Current Report Filing (8-k)

August 26 2015 - 9:40AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT PURSUANT

TO SECTION 13 OR 15(D) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported): August 26, 2015

|

3M COMPANY |

|

|

(Exact Name of Registrant as Specified in Its Charter) |

|

(State or Other Jurisdiction of Incorporation)

|

|

|

|

|

File No. 1-3285 |

|

41-0417775 |

|

(Commission File Number) |

|

(IRS Employer Identification No.) |

|

|

|

|

|

3M Center, St. Paul, Minnesota |

|

55144-1000 |

|

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

(651) 733-1110 |

|

|

(Registrant’s Telephone Number, Including Area Code) |

|

|

|

|

|

(Former Name or Former Address, if Changed Since Last Report) |

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 7.01. Regulation FD Disclosure

On August 26, 2015, 3M Company (the “Company”) announced that it has completed its acquisition of the assets and liabilities associated with Polypore’s Separations Media business from Polypore International Inc. The Company also updated its 2015 earnings guidance to include the estimated impacts from the recently closed acquisitions.

Item 8.01. Other Events

On August 26, 2015, the Company issued a press release announcing completion of the acquisition and updating its 2015 earnings guidance to include the recently closed acquisitions, a copy of which is being filed herewith as Exhibit 99.1 and is incorporated by reference herein. The website and social media addresses of the Company are included in the press release as an inactive textual reference only and the information contained on these websites are not part of the press release and shall not be deemed incorporated by reference in, and should not be considered to be a part of, this Current Report on Form 8-K.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

|

Exhibit No. |

|

Description |

|

|

|

|

|

99.1 |

|

Text of the press release dated August 26, 2015 |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

Date: August 26, 2015 |

3M Company |

|

|

|

|

|

|

By: |

/s/ Gregg M. Larson |

|

|

|

Gregg M. Larson, |

|

|

|

Deputy General Counsel and Secretary |

2

Exhibit 99.1

3M Completes Acquisition of Polypore’s Separations Media Business

Company Updates 2015 Earnings Guidance to Include Recently Closed Acquisitions

ST. PAUL, Minn. – (Aug. 26, 2015) – 3M announced today that it has completed its acquisition of the assets and liabilities associated with Polypore’s Separations Media business from Polypore International Inc. for a purchase price of $1.0 billion.

Polypore’s Separations Media business is a leading provider of membranes and modules for blood treatments, ultrafiltration and gas transfer in the life science, electronic, industrial, and specialty segments. 3M is a leader in residential water, commercial foodservice, industrial and life science filtration. Adding Polypore’s Separations Media business builds on 3M’s fundamental strengths in technology, manufacturing, global capabilities, and brand. Polypore’s Separations Media business has annual global sales of approximately $210 million.

With this acquisition, 3M will be able to offer a broader array of products to customers, which will help meet customers’ emerging needs for high-value filtration solutions and accelerate the global growth of 3M’s membrane business. Polypore’s Separations Media business will become part of the 3M Membranes business unit within 3M’s Industrial Business Group.

On a GAAP reported basis, 3M estimates the Polypore Separations Media acquisition to be $0.03 per share dilutive to 2015 earnings.

3M updated its 2015 earnings guidance to include the estimated impacts from the recently closed acquisitions of Capital Safety and Polypore’s Separations Media business. The company’s previous guidance excluded the estimated impacts from these pending transactions at that time.

Including these transactions, 3M now expects full-year 2015 GAAP earnings per share to be in the range of $7.73 to $7.93 versus its previous guidance of $7.80 to $8.00. The $0.07 per share adjustment will largely be incurred in the third quarter.

About 3M

At 3M, we apply science in collaborative ways to improve lives daily. With $32 billion in sales, our 90,000 employees connect with customers all around the world. Learn more about 3M’s creative solutions to the world’s problems at www.3M.com or on Twitter @3M or @3MNewsroom.

Forward-Looking Statements

This news release contains forward-looking information about 3M’s financial results and estimates and business prospects that involve substantial risks and uncertainties. You can identify these statements by the use of words such as “anticipate,” “estimate,” “expect,” “aim,” “project,” “intend,” “plan,” “believe,” “will,” “should,” “could,” “target,” “forecast” and other words and terms of similar meaning in connection with any discussion of future operating or financial performance or business plans or prospects. Among the factors that could cause actual results to differ materially are the following: (1) worldwide economic and capital markets conditions and other factors beyond the Company’s control, including natural and other disasters affecting the operations of the Company or its customers and suppliers; (2) the Company’s credit ratings and its cost of capital; (3) competitive

conditions and customer preferences; (4) foreign currency exchange rates and fluctuations in those rates; (5) the timing and market acceptance of new product offerings; (6) the availability and cost of purchased components, compounds, raw materials and energy (including oil and natural gas and their derivatives) due to shortages, increased demand or supply interruptions (including those caused by natural and other disasters and other events); (7) the impact of acquisitions, strategic alliances, divestitures, and other unusual events resulting from portfolio management actions and other evolving business strategies, and possible organizational restructuring; (8) generating fewer productivity improvements than estimated; (9) unanticipated problems or delays with the phased implementation of a global enterprise resource planning (ERP) system, or security breaches and other disruptions to the Company’s information technology infrastructure; and (10) legal proceedings, including significant developments that could occur in the legal and regulatory proceedings described in the Company’s Annual Report on Form 10-K for the year ended December 31, 2014, and its subsequent quarterly reports on Form 10-Q (the “Reports”). Changes in such assumptions or factors could produce significantly different results. A further description of these factors is located in the Reports under “Cautionary Note Concerning Factors That May Affect Future Results” and “Risk Factors” in Part I, Items 1 and 1A (Annual Report) and in Part I, Item 2 and Part II, Item 1A (Quarterly Report). The information contained in this news release is as of the date indicated. The Company assumes no obligation to update any forward-looking statements contained in this news release as a result of new information or future events or developments.

Media Contact:

Donna Fleming Runyon, 651-736-7646

Investor Contacts:

Bruce Jermeland, 651-733-1807

Mike Kronebusch, 651-733-1141

3M (NYSE:MMM)

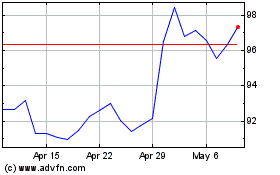

Historical Stock Chart

From Mar 2024 to Apr 2024

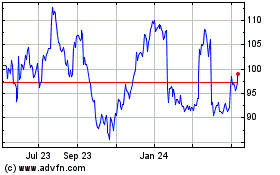

3M (NYSE:MMM)

Historical Stock Chart

From Apr 2023 to Apr 2024