UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of

The Securities Exchange Act of 1934

August 11, 2015

Date of Report (Date of earliest event reported)

OWENS-ILLINOIS, INC.

(Exact name of registrant as specified in its charter)

|

Delaware |

|

1-9576 |

|

22-2781933 |

|

(State or other jurisdiction |

|

(Commission |

|

(IRS Employer |

|

of incorporation) |

|

File Number) |

|

Identification No.) |

|

One Michael Owens Way |

|

|

|

Perrysburg, Ohio |

|

43551-2999 |

|

(Address of principal executive offices) |

|

(Zip Code) |

(567) 336-5000

(Registrant’s telephone number, including area code)

(Former name or former address, if changed since last report)

Check the appropriate box if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

EXPLANATORY NOTE

On August 11, 2015, Owens-Illinois Group, Inc., a wholly-owned subsidiary of Owens-Illinois, Inc., filed a Current Report on Form 8-K as described below.

ITEM 7.01. REGULATION FD DISCLOSURE.

Private Offering

On August 11, 2015, Owens-Illinois, Inc. (“OI Inc.”), the direct parent of Owens-Illinois Group, Inc. (the “Company”), issued a press release (the “Press Release”) announcing that Owens-Brockway Glass Container Inc. (“OBGC”), an indirect wholly owned subsidiary of the Company, intends to offer, subject to market and other conditions, a private offering of senior notes due 2023 and senior notes due 2025, to be guaranteed by the Company and the domestic subsidiaries of the Company that are guarantors under the Company’s credit agreement. A copy of the Press Release is furnished as Exhibit 99.1 to this Current Report.

OBGC’s obligations under the senior notes will be unsecured and guaranteed on a joint and several basis by the Company and the domestic subsidiaries of the Company that are guarantors under the Company’s credit agreement. The senior notes will be issued pursuant to an indenture that will contain covenants which, among other things, restrict the ability of the Company and its subsidiaries to incur liens, engage in certain sale and leaseback transactions and consolidate, merge or sell all or substantially all of the Company’s assets.

OBGC expects to use the net proceeds from the private offering to fund, in part, its previously announced acquisition of the food and beverage glass containers business of Vitro, S.A.B. de C.V. and its subsidiaries as conducted in the United States, Mexico and Bolivia (the “Vitro Acquisition”) and to pay related fees and expenses. The private offering of senior notes will be consummated prior to the consummation of the Vitro Acquisition. Concurrently with the closing of the private offering, the gross proceeds from the sale of the senior notes will be deposited into an escrow account until consummation of the Vitro Acquisition.

The senior notes and the guarantees have not been registered under the Securities Act of 1933, as amended (the “Securities Act”), or applicable state securities laws, and will be offered only to qualified institutional buyers in reliance on Rule 144A under the Securities Act and to certain non-U.S. persons in transactions outside the United States in reliance on Regulation S under the Securities Act. Unless so registered, the senior notes and the guarantees may not be offered or sold in the United States except pursuant to an exemption from the registration requirements of the Securities Act and applicable state securities laws. Prospective purchasers that are qualified institutional buyers are hereby notified that the seller of the senior notes may be relying on the exemption from the provisions of Section 5 of the Securities Act provided by Rule 144A.

Additional Information

The Company is disclosing under this Item 7.01 the information included as Exhibit 99.2 hereto.

Miscellaneous

The information contained in this Item 7.01 is for informational purposes only and shall not constitute an offer to sell or the solicitation of an offer to buy the senior notes or the guarantees, nor shall there be any sale of the senior notes and the guarantees in any state or jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such state.

The information contained in this Item 7.01 is being furnished and shall not be deemed “filed” with the Securities and Exchange Commission for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section or Sections 11 and 12(a)(2) of the Securities Act and such information shall not be deemed incorporated by reference into any registration statement or other document filed pursuant to the Securities Act or the Exchange Act.

2

Forward-Looking Statements

The information contained in this Current Report on Form 8-K contains “forward-looking statements,” as defined by federal securities laws. Forward-looking statements reflect the Company’s current expectations and projections about future events at the time, and thus involve uncertainty and risk. The words “believe,” “expect,” “anticipate,” “will,” “could,” “would,” “should,” “may,” “plan,” “estimate,” “intend,” “predict,” “potential,” “continue,” and the negatives of these words and other similar expressions generally identify forward-looking statements. It is possible the Company’s future financial performance may differ from expectations due to a variety of factors including, but not limited to the following: (1) the Company’s ability to consummate the Vitro Acquisition on a timely basis or at all, (2) risks associated with governmental approvals of the Vitro Acquisition, (3) the Company’s ability to integrate the Vitro Business in a timely and cost effective manner, to maintain on existing terms the permits, licenses and other approvals required for the Vitro Business to operate as currently operated, and to realize the expected synergies from the Vitro Acquisition, (4) risks associated with the significant transaction costs and additional indebtedness that the Company expects to incur in financing the Vitro Acquisition, (5) the Company’s ability to realize expected growth opportunities and cost savings from the Vitro Acquisition, (6) foreign currency fluctuations relative to the U.S. dollar, specifically the Euro, Brazilian real, Mexican peso, Colombian peso and Australian dollar, (7) changes in capital availability or cost, including interest rate fluctuations and the ability of the Company to refinance debt at favorable terms, (8) the general political, economic and competitive conditions in markets and countries where the Company has operations, including uncertainties related to economic and social conditions, disruptions in capital markets, disruptions in the supply chain, competitive pricing pressures, inflation or deflation, and changes in tax rates and laws, (9) consumer preferences for alternative forms of packaging, (10) cost and availability of raw materials, labor, energy and transportation, (11) the Company’s ability to manage its cost structure, including its success in implementing restructuring plans and achieving cost savings, (12) consolidation among competitors and customers, (13) the ability of the Company to acquire businesses and expand plants, integrate operations of acquired businesses and achieve expected synergies, (14) unanticipated expenditures with respect to environmental, safety and health laws, (15) the Company’s ability to further develop its sales, marketing and product development capabilities, and (16) the timing and occurrence of events which are beyond the control of the Company, including any expropriation of the Company’s operations, floods and other natural disasters, events related to asbestos-related claims, and the other risk factors discussed in the Company’s Annual Report on Form 10-K for the year ended December 31, 2014 and any subsequently filed Quarterly Reports on Form 10-Q. It is not possible to foresee or identify all such factors. Any forward-looking statements in this Current Report on Form 8-K are based on certain assumptions and analyses made by the Company in light of its experience and perception of historical trends, current conditions, expected future developments, and other factors it believes are appropriate in the circumstances. Forward-looking statements are not a guarantee of future performance and actual results or developments may differ materially from expectations. The Company’s forward-looking statements speak only as of the date made. While the Company continually reviews trends and uncertainties affecting the Company’s results of operations and financial condition, the Company does not assume any obligation to update or supplement any particular forward-looking statements contained in this Current Report on Form 8-K.

|

ITEM 9.01. |

FINANCIAL STATEMENTS AND EXHIBITS. |

|

|

|

|

(d) |

Exhibits. |

|

Exhibit |

|

|

|

No. |

|

Description |

|

99.1 |

|

Press Release, dated August 11, 2015 |

|

99.2 |

|

Additional Information |

3

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

OWENS-ILLINOIS, INC. |

|

|

|

|

|

|

|

|

|

Date: August 11, 2015 |

By: |

/s/ John A. Haudrich |

|

|

Name: |

John A. Haudrich |

|

|

Title: |

Vice President and Acting Chief Financial Officer |

4

EXHIBIT INDEX

|

Exhibit |

|

|

|

No. |

|

Description |

|

99.1 |

|

Press Release, dated August 11, 2015 |

|

99.2 |

|

Additional Information |

5

Exhibit 99.1

FOR IMMEDIATE RELEASE

|

For more information, contact: |

|

|

|

David Johnson |

|

|

|

Vice President, Investor Relations |

|

|

|

Perrysburg, Ohio, US |

|

|

|

567 336 2600 |

|

|

|

dave.johnson@o-i.com |

|

|

Owens-Brockway Glass Container Inc. Launches Private Offering of $1.0 Billion of Senior Notes

PERRYSBURG, Ohio (August 11, 2015) — Owens-Illinois, Inc. (NYSE: OI) (“OI Inc.”) announced today that Owens-Brockway Glass Container Inc. (“OBGC”), an indirect wholly owned subsidiary of OI Inc., intends to offer, subject to market and other conditions, a total of $1.0 billion aggregate principal amount of senior notes due 2023 and senior notes due 2025 in a private offering to eligible purchasers under Rule 144A and Regulation S of the Securities Act of 1933, as amended (the “Securities Act”). OBGC’s obligations under the senior notes will be guaranteed on a joint and several basis by Owens-Illinois Group, Inc. (“OI Group”), a direct wholly owned subsidiary of OI Inc. and an indirect parent of OBGC, and the domestic subsidiaries of OI Group that are guarantors under OI Group’s credit agreement.

OBGC expects to use the net proceeds from the private offering to fund, in part, its previously announced acquisition of the food and beverage glass containers business of Vitro, S.A.B. de C.V. and its subsidiaries as conducted in the United States, Mexico and Bolivia (the “Vitro Acquisition”) and to pay related fees and expenses. The private offering of senior notes will be consummated prior to the consummation of the Vitro Acquisition. Concurrently with the closing of the private offering, the gross proceeds from the sale of the senior notes will be deposited into an escrow account until the consummation of the Vitro Acquisition.

The senior notes and the guarantees have not been registered under the Securities Act, or applicable state securities laws, and will be offered only to qualified institutional buyers in reliance on Rule 144A under the Securities Act and to certain non-U.S. persons in transactions outside the United States in reliance on Regulation S under the Securities Act. Unless so registered, the senior notes and the guarantees may not be offered or sold in the United States except pursuant to an exemption from the registration requirements of the Securities Act and applicable state securities laws. Prospective purchasers that are qualified institutional buyers are hereby notified that the seller of the senior notes may be relying on the exemption from the provisions of Section 5 of the Securities Act provided by Rule 144A.

This news release is for informational purposes only and shall not constitute an offer to sell or the solicitation of an offer to buy the senior notes or the guarantees, nor shall there be any sale of the senior notes and the guarantees in any state or jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such state.

###

Forward Looking Statements

This document contains “forward-looking statements,” as defined by federal securities laws. Forward-looking statements reflect the Company’s current expectations and projections about future events at the time, and thus involve uncertainty and risk. The words “believe,” “expect,” “anticipate,” “will,” “could,” “would,” “should,” “may,” “plan,” “estimate,” “intend,” “predict,” “potential,” “continue,” and the negatives of these words and other

similar expressions generally identify forward looking statements. It is possible the Company’s future financial performance may differ from expectations due to a variety of factors including, but not limited to the following: (1) the Company’s ability to consummate the Vitro Acquisition on a timely basis or at all, (2) risks associated with governmental approvals of the Vitro Acquisition, (3) the Company’s ability to integrate the Vitro Business in a timely and cost effective manner, to maintain on existing terms the permits, licenses and other approvals required for the Vitro Business to operate as currently operated, and to realize the expected synergies from the Vitro Acquisition, (4) risks associated with the significant transaction costs and additional indebtedness that the Company expects to incur in financing the Vitro Acquisition, (5) the Company’s ability to realize expected growth opportunities and cost savings from the Vitro Acquisition, (6) foreign currency fluctuations relative to the U.S. dollar, specifically the Euro, Brazilian real, Mexican peso, Colombian peso and Australian dollar, (7) changes in capital availability or cost, including interest rate fluctuations and the ability of the Company to refinance debt at favorable terms, (8) the general political, economic and competitive conditions in markets and countries where the Company has operations, including uncertainties related to economic and social conditions, disruptions in capital markets, disruptions in the supply chain, competitive pricing pressures, inflation or deflation, and changes in tax rates and laws, (9) consumer preferences for alternative forms of packaging, (10) cost and availability of raw materials, labor, energy and transportation, (11) the Company’s ability to manage its cost structure, including its success in implementing restructuring plans and achieving cost savings, (12) consolidation among competitors and customers, (13) the ability of the Company to acquire businesses and expand plants, integrate operations of acquired businesses and achieve expected synergies, (14) unanticipated expenditures with respect to environmental, safety and health laws, (15) the Company’s ability to further develop its sales, marketing and product development capabilities, and (16) the timing and occurrence of events which are beyond the control of the Company, including any expropriation of the Company’s operations, floods and other natural disasters, events related to asbestos-related claims, and the other risk factors discussed in the Company’s Annual Report on Form 10-K for the year ended December 31, 2014 and any subsequently filed Quarterly Reports on Form 10-Q. It is not possible to foresee or identify all such factors. Any forward-looking statements in this document are based on certain assumptions and analyses made by the Company in light of its experience and perception of historical trends, current conditions, expected future developments, and other factors it believes are appropriate in the circumstances. Forward-looking statements are not a guarantee of future performance and actual results or developments may differ materially from expectations. The Company’s forward-looking statements speak only as of the date made. While the Company continually reviews trends and uncertainties affecting the Company’s results of operations and financial condition, the Company does not assume any obligation to update or supplement any particular forward looking statements contained in this document.

SOURCE: Owens-Illinois, Inc.

Exhibit 99.2

Supplemental Pro Forma Financial Information

On May 13, 2015, Owens-Illinois Group, Inc. (“OI Group”) announced that it had, through its indirect, wholly-owned subsidiary Owens-Brockway Glass Container Inc. (“Owens-Brockway”), a Delaware corporation, entered into a stock purchase agreement (the “Stock Purchase Agreement”) with Vitro, S.A.B. de C.V. (“Vitro”), a Mexican sociedad anónima bursátil de capital variable, Distribuidora Álcali, S.A. de C.V. (“Distribuidora”), a Mexican sociedad anónima de capital variable, and Vitro Packaging, LLC (“Vitro Packaging” and together with Vitro and Distribuidora, “Vitro”), a U.S. limited liability company, pursuant to which Owens-Brockway has agreed to acquire (the “Vitro Acquisition”) Vitro’s food and beverage glass containers business as conducted in the United States, Mexico and Bolivia (the “Vitro Business”).

Set forth below is OI Group’s pro forma Credit Agreement EBITDA and pro forma Credit Agreement leverage ratio, each presented for the twelve months ended June 30, 2015 (the “LTM Period”), which are not measurements of financial performance under GAAP and should not be considered as alternatives to cash flow from operating activities or as measures of liquidity or alternatives to net income as indicators of OI Group’s operating performance or any other measures of performance derived in accordance with GAAP. This data has been calculated for the LTM Period based on the unaudited pro forma condensed consolidated financial statements of OI Group (“OI Group Pro Forma Financial Data”) by subtracting the unaudited pro forma results of operations data for the six-month period ended June 30, 2014 from the unaudited pro forma results of operations data for the year ended December 31, 2014 and then adding the unaudited pro forma results of operations data for the six-month period ended June 30, 2015. The OI Group Pro Forma Financial data was filed as Exhibit 99.3 to OI Group’s Current Report on Form 8-K dated August 5, 2015 (the “Prior Current Report”) and is incorporated herein by reference. The OI Group Pro Forma Financial Data should be read in conjunction with the Vitro Business financial statements included as Exhibits 99.1 and 99.2 to the Prior Current Report which are incorporated herein by reference as well as with the consolidated financial statements of OI Group and related notes thereto as of and for the year ended December 31, 2014 contained in OI Group’s Annual Report on Form 10-K for the year ended December 31, 2014 and the condensed consolidated financial statements of OI Group and related notes thereto as of and for the six-month period ended June 30, 2015 contained in OI Group’s Quarterly Report on Form 10-Q for the period ended June 30, 2015.

OI Group’s pro forma Credit Agreement EBITDA of $1,369 million for the LTM Period does not include estimated synergies of $30 million OI Group expects to achieve over the three years following the closing of the Vitro Acquisition and does not reflect the estimate of full year EBITDA for new business in 2016 that the Vitro Business signed in 2014.

|

|

|

Pro forma

twelve

months ended

June 30, |

|

|

(Dollars in millions) |

|

2015 |

|

|

Earnings from continuing operations: (1) |

|

$ |

164 |

|

|

Add (deduct): |

|

|

|

|

Provision for income taxes |

|

82 |

|

|

Interest expense, net |

|

341 |

|

|

Amortization of intangibles |

|

116 |

|

|

Depreciation |

|

381 |

|

|

EBITDA (2) |

|

$ |

1,084 |

|

|

Add (deduct) excluded items: |

|

|

|

|

Interest income |

|

5 |

|

|

Additional adjustments |

|

280 |

|

|

Credit Agreement EBITDA (2) |

|

$ |

1,369 |

|

|

Credit Agreement Leverage Ratio (3) |

|

4.2x |

|

(1) The unaudited pro forma results of operations data for the twelve months ended June 30, 2015 have been calculated by subtracting the unaudited pro forma results of operations data for the six-month period ended June 30, 2014 from the unaudited pro forma results of operations data for the year ended December 31, 2014 and then adding the unaudited pro forma results of operations data for the six-month period ended June 30, 2015 as follows:

|

(Dollars in

millions) |

|

Pro forma

year ended

December

31, 2014 |

|

Pro

forma

six

months

ended

June 30,

2014 |

|

Pro

forma six

months

ended

June 30,

2015 |

|

Pro forma

twelve

months

ended

June 30,

2015 |

|

|

Net sales |

|

$ |

7,642 |

|

$ |

3,860 |

|

$ |

3,395 |

|

$ |

7,177 |

|

|

Cost of goods sold |

|

(6,194 |

) |

(3,097 |

) |

(2,732 |

) |

(5,829 |

) |

|

Gross profit |

|

1,448 |

|

763 |

|

663 |

|

1,348 |

|

|

Selling and administrative expense |

|

(602 |

) |

(303 |

) |

(281 |

) |

(580 |

) |

|

Research, development and engineering expense |

|

(63 |

) |

(32 |

) |

(31 |

) |

(62 |

) |

|

Interest expense, net |

|

(328 |

) |

(157 |

) |

(170 |

) |

(341 |

) |

|

Equity earnings |

|

64 |

|

35 |

|

29 |

|

58 |

|

|

Other (expense) income, net |

|

(148 |

) |

18 |

|

(11 |

) |

(177 |

) |

|

Earnings from continuing operations before income taxes |

|

371 |

|

324 |

|

199 |

|

246 |

|

|

Provisions for income taxes |

|

(102 |

) |

(70 |

) |

(50 |

) |

(82 |

) |

|

Earnings from continuing operations |

|

$ |

269 |

|

$ |

254 |

|

$ |

149 |

|

$ |

164 |

|

(2) EBITDA consists of earnings before interest expense, net, provision for income taxes, depreciation and amortization. OI Group presents EBITDA because it more closely resembles compliance measures contained in the Credit Agreement. While EBITDA is frequently used as a measure of operations and the ability to meet debt service requirements, it is not necessarily comparable to other similarly titled captions of other companies due to potential inconsistencies in the method of calculation. OI Group believes that the presentation of Credit Agreement EBITDA will provide investors with

information regarding compliance with the financial ratio covenants in the Credit Agreement. Credit Agreement EBITDA is a compliance measure contained in the Credit Agreement and is based on EBITDA with additional adjustments for certain items defined in the Credit Agreement. Credit Agreement EBITDA is not a measurement of financial performance under GAAP and should not be considered as an alternative to cash flow from operating activities or as a measure of liquidity or an alternative to net income as indicators of OI Group’s operating performance or any other measures of performance derived in accordance with GAAP. The most directly comparable GAAP financial measure to EBITDA is earnings from continuing operations.

(3) Credit Agreement leverage ratio means, as at any date of determination, the ratio of (a) total debt for Owens-Illinois Inc. and its subsidiaries (“Debt”) minus cash and short term investments (together “Cash”) as of the last day of the fiscal quarter ended on such date to (b) Credit Agreement EBITDA for the four fiscal quarters ended on such date. Debt and Cash, on a pro forma basis, as of June 30, 2015 was $5,979 million and $293 million, respectively.

* * *

Risks Relating to the Vitro Acquisition

The Vitro Acquisition may not be completed on a timely basis, on anticipated terms, or at all, and there are uncertainties and risks to consummating the Vitro Acquisition.

The obligation of each party to consummate the Vitro Acquisition is subject to the satisfaction or waiver, to the extent permitted under applicable law, of a number of conditions, many of which are not within our control. These conditions include the receipt of all required clearances, approvals or authorizations required by applicable antitrust and foreign investment laws and the absence of any order, judgment, injunction, law or other legal restraint prohibiting the consummation of the Vitro Acquisition. Each party’s obligation to consummate the Vitro Acquisition is also subject to certain additional closing conditions, including (i) the accuracy of the representations and warranties contained in the Stock Purchase Agreement (subject to certain materiality qualifiers) and (ii) the other party’s compliance in all material respects with its covenants and agreements contained in the Stock Purchase Agreement.

The failure to satisfy all of the required conditions could delay the completion of the Vitro Acquisition for a significant period of time or prevent it from occurring. Any delay in completing the Vitro Acquisition could cause us not to realize some or all of the benefits that we expect to achieve if the Vitro Acquisition is successfully completed within its expected timeframe. Additionally, it is not certain that the conditions set forth in the Stock Purchase Agreement will be met or waived, that the necessary approvals will be obtained, or that we will be able to successfully consummate the Vitro Acquisition as provided for under the Stock Purchase Agreement, or at all.

We face risks and uncertainties due both to the pending Vitro Acquisition as well as the potential failure to consummate the Vitro Acquisition, including:

· if the Vitro Acquisition is not consummated, we will not realize any of the expected benefits of the Vitro Acquisition;

· failure to consummate the Vitro Acquisition could result in negative reactions from the financial markets or in the investment community, including negative impacts on our stock price;

· we will remain liable for significant transaction costs, including legal, financial advisory, accounting and other costs relating to the Vitro Acquisition even if it is not consummated;

· we will incur interest expense on any senior notes issued from the issue date of such notes until the Vitro Acquisition is consummated or abandoned;

· if the Stock Purchase Agreement is terminated before we complete the Vitro Acquisition, under some circumstances, we may have to pay a termination fee to Vitro of $150 million in cash;

· the Vitro Acquisition could have an adverse impact on our relationships with employees, customers and suppliers, and prospective customers or other third parties may delay or decline entering into agreements with us as a result of the announcement of the Vitro Acquisition; and

· the attention of our management and employees may be diverted from day-to-day operations.

The occurrence of any of these events individually or in combination could have a material adverse effect on our share price, business, cash flows, results of operations and financial position.

In order to complete the Vitro Acquisition, we must make certain governmental filings and obtain certain governmental authorizations under applicable antitrust laws, and if such filings and authorizations are not made or granted or are granted with conditions, or if governmental authorities otherwise seek to impose conditions or to challenge the Vitro Acquisition, completion of the Vitro Acquisition may be jeopardized or the anticipated benefits of the Vitro Acquisition could be reduced.

Although we and Vitro have agreed in the Stock Purchase Agreement to use our reasonable best efforts, subject to certain limitations, to make certain governmental filings and obtain the required expiration or termination of the waiting period or approvals under applicable antitrust and foreign investment laws, there can be no assurance that the termination of the waiting period or receipt of approvals under applicable antitrust and foreign investment laws will occur. There can also be no assurance that governmental authorities will not seek to challenge the Vitro Acquisition or impose conditions, terms, obligations or restrictions and that such conditions, terms, obligations or restrictions will not have the effect of delaying completion of the Vitro Acquisition or imposing additional material costs on or materially limiting the revenues of our business and the Vitro Business following the Vitro Acquisition, or otherwise adversely affecting our business and the Vitro Business after completion of the Vitro Acquisition;

provided, that, nothing in the Stock Purchase Agreement requires us, in order to obtain the required consents from antitrust authorities, to take any action with respect to us, the Vitro Business or any of our or its respective subsidiaries or affiliates including agreeing to the sale, divestiture or disposition of assets of us or the Vitro Business (or any combination thereof) or taking actions that would limit our freedom of action with respect to our assets or assets of the Vitro Business (or any combination thereof); provided, however, that if requested by an antitrust governmental body, we are required to take all actions necessary to divest or dispose of any of our businesses, products, rights, services, assets or properties so long as such divestiture, individually or in the aggregate, would result in the loss of EBITDA of us and the Vitro Business combined and our and its affiliates of less than $30 million during the most recently available 12-month period ending on the date such divestiture is requested by an antitrust governmental body. In addition, in the event we fail to obtain the required antitrust approvals and the Stock Purchase Agreement is terminated as a result thereof, we will be required to pay a termination fee to Vitro of $150 million in cash. The occurrence of any of these events individually or in combination could have a material adverse effect on our share price, business, cash flows, results of operations and financial position.

Integration of the Vitro Business into our business will be difficult, costly and time consuming and the anticipated benefits and cost savings of the Vitro Acquisition may not be realized.

Even if the Vitro Acquisition is completed, our ability to realize the anticipated benefits of the Vitro Acquisition will depend, to a large extent, on our ability to integrate the two businesses. The combination of two independent businesses is a complex, costly and time-consuming process and there can be no assurance that we will be able to successfully integrate the Vitro Business into our business, or if such integration is successfully accomplished, that such integration will not be more costly or take longer than presently contemplated. If we cannot successfully integrate and manage the Vitro Business within a reasonable time following the Vitro Acquisition, we may not be able to realize the potential and anticipated benefits of the Vitro Acquisition, which could have a material adverse effect on our share price, business, cash flows, results of operations and financial position.

Our ability to realize the expected synergies and benefits of the Vitro Acquisition is subject to a number of risks and uncertainties, many of which are outside of our control. These risks and uncertainties could adversely impact our business, results of operation and financial condition and include, among other things:

· our ability to complete the timely integration of operations and systems, organizations, standards, controls, procedures, policies and technologies, as well as the harmonization of differences in the business cultures of our company and the Vitro Business;

· our ability to minimize the diversion of management attention from ongoing business concerns of both our business and the Vitro Business during the process of integrating our company and the Vitro Business;

· our ability to retain the service of senior management and other key personnel of both our business and the Vitro Business;

· our ability to preserve customer, supplier and other important relationships of our company and the Vitro Business and resolve potential conflicts that may arise;

· the risk that certain customers and suppliers of the Vitro Business will opt to discontinue business with the Vitro Business or exercise their right to terminate their agreements as a result of the Vitro Acquisition pursuant to consent rights, anti-assignment rights, change of control provisions or similar provisions in their agreements;

· the risk that the Vitro Business may have liabilities that we failed to or were unable to discover in the course of performing due diligence;

· the risk that integrating the Vitro Business into our business may be more difficult, costly or time consuming than anticipated;

· our ability to perform after the transition services agreements terminate;

· difficulties in achieving anticipated cost savings, synergies, business opportunities and growth prospects from the combination; and

· difficulties in managing the expanded operations of a significantly larger and more complex combined business.

We may encounter additional integration-related costs, may fail to realize all of the benefits anticipated in the Vitro Acquisition or be subject to other factors that adversely affect preliminary estimates. In addition, even if the operations of the Vitro Business are integrated successfully, the full benefits of the Vitro Acquisition may not be realized, including the synergies, cost savings or sales or growth opportunities that are expected. The occurrence of any of these events individually or in combination could have a material adverse effect on our share price, business and cash flows, results of operations and financial position. The Vitro Acquisition may not be accretive to earnings or other key financial metrics, which may also negatively affect the price of our common stock following consummation of the Vitro Acquisition.

We may be unable to realize the expected growth opportunities and synergies and cost savings from the Vitro Acquisition.

We currently expect to realize annual synergies and cost savings of approximately $30 million to be fully achieved within three years of the closing of the Vitro Acquisition, with approximately $8 million in the first full year. We also expect to incur integration and restructuring costs to achieve these synergies. These synergies are expected to come from operational efficiencies and procurement savings. The anticipated cost savings are based upon assumptions about our ability to implement integration measures in a timely fashion and within certain cost parameters. Our ability to achieve the planned synergies is dependent upon a

significant number of factors, many of which are beyond our control. For example, we may be unable to eliminate duplicative costs in a timely fashion or at all. Our inability to realize anticipated cost savings and revenue enhancements from the Vitro Acquisition could have a material adverse effect on our share price, business, cash flows, results of operations and financial position.

We will incur significant transaction and acquisition-related costs in connection with financing the Vitro Acquisition.

We expect to incur significant costs associated with financing the Vitro Acquisition and related transactions. Such costs include costs associated with borrowings under the incremental term loan facilities, any senior notes issued and the payment of certain fees and expenses incurred in connection with the Vitro Acquisition, including legal and other fees. The costs of continued borrowing under the incremental term loan facilities will likely be significant and could have a significant adverse effect on our operating results, financial condition and liquidity. The failure by us to complete the acquisition of the Vitro Business could adversely affect our business and could result in substantial termination costs.

There is no assurance that completion of the Vitro Acquisition will occur. Consummation of the Vitro Acquisition is subject to various conditions, including those described above.

We will have incurred significant costs, including the diversion of management resources, for which we will have received little or no benefit if the Vitro Acquisition is not consummated. In addition, failure of the Vitro Acquisition to close, or even a delay in its closing, may have a negative impact on our ability to manage existing operations and pursue alternative strategic transactions or our ability to implement alternative business plans. The Stock Purchase Agreement is subject to termination if the Vitro Acquisition is not completed on or before May 12, 2016. In addition, the Stock Purchase Agreement contains certain other termination rights for both us and Vitro and further provides that, upon termination of the Stock Purchase Agreement under specified circumstances, we may be obligated to pay Vitro a termination fee of $150 million. A failed transaction may result in negative publicity and a negative impression of us in the investment community. The occurrence of any of these events individually or in combination could have a material adverse effect on our operating results, financial condition and liquidity.

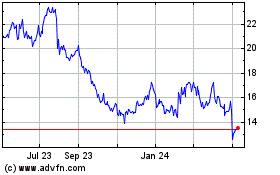

OI Glass (NYSE:OI)

Historical Stock Chart

From Mar 2024 to Apr 2024

OI Glass (NYSE:OI)

Historical Stock Chart

From Apr 2023 to Apr 2024