UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT

TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): August 28, 2015

Commission file number 001-11625

Pentair plc

(Exact name of Registrant as specified in its charter)

|

|

|

| Ireland |

|

98-1141328 |

| (State or other jurisdiction of

incorporation or organization) |

|

(I.R.S. Employer

Identification number) |

P.O. Box 471, Sharp Street, Walkden, Manchester, M28 8BU United Kingdom

(Address of principal executive offices, including Zip Code)

Registrant’s telephone number, including area code: 44-161-703-1885

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the

following provisions:

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

ITEM 1.01 Entry Into A Material Definitive Agreement.

On August 28, 2015, Pentair plc (“Pentair”), Pentair Investments Switzerland GmbH (“PISG”) and Pentair Finance S.A.

(“PFSA”) entered into a First Amendment (the “First Amendment”) and on September 2, 2015, Pentair, PISG and PFSA entered into a Second Amendment (the “Second Amendment,” and together with the First Amendment, the

“Amendments”), each among Pentair, PISG, PFSA and the lenders and agents party thereto. The Amendments amend the existing Amended and Restated Credit Agreement, dated as of October 3, 2014 (as amended, the “Credit

Agreement”), among Pentair, PISG, PFSA, Pentair, Inc. and the lenders and agents party thereto. Pentair and its affiliates may use the revolving credit facility provided by the Credit Agreement for working capital, capital expenditures and for

general corporate purposes, including the acquisition of ERICO Global Company (the “ERICO Acquisition”).

The First Amendment

amends the Credit Agreement to, among other things, increase the maximum permitted ratio of Pentair’s consolidated debt plus synthetic lease obligations to its EBITDA (as defined in the Credit Agreement) for the four consecutive fiscal quarters

then ended (the “Leverage Ratio”) following the closing of the ERICO Acquisition from 3.50 to 1.00 on the last day of each fiscal quarter of Pentair to (a) 4.50 to 1.00 as of the last day of any period of four consecutive fiscal

quarters of Pentair ending on or prior to June 30, 2016; (b) 4.25 to 1.00 as of the last day of the period of four consecutive fiscal quarters of Pentair ending on September 30, 2016; (c) 4.00 to 1.00 as of the last day of the

period of four consecutive fiscal quarters of Pentair ending on December 31, 2016; (d) 3.75 to 1.00 as of the last day of any period of four consecutive fiscal quarters of Pentair ending after December 31, 2016, but on or prior to

June 30, 2017; and (e) 3.50 to 1.00 as of the last day of any period of four consecutive fiscal quarters of Pentair ending after June 30, 2017.

The Second Amendment amends the Credit Agreement to, among other things, increase the maximum aggregate amount of availability under the

revolving credit facility provided by the Credit Agreement from $2.1 billion to $2.5 billion.

The foregoing is only a summary of the

Amendments and is qualified in its entirety by reference to the Amendments, which are filed as Exhibits 4.1 and 4.2 to this Current Report on Form 8-K and are incorporated herein by reference.

ITEM 2.03 Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

The information included in Item 1.01 above is incorporated by reference herein.

ITEM 9.01 Financial Statements and Exhibits.

| |

d) |

Exhibits. The following exhibits are being filed herewith: |

|

|

|

| Exhibit |

|

Description |

|

|

| 4.1 |

|

First Amendment, dated as of August 28, 2015, among Pentair, PISG, PFSA and the lenders and agents party thereto. |

|

|

| 4.2 |

|

Second Amendment, dated as of September 2, 2015, among Pentair, PISG, PFSA and the lenders and agents party thereto. |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned, thereunto duly authorized, on September 3, 2015.

|

|

|

| PENTAIR PLC |

| Registrant |

|

|

| By: |

|

/s/ Angela D. Lageson |

|

|

Angela D. Lageson |

|

|

Senior Vice President, General Counsel and Secretary |

PENTAIR PLC

Exhibit Index to Current Report on Form 8-K

Dated August 28, 2015

|

|

|

| Exhibit

Number |

|

Description |

|

|

| 4.1 |

|

First Amendment, dated as of August 28, 2015, among Pentair, PISG, PFSA and the lenders and agents party thereto. |

|

|

| 4.2 |

|

Second Amendment, dated as of September 2, 2015, among Pentair, PISG, PFSA and the lenders and agents party thereto. |

Exhibit 4.1

EXECUTION VERSION

FIRST AMENDMENT

dated as of August 28, 2015 (this “Amendment”), to the AMENDED AND RESTATED CREDIT AGREEMENT dated as of October 3, 2014 (the “Credit Agreement”), among PENTAIR FINANCE S.A., a public limited liability

company (société anonyme) incorporated under the laws of Luxembourg, with its registered office at 26, boulevard Royal L-2449 Luxembourg and registered with the Luxembourg trade companies register under number B 166.305 (the

“Company”), PENTAIR PLC, an Irish public limited company (the “Parent”), PENTAIR INVESTMENTS SWITZERLAND GmbH, a Swiss Gesellschaft mit beschränkter Haftung (the “Swiss Parent”), the LENDERS

from time to time party thereto, and BANK OF AMERICA, N.A., as administrative agent for the Lenders (the “Administrative Agent”).

The Company has requested that the Lenders (such term and each other capitalized definitional term used but not defined herein having the

meaning assigned to it in the Credit Agreement) agree, and the Lenders whose signatures appear below have agreed, to amend the Credit Agreement on the terms and subject to the conditions set forth herein. Accordingly, in consideration of the

agreements herein contained and other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the parties hereto hereby agree as follows:

SECTION 1. Amendment. The Credit Agreement is hereby amended, effective as of the Effective Date (as defined in Section 3

below), as follows:

(a) The following definition is added in the appropriate alphabetical order to Section 1.1:

“ERICO Acquisition” means the acquisition of ERICO Global Company (“ERICO”) provided for in

the Agreement and Plan of Merger dated as of August 15, 2015, among the Parent, Pentair Lionel Acquisition Co., Pentair Lionel Merger Sub, Inc. and ERICO.

(b) The definition of “Swing Line Sublimit” in Section 1.1 is amended and restated as follows:

“Swing Line Sublimit” means the lesser of (a) US$150,000,000 and (b) the Aggregate Commitments.

(c) Section 2.3.1(a)(B) is amended to read as follows:

“(B) the aggregate Dollar Equivalent principal amount of all Swing Line Loans denominated in Euros shall not exceed

US$45,000,000.”

(d) Section 6.2 is amended to read as follows:

“6.2 Maximum Leverage Ratio. The Parent shall not permit the Leverage Ratio on the last day of any period of four

consecutive fiscal quarters of the Parent to exceed 3.50 to 1.00; provided, however, that, after the closing of the ERICO Acquisition, such ratio may not exceed: (a) 4.50 to 1.00 as of the last day of any period of four

consecutive fiscal quarters of the Parent ending on or prior

to June 30, 2016; (b) 4.25 to 1.00 as of the last day of the period of four consecutive fiscal quarters of the Parent ending on September 30, 2016; (c) 4.00 to 1.00 as of the

last day of the period of four consecutive fiscal quarters of the Parent ending on December 31, 2016; (d) 3.75 to 1.00 as of the last day of any period of four consecutive fiscal quarters of the Parent ending after December 31, 2016,

but on or prior to June 30, 2017; and (e) 3.50 to 1.00 as of the last day of any period of four consecutive fiscal quarters of the Parent ending thereafter.”

(e) Section 6.14 is amended by changing the heading thereof to “Swiss Parent Guarantee; Subsidiary

Guarantees”; by inserting “(a)” immediately before the text thereof; by changing the reference to “$25,000,000” therein to “$75,000,000”; and by inserting at the end thereof the following new

paragraph (b):

“(b) Any Subsidiary of the Parent (other than the Company) that shall at any time have in effect

a Guarantee of the Senior Notes and/or any other Debt of the Company or the Parent (other than Debt under this Agreement) in an aggregate outstanding principal amount that exceeds $75,000,000 shall promptly execute and deliver to the Administrative

Agent a Guarantee of the Obligations, on substantially the terms set forth in Article X and otherwise reasonably satisfactory in form and substance to the Administrative Agent, together with such evidence (including, if requested, one or

more legal opinions) of its authority to enter into such Guarantee and of the enforceability thereof as the Administrative Agent shall reasonably request. Unless the Company elects otherwise, any such Guarantee shall provide that (i) it will

terminate at such time as (A) such Subsidiary shall no longer have in effect a Guarantee of the Senior Notes or of any other Debt of the Company or the Parent (other than Debt under this Agreement) in an aggregate outstanding principal amount

that exceeds $75,000,000 and (B) no Default or Event of Default shall have occurred and be continuing, and (ii) it will terminate if such Subsidiary ceases to be a Subsidiary of the Parent as the result of a transaction not prohibited

hereby. Notwithstanding any provision hereof to the contrary, this Section 6.14(b) shall not apply to any Subsidiary with respect to which, in the reasonable judgment of the Administrative Agent and the Company, the cost or other

consequences of causing such Subsidiary to deliver such a Guarantee would be excessive in view of the benefits to be obtained by the Lenders therefrom.”

SECTION 2. Representations and Warranties. The Company hereby represents and warrants to the Administrative Agent and the Lenders that:

(a) (i) the execution, delivery and performance of this Amendment, and of the Credit Agreement as amended hereby, by

the Company have been duly authorized by all corporate and stockholder action required to be obtained by the Company, (ii) this Amendment has been duly executed and delivered by the Company and (iii) the Credit Agreement, as amended

hereby, constitutes the legal, valid and binding obligation of the Company and the other Loan Parties party thereto, enforceable against the Company and such Loan Parties in accordance with its terms, except as enforceability may be limited by

bankruptcy, insolvency, moratorium, reorganization or other similar laws affecting

creditors’ rights generally and except as enforceability may be limited by general principles of equity (regardless of whether such enforceability is considered in a proceeding in equity or

at law);

(b) on and as of the Effective Date, no Default or Event of Default has occurred and is continuing; and

(c) on and as of the Effective Date and after giving effect to this Amendment, the representations and warranties of the

Company set forth in the Credit Agreement are true and correct in all material respects, except to the extent such representations and warranties expressly relate to an earlier date; provided that any representation and warranty that is

qualified as to “materiality”, “Material Adverse Effect” or similar language shall be true and correct (after giving effect to any qualification therein) in all respects on such respective dates.

SECTION 3. Effectiveness. This Amendment shall become effective on the date (the “Effective Date”) on which the

Administrative Agent shall have received counterparts hereof duly executed and delivered by the Company, Parent, Swiss Parent and Lenders constituting the Required Lenders.

The Administrative Agent shall notify the Company and the Lenders of the Effective Date, and such notice shall be conclusive and binding.

SECTION 4. Amendment Fee. In consideration of the Lenders’ agreements set forth herein, the Company agrees to pay to the

Administrative Agent, for the account of each Consenting Lender (as defined below), an amendment fee (the “Amendment Fee”) in an amount equal to 2.5 basis points (0.025%) of the amount of such Lender’s Commitment as in effect

at the time this Amendment becomes effective on the Effective Date. The Amendment Fee shall be fully-earned as of the Effective Date, payable on the first Business Day after the Effective Date and non-refundable. As used herein, “Consenting

Lender” means a Lender that executes and delivers to the Administrative Agent a signature page to this Amendment prior to 11:59 p.m. New York City time on August 28, 2015.

SECTION 5. Applicable Law. THIS AMENDMENT AND ANY CLAIM, CONTROVERSY, DISPUTE OR CAUSE OF ACTION (WHETHER IN CONTRACT OR TORT OR

OTHERWISE) BASED UPON, ARISING OUT OF OR RELATING TO THIS AMENDMENT AND THE TRANSACTIONS CONTEMPLATED HEREBY SHALL BE GOVERNED BY, AND CONSTRUED IN ACCORDANCE WITH, THE LAW OF THE STATE OF NEW YORK.

SECTION 6. Counterparts. This Amendment may be executed in two or more counterparts, each of which shall constitute an original but all

of which when taken together shall constitute but one contract. Delivery of an executed counterpart of a signature page of this Amendment by facsimile or electronic transmission shall be effective as delivery of a manually executed counterpart of

this Amendment.

SECTION 7. Expenses. The Company agrees to reimburse the Administrative Agent for all reasonable and documented

out-of-pocket expenses incurred by it in connection

with this Amendment, including the reasonable fees, charges and disbursements of Cravath, Swaine & Moore LLP.

SECTION 8. No Other Amendments; Confirmation. Except as expressly set forth herein, this Amendment shall not by implication or

otherwise limit, impair, constitute an amendment of or otherwise affect the rights and remedies of the Lenders or the Administrative Agent under the Credit Agreement, and shall not alter, modify, amend or in any way affect any of the terms,

conditions, obligations, guarantees, covenants or agreements contained in the Credit Agreement, all of which are ratified and affirmed in all respects and shall continue in full force and effect. Nothing herein shall be deemed to entitle the Company

to a consent to, or an amendment, modification or other change of, any of the terms, conditions, obligations, covenants or agreements contained in the Credit Agreement in similar or different circumstances. This Amendment shall apply and be

effective only with respect to the provisions of the Credit Agreement specifically referred to herein and shall constitute a Loan Document.

SECTION 9. Headings. The Section headings of this Amendment are for purposes of reference only and shall not limit or otherwise affect

the meaning hereof.

[Remainder of page intentionally left blank]

IN WITNESS WHEREOF, the parties hereto have caused this Amendment to be duly executed by their

respective authorized officers as of the day and year first above written.

|

|

|

|

|

|

|

| PENTAIR FINANCE S.A., |

|

|

|

|

|

by |

|

/s/ Benjamin Peric |

|

|

|

|

Name: |

|

Benjamin Peric |

|

|

|

|

Title: |

|

Director |

|

| PENTAIR PLC, |

|

|

|

|

|

by |

|

/s/ Christopher Rush Oster |

|

|

|

|

Name: |

|

Christopher Rush Oster |

|

|

|

|

Title: |

|

Authorized Signatory |

|

| PENTAIR INVESTMENTS SWITZERLAND GmbH, |

|

|

|

|

|

by |

|

/s/ Henning Wistorf |

|

|

|

|

Name: |

|

Henning Wistorf |

|

|

|

|

Title: |

|

Managing Director |

|

|

|

|

|

by |

|

/s/ Irena Kulis |

|

|

|

|

Name: |

|

Irena Kulis |

|

|

|

|

Title: |

|

Authorized Signatory |

|

| BANK OF AMERICA, N.A., as Administrative Agent, |

|

|

|

|

|

by |

|

/s/ Anthea Del Bianco |

|

|

|

|

Name: |

|

Anthea Del Bianco |

|

|

|

|

Title: |

|

Vice President |

First Amendment

|

|

|

|

|

|

|

| BANK OF AMERICA MERRILL LYNCH INTERNATIONAL LIMITED, as Euro Swing Line Lender, |

|

|

|

|

|

by |

|

/s/ Gary Saint |

|

|

|

|

Name: |

|

Gary Saint |

|

|

|

|

Title: |

|

Director |

First Amendment

SIGNATURE PAGE TO

FIRST AMENDMENT TO THE AMENDED AND

RESTATED CREDIT AGREEMENT OF PENTAIR

FINANCE S.A.

|

|

|

|

|

|

|

| Name of Lender: Bank of America, N.A. |

|

|

|

|

|

by |

|

/s/ Christopher Wozniak |

|

|

|

|

Name: |

|

Christopher Wozniak |

|

|

|

|

Title: |

|

Vice President |

First Amendment

SIGNATURE PAGE TO

FIRST AMENDMENT TO THE AMENDED AND

RESTATED CREDIT AGREEMENT OF PENTAIR

FINANCE S.A.

|

|

|

|

|

|

|

| U.S. BANK NATIONAL ASSOCIATION, as US Swing Line Lender, |

|

|

|

|

|

by |

|

/s/ Edward B. Hanson |

|

|

|

|

Name: |

|

Edward B. Hanson |

|

|

|

|

Title: |

|

Vice President |

First Amendment

SIGNATURE PAGE TO

FIRST AMENDMENT TO THE AMENDED AND

RESTATED CREDIT AGREEMENT OF PENTAIR

FINANCE S.A.

|

|

|

|

|

|

|

| Name of Lender: U.S. Bank National Association |

|

|

|

|

|

by |

|

/s/ Edward B. Hanson |

|

|

|

|

Name: |

|

Edward B. Hanson |

|

|

|

|

Title: |

|

Vice President |

First Amendment

SIGNATURE PAGE TO

FIRST AMENDMENT TO THE AMENDED AND

RESTATED CREDIT AGREEMENT OF PENTAIR

FINANCE S.A.

|

|

|

|

|

|

|

| Name of Lender: JPMORGAN CHASE BANK, N.A. |

|

|

|

|

|

by |

|

/s/ Suzanne Ergastolo |

|

|

|

|

Name: |

|

Suzanne Ergastolo |

|

|

|

|

Title: |

|

Vice President |

First Amendment

SIGNATURE PAGE TO

FIRST AMENDMENT TO THE AMENDED AND

RESTATED CREDIT AGREEMENT OF PENTAIR

FINANCE S.A.

|

|

|

|

|

|

|

| CITIBANK, N.A., Individually and as Issuing Bank, |

|

|

|

|

|

by |

|

/s/ Richard Rivera |

|

|

|

|

Name: |

|

Richard Rivera |

|

|

|

|

Title: |

|

Vice President |

First Amendment

SIGNATURE PAGE TO

FIRST AMENDMENT TO THE AMENDED AND

RESTATED CREDIT AGREEMENT OF PENTAIR

FINANCE S.A.

|

|

|

|

|

|

|

| Name of Lender: The Bank of Tokyo-Mitsubishi UFJ, Ltd., |

|

|

|

|

|

by |

|

/s/ Mark Maloney |

|

|

|

|

Name: |

|

Mark Maloney |

|

|

|

|

Title: |

|

Authorized Signatory |

|

|

|

|

|

by1 |

|

|

|

|

|

|

Name: |

|

|

|

|

|

|

Title: |

|

|

| 1 |

For any Lender requiring a second signature line. |

First Amendment

SIGNATURE PAGE TO

FIRST AMENDMENT TO THE AMENDED AND

RESTATED CREDIT AGREEMENT OF PENTAIR

FINANCE S.A.

|

|

|

|

|

|

|

| Name of Lender: WELLS FARGO BANK, NATIONAL ASSOCIATION, |

|

|

|

|

|

by |

|

/s/ Keith Luettel |

|

|

|

|

Name: |

|

Keith Luettel |

|

|

|

|

Title: |

|

Vice President |

First Amendment

SIGNATURE PAGE TO

FIRST AMENDMENT TO THE AMENDED AND

RESTATED CREDIT AGREEMENT OF PENTAIR

FINANCE S.A.

|

|

|

|

|

|

|

| DEUTSCHE BANK AG NEW YORK BRANCH, as a lender, |

|

|

|

|

|

by |

|

/s/ Ming K. Chu |

|

|

|

|

Name: |

|

Ming K. Chu |

|

|

|

|

Title: |

|

Vice President |

|

|

|

|

|

by |

|

/s/ Heidi Sandquist |

|

|

|

|

Name: |

|

Heidi Sandquist |

|

|

|

|

Title: |

|

Director |

First Amendment

SIGNATURE PAGE TO

FIRST AMENDMENT TO THE AMENDED AND

RESTATED CREDIT AGREEMENT OF PENTAIR

FINANCE S.A.

|

|

|

|

|

|

|

| SANTANDER BANK, N.A., |

|

|

|

|

|

by |

|

/s/ Thomas J. Devitt |

|

|

|

|

Name: |

|

Thomas J. Devitt |

|

|

|

|

Title: |

|

Senior Vice President |

First Amendment

SIGNATURE PAGE TO

FIRST AMENDMENT TO THE AMENDED AND

RESTATED CREDIT AGREEMENT OF PENTAIR

FINANCE S.A.

|

|

|

|

|

|

|

| Name of Lender: BANCO BILBAO VIZCAYA ARGENTARIA, S.A. NEW YORK BRANCH, |

|

|

|

|

|

by |

|

/s/ Luca Sacchi |

|

|

|

|

Name: |

|

Luca Sacchi |

|

|

|

|

Title: |

|

Managing Director |

|

|

|

|

|

by1 |

|

/s/ Cristina Cignoli |

|

|

|

|

Name: |

|

Cristina Cignoli |

|

|

|

|

Title: |

|

Vice President |

| 1 |

For any Lender requiring a second signature line. |

First Amendment

SIGNATURE PAGE TO

FIRST AMENDMENT TO THE AMENDED AND

RESTATED CREDIT AGREEMENT OF PENTAIR

FINANCE S.A.

|

|

|

|

|

|

|

| Name of Lender: Bank of Montreal, London Branch, |

|

|

|

|

|

by |

|

/s/ Anthony Ebdon |

|

|

|

|

Name: |

|

Anthony Ebdon |

|

|

|

|

Title: |

|

Managing Director |

|

|

|

|

|

by1 |

|

/s/ Lisa Rodriguez |

|

|

|

|

Name: |

|

Lisa Rodriguez |

|

|

|

|

Title: |

|

Managing Director |

| 1 |

For any Lender requiring a second signature line. |

First Amendment

SIGNATURE PAGE TO

FIRST AMENDMENT TO THE AMENDED AND

RESTATED CREDIT AGREEMENT OF PENTAIR

FINANCE S.A.

|

|

|

|

|

|

|

| Name of Lender: BNP PARIBAS, |

|

|

|

|

|

by |

|

/s/ Brendan Heneghan |

|

|

|

|

Name: |

|

Brendan Heneghan |

|

|

|

|

Title: |

|

Director |

|

|

|

|

|

by1 |

|

/s/ Ade Adedeji |

|

|

|

|

Name: |

|

Ade Adedeji |

|

|

|

|

Title: |

|

Vice President |

| 1 |

For any Lender requiring a second signature line. |

First Amendment

SIGNATURE PAGE TO

FIRST AMENDMENT TO THE AMENDED AND

RESTATED CREDIT AGREEMENT OF PENTAIR

FINANCE S.A.

|

|

|

|

|

|

|

| Name of Lender: ING Bank N.V., Dublin Branch, |

|

|

|

|

|

by |

|

/s/ Sean Hassett |

|

|

|

|

Name: |

|

Sean Hassett |

|

|

|

|

Title: |

|

Director |

|

|

|

|

|

by |

|

/s/ Shaun Hawley |

|

|

|

|

Name: |

|

Shaun Hawley |

|

|

|

|

Title: |

|

Vice President |

First Amendment

SIGNATURE PAGE TO

FIRST AMENDMENT TO THE AMENDED AND

RESTATED CREDIT AGREEMENT OF PENTAIR

FINANCE S.A.

|

|

|

|

|

|

|

| Name of Lender: Australia and New Zealand Banking Group Limited, |

|

|

|

|

|

by |

|

/s/ Robert Grillo |

|

|

|

|

Name: |

|

Robert Grillo |

|

|

|

|

Title: |

|

Director |

First Amendment

SIGNATURE PAGE TO

FIRST AMENDMENT TO THE AMENDED AND

RESTATED CREDIT AGREEMENT OF PENTAIR

FINANCE S.A.

|

|

|

|

|

|

|

| Name of Lender: Bank of China, Los Angeles Branch, |

|

|

|

|

|

by |

|

/s/ Ruisong Zhao |

|

|

|

|

Name: |

|

Ruisong Zhao |

|

|

|

|

Title: |

|

Senior Vice President and Branch Manager |

|

|

|

|

|

by1 |

|

|

|

|

|

|

Name: |

|

|

|

|

|

|

Title: |

|

|

| 1 |

For any Lender requiring a second signature line. |

First Amendment

SIGNATURE PAGE TO

FIRST AMENDMENT TO THE AMENDED AND

RESTATED CREDIT AGREEMENT OF PENTAIR

FINANCE S.A.

|

|

|

|

|

|

|

| BARCLAYS BANK PLC, |

|

|

|

|

|

by |

|

/s/ Marguerite Sutton |

|

|

|

|

Name: |

|

Marguerite Sutton |

|

|

|

|

Title: |

|

Vice President |

First Amendment

SIGNATURE PAGE TO

FIRST AMENDMENT TO THE AMENDED AND

RESTATED CREDIT AGREEMENT OF PENTAIR

FINANCE S.A.

|

|

|

|

|

|

|

| Name of Lender: The Northern Trust Company, |

|

|

|

|

|

by |

|

/s/ Molly Drennan |

|

|

|

|

Name: |

|

Molly Drennan |

|

|

|

|

Title: |

|

Senior Vice President |

|

|

|

|

|

by1 |

|

|

|

|

|

|

Name: |

|

|

|

|

|

|

Title: |

|

|

| 1 |

For any Lender requiring a second signature line. |

First Amendment

SIGNATURE PAGE TO

FIRST AMENDMENT TO THE AMENDED AND

RESTATED CREDIT AGREEMENT OF PENTAIR

FINANCE S.A.

|

|

|

|

|

|

|

| Name of Lender: PNC Bank, National Association, |

|

|

|

|

|

by |

|

/s/ Michael Cortese |

|

|

|

|

Name: |

|

Michael Cortese |

|

|

|

|

Title: |

|

Vice President |

First Amendment

SIGNATURE PAGE TO

FIRST AMENDMENT TO THE AMENDED AND

RESTATED CREDIT AGREEMENT OF PENTAIR

FINANCE S.A.

|

|

|

|

|

|

|

| Name of Lender: Sumitomo Mitsui Banking Corporation, |

|

|

|

|

|

by |

|

/s/ James D. Weinstein |

|

|

|

|

Name: |

|

James D. Weinstein |

|

|

|

|

Title: |

|

Managing Director |

First Amendment

Exhibit 4.2

EXECUTION VERSION

SECOND

AMENDMENT dated as of September 2, 2015 (this “Amendment”), to the AMENDED AND RESTATED CREDIT AGREEMENT dated as of October 3, 2014, as amended by the First Amendment dated as of August 28, 2015 (the “Credit

Agreement”), among PENTAIR FINANCE S.A., a public limited liability company (société anonyme) incorporated under the laws of Luxembourg, with its registered office at 26, boulevard Royal L-2449 Luxembourg and registered with

the Luxembourg trade and companies register under number B 166.305 (the “Company”), PENTAIR PLC, an Irish public limited company (the “Parent”), PENTAIR INVESTMENTS SWITZERLAND GmbH, a Swiss Gesellschaft mit

beschränkter Haftung (the “Swiss Parent”), the LENDERS from time to time party thereto, and BANK OF AMERICA, N.A., as administrative agent for the Lenders (the “Administrative Agent”).

The Company has requested that the Lenders agree, and the Lenders whose signatures appear below have agreed, to amend the Credit Agreement on

the terms and subject to the conditions set forth herein. Accordingly, in consideration of the agreements herein contained and other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the parties hereto

hereby agree as follows:

SECTION 1. Definitions. Each capitalized definitional term used but not otherwise defined herein has the

meaning assigned to it in the Credit Agreement as amended hereby. For purposes of this Amendment:

“Existing

Lender” means each Person that is a Lender immediately prior to the effectiveness of this Amendment.

“Increasing Lender” means any Lender the Commitment of which will increase as a result of the effectiveness of

this Amendment.

“New Lender” means any financial institution party hereto not a Lender immediately prior

to the effectiveness of this Amendment that will become a Lender as a result of the effectiveness of this Amendment.

SECTION 2.

Amendment. The Credit Agreement is hereby amended, effective as of the Effective Date (as defined in Section 3 below), as follows:

(a) The definition of “Aggregate Commitments” is amended by deleting the amount “US$2,100,000,000” and

inserting in its place “US$2,500,000,000”.

(b) Schedule 2.1 to the Credit Agreement (“Commitments and Pro

Rata Shares”) is replaced by Schedule 2.1 hereto.

(c) The definition of “EBITDA” in Section 1.1 is

amended by deleting the word “and” immediately before clause “(e)” and inserting the following immediately after clause (e):

“and (f) in addition to (but without duplication of) the fees, costs and expenses referred to in clause

(d) above, any fees, costs and expenses, in an aggregate amount not to exceed $50,000,000, incurred in connection with the ERICO Acquisition and any related incurrence, issuance, repayment or refinancing of Debt”

(d) The definition of “Interest Period” in Section 1.1 is amended by replacing the phrase “one, three or

six months thereafter” with the phrase “one week, one month, three months or six months thereafter”.

SECTION 3. Effective Date Transactions. On the Effective Date:

(a) Each financial institution party hereto that is not a party to the Credit Agreement immediately prior to the effectiveness

of this Amendment will become, and acquire all the rights and obligations of, a “Lender” for all purposes of the Credit Agreement with the Commitment set forth opposite its name in Schedule 2.1 hereto, and will have a participating

interest in each outstanding Swing Line Loan, and in the undrawn amount of each outstanding Letter of Credit, equal to its Pro Rata Share thereof.

(b) In the event that any Committed Loans, L/C Borrowings or funded participations in Swing Line Loans shall be outstanding on

the Effective Date, (i) each Lender shall transfer to the Administrative Agent in same day funds an amount equal to the excess, if any, of (A) its Pro Rata Share (based on its Commitment after giving effect to this Amendment) of the

aggregate outstanding Committed Loans, L/C Borrowings and funded participations in Swing Line Loans over (B) the aggregate amount of its Committed Loans, L/C Borrowings and funded participations in Swing Line Loans immediately prior to the

effectiveness of this Amendment; (ii) the Administrative Agent will apply the funds received from Lenders pursuant to the preceding clause (i) to pay to each other Lender an amount equal to the excess of (A) the aggregate amount of

its Committed Loans, L/C Borrowings and funded participations in Swing Line Loans immediately prior to the effectiveness of this Amendment over (B) its Pro Rata Share (based on its Commitment after giving effect to this Amendment) of the

aggregate outstanding Committed Loans, L/C Borrowings and funded participations in Swing Line Loans, and the amounts so paid to each such other Lender will be applied to reduce the principal amounts of the Committed Loans, L/C Borrowings and funded

participations in Swing Line Loans of such Lender; and (iii) the Borrowers will pay (A) to the Administrative Agent, for the accounts of the Lenders, all interest and fees accrued under the Credit Agreement to the Effective Date (and the

Administrative Agent shall pay the amounts so received to the Lenders as their interests may appear) and (B) to each Lender referred to in clause (ii) above, the amount of any funding losses for which it demands compensation pursuant to

Section 3.5 of the Credit Agreement (and, solely for purposes of determining such amounts, the payment received by each such Lender in respect of its Committed Loans will be deemed to be a prepayment of such Loans on the Effective Date).

SECTION 4. Representations and Warranties. The Company and the Guarantors, as applicable, hereby represents and warrants to the

Administrative Agent and the Lenders (including the parties hereto that will become Lenders on the Effective Date) that:

(a) (i) the execution, delivery and performance of this Amendment, and of the Credit Agreement as amended hereby, by the

Company and the Guarantors have been duly authorized by all required corporate and stockholder action, (ii) this Amendment has been duly executed and delivered by the Company and the Guarantors and (iii) the Credit Agreement, as amended

hereby, constitutes the legal, valid and binding obligation of the Loan Parties, enforceable against the Loan Parties in accordance with its terms, except as enforceability may be limited by bankruptcy, insolvency, moratorium, reorganization or

other similar laws affecting creditors’ rights generally and except as enforceability may be limited by general principles of equity (regardless of whether such enforceability is considered in a proceeding in equity or at law);

2

(b) on and as of the Effective Date, no Default or Event of Default has occurred

and is continuing; and

(c) on and as of the Effective Date and after giving effect to this Amendment, the representations

and warranties of the Loan Parties set forth in the Credit Agreement are true and correct in all material respects, except to the extent such representations and warranties expressly relate to an earlier date; provided that any representation

and warranty that is qualified as to “materiality”, “Material Adverse Effect” or similar language shall be true and correct (after giving effect to any qualification therein) in all respects on such respective dates.

SECTION 5. Effectiveness. This Amendment shall become effective on the date (the “Effective Date”) on which each of

the following conditions is satisfied:

(a) The Administrative Agent shall have received counterparts hereof duly executed

and delivered by the Company, each Guarantor, each Increasing Lender, each New Lender and Existing Lenders constituting at least the Required Lenders (based on the Commitments in effect immediately prior to the effectiveness of this Amendment), and

the Administrative Agent shall have acknowledged this Amendment.

(b) The Administrative Agent shall have received such

documents and certificates as the Administrative Agent or its counsel may reasonably request relating to the organization, existence and good standing of the Company and each other Loan Party, the authorization of the transactions contemplated

hereby and any other legal matters relating to the Loan Parties or such transactions, all in form and substance reasonably satisfactory to the Administrative Agent and its counsel.

(c) The Administrative Agent shall have received a favorable written opinion (addressed to the Administrative Agent, the

Lenders and the Issuing Banks and dated the Effective Date) of each of (i) Angela D. Lageson, Senior Vice President and General Counsel of the Company, (ii) Foley & Lardner LLP, New York counsel for the Loan Parties, and

(iii) Allen & Overy société en commandite simple, Luxembourg counsel for the Company, in each case in a form reasonably satisfactory to the Administrative Agent and covering such matters relating to this Amendment,

the Credit Agreement as amended hereby and the transactions contemplated hereby as the Administrative Agent or the Required Lenders shall reasonably request. Each Loan Party hereby requests such counsel to deliver such opinions.

3

(d) The Administrative Agent shall have received a certificate of a Financial

Officer of Parent confirming the accuracy of the representations and warranties set forth in Section 4(b) and 4(c).

(e) The Administrative Agent shall have received reimbursement or payment of all out-of-pocket expenses required to be

reimbursed or paid by the Company under Section 9, to the extent invoiced to the Company at least two Business Days prior to the Effective Date.

The

Administrative Agent shall notify the Company and the Lenders of the Effective Date, and such notice shall be conclusive and binding.

SECTION 6. Fees for Increased Commitments. In consideration of the increased Commitments provided for herein, the Company agrees to pay

to the Administrative Agent, for the account of each Increasing Lender and New Lender, an upfront fee equal to 0.125% of the amount by which the Commitment of such Increasing Lender or New Lender immediately after the effectiveness of this Amendment

exceeds its Commitment (if any) immediately prior to such effectiveness.

SECTION 7. Applicable Law. THIS AMENDMENT AND ANY

CLAIM, CONTROVERSY, DISPUTE OR CAUSE OF ACTION (WHETHER IN CONTRACT OR TORT OR OTHERWISE) BASED UPON, ARISING OUT OF OR RELATING TO THIS AMENDMENT AND THE TRANSACTIONS CONTEMPLATED HEREBY SHALL BE GOVERNED BY, AND CONSTRUED IN ACCORDANCE WITH, THE

LAW OF THE STATE OF NEW YORK.

SECTION 8. Counterparts. This Amendment may be executed in two or more counterparts, each of

which shall constitute an original but all of which when taken together shall constitute but one contract. Delivery of an executed counterpart of a signature page of this Amendment by facsimile or electronic transmission shall be effective as

delivery of a manually executed counterpart of this Amendment.

SECTION 9. Expenses. The Company agrees to reimburse the

Administrative Agent for all reasonable and documented out-of-pocket expenses incurred by it in connection with this Amendment, including the reasonable fees, charges and disbursements of Cravath, Swaine & Moore LLP.

SECTION 10. No Other Amendments; Confirmation. Except as expressly set forth herein, this Amendment shall not by implication or

otherwise limit, impair, constitute an amendment of or otherwise affect the rights and remedies of the Lenders or the Administrative Agent under the Credit Agreement, and shall not alter, modify, amend or in any way affect any of the terms,

conditions, obligations, covenants or agreements contained in the Credit Agreement, all of which are ratified and affirmed in all respects and shall continue in full force and effect. Nothing herein shall be deemed to entitle the Loan Parties to a

consent to, or an amendment, modification or other change of, any of the terms, conditions, obligations, covenants

4

or agreements contained in the Credit Agreement in similar or different circumstances. This Amendment shall constitute a “Loan Document” for all purposes of the Credit Agreement, and

the representations and warranties set forth herein shall be deemed for all purposes to be representations and warranties in the Credit Agreement. This Amendment shall apply and be effective only with respect to the provisions of the Credit

Agreement specifically referred to herein and shall constitute a Loan Document.

SECTION 11. Reaffirmation. By executing this

Amendment, each Guarantor reaffirms its Guarantee under Article X of the Credit Agreement and agrees that it will apply to the obligations of the Borrowers under the Credit Agreement as amended hereby.

SECTION 12. Headings. The Section headings of this Amendment are for purposes of reference only and shall not limit or otherwise affect

the meaning hereof.

[Remainder of page intentionally left blank]

5

IN WITNESS WHEREOF, the parties hereto have caused this Amendment to be duly executed by their

respective authorized officers as of the day and year first above written.

|

|

|

|

|

|

|

| PENTAIR FINANCE S.A., |

|

|

|

|

|

by |

|

/s/ Benjamin Peric |

|

|

|

|

Name: |

|

Benjamin Peric |

|

|

|

|

Title: |

|

Director |

|

|

|

|

|

|

|

| PENTAIR PLC, |

|

|

|

|

|

by |

|

/s/ Christopher Rush Oster |

|

|

|

|

Name: |

|

Christopher Rush Oster |

|

|

|

|

Title: |

|

Authorized Signatory |

|

|

|

|

|

|

|

| PENTAIR INVESTMENTS SWITZERLAND GmbH, |

|

|

|

|

|

by |

|

/s/ Henning Wistorf |

|

|

|

|

Name: |

|

Henning Wistorf |

|

|

|

|

Title: |

|

Managing Director |

|

|

|

|

|

by |

|

/s/ Irena Kulis |

|

|

|

|

Name: |

|

Irena Kulis |

|

|

|

|

Title: |

|

Authorized Signatory |

|

|

|

|

|

|

|

| BANK OF AMERICA, N.A., individually and as Administrative Agent and Issuing Bank, |

|

|

|

|

|

by |

|

/s/ Christopher Wozniak |

|

|

|

|

Name: |

|

Christopher Wozniak |

|

|

|

|

Title: |

|

Vice President |

Second Amendment

|

|

|

|

|

|

|

| BANK OF AMERICA MERRILL LYNCH INTERNATIONAL LIMITED, as Euro Swing Line Lender, |

|

|

|

|

|

by |

|

/s/ Gary Saint |

|

|

|

|

Name: |

|

Gary Saint |

|

|

|

|

Title: |

|

Director |

|

|

|

|

|

|

|

| JPMORGAN CHASE BANK, N.A., individually and as Issuing Bank, |

|

|

|

|

|

by |

|

/s/ Suzanne Ergastolo |

|

|

|

|

Name: |

|

Suzanne Ergastolo |

|

|

|

|

Title: |

|

Vice President |

|

|

|

|

|

|

|

| CITIBANK, N.A., individually and as Issuing Bank, |

|

|

|

|

|

by |

|

/s/ Susan M. Olsen |

|

|

|

|

Name: |

|

Susan M. Olsen |

|

|

|

|

Title: |

|

Vice President |

|

|

|

|

|

|

|

| U.S BANK NATIONAL ASSOCIATION, individually and as US Swing Line Lender and Issuing Bank, |

|

|

|

|

|

by |

|

/s/ Edward B. Hanson |

|

|

|

|

Name: |

|

Edward B. Hanson |

|

|

|

|

Title: |

|

Vice President |

Second Amendment

|

|

|

|

|

|

|

| THE BANK OF TOKYO-MITSUBISHI UFJ, LTD., individually and as Issuing Bank, |

|

|

|

|

|

by |

|

/s/ Mark Maloney |

|

|

|

|

Name: |

|

Mark Maloney |

|

|

|

|

Title: |

|

Authorized Signatory |

Second Amendment

SIGNATURE PAGE TO

SECOND AMENDMENT TO THE AMENDED AND

RESTATED CREDIT AGREEMENT OF PENTAIR

FINANCE S.A.

|

|

|

|

|

|

|

| Name of Lender: |

|

|

|

|

|

By: |

|

HSBC Bank USA, N.A. |

|

|

|

|

|

|

|

/s/ Fik Durmus |

|

|

|

|

Name: |

|

Fik Durmus |

|

|

|

|

Title: |

|

Senior Vice President |

Second Amendment

SIGNATURE PAGE TO

SECOND AMENDMENT TO THE AMENDED AND

RESTATED CREDIT AGREEMENT OF PENTAIR

FINANCE S.A.

|

|

|

|

|

|

|

| Name of Lender: WELLS FARGO BANK, NATIONAL ASSOCIATION |

|

|

|

|

|

by |

|

/s/ Keith Luettel |

|

|

|

|

Name: |

|

Keith Luettel |

|

|

|

|

Title: |

|

Vice President |

Second Amendment

SIGNATURE PAGE TO

SECOND AMENDMENT TO THE AMENDED AND

RESTATED CREDIT AGREEMENT OF PENTAIR

FINANCE S.A.

|

|

|

|

|

|

|

| DEUTSCHE BANK AG NEW YORK BRANCH, as a lender |

|

|

|

|

|

by |

|

/s/ Ming K. Chu |

|

|

|

|

Name: |

|

Ming K. Chu |

|

|

|

|

Title: |

|

Vice President |

|

|

|

|

|

by |

|

/s/ Heidi Sandquist |

|

|

|

|

Name: |

|

Heidi Sandquist |

|

|

|

|

Title: |

|

Director |

Second Amendment

SIGNATURE PAGE TO

SECOND AMENDMENT TO THE AMENDED AND

RESTATED CREDIT AGREEMENT OF PENTAIR

FINANCE S.A.

|

|

|

|

|

|

|

| SANTANDER BANK, N.A.: |

|

|

|

|

|

by |

|

/s/ Thomas J. Devitt |

|

|

|

|

Name: |

|

Thomas J. Devitt |

|

|

|

|

Title: |

|

Senior Vice President |

Second Amendment

SIGNATURE PAGE TO

SECOND AMENDMENT TO THE AMENDED AND

RESTATED CREDIT AGREEMENT OF PENTAIR

FINANCE S.A.

|

|

|

|

|

|

|

| Name of Lender: BANCO BILBAO VIZCAYA ARGENTARIA, S.A. NEW YORK BRANCH |

|

|

|

|

|

by |

|

/s/ Luca Sacchi |

|

|

|

|

Name: |

|

Luca Sacchi |

|

|

|

|

Title: |

|

Managing Director |

|

|

|

|

|

by1 |

|

/s/ Cristina Cignoli |

|

|

|

|

Name: |

|

Cristina Cignoli |

|

|

|

|

Title: |

|

Vice President |

| 1 |

For any Lender requiring a second signature line. |

Second Amendment

SIGNATURE PAGE TO

SECOND AMENDMENT TO THE AMENDED AND

RESTATED CREDIT AGREEMENT OF PENTAIR

FINANCE S.A.

|

|

|

|

|

|

|

| Name of Lender: Bank of Montreal, London Branch |

|

|

|

|

|

by |

|

/s/ Anthony Ebdon |

|

|

|

|

Name: |

|

Anthony Ebdon |

|

|

|

|

Title: |

|

Managing Director |

|

|

|

|

|

by1 |

|

/s/ Lisa Rodriguez |

|

|

|

|

Name: |

|

Lisa Rodriguez |

|

|

|

|

Title: |

|

Managing Director |

| 1 |

For any Lender requiring a second signature line. |

Second Amendment

SIGNATURE PAGE TO

SECOND AMENDMENT TO THE AMENDED AND

RESTATED CREDIT AGREEMENT OF PENTAIR

FINANCE S.A.

|

|

|

|

|

|

|

| Name of Lender: BNP PARIBAS |

|

|

|

|

|

by |

|

/s/ Brendan Heneghan |

|

|

|

|

Name: |

|

Brendan Heneghan |

|

|

|

|

Title: |

|

Director |

|

|

|

|

|

by1 |

|

/s/ Ade Adedeji |

|

|

|

|

Name: |

|

Ade Adedeji |

|

|

|

|

Title: |

|

Vice President |

| 1 |

For any Lender requiring a second signature line. |

Second Amendment

SIGNATURE PAGE TO

SECOND AMENDMENT TO THE AMENDED AND

RESTATED CREDIT AGREEMENT OF PENTAIR

FINANCE S.A.

|

|

|

|

|

|

|

| Name of Lender: ING Bank N.V., Dublin Branch |

|

|

|

|

|

by |

|

/s/ Sean Hassett |

|

|

|

|

Name: |

|

Sean Hassett |

|

|

|

|

Title: |

|

Director |

|

|

|

|

|

by |

|

/s/ Shaun Hawley |

|

|

|

|

Name: |

|

Shaun Hawley |

|

|

|

|

Title: |

|

Vice President |

Second Amendment

SIGNATURE PAGE TO

SECOND AMENDMENT TO THE AMENDED AND

RESTATED CREDIT AGREEMENT OF PENTAIR

FINANCE S.A.

|

|

|

|

|

|

|

| Name of Lender: Australia and New Zealand Banking Group Limited |

|

|

|

|

|

by |

|

/s/ Robert Grillo |

|

|

|

|

Name: |

|

Robert Grillo |

|

|

|

|

Title: |

|

Director |

Second Amendment

SIGNATURE PAGE TO

SECOND AMENDMENT TO THE AMENDED AND

RESTATED CREDIT AGREEMENT OF PENTAIR

FINANCE S.A.

|

|

|

|

|

|

|

| Name of Lender: Bank of China, Los Angeles Branch |

|

|

|

|

|

by |

|

/s/ Ruisong Zhao |

|

|

|

|

Name: |

|

Ruisong Zhao |

|

|

|

|

Title: |

|

Senior Vice President and Branch Manager |

|

|

|

|

|

by1 |

|

|

|

|

|

|

Name: |

|

|

|

|

|

|

Title: |

|

|

| 1 |

For any Lender requiring a second signature line. |

Second Amendment

SIGNATURE PAGE TO

SECOND AMENDMENT TO THE AMENDED AND

RESTATED CREDIT AGREEMENT OF PENTAIR

FINANCE S.A.

|

|

|

|

|

|

|

| BARCLAYS BANK PLC: |

|

|

|

|

|

by |

|

/s/ Marguerite Sutton |

|

|

|

|

Name: |

|

Marguerite Sutton |

|

|

|

|

Title: |

|

Vice President |

Second Amendment

SIGNATURE PAGE TO

SECOND AMENDMENT TO THE AMENDED AND

RESTATED CREDIT AGREEMENT OF PENTAIR

FINANCE S.A.

|

|

|

|

|

|

|

| Name of Lender: INTESA SANPAOLO S.p.A. |

|

|

|

|

|

by |

|

/s/ Manuela Insana |

|

|

|

|

Name: |

|

Manuela Insana |

|

|

|

|

Title: |

|

Vice President |

|

|

|

|

|

by1 |

|

/s/ Francesco Di Mario |

|

|

|

|

Name: |

|

Francesco Di Mario |

|

|

|

|

Title: |

|

First Vice President |

| 1 |

For any Lender requiring a second signature line. |

Second Amendment

SIGNATURE PAGE TO

SECOND AMENDMENT TO THE AMENDED AND

RESTATED CREDIT AGREEMENT OF PENTAIR

FINANCE S.A.

|

|

|

|

|

|

|

| Name of Lender: The Northern Trust Company |

|

|

|

|

|

by |

|

/s/ Molly Drennan |

|

|

|

|

Name: |

|

Molly Drennan |

|

|

|

|

Title: |

|

Senior Vice President |

|

|

|

|

|

by1 |

|

|

|

|

|

|

Name: |

|

|

|

|

|

|

Title: |

|

|

| 1 |

For any Lender requiring a second signature line. |

Second Amendment

SIGNATURE PAGE TO

SECOND AMENDMENT TO THE AMENDED AND

RESTATED CREDIT AGREEMENT OF PENTAIR

FINANCE S.A.

|

|

|

|

|

|

|

| Name of Lender: PNC Bank, National Association |

|

|

|

|

|

by |

|

/s/ Michael Cortese |

|

|

|

|

Name: |

|

Michael Cortese |

|

|

|

|

Title: |

|

Vice President |

Second Amendment

SIGNATURE PAGE TO

SECOND AMENDMENT TO THE AMENDED AND

RESTATED CREDIT AGREEMENT OF PENTAIR

FINANCE S.A.

|

|

|

|

|

|

|

| Name of Lender: Sumitomo Mitsui Banking Corporation |

|

|

|

|

|

by |

|

/s/ James D. Weinstein |

|

|

|

|

Name: |

|

James D. Weinstein |

|

|

|

|

Title: |

|

Managing Director |

Second Amendment

Schedule 2.1

|

|

|

|

|

|

|

|

|

| Lender |

|

Commitment |

|

|

Pro Rata Share |

|

| Bank of America, N.A. |

|

$ |

242,000,000 |

|

|

|

9.7 |

% |

| JPMorgan Chase, N.A. |

|

$ |

242,000,000 |

|

|

|

9.7 |

% |

| U.S. Bank National Association |

|

$ |

242,000,000 |

|

|

|

9.7 |

% |

| Citibank, N.A. |

|

$ |

242,000,000 |

|

|

|

9.7 |

% |

| The Bank of Tokyo-Mitsubishi UFJ, Ltd. |

|

$ |

242,000,000 |

|

|

|

9.7 |

% |

| HSBC Bank USA, N.A. |

|

$ |

150,000,000 |

|

|

|

6.0 |

% |

| Wells Fargo Bank, National Association |

|

$ |

150,000,000 |

|

|

|

6.0 |

% |

| Deutsche Bank AG, New York Branch |

|

$ |

110,000,000 |

|

|

|

4.4 |

% |

| Santander Bank, N.A. |

|

$ |

110,000,000 |

|

|

|

4.4 |

% |

| Banco BilbaoVizcaya Argentaria, S.A. New York Branch |

|

$ |

90,000,000 |

|

|

|

3.6 |

% |

| Bank of Montreal, London Branch |

|

$ |

90,000,000 |

|

|

|

3.6 |

% |

| BNP Paribas |

|

$ |

90,000,000 |

|

|

|

3.6 |

% |

| ING Bank N.V., Dublin Branch |

|

$ |

90,000,000 |

|

|

|

3.6 |

% |

| Australia and New Zealand Banking Group Limited |

|

$ |

60,000,000 |

|

|

|

2.4 |

% |

| Bank of China, Los Angeles Branch |

|

$ |

60,000,000 |

|

|

|

2.4 |

% |

| Intesa Sanpaolo S.p.A., New York Branch |

|

$ |

60,000,000 |

|

|

|

2.4 |

% |

| The Northern Trust Company |

|

$ |

60,000,000 |

|

|

|

2.4 |

% |

| PNC Bank, National Association |

|

$ |

60,000,000 |

|

|

|

2.4 |

% |

| Sumitomo Mitsui Banking Corporation |

|

$ |

60,000,000 |

|

|

|

2.4 |

% |

| Barclays Bank PLC |

|

$ |

50,000,000 |

|

|

|

2.0 |

% |

|

|

|

|

|

|

|

|

|

| Total |

|

$ |

2,500,000,000 |

|

|

|

100.00 |

% |

|

|

|

|

|

|

|

|

|

Second Amendment

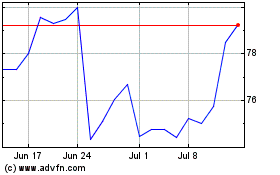

Pentair (NYSE:PNR)

Historical Stock Chart

From Mar 2024 to Apr 2024

Pentair (NYSE:PNR)

Historical Stock Chart

From Apr 2023 to Apr 2024