UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

August 17, 2015

AMARANTUS BIOSCIENCE HOLDINGS, INC.

(Exact name of registrant as specified in

its charter)

| Nevada |

000-55016 |

26-0690857 |

(State or other jurisdiction of

incorporation or organization) |

(Commission File Number) |

IRS Employer

Identification No.) |

|

655 Montgomery Street, Suite 900

San Francisco, CA |

94111 |

| (Address of Principal Executive Offices) |

(Zip Code) |

(408) 737-2734

(Registrant’s telephone number, including

area code)

Check the appropriate box below if the

Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ | Written

communications pursuant to Rule 425 under the Securities Act |

| ¨ | Soliciting

material pursuant to Rule 14a-12 under the Exchange Act |

| ¨ | Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| Item 2.02 | Results of Operations and Financial Condition. |

On August 17, 2015, Amarantus Bioscience

Holdings, Inc. (the “Company”) issued a press release announcing financial results for the three months ended June

30, 2015 and other matters described in the press release. A copy of the Company’s press release is furnished as Exhibit 99.1

to this Current Report on Form 8-K.

The information disclosed under this Item 2.02,

including Exhibit 99.1 hereto, is being furnished and shall not be deemed “filed” for purposes of Section 18

of the Securities Exchange Act of 1934, as amended, nor shall it be incorporated by reference into any registration statement or

other document pursuant to the Securities Act of 1933, as amended, except as expressly set forth in such filing.

| Item 9.01 | Financial Statements and Exhibits. |

(d) Exhibits

Exhibit

No. |

|

Description |

| |

|

|

|

99.1

|

|

Amarantus Bioscience Holdings, Inc. Press Release,

dated August 17, 2015. |

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned

thereunto duly authorized.

| |

AMARANTUS BIOSCIENCE HOLDINGS, INC. |

| |

|

|

|

| |

|

|

|

| Date: August 17, 2015 |

By: |

/s/ Gerald E. Commissiong |

|

| |

|

Name: Gerald E. Commissiong |

|

| |

|

Title: Chief Executive Officer |

|

Exhibit 99.1

Amarantus Reports Second Quarter 2015

Financial Results and

Business Overview

SAN FRANCISCO and GENEVA, Aug. 17, 2015 (GLOBE NEWSWIRE) --

Amarantus BioScience Holdings, Inc. (AMBS),

a biotechnology company developing therapeutic and diagnostic product candidates in orphan indications and neurology, announced

financial results for the second quarter ended June 30, 2015. The Company also highlighted recent corporate and clinical development

achievements for its Therapeutics Division and its wholly-owned subsidiary, Amarantus Diagnostics, Inc.

SECOND QUARTER 2015 AND RECENT HIGHLIGHTS

Corporate

| · | Commenced

trading on the OTCQX Marketplace as part of the

path to progress to a national stock exchange listing; |

| · | Completed

a capital restructuring in order to meet share

price requirements in preparation for a national exchange listing |

Amarantus Therapeutics

| · | Engineered Skin Subsitute (ESS): Autologous full thickness skin

replacement product for severe burns |

| o | Signed a Cooperative Research

and Development Agreement (CRADA) with the U.S. Army Institute of Surgical Research and

Rutgers, The State University of New Jersey to expand the

development of ESS for the treatment of deep partial- and full-thickness burn wounds

in adult patients (ClinicalTrials.gov Identifier: NCT01655407); |

| o | Completed the acquisition

of Cutanogen Corporation from Lonza Walkersville, Inc. (Lonza), a subsidiary of Lonza

Group Ltd., thereby securing full ownership and exclusive

worldwide license to intellectual property rights associated with ESS; and |

| o | Engaged Lonza via a long-term

services agreement to manufacture ESS under Good Manufacturing

Practices for human clinical trials, and subsequent commercial distribution. |

| · | Eltoprazine: Parkinson's disease levodopa-induced dyskinesia (PD-LID),

adult ADHD, and Alzheimer's aggression |

| o | Commenced

enrollment and initiated dosing in

the Phase 2b multi-center, 60-subject, double-blind, placebo-controlled, four-way crossover,

dose range finding clinical study for the treatment of PD-LID (ClinicalTrials.gov Identifier:

NCT02439125); |

| o | Announced the publication

of data on long-term efficacy and elucidating the mechanism

of action of eltoprazine in an animal model of PD-LID; |

| o | Announced the issuance

of the U.S. patent covering proprietary methods of administration for eltoprazine

for the treatment of Parkinson's disease; |

| o | Presented data

from the Phase 1/2a clinical study of eltoprazine in PD-LID at the 19th International

Congress of Parkinson's Disease and Movement Disorders; and |

| o | Completed Phase 2b clinical

investigator meetings in both the United States and European Union. |

| · | MANF: Mesencephalic-astrocyte-derived neurotrophic factor |

| o | Announced the successful

delivery and distribution of MANF in a preclinical model

to brain areas involved in Parkinson's disease, further solidifying the rationale

for its development as a potential disease-modifying treatment for PD; |

| o | Entered into a cGMP

manufacturing agreement with Catalent Biologics for clinical-grade production of MANF

to enable program advancement into human clinical studies in retinitis pigmentosa

(RP), retinal artery occlusion and Parkinson's disease; |

| o | Presented positive preclinical

data showing MANF preserves the light-sensing function of

photoreceptor cells at the leading ophthalmology conference ARVO 2015; |

| o | Received a Notice of Allowance

for the U.S. patent application covering compositions of matter and methods of use related

to proprietary manufacturing processes for synthetic MANF

and its administration for protein therapy and cell therapy; and |

| o | Received European

Union Orphan Drug Designation (ODD) for MANF for the treatment of RP, complementing

the U.S. ODD obtained in December 2014. |

"The completion of the acquisition of Cutanogen from Lonza

this quarter is a significant milestone for Amarantus Therapeutics. ESS is a potentially revolutionary solution for the treatment

of severe burns that has demonstrated initial human proof-of-concept in an investigator-initiated setting," commented Joseph

Rubinfeld, Ph.D., member of the Amarantus Board Directors. "Our collaboration with the U.S. Army is an important part of the

expansion plan for the clinical development program of ESS. We expect to focus on the regulatory strategy for ESS in the weeks

ahead."

Amarantus Diagnostics, Inc. (a wholly owned subsidiary

of Amarantus BioScience Holdings, Inc.)

| · | Established

a Strategic Advisory Committee for Amarantus Diagnostics

comprising three seasoned, results-driven life science and healthcare industry

leaders with expertise in commercializing molecular diagnostics to focus on advancing

and deriving the full value of the company's diagnostics business. |

| · | LymPro Test(R) for the diagnosis of Alzheimer's disease

(AD) |

| o | Presented data

demonstrating that LymPro met primary and secondary endpoints in the blinded, multi-center

LP-002 clinical study that confirms LymPro's Fit-For-Purpose use in AD Clinical

Trials at the 2015 Alzheimer's Association International Conference(R); and |

| o | Advanced business development

activities with the pharmaceutical industry for Investigational Use Only (IUO) LymPro

Test biomarker services. |

| · | MSPrecise(R) for the diagnosis of multiple sclerosis

(MS) |

| o | Published data in the

Journal GENE from a clinical study demonstrating that MSPrecise

supports identification of multiple sclerosis patients with 84% accuracy and performs

well in identifying MS among a broad cohort of potential neurological diseases;

and |

| o | Reported preliminary data

from a blood-based version of MSPrecise showing it has statistically

significant sensitivity and specificity for classifying presentation of MS. |

| · | Georgetown Assays for the diagnosis of AD |

| o | Continued to explore the

potential of the emerging AD IUO blood diagnostics market through the one-year, exclusive

option agreement with Georgetown University to license patent rights for blood

based biomarkers for AD and memory loss. |

"The addition of ESS to our product portfolio adds a first-in-class

regenerative medicine platform to our pipeline. The advancement of Eltoprazine into Phase 2b clinical development represents a

significant achievement as we establish clinical and regulatory excellence at Amarantus Therapeutics," added David A. Lowe,

Ph.D., member of the Amarantus Board of Directors. "As we round out 2015 we expect to see additional momentum in our strategy

for Amarantus Diagnostics under the guidance of our newly appointed Strategic Advisory Committee tasked with realizing the full

value from our neuro-diagnostics business."

EXPECTED NEAR-TERM MILESTONES

| · | Obtain an up-listing to a national stock exchange to position the

Company for an appreciation in value and enabling the expansion of its current shareholder base; |

| · | Initiate the U.S. military study under the ESS CRADA at the first

surgical facility site; |

| · | Enroll the first patent in the Phase 2 study of ESS for the treatment

of severe burns; |

| · | Accelerate the path to commercialization for ESS by establishing a

dialogue with regulatory authorities before the end of 2015; |

| · | Announce top-line results from the ESS Phase 2 severe burn study in

2016; |

| · | Expand the eltoprazine Phase 2b program in PD-LID in Europe in 3Q

2015; |

| · | Complete patient enrollment for the ongoing Phase 2b study in 1Q 2016; |

| · | Report topline results from the Phase 2b clinical study of eltoprazine

in PD-LID in 1H 2016; |

| · | Submit an IND application for MANF for the treatment of retinitis

pigmentosa; |

| · | Continue to advance pre-clinical studies for MANF in other orphan

ophthalmological indications and Parkinson's disease; |

| · | Advance MSPrecise and the LymPro Test into CLIA validation studies

in parallel later this year in preparation for launch under CLIA designation to market to the broader medical community in the

United States; and |

| · | Execute one of the strategic options for the Amarantus Diagnostics,

including a potential sale, co-development or spin-off opportunities, to derive the significant value from the Company's premier

neuro-diagnostics business. |

"The company has evolved significantly over the course

of the past year with the expansion and advancement of our therapeutics pipeline and the continued traction towards commercialization

with Amarantus Diagnostics. This progress has been integral in enabling us to build a strong foundation for the company to advance

to our next stage of growth," added Gerald E. Commissiong, President & CEO of Amarantus Bioscience Holdings. "We

have taken several important steps to prepare the company for an uplisting on a national exchange. We continue working in earnest

to achieve that goal as quickly as possible as it remains the priority and focus of our team, and we intend to continue to engage

the NASDAQ Capital Market to complete this important objective."

SECOND QUARTER 2015 FINANCIAL SUMMARY

Research and development costs for the three months ended June

30, 2015 increased $617,000 to $2,257,000 from $1,640,000 for the three months ended June 30, 2014, primarily due to increase in

clinical related costs and research arrangements.

General and administrative expenses increased $1,238,000 to

$3,339,000 for the three months ended June 30, 2015 from $2,101,000 for the three months ended June 30, 2014, primarily due to

increased spending on Lonza Option payments, acquisition costs and other professional services, including consulting costs.

For the three months ended June 30, 2015, other income (expense)

decreased $158,000 to an expense of $126,000 from $284,000 in three month period ended June 30, 2014. Interest expense increased

from the prior year quarter $55,000 and change in fair value of warrant and derivative liability decreased $193,000.

Net loss for the three months ended June 30, 2015 was $5,722,000

as compared to a net loss of $4,025,000 for the three month period ended June 30, 2014 with the increase in loss driven by research

and development expense, consulting, Lonza Option payments, professional services and acquisition costs.

For the six months ended June 30, 2015 research and development

costs increased $2,577,000 to $4,734,000 from $2,157,000 for the six months ended June 30, 2014, primarily due to increase in clinical

related costs and research arrangements.

General and administrative expenses increased $4,180,000 to

$7,400,000 for the six months ended June 30, 2015 from $3,220,000 for the six months ended June 30, 2014 primarily due to increased

spending on consulting, Lonza Option payments, acquisition costs and other professional services.

For the six months ended June 30, 2015, other income (expense)

decreased $4,022,000 to an expense of $168,000 from $4,190,000 in the six month period ended June 30, 2014. Interest expense and

loss on issuance of warrants decreased $541,000 and $3,867,000, respectively. Change in fair value of warrant and derivative liability

increased $473,000 to $0 for the six months ended June 30, 2015.

Net loss for the six months ended June 30, 2015 was $12,302,000

as compared to a net loss of $9,567,000 for the six month period ended June 30, 2014 with the increase in loss driven by research

and development expense, consulting, Lonza Option payments, professional services and acquisition costs.

As of June 30, 2015, the Company had total current assets of

$784,000 consisting of $315,000 in cash and cash equivalents and $386,000 in prepaid expenses and other current assets, and $83,000

in deferred funding fees.

Amarantus Bioscience Holdings, Inc

CONDENSED CONSOLIDATED BALANCE SHEETS

(Unaudited)

(in thousands, except share and per share

data)

| | |

June 30,

2015 | | |

December 31,

2014 | |

| ASSETS | |

| (Unaudited) | | |

| (Audited) | |

| Current assets: | |

| | | |

| | |

| Cash and cash equivalents | |

$ | 315 | | |

$ | 214 | |

| Deferred financing fees | |

| 83 | | |

| — | |

| Prepaid expenses and other current assets | |

| 386 | | |

| 198 | |

| Total current assets | |

| 784 | | |

| 412 | |

| Restricted cash | |

| 204 | | |

| 204 | |

| Property and equipment, net | |

| 150 | | |

| 145 | |

| Intangible assets, net | |

| 10,245 | | |

| 1,497 | |

| Total assets | |

$ | 11,383 | | |

$ | 2,258 | |

| | |

| | | |

| | |

| LIABILITIES AND STOCKHOLDERS' EQUITY (DEFICIT) | |

| | | |

| | |

| Current liabilities: | |

| | | |

| | |

| Accounts payable and accrued expenses | |

$ | 4,729 | | |

$ | 3,502 | |

| Accounts payable - Regenicin | |

| — | | |

| 2,550 | |

| Related party liabilities and accrued interest | |

| 255 | | |

| 252 | |

| Accrued interest | |

| 139 | | |

| 25 | |

| Note Payable | |

| 2,850 | | |

| — | |

| Total current liabilities | |

| 7,973 | | |

| 6,329 | |

| Total liabilities | |

| 7,973 | | |

| 6,329 | |

| | |

| | | |

| | |

| Stockholders’ equity (deficit) | |

| | | |

| | |

| Convertible preferred stock, $0.001 par value, 10,000,000 shares authorized: | |

| | | |

| | |

| Series A, $0.001 par value, 250,000 shares designated, -0- shares issued and outstanding as of June 30, 2015 and December 31, 2014 | |

| — | | |

| — | |

| Series B, $0.001 par value, 3,000,000 shares designated, -0- shares issued and outstanding as of June 30, 2015 and December 31, 2014 | |

| — | | |

| — | |

| Series C, $0.001 par value, 750,000 shares designated, 750,000 shares issued and outstanding as of June 30, 2015 and December 31, 2014 | |

| 1 | | |

| 1 | |

| Series D, $1,000 stated value; 1,300 shares designated; 350 and 1,299 issued and outstanding as of June 30, 2015 and December 31, 2014, respectively; aggregate liquidation preference of $350 | |

| 315 | | |

| 1,169 | |

| Series E, $1,000 stated value; 13,335 shares designated, 7,722 and 4,500 issued and outstanding as of June 30, 2015 and December 31, 2014 respectively; aggregate liquidation preference of $7,722 | |

| 6,950 | | |

| 4,050 | |

| Series G, $5,000 stated value; 10,000 shares designated; 1,087 and 0 issued and outstanding as of June 30, 2015 and December 31, 2014, respectively; aggregate liquidation preference of $5,435 | |

| 4,950 | | |

| — | |

| Common stock, $0.001 par value, 13,333,333 authorized; 7,084,970 and 5,614,605 shares issued and outstanding at June 30, 2015 and December 31, 2014, respectively | |

| 7 | | |

| 6 | |

| Additional paid-in capital | |

| 62,637 | | |

| 45,886 | |

| Accumulated deficit | |

| (71,450 | ) | |

| (55,183 | ) |

| Total stockholders' equity (deficit) | |

| 3,410 | | |

| (4,071 | ) |

| Total liabilities and stockholders' equity (deficit) | |

$ | 11,383 | | |

$ | 2,258 | |

Amarantus Bioscience Holdings, Inc

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(Unaudited)

(in thousands, except share and per share

data)

| | |

Three Months

Ended

June 30, 2015 | | |

Three Months

Ended

June 30, 2014 | | |

Six Months

Ended

June 30, 2015 | | |

Six Months

Ended

June 30, 2014 | |

| | |

| | |

| | |

| | |

| |

| Net sales | |

$ | — | | |

$ | — | | |

$ | — | | |

$ | — | |

| | |

| | | |

| | | |

| | | |

| | |

| Operating expense: | |

| | | |

| | | |

| | | |

| | |

| Research and development | |

| 2,257 | | |

| 1,640 | | |

| 4,734 | | |

| 2,157 | |

| General and administrative | |

| 3,339 | | |

| 2,101 | | |

| 7,400 | | |

| 3,220 | |

| | |

| | | |

| | | |

| | | |

| | |

| | |

| 5,596 | | |

| 3,741 | | |

| 12,134 | | |

| 5,377 | |

| | |

| | | |

| | | |

| | | |

| | |

| Loss from operations | |

| (5,596 | ) | |

| (3,741 | ) | |

| (12,134 | ) | |

| (5,377 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Other income (expense): | |

| | | |

| | | |

| | | |

| | |

| Interest expense | |

| (126 | ) | |

| (71 | ) | |

| (168 | ) | |

| (709 | ) |

| Loss on issuance of common stock | |

| — | | |

| — | | |

| — | | |

| (67 | ) |

| Loss on issuance of warrants | |

| — | | |

| — | | |

| — | | |

| (3,867 | ) |

| Other expense | |

| — | | |

| (20 | ) | |

| — | | |

| (20 | ) |

| Change in fair value of warrant & derivative liabilities | |

| — | | |

| (193 | ) | |

| — | | |

| 473 | |

| | |

| | | |

| | | |

| | | |

| | |

| Total other income (expense) | |

| (126 | ) | |

| (284 | ) | |

| (168 | ) | |

| (4,190 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Net loss | |

$ | (5,722 | ) | |

$ | (4,025 | ) | |

$ | (12,302 | ) | |

$ | (9,567 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Preferred stock dividend | |

$ | 3,187 | | |

$ | 26 | | |

$ | 4,016 | | |

$ | 52 | |

| Net loss attributable to common stockholders | |

$ | (8,909 | ) | |

$ | (4,051 | ) | |

$ | (16,318 | ) | |

$ | (9,619 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Basic and diluted net loss per common share | |

$ | (1.08 | ) | |

$ | (0.83 | ) | |

$ | (2.13 | ) | |

$ | (2.11 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Basic and diluted weighted average common shares outstanding | |

| 8,230,225 | | |

| 4,893,491 | | |

| 7, 652,163 | | |

| 4,551,050 | |

About Amarantus BioScience Holdings,

Inc.

Amarantus BioScience Holdings (OTCQX: AMBS)

is a biotechnology company developing treatments and diagnostics for diseases in the areas of neurology and orphan diseases. AMBS’

Therapeutics division has development rights to eltoprazine, a small molecule currently in a Phase 2b clinical program for Parkinson's

disease levodopa-induced dyskinesia with the potential to expand into adult ADHD and Alzheimer’s aggression. The Company

has an exclusive worldwide license to intellectual property rights associated to Engineered Skin Substitute (ESS), an orphan drug

designated autologous full thickness skin replacement product in development for the treatment of severe burns currently preparing

to enter Phase 2 clinical studies. AMBS owns the intellectual property rights to a therapeutic protein known as mesencephalic-astrocyte-derived

neurotrophic factor (MANF) and is developing MANF as a treatment for orphan ophthalmic disorders, initially in retinitis pigmentosa

(RP). AMBS also owns the discovery of neurotrophic factors (PhenoGuard™) that led to MANF’s discovery.

AMBS’ Diagnostics division owns the

rights to MSPrecise®, a proprietary next-generation DNA sequencing (NGS) assay for the identification of patients

with relapsing-remitting multiple sclerosis (RRMS), and has an exclusive worldwide license to the Lymphocyte Proliferation test

(LymPro Test®) for Alzheimer's disease, which was developed by Prof. Thomas Arendt, Ph.D., from the University of

Leipzig, and owns further intellectual property for the diagnosis of Parkinson's disease (NuroPro®).

For further information please visit www.Amarantus.com,

or connect with the Company on Facebook, LinkedIn,

Twitter and Google+.

Forward-Looking Statements

Certain statements, other than purely historical

information, including estimates, projections, statements relating to our business plans, objectives, and expected operating results,

and the assumptions upon which those statements are based, are forward-looking statements. These forward-looking statements generally

are identified by the words "believes," "project," "expects," "anticipates," "estimates,"

"intends," "strategy," "plan," "may," "will," "would," "will be,"

"will continue," "will likely result," and similar expressions. Forward-looking statements are based on current

expectations and assumptions that are subject to risks and uncertainties which may cause actual results to differ materially from

the forward-looking statements. Our ability to predict results or the actual effect of future plans or strategies is inherently

uncertain. Factors which could have a material adverse effect on our operations and future prospects on a consolidated basis include,

but are not limited to: changes in economic conditions, legislative/regulatory changes, availability of capital, interest rates,

competition, and generally accepted accounting principles. These risks and uncertainties should also be considered in evaluating

forward-looking statements and undue reliance should not be placed on such statements.

Investor and Media Contact:

Jenene Thomas

Jenene Thomas Communications, LLC

Investor Relations and Corporate Communications

Advisor

T: (US) 908.938.1475

E: jenene@jenenethomascommunications.com

Source: Amarantus Bioscience Holdings,

Inc.

###

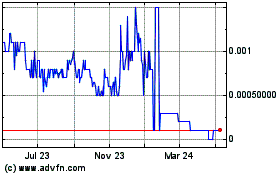

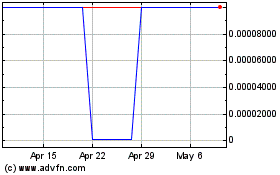

Amarantus Bioscience (CE) (USOTC:AMBS)

Historical Stock Chart

From Mar 2024 to Apr 2024

Amarantus Bioscience (CE) (USOTC:AMBS)

Historical Stock Chart

From Apr 2023 to Apr 2024