UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (date of earliest event reported): August 3, 2015

Insperity, Inc.

(Exact name of registrant as specified in its charter)

|

| | | | |

Delaware | | 1-13998 | | 76-0479645 |

(State or other jurisdiction of incorporation) | | (Commission File Number) | | (I.R.S. Employer Identification No.) |

19001 Crescent Springs Drive

Kingwood, Texas 77339

(Address of principal executive offices and zip code)

Registrant’s telephone number, including area code: (281) 358-8986

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2 below):

[] Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

[] Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

[] Pre-commencement communications pursuant to Rule 14d-2(b) under The Exchange Act (17 CFR 240.14d-2(b))

[] Pre-commencement communications pursuant to Rule 13e-4(c) under The Exchange Act (17 CFR 240.13e-4(c))

Item 2.02. Results of Operations and Financial Condition

On August 3, 2015, Insperity, Inc. issued a press release announcing the company’s financial and operating results for the quarter ended June 30, 2015. A copy of the press release is furnished as Exhibit 99.1 hereto and incorporated by reference.

Item 9.01. Financial Statements and Exhibits

99.1 — Press release issued by Insperity, Inc. on August 3, 2015.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

INSPERITY, INC.

By: /s/ Daniel D. Herink

Daniel D. Herink

Senior Vice President of Legal, General Counsel and Secretary

Date: August 3, 2015

EXHIBIT INDEX

Exhibit

No. Description

99.1 — Press release issued by Insperity, Inc. on August 3, 2015.

Exhibit 99.1

Insperity Announces Strong Second Quarter Results

| |

• | Year-over-year worksite employee growth accelerates from 9% to 12% sequentially |

| |

• | Q2 adjusted EPS up 110% to $0.42 on 11% revenue growth |

| |

• | Q2 adjusted EBITDA increases 56% to $22.6 million |

| |

• | Q2 adjusted operating expenses up less than 1% over 2014 on 12% unit growth |

| |

• | YTD adjusted EBITDA and adjusted EPS up 67% and 100%, respectively |

HOUSTON – Aug. 3, 2015 – Insperity, Inc. (NYSE: NSP), a leading provider of human resources and business performance solutions for America’s best businesses, today reported second quarter adjusted EBITDA of $22.6 million, a 55.5% increase over the second quarter of 2014. Adjusted net income was $10.8 million and adjusted diluted earnings per share were $0.42, a 110.0% increase over the second quarter of 2014. Reported second quarter GAAP net income and earnings per share were $7.3 million and $0.29, respectively.

Second Quarter Results

Revenues for the second quarter of 2015 increased 11.2% over the second quarter of 2014. The average number of worksite employees paid per month increased 11.6% during the quarter, an acceleration from the 9.2% year-over-year growth in the first quarter of 2015. All three drivers to worksite employee growth including sales, client retention and net hiring in our client base, improved over the second quarter of 2014.

“Our second quarter results reflect successful execution of our 2015 plan to accelerate growth while carefully managing operating costs,” said Paul J. Sarvadi, Insperity chairman and chief executive officer. “We expect to continue positive trends in growth and profitability over the balance of this year.”

Adjusted EBITDA increased 55.5% on a 9.2% increase in gross profit and a less than 1% increase in operating expenses over the 2014 period, reflecting planned operating leverage.

Year-to-Date Results

For the six months ended June 30, 2015, adjusted EBITDA increased 66.9% to $64.9 million and adjusted diluted earnings per share increased 100.0% to $1.28. Reported 2015 GAAP net income was $21.1 million, or $0.83 per share.

Revenues in the first six months of 2015 were $1.3 billion, an increase of 10.5% over the 2014 period on a 10.4% increase in the average number of worksite employees paid per month. Gross profit for the six months ended June 30, 2015 increased 16.1% to $234.1 million, while adjusted operating expenses increased only 3.6% to $185.7 million.

Cash outlays in the first six months of 2015 included the repurchase of 645,292 shares of stock at a cost of $33.5 million, dividends totaling $10.4 million and capital expenditures of $5.9 million.

“In spite of recently increasing our dividend rate by 16% and being more aggressive in our share buybacks, our strong cash flow has resulted in a $6.2 million increase in adjusted working capital over Dec. 31, 2014 to $79.3 million at June 30, 2015,” said Douglas S. Sharp, senior vice president of finance, chief financial officer and treasurer. “Our outlook for continued strong cash flow positions us well to execute on our strategic plan and continue our track record of significant returns to stockholders.”

2015 Guidance

The company also announced its updated guidance for 2015, including guidance for the third quarter of 2015.

|

| | | | | | | |

| Q3 2015 | | Full Year 2015 |

| | | | | | | |

Average WSEEs | 148,500 | — | 150,000 | | 145,750 | — | 147,000 |

Year-over-year increase | 13.0% | — | 14.0% | | 11.5% | — | 12.5% |

| | | | | | | |

Adjusted EPS | $0.52 | — | $0.56 | | $2.20 | — | $2.29 |

Year-over-year increase | 33.0% | — | 43.0% | | 52.0% | — | 58.0% |

| | | | | | | |

Adjusted EBITDA (in millions) | $27.0 | — | $29.0 | | $114.0 | — | $117.0 |

Year-over-year increase | 20.0% | — | 28.0% | | 36.0% | — | 39.0% |

Definition of Key Metrics

Average WSEEs - Determined by calculating the company’s cumulative worksite employees paid during the period divided by the number of months in the period.

Adjusted EPS - Represents diluted net income per share computed in accordance with GAAP, excluding the impact of non-cash impairment and other charges, stockholder advisory expenses and stock-based compensation. Note that beginning in 2015, the company began excluding stock-based compensation when reporting Adjusted EPS.

Adjusted EBITDA - Represents net income computed in accordance with GAAP, plus interest expense, income taxes, depreciation, amortization, stock-based compensation, non-cash impairment and other charges and stockholder advisory expenses.

Insperity will be hosting a conference call today at 10 a.m. ET to discuss these results, provide guidance for the third quarter and an update to full year guidance, and answer questions from investment analysts. To listen in, call 877-651-0053 and use conference i.d. number 91929268. The call will also be webcast at http://ir.insperity.com. The conference call script will be available at the same website later today. A replay of the conference call will be available at 855-859-2056, conference i.d. 91929268. The webcast will be archived for one year.

Insperity, a trusted advisor to America’s best businesses for more than 29 years, provides an array of human resources and business solutions designed to help improve business performance. Insperity® Business Performance Advisors offer the most comprehensive suite of products and services available in the marketplace. Insperity delivers administrative relief, better benefits, reduced liabilities and a systematic way to improve productivity through its premier Workforce Optimization® solution. Additional company offerings include Human Capital Management, Payroll Software, Time and Attendance, Performance Management, Organizational Planning, Recruiting Services, Employment Screening, Financial Services, Expense Management, Retirement Services and Insurances Services. Insperity business performance solutions support more than 100,000 businesses with over 2 million employees. With 2014 revenues of $2.4 billion, Insperity operates in 57 offices throughout the United States. For more information, visit http://www.insperity.com.

The statements contained herein that are not historical facts are forward-looking statements within the meaning of the federal securities laws (Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934). You can identify such forward-looking statements by the words “expects,” “intends,” “plans,” “projects,” “believes,” “estimates,” “likely,” “possibly,” “probably,” “goal,” “opportunity,” “objective,” “target,” “assume,” “outlook,” “guidance,” “predicts,” “appears,” “indicator” and similar expressions. Forward-looking statements involve a number of risks and uncertainties. In the normal course of business, Insperity, Inc., in an effort to help keep our stockholders and the public informed about our operations, may from time to time issue such forward-looking statements, either orally or in writing. Generally, these statements relate to business plans or strategies, projected or anticipated benefits or other consequences of such plans or strategies, or projections involving anticipated revenues, earnings, unit growth, profit per worksite employee, pricing, operating expenses or other aspects of operating results. We base the forward-looking statements on our expectations, estimates and projections at the time such statements are made. These statements are not guarantees of future performance and involve risks and uncertainties that we cannot predict. In addition, we have based many of these forward-looking statements on assumptions about future events that may prove to be inaccurate. Therefore, the actual results of the future events described in such forward-looking statements could differ materially from those stated in such forward-looking statements. Among the factors that could cause actual results to differ materially are: (i) adverse economic conditions; (ii) regulatory and tax developments and possible adverse application of various federal, state and local regulations; (iii) the ability to secure competitive replacement contracts for health insurance and workers’ compensation insurance at expiration of current contracts; (iv) increases in health insurance costs and workers’ compensation rates and underlying claims trends, health care reform, financial solvency of workers’ compensation carriers, other insurers or financial institutions, state unemployment tax rates, liabilities for employee and client actions or payroll-related claims; (v) failure to manage growth of our operations and the effectiveness of our sales and marketing efforts;

(vi) the impact of the competitive environment in the PEO industry on our growth and/or profitability; (vii) our liability for worksite employee payroll, payroll taxes and benefits costs; (viii) our liability for disclosure of sensitive or private information; (ix) our ability to integrate or realize expected returns on our acquisitions; (x) failure of our information technology systems; (xi) an adverse final judgment or settlement of claims against Insperity; and (xii) disruptions to our business resulting from the actions of certain stockholders. These factors are discussed in further detail in Insperity’s filings with the U.S. Securities and Exchange Commission. Any of these factors, or a combination of such factors, could materially affect the results of our operations and whether forward-looking statements we make ultimately prove to be accurate.

Except to the extent otherwise required by federal securities law, we do not undertake any obligation to update our forward-looking statements to reflect events or circumstances after the date they are made or to reflect the occurrence of unanticipated events.

Insperity, Inc.

Summary Financial Information

(in thousands, except per share amounts and statistical data)

|

| | | | | | | | |

| | June 30,

2015 | | December 31,

2014 |

| | (Unaudited) | | |

Assets: | | | | |

Cash and cash equivalents | | $ | 167,728 |

| | $ | 276,456 |

|

Restricted cash | | 48,887 |

| | 44,040 |

|

Marketable securities | | 21,648 |

| | 28,631 |

|

Accounts receivable, net | | 265,631 |

| | 175,116 |

|

Prepaid insurance | | 16,459 |

| | 21,301 |

|

Assets held for sale | | 12,182 |

| | — |

|

Other current assets | | 15,522 |

| | 17,649 |

|

Deferred income taxes | | 3,537 |

| | 6,316 |

|

Total current assets | | 551,594 |

| | 569,509 |

|

Property and equipment, net | | 58,142 |

| | 84,345 |

|

Prepaid health insurance | | 9,000 |

| | 9,000 |

|

Deposits | | 114,577 |

| | 117,634 |

|

Goodwill and other intangible assets, net | | 14,006 |

| | 14,457 |

|

Deferred income taxes | | 3,956 |

| | — |

|

Other assets | | 1,773 |

| | 1,725 |

|

Total assets | | $ | 753,048 |

| | $ | 796,670 |

|

Liabilities and Stockholders’ Equity: | | | | |

Accounts payable | | $ | 2,383 |

| | $ | 4,674 |

|

Payroll taxes and other payroll deductions payable | | 122,875 |

| | 176,341 |

|

Accrued worksite employee payroll cost | | 228,091 |

| | 192,396 |

|

Accrued health insurance costs | | 6,284 |

| | 18,329 |

|

Accrued workers’ compensation costs | | 50,841 |

| | 45,592 |

|

Accrued corporate payroll and commissions | | 25,836 |

| | 32,644 |

|

Other accrued liabilities | | 24,801 |

| | 22,444 |

|

Income taxes payable | | 1,652 |

| | 4,031 |

|

Total current liabilities | | 462,763 |

| | 496,451 |

|

Accrued workers’ compensation costs | | 98,938 |

| | 92,048 |

|

Deferred income taxes | | — |

| | 4,075 |

|

Total noncurrent liabilities | | 98,938 |

| | 96,123 |

|

Stockholders’ equity: | | | | |

Common stock | | 308 |

| | 308 |

|

Additional paid-in capital | | 142,681 |

| | 137,769 |

|

Treasury stock, at cost | | (176,817 | ) | | (148,465 | ) |

Accumulated other comprehensive income, net of tax | | — |

| | 3 |

|

Retained earnings | | 225,175 |

| | 214,481 |

|

Total stockholders’ equity | | 191,347 |

| | 204,096 |

|

Total liabilities and stockholders’ equity | | $ | 753,048 |

| | $ | 796,670 |

|

Insperity, Inc.

Summary Financial Information (continued)

(in thousands, except per share amounts and statistical data)

(Unaudited)

|

| | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

June 30, | | Six Months Ended

June 30, |

| 2015 | | 2014 | | Change | | 2015 | | 2014 | | Change |

Operating results: | | | | | | | | | | | |

Revenues (gross billings of $3.703 billion, $3.281 billion, $7.643 billion and $6.869 billion less worksite employee payroll cost of $3.075 billion, $2.716 billion, $6.316 billion and $5.667 billion, respectively) | $ | 627,838 |

| | $ | 564,621 |

| | 11.2 | % | | $ | 1,327,317 |

| | $ | 1,201,620 |

| | 10.5 | % |

Direct costs: | | | | | | | | | | | |

Payroll taxes, benefits and workers’ compensation costs | 523,619 |

| | 469,168 |

| | 11.6 | % | | 1,093,238 |

| | 999,991 |

| | 9.3 | % |

Gross profit | 104,219 |

| | 95,453 |

| | 9.2 | % | | 234,079 |

| | 201,629 |

| | 16.1 | % |

Operating expenses: | | | | | | | | | | | |

Salaries, wages and payroll taxes | 50,234 |

| | 47,829 |

| | 5.0 | % | | 106,982 |

| | 98,861 |

| | 8.2 | % |

Stock-based compensation | 4,041 |

| | 3,245 |

| | 24.5 | % | | 6,464 |

| | 5,645 |

| | 14.5 | % |

Commissions | 4,103 |

| | 3,717 |

| | 10.4 | % | | 8,407 |

| | 6,963 |

| | 20.7 | % |

Advertising | 7,389 |

| | 8,356 |

| | (11.6 | )% | | 11,107 |

| | 13,297 |

| | (16.5 | )% |

General and administrative expenses | 20,332 |

| | 21,116 |

| | (3.7 | )% | | 44,387 |

| | 43,848 |

| | 1.2 | % |

Depreciation and amortization | 4,590 |

| | 5,291 |

| | (13.2 | )% | | 9,875 |

| | 10,525 |

| | (6.2 | )% |

Impairment charges and other | 1,313 |

| | 2,485 |

| | (47.2 | )% | | 11,120 |

| | 2,485 |

| | 347.5 | % |

Total operating expenses | 92,002 |

| | 92,039 |

| | — |

| | 198,342 |

| | 181,624 |

| | 9.2 | % |

Operating income | 12,217 |

| | 3,414 |

| | 257.9 | % | | 35,737 |

| | 20,005 |

| | 78.6 | % |

Other income (expense): | | | | | | | | | | | |

Interest, net | (8 | ) | | 24 |

| | (133.3 | )% | | (1 | ) | | 71 |

| | (101.4 | )% |

Other, net | (32 | ) | | 12 |

| | (366.7 | )% | | (32 | ) | | (14 | ) | | 128.6 | % |

Income before income tax expense | 12,177 |

| | 3,450 |

| | 253.0 | % | | 35,704 |

| | 20,062 |

| | 78.0 | % |

Income tax expense | 4,863 |

| | 1,559 |

| | 211.9 | % | | 14,603 |

| | 8,607 |

| | 69.7 | % |

Net income | $ | 7,314 |

| | $ | 1,891 |

| | 286.8 | % | | $ | 21,101 |

| | $ | 11,455 |

| | 84.2 | % |

Less distributed and undistributed earnings allocated to participating securities | (179 | ) | | (139 | ) | | 28.8 | % | | (521 | ) | | (333 | ) | | 56.5 | % |

Net income allocated to common shares | $ | 7,135 |

| | $ | 1,752 |

| | 307.2 | % | | $ | 20,580 |

| | $ | 11,122 |

| | 85.0 | % |

Basic net income per share of common stock | $ | 0.29 |

| | $ | 0.07 |

| | 314.3 | % | | $ | 0.83 |

| | $ | 0.45 |

| | 84.4 | % |

Diluted net income per share of common stock | $ | 0.29 |

| | $ | 0.07 |

| | 314.3 | % | | $ | 0.83 |

| | $ | 0.45 |

| | 84.4 | % |

Insperity, Inc.

Summary Financial Information (continued)

(in thousands, except per share amounts and statistical data)

(Unaudited)

|

| | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

June 30, | | Six Months Ended

June 30, |

| 2015 | | 2014 | | Change | | 2015 | | 2014 | | Change |

| | | | | | | | | | | |

Statistical Data: | | | | | | | | | | | |

Average number of worksite employees paid per month | 143,131 |

| | 128,274 |

| | 11.6 | % | | 140,545 |

| | 127,281 |

| | 10.4 | % |

Revenues per worksite employee per month(1) | $ | 1,462 |

| | $ | 1,467 |

| | (0.3 | )% | | $ | 1,574 |

| | $ | 1,573 |

| | 0.1 | % |

Gross profit per worksite employee per month | 243 |

| | 248 |

| | (2.0 | )% | | 278 |

| | 264 |

| | 5.3 | % |

Operating expenses per worksite employee per month | 215 |

| | 239 |

| | (10.0 | )% | | 236 |

| | 238 |

| | (0.8 | )% |

Operating income per worksite employee per month | 28 |

| | 9 |

| | 211.1 | % | | 42 |

| | 26 |

| | 61.5 | % |

Net income per worksite employee per month | 17 |

| | 5 |

| | 240.0 | % | | 25 |

| | 15 |

| | 66.7 | % |

(1) Gross billings of $8,623, $8,526, $9,064 and $8,994 per worksite employee per month, less payroll cost of $7,161, $7,059, $7,490 and $7,421 per worksite employee per month, respectively.

Insperity, Inc.

Summary Financial Information (continued)

(in thousands, except per share amounts and statistical data)

(Unaudited)

GAAP to Non-GAAP Reconciliation Tables

|

| | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended

June 30, | | Six Months Ended

June 30, |

| | 2015 | | 2014 | | Change | | 2015 | | 2014 | | Change |

| | | | | | | | | | | | |

Payroll cost (GAAP) | | $ | 3,074,892 |

| | $ | 2,716,514 |

| | 13.2 | % | | $ | 6,315,874 |

| | $ | 5,667,082 |

| | 11.4 | % |

Less: Bonus payroll cost | | 257,367 |

| | 222,005 |

| | 15.9 | % | | 775,870 |

| | 743,346 |

| | 4.4 | % |

Non-bonus payroll cost | | $ | 2,817,525 |

| | $ | 2,494,509 |

| | 12.9 | % | | $ | 5,540,004 |

| | $ | 4,923,736 |

| | 12.5 | % |

| | | | | | | | | | | | |

Payroll cost per worksite employee per month (GAAP) | | $ | 7,161 |

| | $ | 7,059 |

| | 1.4 | % | | $ | 7,490 |

| | $ | 7,421 |

| | 0.9 | % |

Less: Bonus payroll cost per worksite employee per month | | 599 |

| | 577 |

| | 3.8 | % | | 920 |

| | 973 |

| | (5.4 | )% |

Non-bonus payroll cost per worksite employee per month | | $ | 6,562 |

| | $ | 6,482 |

| | 1.2 | % | | $ | 6,570 |

| | $ | 6,448 |

| | 1.9 | % |

Non-bonus payroll cost represents payroll cost excluding the impact of bonus payrolls paid to the company’s worksite employees. Bonus payroll cost varies from period to period, but has no direct impact to the company’s ultimate workers’ compensation costs under the current program. As a result, Insperity management refers to non-bonus payroll cost in analyzing, reporting and forecasting the company’s workers’ compensation costs.

|

| | | | | | | | |

| | June 30,

2015 | | December 31,

2014 |

| | |

Cash, cash equivalents and marketable securities (GAAP) | | $ | 189,376 |

| | $ | 305,087 |

|

Less: Amounts payable for withheld federal and state income taxes, employment taxes and other payroll deductions | | 106,169 |

| | 152,132 |

|

Customer prepayments | | 19,376 |

| | 87,887 |

|

Adjusted cash, cash equivalents and marketable securities | | $ | 63,831 |

| | $ | 65,068 |

|

Adjusted cash, cash equivalents and marketable securities excludes funds associated with federal and state income tax withholdings, employment taxes and other payroll deductions, as well as client prepayments. Insperity management believes adjusted cash, cash equivalents and marketable securities is a useful measure of the company’s available funds.

|

| | | | | | | | |

| | June 30,

2015 | | December 31,

2014 |

| | |

Working capital (GAAP) | | $ | 88,831 |

| | $ | 73,058 |

|

Less: Assets held for sale, net of current deferred tax liabilities | | 9,533 |

| | — |

|

Adjusted working capital | | $ | 79,298 |

| | $ | 73,058 |

|

Adjusted working capital represents working capital excluding assets held for sale that are classified as current assets and their associated current deferred tax liabilities. Insperity management believes adjusted working capital is a useful measure of the company’s liquidity, as it allows for additional analysis of the company’s liquidity separate from the impact of this item.

|

| | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended

June 30, | | Six Months Ended

June 30, |

| | 2015 | | 2014 | | Change | | 2015 | | 2014 | | Change |

| | | | | | | | | | | | |

Operating expenses (GAAP) | | $ | 92,002 |

| | $ | 92,039 |

| | — |

| | $ | 198,342 |

| | $ | 181,624 |

| | 9.2 | % |

Less: Impairment charges and other | | 1,313 |

| | 2,485 |

| | (47.2 | )% | | 11,120 |

| | 2,485 |

| | 347.5 | % |

Stockholder advisory expenses | | 398 |

| | — |

| | — |

| | 1,546 |

| | — |

| | — |

|

Adjusted operating expenses | | $ | 90,291 |

| | $ | 89,554 |

| | 0.8 | % | | $ | 185,676 |

| | $ | 179,139 |

| | 3.6 | % |

Adjusted operating expenses represent operating expenses excluding the impact of impairment and other charges related to the valuation of aircraft held for sale and stockholder advisory expenses in 2015 and an impairment charge associated with the Employment Screening reporting unit in 2014. Insperity management believes adjusted operating expenses is a useful measure of the company’s operating costs, as it allows for additional analysis of the company’s operating expenses separate from the impact of these items.

|

| | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended

June 30, | | Six Months Ended

June 30, |

| | |

| | 2015 | | 2014 | | Change | | 2015 | | 2014 | | Change |

| | | | | | | | | | | | |

Net income (GAAP) | | $ | 7,314 |

| | $ | 1,891 |

| | 286.8 | % | | $ | 21,101 |

| | $ | 11,455 |

| | 84.2 | % |

Income tax expense | | 4,863 |

| | 1,559 |

| | 211.9 | % | | 14,603 |

| | 8,607 |

| | 69.7 | % |

Interest expense | | 124 |

| | 88 |

| | 40.9 | % | | 224 |

| | 177 |

| | 26.6 | % |

Depreciation and amortization | | 4,590 |

| | 5,291 |

| | (13.2 | )% | | 9,875 |

| | 10,525 |

| | (6.2 | )% |

EBITDA | | 16,891 |

| | 8,829 |

| | 91.3 | % | | 45,803 |

| | 30,764 |

| | 48.9 | % |

Impairment charges and other | | 1,313 |

| | 2,485 |

| | (47.2 | )% | | 11,120 |

| | 2,485 |

| | 347.5 | % |

Stock-based compensation | | 4,041 |

| | 3,245 |

| | 24.5 | % | | 6,464 |

| | 5,645 |

| | 14.5 | % |

Stockholder advisory expenses | | 398 |

| | — |

| | — |

| | 1,546 |

| | — |

| | — |

|

Adjusted EBITDA | | $ | 22,643 |

| | $ | 14,559 |

| | 55.5 | % | | $ | 64,933 |

| | $ | 38,894 |

| | 66.9 | % |

EBITDA represents net income computed in accordance with generally accepted accounting principles (“GAAP”), plus interest expense, income tax expense, depreciation and amortization expense. Adjusted EBITDA represents EBITDA plus non-cash impairment and other charges, costs associated with stockholder advisory expenses and stock-based compensation. Insperity management believes EBITDA and Adjusted EBITDA are often useful measures of the company’s operating performance, as they allow for additional analysis of the company’s operating results separate from the impact of these items.

|

| | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended

June 30, | | Six Months Ended

June 30, |

| | |

| | 2015 | | 2014 | | Change | | 2015 | | 2014 | | Change |

| | | | | | | | | | | | |

Net income (GAAP) | | $ | 7,314 |

| | $ | 1,891 |

| | 286.8 | % | | $ | 21,101 |

| | $ | 11,455 |

| | 84.2 | % |

Impairment charges and other, net of tax | | 789 |

| | 1,566 |

| | (49.6 | )% | | 6,572 |

| | 1,566 |

| | 319.7 | % |

Stock-based compensation, net of tax | | 2,429 |

| | 1,778 |

| | 36.6 | % | | 3,820 |

| | 3,223 |

| | 18.5 | % |

Stockholder advisory expenses, net of tax | | 239 |

| | — |

| | — |

| | 914 |

| | — |

| | — |

|

Adjusted net income | | $ | 10,771 |

| | $ | 5,235 |

| | 105.7 | % | | $ | 32,407 |

| | $ | 16,244 |

| | 99.5 | % |

|

| | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended

June 30, | | Six Months Ended

June 30, |

| | |

| | 2015 | | 2014 | | Change | | 2015 | | 2014 | | Change |

| | | | | | | | | | | | |

Diluted net income per share of common stock (GAAP) | | $ | 0.29 |

| | $ | 0.07 |

| | 314.3 | % | | $ | 0.83 |

| | $ | 0.45 |

| | 84.4 | % |

Impairment charges and other, net of tax | | 0.03 |

| | 0.06 |

| | (50.0 | )% | | 0.26 |

| | 0.06 |

| | 333.3 | % |

Stock-based compensation, net of tax | | 0.09 |

| | 0.07 |

| | 28.6 | % | | 0.15 |

| | 0.13 |

| | 15.4 | % |

Stockholder advisory expenses, net of tax | | 0.01 |

| | — |

| | — |

| | 0.04 |

| | — |

| | — |

|

Adjusted diluted net income per share of common stock | | $ | 0.42 |

| | $ | 0.20 |

| | 110.0 | % | | $ | 1.28 |

| | $ | 0.64 |

| | 100.0 | % |

Adjusted net income and adjusted diluted net income per share of common stock represent net income and diluted net income per share computed in accordance with GAAP, excluding the impact of non-cash impairment and other charges related to the valuation of aircraft held for sale in 2015 and an impairment charge associated with the Employment Screening reporting unit in 2014, stock-based compensation and costs associated with stockholder advisory expenses. Insperity management believes adjusted net income and adjusted diluted net income per share are useful measures of the company’s operating performance in this period, as they allow for additional analysis of the company’s operating results separate from the impact of these items.

Non-bonus payroll, adjusted cash, cash equivalents and marketable securities, adjusted working capital, adjusted operating expenses, EBITDA, adjusted EBITDA, adjusted net income and adjusted diluted net income per share of common stock are not financial measures prepared in accordance with GAAP and may be different from similar measures used by other companies. Non-bonus payroll, adjusted cash, cash equivalents and marketable securities, adjusted working capital, adjusted

operating expenses, EBITDA, adjusted EBITDA, adjusted net income and adjusted diluted net income per share of common stock should not be considered as a substitute for, or superior to, measures of financial performance prepared in accordance with GAAP. Investors are encouraged to review the reconciliation of the non-GAAP financial measures used in this press release to their most directly comparable GAAP financial measures as provided in the tables above.

###

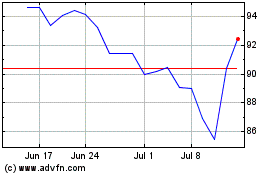

Insperity (NYSE:NSP)

Historical Stock Chart

From Mar 2024 to Apr 2024

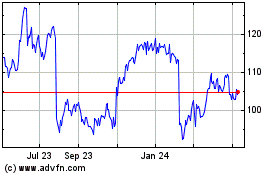

Insperity (NYSE:NSP)

Historical Stock Chart

From Apr 2023 to Apr 2024