Current Report Filing (8-k)

September 21 2015 - 2:02PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15 (d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): September 18, 2015

INTERNATIONAL BANCSHARES CORPORATION

(Exact Name of Registrant as Specified in its Charter)

|

Texas |

|

000-09439 |

|

74-2157138 |

|

(State or other Jurisdiction |

|

(Commission File Number) |

|

(I.R.S. Employer |

|

of incorporation or organization) |

|

|

|

Identification No.) |

|

1200 San Bernardo, Laredo, Texas |

|

78040-1359 |

|

(Address of principal executive offices) |

|

(ZIP Code) |

(Registrant’s telephone number, including area code) (956) 722-7611

None

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below);

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4 (c) under the Exchange Act (17 CFR 250.13e-4 (c))

Item 5.02(d) Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers

On September 21, 2015 International Bancshares Corporation (“IBC”) issued a news release announcing Javier de Anda’s and Roberto R. Resendez’s appointment to IBC’s Board of Directors (the “Board”), effective September 18, 2015. The Board unanimously voted to appoint Mr. de Anda and Mr. Resendez as new directors of IBC.

Mr. de Anda is currently the Senior Vice-President of B. P. Newman Investment Company, an owner of numerous restaurant franchise locations. Mr. de Anda has served as a board member of IBC’s subsidiary bank, International Bank of Commerce, Laredo, Texas, since July 2015. Additionally, he has served as a board member of IBC’s subsidiary bank, Commerce Bank, since March 2010. It has yet to be determined on which, if any, committees of the Board Mr. de Anda will serve.

Mr. Resendez is currently an owner and operator of various beef cattle ranching operations and real estate investments. It has yet to be determined on which, if any, committees of the Board Mr. Resendez will serve.

There was no arrangement or understanding between Mr. de Anda or Mr. Resendez and any other person pursuant to which Mr. de Anda or Mr. Resendez was selected as a director.

Mr. de Anda and Mr. Resendez and members of their immediate family and the companies with which they are associated were customers of, and had banking transactions with, IBC’s subsidiary banks in the ordinary course of the subsidiary banks’ business during 2013, 2014 and 2015, and IBC anticipates that such banking transactions will continue in the future. All loans and commitments to loan included in such banking transactions were made in the ordinary course of business, on substantially the same terms, including interest rates and collateral, as those prevailing at the time for comparable transactions with persons not related to IBC, and all of such indebtedness is fully performing and complies with Federal lending restrictions included in Section 22(h) of the Federal Reserve Act (12 U.S.C. 375b). The indebtedness, in the opinion of IBC’s management, did not involve more than a normal risk of collectability or present other unfavorable features.

Mr. de Anda and Mr. Resendez will receive the standard compensation provided to IBC’s non-employee directors, the details of which are as follows:

· compensation for their services as directors of IBC in the amount of $900 for each IBC Board meeting and $300 for each meeting of a Board committee they attend. Occasionally, Board meetings are held by telephone conference and they will not be paid for those meetings;

· compensation for their services as director of a subsidiary bank in the amount of $900 for each board meeting and $300 for each meeting of a board committee of each bank that they attend; and

· potentially, a discretionary year-end payment, which historically has been approximately $5,000; and

· no stock options or other equity-based awards in connection with their service as members of IBC’s Board or as members of the Laredo Bank’s board of directors.

The news release announcing the directors appointment described in Item 5.02 above attached hereto and filed herewith as Exhibit 99, is incorporated herein by reference.

Item 8.01 Other Events

On September 21, 2015 International Bancshares Corporation (“IBC”) issued a news release announcing that on September 18, 2015, IBC’s Board of Directors approved the declaration of a twenty nine cents per share cash dividend for all holders of Common Stock, $1.00 par value, of record on September 30, 2015. The dividend will be payable on October 15, 2015.

2

The news release announcing the cash dividend attached hereto and filed herewith as Exhibit 99, is incorporated herein by reference.

All of the information furnished in Item 8.01 of this report and the accompanying exhibits are also intended to be included under “Item 7.01 — Regulation Fair Disclosure” and shall not be deemed to be “filed” for the purposes of Section 18 of the Securities and Exchange Act of 1934, as amended, is not subject to the liabilities of that section and shall not be incorporated by reference in any filing under the Securities Act of 1933, as amended.

Item 9.01 Financial Statements and Exhibits.

99 News Release of International Bancshares Corporation dated September 21, 2015 entitled, “International Bancshares Corporation Announces Appointment of Two New Directors and Cash Dividend”

3

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

INTERNATIONAL BANCSHARES CORPORATION |

|

|

(Registrant) |

|

|

|

|

|

|

|

|

By: |

/s/ Dennis E. Nixon |

|

|

|

Dennis E. Nixon, President and CEO |

|

|

|

|

|

|

|

|

|

September 21, 2015 |

|

|

4

EXHIBIT INDEX

|

Exhibit Number |

|

Description |

|

Page

Number |

|

|

|

|

|

|

|

99 |

|

News Release of International Bancshares Corporation dated September 21, 2015 entitled, “International Bancshares Corporation Announces Appointment of Two New Directors and Cash Dividend” |

|

6 |

5

EXHIBIT 99

FOR IMMEDIATE RELEASE

Contact:

Judy Wawroski

Senior Vice President

International Bancshares Corporation

(956) 722-7611 (Laredo)

INTERNATIONAL BANCSHARES CORPORATION ANNOUNCES

APPOINTMENT OF TWO NEW DIRECTORS AND CASH DIVIDEND

LAREDO, TX, September 21, 2015 - International Bancshares Corporation (“IBC”) today, announced that on September 18, 2015, IBC’s Board of Directors approved the declaration of a twenty-nine cents per share cash dividend for all holders of Common Stock, $1.00 par value, of record on September 30, 2015. “The dividend will be payable on October 15, 2015,” said Dennis E. Nixon, Chairman and President of IBC.

The Board also announced today that it has elected Javier de Anda and Roberto R. Resendez to IBC’s Board. The Board unanimously voted to appoint Mr. de Anda and Mr. Resendez. Mr. de Anda has served on the Board of Directors of IBC’s subsidiary bank, International Bank of Commerce, Laredo, Texas, since July 2015. Mr. De Anda has also served as a board member for Commerce Bank; another subsidiary bank of IBC, since 2010. Mr. de Anda is currently the Senior Vice President of B. P. Newman Investment Company, an owner of numerous restaurant franchise locations as well as extensive real estate ventures. Mr. Resendez is currently an owner and operator of various beef cattle ranching operations and real estate investments. Mr. Nixon stated, “I am extremely pleased these two accomplished leaders and businessmen have agreed to serve on IBC’s board. I know their special knowledge and talents will enhance IBC’s future prosperity.”

IBC (NASDAQ:IBOC - News) is a multi-bank financial holding company with $12.1 billion in assets headquartered in Laredo, Texas, with 210 facilities and more than 320 ATMs serving 88 communities in Texas and Oklahoma.

“Safe Harbor” statement under the Private Securities Litigation Reform Act of 1995: The statements contained in this release which are not historical facts contain forward-looking information with respect to future developments or events, expectations, plans, projections or future performance of IBC and its subsidiaries, the occurrence of which involve certain risks and uncertainties, including those detailed in IBC’s filings with the Securities and Exchange Commission.

Copies of IBC’s SEC filings and Annual Report (as an exhibit to the 10-K) may be downloaded from the SEC filings site located at http://www.sec.gov/edgar.shtml or IBC’s website at http://www.ibc.com.

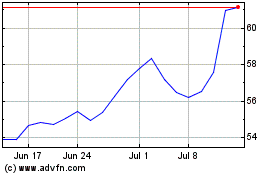

International Bancshares (NASDAQ:IBOC)

Historical Stock Chart

From Mar 2024 to Apr 2024

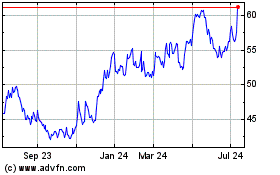

International Bancshares (NASDAQ:IBOC)

Historical Stock Chart

From Apr 2023 to Apr 2024