UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event

reported): July 29, 2015

| AMREP CORPORATION |

| (Exact name of Registrant as specified in its charter) |

| Oklahoma |

1-4702 |

59-0936128 |

| (State or other jurisdiction of |

(Commission File |

(IRS Employer |

| incorporation) |

Number) |

Identification No.) |

| 300 Alexander Park, Suite 204, Princeton, New Jersey |

08540 |

| (Address of principal executive offices) |

(Zip Code) |

Registrant's telephone number, including

area code: (609) 716-8200

| Not Applicable |

| (Former name or former address, if changed since last report) |

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the Registrant under any of the following provisions (see General Instruction

A.2. below):

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Item 2.02 Results of Operations and Financial Condition

On July 29, 2015,

AMREP Corporation issued a press release that reported its results of operations for the year ended April 30, 2015. The

press release is being furnished with this Current Report on Form 8-K as Exhibit 99.1 and is incorporated herein by reference.

The information

in this Form 8-K and the exhibit attached hereto shall not be deemed “filed” for purposes of Section 18 of the Securities

Exchange Act of 1934, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, except as

shall be expressly set forth by specific reference in such filing.

Item 9.01 Financial

Statements and Exhibits.

(d) Exhibits.

| Exhibit Number |

Description |

| 99.1 |

Press Release, dated July 29, 2015, issued by AMREP Corporation. |

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

|

|

|

|

|

|

| |

|

|

|

AMREP Corporation |

| |

|

|

|

| Date: July 29, 2015 |

|

|

|

By: |

|

/s/ Peter M. Pizza |

| |

|

|

|

|

|

Peter M. Pizza |

| |

|

|

|

|

|

Vice President and Chief Financial Officer |

EXHIBIT INDEX

| Exhibit Number |

Description |

| 99.1 |

Press Release, dated July 29, 2015, issued by AMREP Corporation. |

Exhibit 99.1

| FOR: |

AMREP Corporation |

| |

300 Alexander Park, Suite 204 |

| |

Princeton, NJ 08540 |

| |

|

| CONTACT: |

Peter M. Pizza |

| |

Vice President and Chief Financial Officer |

| |

(609) 716-8210 |

AMREP REPORTS FISCAL 2015 RESULTS

Princeton, New Jersey, July 29, 2015 –

AMREP Corporation (the “Company”) (NYSE: AXR) today reported total net income of $11,320,000, or $1.43 per share, for

its 2015 fiscal year ended April 30, 2015 compared to a net loss of $2,939,000, or $0.42 per share, in 2014. Results consisted

of (i) a net loss from continuing operations of $3,584,000, or $0.45 per share, in 2015 compared to a net loss of $647,000, or

$0.09 per share, in 2014 and (ii) net income from discontinued operations of $14,904,000, or $1.88 per share, in 2015, compared

to a net loss of $2,292,000, or $0.33 per share, for 2014.

The net loss from continuing operations

for 2015 included pre-tax, non-cash impairment charges of $2,580,000 ($1,625,000 after tax, or $0.21 per share) while the results

from continuing operations for 2014 included pre-tax, non-cash impairment charges of $686,000 ($432,000 after tax, or $0.06 per

share), with the charges in both years primarily reflecting the write-down of certain real estate inventory and investment assets.

Excluding the impairment charges in both years, results of continuing operations for 2015 were a net loss of $1,959,000, or $0.25

per share, compared to a net loss of $215,000, or $0.03 per share, for 2014. Revenues for 2015 were $49,790,000 compared to $62,197,000

in 2014.

The net income from discontinued operations

for 2015 included a pre-tax gain of $10,729,000 ($7,608,000 after tax, or $0.96 per share) from the gain on the sales of the Newsstand

Distribution Services business, the Product Packaging and Fulfillment Services business and the Staffing Services business and

a pre-tax gain of $11,155,000 ($7,028,000 after tax, or $0.89 per share) from a previously disclosed settlement agreement in the

Newsstand Distribution business with a major customer in the first quarter of the year. The results from discontinued operations

for 2015 were also favorably impacted by the reversal of a previously recorded bad debt reserve of $1,500,000 ($945,000 after tax,

or $0.12 per share) in the Newsstand Distribution Services business as a result of revised estimates of magazine returns and other

customer statement credits. Excluding the gains from the sales of the businesses, the settlement agreement and the reversal of

the bad debt reserve, the pre-tax loss from discontinued operations for 2015 was $1,247,000 ($677,000 after tax, or $0.09 per share).

For additional information regarding the

Company’s financial results, please refer to the Company’s Annual Report on Form 10-K filed today with the Securities

and Exchange Commission.

AMREP Corporation, through its subsidiaries,

is primarily engaged in two business segments: the Fulfillment Services business operated by Palm Coast Data LLC and its subsidiary,

FulCircle Media, LLC, provides subscription fulfillment and related services to publishers and others, and its AMREP Southwest

Inc. subsidiary is a major holder of real estate in New Mexico.

****

AMREP CORPORATION AND SUBSIDIARIES

FINANCIAL HIGHLIGHTS

| | |

Twelve Months Ended April 30, | |

| | |

2015 | | |

2014 | |

| | |

| | |

| |

| Revenues | |

$ | 49,790,000 | | |

$ | 62,197,000 | |

| | |

| | | |

| | |

| Net income (loss): | |

| | | |

| | |

| Continuing Operations | |

$ | (3,584,000 | ) | |

$ | (647,000 | ) |

| Discontinued Operations | |

$ | 14,904,000 | | |

$ | (2,292,000 | ) |

| | |

$ | 11,320,000 | | |

$ | (2,939,000 | ) |

| | |

| | | |

| | |

| Earnings (loss) per share – Basic and Diluted: | |

| | | |

| | |

| Continuing Operations | |

$ | (0.45 | ) | |

$ | (0.09 | ) |

| Discontinued Operations | |

$ | 1.88 | | |

$ | (0.33 | ) |

| | |

$ | 1.43 | | |

$ | (0.42 | ) |

| | |

| | | |

| | |

| Weighted average number of common shares outstanding | |

| 7,919,000 | | |

| 6,988,000 | |

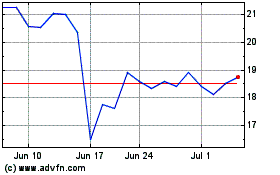

AMREP (NYSE:AXR)

Historical Stock Chart

From Mar 2024 to Apr 2024

AMREP (NYSE:AXR)

Historical Stock Chart

From Apr 2023 to Apr 2024