UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported)

August 17, 2015

The Estée Lauder Companies Inc.

(Exact name of registrant as specified in its charter)

|

Delaware |

|

1-14064 |

|

11-2408943 |

|

(State or other jurisdiction of

incorporation) |

|

(Commission File Number) |

|

(IRS Employer Identification No.) |

|

767 Fifth Avenue, New York, New York |

|

10153 |

|

(Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code

212-572-4200

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 2.02 Results of Operations and Financial Condition

On August 17, 2015, The Estée Lauder Companies Inc. (the “Company”) issued a press release announcing its financial results for its fiscal 2015 full year and fourth quarter. The release also includes the Company’s estimates related to its fiscal 2016 first quarter and full year net sales and diluted net earnings per common share. A copy of the press release is attached hereto as Exhibit 99.1 and is incorporated herein by reference.

Item 8.01 Other Events

On August 14, 2015, the Company announced that a dividend was declared in the amount of $0.24 per share on the Company’s Class A and Class B Common Stock, which is payable in cash on September 15, 2015 to stockholders of record at the close of business on August 31, 2015.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits

|

Exhibit No. |

|

Description |

|

|

|

|

|

99.1 |

|

Press Release, dated August 17, 2015, of The Estée Lauder Companies Inc. |

2

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

THE ESTĒE LAUDER COMPANIES INC. |

|

|

|

|

|

|

|

Date: August 17, 2015 |

By: |

/s/ Tracey T. Travis |

|

|

|

Tracey T. Travis |

|

|

|

Executive Vice President |

|

|

|

and Chief Financial Officer |

|

|

|

(Principal Financial and Accounting Officer) |

3

Exhibit 99.1

|

|

News |

|

|

|

Contact: |

|

Investor Relations: |

|

Dennis D’Andrea

(212) 572-4384 |

|

|

|

|

767 Fifth Avenue |

Media Relations: |

|

New York, NY 10153 |

Alexandra Trower |

|

|

(212) 572-4430 |

|

|

|

THE ESTÉE LAUDER COMPANIES REPORTS STRONG ADJUSTED CONSTANT

CURRENCY SALES AND EARNINGS GROWTH IN FISCAL 2015

FOURTH QUARTER AND FULL YEAR

— NET SALES IN LINE WITH EXPECTATIONS, EPS BETTER THAN ANTICIPATED —

— FISCAL 2016 SALES AND EARNINGS OUTLOOK REMAINS STRONG —

New York, NY, August 17, 2015 - The Estée Lauder Companies Inc. (NYSE: EL) today reported financial results for its fourth quarter and fiscal year ended June 30, 2015. For the three months ended June 30, 2015, the Company reported net sales of $2.52 billion, compared with $2.73 billion in the prior-year period. The fiscal 2014 fourth quarter included the effect of the accelerated retailer orders, described below, which created an unfavorable comparison with the fiscal 2015 fourth-quarter results. Adjusting for the impact of the accelerated orders, net sales in constant currency for the three months ended June 30, 2015 would have increased 7%, in line with the Company’s expectations, and grew in each of the Company’s geographic regions and product categories, except skin care.

The Company’s fourth quarter sales benefited from innovative new products and growth in emerging and developed markets. The Company generated strong gains in the U.S., after adjusting for the accelerated orders, and constant currency double-digit gains in the U.K. Double-digit constant currency increases were generated in many European emerging markets, as well as in Asia/Pacific. The Company reported net earnings of $153.0 million, compared with $257.7 million last year. Diluted net earnings per common share were $.40, compared with $.66 reported in the same prior-year period. Adjusting for the impact of the accelerated orders, diluted net earnings per common share in constant currency for the three months ended June 30, 2015 would have increased 4%.

For the year, the Company achieved net sales of $10.78 billion, a 2% decrease compared with $10.97 billion in the prior year. Net earnings for the year were $1.09 billion, compared with $1.20 billion last year, and diluted net earnings per common share were $2.82, compared with $3.06 reported in the prior year. For the year, the negative impact of foreign currency translation on diluted net earnings per common share was $.24. Excluding the impact of foreign currency translation, net sales increased 3% and diluted net earnings per common share were flat. Adjusting for the impact of the accelerated orders and the charges noted below, net sales and diluted earnings per common share in constant currency for the fiscal year ended June 30, 2015 would have

Page 1 of 15

increased 6% and 12%, respectively. Information about GAAP and non-GAAP financial measures, including reconciliation information, is included in this release.

Fabrizio Freda, President and Chief Executive Officer, said, “Today, our Company is more balanced, resilient, and agile and has demonstrated its ability to produce consistent and sustainable results. Together with our powerful brand portfolio and financial discipline we finished our fiscal year with a strong fourth quarter, generating 7% constant currency sales growth, after adjusting for the accelerated sales orders we reported in fiscal 2014. One of the great strengths of our Company is our ability to successfully execute our well-defined strategy. This was clearly evident in fiscal 2015 as we once again delivered strong results despite considerable macroeconomic headwinds and challenges. For the full year, our adjusted 6% local currency sales growth met our expectations, and we exceeded our earnings per share forecast. These results speak to the strength of our underlying business across brands, product categories, geographies and channels.

“Our sales grew at a faster rate than global prestige beauty, due to the success of our multiple engines of growth. Standout performances generated double-digit sales gains in most of our makeup and luxury brands and the online, specialty-multi and freestanding store channels. By geography, emerging markets, the United Kingdom and accelerated growth in certain developed markets were also key performance drivers. We strengthened and diversified our portfolio with the acquisition of four uniquely positioned brands in fast-growing areas of prestige beauty. Our continued financial discipline provided additional resources to pursue high-growth opportunities and deliver strong bottom line growth.

“I am proud of our accomplishments. Importantly, we are well-positioned for continuing growth through our unique creativity and consumer appeal for our brands and innovative products. Global prestige beauty is a dynamic industry, and we will continue to anticipate and target the areas with the greatest potential. In fiscal 2016, we expect constant currency net sales growth of 6% to 8% and double-digit earnings per share growth, after adjusting for the accelerated sales orders.”

During fiscal 2015 and 2014, the Company recorded remeasurement charges of $5.3 million and $38.3 million, equal to approximately $.01 and $.10 per diluted share, respectively, both before and after tax, related to changes in Venezuelan foreign currency exchange rate mechanisms. In the fiscal 2014 fourth quarter, some retailers accelerated sales orders of approximately $178 million in advance of the Company’s July 2014 implementation of its Strategic Modernization Initiative (SMI) in certain of its largest remaining locations. Those orders would have occurred in the Company’s fiscal 2015 first quarter. This amounted to approximately $127 million in operating income, equal to approximately $.21 per diluted common share. Fiscal 2014 also included adjustments associated with restructuring activities.

Page 2 of 15

Full Year Results by Product Category

|

|

|

Year Ended June 30 |

|

|

|

|

Net Sales |

|

Percent Change |

|

Operating

Income (Loss) |

|

Percent

Change |

|

|

(Unaudited; Dollars in millions) |

|

2015 |

|

2014 |

|

Reported

Basis |

|

Constant

Currency |

|

2015 |

|

2014 |

|

Reported

Basis |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Skin Care |

|

$ |

4,478.7 |

|

$ |

4,769.8 |

|

(6 |

)% |

|

(2 |

)% |

|

$ |

832.2 |

|

$ |

975.8 |

|

(15 |

)% |

|

|

Makeup |

|

4,304.6 |

|

4,210.2 |

|

2 |

|

|

7 |

|

|

659.3 |

|

715.9 |

|

(8 |

) |

|

|

Fragrance |

|

1,416.4 |

|

1,425.0 |

|

(1 |

) |

|

5 |

|

|

82.8 |

|

104.1 |

|

(20 |

) |

|

|

Hair Care |

|

530.6 |

|

515.6 |

|

3 |

|

|

7 |

|

|

37.9 |

|

33.7 |

|

12 |

|

|

|

Other |

|

50.1 |

|

48.1 |

|

4 |

|

|

9 |

|

|

(5.9 |

) |

(4.8 |

) |

(23 |

) |

|

|

Subtotal |

|

10,780.4 |

|

10,968.7 |

|

(2 |

) |

|

3 |

|

|

1,606.3 |

|

1,824.7 |

|

(12 |

) |

|

|

Adjustments associated with restructuring activities |

|

— |

|

0.1 |

|

|

|

|

|

|

|

— |

|

2.9 |

|

|

|

|

|

Total |

|

$ |

10,780.4 |

|

$ |

10,968.8 |

|

(2 |

)% |

|

3 |

% |

|

$ |

1,606.3 |

|

$ |

1,827.6 |

|

(12 |

)% |

|

Net sales and operating income in each of the Company’s product categories were unfavorably impacted by the strength of the U.S. dollar in relation to most currencies. Total operating income in constant currency decreased 5%.

The change in net sales and operating income in the Company’s product categories were unfavorably impacted by the shift in orders from certain retailers due to the Company’s implementation of SMI, as previously mentioned. Additionally, operating results were unfavorably impacted by the Venezuela remeasurement charges. See tables on page 14.

Adjusting for these factors:

· Reported basis net sales in skin care, makeup, fragrance and hair care would have increased/(decreased) (2)%, 5%, 2% and 3%, respectively.

· Operating results in skin care, makeup, fragrance and hair care would have increased/(decreased) (1)%, 2%, (2)% and 13%, respectively.

Skin Care

· Skin care net sales decreased, reflecting the negative impact of foreign currency translation and lower sales of significant products from the Estée Lauder and Clinique brands that were launched in the prior-year period. Sales declines from these two brands were partially offset by recent launches such as Re-Nutriv Ultimate Diamond products from Estée Lauder and Clinique Smart custom-repair serum.

· Also partially offsetting these decreases were higher sales from La Mer, one of the Company’s luxury skin care brands, and from Origins, as well as incremental sales from recent acquisitions.

· Operating income decreased, driven by the impact of the accelerated orders and a difficult comparison to the prior year’s significant launch activity by the Estée Lauder and Clinique brands.

Makeup

· Higher makeup sales were primarily driven by excellent growth from the Company’s makeup artist brands and strong double-digit growth from Smashbox and Tom Ford. These sales

Page 3 of 15

increases resulted from new product offerings, as well as expanded distribution in a number of channels, including freestanding retail stores, travel retail and specialty multi-brand retailers.

· The Company’s makeup category is experiencing strong growth in product areas such as lipsticks and foundations, as well as increased prestige makeup usage in Asia.

· While new product offerings in the category, such as Beyond Perfecting foundation and concealer from Clinique and the Pure Color Envy line of lip products from Estée Lauder contributed sales gains, both of these brands posted overall lower makeup sales.

· The decrease in makeup operating income was primarily due to lower results from heritage brands, reflecting, in part, the impact of the accelerated orders, partially offset by improved results from makeup artist brands.

Fragrance

· In fragrance, sales decreased due to the negative impact of foreign currency translation and lower sales of certain Estée Lauder, Clinique and designer fragrances.

· Michael Kors and luxury brands Jo Malone London and Tom Ford recorded strong double-digit sales gains, partially driven by new product launches and expanded distribution.

· Fragrance operating income decreased, reflecting the lower launch activity from certain designer fragrances and heritage brands as well as the impact of the accelerated orders, partially offset by higher results from luxury fragrance brands.

Hair Care

· The hair care category’s growth benefited from expanded global distribution, primarily in salons, freestanding stores and travel retail for Aveda and from specialty-multi brand retailers for Bumble and bumble.

· Hair care also reflects net sales growth of Smooth Infusion Naturally Straight by Aveda and the expansion of Bumble and bumble’s Hairdresser’s Invisible Oil line of products.

· Hair care operating income increased, primarily reflecting higher net sales driven by expanded global distribution and new product launches, as well as lower investment spending as compared with the higher level of spending in the prior-year period to support Aveda’s Invati line of products.

Full Year Results by Geographic Region

|

|

|

Year Ended June 30 |

|

|

|

|

Net Sales |

|

Percent Change |

|

Operating

Income (Loss) |

|

Percent

Change |

|

|

(Unaudited; Dollars in millions) |

|

2015 |

|

2014 |

|

Reported

Basis |

|

Constant

Currency |

|

2015 |

|

2014 |

|

Reported

Basis |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The Americas |

|

$ |

4,513.8 |

|

$ |

4,572.3 |

|

(1 |

)% |

|

2 |

% |

|

$ |

302.3 |

|

$ |

537.3 |

|

(44 |

)% |

|

|

Europe, the Middle East & Africa |

|

4,086.4 |

|

4,163.7 |

|

(2 |

) |

|

5 |

|

|

943.3 |

|

938.3 |

|

1 |

|

|

|

Asia/Pacific |

|

2,180.2 |

|

2,232.7 |

|

(2 |

) |

|

1 |

|

|

360.7 |

|

349.1 |

|

3 |

|

|

|

Subtotal |

|

10,780.4 |

|

10,968.7 |

|

(2 |

) |

|

3 |

|

|

1,606.3 |

|

1,824.7 |

|

(12 |

) |

|

|

Adjustments associated with restructuring activities |

|

— |

|

0.1 |

|

|

|

|

|

|

|

— |

|

2.9 |

|

|

|

|

|

Total |

|

$ |

10,780.4 |

|

$ |

10,968.8 |

|

(2 |

)% |

|

3 |

% |

|

$ |

1,606.3 |

|

$ |

1,827.6 |

|

(12 |

)% |

|

Page 4 of 15

The change in net sales and operating income in the Company’s geographic regions was unfavorably impacted by the shift in orders from certain retailers due to the Company’s implementation of SMI, as previously mentioned. Additionally, operating results were unfavorably impacted by the Venezuela remeasurement charges. See tables on page 14.

Adjusting for these factors:

· Reported basis net sales in the Americas, Europe, the Middle East & Africa and Asia/Pacific would have increased 2%, 1% and 0%, respectively.

· Operating income in the Americas, Europe, the Middle East & Africa and Asia/Pacific would have increased/(decreased) (31)%, 13% and 16%, respectively.

The Americas

· Sales in the United States decreased, due to the impact of the accelerated orders, as well as a difficult comparison with the prior-year period that featured significant launches of reformulated iconic products from certain heritage brands.

· Strong sales increases were generated from the Company’s makeup, luxury and hair care brands, driven in part by new product introductions and expanded distribution, and partially offset by decreases from certain heritage brands. Sales in the Company’s online business grew strong double digits.

· In constant currency, sales in Canada were flat, due to the impact of the accelerated orders, while sales grew strongly in Latin America, primarily from higher sales in Venezuela and Brazil.

· Operating income in the Americas declined, due to the lower sales as noted above, higher general and administrative costs and acquisition-related expenses. This decrease was partially offset by lower advertising, merchandising and sampling spending by heritage brands due to the lower level of launch activity and the mix of spending among media formats, as well as lower charges related to the remeasurement of net monetary assets in Venezuela.

Europe, the Middle East & Africa

· The Company estimates that it continued to outperform prestige beauty in most markets in the region.

· All countries recorded constant currency sales growth, led by double-digit gains in the United Kingdom, Benelux, the Balkans, and a number of emerging markets, including Russia, the Middle East, Turkey and South Africa.

· In travel retail, net sales decreased, driven by the impact of the accelerated orders and softness of some key foreign currencies affecting the mix of travelers and their consumption. Excluding this impact, travel retail net sales increased and continues to benefit from new launch initiatives, an increase in global airline passenger traffic and expanded distribution.

· Operating income increased slightly, with higher operating results posted in the United Kingdom, the Middle East, France, Russia, India and Switzerland. Lower operating results were recorded primarily in travel retail, due to the accelerated orders, and Germany.

Asia/Pacific

· Sales in the region increased in constant currency, with double-digit growth in Australia, New Zealand and the Philippines.

· Higher constant currency sales were also recorded in China, Korea, Thailand and Taiwan. The higher sales in China were primarily from certain heritage, luxury and makeup artist brands as a result of expanded distribution.

Page 5 of 15

· Lower sales were reported in a few countries, including Japan and Hong Kong. The lower sales in Japan reflected the impact of the accelerated orders. In Hong Kong, social instability continued to affect tourism and negatively impact business, and the Company remains cautious of the near-term slower growth there.

· In Asia/Pacific, operating income increased, led by higher results in China, Korea and Australia. Lower operating results were posted primarily in Japan, Hong Kong and Singapore.

Full-Year Cash Flows

· For the 12 months ended June 30, 2015, net cash flows provided by operating activities increased 27% to $1.94 billion, compared with $1.54 billion in the prior year.

· The improvement primarily reflected an increase in cash from certain working capital components, partially offset by lower net earnings due to the impact of foreign currency and the accelerated orders.

Outlook for Fiscal 2016 First Quarter and Full Year

The Company expects to grow ahead of the industry by focusing on fast growing opportunities in product categories, channels and countries. The Company also expects to leverage its strong sales growth and increase its cash flow from operations.

While the Company’s business is performing well overall, it continues to experience economic challenges in certain countries around the world. The Company is cautious of slower retail growth in Hong Kong and China, a decline in spending by Russian and Brazilian travelers, the impact of the MERS virus on its travel retail business in Korea and the impact of unfavorable foreign exchange due to the strength of the U.S. dollar in relation to most currencies. The Company continues to expect to deliver strong financial results despite these challenges.

The comparison of the Company’s fiscal 2016 first quarter and full year results with the prior-year periods will be affected by the previously mentioned July 2014 accelerated orders.

First Quarter Fiscal 2016

· Net sales are forecasted to increase between 13% and 14% in constant currency.

· Reflecting the strength of the U.S. dollar, foreign currency translation is expected to negatively impact sales by approximately 6% to 7% versus the prior-year period.

· The accelerated retailer orders as previously mentioned will affect the comparison between the fiscal 2016 and fiscal 2015 first quarter sales by approximately 7%.

· Net sales adjusting for the effect of the accelerated retailer orders are forecasted to grow between 6% and 7% in constant currency.

· The acquisitions the Company made beginning in the second quarter of fiscal 2015 are forecast to contribute approximately 90 basis points to the Company’s overall sales growth in its fiscal 2016 first quarter. Acquisitions are estimated to dilute earnings per share by approximately $.01.

· During the fiscal 2016 first quarter, the Company expects to increase investment spending above the prior-year period to continue to build momentum, drive growth and gain share. This planned spending coincides with the cadence of new product launches and supports successful existing products, as well as enhanced initiatives to reignite growth in the Estée Lauder and Clinique brands and continue momentum in the fastest growing brands and markets. The Company also expects to increase spending behind capability-building initiatives, such as information technology.

Page 6 of 15

· Diluted net earnings per share, including the negative impact of foreign currency translation and acquisitions, are projected to be between $.66 and $.69.

· The approximate 6% to 7% negative currency impact on the sales growth equates to about $.09 of earnings per share. On a constant currency basis and adjusting for the effect of the accelerated retailer orders, diluted earnings per share are expected to decrease 3% to 6%.

Full Year Fiscal 2016

· Net sales are forecasted to grow between 8% and 10% in constant currency.

· Reflecting the strength of the U.S. dollar, foreign currency translation is expected to negatively impact sales by approximately 3% to 4% versus the prior-year period.

· The accelerated retailer orders will affect the comparison between the fiscal 2016 and fiscal 2015 full year sales by approximately 2%.

· Net sales adjusting for the effect of the accelerated retailer orders are forecasted to grow between 6% and 8% in constant currency.

· The Company’s recent acquisitions are forecast to contribute approximately 50 basis points to the Company’s overall sales growth. Acquisitions are estimated to dilute earnings per share by approximately $.05.

· Diluted net earnings per share, including the negative impact of foreign currency translation and acquisitions, are projected to be between $3.10 to $3.17.

· The approximate 3% to 4% negative currency impact on the sales growth equates to about $.18 of earnings per share. On a constant currency basis and adjusting for the effect of the accelerated retailer orders, diluted earnings per share are expected to grow between 8% to 10%.

|

|

|

Diluted Earnings Per Share |

|

|

Reconciliation between GAAP and

non-GAAP |

|

Three Months

September 30 |

|

Twelve Months June 30 |

|

|

(Unaudited) |

|

2015(F) |

|

2014 |

|

2016(F) |

|

2015 |

|

|

Forecast / actual results including the fiscal 2015 Venezuela charge and accelerated retailer orders |

|

$.66 - $69 |

(1) |

$.59 |

(1) |

$3.10 – 3.17 |

(1) |

$2.82 |

(1) |

|

Non-GAAP |

|

|

|

|

|

|

|

|

|

|

Venezuela charge |

|

— |

|

— |

|

— |

|

.01 |

|

|

Impact of fiscal 2015 accelerated orders |

|

— |

|

.21 |

|

— |

|

.21 |

|

|

Results excluding the Venezuela charge and accelerated retailer orders |

|

.66 - .69 |

|

$.80 |

|

3.10 – 3.17 |

|

$3.05 |

|

|

Impact of foreign currency on earnings per share |

|

.09 |

|

|

|

.18 |

|

|

|

|

Forecasted constant currency earnings per share |

|

$.75 - $.78 |

|

|

|

$3.28 - $3.35 |

|

|

|

(1) Represents GAAP forecast or actual results.

(F) Represents forecast

Amounts may not sum due to rounding.

Page 7 of 15

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ending September 30, 2015 |

|

Year Ending June 30, 2016 |

|

|

Reconciliation between GAAP |

|

Net Sales Growth |

|

Diluted EPS Growth |

|

Net Sales Growth |

|

Diluted EPS Growth |

|

|

and non-GAAP

(Unaudited) |

|

Reported

Basis |

|

Constant

Currency |

|

Reported

Basis |

|

Constant

Currency |

|

Reported

Basis |

|

Constant

Currency |

|

Reported

Basis |

|

Constant

Currency |

|

|

Forecast including the fiscal 2015 Venezuela charge and accelerated retailer orders |

|

6-8 |

%(1) |

|

13-14 |

% |

|

12-17 |

%(1) |

|

27-32 |

% |

|

4-7 |

%(1) |

|

8-10 |

% |

|

10-12 |

%(1) |

|

16-19 |

% |

|

|

Non-GAAP |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Impact of fiscal 2015 accelerated orders |

|

~(7 |

)% |

|

~(7 |

)% |

|

~(30)-(31 |

)% |

|

~(33)-(35 |

)% |

|

~(2 |

)% |

|

~(2 |

)% |

|

~(8) |

% |

|

~(8)-(9 |

)% |

|

|

Forecast excluding the fiscal 2015 Venezuela charge and accelerated retailer orders |

|

(1)-1 |

% |

|

6-7 |

% |

|

(18)-(14) |

% |

|

(6)-(3) |

% |

|

2-5 |

% |

|

6-8 |

% |

|

2-4 |

% |

|

8-10 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1) Represents GAAP forecast.

Amounts may not sum due to rounding.

Conference Call

The Estée Lauder Companies will host a conference call at 9:30 a.m. (ET) today, August 17, 2015 to discuss its results. The dial-in number for the call is 888-294-4716 in the U.S. or 706-902-0101 internationally (conference ID number: 85104187). The call will also be webcast live at http://investors.elcompanies.com.

Cautionary Note Regarding Forward-Looking Statements

The forward-looking statements in this press release, including those containing words like “expect,” “plans,” “may,” “could,” “anticipate,” “estimate,” “projected,” “forecasted,” those in Mr. Freda’s remarks and those in the “Outlook for Fiscal 2016 First Quarter and Full Year” section involve risks and uncertainties. Factors that could cause actual results to differ materially from those forward-looking statements include the following:

(1) increased competitive activity from companies in the skin care, makeup, fragrance and hair care businesses, some of which have greater resources than the Company does;

(2) the Company’s ability to develop, produce and market new products on which future operating results may depend and to successfully address challenges in the Company’s business;

(3) consolidations, restructurings, bankruptcies and reorganizations in the retail industry causing a decrease in the number of stores that sell the Company’s products, an increase in the ownership concentration within the retail industry, ownership of retailers by the Company’s competitors or ownership of competitors by the Company’s customers that are retailers and our inability to collect receivables;

(4) destocking and tighter working capital management by retailers;

(5) the success, or changes in timing or scope, of new product launches and the success, or changes in the timing or the scope, of advertising, sampling and merchandising programs;

(6) shifts in the preferences of consumers as to where and how they shop for the types of products and services the Company sells;

(7) social, political and economic risks to the Company’s foreign or domestic manufacturing, distribution and retail operations, including changes in foreign investment and trade policies and regulations of the host countries and of the United States;

(8) changes in the laws, regulations and policies (including the interpretations and enforcement thereof) that affect, or will affect, the Company’s business, including those relating to its products or distribution networks, changes in accounting standards, tax laws and regulations, environmental or climate change laws, regulations or accords, trade rules and customs regulations, and the outcome and expense of legal or regulatory proceedings, and any action the Company may take as a result;

(9) foreign currency fluctuations affecting the Company’s results of operations and the value of its foreign assets, the relative prices at which the Company and its foreign competitors sell products in the same markets and the Company’s operating and manufacturing costs outside of the United States;

(10) changes in global or local conditions, including those due to the volatility in the global credit and equity markets, natural or man-made disasters, real or perceived epidemics, or energy costs, that could affect consumer purchasing, the willingness or ability of consumers to travel and/or purchase the Company’s products while traveling, the financial strength of the Company’s customers, suppliers or other contract counterparties, the Company’s operations, the cost and availability of capital which the Company may need

Page 8 of 15

for new equipment, facilities or acquisitions, the returns that the Company is able to generate on its pension assets and the resulting impact on its funding obligations, the cost and availability of raw materials and the assumptions underlying the Company’s critical accounting estimates;

(11) shipment delays, commodity pricing, depletion of inventory and increased production costs resulting from disruptions of operations at any of the facilities that manufacture nearly all of the Company’s supply of a particular type of product (i.e., focus factories) or at the Company’s distribution or inventory centers, including disruptions that may be caused by the implementation of information technology initiatives or by restructurings;

(12) real estate rates and availability, which may affect the Company’s ability to increase or maintain the number of retail locations at which the Company sells its products and the costs associated with the Company’s other facilities;

(13) changes in product mix to products which are less profitable;

(14) the Company’s ability to acquire, develop or implement new information and distribution technologies and initiatives on a timely basis and within the Company’s cost estimates and the Company’s ability to maintain continuous operations of such systems and the security of data and other information that may be stored in such systems or other systems or media;

(15) the Company’s ability to capitalize on opportunities for improved efficiency, such as publicly-announced strategies and restructuring and cost-savings initiatives, and to integrate acquired businesses and realize value therefrom;

(16) consequences attributable to local or international conflicts around the world, as well as from any terrorist action, retaliation and the threat of further action or retaliation;

(17) the timing and impact of acquisitions, investments and divestitures; and

(18) additional factors as described in the Company’s filings with the Securities and Exchange Commission, including its Annual Report on Form 10-K for the fiscal year ended June 30, 2014.

The Company assumes no responsibility to update forward-looking statements made herein or otherwise.

The Estée Lauder Companies Inc. is one of the world’s leading manufacturers and marketers of quality skin care, makeup, fragrance and hair care products. The Company’s products are sold in over 150 countries and territories under brand names including: Estée Lauder, Aramis, Clinique, Prescriptives, Lab Series, Origins, Tommy Hilfiger, M•A•C, Kiton, La Mer, Bobbi Brown, Donna Karan New York, DKNY, Aveda, Jo Malone London, Bumble and bumble, Michael Kors, Darphin, GoodSkin Labs, Tom Ford, Ojon, Smashbox, Ermenegildo Zegna, AERIN, Osiao, Marni, Tory Burch, RODIN olio lusso, Le Labo, Editions de Parfums Frédéric Malle and GLAMGLOW.

An electronic version of this release can be found at the Company’s website, www.elcompanies.com.

Page 9 of 15

THE ESTÉE LAUDER COMPANIES INC.

CONSOLIDATED STATEMENTS OF EARNINGS

(Unaudited; In millions, except per share data and percentages)

|

|

|

Three Months Ended

June 30 |

|

Percent |

|

Year Ended June 30 |

|

Percent |

|

|

|

|

2015 |

|

2014 |

|

Change |

|

2015 |

|

2014 |

|

Change |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Sales |

|

$ |

2,524.4 |

|

$ |

2,725.3 |

|

(7 |

)% |

|

$ |

10,780.4 |

|

$ |

10,968.8 |

|

(2 |

)% |

|

|

Cost of Sales |

|

488.0 |

|

533.8 |

|

|

|

|

2,100.6 |

|

2,158.2 |

|

|

|

|

|

Gross Profit |

|

2,036.4 |

|

2,191.5 |

|

(7 |

)% |

|

8,679.8 |

|

8,810.6 |

|

(1 |

)% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gross Margin |

|

80.7 |

% |

80.4 |

% |

|

|

|

80.5 |

% |

80.3 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Selling, general and administrative (A) |

|

1,808.1 |

|

1,812.0 |

|

|

|

|

7,073.5 |

|

6,985.9 |

|

|

|

|

|

Restructuring and other charges |

|

— |

|

(0.7 |

) |

|

|

|

— |

|

(2.9 |

) |

|

|

|

|

|

|

1,808.1 |

|

1,811.3 |

|

0 |

% |

|

7,073.5 |

|

6,983.0 |

|

1 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating Expense Margin |

|

71.6 |

% |

66.4 |

% |

|

|

|

65.6 |

% |

63.6 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating Income |

|

228.3 |

|

380.2 |

|

(40 |

)% |

|

1,606.3 |

|

1,827.6 |

|

(12 |

)% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating Income Margin |

|

9.1 |

% |

14.0 |

% |

|

|

|

14.9 |

% |

16.7 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest expense |

|

15.0 |

|

15.2 |

|

|

|

|

60.0 |

|

59.4 |

|

|

|

|

|

Interest income and investment income, net |

|

5.8 |

|

2.6 |

|

|

|

|

14.3 |

|

8.6 |

|

|

|

|

|

Earnings before Income Taxes |

|

219.1 |

|

367.6 |

|

(40 |

)% |

|

1,560.6 |

|

1,776.8 |

|

(12 |

)% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Provision for income taxes |

|

65.3 |

|

109.2 |

|

|

|

|

467.2 |

|

567.7 |

|

|

|

|

|

Net Earnings |

|

153.8 |

|

258.4 |

|

(40 |

)% |

|

1,093.4 |

|

1,209.1 |

|

(10 |

)% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net earnings attributable to noncontrolling interests |

|

(0.8 |

) |

(0.7 |

) |

|

|

|

(4.5 |

) |

(5.0 |

) |

|

|

|

|

Net Earnings Attributable to The Estée Lauder Companies Inc. |

|

$ |

153.0 |

|

$ |

257.7 |

|

(41 |

)% |

|

$ |

1,088.9 |

|

$ |

1,204.1 |

|

(10 |

)% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net earnings attributable to The Estée Lauder Companies Inc. per common share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

$ |

.41 |

|

$ |

.67 |

|

(40 |

)% |

|

$ |

2.87 |

|

$ |

3.12 |

|

(8 |

)% |

|

|

Diluted |

|

.40 |

|

.66 |

|

(40 |

)% |

|

2.82 |

|

3.06 |

|

(8 |

)% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average common shares outstanding: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

377.0 |

|

383.0 |

|

|

|

|

379.3 |

|

386.2 |

|

|

|

|

|

Diluted |

|

383.7 |

|

389.8 |

|

|

|

|

385.7 |

|

393.1 |

|

|

|

|

In the fiscal 2014 fourth quarter some retailers accelerated sales orders in advance of the Company’s July 2014 implementation of its Strategic Modernization Initiative (SMI) in certain of its largest remaining locations of approximately $178 million. These orders would have occurred in the Company’s fiscal 2015 first quarter ended September 30, 2014. This amounted to approximately $127 million in operating income, equal to approximately $.21 per diluted common share. The impact of this shift is reflected in the consolidated statements of earnings for the three months and year ended June 30, 2015.

(A) During the third quarter of fiscal 2014, based on changes to Venezuela’s foreign currency exchange rate regulations made at that time, the Company changed the exchange rate used to remeasure its Venezuelan net monetary assets to a newly enacted SICAD II rate. Accordingly, the Company recorded a remeasurement charge of $38.3 million, both before and after tax, equal to approximately $.10 per diluted common share.

During the fiscal 2015 third quarter, the Venezuelan government introduced a new open market foreign exchange system, SIMADI, which effectively replaced the SICAD II mechanism. As a result, the Company changed the exchange rate used to remeasure the net monetary assets of its Venezuelan subsidiary to the SIMADI rate. Accordingly, the Company recorded a remeasurement charge of $5.3 million, both before and after tax, equal to approximately $.01 per diluted share.

Page 10 of 15

THE ESTÉE LAUDER COMPANIES INC.

SUMMARY OF CONSOLIDATED RESULTS

(Unaudited; Dollars in millions)

|

|

|

Three Months Ended June 30 |

|

|

|

|

|

|

|

|

|

|

|

|

Operating |

|

Percent |

|

|

|

|

Net Sales |

|

Percent Change |

|

Income (Loss) |

|

Change |

|

|

|

|

2015 |

|

2014 |

|

Reported

Basis |

|

Constant

Currency |

|

2015 |

|

2014 |

|

Reported

Basis |

|

|

Results by Geographic Region |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The Americas |

|

$ |

1,087.7 |

|

$ |

1,103.3 |

|

(1 |

)% |

|

3 |

% |

|

$ |

14.5 |

|

$ |

117.6 |

|

(88 |

)% |

|

|

Europe, the Middle East & Africa |

|

982.4 |

|

1,132.1 |

|

(13 |

) |

|

(3 |

) |

|

213.9 |

|

264.9 |

|

(19 |

) |

|

|

Asia/Pacific |

|

454.3 |

|

489.9 |

|

(7 |

) |

|

(2 |

) |

|

(0.1 |

) |

(3.1 |

) |

97 |

|

|

|

Subtotal |

|

2,524.4 |

|

2,725.3 |

|

(7 |

) |

|

0 |

|

|

228.3 |

|

379.4 |

|

(40 |

) |

|

|

Adjustments associated with restructuring activities |

|

— |

|

— |

|

|

|

|

|

|

|

— |

|

0.8 |

|

|

|

|

|

Total |

|

$ |

2,524.4 |

|

$ |

2,725.3 |

|

(7 |

)% |

|

0 |

% |

|

$ |

228.3 |

|

$ |

380.2 |

|

(40 |

)% |

|

|

Results by Product Category |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Skin Care |

|

$ |

1,011.9 |

|

$ |

1,205.4 |

|

(16 |

)% |

|

(9 |

)% |

|

$ |

123.0 |

|

$ |

217.2 |

|

(43 |

)% |

|

|

Makeup |

|

1,024.6 |

|

1,064.4 |

|

(4 |

) |

|

3 |

|

|

120.7 |

|

151.4 |

|

(20 |

) |

|

|

Fragrance |

|

336.1 |

|

309.3 |

|

9 |

|

|

18 |

|

|

(21.2 |

) |

8.6 |

|

(100 |

)+ |

|

|

Hair Care |

|

139.8 |

|

134.9 |

|

4 |

|

|

10 |

|

|

5.8 |

|

4.4 |

|

32 |

|

|

|

Other |

|

12.0 |

|

11.3 |

|

6 |

|

|

13 |

|

|

— |

|

(2.2 |

) |

100 |

|

|

|

Subtotal |

|

2,524.4 |

|

2,725.3 |

|

(7 |

) |

|

0 |

|

|

228.3 |

|

379.4 |

|

(40 |

) |

|

|

Adjustments associated with restructuring activities |

|

— |

|

— |

|

|

|

|

|

|

|

— |

|

0.8 |

|

|

|

|

|

Total |

|

$ |

2,524.4 |

|

$ |

2,725.3 |

|

(7 |

)% |

|

0 |

% |

|

$ |

228.3 |

|

$ |

380.2 |

|

(40 |

)% |

|

Net sales and operating income in each of the Company’s product categories and geographic regions were unfavorably impacted by the strength of the U.S. dollar in relation to most currencies. Total operating income in constant currency decreased 30%.

The change in net sales and operating income for the three months ended June 30, 2015 in the Company’s geographic regions and product categories was unfavorably impacted by the shift in orders from certain retailers due to the Company’s implementation of SMI, as previously mentioned. See tables on page 14 that exclude the impact of the shift in orders on the Company’s net sales and operating income by geographic regions and product categories for the three months ended June 30, 2015.

This earnings release includes some non-GAAP financial measures relating to adjustments associated with restructuring activities, the Venezuela remeasurements and the accelerated orders associated with the Company’s SMI rollout. The following are reconciliations between the non-GAAP financial measures and the most directly comparable GAAP measures for certain consolidated statements of earnings accounts before and after these items. The Company uses these non-GAAP financial measures, among other financial measures, to evaluate its operating performance, and the measures represent the manner in which the Company conducts and views its business. Management believes that excluding these items that are not comparable from period to period helps investors and others compare operating performance between two periods. While the Company considers the non-GAAP measures useful in analyzing its results, they are not intended to replace, or act as a substitute for, any presentation included in the consolidated financial statements prepared in conformity with GAAP.

The Company operates on a global basis, with the majority of its net sales generated outside the United States. Accordingly, fluctuations in foreign currency exchange rates can affect the Company’s results of operations. Therefore, the Company presents certain net sales, operating results and diluted earnings per share information excluding the effect of foreign currency rate fluctuations to provide a framework for assessing the performance of its underlying business outside the United States. Constant currency information compares results between periods as if exchange rates had remained constant period-over-period. The Company calculates constant currency information by translating current-period results using prior-year period weighted average foreign currency exchange rates.

Page 11 of 15

THE ESTÉE LAUDER COMPANIES INC.

As part of SMI, the Company implemented the last major wave of SAP-based technologies in July 2014. As a result, and consistent with prior waves, the Company experienced a shift in its sales and operating results from accelerated orders from certain of its retailers to provide adequate safety stock and to mitigate any potential short-term business interruption associated with the July 2014 SMI rollout. In particular, approximately $178 million of accelerated orders were recorded as net sales in the fiscal 2014 fourth quarter that would have occurred in the fiscal 2015 first quarter.

This action created an unfavorable comparison between the fiscal 2015 and fiscal 2014 full year of approximately $178 million in net sales and approximately $127 million in operating income, equal to $.21 per diluted common share and impacted the Company’s operating margin comparisons. The Company believes the presentation of certain comparative information in the discussions in this release that exclude the impact of the timing of these orders is useful in analyzing the net sales performance and operating results of its business.

Reconciliation of Certain Consolidated Statements of Earnings Accounts Before and After

Returns and Charges and Accelerated Orders Associated with the Company’s Implementation of SMI

(Unaudited; In millions, except per share data and percentages)

|

|

|

Three Months Ended June 30, 2015 |

|

Three Months Ended June 30, 2014 |

|

|

|

|

|

|

|

|

As

Reported |

|

Returns/

Charges |

|

SMI

Adjust-

ments |

|

Before

Charges

/SMI |

|

Impact of

foreign

currency

transla-

tion |

|

Constant

Currency |

|

As

Reported |

|

Returns/

Charges |

|

SMI

Adjust-

ments |

|

Before

Charges

/SMI |

|

% Change

versus Prior

Year Before

Charges/SMI |

|

%

Change

Constant

Currency |

|

|

Net Sales |

|

$ |

2,524.4 |

|

$ |

— |

|

$ |

— |

|

$ |

2,524.4 |

|

$ |

193.3 |

|

$ |

2,717.7 |

|

$ |

2,725.3 |

|

$ |

0.0 |

|

$ |

(178.3 |

) |

$ |

2,547.0 |

|

(1)% |

|

7% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cost of sales |

|

488.0 |

|

— |

|

— |

|

488.0 |

|

|

|

|

|

533.8 |

|

0.1 |

|

(35.1 |

) |

498.8 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gross Profit |

|

2,036.4 |

|

— |

|

— |

|

2,036.4 |

|

|

|

|

|

2,191.5 |

|

(0.1 |

) |

(143.2 |

) |

2,048.2 |

|

(1)% |

|

|

|

|

Gross Margin |

|

80.7 |

% |

|

|

|

|

80.7 |

% |

|

|

|

|

80.4 |

% |

|

|

|

|

80.4 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating expenses |

|

1,808.1 |

|

— |

|

— |

|

1,808.1 |

|

|

|

|

|

1,811.3 |

|

0.7 |

|

(16.0 |

) |

1,796.0 |

|

1% |

|

|

|

|

Operating Expense Margin |

|

71.6 |

% |

|

|

|

|

71.6 |

% |

|

|

|

|

66.4 |

% |

|

|

|

|

70.5 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating Income |

|

228.3 |

|

— |

|

— |

|

228.3 |

|

|

|

|

|

380.2 |

|

(0.8 |

) |

(127.2 |

) |

252.2 |

|

(9)% |

|

|

|

|

Operating Income Margin |

|

9.1 |

% |

|

|

|

|

9.1 |

% |

|

|

|

|

14.0 |

% |

|

|

|

|

9.9 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Provision for income taxes |

|

65.3 |

|

— |

|

— |

|

65.3 |

|

|

|

|

|

109.2 |

|

(0.2 |

) |

(45.3 |

) |

63.7 |

|

|

|

|

|

|

Net Earnings Attributable to The Estée Lauder Companies Inc. |

|

153.0 |

|

— |

|

— |

|

153.0 |

|

|

|

|

|

257.7 |

|

(0.6 |

) |

(81.9 |

) |

175.2 |

|

(13)% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Diluted net earnings attributable to The Estée Lauder Companies Inc. per common share |

|

.40 |

|

— |

|

— |

|

.40 |

|

.07 |

|

.47 |

|

.66 |

|

.00 |

|

(.21 |

) |

.45 |

|

(11)% |

|

4% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Amounts may not sum due to rounding.

Page 12 of 15

THE ESTÉE LAUDER COMPANIES INC.

Reconciliation of Certain Consolidated Statements of Earnings Accounts Before and After

Returns and Charges and Accelerated Orders Associated with the Company’s Implementation of SMI

(Unaudited; In millions, except per share data and percentages)

|

|

|

Year Ended June 30, 2015 |

|

Year Ended June 30, 2014 |

|

|

|

|

|

|

|

|

As

Reported |

|

Returns/

Charges |

|

SMI

Adjust-

ments |

|

Before

Charges

/SMI |

|

Impact of

foreign

currency

transla-

tion |

|

Constant

Currency |

|

As

Reported |

|

Returns/

Charges |

|

SMI

Adjust-

ments |

|

Before

Charges

/SMI |

|

% Change

versus Prior

Year Before

Charges/SMI |

|

%

Change

Constant

Currency |

|

|

Net Sales |

|

$ |

10,780.4 |

|

$ |

0.0 |

|

$ |

178.3 |

|

$ |

10,958.7 |

|

$ |

519.8 |

|

$ |

11,478.5 |

|

$ |

10,968.8 |

|

$ |

(0.1 |

) |

$ |

(178.3 |

) |

$ |

10,790.4 |

|

2% |

|

6% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cost of sales |

|

2,100.6 |

|

0.0 |

|

35.1 |

|

2,135.7 |

|

|

|

|

|

2,158.2 |

|

(0.1 |

) |

(35.1 |

) |

2,123.0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gross Profit |

|

8,679.8 |

|

0.0 |

|

143.2 |

|

8,823.0 |

|

|

|

|

|

8,810.6 |

|

0.0 |

|

(143.2 |

) |

8,667.4 |

|

2% |

|

|

|

|

Gross Margin |

|

80.5 |

% |

|

|

|

|

80.5 |

% |

|

|

|

|

80.3 |

% |

|

|

|

|

80.3 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating expenses |

|

7,073.5 |

|

(5.3 |

) |

16.0 |

|

7,084.2 |

|

|

|

|

|

6,983.0 |

|

(35.4 |

) |

(16.0 |

) |

6,931.6 |

|

2% |

|

|

|

|

Operating Expense Margin |

|

65.6 |

% |

|

|

|

|

64.6 |

% |

|

|

|

|

63.6 |

% |

|

|

|

|

64.2 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating Income |

|

1,606.3 |

|

5.3 |

|

127.2 |

|

1,738.8 |

|

|

|

|

|

1,827.6 |

|

35.4 |

|

(127.2 |

) |

1,735.8 |

|

0% |

|

|

|

|

Operating Income Margin |

|

14.9 |

% |

|

|

|

|

15.9 |

% |

|

|

|

|

16.7 |

% |

|

|

|

|

16.1 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Provision for income taxes |

|

467.2 |

|

0.0 |

|

45.3 |

|

512.5 |

|

|

|

|

|

567.7 |

|

(1.1 |

) |

(45.3 |

) |

521.3 |

|

|

|

|

|

|

Net Earnings Attributable to The Estée Lauder Companies Inc. |

|

1,088.9 |

|

5.3 |

|

81.9 |

|

1,176.1 |

|

|

|

|

|

1,204.1 |

|

36.5 |

|

(81.9 |

) |

1,158.7 |

|

2% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Diluted net earnings attributable to The Estée Lauder Companies Inc. per common share |

|

2.82 |

|

.01 |

|

.21 |

|

3.05 |

|

.24 |

|

3.29 |

|

3.06 |

|

.09 |

|

(.21 |

) |

2.95 |

|

3% |

|

12% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Amounts may not sum due to rounding.

Page 13 of 15

THE ESTÉE LAUDER COMPANIES INC.

The impact on net sales and operating results of accelerated orders from certain retailers associated with the Company’s implementation of SMI, as well as the impact of the Venezuela remeasurement charges by product category and geographic region is as follows:

|

|

|

Accelerated Sales Orders |

|

Venezuela

Remeasurement Charges |

|

|

|

|

Three Months and Year Ended |

|

Operating Results |

|

|

|

|

June 30, 2015 |

|

Year Ended June 30 |

|

|

(Unaudited; In millions) |

|

Net Sales |

|

Operating Results |

|

2015 |

|

2014 |

|

|

Product Category: |

|

|

|

|

|

|

|

|

|

|

Skin Care |

|

$ |

91 |

|

$ |

72 |

|

$ |

2 |

|

$ |

12 |

|

|

Makeup |

|

65 |

|

41 |

|

2 |

|

16 |

|

|

Fragrance |

|

21 |

|

14 |

|

1 |

|

10 |

|

|

Hair Care |

|

1 |

|

— |

|

— |

|

— |

|

|

Other |

|

— |

|

— |

|

— |

|

— |

|

|

Total |

|

$ |

178 |

|

$ |

127 |

|

$ |

5 |

|

$ |

38 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Geographic Region: |

|

|

|

|

|

|

|

|

|

|

The Americas |

|

$ |

84 |

|

$ |

53 |

|

$ |

5 |

|

$ |

38 |

|

|

Europe, the Middle East & Africa |

|

68 |

|

53 |

|

— |

|

— |

|

|

Asia/Pacific |

|

26 |

|

21 |

|

— |

|

— |

|

|

Total |

|

$ |

178 |

|

$ |

127 |

|

$ |

5 |

|

$ |

38 |

|

Excluding the impact of the shift in orders, the adjustments associated with restructuring activities and, for the full fiscal year, the Venezuela remeasurement charges, net sales and operating results for the three months and year ended June 30, 2015 would have increased/(decreased) as follows:

|

|

|

Three Months Ended June 30, 2015 |

|

Year Ended June 30, 2015 |

|

|

|

|

Net Sales As Adjusted |

|

Operating |

|

Net Sales As Adjusted |

|

Operating |

|

|

|

|

Reported |

|

Constant |

|

Results As |

|

Reported |

|

Constant |

|

Results As |

|

|

(Unaudited) |

|

Basis |

|

Currency |

|

Adjusted |

|

Basis |

|

Currency |

|

Adjusted |

|

|

Product Category: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Skin Care |

|

(9 |

)% |

|

(2 |

)% |

|

(15 |

)% |

|

(2 |

)% |

|

2 |

% |

|

(1 |

)% |

|

|

Makeup |

|

3 |

|

|

10 |

|

|

10 |

|

|

5 |

|

|

10 |

|

|

2 |

|

|

|

Fragrance |

|

17 |

|

|

26 |

|

|

(100 |

)+ |

|

2 |

|

|

8 |

|

|

(2 |

) |

|

|

Hair Care |

|

4 |

|

|

10 |

|

|

35 |

|

|

3 |

|

|

7 |

|

|

13 |

|

|

|

Other |

|

7 |

|

|

14 |

|

|

100 |

|

|

4 |

|

|

9 |

|

|

(28 |

) |

|

|

Total |

|

(1 |

)% |

|

7 |

% |

|

(9 |

)% |

|

2 |

% |

|

6 |

% |

|

0 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Geographic Region: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The Americas |

|

7 |

% |

|

12 |

% |

|

(78 |

)% |

|

2 |

% |

|

6 |

% |

|

(31 |

)% |

|

|

Europe, the Middle East & Africa |

|

(8 |

) |

|

3 |

|

|

1 |

|

|

1 |

|

|

8 |

|

|

13 |

|

|

|

Asia/Pacific |

|

(2 |

) |

|

4 |

|

|

100 |

|

|

0 |

|

|

4 |

|

|

16 |

|

|

|

Total |

|

(1 |

)% |

|

7 |

% |

|

(9 |

)% |

|

2 |

% |

|

6 |

% |

|

0 |

% |

|

Total operating income in constant currency for the three months and year ended June 30, 2015, excluding the impact of the shift in orders, the adjustments associated with restructuring activities and, for the full fiscal year, the Venezuela remeasurement charges, increased 6% and 8%, respectively.

Page 14 of 15

THE ESTÉE LAUDER COMPANIES INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

(Unaudited; In millions)

|

|

|

June 30 |

|

June 30 |

|

|

|

|

2015 |

|

2014 |

|

|

ASSETS |

|

|

|

|

|

|

Current Assets |

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

1,021.4 |

|

$ |

1,629.1 |

|

|

Short-term investments |

|

503.7 |

|

— |

|

|

Accounts receivable, net |

|

1,174.5 |

|

1,379.3 |

|

|

Inventory and promotional merchandise, net |

|

1,215.8 |

|

1,294.0 |

|

|

Prepaid expenses and other current assets |

|

553.1 |

|

522.8 |

|

|

Total Current Assets |

|

4,468.5 |

|

4,825.2 |

|

|

|

|

|

|

|

|

|

Property, Plant and Equipment, net |

|

1,490.2 |

|

1,502.6 |

|

|

Other Assets |

|

2,280.5 |

|

1,541.0 |

|

|

Total Assets |

|

$ |

8,239.2 |

|

$ |

7,868.8 |

|

|

|

|

|

|

|

|

|

LIABILITIES AND EQUITY |

|

|

|

|

|

|

Current Liabilities |

|

|

|

|

|

|

Current debt |

|

$ |

29.8 |

|

$ |

18.4 |

|

|

Accounts payable |

|

635.4 |

|

524.5 |

|

|

Other accrued liabilities |

|

1,470.4 |

|

1,513.8 |

|

|

Total Current Liabilities |

|

2,135.6 |

|

2,056.7 |

|

|

|

|

|

|

|

|

|

Noncurrent Liabilities |

|

|

|

|

|

|

Long-term debt |

|

1,607.5 |

|

1,324.7 |

|

|

Other noncurrent liabilities |

|

841.8 |

|

618.0 |

|

|

Total Noncurrent Liabilities |

|

2,449.3 |

|

1,942.7 |

|

|

|

|

|

|

|

|

|

Total Equity |

|

3,654.3 |

|

3,869.4 |

|

|

Total Liabilities and Equity |

|

$ |

8,239.2 |

|

$ |

7,868.8 |

|

SELECT CASH FLOW DATA

(Unaudited; In millions)

|

|

|

Year Ended June 30 |

|

|

|

|

2015 |

|

2014 |

|

|

Cash Flows from Operating Activities |

|

|

|

|

|

|

Net earnings |

|

$ |

1,093.4 |

|

$ |

1,209.1 |

|

|

Depreciation and amortization |

|

409.3 |

|

384.6 |

|

|

Deferred income taxes |

|

(52.6 |

) |

(56.4 |

) |

|

Loss on Venezuela remeasurement |

|

5.3 |

|

38.3 |

|

|

Other items |

|

139.7 |

|

154.9 |

|

|

Changes in operating assets and liabilities: |

|

|

|

|

|

|

Decrease (increase) in accounts receivable, net |

|

103.2 |

|

(196.2 |

) |

|

Increase in inventory and promotional merchandise, net |

|

(26.2 |

) |

(156.8 |

) |

|

Decrease (increase) in other assets, net |

|

7.8 |

|

(45.2 |

) |

|

Increase in accounts payable and other liabilities |

|

263.4 |

|

202.9 |

|

|

Net cash flows provided by operating activities |

|

$ |

1,943.3 |

|

$ |

1,535.2 |

|

|

|

|

|

|

|

|

|

Capital expenditures |

|

$ |

473.0 |

|

$ |

510.2 |

|

|

Payments to acquire treasury stock |

|

982.8 |

|

667.2 |

|

|

Dividends paid |

|

349.9 |

|

301.8 |

|

|

Acquisition of businesses and other intangible assets |

|

241.0 |

|

9.2 |

|

|

Proceeds from disposition (purchases) of investments, net |

|

(902.2 |

) |

7.8 |

|

# # #

Page 15 of 15

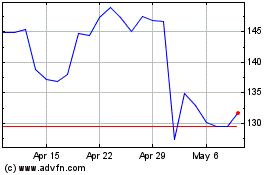

Estee Lauder Companies (NYSE:EL)

Historical Stock Chart

From Mar 2024 to Apr 2024

Estee Lauder Companies (NYSE:EL)

Historical Stock Chart

From Apr 2023 to Apr 2024