UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): August 17, 2015

AGILENT TECHNOLOGIES, INC.

(Exact name of registrant as specified in its charter)

|

| | | | |

Delaware | | 001-15405 | | 77-0518772 |

(State or other jurisdiction | | (Commission | | (IRS Employer |

of incorporation) | | File Number) | | Identification No.) |

|

| | |

5301 Stevens Creek Boulevard, Santa Clara, CA | | 95051 |

(Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code (408) 345-8886

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 2.02. Results of Operations and Financial Condition.

The information in this Item 2.02 of Form 8-K and Exhibit 99.1 attached hereto is furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended.

On August 17, 2015, Agilent Technologies, Inc. (the “Company”) issued its press release announcing financial results for the third fiscal quarter ended July 31, 2015. A copy of this press release is attached as Exhibit 99.1.

We provide non-GAAP financial information in order to provide meaningful supplemental information regarding our operational performance and to enhance our investors’ overall understanding of our core current financial performance and our prospects for the future. We believe that our investors benefit from seeing our results “through the eyes” of management in addition to the GAAP presentation. Management measures segment and enterprise performance using measures such as those that are disclosed in this release. This information facilitates management’s internal comparisons to the Company’s historical operating results and comparisons to competitors’ operating results. Non-GAAP information allows for greater transparency to supplemental information used by management in its financial and operations decision making. Historically, we have reported similar non-GAAP information to our investors and believe that the inclusion of comparative numbers provides consistency in our financial reporting.

This information is not in accordance with, or an alternative for, generally accepted accounting principles in the United States. It excludes items, such as restructuring and amortization, that may have a material effect on the Company’s expenses and earnings per share calculated in accordance with GAAP. Management monitors these items to ensure that expenses are in line with expectations and that our GAAP results are correctly stated but does not use them to measure the ongoing operating performance of the Company. The non-GAAP information we provide may be different from the non-GAAP information provided by other companies.

Additional explanation of non-GAAP information is provided in Exhibit 99.1.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

The following is furnished as an exhibit to this report and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended:

|

| | | | | | |

Exhibit No. | | Description | | | |

99.1 |

| | Press release announcing financial results for the third fiscal quarter ended July 31, 2015 |

| | |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

| | |

| AGILENT TECHNOLOGIES, INC. |

| |

| |

| By: | /s/ Michael Tang |

| Name: | Michael Tang |

| Title: | Vice President, Assistant General Counsel and |

| | Secretary |

| |

| |

Date: August 17, 2015 | |

EXHIBIT INDEX

|

| | | | | |

Exhibit No. | | Description | | | |

99.1 | | Press release announcing financial results for the third fiscal quarter ended July 31, 2015 |

| | |

| | | | | |

| | | | | |

| | | | | |

Exhibit 99.1

EDITORIAL CONTACT:

Michele Drake

+1 408 345 8396

michele_drake@agilent.com

INVESTOR CONTACT:

Alicia Rodriguez

+1 408 345 8948

alicia_rodriguez@agilent.com

Agilent Technologies Reports Third-Quarter 2015 Results

Highlights:

| |

• | GAAP income from continuing operations of $105 million, or $0.31 per share |

| |

• | Non-GAAP income from continuing operations of $147 million, or $0.44 per share(1) |

| |

• | Orders of $953 million and revenue of $1.01 billion |

| |

• | Fourth-quarter fiscal year 2015 revenue guidance of $1.03 billion to $1.05 billion, and non-GAAP earnings guidance of $0.45 to $0.49 per share(2) |

| |

• | Fiscal year 2015 revenue guidance of $4.03 billion to $4.05 billion, and non-GAAP earnings guidance of $1.68 to $1.72 per share(2) |

SANTA CLARA, Calif., Aug. 17, 2015 - Agilent Technologies Inc. (NYSE: A) today reported orders of $953 million, down 6 percent (up 3 percent on a core basis(3)) over one year ago for the third fiscal quarter ended July 31, 2015. Third-quarter revenue was $1.01 billion, up 1 percent (up 9 percent on a core basis(3)) compared with one year ago.

Third-quarter GAAP income from continuing operations was $105 million, or $0.31 per share. Last year’s third-quarter GAAP income from continuing operations was $63 million, or $0.19 per share.

During the third quarter, Agilent had intangible amortization of $38 million, transformation costs of $12 million, acquisition and integration costs of $4 million, and a tax benefit of $14 million. Excluding these items, and $2 million of other costs, Agilent reported third-quarter adjusted income from continuing operations of $147 million, or $0.44 per share(1).

“Agilent delivered excellent results for our shareholders in the third quarter,” said Mike McMullen, Agilent president and CEO. “Revenue was at the high end of our guidance, and earnings per share were above our guidance range.”

“Our operating model is driving above-market revenue growth and margin expansion,” he added. “In Q3, we delivered an adjusted operating margin of 19.9 percent(4), up 110 basis points from last year.”

Third-quarter revenue of $511 million from Agilent’s Life Sciences and Applied Markets Group (LSAG) grew 1 percent year over year (up 9 percent on a core basis(3)), driven by strong performance in pharma, environmental and forensics markets. LSAG’s Q3 operating margin was 18.7 percent.

Third-quarter revenue of $336 million from the Agilent CrossLab Group (ACG) was flat year over year (up 8 percent on a core basis(3)), led by continued strong acceptance of the company’s CrossLab services and consumables offerings. ACG’s operating margin was 22.6 percent in the quarter.

Third-quarter revenue of $167 million from Agilent’s Diagnostics and Genomics Group (DGG) was flat year over year (up 10 percent on a core basis(3)), with continued strong growth across all its businesses. DGG’s operating margin for the quarter was 16.8 percent.

Agilent expects fourth-quarter 2015 revenue in the range of $1.03 billion to $1.05 billion. Fourth-quarter non-GAAP earnings are expected to be in the range of $0.45 to $0.49 per share(2).

For fiscal year 2015, Agilent expects revenue of $4.03 billion to $4.05 billion and non-GAAP earnings of $1.68 to $1.72 per share(2). The guidance is based on July 31, 2015, exchange rates.

About Agilent Technologies

Agilent Technologies Inc. (NYSE: A), a global leader in life sciences, diagnostics and applied chemical markets, is the premier laboratory partner for a better world. Agilent works with customers in more than 100 countries, providing instruments, software, services and consumables for the entire laboratory workflow. Agilent generated revenue of $4.0 billion in fiscal 2014. The company employs about 12,000 people worldwide. Agilent marks its 50th anniversary in analytical instrumentation this year. Information about Agilent is available at www.agilent.com.

Agilent’s management will present more details about its third-quarter FY2015 financial results on a conference call with investors today at 1:30 p.m. PT. This event will be webcast live in listen-only mode. Listeners may log on at www.investor.agilent.com and select “Q3 2015 Agilent Technologies Inc. Earnings Conference Call” in the “News & Events Calendar of Events” section. The webcast will remain available on the company’s website for 90 days.

Additional information regarding financial results can be found at www.investor.agilent.com by selecting “Financial Results” in the “Financial Information” section.

A telephone replay of the conference call will be available at approximately 5:30 p.m. PT today through Aug. 25 by dialing +1 855 859 2056 (or +1 404 537 3406 from outside the United States) and entering passcode 87671650.

Forward-Looking Statements

This news release contains forward-looking statements as defined in the Securities Exchange Act of 1934 and is subject to the safe harbors created therein. The forward-looking statements contained herein include, but are not limited to, information regarding Agilent’s future revenue, earnings and profitability; planned new products; market trends; the future demand for the company’s products and

services; customer expectations; and revenue and non-GAAP earnings guidance for the fourth quarter and full fiscal year 2015. These forward-looking statements involve risks and uncertainties that could cause Agilent’s results to differ materially from management’s current expectations. Such risks and uncertainties include, but are not limited to, unforeseen changes in the strength of our customers’ businesses; unforeseen changes in the demand for current and new products, technologies, and services; unforeseen changes in the currency markets; customer purchasing decisions and timing, and the risk that we are not able to realize the savings expected from integration and restructuring activities.

In addition, other risks that Agilent faces in running its operations include the ability to execute successfully through business cycles; the ability to meet and achieve the benefits of its cost-reduction goals and otherwise successfully adapt its cost structures to continuing changes in business conditions; ongoing competitive, pricing and gross-margin pressures; the risk that our cost-cutting initiatives will impair our ability to develop products and remain competitive and to operate effectively; the impact of geopolitical uncertainties and global economic conditions on our operations, our markets and our ability to conduct business; the ability to improve asset performance to adapt to changes in demand; the ability of our supply chain to adapt to changes in demand; the ability to successfully introduce new products at the right time, price and mix; the ability of Agilent to successfully integrate recent acquisitions; the ability of Agilent to successfully comply with certain complex regulations; and other risks detailed in Agilent’s filings with the Securities and Exchange Commission, including our quarterly report on Form 10-Q for the quarter ended April 30, 2015. Forward-looking statements are based on the beliefs and assumptions of Agilent’s management and on currently available information. Agilent undertakes no responsibility to publicly update or revise any forward-looking statement.

# # #

| |

(1) | Non-GAAP income from continuing operations and non-GAAP income from continuing operations per share exclude primarily the impacts of acquisition and integration costs, pre-separation costs, transformation initiatives and restructuring costs, business exit and divestiture costs, and non-cash intangibles amortization. We also exclude any tax benefits that are not directly related to ongoing operations and which are either isolated or cannot be expected to occur again with any regularity or predictability. A reconciliation between non-GAAP net income and GAAP net income is set forth on page 6 of the attached tables along with additional information regarding the use of this non-GAAP measure. |

| |

(2) | Non-GAAP earnings per share as projected for Q4 FY15 and full fiscal year 2015 excludes primarily the impact of acquisition and integration costs, future restructuring costs, asset impairment charges, business exit and divestiture costs and non-cash intangibles amortization. We also exclude any tax benefits that are not directly related to ongoing operations and which are either isolated or cannot be expected to occur again with any regularity or predictability. Most of these excluded amounts pertain to events that have not yet occurred and are not currently possible to estimate with a reasonable degree of accuracy. Therefore, no reconciliation to GAAP amounts has been provided. Future amortization of intangibles is expected to be approximately $40 million per quarter. |

| |

(3) | Core orders and revenue exclude the impact of currency, the NMR business and acquisitions and divestitures within the past 12 months. Core revenue is a non-GAAP measure. A reconciliation between GAAP revenue and core revenue is set forth on page 8 of the attached tables along with additional information regarding the use of this non-GAAP measure. |

| |

(4) | Adjusted operating margin is a non-GAAP measure and excludes primarily the impacts of acquisition and integration costs, transformation initiatives and restructuring costs, business exit and divestiture costs, and non-cash intangibles amortization in addition to the costs related to services Agilent is providing to Keysight post separation. A reconciliation is set forth on page 9 of the attached tables along with additional information regarding the use of this non-GAAP measure. |

NOTE TO EDITORS: Further technology, corporate citizenship and executive news is available on the Agilent news site at www.agilent.com/go/news.

AGILENT TECHNOLOGIES, INC.

CONDENSED CONSOLIDATED STATEMENT OF OPERATIONS

(In millions, except per share amounts)

(Unaudited)

PRELIMINARY

|

| | | | | | | | | | |

| | Three Months Ended | | |

| | July 31, | | Percent |

| | 2015 | | 2014 | | Inc/(Dec) |

Orders | | $ | 953 |

| | $ | 1,017 |

| | (6)% |

| | | | | | |

Net revenue | | $ | 1,014 |

| | $ | 1,009 |

| | 1% |

| | | | | | |

Costs and expenses: | | | | | | |

Cost of products and services | | 501 |

| | 507 |

| | (1)% |

Research and development | | 79 |

| | 86 |

| | (8)% |

Selling, general and administrative | | 290 |

| | 285 |

| | 2% |

Total costs and expenses | | 870 |

| | 878 |

| | (1)% |

| | | | | | |

Income from operations | | 144 |

| | 131 |

| | 10% |

| | | | | | |

Interest income | | 2 |

| | 3 |

| | (33)% |

Interest expense | | (17 | ) | | (28 | ) | | (39)% |

Other income (expense), net | | (1 | ) | | (21 | ) | | (95)% |

| | | | | | |

Income from continuing operations before taxes | | 128 |

| | 85 |

| | 51% |

| | | | | | |

Provision for income taxes | | 23 |

| | 22 |

| | 5% |

| | | | | | |

Income from continuing operations | | 105 |

| | 63 |

| | 67% |

| | | | | | |

Income (loss) from discontinued operations, net of tax | | (2 | ) | | 84 |

| | |

| | | | | | |

Net income | | $ | 103 |

| | $ | 147 |

| | (30)% |

| | | | | | |

| | | | | | |

Net income per share - Basic: | | | | | | |

Income from continuing operations | | $ | 0.32 |

| | $ | 0.19 |

| | |

Income (loss) from discontinued operations | | $ | (0.01 | ) | | $ | 0.25 |

| | |

Net income per share - Basic | | $ | 0.31 |

| | $ | 0.44 |

| | |

| | | |

| | |

| | | | | | |

Net income per share - Diluted: | | | | | | |

Income from continuing operations | | $ | 0.31 |

| | $ | 0.19 |

| | |

Income from discontinued operations | | $ | — |

| | $ | 0.24 |

| | |

Net income per share - Diluted | | $ | 0.31 |

| | $ | 0.43 |

| | |

| | | |

| | |

| | | | | | |

Weighted average shares used in computing net income per share: | | | | | | |

Basic | | 332 |

| | 334 |

| | |

Diluted | | 334 |

| | 338 |

| | |

| | | | | | |

Cash dividends declared per common share | | $ | 0.100 |

| | $ | 0.132 |

| | |

The preliminary income statement is estimated based on our current information.

AGILENT TECHNOLOGIES, INC.

CONDENSED CONSOLIDATED STATEMENT OF OPERATIONS

(In millions, except per share amounts)

(Unaudited)

PRELIMINARY

|

| | | | | | | | | | |

| | Nine Months Ended | | |

| | July 31, | | Percent |

| | 2015 | | 2014 | | Inc/(Dec) |

Orders | | $ | 2,987 |

| | $ | 3,027 |

| | (1)% |

| | | | | | |

Net revenue | | $ | 3,003 |

| | $ | 3,005 |

| | — |

| | | | | | |

Costs and expenses: | | | | | | |

Cost of products and services | | 1,497 |

| | 1,508 |

| | (1)% |

Research and development | | 248 |

| | 261 |

| | (5)% |

Selling, general and administrative | | 892 |

| | 887 |

| | 1% |

Total costs and expenses | | 2,637 |

| | 2,656 |

| | (1)% |

| | | | | | |

Income from operations | | 366 |

| | 349 |

| | 5% |

| | | | | | |

Interest income | | 6 |

| | 7 |

| | (14)% |

Interest expense | | (50 | ) | | (87 | ) | | (43)% |

Other income (expense), net | | 15 |

| | (18 | ) | | — |

| | | | | | |

Income from continuing operations before taxes | | 337 |

| | 251 |

| | 34% |

| | | | | | |

Provision for income taxes | | 42 |

| | 27 |

| | 56% |

| | | | | | |

Income from continuing operations | | 295 |

| | 224 |

| | 32% |

| | | | | | |

Income (loss) from discontinued operations, net of tax | | (37 | ) | | 257 |

| | |

| | | | | | |

Net income | | $ | 258 |

| | $ | 481 |

| | (46)% |

| | | | | | |

| | | | | | |

Net income per share - Basic: | | | | | | |

Income from continuing operations | | $ | 0.88 |

| | $ | 0.67 |

| | |

Income (loss) from discontinued operations | | $ | (0.11 | ) | | $ | 0.77 |

| | |

Net income per share - Basic | | $ | 0.77 |

| | $ | 1.44 |

| | |

| | | |

| | |

| | | | | | |

Net income per share - Diluted: | | | | | | |

Income from continuing operations | | $ | 0.88 |

| | $ | 0.66 |

| | |

Income (loss) from discontinued operations | | $ | (0.11 | ) | | $ | 0.76 |

| | |

Net income per share - Diluted | | $ | 0.77 |

| | $ | 1.42 |

| | |

| | | |

| | |

| | | | | | |

Weighted average shares used in computing net income per share: | | | | | | |

Basic | | 334 |

| | 333 |

| | |

Diluted | | 336 |

| | 338 |

| | |

| | | | | | |

Cash dividends declared per common share | | $ | 0.300 |

| | $ | 0.396 |

| | |

The preliminary income statement is estimated based on our current information.

AGILENT TECHNOLOGIES, INC.

CONDENSED CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

(In millions)

(Unaudited)

PRELIMINARY

|

| | | | | | | | | | | | | | | | | |

| | Three Months Ended | | Nine Months Ended | |

| | July 31, | | July 31, | |

| | 2015 | | 2014 | | 2015 | | 2014 | |

Net Income | | $ | 103 |

| | $ | 147 |

| | $ | 258 |

| | $ | 481 |

| |

| | | | | | | | | |

Other comprehensive income (loss), net of tax: | | | | | | | | | |

| | | | | | | | | |

Unrealized gain on investments | | — |

| | 8 |

| | — |

| | 8 |

| |

Amounts reclassified into earnings related to investments | | — |

| | (1 | ) | | — |

| | (1 | ) | |

Unrealized gain on derivative instruments | | 1 |

| | 2 |

| | 7 |

| | 1 |

| |

Amounts reclassified into earnings related to derivative instruments | | (1 | ) | | 1 |

| | (9 | ) | | 1 |

| |

Foreign currency translation | | (66 | ) | | (92 | ) | | (337 | ) | | (59 | ) | |

Net defined benefit pension cost and post retirement plan costs: | | | | | | | | | |

Change in actuarial net loss | | 7 |

| | 11 |

| | 17 |

| | 36 |

| |

Change in net prior service benefit | | (3 | ) | | (8 | ) | | (8 | ) | | (24 | ) | |

Other comprehensive loss | | (62 | ) | | (79 | ) | | (330 | ) | | (38 | ) | |

| | | | | | | | | |

Total comprehensive income (loss) | | $ | 41 |

| | $ | 68 |

| | $ | (72 | ) | | $ | 443 |

| |

The preliminary statement of comprehensive income is estimated based on our current information.

AGILENT TECHNOLOGIES, INC.

CONDENSED CONSOLIDATED BALANCE SHEET

(In millions, except par value and share amounts)

(Unaudited)

PRELIMINARY |

| | | | | | | | |

| | July 31,

2015 | | October 31,

2014 |

ASSETS | | |

| | |

|

Current assets: | | |

| | |

|

Cash and cash equivalents | | $ | 2,075 |

| | $ | 2,218 |

|

Accounts receivable, net | | 584 |

| | 626 |

|

Inventory | | 545 |

| | 574 |

|

Other current assets | | 274 |

| | 261 |

|

Current assets of discontinued operations | | — |

| | 1,821 |

|

Total current assets | | 3,478 |

| | 5,500 |

|

| | | | |

Property, plant and equipment, net | | 587 |

| | 631 |

|

Goodwill | | 2,366 |

| | 2,507 |

|

Other intangible assets, net | | 484 |

| | 649 |

|

Long-term investments | | 88 |

| | 96 |

|

Other assets | | 248 |

| | 283 |

|

Non-current assets of discontinued operations | | — |

| | 1,165 |

|

Total assets | | $ | 7,251 |

| | $ | 10,831 |

|

| | | | |

LIABILITIES AND EQUITY | | |

| | |

|

| | | | |

Current liabilities: | | |

| | |

|

Accounts payable | | $ | 248 |

| | $ | 302 |

|

Employee compensation and benefits | | 186 |

| | 228 |

|

Deferred revenue | | 265 |

| | 260 |

|

Other accrued liabilities | | 154 |

| | 289 |

|

Current liabilities of discontinued operations | | — |

| | 623 |

|

Total current liabilities | | 853 |

| | 1,702 |

|

| | | | |

Long-term debt | | 1,655 |

| | 1,663 |

|

Retirement and post-retirement benefits | | 168 |

| | 209 |

|

Other long-term liabilities | | 469 |

| | 522 |

|

Long-term liabilities of discontinued operations | | — |

| | 1,434 |

|

Total liabilities | | 3,145 |

| | 5,530 |

|

| | | | |

Total Equity: | | |

| | |

|

Stockholders' equity: | | |

| | |

|

Preferred stock; $0.01 par value; 125 million shares authorized; none issued and outstanding | | — |

| | — |

|

Common stock; $0.01 par value; 2 billion shares authorized; 611 million shares at July 31, 2015 and 608 million shares at October 31, 2014, issued | | 6 |

| | 6 |

|

Treasury stock at cost; 279 million shares at July 31, 2015 and 273 million shares at October 31, 2014 | | (10,074 | ) | | (9,807 | ) |

Additional paid-in-capital | | 9,029 |

| | 8,967 |

|

Retained earnings | | 5,474 |

| | 6,466 |

|

Accumulated other comprehensive loss | | (332 | ) | | (334 | ) |

Total stockholders' equity | | 4,103 |

| | 5,298 |

|

Non-controlling interest | | 3 |

| | 3 |

|

Total equity | | 4,106 |

| | 5,301 |

|

Total liabilities and equity | | $ | 7,251 |

| | $ | 10,831 |

|

The preliminary balance sheet is estimated based on our current information.

AGILENT TECHNOLOGIES, INC.

CONDENSED CONSOLIDATED STATEMENT OF CASH FLOWS

(In millions)

(Unaudited)

PRELIMINARY

|

| | | | | | | | |

| | Three Months Ended | | Nine Months Ended |

| | July 31, | | July 31, |

| | 2015 | | 2015 |

Cash flows from operating activities: | | |

| | |

Net income | | $ | 103 |

| | $ | 258 |

|

Adjustments to reconcile net income to net cash provided by (used in) operating activities: | | | | |

Depreciation and amortization | | 62 |

| | 193 |

|

Share-based compensation | | 10 |

| | 43 |

|

Excess tax benefit from share-based plans | | (5 | ) | | (5 | ) |

Excess and obsolete inventory related charges | | 7 |

| | 20 |

|

Other non-cash expenses, net | | 8 |

| | 13 |

|

Changes in assets and liabilities: | | | | |

Accounts receivable | | (15 | ) | | 1 |

|

Inventory | | — |

| | (18 | ) |

Accounts payable | | (12 | ) | | (47 | ) |

Employee compensation and benefits | | (20 | ) | | (27 | ) |

Other assets and liabilities | | (47 | ) | | (177 | ) |

Net cash provided by operating activities (a) | | 91 |

| | 254 |

|

| | | | |

Cash flows from investing activities: | | | | |

Investments in property, plant and equipment | | (19 | ) | | (71 | ) |

Proceeds from sale of property, plant and equipment | | — |

| | 11 |

|

Proceeds from divestiture | | — |

| | 3 |

|

Payment to acquire equity method investment | | — |

| | (1 | ) |

Change in restricted cash and cash equivalents, net | | — |

| | 1 |

|

Payment in exchange for convertible note | | (2 | ) | | (2 | ) |

Acquisition of businesses and intangible assets, net of cash acquired | | (66 | ) | | (66 | ) |

Net cash used in investing activities | | (87 | ) | | (125 | ) |

| | | | |

Cash flows from financing activities: | | | | |

Issuance of common stock under employee stock plans | | 17 |

| | 57 |

|

Treasury stock repurchases | | (99 | ) | | (267 | ) |

Payment of dividends | | (33 | ) | | (100 | ) |

Net transfer to Keysight | | — |

| | (734 | ) |

Excess tax benefit from share-based plans | | 5 |

| | 5 |

|

Net cash used in financing activities | | (110 | ) | | (1,039 | ) |

| | | | |

Effect of exchange rate movements | | (16 | ) | | (43 | ) |

| | | | |

Net decrease in cash and cash equivalents | | (122 | ) | | (953 | ) |

| | | | |

Change in cash and cash equivalents within current assets of discontinued operations | | — |

| | 810 |

|

| | | | |

Cash and cash equivalents at beginning of period | | 2,197 |

| | 2,218 |

|

Cash and cash equivalents at end of period | | $ | 2,075 |

| | $ | 2,075 |

|

| | | | |

(a) Cash payments included in operating activities: | | | | |

Severance payments | | $ | 7 |

| | $ | 30 |

|

Income tax payments, net | | $ | 42 |

| | $ | 121 |

|

The preliminary cash flow is estimated based on our current information.

AGILENT TECHNOLOGIES, INC.

NON-GAAP INCOME FROM CONTINUING OPERATIONS AND DILUTED EPS RECONCILIATIONS

(In millions, except per share amounts)

(Unaudited)

PRELIMINARY |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | Nine Months Ended |

| | July 31, | | July 31, |

| | 2015 | | Diluted EPS | | 2014 | | Diluted EPS | | 2015 | | Diluted EPS | | 2014 | | Diluted EPS |

GAAP Income from continuing operations | | $ | 105 |

| | $ | 0.31 |

| | $ | 63 |

| | $ | 0.19 |

| | $ | 295 |

| | $ | 0.88 |

| | $ | 224 |

| | $ | 0.66 |

|

Non-GAAP adjustments: | | |

| | |

| | |

| | |

| | |

| | | | |

| | |

|

Restructuring and other related costs | | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | (2 | ) | | (0.01 | ) |

Acceleration of share-based compensation related to workforce reduction | | — |

| | — |

| | — |

| | — |

| | 2 |

| | 0.01 |

| | — |

| | — |

|

Intangible amortization | | 38 |

| | 0.11 |

| | 46 |

| | 0.14 |

| | 119 |

| | 0.35 |

| | 144 |

| | 0.43 |

|

Business exit and divestiture costs | | — |

| | — |

| | — |

| | — |

| | 13 |

| | 0.04 |

| | — |

| | — |

|

Transformational initiatives | | 12 |

| | 0.04 |

| | 7 |

| | 0.02 |

| | 41 |

| | 0.12 |

| | 18 |

| | 0.05 |

|

Acquisition and integration costs | | 4 |

| | 0.01 |

| | 2 |

| | 0.01 |

| | 6 |

| | 0.02 |

| | 10 |

| | 0.03 |

|

Pre-separation costs | | — |

| | — |

| | 4 |

| | 0.01 |

| | — |

| | — |

| | 8 |

| | 0.02 |

|

Net loss on extinguishment of debt | | | | | | 21 |

| | 0.06 |

| | | | | | 21 |

| | 0.06 |

|

Unallocated corporate costs | | — |

| | — |

| | 12 |

| | 0.03 |

| | — |

| | — |

| | 32 |

| | 0.09 |

|

Other | | 2 |

| | 0.01 |

| | (13 | ) | | (0.04 | ) | | 1 |

| | — |

| | (10 | ) | | (0.03 | ) |

Adjustment for taxes (a) | | (14 | ) | | (0.04 | ) | | (5 | ) | | (0.01 | ) | | (62 | ) | | (0.18 | ) | | (49 | ) | | (0.13 | ) |

Non-GAAP Income from continuing operations | | $ | 147 |

| | $ | 0.44 |

| | $ | 137 |

| | $ | 0.41 |

| | $ | 415 |

| | $ | 1.24 |

| | $ | 396 |

| | $ | 1.17 |

|

(a) The adjustment for taxes excludes tax benefits that management believes are not directly related to ongoing operations and which are either isolated or cannot be expected to occur again with any regularity or predictability. For the three and nine months ended July 31, 2015 and 2014 , management uses a non-GAAP effective tax rate of 20% and 16%, respectively, that we believe to be indicative of on-going operations.

Historical amounts are reclassified to conform with current presentation.

We provide non-GAAP income from continuing operations and non-GAAP income from continuing operations per share amounts in order to provide meaningful supplemental information regarding our operational performance and our prospects for the future. These supplemental measures exclude, among other things, charges related to the amortization of intangibles, the impact of restructuring charges, transformational initiatives, acquisition and integration costs, business exit and divestiture and pre-separation costs.

Restructuring costs include incremental expenses associated with publicly announced major restructuring programs, usually aimed at material changes in business and/or cost structure. Such costs may include one-time termination benefits, asset impairments, facility-related costs and contract termination fees.

Business exit and divestiture costs include costs associated with the exit of the NMR business and the divestiture of the XRD business.

Transformational initiatives include expenses associated with targeted cost reduction activities such as manufacturing transfers, small site consolidations, reorganizations, insourcing or outsourcing of activities. Such costs may include move and relocation costs, one-time termination benefits and other one-time reorganization costs. Included in this category are also expenses associated with the post-separation resizing of the IT infrastructure and streamlining of IT systems as well as the expenses incurred to effect the Agile Agilent reengineering.

Acquisition and Integration costs include all incremental expenses incurred to effect a business combination. Such acquisition costs may include advisory, legal, accounting, valuation, and other professional or consulting fees. Such integration costs may include expenses directly related to integration of business and facility operations, information technology systems and infrastructure and other employee-related costs.

Pre-separation costs include Agilent-specific incremental expenses incurred in order to effect the separation, through November 1, 2014 distribution date.

Net loss on extinguishment of debt relates to the early redemption of some of our senior notes.

Our management uses non-GAAP measures to evaluate the performance of our core businesses, to estimate future core performance and to compensate employees. Since management finds this measure to be useful, we believe that our investors benefit from seeing our results “through the eyes” of management in addition to seeing our GAAP results. This information facilitates our management’s internal comparisons to our historical operating results as well as to the operating results of our competitors.

Our management recognizes that items such as amortization of intangibles and restructuring charges can have a material impact on our cash flows and/or our net income. Our GAAP financial statements including our statement of cash flows portray those effects. Although we believe it is useful for investors to see core performance free of special items, investors should understand that the excluded items are actual expenses that may impact the cash available to us for other uses. To gain a complete picture of all effects on the company’s profit and loss from any and all events, management does (and investors should) rely upon the GAAP income statement. The non-GAAP numbers focus instead upon the core business of the company, which is only a subset, albeit a critical one, of the company’s performance.

Readers are reminded that non-GAAP numbers are merely a supplement to, and not a replacement for, GAAP financial measures. They should be read in conjunction with the GAAP financial measures. It should be noted as well that our non-GAAP information may be different from the non-GAAP information provided by other companies.

The preliminary non-GAAP net income and diluted EPS reconciliation is estimated based on our current information.

AGILENT TECHNOLOGIES, INC.

SEGMENT INFORMATION

(In millions, except where noted)

(Unaudited)

PRELIMINARY

Life Sciences and Applied Markets Group

|

| | | | | | | | | | | | |

| | Q3'15 | | Q3'14 | | Q2'15 |

Orders | | $ | 471 |

| | $ | 527 |

| | $ | 506 |

|

Revenues | | $ | 511 |

| | $ | 507 |

| | $ | 473 |

|

Gross Margin, % | | 55.6 | % | | 55.2 | % | | 56.1 | % |

Income from Operations | | $ | 95 |

| | $ | 84 |

| | $ | 75 |

|

Operating margin, % | | 18.7 | % | | 16.5 | % | | 15.8 | % |

Diagnostics and Genomics Group

|

| | | | | | | | | | | | |

| | Q3'15 | | Q3'14 | | Q2'15 |

Orders | | $ | 168 |

| | $ | 169 |

| | $ | 168 |

|

Revenues | | $ | 167 |

| | $ | 166 |

| | $ | 169 |

|

Gross Margin, % | | 57.0 | % | | 55.7 | % | | 54.8 | % |

Income from Operations | | $ | 28 |

| | $ | 22 |

| | $ | 25 |

|

Operating margin, % | | 16.8 | % | | 13.5 | % | | 15.0 | % |

Agilent CrossLab™ Group

|

| | | | | | | | | | | | |

| | Q3'15 | | Q3'14 | | Q2'15 |

Orders | | $ | 314 |

| | $ | 321 |

| | $ | 365 |

|

Revenues | | $ | 336 |

| | $ | 336 |

| | $ | 321 |

|

Gross Margin, % | | 48.5 | % | | 49.1 | % | | 49.6 | % |

Income from Operations | | $ | 76 |

| | $ | 84 |

| | $ | 69 |

|

Operating margin, % | | 22.6 | % | | 24.9 | % | | 21.5 | % |

Income from operations reflect the results of our reportable segments under Agilent's management reporting system which are not necessarily in conformity with GAAP financial measures. Income from operations of our reporting segments exclude, among other things, charges related to the amortization of intangibles, the impact of restructuring charges, transformational initiatives, acquisition and integration costs, business exit and divestiture and pre-separation costs.

In general, recorded orders represent firm purchase commitments from our customers with established terms and conditions for products and services that will be delivered within six months.

Readers are reminded that non-GAAP numbers are merely a supplement to, and not a replacement for, GAAP financial measures. They should be read in conjunction with the GAAP financial measures. It should be noted as well that our non-GAAP information may be different from the non-GAAP information provided by other companies.

The preliminary segment information is estimated based on our current information.

AGILENT TECHNOLOGIES, INC.

RECONCILIATION OF REVENUE BY SEGMENT EXCLUDING THE NMR BUSINESS, ACQUISITIONS, DIVESTITURES AND THE IMPACT OF CURRENCY ADJUSTMENTS (CORE)

(In millions)

(Unaudited)

PRELIMINARY

|

| | | | | | | | | | | | | | | | | | | | | |

| Year-over-Year |

|

|

|

|

| | | | | |

| GAAP | | | | | | |

GAAP Revenue by Segment | Q3'15 | Q3'14 | Year-over-Year

% change | | | | | | |

| | | | | | | | | |

Life Sciences and Applied Markets Group | $ | 511 |

| $ | 507 |

| 1 | % | | | |

|

|

|

| |

| | | | | | | | | |

Diagnostics and Genomics Group | 167 |

| 166 |

| 0 | % | | | |

|

|

|

| |

| | | | | | | | | |

Agilent CrossLab™ Group | 336 |

| 336 |

| 0 | % | | | |

|

|

|

| |

| | | | | | | | | |

Agilent | $ | 1,014 |

| $ | 1,009 |

| 1 | % | |

| |

|

|

|

| |

| | | | | | | | | |

| Non-GAAP | | Currency Adjustments (a) | | Currency-Adjusted |

Non-GAAP Revenue by Segment | Q3'15 | Q3'14 |

| Year-over-Year % change | | Q3'15 | | Q3'15 | Q3'14 |

| Year-over-Year % change |

| | | | | | | | | |

Life Sciences and Applied Markets Group excluding NMR | $ | 503 |

| $ | 485 |

| 4 | % | | $ | (28 | ) | | $ | 531 |

| $ | 485 |

| 9 | % |

| | | | |

| | | | |

Diagnostics and Genomics Group excluding acquisition | 166 |

| 166 |

| 0 | % | | (16 | ) | | 182 |

| 166 |

| 10 | % |

| | | | | | | | | |

Agilent CrossLab™ Group | 336 |

| 336 |

| 0 | % | | (27 | ) | | 363 |

| 336 |

| 8 | % |

| | | | | | | | | |

Agilent Revenue (Core) | $ | 1,005 |

| $ | 987 |

| 2 | % | | $ | (71 | ) | | $ | 1,076 |

| $ | 987 |

| 9 | % |

| | | | | | | | | |

.

(a) We compare the year-over-year change in revenue excluding the effect of the NMR business, recent acquisitions and divestitures and foreign currency rate fluctuations to assess the performance of our underlying business. To determine the impact of currency fluctuations, current period results for entities reporting in currencies other than United States dollars are converted into United States dollars at the actual exchange rate in effect during the respective prior periods.

The preliminary reconciliation of GAAP revenue adjusted for the NMR business, recent acquisitions and divestitures and impact of currency is estimated based on our current information.

AGILENT TECHNOLOGIES, INC.

RECONCILIATION OF ADJUSTED NON-GAAP INCOME FROM OPERATIONS AND OPERATING MARGINS

(In millions, except margin data)

(Unaudited)

PRELIMINARY

|

| | | | | |

| | | Operating |

| | Q3 2015 | Margin % |

| | | |

Revenue: | | $ | 1,014 |

| |

| | | |

Income from operations: | | | |

GAAP Income from operations | | $ | 144 |

| 14.2% |

Add: | | | |

Amortization of intangible assets | | 38 |

| |

Transformational initiatives | | 12 |

| |

Acquisition and integration costs | | 4 |

| |

Other | | 1 |

| |

Non-GAAP income from operations | | $ | 199 |

| 19.7% |

Reimbursement from Keysight for services (a) | | 4 |

| |

Adjusted non-GAAP income from operations | | $ | 203 |

| 19.9% |

(a) Post separation, Agilent is providing Keysight Technologies, Inc. certain IT and site services. These IT and site services are included in our operating expenses. The amounts billed to Keysight for these services are recorded in other income.

We provide non-GAAP income from operations in order to provide meaningful supplemental information regarding our operational performance and our prospects for the future. These supplemental measures exclude, among other things, charges related to the amortization of intangibles, transformational initiatives, acquisition and integration costs and business exit and divestiture costs.

Our management recognizes that items such as amortization of intangibles and restructuring charges can have a material impact on our cash flows and/or our net income. Our GAAP financial statements including our statement of cash flows portray those effects. Although we believe it is useful for investors to see core performance free of special items, investors should understand that the excluded items are actual expenses that may impact the cash available to us for other uses. To gain a complete picture of all effects on the company’s profit and loss from any and all events, management does (and investors should) rely upon the GAAP income statement. The non-GAAP numbers focus instead upon the core business of the company, which is only a subset, albeit a critical one, of the company’s performance.

Readers are reminded that non-GAAP numbers are merely a supplement to, and not a replacement for, GAAP financial measures. They should be read in conjunction with the GAAP financial measures. It should be noted as well that our non-GAAP information may be different from the non-GAAP information provided by other companies.

The preliminary reconciliation of income from operations and operating margins is estimated based on our current information.

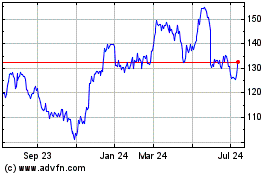

Agilent Technologies (NYSE:A)

Historical Stock Chart

From Mar 2024 to Apr 2024

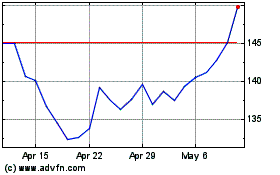

Agilent Technologies (NYSE:A)

Historical Stock Chart

From Apr 2023 to Apr 2024