UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): October 6, 2015

ALLEGHENY TECHNOLOGIES INCORPORATED

(Exact name of registrant as specified in its charter)

|

| | | | |

Delaware | | 1-12001 | | 25-1792394 |

(State or other jurisdiction of | | (Commission | | (IRS Employer |

incorporation) | | File Number) | | Identification No.) |

| | | | |

|

| | |

1000 Six PPG Place, Pittsburgh, Pennsylvania | | 15222-5479 |

(Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code (412) 394-2800

N/A

(Former name or former address, if changed since last report).

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

¨ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 2.02. Results of Operations and Financial Condition.

On October 6, 2015, Allegheny Technologies Incorporated (“ATI” or the “Company”) issued a press release commenting on third quarter 2015 expected financial results. A copy of the press release is attached hereto as Exhibit 99.1.

Item 8.01. Other Events.

Effective with the third quarter 2015, the Company changed its method of determining business unit performance as internally reported to its senior management, CEO, and Board of Directors. Segment operating profit is now reported excluding all effects of LIFO inventory accounting and any related changes in net realizable value inventory reserves which offset the Company’s aggregate net debit LIFO valuation balance.

Additionally, segment operating profit is now measured including all retirement benefit expense attributable to the business unit, for both current and former employees. Previously, ATI excluded defined benefit pension expense and all defined benefit and defined contribution postretirement medical and life insurance expense from segment operating profit. This change better aligns comparative operating performance following the 2014 U.S. defined benefit pension freeze for all non-represented employees and the change in 2015 to a company-wide defined contribution retirement plan structure. Under the Company’s previous reporting methodology, defined contribution retirement plan expense remained in segment operating results whereas defined benefit plan costs were excluded. Operating results for business segments, corporate and closed company and other expenses now include all applicable retirement benefit plan costs for pension and other postretirement benefits.

Management considers these changes to be a more useful method of measuring business unit financial performance based on changes to retirement benefit plans and the impact of the Company’s aggregate net debit LIFO position.

The following segment reporting information reflects this new internal management reporting basis of segment operating profit and is filed as part of this Current Report on Form 8-K.

|

| | | | | | | | | | | | | | | | | | | |

Segment Operating Profit (dollars in millions) | | | | | | | | |

| For the six months | | For the three months ended |

| ended June 30, | | June 30, | | March 31, | | June 30, |

| 2015 | | 2014 | | 2015 | | 2015 | | 2014 |

Sales: | | | | | | | | | |

High Performance Materials & Components | $ | 1,053.9 |

| | $ | 998.5 |

| | $ | 511.1 |

| | $ | 542.8 |

| | $ | 514.1 |

|

Flat Rolled Products | 1,094.1 |

| | 1,107.8 |

| | 511.4 |

| | 582.7 |

| | 604.9 |

|

Total sales | $ | 2,148.0 |

| | $ | 2,106.3 |

| | $ | 1,022.5 |

| | $ | 1,125.5 |

| | $ | 1,119.0 |

|

| | | | | | | | | |

Operating Profit (Loss): | | | | | | | | | |

High Performance Materials & Components | $ | 117.3 |

| | $ | 108.7 |

| | $ | 44.4 |

| | $ | 72.9 |

| | $ | 52.7 |

|

% of sales | 11.1 | % | | 10.9 | % | | 8.7 | % | | 13.4 | % | | 10.3 | % |

| | | | | | | | | |

Flat Rolled Products | (30.0 | ) | | (38.8 | ) | | (23.2 | ) | | (6.8 | ) | | (5.6 | ) |

% of sales | (2.7 | )% | | (3.5 | )% | | (4.5 | )% | | (1.2 | )% | | (0.9 | )% |

| | | | | | | | | |

Total operating profit | 87.3 |

| | 69.9 |

| | 21.2 |

| | 66.1 |

| | 47.1 |

|

% of sales | 4.1 | % | | 3.3 | % | | 2.1 | % | | 5.9 | % | | 4.2 | % |

| | | | | | | | | |

LIFO and net realizable value reserves | 0.2 |

| | (2.9 | ) | | 0.2 |

| | — |

| | (2.9 | ) |

Corporate expenses | (22.9 | ) | | (25.9 | ) | | (10.1 | ) | | (12.8 | ) | | (13.0 | ) |

Closed company and other expenses | (12.1 | ) | | (12.9 | ) | | (6.1 | ) | | (6.0 | ) | | (6.1 | ) |

Restructuring costs | — |

| | — |

| | — |

| | — |

| | — |

|

Interest expense, net | (53.5 | ) | | (57.6 | ) | | (26.8 | ) | | (26.7 | ) | | (28.5 | ) |

| | | | | | | | | |

Income (loss) from continuing operations before income taxes | $ | (1.0 | ) | | $ | (29.4 | ) | | $ | (21.6 | ) | | $ | 20.6 |

| | $ | (3.4 | ) |

| | | | | | | | | |

| For the year ended December 31, |

| 2014 | | 2013 | | 2012 | | 2011 | | 2010 |

Sales: | | | | | | | | | |

High Performance Materials & Components | $ | 2,006.8 |

| | $ | 1,944.8 |

| | $ | 2,314.0 |

| | $ | 2,081.0 |

| | $ | 1,422.8 |

|

Flat Rolled Products | 2,216.6 |

| | 2,098.7 |

| | 2,352.9 |

| | 2,731.3 |

| | 2,343.4 |

|

Total sales | $ | 4,223.4 |

| | $ | 4,043.5 |

| | $ | 4,666.9 |

| | $ | 4,812.3 |

| | $ | 3,766.2 |

|

| | | | | | | | | |

Operating Profit (Loss): | | | | | | | | | |

High Performance Materials & Components | $ | 234.8 |

| | $ | 159.6 |

| | $ | 315.7 |

| | $ | 367.7 |

| | $ | 230.2 |

|

% of sales | 11.7 | % | | 8.2 | % | | 13.6 | % | | 17.7 | % | | 16.2 | % |

| | | | | | | | | |

Flat Rolled Products | (47.0 | ) | | (147.8 | ) | | 19.7 |

| | 136.0 |

| | 103.8 |

|

% of sales | (2.1 | )% | | (7.0 | )% | | 0.8 | % | | 5 | % | | 4.4 | % |

| | | | | | | | | |

Total operating profit | 187.8 |

| | 11.8 |

| | 335.4 |

| | 503.7 |

| | 334.0 |

|

% of sales | 4.4 | % | | 0.3 | % | | 7.2 | % | | 10.5 | % | | 8.9 | % |

| | | | | | | | | |

LIFO and net realizable value reserves | 0.3 |

| | 45.9 |

| | 75.6 |

| | 25.9 |

| | (54.8 | ) |

Corporate expenses | (49.6 | ) | | (48.9 | ) | | (75.6 | ) | | (98.1 | ) | | (69.3 | ) |

Closed company and other expenses | (28.3 | ) | | (30.9 | ) | | (31.5 | ) | | (17.1 | ) | | (23.0 | ) |

Restructuring costs | — |

| | (67.5 | ) | | — |

| | — |

| | — |

|

Interest expense, net | (108.7 | ) | | (65.2 | ) | | (71.6 | ) | | (92.3 | ) | | (62.7 | ) |

| | | | | | | | | |

Income (loss) from continuing operations before income taxes | $ | 1.5 |

| | $ | (154.8 | ) | | $ | 232.3 |

| | $ | 322.1 |

| | $ | 124.2 |

|

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

| | | | |

| | | ALLEGHENY TECHNOLOGIES INCORPORATED |

| | | By: | /s/ Patrick J. DeCourcy |

| | | | Patrick J. DeCourcy |

| | | | Senior Vice President, Finance and Chief Financial Officer |

| | | | |

Dated: | October 6, 2015 | | | |

Exhibit 99.1

ATI Comments on Third Quarter 2015

Pittsburgh, PA, October 6, 2015 - Allegheny Technologies Incorporated (NYSE: ATI) today commented that business and operating conditions in its flat rolled products business remain challenging and demand from the oil & gas market further weakened. Due primarily to the effects of rapid declines in current and projected raw material values, particularly for nickel that is near decade-low exchange-determined prices, ATI also expects to report the following items in its third quarter results:

| |

• | A LIFO inventory valuation benefit of approximately $76 million, pretax; |

| |

• | An offsetting $76 million pretax non-cash charge for Net Realizable Value (NRV) inventory reserves, which are required to offset ATI’s aggregate net debit LIFO inventory balance that exceeds current inventory replacement cost; |

| |

• | A non-cash charge for income tax valuation allowances of approximately $65 million, net of tax, as a result of a three year cumulative loss from U.S. operations. |

For the third quarter, ATI expects to report a net loss attributable to ATI of $142 to $148 million, or $(1.32) to $(1.38) per share. Excluding the non-cash NRV inventory reserve and income tax valuation charges, ATI’s third quarter net loss attributable to ATI is expected to be $29 to $34 million, or $(0.27) to $(0.32) per share.

ATI's third quarter performance continued to be pressured by the ATI Flat Rolled Products segment. Business conditions in this segment remained challenging. Stainless steel demand was soft mainly due to unusually high domestic inventory levels that resulted from the first-half 2015 surge of low-priced imports, primarily from China, and generally weak demand which is affected by falling raw material surcharges. Demand from the oil & gas market continued to deteriorate during the quarter. In addition, ATI Flat Rolled Products issued a lockout notice, effective August 15, 2015, to more than 2,000 employees at various locations, due to lack of progress in ongoing contract negotiations with the United Steelworkers (USW). The facilities are being operated by salaried and temporary workers. After an initial drop in asset utilization due to the work stoppage, production rates continue to improve. These facilities are meeting and in many cases exceeding output, quality, and safety expectations.

In the High Performance Materials and Components segment, weakened demand from the oil & gas market continued to negatively impact results. Third quarter sales to the aerospace market were lower than the previous quarter due to seasonal demand, primarily in Europe, as well as the rapid decline in the value of raw materials, particularly for nickel.

“We remain confident that our High Performance Materials and Components segment operating performance will significantly improve in 2016. Our production schedules from our aerospace customers show demand improvement for our next-generation nickel-based alloys and titanium-based alloys and our precision forgings, castings, and components,” said Rich Harshman, Chairman, President and CEO.

“In our Flat Rolled Products segment, as reported last week, repair of the Hot-Rolling and Processing Facility's Rotary Crop Shear was successfully completed on schedule. Our flat rolled products facilities are operating, mostly at pre-work stoppage levels, and asset utilization continues to improve. We are committed to reaching a fair and more competitive labor agreement with the USW. Our goal is to have the cost structure and enhanced product mix that enables ATI Flat Rolled Products to be a competitive business now and in the future.

ATI will provide live Internet listening access to its conference call with investors and analysts scheduled for Tuesday, October 20, 2015 at 8:30 a.m. ET. The conference call will be conducted after the Company’s planned release of third quarter 2015 results. The conference call will be broadcast, and accompanying presentation slides will be available, at www.ATImetals.com. To access the broadcast, go to the home page and select “Conference Call”. Replay of the conference call will be available on the ATI website.

This news release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements are based on management’s current expectations and include known and unknown risks, uncertainties and other factors, many of which we are unable to predict or control, that may cause our actual results, performance or achievements to materially differ from those expressed or implied in the forward-looking statements. Additional information concerning factors that could cause actual results to differ materially from those projected in the forward-looking statements is contained in our filings with the Securities and Exchange Commission. We assume no duty to update our forward-looking statements.

Creating Value Thru Relentless Innovation®

Allegheny Technologies Incorporated is one of the largest and most diversified specialty materials and components producers in the world with revenues of approximately $4.3 billion for the twelve months ended June 30, 2015. ATI has approximately 9,600 full-time employees world-wide who use innovative technologies to offer global markets a wide range of specialty materials solutions. Our major markets are aerospace and defense, oil and gas/chemical process industry, electrical energy, medical, automotive, food equipment and appliance, and construction and mining. The ATI website is www.ATImetals.com.

ATI (NYSE:ATI)

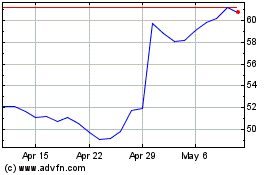

Historical Stock Chart

From Mar 2024 to Apr 2024

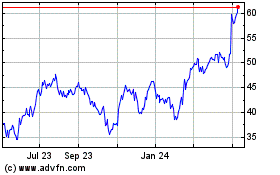

ATI (NYSE:ATI)

Historical Stock Chart

From Apr 2023 to Apr 2024