Current Report Filing (8-k)

October 07 2015 - 12:42PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

October 6, 2015

Date of Report (Date of earliest event reported)

AAR CORP.

(Exact Name of Registrant as Specified in Its Charter)

Delaware

(State or other jurisdiction of incorporation)

|

1-6263 |

|

36-2334820 |

|

(Commission File Number) |

|

(IRS Employer Identification No.) |

One AAR Place, 1100 N. Wood Dale Road

Wood Dale, Illinois 60191

(Address and Zip Code of Principal Executive Offices)

Registrant’s telephone number, including area code: (630) 227-2000

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 5.02. Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On October 6, 2015, AAR CORP. (the “Company”) amended the Severance and Change in Control Agreements it has with certain key employees, including Timothy J. Romenesko (Vice Chairman and Chief Operating Officer of Expeditionary Services), Robert J. Regan (Vice President, General Counsel and Secretary) and Michael J. Sharp (Vice President, Chief Financial Officer and Treasurer), to remove the “single-trigger” provision that outstanding stock options, restricted stock and other equity awards will vest immediately upon a change in control.

Under the amended agreements, an executive’s equity awards will accelerate only if, within 18 months following a “Change in Control,” the executive’s employment is terminated by the Company other than for “Cause” or “Disability” or by the executive for “Good Reason” (as each of those capitalized terms is defined in the agreements). For a description of the Severance and Change in Control Agreements as in effect prior to the “double-trigger” amendment, including the related definitions, see “Executive Compensation — Potential Payments Upon a Termination of Employment or a Change in Control of the Company — Severance and Change in Control Agreements” on pages 50-51 of the Company’s definitive proxy statement dated August 28, 2015.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

10.1 Form of Second Amendment to Severance and Change in Control Agreement

2

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

Date: October 7, 2015 |

|

|

|

|

|

|

|

|

|

AAR CORP. |

|

|

|

|

|

|

|

|

|

By: |

/s/ Robert J. Regan |

|

|

|

Robert J. Regan |

|

|

|

Vice President, General Counsel and Secretary |

3

Exhibit 10.1

FORM OF

AMENDMENT TO SEVERANCE

AND CHANGE IN CONTROL AGREEMENT

This Amendment to the Severance and Change in Control Agreement is made and entered into on October 6, 2015, by and between AAR CORP., a Delaware corporation (the “Company”), and (“Employee”).

WHEREAS, the Company and Employee are parties to a Severance and Change in Control Agreement dated as of , 20 and amendment dated as of December 18, 2008 (the “Agreement”) and now desire to further amend the Agreement to reflect a technical compliance revision and to provide for a “double-trigger” requirement for accelerated vesting of outstanding equity awards.

NOW, THEREFORE, in consideration of the mutual covenants and promises contained herein, and other good and valuable consideration, the receipt and sufficiency of which is hereby acknowledged, the parties agree to amend the Agreement, effective as of October 6, 2015, to read as follows:

1. Section 7(a)(2) is amended to read as follows:

The Company shall, within 30 days following such termination of employment, pay to Employee in a lump sum, a cash payment in an amount equal to [two] [three] times Employee’s total compensation (base salary plus annual cash bonus) for either the fiscal year of the Company most recently ended prior to the date of termination, or the preceding fiscal year, whichever is the highest total compensation, subject to applicable withholding.

2. Section 7(b) is amended to read as follows:

In the event that a Change in Control occurs and Employee becomes entitled to the benefits described in Section 7(a) above following termination of employment by the Company for other than Cause or Disability or by Employee for Good Reason, then notwithstanding any conditions or restrictions related to any Award granted to Employee under the AAR CORP. Stock Benefit Plan, 2013 Stock Plan or any successor plan of the Company, (i) all performance opportunity restricted stock shares eligible for award hereunder shall be immediately awarded based on the higher of target or actual performance through the effective date of a Change in Control using the latest data then available to determine goals applicable for the partial performance period, and all restrictions thereon shall be immediately released, and (ii) all outstanding option grants, stock appreciation rights, restricted stock and restricted stock units granted or awarded under the Plan which have not then become vested or exercisable or which remain restricted, shall immediately become vested or

exercisable and restrictions will lapse, as the case may be, and any such options shall remain exercisable for the full remaining life of the options.

IN WITNESS WHEREOF, the parties have executed this Second Amendment to the Agreement on the 6th day of October, 2015.

|

|

AAR CORP. |

|

|

|

|

|

|

By: |

|

|

|

Its: |

|

|

|

|

|

|

EMPLOYEE |

|

|

|

|

|

|

2

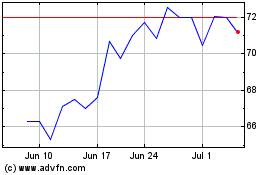

AAR (NYSE:AIR)

Historical Stock Chart

From Mar 2024 to Apr 2024

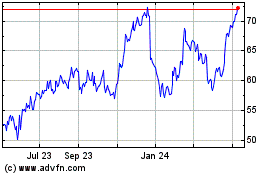

AAR (NYSE:AIR)

Historical Stock Chart

From Apr 2023 to Apr 2024