UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): July 30, 2015

BORGWARNER INC.

________________________________________________

(Exact name of registrant as specified in its charter)

|

| | | | |

Delaware | | 1-12162 | | 13-3404508 |

State or other jurisdiction of | | Commission File No. | | (I.R.S. Employer |

Incorporation or organization | | | | Identification No.) |

|

| | |

3850 Hamlin Road, Auburn Hills, Michigan | | 48326 |

(Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code: (248) 754-9200

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

| |

o | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

o | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

o | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

o | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Item 2.02. Results of Operations and Financial Condition

On July 30, 2015, BorgWarner Inc. issued a press release announcing its financial results for the three and six months ended June 30, 2015. A copy of the press release is attached hereto as Exhibit 99.1 and is incorporated herein by reference.

The information contained in this Item 2.02 of this Current Report on Form 8-K, including Exhibit 99.1, is being furnished and shall not be deemed to be “filed” for the purpose of the Securities Exchange Act of 1934, as amended, nor shall it be deemed incorporated by reference in any filing under the Exchange Act or the Securities Act of 1933, as amended, regardless of any general incorporation language in any such filings.

Item 9.01. Financial Statements and Exhibits

(d) Exhibits. The following exhibits are being furnished as part of this Report.

|

| |

Exhibit Number | Description |

| |

99.1 | Press release regarding earnings issued by BorgWarner Inc. dated July 30, 2015 |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

| | |

| BorgWarner Inc. |

| | |

Date: July 30, 2015 | By: | /s/ John J. Gasparovic |

| | Name: John J. Gasparovic |

| | Title: Secretary |

|

| |

EXHIBIT INDEX |

| |

Exhibit Number | Description |

| |

99.1 | Press release regarding earnings issued by BorgWarner Inc. dated July 30, 2015 |

|

|

Immediate Release |

Contact: Ken Lamb |

248.754.0884 |

BORGWARNER REPORTS SECOND QUARTER 2015 U.S. GAAP NET EARNINGS OF $0.65 PER DILUTED SHARE, OR $0.75 PER DILUTED SHARE EXCLUDING NON-COMPARABLE ITEMS

UPDATES FULL YEAR NET SALES AND NET EARNINGS GUIDANCE FOR WEAKER THAN EXPECTED MARKET CONDITIONS

Auburn Hills, Michigan, July 30, 2015 – BorgWarner Inc. (NYSE: BWA) today reported second quarter 2015 U.S. GAAP net earnings of $0.65 per diluted share. Excluding non-comparable items, net earnings were $0.75 per diluted share. Net sales were $2,032 million in the quarter.

Second Quarter Highlights:

| |

• | U.S. GAAP net sales of $2,032 million, down 7% compared with second quarter 2014. |

| |

◦ | The impact of foreign currencies decreased second quarter 2015 net sales growth by approximately 11% compared with second quarter 2014. |

| |

◦ | Excluding the impact of foreign currencies, net sales were up 4% compared with second quarter 2014. |

| |

• | U.S. GAAP net earnings of $0.65 per diluted share. |

| |

◦ | Excluding the $(0.08) per diluted share impact of restructuring and the $(0.02) per diluted share impact of tax adjustments, net earnings were $0.75 per diluted share. |

| |

◦ | The impact of foreign currencies decreased net earnings by approximately $0.09 per diluted share in second quarter 2015 compared with second quarter 2014. |

| |

• | U.S. GAAP operating income of $243 million. |

| |

◦ | Excluding the $20 million pretax impact of restructuring expense, operating income was $262 million, or 12.9% of net sales, down from 13.5% in second quarter 2014. |

Second Quarter Results: “Our operations performed well in the second quarter despite a challenging environment for growth,” said James R. Verrier, President and Chief Executive Officer, BorgWarner. "The demand for our advanced powertrain technology, designed to improve fuel economy, emissions and vehicle performance, remained strong around the globe, but our growth was impacted by an unfavorable mix of light vehicle production in North America, slower light vehicle production growth in China and weak commercial vehicle markets around the world. Despite this, our operating income margin was an impressive 12.9% in the quarter, excluding non-comparable items."

2015 Guidance: Demand for the company's advanced powertrain technology remains strong around the globe. However, due to the impact of weaker than expected market conditions on its business, particularly slower light vehicle production growth in China, unfavorable mix of light vehicle production in North America and weak commercial vehicle markets around the world, the company has updated its 2015 full year guidance:

| |

• | Net sales growth is now expected to be within a range of -5.5% to -2.5% compared with 2014, down from -4% to 0% previously. |

| |

• | Net earnings per share, excluding non-comparable items, is now expected to be within a range of $2.95 to $3.10 per diluted share compared with a previous range of $3.10 to $3.30 per diluted share. |

| |

• | Operating income, as a percentage of net sales, excluding non-comparable items, is now expected to be "approximately 13%" compared with "above 13%", previously. |

Financial Results: Net sales were $2,032 million in second quarter 2015, down 7% from $2,197 million in second quarter 2014. Net earnings in the quarter were $148 million, or $0.65 per diluted share, compared with $190 million, or $0.83 per diluted share, in second quarter 2014. Second quarter 2015 net earnings included non-comparable items of $(0.10) per diluted share. Second quarter 2014 net earnings included a non-comparable item of $(0.06) per diluted share. These items are listed in a table below as reconciliations of non-U.S. GAAP measures, which are provided by the company for comparison with other results, and the most directly comparable U.S. GAAP measures. The impact of foreign currencies decreased net sales by approximately $248 million and decreased net earnings by approximately $0.09 per diluted share in second quarter 2015 compared with second quarter 2014.

For the first six months of 2015, net sales were $4,016 million, down 6% from $4,281 million in the first six months of 2014. Net earnings in the first six months of 2015 were $327 million, or $1.44 per diluted share, compared with $349 million, or $1.52 per diluted share, in the first six months of 2014. Net earnings in the first six months of 2015 included net non-comparable items of $(0.09) per diluted share. Net earnings in the first six months of 2014 included a non-comparable item of $(0.19) per diluted share. These items are listed in a table below as reconciliations of non-U.S. GAAP measures, which are provided by the company for comparison with other results, and the most directly comparable U.S. GAAP measures. The impact of foreign currencies decreased net sales by approximately $470 million and decreased net earnings by approximately $0.18 per diluted share in the first six months of 2015 compared with the first six months of 2014.

The following table reconciles the company's non-U.S. GAAP measures included in the press release, which are provided for comparison with other results, and the most directly comparable U.S. GAAP measures:

|

| | | | | | | | | | | | | | | | |

Net earnings per diluted share | Second Quarter | | First Six Months | |

| 2015 | | 2014 | | 2015 | | 2014 | |

| | | | | | | | |

Non – U.S. GAAP | $ | 0.75 |

| | $ | 0.89 |

| | $ | 1.53 |

| | $ | 1.71 |

| |

| | | | | | | | |

Reconciliations: | | | | | | | | |

Restructuring expense | (0.08 | ) | | (0.06 | ) | | (0.13 | ) | | (0.19 | ) | |

Gain on previously held equity interest | | | | | 0.05 |

| | | |

Tax adjustments | (0.02 | ) | | | | (0.01 | ) | | | |

| | | | | | |

|

| |

U.S. GAAP | $ | 0.65 |

| | $ | 0.83 |

| | $ | 1.44 |

| | $ | 1.52 |

| |

Net cash provided by operating activities was $319 million in the first six months of 2015 compared with $326 million in first six months of 2014. Investments in capital expenditures, including tooling outlays, totaled $285 million in the first six months of 2015, compared with $257 million in the first six months of 2014. Balance sheet debt increased by $464 million and cash increased by $310 million at the end of second quarter 2015 compared with the end of 2014. The $154 million increase in net debt was primarily due to capital expenditures, dividend payments to shareholders and share repurchases. The company's net debt to net capital ratio was 15.6% at the end of second quarter 2015 compared with 12.8% at the end of 2014.

Engine Segment Results: Engine segment net sales were $1,413 million in second quarter 2015 compared with $1,498 million in second quarter 2014. Excluding the impact of foreign currencies, primarily the Euro, net sales were up 7% from the prior year's quarter, primarily due to higher sales of turbochargers. Adjusted earnings before interest, income taxes and non-controlling interest ("Adjusted EBIT") were $228 million in second quarter 2015, down 6% from $242 million in second quarter 2014. Excluding the impact of foreign currencies, Adjusted EBIT was $252 million, up 4% from second quarter 2014.

Drivetrain Segment Results: Drivetrain segment net sales were $627 million in second quarter 2015 compared with $709 million in second quarter 2014. Excluding the impact of foreign currencies, primarily the Euro, net sales were down 3% from the prior year’s quarter, primarily due to lower sales of all-wheel drive systems. Adjusted EBIT was $72 million in second quarter 2015, down 19% from $89 million in second quarter 2014. Excluding the impact of foreign currencies, Adjusted EBIT was $76 million, down 14% from second quarter 2014.

Recent Highlights:

| |

• | BorgWarner has entered into a definitive agreement to acquire Remy International, Inc. (Remy), a global market leading producer of rotating electrical components. Under the terms of the agreement, BorgWarner will acquire each of the outstanding shares of Remy for $29.50 in cash, which implies an enterprise value of Remy of approximately $1.2 billion.The transaction is expected to close in the fourth quarter of 2015. |

| |

• | BorgWarner supplies its latest wet friction technology for ZF’s new 8- and 9-speed automatic transmissions. The 8-speed transmission features BorgWarner’s multi-segment friction plates with intricate groove designs, and the torque converter for the 9-speed transmission utilizes a piston plate with BorgWarner proprietary friction material. |

| |

• | BorgWarner produces a number of its advanced engine and drivetrain technologies for the new Great Wall Haval H9. The domestically produced sport utility vehicle is powered by a turbocharged 2.0-liter gasoline engine and features a BorgWarner engine timing system, turbocharger and 2-speed Torque-On-Demand® (TOD) transfer case. |

| |

• | The first dual-clutch transmission (DCT) for class 6 and 7 medium-duty trucks in North America is powered by BorgWarner’s DualTronic™ clutch module. BorgWarner’s fuel-efficient technology helps Eaton’s new Procision™ 7-speed DCT improve fuel economy 8 to 10 percent compared with similarly equipped vehicles with torque converter automatic transmissions. |

| |

• | BorgWarner’s facilities in Bellwood and Frankfort, Illinois, received 2014 Certificates of Achievement from Toyota Motor Engineering & Manufacturing North America, Inc. for Quality Performance. This Achievement Award recognizes suppliers that maintain less than 15 defects per million parts (PPMs). Both facilities achieved 100% quality ratings and 0 PPMs in 2014. |

| |

• | BorgWarner’s regulated two-stage (R2S®) turbocharging technology improves the performance and fuel economy of Ford’s new powerful 2.0-liter diesel engine, the first Ford engine for passenger cars equipped with a two-stage turbocharging system. The fuel-efficient diesel engine will debut in the Ford Mondeo, S-Max and Galaxy in mid-2015 and will replace the 2.2-liter TDCi diesel engine. |

| |

• | BorgWarner’s manufacturing plant in Seneca, South Carolina, was presented with an Excellence in Quality Award from Honda North America. The award recognized outstanding product quality in 2014. Since 2002, BorgWarner’s facility in Seneca has earned 12 supplier awards from Honda, including seven awards for quality, four for delivery and one for engineering innovation. |

At 9:30 a.m. ET today, a brief conference call concerning 2015 second quarter results will be webcast at: http://www.borgwarner.com/en/Investors/default.aspx.

BorgWarner Inc. (NYSE: BWA) is a product leader in highly engineered components and systems for powertrains around the world. Operating manufacturing and technical facilities in 57 locations in 18 countries, the company delivers innovative powertrain solutions to improve fuel economy, reduce emissions and enhance performance. For more information, please visit borgwarner.com.

# # #

Statements contained in this news release may contain forward-looking statements as contemplated by the 1995 Private Securities Litigation Reform Act that are based on management’s current outlook, expectations, estimates and projections. Words such as “anticipates,” “believes,” “continues,” “could,” “designed,” “effect,” “estimates,” “evaluates,” “expects,” “forecasts,” “goal,” “initiative,” “intends,” “outlook,” “plans,” “potential,” “project,” “pursue,” “seek,” “should,” “target,” “when,” “would,” and variations of such words and similar expressions are intended to identify such forward-looking statements. Forward-looking statements are subject to risks and uncertainties, many of which are difficult to predict and generally beyond our control, that could cause actual results to differ materially from those expressed, projected or implied in or by the forward-looking statements. Such risks and uncertainties include: the failure to complete or receive the anticipated benefits from BorgWarner’s acquisition of Remy International Inc. ("Remy"), the possibility that the parties may be unable to successfully integrate Remy’s operations with those of BorgWarner, that such integration may be more difficult, time-consuming or costly than expected, revenues following the transaction may be lower than expected, customer loss and business disruption (including, without limitation, difficulties in maintaining relationships with employees, customers, or suppliers) may be greater than expected following the transaction; the retention of key employees at Remy may not be achieved, the conditions to the completion of the transaction may not be satisfied, or the regulatory approvals required for the transaction may not be obtained on the terms expected or on the anticipated schedule, the failure to obtain Remy stockholder approval in a timely manner or otherwise, fluctuations in domestic or foreign vehicle production, the continued use by original equipment manufacturers of outside suppliers, fluctuations in demand for vehicles containing our products, changes in general economic conditions, as well as other risks noted in reports that we file with the Securities and Exchange Commission, including the Risk Factors identified in our most recently filed Annual Report on Form 10-K. We do not undertake any obligation to update or announce publicly any updates to or revision to any of the forward-looking statements.

|

| | | | | | | | | | | | | | | |

BorgWarner Inc. | | | | | | | |

Condensed Consolidated Statements of Operations (Unaudited) | | | | |

(millions, except per share amounts) | | | | | | |

| Three Months Ended

June 30, | | Six Months Ended

June 30, |

| 2015 | | 2014 | | 2015 | | 2014 |

Net sales | $ | 2,031.9 |

| | $ | 2,197.0 |

| | $ | 4,016.1 |

| | $ | 4,281.1 |

|

Cost of sales | 1,602.9 |

| | 1,724.2 |

| | 3,158.1 |

| | 3,362.5 |

|

Gross profit | 429.0 |

| | 472.8 |

| | 858.0 |

| | 918.6 |

|

| | | | | | | |

Selling, general and administrative expenses | 167.4 |

| | 181.2 |

| | 335.6 |

| | 355.0 |

|

Other expense, net | 19.1 |

| | 11.0 |

| | 20.3 |

| | 49.8 |

|

Operating income | 242.5 |

| | 280.6 |

| | 502.1 |

| | 513.8 |

|

| | | | | | | |

Equity in affiliates’ earnings, net of tax | (11.1 | ) | | (12.2 | ) | | (19.6 | ) | | (21.0 | ) |

Interest income | (1.6 | ) | | (1.4 | ) | | (3.3 | ) | | (2.9 | ) |

Interest expense and finance charges | 17.6 |

| | 9.0 |

| | 27.6 |

| | 17.2 |

|

Earnings before income taxes and noncontrolling interest | 237.6 |

| | 285.2 |

| | 497.4 |

| | 520.5 |

|

| | | | | | | |

Provision for income taxes | 80.2 |

| | 85.3 |

| | 152.3 |

| | 153.4 |

|

Net earnings | 157.4 |

| | 199.9 |

| | 345.1 |

| | 367.1 |

|

| | | | | | | |

Net earnings attributable to the noncontrolling interest, net of tax | 9.3 |

| | 9.7 |

| | 18.1 |

| | 17.8 |

|

Net earnings attributable to BorgWarner Inc. | $ | 148.1 |

| | $ | 190.2 |

| | $ | 327.0 |

| | $ | 349.3 |

|

| | | | | | | |

| | | | | | | |

Earnings per share — diluted | $ | 0.65 |

| | $ | 0.83 |

| | $ | 1.44 |

| | $ | 1.52 |

|

| | | | | | | |

Weighted average shares outstanding — diluted | 226.615 |

| | 229.670 |

| | 226.852 |

| | 229.499 |

|

| | | | | | | |

Supplemental Information (Unaudited) | | | | | | | |

(millions of dollars) | | | | | | | |

| Three Months Ended

June 30, | | Six Months Ended

June 30, |

| 2015 | | 2014 | | 2015 | | 2014 |

Capital expenditures, including tooling outlays | $ | 145.0 |

| | $ | 131.1 |

| | $ | 285.0 |

| | $ | 257.3 |

|

| | | | | | | |

Depreciation and amortization: | | | | | | | |

Fixed assets and tooling | $ | 76.6 |

| | $ | 77.3 |

| | $ | 149.3 |

| | $ | 151.4 |

|

Intangible assets and other | 4.3 |

| | 7.8 |

| | 8.7 |

| | 13.8 |

|

| $ | 80.9 |

| | $ | 85.1 |

| | $ | 158.0 |

| | $ | 165.2 |

|

|

| | | | | | | | | | | | | | | |

BorgWarner Inc. | | | | | | | |

Net Sales by Reporting Segment (Unaudited) | | | | | | |

(millions of dollars) | | | | | | | |

| | | | | | | |

| Three Months Ended

June 30, | | Six Months Ended

June 30, |

| 2015 | | 2014 | | 2015 | | 2014 |

Engine | $ | 1,413.0 |

| | $ | 1,497.5 |

| | $ | 2,793.9 |

| | $ | 2,909.6 |

|

Drivetrain | 626.9 |

| | 708.7 |

| | 1,238.1 |

| | 1,389.4 |

|

Inter-segment eliminations | (8.0 | ) | | (9.2 | ) | | (15.9 | ) | | (17.9 | ) |

Net sales | $ | 2,031.9 |

| | $ | 2,197.0 |

| | $ | 4,016.1 |

| | $ | 4,281.1 |

|

| | | | | | | |

| | | | | | | |

Adjusted Earnings Before Interest, Income Taxes and Noncontrolling Interest ("Adjusted EBIT") (Unaudited) |

(millions of dollars) | | | | | | | |

| | | | | | | |

| Three Months Ended

June 30, | | Six Months Ended

June 30, |

| 2015 | | 2014 | | 2015 | | 2014 |

Engine | $ | 228.0 |

| | $ | 241.7 |

| | $ | 458.4 |

| | $ | 473.4 |

|

Drivetrain | 72.1 |

| | 89.1 |

| | 143.1 |

| | 169.6 |

|

Adjusted EBIT | 300.1 |

| | 330.8 |

| | 601.5 |

| | 643.0 |

|

Restructuring expense | 19.9 |

| | 15.0 |

| | 32.0 |

| | 54.5 |

|

Gain on previously held equity interest | — |

| | — |

| | (10.8 | ) | | — |

|

Corporate, including equity in affiliates' earnings and stock-based compensation | 26.6 |

| | 23.0 |

| | 58.6 |

| | 53.7 |

|

Interest income | (1.6 | ) | | (1.4 | ) | | (3.3 | ) | | (2.9 | ) |

Interest expense and finance charges | 17.6 |

| | 9.0 |

| | 27.6 |

| | 17.2 |

|

Earnings before income taxes and noncontrolling interest | 237.6 |

| | 285.2 |

| | 497.4 |

| | 520.5 |

|

Provision for income taxes | 80.2 |

| | 85.3 |

| | 152.3 |

| | 153.4 |

|

Net earnings | 157.4 |

| | 199.9 |

| | 345.1 |

| | 367.1 |

|

Net earnings attributable to the noncontrolling interest, net of tax | 9.3 |

| | 9.7 |

| | 18.1 |

| | 17.8 |

|

Net earnings attributable to BorgWarner Inc. | $ | 148.1 |

| | $ | 190.2 |

| | $ | 327.0 |

| | $ | 349.3 |

|

|

| | | | | | | |

BorgWarner Inc. | | | |

Condensed Consolidated Balance Sheets (Unaudited) |

(millions of dollars) | | | |

| | | |

| June 30,

2015 | | December 31,

2014 |

Assets | | | |

| | | |

Cash | $ | 1,107.9 |

| | $ | 797.8 |

|

Receivables, net | 1,573.0 |

| | 1,443.5 |

|

Inventories, net | 525.7 |

| | 505.7 |

|

Other current assets | 194.8 |

| | 223.8 |

|

Total current assets | 3,401.4 |

| | 2,970.8 |

|

| | | |

Property, plant and equipment, net | 2,160.5 |

| | 2,093.9 |

|

Other non-current assets | 2,204.4 |

| | 2,163.3 |

|

Total assets | $ | 7,766.3 |

| | $ | 7,228.0 |

|

| | | |

Liabilities and Equity | | | |

| | | |

Notes payable and other short-term debt | $ | 72.1 |

| | $ | 623.7 |

|

Accounts payable and accrued expenses | 1,528.2 |

| | 1,530.3 |

|

Income taxes payable | 35.3 |

| | 14.2 |

|

Total current liabilities | 1,635.6 |

| | 2,168.2 |

|

| | | |

Long-term debt | 1,731.7 |

| | 716.3 |

|

Other non-current liabilities | 647.5 |

| | 652.6 |

|

| | | |

Total BorgWarner Inc. stockholders’ equity | 3,686.7 |

| | 3,616.2 |

|

Noncontrolling interest | 64.8 |

| | 74.7 |

|

Total equity | 3,751.5 |

| | 3,690.9 |

|

Total liabilities and equity | $ | 7,766.3 |

| | $ | 7,228.0 |

|

|

| | | | | | | |

BorgWarner Inc. | | | |

Condensed Consolidated Statements of Cash Flows (Unaudited) |

(millions of dollars) | | | |

| | | |

| Six Months Ended

June 30, |

| 2015 | | 2014 |

Operating | | | |

Net earnings | $ | 345.1 |

| | $ | 367.1 |

|

Non-cash charges (credits) to operations: | | | |

Depreciation and amortization | 158.0 |

| | 165.2 |

|

Restructuring expense, net of cash paid | 19.1 |

| | 38.9 |

|

Gain on previously held equity interest | (10.8 | ) | | — |

|

Deferred income tax provision | 22.3 |

| | 37.6 |

|

Other non-cash items | 1.9 |

| | (5.0 | ) |

Net earnings adjusted for non-cash charges to operations | 535.6 |

| | 603.8 |

|

Changes in assets and liabilities | (216.3 | ) | | (277.6 | ) |

Net cash provided by operating activities | 319.3 |

| | 326.2 |

|

| | | |

Investing | | | |

Capital expenditures, including tooling outlays | (285.0 | ) | | (257.3 | ) |

Payments for businesses acquired, net of cash acquired | (12.6 | ) | | (106.4 | ) |

Proceeds from asset disposals and other | 2.5 |

| | 2.0 |

|

Net cash used in investing activities | (295.1 | ) | | (361.7 | ) |

| | | |

Financing | | | |

Net (decrease) increase in notes payable | (539.0 | ) | | 304.5 |

|

Additions to long-term debt, net of debt issuance costs | 1,015.9 |

| | 97.8 |

|

Repayments of long-term debt, including current portion | (15.5 | ) | | (420.2 | ) |

Payments for purchase of treasury stock | (62.9 | ) | | (25.0 | ) |

Proceeds from stock options exercised, including the tax benefit | 13.6 |

| | 12.8 |

|

Taxes paid on employees' restricted stock award vestings | (13.2 | ) | | (23.4 | ) |

Dividends paid to BorgWarner stockholders | (58.7 | ) | | (56.8 | ) |

Dividends paid to noncontrolling stockholders | (18.1 | ) | | (18.8 | ) |

Net cash provided by (used in) financing activities | 322.1 |

| | (129.1 | ) |

| | | |

Effect of exchange rate changes on cash | (36.2 | ) | | (3.5 | ) |

| | | |

Net increase (decrease) in cash | 310.1 |

| | (168.1 | ) |

| | | |

Cash at beginning of year | 797.8 |

| | 939.5 |

|

Cash at end of period | $ | 1,107.9 |

| | $ | 771.4 |

|

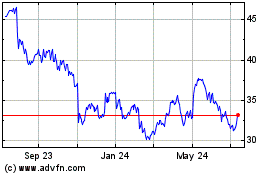

BorgWarner (NYSE:BWA)

Historical Stock Chart

From Mar 2024 to Apr 2024

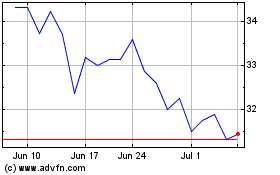

BorgWarner (NYSE:BWA)

Historical Stock Chart

From Apr 2023 to Apr 2024