Current Report Filing (8-k)

July 31 2015 - 11:17AM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM

8-K

CURRENT

REPORT

PURSUANT

TO SECTION 13 OR 15(d) OF

THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): June 9, 2015

Textmunication Holdings Inc.

(Exact name of registrant as specified in its charter)

| Nevada |

|

000-21202 |

|

58-1588291 |

| (State

or other jurisdiction |

|

(Commission |

|

(I.R.S.

Employer |

| of

incorporation) |

|

File

Number) |

|

Identification

No.) |

1940

Contra Costa Blvd.

Pleasant

Hill, CA |

|

94523 |

| (Address

of principal executive offices) |

|

(Zip

Code) |

Registrant’s

telephone number, including area code: 925-777-2111

| |

|

|

| |

(Former

name or former address, if changed since last report) |

|

Check the

appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| [ ] |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| [ ] |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| [ ] |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| [ ] |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

SECTION

4 – Matters Related to Accountants and Financial Statements

Item

4.01 Changes in Registrant’s Certifying Accountant.

On July

24, 2015, Textmunication Holdings Inc. (the “Company”) dismissed RBSM, LLP (the “Former Accountant”)

as the Company’s independent registered public accounting firm and on June 9, 2015 the Company engaged Seale & Beers,

CPAs (the “New Accountant”) as the Company’s independent registered public accounting firm. The dismissal of

the Former Accountant and the engagement of the New Accountant was approved by the Company’s Board of Directors.

The Former

Accountant’s audit report on the financial statements of the Company for the year ended December 31, 2014 contained no adverse

opinion or disclaimer of opinion, nor was it qualified or modified as to uncertainty, audit scope or accounting principles, except

that the audit report on the financial statements of the Company for the year ended December 31, 2014 contained an uncertainty

about the Company’s ability to continue as a going concern.

For the

year ended December 31, 2014, and through the interim period ended June 9, 2015, there were no “disagreements” (as

such term is defined in Item 304 of Regulation S-K) with the Former Accountant on any matter of accounting principles or practices,

financial statement disclosure, or auditing scope or procedures, which disagreements if not resolved to the satisfaction of the

Former Accountant would have caused them to make reference thereto in their reports on the financial statements for such periods.

For the

year ended December 31, 2014, and through the interim period ended June 9, 2015, there were the following “reportable events”

(as such term is defined in Item 304 of Regulation S-K). As disclosed in Part II, Item 9A. of the Company’s Form 10-K for

the year ended December 31, 2014, the Company’s management determined that the Company’s internal controls over financial

reporting were not effective as of the end of such period due to the existence of material weaknesses related to the following:

| |

1. |

The

Company does not have written documentation of its internal control policies and procedures. Written documentation of key

internal controls over financial reporting is a requirement of Section 404 of the Sarbanes-Oxley Act as of the year ending

December 31, 2014. Management evaluated the impact of the Company’s failure to have written documentation of its internal

controls and procedures on its assessment of its disclosure controls and procedures and has concluded that the control deficiency

that resulted represented a material weakness. |

| |

|

|

| |

2. |

The

Company does not have sufficient segregation of duties within accounting functions, which is a basic internal control. Due

to the Company’s size and nature, segregation of all conflicting duties may not always be possible and may not be economically

feasible. However, to the extent possible, the initiation of transactions, the custody of assets and the recording of transactions

should be performed by separate individuals. Management evaluated the impact of the Company’s failure to have segregation

of duties on its assessment of its disclosure controls and procedures and has concluded that the control deficiency that resulted

represented a material weakness. |

| |

|

|

| |

3. |

Effective

controls over the control environment were not maintained. Specifically, a formally adopted written code of business conduct

and ethics that governs our employees, officers, and directors was not in place. Additionally, management has not developed

and effectively communicated to employees its accounting policies and procedures. This has resulted in inconsistent practices.

Further, the Company’s Board of Directors does not currently have any independent members and no director qualifies

as an audit committee financial expert as defined in Item 407(d)(5)(ii) of Regulation S-K. Since these entity level programs

have a pervasive effect across the organization, management has determined that these circumstances constitute a material

weakness. |

These material

weaknesses have not been remediated as of the date of this Current Report on Form 8-K.

Other than

as disclosed above, there were no reportable events for the year ended December 31, 2014, and through the interim period ended

June 9, 2015. The Company’s Board of Directors discussed the subject matter of each reportable event with the Former Accountant.

The Company authorized the Former Accountant to respond fully and without limitation to all requests of the New Accountant concerning

all matters related to the audited period by the Former Accountant, including with respect to the subject matter of each reportable

event.

Prior to

retaining the New Accountant, the Company did not consult with the New Accountant regarding either: (i) the application of accounting

principles to a specified transaction, either contemplated or proposed, or the type of audit opinion that might be rendered on

the Company’s financial statements; or (ii) any matter that was the subject of a “disagreement” or a “reportable

event” (as those terms are defined in Item 304 of Regulation S-K).

On July

29, 2015, the Company provided the Former Accountant with its disclosures in the Current Report on Form 8-K disclosing the dismissal

of the Former Accountant and requested in writing that the Former Accountant furnish the Company with a letter addressed to the

Securities and Exchange Commission stating whether or not they agree with such disclosures. The Former Accountant’s response

is filed as an exhibit to this Current Report on Form 8-K.

SECTION

9 – Financial Statements and Exhibits

Item

9.01 Financial Statements and Exhibits.

| Exhibit

No. |

|

Description |

| |

|

|

| 16.1 |

|

Letter

from RBSM LLP to the Securities and Exchange Commission |

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf

by the undersigned hereunto duly authorized.

| Textmunication

Holdings Inc. |

|

| |

|

| /s/ Wais Asefi |

|

| Wais

Asefi |

|

| Chief

Executive Officer |

|

Date: July

31, 2015

EXHIBIT

16.1

RBSM

LLP

New

York, New York

July

29, 2015

Securities

and Exchange Commission

100 F Street,

N.E.

Washington,

DC 20549-7561

Dear Sirs/Madams:

We

have read Item 4.01 of Textmunication Holdings Inc. (the “Company”) Form 8-K dated June 9, 2015, and are in agreement

with the statements relating only to RBSM LLP contained therein. We have no basis to agree or disagree with other statements of

the Company contained therein.

| Very

truly yours, |

|

| |

|

| /s/

RBSM LLP |

|

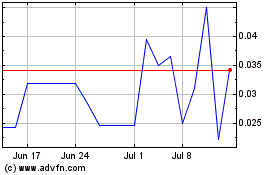

Resonate Blends (PK) (USOTC:KOAN)

Historical Stock Chart

From Mar 2024 to Apr 2024

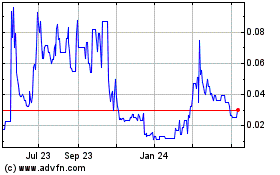

Resonate Blends (PK) (USOTC:KOAN)

Historical Stock Chart

From Apr 2023 to Apr 2024