Current Report Filing (8-k)

August 06 2015 - 4:16PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant

to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): August 3, 2015

NetApp, Inc.

(Exact

name of registrant as specified in its charter)

|

|

|

|

|

| Delaware |

|

0-27130 |

|

77-0307520 |

| (State or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

| |

|

495 East Java Drive

Sunnyvale, CA 94089

(Address of principal executive offices) (Zip Code)

(408) 822-6000

(Registrant’s telephone number, including area code)

Not Applicable

(Former

name or former address, if changed since last report.)

Check the appropriate box below

if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Item 5.02. Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain

Officers; Compensatory Arrangements of Certain Officers.

Approval of George Kurian’s Fiscal 2016 Compensation

On August 3, 2015, the Compensation Committee (the “Committee”) of the Board of Directors (the “Board”) of NetApp, Inc. (the

“Company”) approved the compensation for Mr. Kurian, effective June 1, 2015, in connection with the promotion of Mr. Kurian to the role of Chief Executive Officer, as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Previous

Base Salary |

|

|

FY 16 Incentive

Compensation

Target(1) |

|

New Base

Salary |

|

|

FY 16 Incentive

Compensation

Target(1) |

| George Kurian |

|

$ |

460,000 |

|

|

110% |

|

$ |

800,000 |

|

|

150%(2) |

| (1) |

Incentive compensation for the Company’s named executive officers has been established pursuant and subject to the terms of the Company’s Executive Compensation Plan (the “Plan”). Under the Plan, the

funding of the bonus pool from which bonuses are paid is based on the Company’s actual achievement against annual revenue and operating profit targets, with revenue weighted 1/3rd and operating profit weighted 2/3rd. |

| (2) |

The Committee previously awarded Mr. Kurian an annual cash incentive under the Plan with a target award opportunity equal to 110% of his base salary for the full 2016 fiscal year. In connection with his promotion

to Chief Executive Officer, the Committee awarded Mr. Kurian an additional cash incentive opportunity under the Plan with a target award equal to 40% of his base salary during a pro-rated performance period from June 1, 2015 through

the end of the Company’s 2016 fiscal year with revenue and operating income funding targets that will be measured over the pro-rated performance period and that are different than the funding targets for the cash incentives that are based on

the full fiscal year performance. The additional cash incentive opportunity is intended to provide Mr. Kurian a total target cash incentive opportunity equal to 150% from June 1, 2015 through the end of the Company’s 2016 fiscal year.

|

Grant of Equity Awards

In connection

with the promotion of Mr. Kurian to Chief Executive Officer and as part of its long-term incentive compensation strategy, on August 3, 2015, the Committee awarded restricted stock units (“RSUs”) that are to vest based on

achievement of certain performance goals and time-based RSUs in the amounts set forth below. The performance-based RSUs will be granted pursuant to the Restricted Stock Unit Agreement (Performance Based) previously approved by the Committee and the

time-based RSUs will be granted pursuant to the form of RSU Agreement previously approved by the Committee.

Additionally, the Committee awarded

Mr. Kurian a one-time promotion grant in the amount set forth below. This promotion grant is in the form of performance-based RSUs and time-based RSUs.

Grant of Performance-Based Restricted Stock Units

Long-Term Incentive Award(1):

|

|

|

| Target Number of RSUs |

|

Maximum Number of RSUs |

| 128,600 |

|

257,200 |

One-Time Promotion Award(1):

|

|

|

| Target Number of RSUs |

|

Maximum Number of RSUs |

| 42,900 |

|

85,800 |

| (1) |

The terms of Mr. Kurian’s performance-based RSU awards are identical to those previously granted to other Company executive officers, except that the performance period for Mr. Kurian’s awards will

commence on June 1, 2015 and performance will be measured from that date whereas the performance period for other Company executive officers commenced on April 27, 2015, the first day of the Company’s 2016 fiscal year.

|

Grant of Time-Based Restricted Stock Units

Long-Term Incentive Award:

One-Time Promotion Award:

The time-based RSUs are scheduled to vest in equal annual installments over four years with the first vesting date to occur on

June 1, 2016, subject to continued service through the applicable vesting dates.

On August 3, 2015, the Board determined to terminate the previously announced search

for a Chief Executive Officer.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on

its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

NETAPP, INC. |

|

|

|

|

| Date: August 6, 2015 |

|

|

|

By: |

|

/s/ Matthew K. Fawcett |

|

|

|

|

|

|

Matthew K. Fawcett |

|

|

|

|

|

|

Senior Vice President, General Counsel and Corporate Secretary |

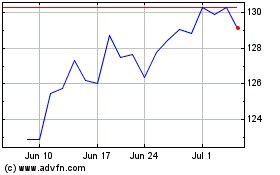

NetApp (NASDAQ:NTAP)

Historical Stock Chart

From Mar 2024 to Apr 2024

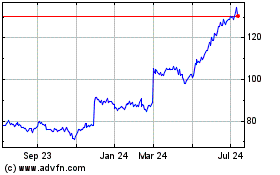

NetApp (NASDAQ:NTAP)

Historical Stock Chart

From Apr 2023 to Apr 2024