UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported): July 29, 2015

MOELIS & COMPANY

(Exact name of registrant as specified in its charter)

|

Delaware |

|

001-36418 |

|

46-4500216 |

|

(State or other jurisdiction of

incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

|

399 Park Avenue, 5th Floor |

|

|

|

New York, New York |

|

10022 |

|

(Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code (212) 883-3800

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 2.02 Results of Operations and Financial Condition

On July 29, 2015, Moelis & Company issued a press release announcing financial results for its second quarter ended June 30, 2015.

A copy of the press release is attached hereto as Exhibit 99.1. All information in the press release is furnished but not filed.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits:

|

Exhibit

Number |

|

Description |

|

99.1 |

|

Press release of Moelis & Company dated July 29, 2015. |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

MOELIS & COMPANY |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

By: |

/s/ Joseph Simon |

|

|

|

|

Name: Joseph Simon |

|

|

|

Title: Chief Financial Officer |

|

|

|

|

|

Date: July 29, 2015 |

|

|

EXHIBIT INDEX

|

Exhibit

Number |

|

Description |

|

99.1 |

|

Press release of Moelis & Company dated July 29, 2015. |

Exhibit 99.1

Moelis & Company Reports Second Quarter 2015 Financial Results;

Increases Quarterly Dividend to $0.30 Per Share

· Second quarter revenues of $125.9 million as compared with $131.7 million for the second quarter of 2014

· Adjusted Pro Forma net income of $0.37 per share (diluted) for the second quarter of 2015 as compared with $0.42 per share (diluted) for the same period in 2014; GAAP net income of $0.34 per share (diluted) for the second quarter of 2015 as compared with a net loss of $1.25 per share (diluted) for the period from the IPO closing on April 22, 2014 through June 30, 2014

· Board of Directors approved 50% increase in quarterly dividend to $0.30 per share

· Continued to execute on growth strategy

— Recruited four Managing Directors since last quarter-end to enhance industry expertise in oil & gas and technology and to further build out EMEA footprint

— Expanded Private Funds Advisory business with additional Partner

NEW YORK, July 29, 2015 - Moelis & Company (“we” or the “Firm”) (NYSE: MC) today reported financial results for the second quarter ended June 30, 2015. The Firm’s total revenues for the second quarter were $125.9 million as compared with $131.7 million for the second quarter of 2014. Adjusted Pro Forma net income was $20.6 million or $0.37 per share (diluted) for the second quarter of 2015, as compared with $23.2 million or $0.42 per share (diluted) in the prior year period.

First half 2015 revenues were $225.3 million as compared with $246.2 million for the first half of 2014. First half 2015 Adjusted Pro Forma net income was $36.0 million or $0.65 per share (diluted). This compares with $42.8 million of Adjusted Pro Forma net income or $0.78 per share (diluted) in the first half of 2014.

On a GAAP basis, the Firm reported net income of $26.9 million, or $0.34 per share (diluted) for the second quarter and $46.8 million, or $0.59 per share (diluted) for the first half of 2015. This compares with a GAAP net loss of $60.6 million and $38.5 million for the second quarter and first half of 2014, respectively, or a net loss of $1.25 per share (diluted) for the period from the IPO closing on April 22, 2014 through June 30, 2014.

1

“We had a very active quarter as we continued to participate in the improving M&A market with healthy growth in our M&A related activity. We also continued to execute on our growth strategy with the hiring of senior talent in important sectors and regions and the development of a strong recruiting pipeline for next year,” said Ken Moelis, Chairman and Chief Executive Officer.

“As demonstrated by the 50% increase in our quarterly dividend, we remain confident that the strength of our franchise, capital light business model and focus on cost discipline will deliver consistent strong cash flow, which we are committed to returning to our shareholders.”

The Firm’s revenues and net income can fluctuate materially depending on the number, size and timing of completed transactions on which it advised as well as other factors. Accordingly, financial results in any particular quarter may not be representative of future results over a longer period of time.

Moelis & Company completed its IPO on April 22, 2014 and introduced a new corporate structure. Currently 37% of the operating partnership (Moelis & Company Group LP) is owned by the corporation (Moelis & Company) and is taxed as a corporation. The remaining 63% is owned by partners and is primarily subject to tax at the partner level (except for certain state and local and foreign income taxes). The Adjusted Pro Forma results included herein remove the impact of charges related to the Firm’s IPO and assume all outstanding Class A partnership units of Moelis & Company Group LP have been exchanged into Class A common stock of Moelis & Company. Accordingly, the Adjusted Pro Forma presentation reflects 100% of the Firm’s income being taxed as a corporation from January 1, 2014. We believe the Adjusted Pro Forma results, when presented together with comparable GAAP results, are useful to investors to compare our performance across periods and to better understand our operating results. A reconciliation of our GAAP results to our Adjusted Pro Forma results is presented in the Appendix to this press release.

2

GAAP and Adjusted Pro Forma Selected Financial Data (Unaudited)

|

|

|

U.S. GAAP |

|

Adjusted Pro Forma* |

|

|

|

Three Months Ended June 30, |

|

($ in thousands except per share data) |

|

2015 |

|

2014 |

|

2015 vs.

2014

Variance |

|

2015 |

|

2014 |

|

2015 vs.

2014

Variance |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenues |

|

$125,873 |

|

$131,687 |

|

-4% |

|

$125,873 |

|

$131,687 |

|

-4% |

|

Expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Compensation and benefits |

|

69,663 |

|

162,204 |

|

-57% |

|

68,276 |

|

69,258 |

|

-1% |

|

Non-compensation expenses |

|

23,438 |

|

26,790 |

|

-13% |

|

23,438 |

|

23,092 |

|

1% |

|

Total operating expenses |

|

93,101 |

|

188,994 |

|

-51% |

|

91,714 |

|

92,350 |

|

-1% |

|

Operating income (loss) |

|

32,772 |

|

(57,307) |

|

N/M |

|

34,159 |

|

39,337 |

|

-13% |

|

Other income and expenses |

|

(33) |

|

(14) |

|

136% |

|

(33) |

|

(14) |

|

136% |

|

Income (loss) from equity method investments |

|

195 |

|

(2,851) |

|

N/M |

|

195 |

|

(393) |

|

N/M |

|

Income (loss) before income taxes |

|

32,934 |

|

(60,172) |

|

N/M |

|

34,321 |

|

38,930 |

|

-12% |

|

Provision for income taxes |

|

6,079 |

|

438 |

|

N/M |

|

13,729 |

|

15,767 |

|

-13% |

|

Net income (loss) |

|

26,855 |

|

(60,610) |

|

N/M |

|

20,592 |

|

23,163 |

|

-11% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income (loss) attributable to noncontrolling interests |

|

19,724 |

|

(41,600) |

|

N/M |

|

- |

|

- |

|

N/M |

|

Net income (loss) attributable to Moelis & Company |

|

$7,131 |

|

$(19,010) |

|

N/M |

|

$20,592 |

|

$23,163 |

|

-11% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Diluted earnings per share |

|

$0.34 |

|

$(1.25) |

|

N/M |

|

$0.37 |

|

$0.42 |

|

-12% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

N/M = not meaningful |

|

|

|

|

|

|

|

|

|

|

|

|

|

* See Appendix for a reconciliation of GAAP to Adjusted Pro Forma |

|

|

|

|

|

|

|

|

|

|

|

|

|

U.S. GAAP |

|

Adjusted Pro Forma* |

|

|

|

Six Months Ended June 30, |

|

($ in thousands except per share data) |

|

2015 |

|

2014 |

|

2015 vs.

2014

Variance |

|

2015 |

|

2014 |

|

2015 vs.

2014

Variance |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenues |

|

$225,285 |

|

$246,204 |

|

-8% |

|

$225,285 |

|

$246,204 |

|

-8% |

|

Expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Compensation and benefits |

|

125,056 |

|

232,645 |

|

-46% |

|

122,209 |

|

129,350 |

|

-6% |

|

Non-compensation expenses |

|

46,076 |

|

46,931 |

|

-2% |

|

46,076 |

|

43,233 |

|

7% |

|

Total operating expenses |

|

171,132 |

|

279,576 |

|

-39% |

|

168,285 |

|

172,583 |

|

-2% |

|

Operating income (loss) |

|

54,153 |

|

(33,372) |

|

N/M |

|

57,000 |

|

73,621 |

|

-23% |

|

Other income and expenses |

|

(18) |

|

5 |

|

N/M |

|

(18) |

|

5 |

|

N/M |

|

Income (loss) from equity method investments |

|

3,060 |

|

(4,071) |

|

N/M |

|

3,060 |

|

(1,613) |

|

N/M |

|

Income (loss) before income taxes |

|

57,195 |

|

(37,438) |

|

N/M |

|

60,042 |

|

72,013 |

|

-17% |

|

Provision for income taxes |

|

10,379 |

|

1,080 |

|

N/M |

|

24,017 |

|

29,166 |

|

-18% |

|

Net income (loss) |

|

46,816 |

|

(38,518) |

|

N/M |

|

36,025 |

|

42,847 |

|

-16% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income (loss) attributable to noncontrolling interests |

|

34,349 |

|

(19,508) |

|

N/M |

|

- |

|

- |

|

N/M |

|

Net income (loss) attributable to Moelis & Company |

|

$12,467 |

|

$(19,010) |

|

N/M |

|

$36,025 |

|

$42,847 |

|

-16% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Diluted earnings per share |

|

$0.59 |

|

$(1.25) |

|

N/M |

|

$0.65 |

|

$0.78 |

|

-17% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

N/M = not meaningful |

|

|

|

|

|

|

|

|

|

|

|

|

|

* See Appendix for a reconciliation of GAAP to Adjusted Pro Forma |

|

|

|

|

|

|

|

|

|

|

3

Revenues

For the second quarter of 2015, revenues were $125.9 million as compared with $131.7 million in the second quarter of 2014, representing a decrease of 4%. This decrease was primarily driven by a continued soft restructuring market and fewer capital markets advisory completions.

For the first half of 2015, revenues were $225.3 million as compared with $246.2 million in the same period of 2014, representing a decrease of 8%. We advised 168 total clients in the first half of 2015 (63 of whom paid fees equal to or greater than $1 million) as compared with 163 clients (57 of whom paid fees equal to or greater than $1 million) during the same period in 2014.

We continued to execute on our strategy of profitable expansion. Since the first quarter, we have hired four Managing Directors who will strengthen our sector expertise in oil & gas, retail and technology. We also added to our Private Funds Advisory business with the hiring of an additional Partner. These individuals will join the Firm before the end of the year.

Expenses

The following tables set forth information relating to the Firm’s operating expenses, which are reported net of client expense reimbursements.

|

|

|

U.S. GAAP |

|

Adjusted Pro Forma* |

|

|

|

Three Months Ended June 30, |

|

($ in thousands) |

|

2015 |

|

2014 |

|

2015 vs.

2014

Variance |

|

2015 |

|

2014 |

|

2015 vs.

2014

Variance |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Compensation and benefits |

|

$69,663 |

|

$162,204 |

|

-57% |

|

$68,276 |

|

$69,258 |

|

-1% |

|

% of revenues |

|

55% |

|

123% |

|

|

|

54% |

|

53% |

|

|

|

Non-compensation expenses |

|

$23,438 |

|

$26,790 |

|

-13% |

|

$23,438 |

|

$23,092 |

|

1% |

|

% of revenues |

|

19% |

|

20% |

|

|

|

19% |

|

18% |

|

|

|

Total operating expenses |

|

$93,101 |

|

$188,994 |

|

-51% |

|

$91,714 |

|

$92,350 |

|

-1% |

|

% of revenues |

|

74% |

|

144% |

|

|

|

73% |

|

70% |

|

|

|

Income (loss) before income taxes |

|

$32,934 |

|

$(60,172) |

|

N/M |

|

$34,321 |

|

$38,930 |

|

-12% |

|

% of revenues |

|

26% |

|

N/M |

|

|

|

27% |

|

30% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

N/M = not meaningful |

|

|

|

|

|

|

|

|

|

|

|

|

|

* See Appendix for a reconciliation of GAAP to Adjusted Pro Forma |

|

|

|

|

|

|

|

|

|

|

4

|

|

|

U.S. GAAP |

|

Adjusted Pro Forma* |

|

|

|

Six Months Ended June 30, |

|

($ in thousands) |

|

2015 |

|

2014 |

|

2015 vs.

2014

Variance |

|

2015 |

|

2014 |

|

2015 vs.

2014

Variance |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Compensation and benefits |

|

$125,056 |

|

$232,645 |

|

-46% |

|

$122,209 |

|

$129,350 |

|

-6% |

|

% of revenues |

|

56% |

|

94% |

|

|

|

54% |

|

53% |

|

|

|

Non-compensation expenses |

|

$46,076 |

|

$46,931 |

|

-2% |

|

$46,076 |

|

$43,233 |

|

7% |

|

% of revenues |

|

20% |

|

19% |

|

|

|

20% |

|

18% |

|

|

|

Total operating expenses |

|

$171,132 |

|

$279,576 |

|

-39% |

|

$168,285 |

|

$172,583 |

|

-2% |

|

% of revenues |

|

76% |

|

114% |

|

|

|

75% |

|

70% |

|

|

|

Income (loss) before income taxes |

|

$57,195 |

|

$(37,438) |

|

N/M |

|

$60,042 |

|

$72,013 |

|

-17% |

|

% of revenues |

|

25% |

|

N/M |

|

|

|

27% |

|

29% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

N/M = not meaningful |

|

|

|

|

|

|

|

|

|

|

|

|

|

* See Appendix for a reconciliation of GAAP to Adjusted Pro Forma |

|

|

|

|

|

|

|

|

|

|

Total operating expenses on an Adjusted Pro Forma basis were $91.7 million for the second quarter of 2015 as compared with Adjusted Pro Forma operating expenses of $92.4 million for the second quarter of 2014. For the first half of 2015, Adjusted Pro Forma operating expenses were $168.3 million as compared with $172.6 million in the same period of 2014. The decrease in operating expenses in 2015 primarily resulted from reduced compensation and benefits expenses due to lower revenues earned during the period, partially offset by a small increase in non-compensation expenses. The pre-tax income margin was 27% on an Adjusted Pro Forma basis in both the second quarter and first half of 2015 as compared with 30% and 29% on an Adjusted Pro Forma basis in the second quarter and first half of 2014, respectively.

In the second quarter of 2015, compensation and benefits expenses on an Adjusted Pro Forma basis were $68.3 million, or 54% of revenues, which compares with $69.3 million of compensation and benefits expenses, or 53% of revenues in 2014. In the first half of 2015, compensation and benefits expenses on an Adjusted Pro Forma basis were $122.2 million, or 54% of revenues, which compares with Adjusted Pro Forma compensation and benefits expense of $129.4 million, or 53% of revenues in the first half of 2014. Compensation expense in 2015 reflects an additional tranche of equity amortization expense arising from 2014 equity incentive grants made in early 2015. As annual equity compensation granted in the future accumulates and amortizes, we expect that our compensation expense ratio will increase toward our targeted long-term compensation ratio of approximately 57% to 58% of revenues.

Adjusted Pro Forma non-compensation expenses were $23.4 million for the second quarter of 2015 as compared with $23.1 million for the same period of the prior year. Our Adjusted Pro Forma non-compensation expense ratio increased to 19% from 18% in the same period of the prior year. For the first half of 2015, Adjusted Pro Forma non-compensation expenses were $46.1 million as compared with $43.2 million for the same period of the prior year, and the Adjusted Pro Forma non-compensation expense ratio increased to 20% from 18% due to the increase in non-compensation expenses, primarily driven by headcount, together with the decline in revenues.

5

Provision for Income Taxes

Prior to our IPO, the Firm was not subject to federal income taxes, but was primarily subject to New York City unincorporated business tax and certain foreign income taxes. As a result of completing our IPO in April 2014, we have a new corporate structure and currently 37% of the operating partnership (Moelis & Company Group LP) is owned by the corporation (Moelis & Company) and is subject to U.S. federal income tax as a corporation. Income tax on the remaining 63% continues to be subject to New York City unincorporated business tax and certain foreign income taxes and is accounted for at the partner level through our non-controlling interest adjustment. For Adjusted Pro Forma purposes, we have assumed all outstanding Class A partnership units of Moelis & Company Group LP have been exchanged into Class A common stock of Moelis & Company such that 100% of the Firm’s second quarter 2015 income was taxed at our current corporate effective tax rate of 40.0%, versus a corporate effective tax rate of 40.5% for the second quarter of 2014.

Capital Management and Balance Sheet

Moelis & Company continues to maintain a strong financial position and as of June 30, 2015, we held cash and short term investments of $154.6 million and had no debt on our balance sheet.

On July 28, 2015, the Board of Directors of Moelis & Company declared a quarterly dividend of $0.30 per share. The dividend will be paid on September 8, 2015 to common stockholders of record on August 24, 2015.

During the second quarter, the Firm repurchased 56,754 restricted stock units from employees at the time of vesting to settle tax liabilities at an average price of $28.65 per unit. During the first half, the Firm repurchased 129,863 shares of its Class A common stock and 62,797 restricted stock units from employees at the time of vesting to settle tax liabilities at an average price of $30.90 per share/unit.

Earnings Call

We will host a conference call beginning at 4:30pm ET on Wednesday, July 29, 2015, accessible via telephone and the internet. Ken Moelis, Chairman and Chief Executive Officer, and Joe Simon, Chief Financial Officer, will review our second quarter 2015 financial results. Following the review, there will be a question and answer session.

Investors and analysts may participate in the live conference call by dialing 1-877-510-3938 (domestic) or 1-412-902-4137 (international) and referencing the Moelis & Company Second Quarter 2015 Earnings Call. Please dial in 15 minutes before the conference call begins. The conference call will also be accessible as a listen-only audio webcast through the Investor Relations section of the Moelis & Company website at www.moelis.com.

6

For those unable to listen to the live broadcast, a replay of the call will be available for one month via telephone starting approximately one hour after the live call ends. The replay can be accessed at 1-877-344-7529 (domestic) or 1-412-317-0088 (international); the conference number is 10068929.

About Moelis & Company

Moelis & Company is a leading global independent investment bank that provides innovative strategic advice and solutions to a diverse client base, including corporations, governments and financial sponsors. The Firm assists its clients in achieving their strategic goals by offering comprehensive integrated financial advisory services across all major industry sectors. Moelis & Company’s experienced professionals advise clients on their most critical decisions, including mergers and acquisitions, recapitalizations and restructurings and other corporate finance matters. The Firm serves its clients with over 650 employees based in 17 offices in North and South America, Europe, the Middle East, Asia and Australia. For further information about Moelis & Company, please visit www.moelis.com.

Forward-Looking Statements

This press release contains forward-looking statements, which reflect the Firm’s current views with respect to, among other things, its operations and financial performance. You can identify these forward-looking statements by the use of words such as “outlook,” “believes,” “expects,” “potential,” “continues,” “may,” “will,” “should,” “seeks,” “target,” “approximately,” “predicts,” “intends,” “plans,” “estimates,” “anticipates” or the negative version of these words or other comparable words. Such forward-looking statements are subject to various risks and uncertainties. Accordingly, there are or will be important factors that could cause actual outcomes or results to differ materially from those indicated in these statements. For a further discussion of such factors, you should read the Firm’s filings with the Securities and Exchange Commission. The Firm undertakes no obligation to publicly update or review any forward-looking statement, whether as a result of new information, future developments or otherwise.

Non-GAAP Financial Measures

Adjusted Pro Forma results are a non-GAAP measure which better reflect management’s view of operating results. We believe that the disclosed Adjusted Pro Forma measures and any adjustments thereto, when presented in conjunction with comparable GAAP measures, are useful to investors to understand the Firm’s operating results by removing the significant accounting impact of one-time charges associated with the Firm’s IPO and assuming all Class A partnership units have been exchanged into Class A common stock. These measures should not be considered a substitute for, or superior to, measures of financial performance prepared in accordance with GAAP. A reconciliation of GAAP results to Adjusted Pro Forma results is presented in the Appendix.

|

Contacts |

|

|

|

|

|

|

|

Investor Relations Contact: |

|

Media Contact: |

|

Michele Miyakawa |

|

Andrea Hurst |

|

Moelis & Company |

|

Moelis & Company |

|

t: + 1 310 443 2344 |

|

t: + 1 212 883 3666 |

|

michele.miyakawa@moelis.com |

|

m: +1 347 583 9705 |

|

|

|

andrea.hurst@moelis.com |

7

Appendix

GAAP Consolidated and Combined Statement of Operations (Unaudited)

GAAP Reconciliation to Adjusted Pro Forma Financial Information (Unaudited)

Moelis & Company

GAAP Consolidated and Combined Statement of Operations

Unaudited

(dollars in thousands, except for share and per share data)

|

|

|

Three Months Ended June 30, |

|

Six Months Ended June 30, |

|

|

|

2015 |

|

2014 |

|

2015 |

|

2014 |

|

|

|

|

|

|

|

|

|

|

|

Revenues |

|

$125,873 |

|

$131,687 |

|

$225,285 |

|

$246,204 |

|

|

|

|

|

|

|

|

|

|

|

Expenses |

|

|

|

|

|

|

|

|

|

Compensation and benefits |

|

69,663 |

|

162,204 |

|

125,056 |

|

232,645 |

|

Occupancy |

|

3,715 |

|

3,331 |

|

7,392 |

|

6,635 |

|

Professional fees |

|

4,143 |

|

5,258 |

|

7,697 |

|

8,593 |

|

Communication, technology and information services |

|

4,440 |

|

3,870 |

|

8,541 |

|

7,644 |

|

Travel and related expenses |

|

5,131 |

|

6,265 |

|

10,744 |

|

11,350 |

|

Depreciation and amortization |

|

688 |

|

519 |

|

1,308 |

|

1,094 |

|

Other expenses |

|

5,321 |

|

7,547 |

|

10,394 |

|

11,615 |

|

Total expenses |

|

93,101 |

|

188,994 |

|

171,132 |

|

279,576 |

|

|

|

|

|

|

|

|

|

|

|

Operating income (loss) |

|

32,772 |

|

(57,307) |

|

54,153 |

|

(33,372) |

|

Other income and expenses |

|

(33) |

|

(14) |

|

(18) |

|

5 |

|

Income (loss) from equity method investments |

|

195 |

|

(2,851) |

|

3,060 |

|

(4,071) |

|

Income (loss) before income taxes |

|

32,934 |

|

(60,172) |

|

57,195 |

|

(37,438) |

|

Provision for income taxes |

|

6,079 |

|

438 |

|

10,379 |

|

1,080 |

|

Net income (loss) |

|

26,855 |

|

(60,610) |

|

46,816 |

|

(38,518) |

|

|

|

|

|

|

|

|

|

|

|

Net income (loss) attributable to noncontrolling interests |

|

19,724 |

|

(41,600) |

|

34,349 |

|

(19,508) |

|

Net income (loss) attributable to Moelis & Company |

|

$7,131 |

|

$(19,010) |

|

$12,467 |

|

$(19,010) |

|

|

|

|

|

|

|

|

|

|

|

Weighted-average shares of Class A common stock outstanding |

|

|

|

|

|

|

|

|

|

Basic |

|

19,978,108 |

|

15,263,653 |

|

19,961,286 |

|

15,263,653 |

|

Diluted |

|

21,088,220 |

|

15,263,653 |

|

21,144,161 |

|

15,263,653 |

|

Net income (loss) attributable to holders of shares of Class A common stock per share |

|

|

|

|

|

|

|

|

|

Basic |

|

$0.36 |

|

$(1.25) |

|

$0.62 |

|

$(1.25) |

|

Diluted |

|

$0.34 |

|

$(1.25) |

|

$0.59 |

|

$(1.25) |

A-1

Moelis & Company

Reconciliation of GAAP to Adjusted Pro Forma Financial Information

Unaudited

(dollars in thousands, except share and per share data)

|

|

|

Three Months Ended June 30, 2015 |

|

|

|

GAAP |

|

IPO-Related

Expense

Adjustments |

|

Adjusted |

|

As if

Partnership

Units

Converted to

Class A (b) |

|

Adjusted

Pro Forma |

|

Revenues |

|

$ 125,873 |

|

$ - |

|

$ 125,873 |

|

$ - |

|

$ 125,873 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Expenses |

|

|

|

|

|

|

|

|

|

|

|

Compensation and benefits |

|

69,663 |

|

(1,387) |

(a) |

68,276 |

|

- |

|

68,276 |

|

Non-compensation expenses |

|

23,438 |

|

- |

|

23,438 |

|

- |

|

23,438 |

|

Total operating expenses |

|

93,101 |

|

(1,387) |

|

91,714 |

|

- |

|

91,714 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating income (loss) |

|

32,772 |

|

1,387 |

|

34,159 |

|

- |

|

34,159 |

|

Other income and expenses |

|

(33) |

|

- |

|

(33) |

|

- |

|

(33) |

|

Income (loss) from equity method investments |

|

195 |

|

- |

|

195 |

|

- |

|

195 |

|

Income (loss) before income taxes |

|

32,934 |

|

1,387 |

|

34,321 |

|

- |

|

34,321 |

|

Provision for income taxes |

|

6,079 |

|

257 |

|

6,336 |

|

7,393 |

|

13,729 |

|

Net income (loss) |

|

26,855 |

|

1,130 |

|

27,985 |

|

(7,393) |

|

20,592 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income (loss) attributable to noncontrolling interests |

|

19,724 |

|

832 |

|

20,556 |

|

(20,556) |

|

- |

|

Net income (loss) attributable to Moelis & Company |

|

$7,131 |

|

$298 |

|

$7,429 |

|

$13,163 |

|

$20,592 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted-average shares of Class A common stock outstanding |

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

19,978,108 |

|

|

|

19,978,108 |

|

34,160,239 |

|

54,138,347 |

|

Diluted |

|

21,088,220 |

|

|

|

21,088,220 |

|

34,160,239 |

|

55,248,459 |

|

Net income (loss) attributable to holders of shares of Class A common stock per share |

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

$0.36 |

|

|

|

$0.37 |

|

|

|

$0.38 |

|

Diluted |

|

$0.34 |

|

|

|

$0.35 |

|

|

|

$0.37 |

(a) Expense associated with the amortization of restricted stock units and stock options granted in connection with the IPO. In accordance with GAAP, amortization expense of RSUs and stock options granted in connection with the IPO will be recognized over the five year vesting period; we will continue to adjust for this expense due to the one-time nature of the grant.

(b) Assumes all outstanding Class A partnership units have been exchanged into Class A common stock. Accordingly, an adjustment has been made such that 100% of the Firm’s income is taxed at the corporate effective tax rate of 40.0% for the period presented.

A-2

|

|

|

Three Months Ended June 30, 2014 |

|

|

|

GAAP |

|

IPO-Related

Expense

Adjustments |

|

Adjusted |

|

As if

Partnership

Units

Converted to

Class A (d) |

|

Adjusted

Pro Forma |

|

Revenues |

|

$131,687 |

|

$ - |

|

$131,687 |

|

$ - |

|

$131,687 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Expenses |

|

|

|

|

|

|

|

|

|

|

|

Compensation and benefits |

|

162,204 |

|

(92,946) |

(a) |

69,258 |

|

- |

|

69,258 |

|

Non-compensation expenses |

|

26,790 |

|

(3,698) |

(b) |

23,092 |

|

- |

|

23,092 |

|

Total operating expenses |

|

188,994 |

|

(96,644) |

|

92,350 |

|

- |

|

92,350 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating income (loss) |

|

(57,307) |

|

96,644 |

|

39,337 |

|

- |

|

39,337 |

|

Other income and expenses |

|

(14) |

|

- |

|

(14) |

|

- |

|

(14) |

|

Income (loss) from equity method investments |

|

(2,851) |

|

2,458 |

(c) |

(393) |

|

- |

|

(393) |

|

Income (loss) before income taxes |

|

(60,172) |

|

99,102 |

|

38,930 |

|

- |

|

38,930 |

|

Provision for income taxes |

|

438 |

|

4,564 |

|

5,002 |

|

10,765 |

|

15,767 |

|

Net income (loss) |

|

(60,610) |

|

94,538 |

|

33,928 |

|

(10,765) |

|

23,163 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income (loss) attributable to noncontrolling interests |

|

(41,600) |

|

68,960 |

|

27,360 |

|

(27,360) |

|

- |

|

Net income (loss) attributable to Moelis & Company |

|

$(19,010) |

|

$25,578 |

|

$6,568 |

|

$16,595 |

|

$23,163 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted-average shares of Class A common stock outstanding |

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

15,263,653 |

|

- |

|

15,263,653 |

|

39,021,417 |

|

54,285,070 |

|

Diluted |

|

15,263,653 |

|

432,400 |

|

15,696,053 |

|

39,021,417 |

|

54,717,470 |

|

Net income (loss) attributable to holders of shares of Class A common stock per share |

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

$(1.25) |

|

|

|

$0.43 |

|

|

|

$0.43 |

|

Diluted |

|

$(1.25) |

|

|

|

$0.42 |

|

|

|

$0.42 |

(a) Expense associated with the one time non-cash acceleration of Managing Director unvested equity accelerated upon completion of the IPO and amortization of equity awards granted in connection with the IPO.

(b) Expense associated with the one-time non-cash acceleration of unvested equity held by non-employees of Moelis & Company.

(c) Expense associated with the one-time non-cash acceleration of unvested equity held by employees of the Firm’s joint venture in Australia (the “Australian JV”).

(d) Assumes all outstanding Class A partnership units have been exchanged into Class A common stock. Accordingly, an adjustment has been made such that 100% of the Firm’s income is taxed at the corporate effective tax rate of 40.5% for the period presented.

A-3

|

|

|

Six Months Ended June 30, 2015 |

|

|

|

GAAP |

|

IPO-Related

Expense

Adjustments |

|

Adjusted |

|

As if

Partnership

Units

Converted to

Class A (b) |

|

Adjusted

Pro Forma |

|

Revenues |

|

$225,285 |

|

$ - |

|

$225,285 |

|

$ - |

|

$225,285 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Expenses |

|

|

|

|

|

|

|

|

|

|

|

Compensation and benefits |

|

125,056 |

|

(2,847) |

(a) |

122,209 |

|

- |

|

122,209 |

|

Non-compensation expenses |

|

46,076 |

|

- |

|

46,076 |

|

- |

|

46,076 |

|

Total operating expenses |

|

171,132 |

|

(2,847) |

|

168,285 |

|

- |

|

168,285 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating income (loss) |

|

54,153 |

|

2,847 |

|

57,000 |

|

- |

|

57,000 |

|

Other income and expenses |

|

(18) |

|

- |

|

(18) |

|

- |

|

(18) |

|

Income (loss) from equity method investments |

|

3,060 |

|

- |

|

3,060 |

|

- |

|

3,060 |

|

Income (loss) before income taxes |

|

57,195 |

|

2,847 |

|

60,042 |

|

- |

|

60,042 |

|

Provision for income taxes |

|

10,379 |

|

516 |

|

10,895 |

|

13,122 |

|

24,017 |

|

Net income (loss) |

|

46,816 |

|

2,331 |

|

49,147 |

|

(13,122) |

|

36,025 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income (loss) attributable to noncontrolling interests |

|

34,349 |

|

1,714 |

|

36,063 |

|

(36,063) |

|

- |

|

Net income (loss) attributable to Moelis & Company |

|

$12,467 |

|

$617 |

|

$13,084 |

|

$22,941 |

|

$36,025 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted-average shares of Class A common stock outstanding |

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

19,961,286 |

|

|

|

19,961,286 |

|

34,177,061 |

|

54,138,347 |

|

Diluted |

|

21,144,161 |

|

|

|

21,144,161 |

|

34,177,061 |

|

55,321,222 |

|

Net income (loss) attributable to holders of shares of Class A common stock per share |

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

$0.62 |

|

|

|

$0.66 |

|

|

|

$0.67 |

|

Diluted |

|

$0.59 |

|

|

|

$0.62 |

|

|

|

$0.65 |

(a) Expense associated with the amortization of restricted stock units and stock options granted in connection with the IPO. In accordance with GAAP, amortization expense of RSUs and stock options granted in connection with the IPO will be recognized over the five year vesting period; we will continue to adjust for this expense due to the one-time nature of the grant.

(b) Assumes all outstanding Class A partnership units have been exchanged into Class A common stock. Accordingly, an adjustment has been made such that 100% of the Firm’s income is taxed at the corporate effective tax rate of 40.0% for the period presented.

A-4

|

|

|

Sixth Months Ended June 30, 2014 |

|

|

|

GAAP |

|

IPO-Related

Expense

Adjustments |

|

Adjusted |

|

As if

Partnership

Units

Converted to

Class A (d) |

|

Adjusted

Pro Forma |

|

Revenues |

|

$246,204 |

|

$ - |

|

$246,204 |

|

$ - |

|

$246,204 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Expenses |

|

|

|

|

|

|

|

|

|

|

|

Compensation and benefits |

|

232,645 |

|

(103,295) |

(a) |

129,350 |

|

- |

|

129,350 |

|

Non-compensation expenses |

|

46,931 |

|

(3,698) |

(b) |

43,233 |

|

- |

|

43,233 |

|

Total operating expenses |

|

279,576 |

|

(106,993) |

|

172,583 |

|

- |

|

172,583 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating income (loss) |

|

(33,372) |

|

106,993 |

|

73,621 |

|

- |

|

73,621 |

|

Other income and expenses |

|

5 |

|

- |

|

5 |

|

- |

|

5 |

|

Income (loss) from equity method investments |

|

(4,071) |

|

2,458 |

(c) |

(1,613) |

|

- |

|

(1,613) |

|

Income (loss) before income taxes |

|

(37,438) |

|

109,451 |

|

72,013 |

|

- |

|

72,013 |

|

Provision for income taxes |

|

1,080 |

|

8,104 |

|

9,184 |

|

19,982 |

|

29,166 |

|

Net income (loss) |

|

(38,518) |

|

101,347 |

|

62,829 |

|

(19,982) |

|

42,847 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income (loss) attributable to noncontrolling interests |

|

(19,508) |

|

70,188 |

|

50,680 |

|

(50,680) |

|

- |

|

Net income (loss) attributable to Moelis & Company |

|

$(19,010) |

|

$31,159 |

|

$12,149 |

|

$30,698 |

|

$42,847 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted-average shares of Class A common stock outstanding |

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

15,263,653 |

|

- |

|

15,263,653 |

|

39,021,417 |

|

54,285,070 |

|

Diluted |

|

15,263,653 |

|

432,400 |

|

15,696,053 |

|

39,021,417 |

|

54,717,470 |

|

Net income (loss) attributable to holders of shares of Class A common stock per share |

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

$(1.25) |

|

|

|

$0.80 |

|

|

|

$0.79 |

|

Diluted |

|

$(1.25) |

|

|

|

$0.77 |

|

|

|

$0.78 |

(a) Expense associated with the one time non-cash acceleration of Managing Director unvested equity accelerated upon completion of the IPO and amortization of equity awards granted in connection with the IPO.

(b) Expense associated with the one-time non-cash acceleration of unvested equity held by non-employees of Moelis & Company.

(c) Expense associated with the one-time non-cash acceleration of unvested equity held by employees of the Australian JV.

(d) Assumes all outstanding Class A partnership units have been exchanged into Class A common stock. Accordingly, an adjustment has been made such that 100% of the Firm’s income is taxed at the corporate effective tax rate of 40.5% for the period presented.

A-5

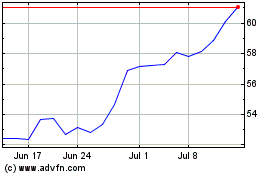

Moelis (NYSE:MC)

Historical Stock Chart

From Mar 2024 to Apr 2024

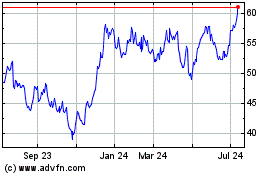

Moelis (NYSE:MC)

Historical Stock Chart

From Apr 2023 to Apr 2024