Current Report Filing (8-k)

November 03 2015 - 5:06PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): November 2, 2015

ALPHATEC HOLDINGS, INC.

(Exact Name of Registrant as Specified in its Charter)

|

| | | | |

| | | | |

Delaware | | 000-52024 | | 20-2463898 |

(State or Other Jurisdiction of Incorporation) | | (Commission File Number) | | (IRS Employer Identification No.) |

| |

5818 El Camino Real, Carlsbad, CA | | 92008 |

(Address of Principal Executive Offices) | | (Zip Code) |

Registrant’s telephone number, including area code: (760) 431-9286

(Former Name or Former Address, if Changed Since Last Report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

¨ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 1.01 Entry into a Material Definitive Agreement.

On November 2, 2015, each of Alphatec Spine, Inc. (“Alphatec Spine”), a wholly owned subsidiary of Alphatec Holdings, Inc. (the “Company”) entered a first amendment (the “First Amendment”) to that certain Collaboration Agreement by and among Alphatec Spine, the Company, Elite Medical Holdings, LLC and Pac 3 Surgical Products, LLC (the “Collaborators”) (the “Collaboration Agreement”). Under the Collaboration Agreement, the Collaborators agreed to provide services related to the development and commercialization of the Company’s current products and products in the Company’s product pipeline. As consideration for the services, the Collaboration Agreement provides that the Company will issue an aggregate $8.0 million of the Company’s common stock, based on a per share price of $1.95 per share, which was the average of the closing price of the Company’s common stock on The NASDAQ Global Select Market on each of the four days prior to the effective date and the effective of the Collaboration Agreement. Pursuant to the First Amendment, in exchange for a "lock up" restriction on selling or transferring each tranche of shares issued to the Collaborators and a maximum value cap (as discussed below), the Company has agreed to make a cash payment to the Collaborators in the event that the shares in such tranche do not have a minimum amount of value based on the market value of the Company’s common stock at the end of the lock up period applicable to such tranche of shares. In addition, in the event that at the end of a lock up period the value of a tranche of shares issued to the Collaborators exceeds a certain amount, the Collaborators have agreed to forfeit shares back to the Company, so as to limit the maximum amount of value derived from such shares at the end of a lock up period. Pursuant to the First Amendment, the shares issued to the Collaborators in each of 2014, 2015 and 2016 are subject to a lock up that lasts until the first quarter of 2017, 2018 and 2019, respectively. The valuation of each tranche of shares occurs at the end of the applicable lock up period. Based on the closing price of the Company’s common stock on October 30, 2015, the Company could have an additional liability of $3.5 million for shares of the Company’s common stock previously issued under the Collaboration Agreement, with $2.1 million payable in 2017, and $1.4 million payable in 2018. In addition, based on the closing price of the Company’s common stock on October 30, 2015, the Company could have an additional liability of $2.8 million for shares of the Company’s common stock issuable under the remaining terms of the Collaboration Agreement (assuming that all of the shares issuable under the Collaboration Agreement are issued), with $0.7 million payable in 2018 (in addition to the amount above payable in 2018), and $2.1 million payable in 2019. If the Collaborators elect to sell, assign or transfer: (i) more than 20% of the shares issued to the Collaborators prior to the first valuation date; or (ii) any of the Collaborator shares still subject to a lockup after the first valuation date, all of the aforementioned restrictions on transfer and valuation minimums and maximums are null and void. In addition, in the event of a change of control, the First Amendment provides that the surviving entity will assume the Collaboration Agreement, as amended by the First Amendment and the holders of any outstanding shares issued under the Collaboration Agreement, as amended by the First Amendment, will be entitled to receive the consideration to which a holder of a share of the Company’s common stock on the effective date of the change of control is entitled (“successor consideration”). In addition, in the event of a change of control, the valuation adjustment provisions described above will remain in full force and effect, but the applicable valuations will be performed based on such successor consideration and the restrictions on sales, transfers and pledges on such shares will apply to such successor consideration, other than that portion of such consideration that is comprised of cash. Other than as set forth in the First Amendment, the Collaboration Agreement remains in full force and effect. This summary of First Amendment is qualified in its entirety by reference to the full text of the First Amendment, which shall be attached as an exhibit to the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2015.

| |

Item 3.02 | Issuance of Unregistered Securities. |

The disclosure under Item 1.01 to this current report on Form 8-K is incorporated into this Item 3.02 by reference.

Pursuant to the Collaboration Agreement described above, on October 9, 2015, the Company issued 883,152 unregistered shares of its common stock in exchange for services performed for part of the second year of the Collaboration Agreement. The shares were issued in reliance upon an exemption from registration under federal

securities laws provided by Section 4(2) of the Securities Act of 1933 (the “Securities Act”), for the issuance and exchange of securities in transactions by an issuer not involving a public offering. The Company does not have an obligation, nor does it anticipate, registering the issued shares for resale on a registration statement pursuant to the Securities Act. The Company anticipates that prior to the end of 2015 it shall make an additional issuance of shares under the Collaboration Agreement in exchange for the remainder of the services provided in the second year of the Collaboration Agreement.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

| | | | |

| | | | |

| | | | ALPHATEC HOLDINGS, INC. (Registrant) |

| | |

Date: November 3, 2015 | | | | /s/ Ebun S. Garner, Esq. |

| | | | Ebun S. Garner, Esq. |

| | | | General Counsel and Senior Vice President |

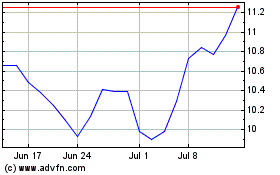

Alphatec (NASDAQ:ATEC)

Historical Stock Chart

From Mar 2024 to Apr 2024

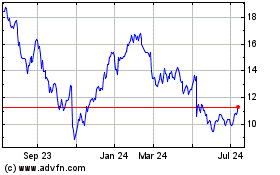

Alphatec (NASDAQ:ATEC)

Historical Stock Chart

From Apr 2023 to Apr 2024