United States

Securities and Exchange Commission

Washington, DC 20549

Form 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): July 30, 2015

PERFICIENT, INC.

(Exact Name of Registrant as Specified in its Charter)

|

Delaware

|

001-15169

|

74-2853258

|

|

(State or Other Jurisdiction of Incorporation)

|

(Commission File Number)

|

(IRS Employer Identification No.)

|

|

|

|

|

555 Maryville University Drive, Suite 600, Saint Louis, Missouri

|

63141

|

|

(Address of Principal Executive Offices)

|

(Zip Code)

|

Registrant's telephone number, including area code (314) 529-3600

|

Not Applicable

|

|

(Former Name or Former Address, if Changed Since Last Report)

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

ITEM 2.02 RESULTS OF OPERATIONS AND FINANCIAL CONDITION

On July 30, 2015, Perficient, Inc. (“Perficient”) announced its financial results for the three and six months ended June 30, 2015. A copy of the press release is being furnished as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated by reference into this Item 2.02.

In accordance with General Instruction B.2 of Form 8-K, the information in this Current Report on Form 8-K, including Exhibit 99.1, shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that Section, nor shall such information and Exhibit be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

ITEM 8.01 OTHER EVENTS

On July 30, 2015, Perficient posted on the Investor Relations page of its website at www.perficient.com a slide presentation related to its second quarter 2015 financial results and operating metrics. A copy of the slide presentation is furnished as Exhibit 99.2 to this Current Report on Form 8-K. The information contained or incorporated in our website is not part of this filing.

ITEM 9.01 FINANCIAL STATEMENTS AND EXHIBITS

|

Exhibit

|

|

|

Number

|

Description

|

| |

|

|

99.1

|

Perficient, Inc. Press Release, dated July 30, 2015, announcing financial results for the three and six months ended June 30, 2015

|

|

99.2

|

Perficient, Inc. Q2 2015 Financial Results Presentation

|

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

PERFICIENT, INC.

|

| |

|

|

|

Date: July 30, 2015

|

By:

|

/s/ Paul E. Martin

|

| |

|

Paul E. Martin

|

| |

|

Chief Financial Officer

|

Exhibit Index

|

Exhibit

|

|

|

Number

|

Description

|

| |

|

|

99.1

|

Perficient, Inc. Press Release, dated July 30, 2015, announcing financial results for the three and six months ended June 30, 2015

|

|

99.2

|

Perficient, Inc. Q2 2015 Financial Results Presentation

|

EXHIBIT 99.1

For more information, please contact:

Bill Davis, Perficient, 314-529-3555

bill.davis@perficient.com

PERFICIENT REPORTS SECOND QUARTER 2015 RESULTS

ST. LOUIS (July 30, 2015) – Perficient, Inc. (NASDAQ: PRFT) ("Perficient"), a leading information technology and management consulting firm serving Global 2000® and other large enterprise customers throughout North America, today reported its financial results for the quarter ended June 30, 2015.

Financial Highlights

For the quarter ended June 30, 2015:

|

·

|

Revenue decreased 7% to $108.5 million from $116.7 million for the second quarter of 2014;

|

|

·

|

Services revenue decreased 1% to $97.2 million from $98.3 million for the second quarter of 2014;

|

|

·

|

Gross margin decreased 8% to $34.9 million from $37.8 million for the second quarter of 2014;

|

|

·

|

Adjusted earnings per share results (a non-GAAP measure; see attached schedule, which reconciles to GAAP earnings per share) on a fully diluted basis decreased to $0.25 from $0.33 for the second quarter of 2014;

|

|

·

|

Earnings per share results on a fully diluted basis decreased to $0.12 from $0.19 for the second quarter of 2014;

|

|

·

|

EBITDAS (a non-GAAP measure; see attached schedule, which reconciles to GAAP net income) decreased to $13.4 million from $18.8 million for the second quarter of 2014;

|

|

·

|

Net income decreased to $4.0 million from $6.4 million for the second quarter of 2014; and

|

|

·

|

Perficient repurchased approximately 130,000 shares of its common stock at a total cost of $2.6 million.

|

"We believe strong second quarter bookings and business momentum will drive substantial margin and earnings improvements in the second half of 2015," said Jeff Davis, chief executive officer and president. "The world's most innovative enterprises continue to seek our partnership and guidance on digital experience, business optimization and industry solutions that leverage a variety of leading technology products and platforms."

Other Highlights

Among other recent achievements, Perficient:

|

·

|

Received U.S. Partner and Industry Team Partner of the Year honors from Microsoft, the result of Perficient sweeping Microsoft's regional Enterprise Platform Group awards. Perficient was named Microsoft's East Region National Solution Provider Partner of the Year, Central Region NSP Partner of the Year, and West Region NSP Partner of the Year, the first time Perficient has won all three honors at once;

|

|

·

|

Received 2015 Top Workplace awards from the St. Louis Post-Dispatch and Minneapolis Star Tribune. The honor was the third in a row from the Post-Dispatch. Perficient was honored previously by the Star Tribune in 2012 and 2013; and

|

|

·

|

Added new customer relationships and follow-on projects with leading companies such as Bell Aliant, Blue Shield of California, Cengage Learning, Energizer Holdings, Gulf States Toyota, Kaiser Permanente, Royal Caribbean Cruise Lines, the St. Louis Rams, and Symantec.

|

Business Outlook

The following statements are based on current expectations. These statements are forward-looking and actual results may differ materially. See "Safe Harbor Statement" below.

Perficient expects its third quarter 2015 services and software revenue, including reimbursed expenses, to be in the range of $111.5 million to $122.0 million, comprised of $104.5 million to $110.0 million of revenue from services including reimbursed expenses and $7.0 million to $12.0 million of revenue from sales of software. The midpoint of third quarter 2015 services revenue guidance represents growth of 7% over third quarter 2014 services revenue.

Conference Call Details

Perficient will host a conference call regarding second quarter 2015 financial results today at 10 a.m. Eastern.

WHAT: Perficient Reports Second Quarter 2015 Results

WHEN: Thursday, July 30, 2015, at 10 a.m. Eastern

CONFERENCE CALL NUMBERS: 800-884-5695 (U.S. and Canada); 617-786-2960 (International)

PARTICIPANT PASSCODE: 62080438

REPLAY TIMES: Thursday, July 30, 2015, at 1 p.m. Eastern, through Thursday, Aug. 6, 2015, at 11:59 p.m. Eastern

REPLAY NUMBER: 888-286-8010 (U.S. and Canada) 617-801-6888 (International)

REPLAY PASSCODE: 69293494

About Perficient

Perficient is a leading information technology and management consulting firm serving Global 2000 and enterprise customers throughout North America. Perficient delivers digital experience, business optimization and industry solutions that enable clients to improve productivity and competitiveness; strengthen relationships with customers, suppliers and partners; and reduce costs. Perficient's professionals serve clients from locations across North America and offshore facilities in Europe, India and China. Traded on the Nasdaq Global Select Market, Perficient is a member of the Russell 2000 index and the S&P SmallCap 600 index. Perficient is an award-winning Premier Level IBM business partner, a Microsoft National Solution Provider and Gold Certified Partner, an Oracle Platinum Partner, and a Platinum Salesforce Cloud Alliance Partner. For more information, visit www.perficient.com.

Safe Harbor Statement

Some of the statements contained in this news release that are not purely historical statements discuss future expectations or state other forward-looking information related to financial results and business outlook for 2015. Those statements are subject to known and unknown risks, uncertainties, and other factors that could cause the actual results to differ materially from those contemplated by the statements. The forward-looking information is based on management's current intent, belief, expectations, estimates, and projections regarding our company and our industry. You should be aware that those statements only reflect our predictions. Actual events or results may differ substantially. Important factors that could cause our actual results to be materially different from the forward-looking statements include (but are not limited to) those disclosed under the heading "Risk Factors" in our annual report on Form 10-K for the year ended December 31, 2014, and the following:

(1) the possibility that our actual results do not meet the projections and guidance contained in this news release;

(2) the impact of the general economy and economic uncertainty on our business;

(3) risks associated with the operation of our business generally, including:

|

a)

|

client demand for our services and solutions;

|

|

b)

|

maintaining a balance of our supply of skills and resources with client demand;

|

|

c)

|

effectively competing in a highly competitive market;

|

|

d)

|

protecting our clients' and our data and information;

|

|

e)

|

risks from international operations including fluctuations in exchange rates;

|

|

f)

|

obtaining favorable pricing to reflect services provided;

|

|

g)

|

adapting to changes in technologies and offerings;

|

|

h)

|

risk of loss of one or more significant software vendors; and

|

|

i)

|

the implementation of our new enterprise resource planning system in July 2014;

|

(4) legal liabilities, including intellectual property protection and infringement or personally identifiable information;

(5) risks associated with managing growth organically and through acquisitions; and

(6) the risks detailed from time to time within our filings with the Securities and Exchange Commission.

Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance, or achievements. This cautionary statement is provided pursuant to Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. The forward-looking statements in this release are made only as of the date hereof and we undertake no obligation to update publicly any forward-looking statement for any reason, even if new information becomes available or other events occur in the future.

|

PERFICIENT, INC.

|

|

CONSOLIDATED STATEMENTS OF OPERATIONS

|

|

(unaudited)

|

|

(in thousands, except per share data)

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended June 30,

|

|

|

Six Months Ended June 30,

|

|

| |

|

2015

|

|

|

2014

|

|

|

2015

|

|

|

2014

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenues

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Services

|

|

$

|

97,186

|

|

|

$

|

98,316

|

|

|

$

|

195,815

|

|

|

$

|

186,805

|

|

|

Software and hardware

|

|

|

7,468

|

|

|

|

13,913

|

|

|

|

15,970

|

|

|

|

18,916

|

|

|

Reimbursable expenses

|

|

|

3,810

|

|

|

|

4,480

|

|

|

|

7,277

|

|

|

|

8,158

|

|

|

Total revenues

|

|

|

108,464

|

|

|

|

116,709

|

|

|

|

219,062

|

|

|

|

213,879

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cost of revenues

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Project personnel costs

|

|

|

61,103

|

|

|

|

59,862

|

|

|

|

123,350

|

|

|

|

115,525

|

|

|

Software and hardware costs

|

|

|

6,636

|

|

|

|

12,393

|

|

|

|

13,364

|

|

|

|

16,895

|

|

|

Reimbursable expenses

|

|

|

3,810

|

|

|

|

4,480

|

|

|

|

7,277

|

|

|

|

8,158

|

|

|

Other project related expenses

|

|

|

827

|

|

|

|

886

|

|

|

|

1,723

|

|

|

|

1,672

|

|

|

Stock compensation

|

|

|

1,187

|

|

|

|

1,240

|

|

|

|

2,387

|

|

|

|

2,322

|

|

|

Total cost of revenues

|

|

|

73,563

|

|

|

|

78,861

|

|

|

|

148,101

|

|

|

|

144,572

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gross margin

|

|

|

34,901

|

|

|

|

37,848

|

|

|

|

70,961

|

|

|

|

69,307

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Selling, general and administrative

|

|

|

22,653

|

|

|

|

20,253

|

|

|

|

44,389

|

|

|

|

38,823

|

|

|

Stock compensation

|

|

|

2,160

|

|

|

|

2,180

|

|

|

|

4,467

|

|

|

|

4,293

|

|

|

Total selling, general and administrative

|

|

|

24,813

|

|

|

|

22,433

|

|

|

|

48,856

|

|

|

|

43,116

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Depreciation

|

|

|

1,093

|

|

|

|

870

|

|

|

|

2,174

|

|

|

|

1,781

|

|

|

Amortization

|

|

|

3,411

|

|

|

|

3,730

|

|

|

|

7,212

|

|

|

|

6,466

|

|

|

Acquisition costs

|

|

|

21

|

|

|

|

1,076

|

|

|

|

21

|

|

|

|

2,569

|

|

|

Adjustment to fair value of contingent consideration

|

|

|

89

|

|

|

|

(1,677

|

)

|

|

|

174

|

|

|

|

(1,463

|

)

|

|

Income from operations

|

|

|

5,474

|

|

|

|

11,416

|

|

|

|

12,524

|

|

|

|

16,838

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net interest expense

|

|

|

(548

|

)

|

|

|

(425

|

)

|

|

|

(1,101

|

)

|

|

|

(593

|

)

|

|

Net other income (expense)

|

|

|

9

|

|

|

|

49

|

|

|

|

(271

|

)

|

|

|

69

|

|

|

Income before income taxes

|

|

|

4,935

|

|

|

|

11,040

|

|

|

|

11,152

|

|

|

|

16,314

|

|

|

Provision for income taxes

|

|

|

938

|

|

|

|

4,653

|

|

|

|

3,089

|

|

|

|

6,881

|

|

|

Net income

|

|

$

|

3,997

|

|

|

$

|

6,387

|

|

|

$

|

8,063

|

|

|

$

|

9,433

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic earnings per share

|

|

$

|

0.12

|

|

|

$

|

0.20

|

|

|

$

|

0.24

|

|

|

$

|

0.30

|

|

|

Diluted earnings per share

|

|

$

|

0.12

|

|

|

$

|

0.19

|

|

|

$

|

0.24

|

|

|

$

|

0.29

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Shares used in computing basic earnings per share

|

|

|

33,333

|

|

|

|

31,564

|

|

|

|

33,190

|

|

|

|

31,147

|

|

|

Shares used in computing diluted earnings per share

|

|

|

34,138

|

|

|

|

33,271

|

|

|

|

34,151

|

|

|

|

32,949

|

|

|

PERFICIENT, INC.

|

|

CONSOLIDATED BALANCE SHEETS

|

|

(unaudited)

|

|

(in thousands)

|

| |

|

|

|

|

|

|

| |

|

June 30,

|

|

|

December 31,

|

|

| |

|

2015

|

|

|

2014

|

|

|

ASSETS

|

|

|

|

|

|

|

|

Current assets:

|

|

|

|

|

|

|

|

Cash and cash equivalents

|

|

$

|

6,839

|

|

|

$

|

10,935

|

|

|

Accounts receivable, net

|

|

|

96,734

|

|

|

|

113,928

|

|

|

Prepaid expenses

|

|

|

3,519

|

|

|

|

2,476

|

|

|

Other current assets

|

|

|

7,028

|

|

|

|

4,679

|

|

|

Total current assets

|

|

|

114,120

|

|

|

|

132,018

|

|

|

Property and equipment, net

|

|

|

8,619

|

|

|

|

7,966

|

|

|

Goodwill

|

|

|

255,189

|

|

|

|

236,130

|

|

|

Intangible assets, net

|

|

|

51,968

|

|

|

|

46,105

|

|

|

Other non-current assets

|

|

|

4,017

|

|

|

|

3,823

|

|

|

Total assets

|

|

$

|

433,913

|

|

|

$

|

426,042

|

|

| |

|

|

|

|

|

|

|

|

|

LIABILITIES AND STOCKHOLDERS' EQUITY

|

|

|

|

|

|

|

|

|

|

Current liabilities:

|

|

|

|

|

|

|

|

|

|

Accounts payable

|

|

$

|

11,160

|

|

|

$

|

22,035

|

|

|

Other current liabilities

|

|

|

26,851

|

|

|

|

33,028

|

|

|

Total current liabilities

|

|

|

38,011

|

|

|

|

55,063

|

|

|

Long-term debt

|

|

|

60,000

|

|

|

|

54,000

|

|

|

Other non-current liabilities

|

|

|

10,419

|

|

|

|

12,251

|

|

|

Total liabilities

|

|

|

108,430

|

|

|

|

121,314

|

|

| |

|

|

|

|

|

|

|

|

|

Stockholders' equity:

|

|

|

|

|

|

|

|

|

|

Common stock

|

|

|

44

|

|

|

|

43

|

|

|

Additional paid-in capital

|

|

|

353,759

|

|

|

|

334,645

|

|

|

Accumulated other comprehensive loss

|

|

|

(803

|

)

|

|

|

(651

|

)

|

|

Treasury stock

|

|

|

(101,624

|

)

|

|

|

(95,353

|

)

|

|

Retained earnings

|

|

|

74,107

|

|

|

|

66,044

|

|

|

Total stockholders' equity

|

|

|

325,483

|

|

|

|

304,728

|

|

|

Total liabilities and stockholders' equity

|

|

$

|

433,913

|

|

|

$

|

426,042

|

|

About Non-GAAP Financial Information

This news release includes non-GAAP financial measures. For a description of these non-GAAP financial measures, including the reasons management uses each measure, and reconciliations of these non-GAAP financial measures to the most directly comparable financial measures prepared in accordance with Generally Accepted Accounting Principles ("GAAP"), please see the section entitled "About Non-GAAP Financial Measures" and the accompanying tables entitled "Reconciliation of GAAP to Non-GAAP Measures."

About Non-GAAP Financial Measures

Perficient provides non-GAAP financial measures for EBITDAS (earnings before interest, income taxes, depreciation, amortization, and stock compensation), adjusted net income, and adjusted earnings per share data as supplemental information regarding Perficient's business performance. Perficient believes that these non-GAAP financial measures are useful to investors because they provide investors with a better understanding of Perficient's past financial performance and future results. Perficient's management uses these non-GAAP financial measures when it internally evaluates the performance of Perficient's business and makes operating decisions, including internal operating budgeting, performance measurement, and the calculation of bonuses and discretionary compensation. Management excludes stock-based compensation related to employee stock options and restricted stock awards, the amortization of intangible assets, acquisition costs, adjustments to the fair value of contingent consideration, and income tax effects of the foregoing, when making operational decisions.

Perficient believes that providing the non-GAAP financial measures to its investors is useful because it allows investors to evaluate Perficient's performance using the same methodology and information used by Perficient's management. Specifically, adjusted net income is used by management primarily to review business performance and determine performance-based incentive compensation for executives and other employees. Management uses EBITDAS to measure operating profitability, evaluate trends, and make strategic business decisions.

Non-GAAP financial measures are subject to inherent limitations because they do not include all of the expenses included under GAAP and because they involve the exercise of discretionary judgment as to which charges are excluded from the non-GAAP financial measure. However, Perficient's management compensates for these limitations by providing the relevant disclosure of the items excluded in the calculation of EBITDAS, adjusted net income, and adjusted earnings per share. In addition, some items that are excluded from adjusted net income and adjusted earnings per share can have a material impact on cash. Management compensates for these limitations by evaluating the non-GAAP measure together with the most directly comparable GAAP measure. Perficient has historically provided non-GAAP financial measures to the investment community as a supplement to its GAAP results to enable investors to evaluate Perficient's business performance in the way that management does. Perficient's definition may be different from similar non-GAAP financial measures used by other companies and/or analysts.

The non-GAAP adjustments, and the basis for excluding them, are outlined below:

Amortization of Intangible Assets

Perficient has incurred expense on amortization of intangible assets primarily related to various acquisitions. Management excludes these items for the purposes of calculating EBITDAS, adjusted net income, and adjusted earnings per share. Perficient believes that eliminating this expense from its non-GAAP financial measures is useful to investors because the amortization of intangible assets can be inconsistent in amount and frequency, and is significantly impacted by the timing and magnitude of Perficient's acquisition transactions, which also vary substantially in frequency from period to period.

Acquisition Costs

Perficient incurs transaction costs related to acquisitions which are expensed in its GAAP financial statements. Management excludes these items for the purposes of calculating EBITDAS, adjusted net income, and adjusted earnings per share. Perficient believes that excluding these expenses from its non-GAAP financial measures is useful to investors because these are expenses associated with each transaction, and are inconsistent in amount and frequency causing comparison of current and historical financial results to be difficult.

Adjustments to Fair Value of Contingent Consideration

Perficient is required to remeasure its contingent consideration liability related to acquisitions each reporting period until the contingency is settled. Any changes in fair value are recognized in earnings. Management excludes these items for the purposes of calculating adjusted net income and adjusted earnings per share. Perficient believes that excluding these adjustments from its non-GAAP financial measures is useful to investors because they are related to acquisitions, and are inconsistent in amount and frequency from period to period.

Stock-Based Compensation

Perficient incurs stock-based compensation expense under Financial Accounting Standards Board Accounting Standards Codification Topic 718, Compensation – Stock Compensation. Perficient excludes this item for the purposes of calculating EBITDAS, adjusted net income, and adjusted earnings per share because it is a non-cash expense, which Perficient believes is not reflective of its business performance. The nature of stock-based compensation expense also makes it very difficult to estimate prospectively, since the expense will vary with changes in the stock price and market conditions at the time of new grants, varying valuation methodologies, subjective assumptions, and different award types, making the comparison of current results with forward looking guidance potentially difficult for investors to interpret. The tax effects of stock-based compensation expense may also vary significantly from period to period, without any change in underlying operational performance, thereby obscuring the underlying profitability of operations relative to prior periods. Perficient believes that non-GAAP measures of profitability, which exclude stock-based compensation are widely used by analysts and investors.

|

PERFICIENT, INC.

|

|

RECONCILIATION OF GAAP TO NON-GAAP MEASURES

|

|

(unaudited)

|

|

(in thousands, except per share data)

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended June 30,

|

|

|

Six Months Ended June 30,

|

|

| |

|

2015

|

|

|

2014

|

|

|

2015

|

|

|

2014

|

|

|

GAAP Net Income

|

|

$

|

3,997

|

|

|

$

|

6,387

|

|

|

$

|

8,063

|

|

|

$

|

9,433

|

|

|

Additions:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Provision for income taxes

|

|

|

938

|

|

|

|

4,653

|

|

|

|

3,089

|

|

|

|

6,881

|

|

|

Amortization

|

|

|

3,411

|

|

|

|

3,730

|

|

|

|

7,212

|

|

|

|

6,466

|

|

|

Acquisition costs

|

|

|

21

|

|

|

|

1,076

|

|

|

|

21

|

|

|

|

2,569

|

|

|

Adjustment to fair value of contingent consideration

|

|

|

89

|

|

|

|

(1,677

|

)

|

|

|

174

|

|

|

|

(1,463

|

)

|

|

Stock compensation

|

|

|

3,347

|

|

|

|

3,420

|

|

|

|

6,854

|

|

|

|

6,615

|

|

|

Adjusted Net Income Before Tax

|

|

|

11,803

|

|

|

|

17,589

|

|

|

|

25,413

|

|

|

|

30,501

|

|

|

Adjusted income tax (1)

|

|

|

3,423

|

|

|

|

6,782

|

|

|

|

8,234

|

|

|

|

11,651

|

|

|

Adjusted Net Income

|

|

$

|

8,380

|

|

|

$

|

10,807

|

|

|

$

|

17,179

|

|

|

$

|

18,850

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

GAAP Earnings Per Share (diluted)

|

|

$

|

0.12

|

|

|

$

|

0.19

|

|

|

$

|

0.24

|

|

|

$

|

0.29

|

|

|

Adjusted Earnings Per Share (diluted)

|

|

$

|

0.25

|

|

|

$

|

0.33

|

|

|

$

|

0.50

|

|

|

$

|

0.57

|

|

|

Shares used in computing GAAP and Adjusted Earnings Per Share (diluted)

|

|

|

34,138

|

|

|

|

33,271

|

|

|

|

34,151

|

|

|

|

32,949

|

|

|

(1) The estimated adjusted effective tax rate of 29.0% and 38.5% for the three months ended June 30, 2015 and 2014, respectively, and 32.4% and 38.2% for the six months ended June 30, 2015 and 2014, respectively, has been used to calculate the provision for income taxes for non-GAAP purposes.

|

|

PERFICIENT, INC.

|

|

RECONCILIATION OF GAAP TO NON-GAAP MEASURES

|

|

(unaudited)

|

|

(in thousands)

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended June 30,

|

|

|

Six Months Ended June 30,

|

|

| |

|

2015

|

|

|

2014

|

|

|

2015

|

|

|

2014

|

|

|

GAAP Net Income

|

|

$

|

3,997

|

|

|

$

|

6,387

|

|

|

$

|

8,063

|

|

|

$

|

9,433

|

|

|

Additions:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Provision for income taxes

|

|

|

938

|

|

|

|

4,653

|

|

|

|

3,089

|

|

|

|

6,881

|

|

|

Net interest expense

|

|

|

548

|

|

|

|

425

|

|

|

|

1,101

|

|

|

|

593

|

|

|

Net other (income) expense

|

|

|

(9

|

)

|

|

|

(49

|

)

|

|

|

271

|

|

|

|

(69

|

)

|

|

Depreciation

|

|

|

1,093

|

|

|

|

870

|

|

|

|

2,174

|

|

|

|

1,781

|

|

|

Amortization

|

|

|

3,411

|

|

|

|

3,730

|

|

|

|

7,212

|

|

|

|

6,466

|

|

|

Acquisition costs

|

|

|

21

|

|

|

|

1,076

|

|

|

|

21

|

|

|

|

2,569

|

|

|

Adjustment to fair value of contingent consideration

|

|

|

89

|

|

|

|

(1,677

|

)

|

|

|

174

|

|

|

|

(1,463

|

)

|

|

Stock compensation

|

|

|

3,347

|

|

|

|

3,420

|

|

|

|

6,854

|

|

|

|

6,615

|

|

|

EBITDAS (1)

|

|

$

|

13,435

|

|

|

$

|

18,835

|

|

|

$

|

28,959

|

|

|

$

|

32,806

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1) EBITDAS is a non-GAAP performance measure and is not intended to be a performance measure that should be regarded as an alternative to or more meaningful than either GAAP operating income or GAAP net income. EBITDAS measures presented may not be comparable to similarly titled measures presented by other companies.

|

EXHIBIT 99.2

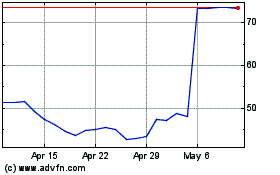

Perficient (NASDAQ:PRFT)

Historical Stock Chart

From Mar 2024 to Apr 2024

Perficient (NASDAQ:PRFT)

Historical Stock Chart

From Apr 2023 to Apr 2024