 0.02 |

| | — |

|

Litigation reserve | — |

| | — |

| | — |

| | (0.01 | ) |

Extinguishment of debt | — |

| | — |

| | — |

| | 0.10 |

|

Operating income (a non-GAAP financial measure) | $ | 0.56 |

| | $ | 0.81 |

| | $ | 1.82 |

| | $ | 1.76 |

|

| |

(a) | Adjustments to net income to arrive at operating income are presented net of income taxes and where applicable, are net of related adjustments to amortization of deferred sales inducements (DSI) and deferred policy acquisition costs (DAC). |

American Equity Investment Life Holding Company

NON-GAAP FINANCIAL MEASURES

Average Stockholders' Equity and Return on Average Equity (Unaudited)

Return on equity measures how efficiently we generate profits from the resources provided by our net assets. Return on equity is calculated by dividing net income and operating income for the trailing twelve months by average equity excluding average accumulated other comprehensive income ("AOCI").

|

| | | |

| Twelve Months Ended |

| September 30, 2015 |

| (Dollars in thousands) |

Average Stockholders' Equity 1 | |

Average equity including average AOCI | $ | 2,024,565 |

|

Average AOCI | (486,243 | ) |

Average equity excluding average AOCI | $ | 1,538,322 |

|

| |

Net income | $ | 217,271 |

|

Operating income | 196,382 |

|

| |

Return on Average Equity Excluding Average AOCI | |

Net income | 14.12 | % |

Operating income | 12.77 | % |

1 - The net proceeds received from our public offering of common stock in August 2015 are included in the computations of average stockholders' equity on a weighted average basis based upon the number of days they were available to us in the twelve month period. The weighted average amount is added to the simple average of (a) stockholders' equity at the beginning of the twelve month period and (b) stockholders' equity at the end of the twelve month period excluding the net proceeds received from the public stock offering in August 2015.

Exhibit 99.2

AMERICAN EQUITY INVESTMENT LIFE HOLDING COMPANY

Financial Supplement

September 30, 2015

|

| | |

A. | Financial Highlights | |

| | |

| | |

| | |

| Non-GAAP Financial Measures | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

B. | Product Summary | |

| | |

| | |

| | |

| | |

| | |

| | |

C. | Investment Summary | |

| | |

| | |

| | |

| | |

| | |

| | |

D. | | |

| | |

E. | | |

AMERICAN EQUITY INVESTMENT LIFE HOLDING COMPANY

Financial Supplement - September 30, 2015

AMERICAN EQUITY INVESTMENT LIFE HOLDING COMPANY

CONDENSED CONSOLIDATED BALANCE SHEETS

(Dollars in thousands)

(Unaudited)

|

| | | | | | | |

| September 30, 2015 | | December 31, 2014 |

Assets | | | |

Investments: | | | |

Fixed maturity securities: | | | |

Available for sale, at fair value | $ | 35,389,842 |

| | $ | 32,445,202 |

|

Held for investment, at amortized cost | 76,574 |

| | 76,432 |

|

Equity securities, available for sale, at fair value | 7,833 |

| | 7,805 |

|

Mortgage loans on real estate | 2,452,402 |

| | 2,434,580 |

|

Derivative instruments | 180,649 |

| | 731,113 |

|

Other investments | 284,994 |

| | 286,726 |

|

Total investments | 38,392,294 |

| | 35,981,858 |

|

| | | |

Cash and cash equivalents | 523,614 |

| | 701,514 |

|

Coinsurance deposits | 3,062,924 |

| | 3,044,342 |

|

Accrued investment income | 375,522 |

| | 326,559 |

|

Deferred policy acquisition costs | 2,591,327 |

| | 2,058,556 |

|

Deferred sales inducements | 1,981,209 |

| | 1,587,257 |

|

Deferred income taxes | 129,948 |

| | — |

|

Income taxes recoverable | 4,693 |

| | 9,252 |

|

Other assets | 66,890 |

| | 280,396 |

|

Total assets | $ | 47,128,421 |

| | $ | 43,989,734 |

|

| | | |

Liabilities and Stockholders' Equity | | | |

Liabilities: | | | |

Policy benefit reserves | $ | 43,582,521 |

| | $ | 39,802,861 |

|

Other policy funds and contract claims | 335,185 |

| | 365,819 |

|

Notes payable | 400,000 |

| | 421,679 |

|

Subordinated debentures | 246,397 |

| | 246,243 |

|

Deferred income taxes | — |

| | 3,895 |

|

Other liabilities | 414,409 |

| | 1,009,361 |

|

Total liabilities | 44,978,512 |

| | 41,849,858 |

|

| | | |

Stockholders' equity: | | | |

Common stock | 81,191 |

| | 76,062 |

|

Additional paid-in capital | 626,914 |

| | 513,218 |

|

Accumulated other comprehensive income | 426,555 |

| | 721,401 |

|

Retained earnings | 1,015,249 |

| | 829,195 |

|

Total stockholders' equity | 2,149,909 |

| | 2,139,876 |

|

Total liabilities and stockholders' equity | $ | 47,128,421 |

| | $ | 43,989,734 |

|

AMERICAN EQUITY INVESTMENT LIFE HOLDING COMPANY

Financial Supplement - September 30, 2015

AMERICAN EQUITY INVESTMENT LIFE HOLDING COMPANY

CONSOLIDATED STATEMENTS OF OPERATIONS

(Dollars in thousands, except per share data)

(Unaudited)

|

| | | | | | | | | | | | | | | |

| Three Months Ended

September 30, | | Nine Months Ended

September 30, |

| 2015 | | 2014 | | 2015 | | 2014 |

Revenues: | | | | | | | |

Premiums and other considerations | $ | 8,335 |

| | $ | 6,043 |

| | $ | 25,369 |

| | $ | 22,497 |

|

Annuity product charges | 37,975 |

| | 31,958 |

| | 99,066 |

| | 86,477 |

|

Net investment income | 436,085 |

| | 386,931 |

| | 1,253,930 |

| | 1,127,818 |

|

Change in fair value of derivatives | (351,360 | ) | | 39,218 |

| | (405,484 | ) | | 358,594 |

|

Net realized gains (losses) on investments, excluding other than temporary impairment ("OTTI") losses | 1,159 |

| | (3,190 | ) | | 10,362 |

| | (6,134 | ) |

OTTI losses on investments: | | | | | | | |

Total OTTI losses | (10,000 | ) | | — |

| | (10,132 | ) | | — |

|

Portion of OTTI losses recognized in (from) other comprehensive income | 4,771 |

| | (564 | ) | | 3,943 |

| | (2,063 | ) |

Net OTTI losses recognized in operations | (5,229 | ) | | (564 | ) | | (6,189 | ) | | (2,063 | ) |

Loss on extinguishment of debt | — |

| | — |

| | — |

| | (10,551 | ) |

Total revenues | 126,965 |

| | 460,396 |

| | 977,054 |

| | 1,576,638 |

|

| | | | | | | |

Benefits and expenses: | | | | | | | |

Insurance policy benefits and change in future policy benefits | 10,959 |

| | 9,109 |

| | 32,629 |

| | 30,191 |

|

Interest sensitive and index product benefits | 213,465 |

| | 429,415 |

| | 802,431 |

| | 1,114,381 |

|

Amortization of deferred sales inducements | 65,807 |

| | 40,661 |

| | 152,278 |

| | 96,676 |

|

Change in fair value of embedded derivatives | (414,724 | ) | | (195,206 | ) | | (583,112 | ) | | (21,652 | ) |

Interest expense on notes payable | 7,283 |

| | 8,741 |

| | 21,976 |

| | 28,126 |

|

Interest expense on subordinated debentures | 3,075 |

| | 3,044 |

| | 9,138 |

| | 9,076 |

|

Amortization of deferred policy acquisition costs | 67,885 |

| | 39,671 |

| | 186,871 |

| | 113,949 |

|

Other operating costs and expenses | 24,497 |

| | 20,616 |

| | 70,487 |

| | 60,588 |

|

Total benefits and expenses | (21,753 | ) | | 356,051 |

| | 692,698 |

| | 1,431,335 |

|

Income before income taxes | 148,718 |

| | 104,345 |

| | 284,356 |

| | 145,303 |

|

Income tax expense | 51,412 |

| | 36,530 |

| | 98,302 |

| | 50,497 |

|

Net income | $ | 97,306 |

| | $ | 67,815 |

| | $ | 186,054 |

| | $ | 94,806 |

|

| | | | | | | |

Earnings per common share | $ | 1.22 |

| | $ | 0.90 |

| | $ | 2.39 |

| | $ | 1.28 |

|

Earnings per common share - assuming dilution | $ | 1.19 |

| | $ | 0.85 |

| | $ | 2.33 |

| | $ | 1.19 |

|

Weighted average common shares outstanding (in thousands): | | | | | | | |

Earnings per common share | 79,676 |

| | 75,083 |

| | 77,995 |

| | 74,030 |

|

Earnings per common share - assuming dilution | 81,559 |

| | 79,467 |

| | 79,977 |

| | 79,477 |

|

AMERICAN EQUITY INVESTMENT LIFE HOLDING COMPANY

Financial Supplement - September 30, 2015

Quarterly Summary - Most Recent 5 Quarters (Unaudited)

|

| | | | | | | | | | | | | | | | | | | |

| Q3 2015 | | Q2 2015 | | Q1 2015 | | Q4 2014 | | Q3 2014 |

| (Dollars in thousands, except per share data) |

Revenues: | | | | | | | | | |

Traditional life insurance premiums | $ | 2,664 |

| | $ | 2,659 |

| | $ | 2,703 |

| | $ | 2,537 |

| | $ | 2,615 |

|

Life contingent immediate annuity considerations | 5,671 |

| | 7,378 |

| | 4,294 |

| | 7,589 |

| | 3,428 |

|

Surrender charges | 13,104 |

| | 11,413 |

| | 11,554 |

| | 10,418 |

| | 11,717 |

|

Lifetime income benefit rider fees | 24,871 |

| | 20,996 |

| | 17,128 |

| | 22,095 |

| | 20,241 |

|

Net investment income | 436,085 |

| | 418,176 |

| | 399,669 |

| | 403,849 |

| | 386,931 |

|

Change in fair value of derivatives | (351,360 | ) | | (23,024 | ) | | (31,100 | ) | | 146,231 |

| | 39,218 |

|

Net realized gains (losses) on investments, excluding OTTI | 1,159 |

| | 4,324 |

| | 4,879 |

| | 2,131 |

| | (3,190 | ) |

Net OTTI losses recognized in operations | (5,229 | ) | | (828 | ) | | (132 | ) | | (564 | ) | | (564 | ) |

Loss on extinguishment of debt | — |

| | — |

| | — |

| | (1,951 | ) | | — |

|

Total revenues | 126,965 |

| | 441,094 |

| | 408,995 |

| | 592,335 |

| | 460,396 |

|

| | | | | | | | | |

Benefits and expenses: | | | | | | | | | |

Traditional life insurance policy benefits and change in future policy benefits | 1,730 |

| | 1,971 |

| | 1,931 |

| | 1,300 |

| | 2,420 |

|

Life contingent immediate annuity benefits and change in future policy benefits | 9,229 |

| | 10,479 |

| | 7,289 |

| | 10,324 |

| | 6,689 |

|

Interest sensitive and index product benefits (a) | 213,465 |

| | 306,141 |

| | 282,825 |

| | 359,319 |

| | 429,415 |

|

Amortization of deferred sales inducements (b) | 65,807 |

| | 75,518 |

| | 10,953 |

| | 34,743 |

| | 40,661 |

|

Change in fair value of embedded derivatives | (414,724 | ) | | (219,601 | ) | | 51,213 |

| | 53,973 |

| | (195,206 | ) |

Interest expense on notes payable | 7,283 |

| | 7,354 |

| | 7,339 |

| | 8,244 |

| | 8,741 |

|

Interest expense on subordinated debentures | 3,075 |

| | 3,047 |

| | 3,016 |

| | 3,046 |

| | 3,044 |

|

Amortization of deferred policy acquisition costs (b) | 67,885 |

| | 104,700 |

| | 14,286 |

| | 49,629 |

| | 39,671 |

|

Other operating costs and expenses | 24,497 |

| | 24,868 |

| | 21,122 |

| | 20,996 |

| | 20,616 |

|

Total benefits and expenses | (21,753 | ) | | 314,477 |

| | 399,974 |

| | 541,574 |

| | 356,051 |

|

Income before income taxes | 148,718 |

| | 126,617 |

| | 9,021 |

| | 50,761 |

| | 104,345 |

|

Income tax expense | 51,412 |

| | 43,772 |

| | 3,118 |

| | 19,544 |

| | 36,530 |

|

Net income (a)(b) | $ | 97,306 |

| | $ | 82,845 |

| | $ | 5,903 |

| | $ | 31,217 |

| | $ | 67,815 |

|

| | | | | | | | | |

Earnings per common share | $ | 1.22 |

| | $ | 1.07 |

| | $ | 0.08 |

| | $ | 0.41 |

| | $ | 0.90 |

|

Earnings per common share - assuming dilution (a)(b) | $ | 1.19 |

| | $ | 1.05 |

| | $ | 0.07 |

| | $ | 0.39 |

| | $ | 0.85 |

|

Weighted average common shares outstanding (in thousands): | | | | | | | | | |

Earnings per common share | 79,676 |

| | 77,237 |

| | 77,042 |

| | 75,620 |

| | 75,083 |

|

Earnings per common share - assuming dilution | 81,559 |

| | 79,227 |

| | 79,118 |

| | 80,154 |

| | 79,467 |

|

| |

(a) | Q3 2015 includes expense from the revision of assumptions used in determining reserves held for living income benefit riders. The impact increased interest sensitive and index product benefits by $18.3 million and decreased net income and earnings per common share - assuming dilution by $11.8 million and $0.14 per share, respectively. |

Q3 2014 includes expense from the revision of assumptions used in determining reserves held for living income benefit riders. The impact increased interest sensitive and index product benefits by $12.4 million and decreased net income and earnings per common share - assuming dilution by $8.0 million and $0.10 per share, respectively.

| |

(b) | Q3 2015 includes benefit from unlocking which reduced amortization of deferred sales inducements and deferred policy acquisition costs by $5.6 million and $11.0 million, respectively, and increased net income and earnings per common share- assuming dilution by $10.7 million and $0.13 per share, respectively. |

Q3 2014 includes benefit from unlocking which reduced amortization of deferred sales inducements and deferred policy acquisition costs by $12.6 million and $35.5 million, respectively, and increased net income and earnings per common share- assuming dilution by $31.0 million and $0.39 per share, respectively.

AMERICAN EQUITY INVESTMENT LIFE HOLDING COMPANY

Financial Supplement - September 30, 2015

NON-GAAP FINANCIAL MEASURES

In addition to net income, we have consistently utilized operating income and operating income per common share - assuming dilution, non-GAAP financial measures commonly used in the life insurance industry, as economic measures to evaluate our financial performance. Operating income equals net income adjusted to eliminate the impact of net realized gains and losses on investments including net OTTI losses recognized in operations, fair value changes in derivatives and embedded derivatives, loss on extinguishment of debt and changes in litigation reserves. Because these items fluctuate from quarter to quarter in a manner unrelated to core operations, we believe measures excluding their impact are useful in analyzing operating trends. We believe the combined presentation and evaluation of operating income together with net income provides information that may enhance an investor’s understanding of our underlying results and profitability.

Reconciliation from Net Income to Operating Income (Unaudited)

|

| | | | | | | | | | | | | | | |

| Three Months Ended

September 30, | | Nine Months Ended

September 30, |

| 2015 | | 2014 | | 2015 | | 2014 |

| (Dollars in thousands, except per share data) |

Net income | $ | 97,306 |

| | $ | 67,815 |

| | $ | 186,054 |

| | $ | 94,806 |

|

Adjustments to arrive at operating income: (a) | | | | | | | |

Net realized investment (gains) losses, including OTTI | 1,639 |

| | 1,551 |

| | (1,829 | ) | | 3,476 |

|

Change in fair value of derivatives and embedded derivatives - index annuities | (54,535 | ) | | (4,957 | ) | | (40,152 | ) | | 34,636 |

|

Change in fair value of derivatives and embedded derivatives - debt | 1,506 |

| | (427 | ) | | 1,606 |

| | 29 |

|

Litigation reserve | — |

| | — |

| | — |

| | (916 | ) |

Extinguishment of debt | — |

| | — |

| | — |

| | 7,912 |

|

Operating income (a non-GAAP financial measure) | $ | 45,916 |

| | $ | 63,982 |

| | $ | 145,679 |

| | $ | 139,943 |

|

| | | | | | | |

Per common share - assuming dilution: | | | | | | | |

Net income | $ | 1.19 |

| | $ | 0.85 |

| | $ | 2.33 |

| | $ | 1.19 |

|

Adjustments to arrive at operating income: | | | | | | | |

Net realized investment (gains) losses, including OTTI | 0.02 |

| | 0.02 |

| | (0.03 | ) | | 0.04 |

|

Change in fair value of derivatives and embedded derivatives - index annuities | (0.67 | ) | | (0.06 | ) | | (0.50 | ) | | 0.44 |

|

Change in fair value of derivatives and embedded derivatives - debt | 0.02 |

| | — |

| | 0.02 |

| | — |

|

Litigation reserve | — |

| | — |

| | — |

| | (0.01 | ) |

Extinguishment of debt | — |

| | — |

| | — |

| | 0.10 |

|

Operating income (a non-GAAP financial measure) | $ | 0.56 |

| | $ | 0.81 |

| | $ | 1.82 |

| | $ | 1.76 |

|

| |

(a) | Adjustments to net income to arrive at operating income are presented net of income taxes and where applicable, are net of related adjustments to amortization of deferred sales inducements (DSI) and deferred policy acquisition costs (DAC). |

AMERICAN EQUITY INVESTMENT LIFE HOLDING COMPANY

Financial Supplement - September 30, 2015

NON-GAAP FINANCIAL MEASURES

Summary of Adjustments to Arrive at Operating Income (Unaudited)

|

| | | | | | | | | | | | | | | |

| Three Months Ended

September 30, | | Nine Months Ended

September 30, |

| 2015 | | 2014 | | 2015 | | 2014 |

| (Dollars in thousands) |

Net realized investment gains and losses, including OTTI: | | | | | | | |

Net realized (gains) losses on investments, including OTTI | $ | 4,070 |

| | $ | 3,754 |

| | $ | (4,173 | ) | | $ | 8,197 |

|

Amortization of DAC and DSI | (1,528 | ) | | (1,355 | ) | | 1,338 |

| | (2,820 | ) |

Income taxes | (903 | ) | | (848 | ) | | 1,006 |

| | (1,901 | ) |

| $ | 1,639 |

| | $ | 1,551 |

| | $ | (1,829 | ) | | $ | 3,476 |

|

Change in fair value of derivatives and embedded derivatives: | | | | | | | |

Index annuities | $ | (93,752 | ) | | $ | (16,380 | ) | | $ | (27,466 | ) | | $ | 134,925 |

|

2015 notes, note hedge and warrants | — |

| | — |

| | — |

| | (4,231 | ) |

Interest rate caps and swap | 2,575 |

| | (729 | ) | | 2,746 |

| | 4,281 |

|

Amortization of DAC and DSI | 10,342 |

| | 8,590 |

| | (33,811 | ) | | (80,503 | ) |

Income taxes | 27,806 |

| | 3,135 |

| | 19,985 |

| | (19,807 | ) |

| $ | (53,029 | ) | | $ | (5,384 | ) | | $ | (38,546 | ) | | $ | 34,665 |

|

Litigation reserve: | | | | | | | |

Change in litigation reserve recorded in other operating costs | $ | — |

| | $ | — |

| | $ | — |

| | $ | (2,212 | ) |

Amortization of DAC and DSI | — |

| | — |

| | — |

| | 795 |

|

Income taxes | — |

| | — |

| | — |

| | 501 |

|

| $ | — |

| | $ | — |

| | $ | — |

| | $ | (916 | ) |

Extinguishment of debt: | | | | | | | |

Loss on extinguishment of debt | $ | — |

| | $ | — |

| | $ | — |

| | $ | 10,551 |

|

Income taxes | — |

| | — |

| | — |

| | (2,639 | ) |

| $ | — |

| | $ | — |

| | $ | — |

| | $ | 7,912 |

|

AMERICAN EQUITY INVESTMENT LIFE HOLDING COMPANY

Financial Supplement - September 30, 2015

NON-GAAP FINANCIAL MEASURES

Quarterly Summary - Most Recent 5 Quarters (Unaudited)

Reconciliation from Net Income to Operating Income

|

| | | | | | | | | | | | | | | | | | | |

| Q3 2015 | | Q2 2015 | | Q1 2015 | | Q4 2014 | | Q3 2014 |

| (Dollars in thousands, except per share data) |

Net income | $ | 97,306 |

| | $ | 82,845 |

| | $ | 5,903 |

| | $ | 31,217 |

| | $ | 67,815 |

|

Adjustments to arrive at operating income: (a) | | | | | | | | | |

Net realized investment (gains) losses, including OTTI | 1,639 |

| | (1,649 | ) | | (1,819 | ) | | (613 | ) | | 1,551 |

|

Change in fair value of derivatives and embedded derivatives - index annuities | (54,535 | ) | | (29,274 | ) | | 43,657 |

| | 16,463 |

| | (4,957 | ) |

Change in fair value of derivatives and embedded derivatives - debt | 1,506 |

| | (977 | ) | | 1,077 |

| | 32 |

| | (427 | ) |

Extinguishment of debt | — |

| | — |

| | — |

| | 3,604 |

| | — |

|

Operating income (a non-GAAP financial measure) (b)(c) | $ | 45,916 |

| | $ | 50,945 |

| | $ | 48,818 |

| | $ | 50,703 |

| | $ | 63,982 |

|

| | | | | | | | | |

Operating income per common share - assuming dilution (b)(c) | $ | 0.56 |

| | $ | 0.64 |

| | $ | 0.62 |

| | $ | 0.63 |

| | $ | 0.81 |

|

| |

(a) | Adjustments to net income to arrive at operating income are presented net of income taxes and where applicable, are net of related adjustments to amortization of deferred sales inducements and deferred policy acquisition costs. |

| |

(b) | Q3 2015 includes a benefit from unlocking which reduced amortization of deferred sales inducements and deferred policy acquisition costs by $0.5 million and $4.3 million, respectively, and increased operating income and operating income per common share- assuming dilution by $3.1 million and $0.04 per share, respectively. |

Q3 2014 includes a benefit from unlocking which reduced amortization of deferred sales inducements and deferred policy acquisition costs by $10.7 million and $33.0 million, respectively, and increased operating income and operating income per common share- assuming dilution by $28.2 million and $0.36 per share, respectively.

| |

(c) | Q3 2015 includes expense from the revision of assumptions used in determining reserves held for living income benefit riders. The impact increased interest sensitive and index product benefits by $18.3 million and decreased operating income and operating income per common share - assuming dilution by $11.8 million and $0.14 per share, respectively. |

Q3 2014 includes expense from the revision of assumptions used in determining reserves held for living income benefit riders. The impact increased interest sensitive and index product benefits by $12.4 million and decreased operating income and operating income per common share - assuming dilution by $8.0 million and $0.10 per share, respectively.

AMERICAN EQUITY INVESTMENT LIFE HOLDING COMPANY

Financial Supplement - September 30, 2015

NON-GAAP FINANCIAL MEASURES

Summary of Adjustments to Arrive at Operating Income (Unaudited)

|

| | | | | | | | | | | | | | | | | | | |

| Q3 2015 | | Q2 2015 | | Q1 2015 | | Q4 2014 | | Q3 2014 |

| (Dollars in thousands) |

Net realized (gains) losses on investments | $ | (1,159 | ) | | $ | (4,324 | ) | | $ | (4,879 | ) | | $ | (2,131 | ) | | $ | 3,190 |

|

Net OTTI losses recognized in operations | 5,229 |

| | 828 |

| | 132 |

| | 564 |

| | 564 |

|

Change in fair value of derivatives | 322,406 |

| | 116,627 |

| | 114,843 |

| | 19,033 |

| | 171,274 |

|

Loss on extinguishment of debt | — |

| | — |

| | — |

| | 1,951 |

| | — |

|

Increase in total revenues | 326,476 |

| | 113,131 |

| | 110,096 |

| | 19,417 |

| | 175,028 |

|

| | | | | | | | | |

Amortization of deferred sales inducements | (12,644 | ) | | (23,306 | ) | | 38,686 |

| | 14,579 |

| | (3,886 | ) |

Change in fair value of embedded derivatives | 413,583 |

| | 215,659 |

| | (50,646 | ) | | (42,912 | ) | | 188,383 |

|

Amortization of deferred policy acquisition costs | 3,830 |

| | (30,593 | ) | | 56,500 |

| | 22,063 |

| | (3,349 | ) |

Increase (decrease) in total benefits and expenses | 404,769 |

| | 161,760 |

| | 44,540 |

| | (6,270 | ) | | 181,148 |

|

Increase (decrease) in income before income taxes | (78,293 | ) | | (48,629 | ) | | 65,556 |

| | 25,687 |

| | (6,120 | ) |

Increase (decrease) in income tax expense | (26,903 | ) | | (16,729 | ) | | 22,641 |

| | 6,201 |

| | (2,287 | ) |

Increase (decrease) in net income | $ | (51,390 | ) | | $ | (31,900 | ) | | $ | 42,915 |

| | $ | 19,486 |

| | $ | (3,833 | ) |

AMERICAN EQUITY INVESTMENT LIFE HOLDING COMPANY

Financial Supplement - September 30, 2015

Capitalization/Book Value per Share

|

| | | | | | | |

| September 30, 2015 | | December 31, 2014 |

| (Dollars in thousands, except per share data) |

Capitalization: | | | |

Notes payable: | | | |

September 2015 Notes | $ | — |

| | $ | 21,679 |

|

July 2021 Notes | 400,000 |

| | 400,000 |

|

Subordinated debentures payable to subsidiary trusts | 246,397 |

| | 246,243 |

|

Total debt | 646,397 |

| | 667,922 |

|

Total stockholders’ equity | 2,149,909 |

| | 2,139,876 |

|

Total capitalization | 2,796,306 |

| | 2,807,798 |

|

Accumulated other comprehensive income (AOCI) | (426,555 | ) | | (721,401 | ) |

Total capitalization excluding AOCI (a) | $ | 2,369,751 |

| | $ | 2,086,397 |

|

| | | |

Total stockholders’ equity | $ | 2,149,909 |

| | $ | 2,139,876 |

|

Accumulated other comprehensive income | (426,555 | ) | | (721,401 | ) |

Total stockholders’ equity excluding AOCI (a) | $ | 1,723,354 |

| | $ | 1,418,475 |

|

| | | |

Common shares outstanding (b) | 81,420,948 |

| | 76,605,527 |

|

| | | |

Book Value per Share: (c) | | | |

Book value per share including AOCI | $ | 26.40 |

| | $ | 27.93 |

|

Book value per share excluding AOCI (a) | $ | 21.17 |

| | $ | 18.52 |

|

| | | |

Debt-to-Capital Ratios: (d) | | | |

Senior debt / Total capitalization | 16.9 | % | | 20.2 | % |

Adjusted debt / Total capitalization | 16.9 | % | | 20.2 | % |

| |

(a) | Total capitalization, total stockholders’ equity and book value per share excluding AOCI, non-GAAP financial measures, are based on stockholders’ equity excluding the effect of AOCI. Since AOCI fluctuates from quarter to quarter due to unrealized changes in the fair value of available for sale investments, we believe these non-GAAP financial measures provide useful supplemental information. |

| |

(b) | Common shares outstanding include shares held by the NMO Deferred Compensation Trust: 2015 - 230,012 shares; 2014 - 543,120 shares |

| |

(c) | Book value per share including and excluding AOCI is calculated as total stockholders’ equity and total stockholders’ equity excluding AOCI divided by the total number of shares of common stock outstanding. |

| |

(d) | Debt-to-capital ratios are computed using total capitalization excluding AOCI. Adjusted debt includes notes payable and the portion of the total subordinated debentures payable to subsidiary trusts outstanding (qualifying trust preferred securities) that exceeds 15% of total capitalization excluding AOCI. |

AMERICAN EQUITY INVESTMENT LIFE HOLDING COMPANY

Financial Supplement - September 30, 2015

Spread Results

|

| | | | | | | |

| Three Months Ended

September 30, | | Nine Months Ended

September 30, |

| 2015 | | 2014 | | 2015 | | 2014 |

Average yield on invested assets | 4.79% | | 4.89% | | 4.77% | | 4.89% |

Aggregate cost of money | 1.96% | | 2.07% | | 1.96% | | 2.12% |

Aggregate investment spread | 2.83% | | 2.82% | | 2.81% | | 2.77% |

| | | | | | | |

Impact of: | | | | | | | |

Investment yield - additional prepayment income | 0.14% | | 0.07% | | 0.08% | | 0.05% |

Cost of money effect of over hedging | 0.02% | | 0.05% | | 0.05% | | 0.03% |

| | | | | | | |

Weighted average investments (in thousands) | $36,518,093 | | $31,715,221 | | $35,124,768 | | $30,832,526 |

Weighted average investments include fixed maturity securities at amortized cost and equity securities at cost. The numerator for average yield on invested assets includes net investment income and the tax effect of investment income that is exempt from income taxes.

Summary of Cost of Money for Deferred Annuities

|

| | | | | | | | | | | | | | | |

| Three Months Ended

September 30, | | Nine Months Ended

September 30, |

| 2015 | | 2014 | | 2015 | | 2014 |

| (Dollars in thousands) |

Included in interest sensitive and index product benefits: | | | | | | | |

Index credits | $ | 101,170 |

| | $ | 323,682 |

| | $ | 515,675 |

| | $ | 831,524 |

|

Interest credited | 62,519 |

| | 69,266 |

| | 187,946 |

| | 208,525 |

|

Included in change in fair value of derivatives: | | | | | | | |

Proceeds received at option expiration | (103,750 | ) | | (327,773 | ) | | (529,196 | ) | | (834,502 | ) |

Pro rata amortization of option cost | 130,956 |

| | 109,838 |

| | 374,466 |

| | 318,107 |

|

Cost of money for deferred annuities | $ | 190,895 |

| | $ | 175,013 |

| | $ | 548,891 |

| | $ | 523,654 |

|

| | | | | | | |

Weighted average liability balance outstanding (in thousands) | $ | 38,863,688 |

| | $ | 33,841,644 |

| | $ | 37,358,304 |

| | $ | 32,861,022 |

|

Annuity Account Balance Rollforward

|

| | | | | | | | | | | | | | | |

| Three Months Ended

September 30, | | Nine Months Ended

September 30, |

| 2015 | | 2014 | | 2015 | | 2014 |

| (Dollars in thousands) |

Account balances at beginning of period | $ | 38,117,343 |

| | $ | 33,304,540 |

| | $ | 35,363,041 |

| | $ | 31,535,846 |

|

Net deposits | 1,718,755 |

| | 1,029,841 |

| | 4,640,646 |

| | 2,898,157 |

|

Premium bonuses | 127,220 |

| | 85,320 |

| | 346,410 |

| | 241,277 |

|

Fixed interest credited and index credits | 163,689 |

| | 392,948 |

| | 703,621 |

| | 1,040,049 |

|

Surrender charges | (13,104 | ) | | (11,717 | ) | | (36,071 | ) | | (37,082 | ) |

Lifetime income benefit rider fees | (24,871 | ) | | (20,241 | ) | | (62,995 | ) | | (49,395 | ) |

Surrenders, withdrawals, deaths, etc. | (478,998 | ) | | (401,943 | ) | | (1,344,618 | ) | | (1,250,104 | ) |

Account balances at end of period | $ | 39,610,034 |

| | $ | 34,378,748 |

| | $ | 39,610,034 |

| | $ | 34,378,748 |

|

AMERICAN EQUITY INVESTMENT LIFE HOLDING COMPANY

Financial Supplement - September 30, 2015

Annuity Deposits by Product Type

|

| | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended

September 30, | | Nine Months Ended

September 30, | | Year Ended December 31, |

Product Type | | 2015 | | 2014 | | 2015 | | 2014 | | 2014 |

| | (Dollars in thousands) |

Fixed index annuities | | $ | 1,764,179 |

| | $ | 1,041,449 |

| | $ | 4,748,612 |

| | $ | 2,883,106 |

| | $ | 3,999,439 |

|

Annual reset fixed rate annuities | | 8,425 |

| | 10,959 |

| | 32,612 |

| | 43,359 |

| | 57,273 |

|

Multi-year fixed rate annuities | | 45,032 |

| | 13,741 |

| | 132,249 |

| | 90,391 |

| | 103,293 |

|

Single premium immediate annuities | | 8,921 |

| | 5,633 |

| | 27,085 |

| | 18,059 |

| | 24,580 |

|

Total before coinsurance ceded | | 1,826,557 |

| | 1,071,782 |

| | 4,940,558 |

| | 3,034,915 |

| | 4,184,585 |

|

Coinsurance ceded | | 98,881 |

| | 36,308 |

| | 272,827 |

| | 118,699 |

| | 171,124 |

|

Net after coinsurance ceded | | $ | 1,727,676 |

| | $ | 1,035,474 |

| | $ | 4,667,731 |

| | $ | 2,916,216 |

| | $ | 4,013,461 |

|

Surrender Charge Protection and Account Values by Product Type

Annuity Surrender Charges and Net (of coinsurance) Account Values at September 30, 2015:

|

| | | | | | | | | | | | | |

| | Surrender Charge | | Net Account Value |

Product Type | | Avg. Years At Issue | | Avg. Years Remaining | | Avg. % Remaining | | Dollars in Thousands | | % |

| | | | | | | | | | |

Fixed Index Annuities | | 13.9 | | 9.4 | | 14.8% | | $ | 37,701,715 |

| | 95.2 | % |

Annual Reset Fixed Rate Annuities | | 10.9 | | 3.8 | | 7.7% | | 1,419,476 |

| | 3.6 | % |

Multi-Year Fixed Rate Annuities (a) | | 6.6 | | 1.6 | | 4.1% | | 488,843 |

| | 1.2 | % |

Total | | 13.7 | | 9.1 | | 14.4% | | $ | 39,610,034 |

| | 100.0 | % |

| |

(a) | 31% of Net Account Value is no longer in multi-year guarantee period and can be adjusted annually. |

AMERICAN EQUITY INVESTMENT LIFE HOLDING COMPANY

Financial Supplement - September 30, 2015

Annuity Liability Characteristics

|

| | | | | | | |

| Fixed Annuities Account Value | | Fixed Index Annuities Account Value |

| (Dollars in thousands) |

SURRENDER CHARGE PERCENTAGES: | | | |

No surrender charge | $ | 716,633 |

| | $ | 1,305,728 |

|

0.0% < 2.0% | 29,616 |

| | 408,342 |

|

2.0% < 3.0% | 83,678 |

| | 67,489 |

|

3.0% < 4.0% | 11,483 |

| | 754,092 |

|

4.0% < 5.0% | 84,579 |

| | 65,603 |

|

5.0% < 6.0% | 85,871 |

| | 565,842 |

|

6.0% < 7.0% | 113,066 |

| | 188,608 |

|

7.0% < 8.0% | 56,100 |

| | 480,735 |

|

8.0% < 9.0% | 71,950 |

| | 712,758 |

|

9.0% < 10.0% | 82,647 |

| | 1,057,127 |

|

10.0% or greater | 572,696 |

| | 32,095,391 |

|

| $ | 1,908,319 |

| | $ | 37,701,715 |

|

|

| | | | | | |

| Fixed and Fixed Index Annuities Account Value | | Weighted Average Surrender Charge |

| (Dollars in thousands) | | |

SURRENDER CHARGE EXPIRATION BY YEAR: | | | |

Out of Surrender Charge | $ | 2,022,361 |

| | 0.00 | % |

2015 | 119,103 |

| | 2.01 | % |

2016 | 713,169 |

| | 2.27 | % |

2017 | 863,996 |

| | 3.65 | % |

2018 | 781,432 |

| | 5.99 | % |

2019 | 576,976 |

| | 7.34 | % |

2020 | 931,342 |

| | 8.99 | % |

2021 | 1,247,673 |

| | 10.58 | % |

2022 | 1,986,991 |

| | 12.51 | % |

2023 | 4,963,744 |

| | 14.23 | % |

2024 | 5,506,841 |

| | 15.32 | % |

2025 | 5,084,210 |

| | 15.51 | % |

2026 | 2,703,964 |

| | 17.55 | % |

2027 | 2,828,385 |

| | 18.26 | % |

2028 | 2,516,579 |

| | 18.63 | % |

2029 | 2,760,676 |

| | 19.08 | % |

2030 | 2,012,521 |

| | 19.62 | % |

2031 | 1,983,385 |

| | 19.99 | % |

2032 | 6,686 |

| | 20.00 | % |

| $ | 39,610,034 |

| | 14.45 | % |

AMERICAN EQUITY INVESTMENT LIFE HOLDING COMPANY

Financial Supplement - September 30, 2015

Annuity Liability Characteristics

|

| | | | | | | |

| Fixed Annuities Account Value | | Fixed Index Annuities Account Value |

| (Dollars in thousands) |

CREDITED RATE VS. ULTIMATE MINIMUM GUARANTEED RATE DIFFERENTIAL: | | | |

No differential | $ | 921,547 |

| | $ | 1,112,302 |

|

› 0.0% - 0.25% | 218,500 |

| | 31,521 |

|

› 0.25% - 0.5% | 199,142 |

| | 228,756 |

|

› 0.5% - 1.0% | 156,178 |

| | 633,889 |

|

› 1.0% - 1.5% | 73,015 |

| | 5,778 |

|

› 1.5% - 2.0% | 1,364 |

| | — |

|

› 2.0% - 2.5% | 77 |

| | — |

|

1.00% ultimate guarantee - 2.48% wtd avg interest rate (a) | 115,219 |

| | 17,038 |

|

1.50% ultimate guarantee - 1.45% wtd avg interest rate (a) | 122,721 |

| | 3,477,852 |

|

2.00% ultimate guarantee - 2.29% wtd avg interest rate (a) | 100,556 |

| | — |

|

2.25% ultimate guarantee - 2.34% wtd avg interest rate (a) | — |

| | 1,201,690 |

|

3.00% ultimate guarantee - 2.56% wtd avg interest rate (a) | — |

| | 2,373,968 |

|

Allocated to index strategies (see tables that follow) | — |

| | 28,618,921 |

|

| $ | 1,908,319 |

| | $ | 37,701,715 |

|

| |

(a) | The minimum guaranteed interest rate for the fixed rate or the fixed rate strategy is 1.00%. The ultimate guaranteed rate is applied on less than 100% of the premium. |

If all crediting rates were reduced to minimum guaranteed rates (subject to limitations imposed by ultimate minimum guaranteed rates where applicable) the weighted average crediting rate as of September 30, 2015 for fixed annuities and funds allocated to the fixed rate strategy for fixed index annuities would decrease by 0.38%.

AMERICAN EQUITY INVESTMENT LIFE HOLDING COMPANY

Financial Supplement - September 30, 2015

Annuity Liability Characteristics

FIXED INDEX ANNUITIES ACCOUNT VALUE - INDEX STRATEGIES

|

| | | | | | | | | | | | | | | | | | | |

Annual Monthly Average and Point-to-Point with Caps |

| Minimum Guaranteed Cap |

| 1% | | 3% | | 4% | | 7% | | 8% + |

Current Cap | (Dollars in thousands) |

At minimum | $ | 1,518 |

| | $ | 10,463 |

| | $ | 1,572,672 |

| | $ | 53,927 |

| | $ | 265,346 |

|

1.75% - 3% | 2,259,138 |

| | — |

| | — |

| | — |

| | — |

|

3% - 4% | 3,230,770 |

| | 100,493 |

| | — |

| | — |

| | — |

|

4% - 5% | 90,098 |

| | 88,546 |

| | 2,519,759 |

| | — |

| | — |

|

5% - 6% | 195,799 |

| | 63,246 |

| | 3,840,469 |

| | — |

| | — |

|

6% - 7% | — |

| | — |

| | 89 |

| | — |

| | — |

|

>= 7% | — |

| | 15,437 |

| | 1,487 |

| | 79,441 |

| | 17,543 |

|

|

| | | | | | | | | | | | | | | |

Annual Monthly Average and Point-to-Point with Participation Rates |

| Minimum Guaranteed Participation Rate |

| 10% | | 25% | | 35% | | 50% + |

Current Participation Rate | (Dollars in thousands) |

At minimum | $ | 633 |

| | $ | 381,975 |

| | $ | 157,524 |

| | $ | 186,483 |

|

< 20% | 309,163 |

| | — |

| | — |

| | — |

|

20% - 40% | 578,755 |

| | 320,176 |

| | — |

| | — |

|

40% - 60% | 136,535 |

| | 139,185 |

| | 105,119 |

| | 845 |

|

>= 60% | 5,079 |

| | — |

| | — |

| | — |

|

|

| | | |

S&P 500 Monthly Point-to-Point - Minimum Guaranteed Monthly Cap = 1.0% |

(Dollars in thousands) | |

Current Cap | |

At minimum | $ | 17,286 |

|

1.2% - 1.9% | 8,109,234 |

|

2.0% - 2.3% | 2,073,248 |

|

>= 2.4% | 92,993 |

|

|

| | | |

Volatility Control Index | |

(Dollars in thousands) | |

Current Asset Fee | |

At Maximum | $ | — |

|

0.75% - 1.75% | 83,532 |

|

2.25% - 2.75% | 1,013,802 |

|

3.00% | 430,088 |

|

If all caps and participation rates were reduced to minimum caps and participation rates and current asset fees were increased to their maximums, the cost of options would decrease by 0.63% based upon prices of options for the week ended October 20, 2015.

AMERICAN EQUITY INVESTMENT LIFE HOLDING COMPANY

Financial Supplement - September 30, 2015

Summary of Invested Assets

|

| | | | | | | | | | | | | |

| September 30, 2015 | | December 31, 2014 |

| Carrying Amount | | Percent | | Carrying Amount | | Percent |

| (Dollars in thousands) |

Fixed maturity securities: | | | | | | | |

United States Government full faith and credit | $ | 37,681 |

| | 0.1 | % | | $ | 138,460 |

| | 0.4 | % |

United States Government sponsored agencies | 1,314,748 |

| | 3.4 | % | | 1,393,890 |

| | 3.9 | % |

United States municipalities, states and territories | 3,760,888 |

| | 9.8 | % | | 3,723,309 |

| | 10.4 | % |

Foreign government obligations | 216,987 |

| | 0.6 | % | | 193,803 |

| | 0.5 | % |

Corporate securities | 23,536,322 |

| | 61.3 | % | | 21,566,724 |

| | 59.9 | % |

Residential mortgage backed securities | 1,556,308 |

| | 4.0 | % | | 1,751,345 |

| | 4.9 | % |

Commercial mortgage backed securities | 3,941,863 |

| | 10.3 | % | | 2,807,620 |

| | 7.8 | % |

Other asset backed securities | 1,101,619 |

| | 2.9 | % | | 946,483 |

| | 2.6 | % |

Total fixed maturity securities | 35,466,416 |

| | 92.4 | % | | 32,521,634 |

| | 90.4 | % |

Equity securities | 7,833 |

| | — | % | | 7,805 |

| | — | % |

Mortgage loans on real estate | 2,452,402 |

| | 6.4 | % | | 2,434,580 |

| | 6.8 | % |

Derivative instruments | 180,649 |

| | 0.5 | % | | 731,113 |

| | 2.0 | % |

Other investments | 284,994 |

| | 0.7 | % | | 286,726 |

| | 0.8 | % |

| $ | 38,392,294 |

| | 100.0 | % | | $ | 35,981,858 |

| | 100.0 | % |

Credit Quality of Fixed Maturity Securities - September 30, 2015

|

| | | | | | | | | | | | | | | | |

NAIC Designation | | Carrying Amount | | Percent | | Rating Agency Rating | | Carrying Amount | | Percent |

| | (Dollars in thousands) | | | | | | (Dollars in thousands) | | |

1 | | $ | 23,171,086 |

| | 65.3 | % | | Aaa/Aa/A | | $ | 22,808,058 |

| | 64.3 | % |

2 | | 11,581,162 |

| | 32.7 | % | | Baa | | 11,300,580 |

| | 31.9 | % |

3 | | 693,863 |

| | 2.0 | % | | Ba | | 704,655 |

| | 2.0 | % |

4 | | 17,256 |

| | — | % | | B | | 56,943 |

| | 0.1 | % |

5 | | — |

| | — | % | | Caa and lower | | 421,999 |

| | 1.2 | % |

6 | | 3,049 |

| | — | % | | In or near default | | 174,181 |

| | 0.5 | % |

| | $ | 35,466,416 |

| | 100.0 | % | | | | $ | 35,466,416 |

| | 100.0 | % |

Watch List Securities - September 30, 2015

|

| | | | | | | | | | | | | | |

General Description | | Amortized Cost | | Unrealized Gains (Losses) | | Fair Value | | Months Below Amortized Cost |

| | (Dollars in thousands) | | |

Corporate bonds: | | | | | | | | |

Finance | | $ | 20,000 |

| | $ | (3,618 | ) | | $ | 16,382 |

| | 49 |

Industrial | | 63,947 |

| | (30,435 | ) | | 33,512 |

| | 13 - 31 |

Telecommunications | | 6,000 |

| | (3,090 | ) | | 2,910 |

| | 15 |

| | 89,947 |

| | (37,143 | ) | | 52,804 |

| | |

Other asset backed securities | | 11,372 |

| | (6,090 | ) | | 5,282 |

| | 28 - 54 |

| | $ | 101,319 |

| | $ | (43,233 | ) | | $ | 58,086 |

| | |

AMERICAN EQUITY INVESTMENT LIFE HOLDING COMPANY

Financial Supplement - September 30, 2015

Fixed Maturity Securities by Sector

|

| | | | | | | | | | | | | | | |

| September 30, 2015 | | December 31, 2014 |

| Amortized Cost | | Fair Value | | Amortized Cost | | Fair Value |

| (Dollars in thousands) |

Available for sale: | | | | | | | |

United States Government full faith and credit and sponsored agencies | $ | 1,322,941 |

| | $ | 1,352,429 |

| | $ | 1,502,134 |

| | $ | 1,532,350 |

|

United States municipalities, states and territories | 3,405,519 |

| | 3,760,888 |

| | 3,293,551 |

| | 3,723,309 |

|

Foreign government obligations | 210,941 |

| | 216,987 |

| | 181,128 |

| | 193,803 |

|

Corporate securities: | | | | | | | |

Consumer discretionary | 1,936,633 |

| | 1,996,159 |

| | 1,677,362 |

| | 1,800,455 |

|

Consumer staples | 1,564,523 |

| | 1,625,307 |

| | 1,376,634 |

| | 1,489,951 |

|

Energy | 2,587,080 |

| | 2,517,720 |

| | 2,307,432 |

| | 2,378,038 |

|

Financials | 4,626,438 |

| | 4,857,326 |

| | 3,928,295 |

| | 4,246,882 |

|

Health care | 1,915,811 |

| | 1,999,930 |

| | 1,742,218 |

| | 1,884,132 |

|

Industrials | 2,995,749 |

| | 3,117,625 |

| | 2,537,927 |

| | 2,746,752 |

|

Information technology | 1,616,067 |

| | 1,646,162 |

| | 1,324,095 |

| | 1,388,990 |

|

Materials | 1,740,836 |

| | 1,698,367 |

| | 1,589,219 |

| | 1,654,125 |

|

Telecommunications | 534,671 |

| | 547,295 |

| | 509,913 |

| | 542,055 |

|

Utilities | 3,220,984 |

| | 3,453,837 |

| | 2,991,652 |

| | 3,358,901 |

|

Residential mortgage backed securities: | | | | | | | |

Government agency | 691,614 |

| | 768,003 |

| | 689,378 |

| | 759,902 |

|

Prime | 524,645 |

| | 549,533 |

| | 683,206 |

| | 721,454 |

|

Alt-A | 215,397 |

| | 238,772 |

| | 244,262 |

| | 269,989 |

|

Commercial mortgage backed securities: | | | | | | | |

Government agency | 345,208 |

| | 368,443 |

| | 299,288 |

| | 320,343 |

|

Other | 3,536,279 |

| | 3,573,420 |

| | 2,421,006 |

| | 2,487,277 |

|

Other asset backed securities: | | | | | | | |

Consumer discretionary | 74,162 |

| | 75,711 |

| | 71,081 |

| | 73,298 |

|

Energy | 8,152 |

| | 9,296 |

| | 8,230 |

| | 9,459 |

|

Financials | 774,288 |

| | 791,515 |

| | 628,464 |

| | 649,388 |

|

Industrials | 191,209 |

| | 202,957 |

| | 177,864 |

| | 190,217 |

|

Telecommunications | 13,789 |

| | 15,061 |

| | 14,837 |

| | 16,139 |

|

Utilities | 5,394 |

| | 7,079 |

| | 5,870 |

| | 7,982 |

|

Redeemable preferred stock - financials | — |

| | 20 |

| | — |

| | 11 |

|

| $ | 34,058,330 |

| | $ | 35,389,842 |

| | $ | 30,205,046 |

| | $ | 32,445,202 |

|

Held for investment: | | | | | | | |

Corporate security - financials | $ | 76,574 |

| | $ | 62,000 |

| | $ | 76,432 |

| | $ | 75,838 |

|

AMERICAN EQUITY INVESTMENT LIFE HOLDING COMPANY

Financial Supplement - September 30, 2015

Mortgage Loans on Commercial Real Estate

|

| | | | | | | | | | | | | | |

| September 30, 2015 | | December 31, 2014 |

| Principal | | Percent | | Principal | | Percent |

| (Dollars in thousands) |

Geographic distribution | | | | | | | |

East | $ | 720,522 |

| | 29.2 | % | | $ | 701,638 |

| | 28.5 | % |

Middle Atlantic | 160,946 |

| | 6.5 | % | | 166,249 |

| | 6.8 | % |

Mountain | 255,454 |

| | 10.3 | % | | 279,075 |

| | 11.4 | % |

New England | 13,267 |

| | 0.5 | % | | 12,280 |

| | 0.5 | % |

Pacific | 359,231 |

| | 14.6 | % | | 302,307 |

| | 12.3 | % |

South Atlantic | 451,123 |

| | 18.3 | % | | 471,849 |

| | 19.2 | % |

West North Central | 311,774 |

| | 12.6 | % | | 349,028 |

| | 14.2 | % |

West South Central | 198,139 |

| | 8.0 | % | | 175,295 |

| | 7.1 | % |

| $ | 2,470,456 |

| | 100.0 | % | | $ | 2,457,721 |

| | 100.0 | % |

| | | | | | | |

Property type distribution | | | | | | | |

Office | $ | 417,122 |

| | 16.9 | % | | $ | 484,585 |

| | 19.7 | % |

Medical office | 84,843 |

| | 3.4 | % | | 88,275 |

| | 3.6 | % |

Retail | 768,210 |

| | 31.1 | % | | 711,775 |

| | 29.0 | % |

Industrial/Warehouse | 688,336 |

| | 27.9 | % | | 649,425 |

| | 26.4 | % |

Hotel | 3,412 |

| | 0.1 | % | | 30,640 |

| | 1.3 | % |

Apartment | 362,809 |

| | 14.7 | % | | 335,087 |

| | 13.6 | % |

Mixed use/other | 145,724 |

| | 5.9 | % | | 157,934 |

| | 6.4 | % |

| $ | 2,470,456 |

| | 100.0 | % | | $ | 2,457,721 |

| | 100.0 | % |

| | | | | | | |

| September 30, 2015 | | December 31, 2014 | | | | |

Credit Exposure - By Payment Activity | | | | | | | |

Performing | $ | 2,443,679 |

| | $ | 2,451,760 |

| | | | |

In workout | 10,739 |

| | — |

| | | | |

Delinquent | — |

| | — |

| | | | |

Collateral dependent | 16,038 |

| | 5,961 |

| | | | |

| 2,470,456 |

| | 2,457,721 |

| | | | |

Specific loan loss allowance | (10,618 | ) | | (12,333 | ) | | | | |

General loan loss allowance | (6,900 | ) | | (10,300 | ) | | | | |

Deferred prepayment fees | (536 | ) | | (508 | ) | | | | |

| $ | 2,452,402 |

| | $ | 2,434,580 |

| | | | |

AMERICAN EQUITY INVESTMENT LIFE HOLDING COMPANY

Financial Supplement - September 30, 2015

Shareholder Information

Corporate Offices:

American Equity Investment Life Holding Company

6000 Westown Parkway

West Des Moines, IA 50266

Inquiries:

John M. Matovina, Chief Executive Officer and President

(515) 457-1813, jmatovina@american-equity.com

Ted M. Johnson, Chief Financial Officer and Treasurer

(515) 457-1980, tjohnson@american-equity.com

Debra J. Richardson, Executive Vice President and Secretary

(515) 273-3551, drichardson@american-equity.com

Common Stock and Dividend Information:

New York Stock Exchange symbol: “AEL”

|

| | | | | | | |

| High | | Low | | Close | | Dividend Declared |

2015 | | | | | | | |

First Quarter | $29.62 | | $25.46 | | $29.13 | | $0.00 |

Second Quarter | $29.90 | | $25.06 | | $26.98 | | $0.00 |

Third Quarter | $30.02 | | $22.36 | | $23.31 | | $0.00 |

| | | | | | | |

2014 | | | | | | | |

First Quarter | $26.42 | | $18.84 | | $23.62 | | $0.00 |

Second Quarter | $25.15 | | $20.97 | | $24.60 | | $0.00 |

Third Quarter | $25.25 | | $21.69 | | $22.88 | | $0.00 |

Fourth Quarter | $29.75 | | $21.36 | | $29.19 | | $0.20 |

| | | | | | | |

2013 | | | | | | | |

First Quarter | $15.03 | | $12.33 | | $14.89 | | $0.00 |

Second Quarter | $16.60 | | $14.03 | | $15.70 | | $0.00 |

Third Quarter | $21.42 | | $15.64 | | $21.22 | | $0.00 |

Fourth Quarter | $26.46 | | $20.01 | | $26.38 | | $0.18 |

Transfer Agent:

Computershare Trust Company, N.A.

P.O. Box 43010

Providence, RI 02940-0310

Phone: (877) 282-1169

Fax: (781) 575-2723

www.computershare.com

Annual Report and Other Information:

Shareholders may receive when available, without charge, a copy of American Equity’s Annual Report, SEC filings and/or press releases by calling Julie L. LaFollette, Investor Relations, at (515) 273-3602 or by visiting our web site at www.american-equity.com.

AMERICAN EQUITY INVESTMENT LIFE HOLDING COMPANY

Financial Supplement - September 30, 2015

Research Analyst Coverage

Steven Schwartz

Raymond James & Associates, Inc.

(312) 612-7686

steven.schwartz@raymondjames.com

Randy Binner

Friedman, Billings, Ramsey & Co., Inc.

(703) 312-1890

rbinner@fbr.com

Mark Hughes

SunTrust Robinson Humphrey

(615) 748-5680

mark_hughes@rhco.com

John Barnidge

Sandler O'Neill & Partners, L.P.

(312) 281-3412

jbarnidge@sandleroneill.com

Erik J. Bass

Citigroup Global Markets, Inc.

(212) 816-5257

erik.bass@citi.com

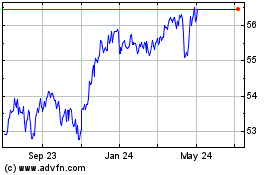

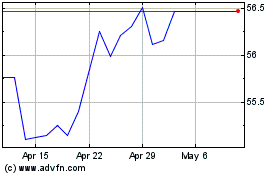

American Equity Investme... (NYSE:AEL)

Historical Stock Chart

From Mar 2024 to Apr 2024

American Equity Investme... (NYSE:AEL)

Historical Stock Chart

From Apr 2023 to Apr 2024