UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): July 27, 2015

MAJESCO ENTERTAINMENT COMPANY

(Exact name of registrant as specified in its charter)

|

Delaware

|

|

000-51128

|

|

06-1529524

|

|

(State or other jurisdiction

|

|

(Commission File Number)

|

|

(IRS Employer

|

|

of incorporation)

|

|

|

|

Identification No.)

|

404I-T Hadley Road

S. Plainfield, New Jersey 07080

(Address of principal executive offices and zip code)

Registrant’s telephone number, including area code: (732) 225-8910

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Item 1.01 Entry into a Material Definitive Agreement

On July 27, 2015 Majesco Entertainment Company (the “Company”) and Mr. Rector entered into a Director and Officer Indemnification Agreement in connection with Mr. Rector’s appointment as principal executive officer of the Company (as further described below).

The foregoing summary of the agreement with Mr. Rector is incomplete. For a full description of the agreement reference is made to Exhibit 10.1 incorporated herein by reference.

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On July 27, 2015 the board of directors (the “Board”) of the Company appointed David Rector as a Class I member, and Chairman, of the Board.

Following the appointment of Mr. Rector, on July 27, 2015, Jesse Sutton resigned from his position as Chief Executive Officer of the Company effective immediately and Mr. Sutton and the Company, entered into a separation agreement (the “Sutton Separation Agreement”). Under the terms of the Sutton Separation Agreement, Mr. Sutton will, for twenty-four (24) months following his resignation, provide consulting and support services (the “Services”) to the Company’s Download Business (as defined in the Separation Agreement). Pursuant to the Sutton Separation Agreement, Mr. Sutton is expected to receive a severance payment, which will include 50% of the Net Monthly Revenues (as defined in the Sutton Separation Agreement) generated by the Company from the Download Business (as defined in the Sutton Separation Agreement), but in no even more than $10,000 per month; provided that Mr. Sutton is still providing the Services. In addition, the Company will continue its contributions towards Mr. Sutton’s health care benefits for a period of twelve (12) months following Mr. Sutton’s resignation or until Mr. Sutton becomes covered by an equivalent benefit and Mr. Sutton shall have a period of eighteen (18) months from his date of resignation to exercise any previously issued stock options, except that the original expiration date of any such options shall not be extended.

Following Mr. Sutton’s resignation, the Board then appointed Mr. Rector (age 68) to act in the capacity of principal executive officer of the Company effective immediately. Mr. Rector will not receive compensation in connection with this title.

Mr. Rector has served as a director of Sevion Therapeutics, Inc. since February 2002 and also serves as a director and member of the compensation and audit committee of the Dallas Gold and Silver Exchange Companies Inc. (formerly Superior Galleries, Inc.) Since January 2014 through present, Mr. Rector serves on the board of directors of MV Portfolios, Inc. (formerly California Gold Corp.) Since 1985, Mr. Rector has been the Principal of The David Stephen Group, which provides enterprise consulting services to emerging and developing companies in a variety of industries. From November 2012 through January 2014, Mr. Rector has served as the CEO and President of Valor Gold. Since February 2012 through January 2013, Mr. Rector has served as the VP Finance & Administration of Pershing Gold Corp. From May 2011 through February 2012, Mr. Rector served as the President of Sagebrush Gold, Ltd. From October 2009 through August 2011, Mr. Rector had served as President and CEO of Li3 Energy, Inc. From July 2009 through May 2011, Mr. Rector had served as President and CEO of Nevada Gold Holdings, Inc. From September 2008 through November 2010, Mr. Rector served as President and CEO Universal Gold Mining Corp. From October 2007 through February 2013, Mr. Rector has served as President and CEO of Standard Drilling, Inc.

There is no arrangement or understanding between Mr. Rector and any other person pursuant to which he was selected as an officer of the Company and there are no family relationships between Mr. Rector and any of the Company’s directors or executive officers. There are no transactions to which the Company is a party and in which Mr. Rector has a direct or indirect material interest that would be required to be disclosed under Item 404(a) of Regulation S-K.

In addition, on July 27, 2015, Trent Donald Davis resigned as a Class I member of the Board, effective immediately. Mr. Davis’s resignation was not due to a disagreement with the Company on any matter relating to the Company’s operations, policies or practices.

The foregoing summary of the separation agreement with Mr. Sutton is incomplete. For a full description of the agreement reference is made to Exhibit 10.2 incorporated herein by reference.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

| Exhibit Number |

|

Description |

| 10.1 |

|

Form of Personal Indemnification Agreement |

| 10.2 |

|

Separation Agreement between Majesco Entertainment Company and Jesse Sutton, dated as of July 27, 2015 |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

MAJESCO ENTERTAINMENT COMPANY

|

| |

|

| |

|

|

Dated: July 28, 2015

|

/s/ Gary Anthony

|

| |

Gary Anthony

|

| |

Chief Accounting Officer

|

| |

|

EXHIBIT INDEX

| Exhibit Number |

|

Description |

| 10.1 |

|

Form of Personal Indemnification Agreement |

| 10.2 |

|

Separation Agreement between Majesco Entertainment Company and Jesse Sutton, dated as of July 27, 2015 |

Exhibit 10.1

PERSONAL INDEMNIFICATION AGREEMENT

This Personal Indemnification Agreement is entered into as _________, 2015 (the “Agreement”), by and between Majesco Entertainment Company, a Delaware corporation (the “Company,” which term shall include, where appropriate, any Entity (as hereinafter defined) controlled, directly or indirectly, by the Company) and ________________ (the “Indemnitee”).

WHEREAS, it is essential to the Company that it be able to retain and attract as directors and officers the most capable persons available;

WHEREAS, increased corporate litigation has subjected directors and officers to litigation risks and expenses, and the limitations on the availability of directors and officers liability insurance have made it increasingly difficult for the Company to attract and retain such persons;

WHEREAS, the Company’s Restated Bylaws (the “Bylaws”) require it to indemnify its directors to the fullest extent permitted by law and permit it to make other indemnification arrangements and agreements;

WHEREAS, the Company desires to provide Indemnitee with specific contractual assurance of Indemnitee’s rights to full indemnification against litigation risks and expenses (regardless, among other things, of any amendment to or revocation of the Company’s Amended and Restated Certificate of Incorporation (the “Certificate of Incorporation”) or Bylaws or any change in the ownership of the Company or the composition of its board of directors);

WHEREAS, the Company intends that this Agreement provide Indemnitee with greater protection than that which is provided by the Company’s Bylaws; and

WHEREAS, Indemnitee is relying upon the rights afforded under this Agreement in becoming or continuing as a director or officer of the Company.

NOW, THEREFORE, in consideration of the promises and the covenants contained herein, the Company and Indemnitee do hereby covenant and agree as follows:

1. Definitions.

| |

(a) |

Corporate “Status” describes the status of a person who is serving or has served (i) as a director of the Company, (ii) in any capacity with respect to any employee benefit plan of the Company, or (iii) as a director, partner, trustee, officer, employee, or agent of any other Entity at the request of the Company. For purposes of subsection (iii) of this Section 1(a), if Indemnitee is serving or has served as a director, partner, trustee, officer, employee or agent of a Subsidiary, Indemnitee shall be deemed to be serving at the request of the Company.

|

| |

(b) |

“Entity” shall mean any corporation, partnership, limited liability company, joint venture, trust, foundation, association, organization or other legal entity.

|

| |

(c) |

“Enterprise” shall mean the Company and any Entity of which Indemnitee is or was serving at the request of the Company as a director, officer, employee, agent or fiduciary

|

| |

(d) |

“Expenses” shall mean all fees, costs and expenses incurred by Indemnitee in connection with any Proceeding (as defined below), including, without limitation, attorneys’ fees, disbursements and retainers (including, without limitation, any such fees, disbursements and retainers incurred by Indemnitee pursuant to Sections 13 and 14(c) of this Agreement), fees and disbursements of expert witnesses, private investigators and professional advisors and other disbursements and expenses.

|

| |

(e) |

“Indemnifiable Amounts” shall have the meaning ascribed to that term in Section 3 below

|

| |

(f) |

“Liabilities” shall mean judgments, damages, liabilities, losses, penalties, excise taxes, fines and amounts paid in settlement.

|

| |

(g) |

“Proceeding” shall mean any threatened, pending or completed claim, action, suit, arbitration, alternate dispute resolution process, investigation, administrative hearing, appeal, or any other proceeding, whether civil, criminal, administrative, arbitrative or investigative, whether formal or informal, including a proceeding initiated by Indemnitee pursuant to Section 13 of this Agreement to enforce Indemnitee’s rights hereunder.

|

| |

(h) |

“Subsidiary” shall mean any Entity of which the Company owns (either directly or through or together with another Subsidiary of the Company) either (i) a general partner, managing member or other similar interest or (ii) (A) 50% or more of the voting power of the voting capital equity interests of such Entity, or (B) 50% or more of the outstanding voting capital stock or other voting equity interests of such Entity. |

2. Services of Indemnitee. In consideration of the Company’s covenants and commitments hereunder, Indemnitee agrees to serve or continue to serve as a director or officer of the Company. However, this Agreement shall not impose any obligation on Indemnitee or the Company to continue Indemnitee’s service to the Company beyond any period otherwise required by law or by other agreements or commitments of the parties, if any. Indemnitee may at any time and for any reason resign from such position (subject to any other contractual obligation or any obligation imposed by operation of law), upon which event the Company shall have no obligation under this Agreement to continue Indemnitee in such position. Notwithstanding the forgoing, this Agreement shall continue in force until and terminate upon the later of: (a) ten (10) years after the date that the Corporate Status of Indemnitee has been terminated and (b) the final termination of all pending Proceedings.

3. Indemnity in Third-Party Proceedings. The Company shall indemnify Indemnitee in accordance with the provisions of this Section 3 if Indemnitee is, or is threatened to be made, by reason of Indemnitee’s Corporate Status, a party to or a participant in any Proceeding, other than a Proceeding by or in the right of the Company to procure a judgment in its favor. Pursuant to this Section 3, Indemnitee shall be indemnified against all Expenses and Liabilities actually and reasonably incurred by Indemnitee or on his behalf in connection with such Proceeding or any claim, issue or matter therein (indemnifiable Expenses and Liabilities collectively referred herein as “Indemnifiable Amounts”), if Indemnitee acted in good faith and in a manner he or she reasonably believed to be in or not opposed to the best interests of the Company and, in the case of a criminal Proceeding, had no reasonable cause to believe that his or her conduct was unlawful. Indemnitee shall not enter into any settlement in connection with a Proceeding without the consent of the Company, which consent shall not be unreasonably withheld or delayed.

4. Indemnity in Proceedings by or in the Right of the Company. The Company shall indemnify Indemnitee in accordance with the provisions of this Section 4 if Indemnitee is, or is threatened to be made, by reason of Indemnitee’s Corporate Status, a party to or a participant in any Proceeding by

or in the right of the Company to procure a judgment in its favor. Pursuant to this Section 4, Indemnitee shall be indemnified against all Expenses actually and reasonably incurred by him or on his behalf in connection with such Proceeding or any claim, issue or matter therein, if Indemnitee acted in good faith and in a manner he reasonably believed to be in or not opposed to the best interests of the Company. No indemnification for Expenses shall be made under this Section 4 in respect of any claim, issue or matter as to which Indemnitee shall have been finally adjudged by a court to be liable to the Company, unless and only to the extent that the Delaware Court of Chancery (the “Delaware Chancery Court”) or any court in which the Proceeding was brought shall determine upon application that, despite the adjudication of liability, but in view of all the circumstances of the case, Indemnitee is fairly and reasonably entitled to indemnification for such Expenses as the Delaware Chancery Court or such other court shall deem proper.

5. Indemnification for Expenses of a Party Who is Wholly or Partly Successful. If Indemnitee is not wholly successful in such Proceeding but is successful, on the merits or otherwise, as to one or more but less than all claims, issues or matters in such Proceeding, the Company shall indemnify Indemnitee against: (a) all Expenses reasonably incurred by Indemnitee or on Indemnitee’s behalf in connection with each successfully resolved claim, issue or matter; and (b) any claim, issue or matter related to any such successfully resolved claim, issue or matter. For purposes of this Agreement, the termination of any claim, issue or matter in such a Proceeding by dismissal, with or without prejudice, by reason of settlement, judgment, order or otherwise, shall be deemed to be a successful result as to such claim, issue or matter.

6. Procedure for Payment of Indemnifiable Amounts. Indemnitee shall submit to the Company a written request specifying the Indemnifiable Amounts for which Indemnitee seeks payment under Sections 3, 4 or 5 of this Agreement and the basis for the claim. The Company shall pay such Indemnifiable Amounts to Indemnitee promptly upon receipt of Indemnitee’s written request. If the Indemnifiable Amounts have not been paid in full within sixty (60) days after the written request has been received by the Company, Indemnitee may at any time thereafter bring suit against the Company to recover any such unpaid amounts. At the request of the Company, Indemnitee shall furnish such documentation and information as are reasonably available to Indemnitee and necessary to establish that Indemnitee is entitled to indemnification hereunder.

7. Indemnification for Expenses as a Witness. Notwithstanding any other provision of this Agreement, to the extent that Indemnitee is, by reason of his or her Corporate Status, a witness in any Proceeding to which Indemnitee is not a party, he or she shall be indemnified against all Expenses actually and reasonably incurred by him or her or on his or her behalf in connection therewith.

8. Effect of Certain Resolutions. Neither the settlement or termination of any Proceeding nor the failure of the Company to award indemnification or to determine that indemnification is payable shall create a presumption that Indemnitee is not entitled to indemnification hereunder. In addition, the termination of any proceeding by judgment, order, settlement, conviction, or upon a plea of nolo contendere or its equivalent shall not create a presumption that Indemnitee did not act in good faith and in a manner which Indemnitee reasonably believed to be in or not opposed to the best interests of the Company or, with respect to any criminal Proceeding, had reasonable cause to believe that Indemnitee’s action was unlawful.

9. Exclusions. Notwithstanding any provision in this Agreement to the contrary, the Company shall not be obligated under this Agreement to make any indemnity in connection with any claim made against Indemnitee:

(a) for which payment has actually been made to or on behalf of Indemnitee under any insurance policy or other indemnity provision, except with respect to any excess beyond the amount paid under any insurance policy or other indemnity provisions;

(b) for an accounting of profits made from the purchase and sale (or sale and purchase) by Indemnitee of securities of the Company within the meaning of Section 16(b) of the Securities Exchange Act of 1934, as amended, or similar provisions of state statutory law or common law; or

(c) for which payment is prohibited by applicable law.

10. Agreement to Advance Expenses; Undertaking. The Company shall advance all Expenses incurred by or on behalf of Indemnitee in connection with any Proceeding, including a Proceeding by or in the right of the Company, in which Indemnitee is involved by reason of such Indemnitee’s Corporate Status within twenty (20) business days after the receipt by the Company of a written statement from Indemnitee requesting such advance or advances from time to time, whether prior to or after final disposition of such Proceeding. Advances shall be made without regard to Indemnitee’s ability to repay the expenses and without regard to Indemnitee’s ultimate entitlement to indemnification under the other provisions of this Agreement. To the extent required by Delaware law, Indemnitee hereby undertakes to repay any and all of the amount of indemnifiable Expenses paid to Indemnitee if it is finally determined by a court of competent jurisdiction that Indemnitee is not entitled under this Agreement to indemnification with respect to such Expenses. This undertaking is an unlimited general obligation of Indemnitee.

11. Procedure for Advance Payment of Expenses. Indemnitee shall submit to the Company a written request specifying the Expenses for which Indemnitee seeks an advancement under Section 10 of this Agreement, together with documentation evidencing that Indemnitee has incurred such Expenses (which shall include invoices received by Indemnitee in connection with such Expenses but, in the case of invoices in connection with legal services, any reference to legal work performed or to expenditures made that would cause Indemnitee to waive any privilege accorded by applicable law shall not be included with the invoice). Advances under Section 10 shall be made no later than twenty (20) business days after the Company’s receipt of such request. If a claim for advancement of Expenses hereunder by Indemnitee is not paid in full by the Company within twenty (20) business days after receipt by the Company of documentation of Expenses and the required undertaking, Indemnitee may at any time thereafter bring suit against the Company to recover the unpaid amount of the claim and if successful in whole or in part, Indemnitee shall also be entitled to be paid the expenses of prosecuting such claim. The burden of proving that Indemnitee is not entitled to an advancement of expenses shall be on the Company.

12. Presumptions and Effect of Certain Proceedings.

(a) In making a determination required to be made under Delaware law with respect to entitlement to indemnification hereunder, the person, persons or entity making such determination shall presume that Indemnitee is entitled to indemnification under this Agreement if Indemnitee has submitted a request for indemnification in accordance with Section 6 of this Agreement, and the Company shall have the burden of proof to overcome that presumption in connection with the making of any determination contrary to that presumption. Neither the failure of the Company or of any person, persons or entity to have made a determination prior to the commencement of any action pursuant to this Agreement that indemnification is proper in the circumstances because Indemnitee has met the applicable standard of conduct, nor an actual determination by the Company or by any person, persons or entity that Indemnitee has not met such applicable standard of conduct, shall be a defense to the action or create a presumption that Indemnitee has not met the applicable standard of conduct.

(b) The termination of any Proceeding or of any claim, issue or matter therein, by judgment, order, settlement or conviction, or upon a plea of nolo contendere or its equivalent, shall not (except as otherwise expressly provided in this Agreement) of itself adversely affect the right of Indemnitee to indemnification or create a presumption that Indemnitee did not act in good faith and in a manner which he reasonably believed to be in or not opposed to the best interests of the Company or, with respect to any criminal Proceeding, that Indemnitee had no reasonable cause to believe that his conduct was unlawful.

(c) For purposes of any determination of good faith, Indemnitee shall be deemed to have acted in good faith if Indemnitee’s action is based on the records or books of account of the Enterprise, including financial statements, or on information supplied to Indemnitee by the officers of the Enterprise in the course of their duties, or on the advice of legal counsel for the Enterprise or the board of directors or counsel selected by any committee of the board of directors or on information or records given or reports made to the Enterprise by an independent certified public accountant or by an appraiser, investment banker or other expert selected with reasonable care by the Company or the board of directors or any committee of the board of directors. The provisions of this Section 12(c) shall not be deemed to be exclusive or to limit in any way the other circumstances in which the Indemnitee may be deemed to have met the applicable standard of conduct set forth in this Agreement.

(d) The knowledge and/or actions, or failure to act, of any director, officer, agent or employee of the Enterprise shall not be imputed to Indemnitee for purposes of determining the right to indemnification under this Agreement.

13. Remedies of Indemnitee.

(a) Right to Petition Court. In the event that Indemnitee makes a request for payment of Indemnifiable Amounts under Sections 3, 4 and 5 above or a request for an advancement of Expenses under Sections 10 and 11 above and the Company fails to make such payment or advancement in a timely manner pursuant to the terms of this Agreement, Indemnitee may petition the Delaware Chancery Court to enforce the Company’s obligations under this Agreement.

(b) Burden of Proof. In any judicial proceeding brought under Section 13(a) above, the Company shall have the burden of proving that Indemnitee is not entitled to payment of Indemnifiable Amounts hereunder.

(c) Expenses. The Company agrees to reimburse Indemnitee in full for any Expenses incurred by Indemnitee in connection with investigating, preparing for, litigating, defending or settling any action brought by Indemnitee under Section 13(a) above, or in connection with any claim or counterclaim brought by the Company in connection therewith, if Indemnitee is successful in whole or in part in connection with any such action.

(d) Failure to Act Not a Defense. The failure of the Company (including its board of directors or any committee thereof, independent legal counsel, or stockholders) to make a determination concerning the permissibility of the payment of Indemnifiable Amounts or the advancement of indemnifiable Expenses under this Agreement shall not be a defense in any action brought under Section 13(a) above, and shall not create a presumption that such payment or advancement is not permissible.

14. Defense of the Underlying Proceeding.

(a) Notice by Indemnitee. Indemnitee agrees to notify the Company within five (5) calendar days of being served with any summons, citation, subpoena, complaint, indictment, information, or other document relating to any Proceeding which may result in the payment of Indemnifiable Amounts or the advancement of Expenses hereunder; provided, however, that the failure to give any such notice shall not disqualify Indemnitee from the right, or otherwise affect in any manner any right of Indemnitee, to receive payments of Indemnifiable Amounts or advancements of Expenses unless the Company’s ability to defend in such Proceeding is materially and adversely prejudiced thereby.

(b) Defense by Company. Subject to the provisions of the last sentence of this Section 14(b) and of Section 14(c) below, the Company shall have the right to defend Indemnitee in any Proceeding which may give rise to the payment of Indemnifiable Amounts hereunder; provided, however, that the Company shall notify Indemnitee of any such decision to defend within thirty (30) calendar days of receipt of notice of any such Proceeding under Section 14(a) above. The Company shall not, without the prior written consent of Indemnitee, consent to the entry of any judgment against Indemnitee or enter into any settlement or compromise which (i) includes an admission of fault of Indemnitee or (ii) does not include, as an unconditional term thereof, the full release of Indemnitee from all liability in respect of such Proceeding, which release shall be in form and substance reasonably satisfactory to Indemnitee. This Section 14(b) shall not apply to a Proceeding brought by Indemnitee under Section 13(a) above or pursuant to Section 22 below.

(c) Indemnitee’s Right to Counsel. Notwithstanding the provisions of Section 14(b) above, if in a Proceeding to which Indemnitee is a party by reason of Indemnitee’s Corporate Status, (i) Indemnitee reasonably concludes that he or she may have separate defenses or counterclaims to assert with respect to any issue which may not be consistent with the position of other defendants in such Proceeding, (ii) a conflict of interest or potential conflict of interest exists between Indemnitee and the Company, or (iii) if the Company fails to assume the defense of such proceeding in a timely manner, Indemnitee shall be entitled to be represented by a separate legal counsel of Indemnitee’s choice at the expense of the Company. In addition, if the Company fails to comply with any of its obligations under this Agreement or in the event that the Company or any other person takes any action to declare this Agreement void or unenforceable, or institutes any action, suit or proceeding to deny or to recover from Indemnitee the benefits intended to be provided to Indemnitee hereunder, Indemnitee shall have the right to retain a counsel of Indemnitee’s choice, at the expense of the Company, to represent Indemnitee in connection with any such matter.

15. Representations and Warranties of the Company. The Company hereby represents and warrants to Indemnitee as follows:

(a) Authority. The Company has all necessary power and authority to enter into, and be bound by the terms of, this Agreement, and the execution, delivery and performance of the undertakings contemplated by this Agreement have been duly authorized by the Company.

(b) Enforceability. This Agreement, when executed and delivered by the Company in accordance with the provisions hereof, shall be a legal, valid and binding obligation of the Company, enforceable against the Company in accordance with its terms, except as such enforceability may be limited by applicable bankruptcy, insolvency, moratorium, reorganization or similar laws affecting the enforcement of creditors’ rights generally.

16. Insurance.

(a) For the duration of Indemnitee’s service as a director and/or officer of the Company, and thereafter for so long as Indemnitee shall be subject to any pending or possible liability or expense for which indemnification may be provided under this Agreement, the Company shall use commercially reasonable efforts (taking into account the scope and amount of coverage available relative to the cost thereof) to cause to be maintained in effect policies of directors’ and officers’ liability insurance providing coverage for directors and/or officers of the Company that is at least substantially comparable in scope and amount to that provided by the Company’s current policies of directors’ and officers’ liability insurance. In all policies of directors’ and officers’ liability insurance obtained by the Company, Indemnitee shall be named as an insured in such a manner as to provide Indemnitee the same rights and benefits, subject to the same limitations, as are accorded to the Company’s directors and officers most favorably insured by such policy. The Company may, but shall not be required to, create a trust fund, grant a security interest or use other means, including without limitation a letter of credit, to ensure the payment of such amounts as may be necessary to satisfy its obligations to indemnify and advance expenses pursuant to this Agreement.

(b) In the event of and immediately upon a Change of Control, the Company (or any successor to the interests of the Company by way of merger, sale of assets, or otherwise) shall be obligated to continue, procure, and otherwise maintain in effect for a period of six (6) years from the date on which such Change in Control is effective a policy or policies of insurance (which may be a “tail” policy) (the “Change in Control Coverage”) providing Indemnitee with coverage for losses from alleged wrongful acts occurring on or before the effective date of the Change in Control. If such insurance is in place immediately prior to the Change in Control, then the Change of Control Coverage shall contain limits, retentions or deductibles, terms and exclusions that are no less favorable to Indemnitee than those set forth above. Each policy evidencing the Change of Control Coverage shall be non-cancellable by the insurer except for non-payment of premium. No such policy shall contain any provision that limits or impacts adversely any right or privilege of Indemnitee given this agreement

17. Contract Rights Not Exclusive. The rights to payment of Indemnifiable Amounts and advancement of indemnifiable Expenses provided by this Agreement shall be in addition to, but not exclusive of, any other rights which Indemnitee may have at any time under applicable law, the Company’s Certificate of Incorporation or Bylaws, or any other agreement, vote of stockholders or directors (or a committee of directors), or otherwise, both as to action in Indemnitee’s official capacity and as to action in any other capacity as a result of Indemnitee’s serving as a director of the Company.

18. Successors. This Agreement shall be (a) binding upon all successors and assigns of the Company (including any transferee of all or a substantial portion of the business, stock and/or assets of the Company and any direct or indirect successor by merger or consolidation or otherwise by operation of law) and (b) binding on and shall inure to the benefit of the heirs, personal representatives, executors and administrators of Indemnitee. This Agreement shall continue for the benefit of Indemnitee and such heirs, personal representatives, executors and administrators after Indemnitee has ceased to have Corporate Status.

19. Subrogation. In the event of any payment of Indemnifiable Amounts under this Agreement, the Company shall be subrogated to the extent of such payment to all of the rights of contribution or recovery of Indemnitee against other persons, and Indemnitee shall take, at the request of the Company, all reasonable action necessary to secure such rights, including the execution of such documents as are necessary to enable the Company to bring suit to enforce such rights.

20. Change in Law. To the extent that a change in Delaware law (whether by statute or judicial decision) shall permit broader indemnification or advancement of expenses than is provided under the terms of the Bylaws and this Agreement, Indemnitee shall be entitled to such broader indemnification and advancements, and this Agreement shall be deemed to be amended to such extent.

21. Severability. Whenever possible, each provision of this Agreement shall be interpreted in such a manner as to be effective and valid under applicable law, but if any provision of this Agreement, or any clause thereof, shall be determined by a court of competent jurisdiction to be illegal, invalid or unenforceable, in whole or in part, such provision or clause shall be limited or modified in its application to the minimum extent necessary to make such provision or clause valid, legal and enforceable, and the remaining provisions and clauses of this Agreement shall remain fully enforceable and binding on the

parties.

22. Indemnitee as Plaintiff. Except as provided in Section 13(c) of this Agreement and in the next sentence, Indemnitee shall not be entitled to payment of Indemnifiable Amounts or advancement of indemnifiable Expenses with respect to any Proceeding brought by Indemnitee against the Company, any Entity which it controls, any director or officer thereof, or any third party, unless the board of directors of the Company has consented to the initiation of such Proceeding. This Section 22 shall not apply to counterclaims or affirmative defenses asserted by Indemnitee in an action brought against Indemnitee.

23. Modifications and Waiver. Except as provided in Section 20 above with respect to changes in Delaware law which broaden the right of Indemnitee to be indemnified by the Company, no supplement, modification or amendment of this Agreement shall be binding unless executed in writing by each of the parties hereto. No waiver of any of the provisions of this Agreement shall be deemed or

shall constitute a waiver of any other provisions of this Agreement (whether or not similar), nor shall such waiver constitute a continuing waiver.

24. General Notices. All notices, requests, demands and other communications hereunder shall be in writing and shall be deemed to have been duly given (a) when delivered by hand, (b) when transmitted by facsimile and receipt is acknowledged, or (c) if mailed by certified or registered mail with postage prepaid, on the third business day after the date on which it is so mailed:

| |

(i) If to Indemnitee, to: |

DIRECTOR INFORMATION

ADDRESS

ADDRESS

|

| |

|

|

| |

(ii) If to the Company, to: |

Majesco Entertainment Company

South Plainfield, NJ 07080

Telephone: 732-225-8910

Fax: 732-601-4925

Attention: Legal Department

|

or to such other address as may have been furnished in the same manner by any party to the others.

25. Governing Law; Consent to Jurisdiction. This Agreement shall be governed by and construed in accordance with the laws of the State of Delaware without regard to its rules of conflict of laws. Each of the Company and the Indemnitee hereby irrevocably and unconditionally consents to submit to the exclusive jurisdiction of the Delaware Chancery Court and the courts of the United States of America located in the State of Delaware (the “Delaware Courts”) for any litigation arising out of or relating to this Agreement and the transactions contemplated hereby (and agrees not to commence any litigation relating thereto except in such courts), waives any objection to the laying of venue of any such litigation in the Delaware Courts and agrees not to plead or claim in any Delaware Court that such litigation brought therein has been brought in an inconvenient forum.

IN WITNESS WHEREOF, the parties hereto have executed this Personal Indemnification Agreement as of the day and year first above written.

| INSERT NAME |

|

MAJESCO ENTERTAINMENT

COMPANY

|

| |

|

|

| ______________________________ |

|

By: _____________________________

Name: ___________________________

Title: ____________________________

|

Exhibit 10.2

SEPARATION AGREEMENT

THIS SEPARATION AGREEMENT (the “Agreement”) is entered into as of the 27th day of July, 2015 by and between Jesse Sutton (“Sutton”) and Majesco Entertainment Company, a Delaware corporation (the “Company”).

WHEREAS, Sutton is employed as the Chief Executive Officer of the Company pursuant to the Employment Agreement dated as of January 8, 2009, as amended (the “Sutton Employment Agreement”); and

WHEREAS, the Company and Sutton desire to enter into this Agreement providing for (i) Sutton’s amicable resignation from the Company’s employment, (ii) to provide for a payment to Sutton for continued services as a consultant following termination in order to assure a smooth transition and (iii) to provide for the transfer to Sutton of all of the membership interests in Zift Interactive LLC a Nevada limited liability company (“Zift”) and wholly owned subsidiary of the Company which on the closing date of such transaction will own certain assets and have certain rights to distribute certain retail video games previously developed or in development, and will assume certain liabilities of the Company relating to the Company’s retail sale of video games business and indemnify the Company therefore (the “Retail Business”) which assets and liabilities are set forth on Exhibits “A” and “B” attached hereto, as may be amended with the mutual agreement of the Company and Sutton1 (the “Zift Transaction”).

NOW, THEREFORE, in consideration of the mutual covenants and agreements contained herein and for other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, and intending to be legally bound, the parties hereby agree as follows:

1. Termination Date. Sutton acknowledges that his last day of employment with the Company will be July 27, 2015, or such other later date mutually agreed upon between the Company and Sutton (the “Termination Date”). Sutton hereby resigns as the Company’s Chief Executive Officer. Sutton further understands and agrees that, as of the Termination Date, he will be no longer authorized to conduct any business on behalf of the Company as an executive or to hold himself out as an officer of the Company or its subsidiaries (the “Subsidiaries”), except as otherwise provided herein. Any and all positions and/or titles held by Sutton with the Company or any Subsidiaries of the Company will be deemed to have been resigned as of the Termination Date, except as otherwise provided herein.

2. Severance Payment. Provided that Sutton: continues to perform the consulting services to the Company heretofore provided the Company shall pay or provide to Sutton the following benefits:

(i) Fifty (50%) percent of the Net Monthly Revenues generated by the Company from the Download Business (as defined below), but in no event more than $10,000 per month payable on or before the 15th day of the immediately succeeding month which payment shall be accompanied by a statement of Net Monthly Revenues for the prior month (the “Monthly Payment Amount”);

(ii) The Company shall continue its contribution towards Sutton’s health care benefits on the same basis as immediately prior to the Termination Date, except as provided below, for twelve (12) months following the Termination Date. During the period the Company provides Sutton with this coverage, an amount equal to the applicable COBRA premiums (or such other amounts as may be required by law) will be included in Sutton’s income for tax purposes to the extent required by applicable law and the Company may withhold taxes from Sutton’s other payments. Notwithstanding the foregoing, the Company shall not be required to provide any health care benefit otherwise receivable by Sutton if Sutton is eligible to be covered by an equivalent benefit (at the same cost to Sutton, if any) for another source. Any such benefit made available to Sutton shall be reported to the Company; and

(iii) on the Termination Date, all restricted stock awards and/or stock option grants held by Sutton on the Termination Date shall, other than those grants made in December 2014 which shall remain subject to their applicable vesting provisions within the period following the Termination Date originally contemplated therein, as may be extended from time to time, vest in full provided that such awards and grants shall be subject to the following amendment: Sutton shall have a period of eighteen (18) months from the Termination Date to exercise any previously issued such stock options, but such eighteen (18) month period shall not extend the original expiration date of any such options.

Net Monthly Revenues shall be determined in good faith by the management of the Company but will be substantially calculated by subtracting monthly salaries of management, employees and consultants who are dedicated to the Download Business, operating expenses solely of the Download Business, including the costs associated with testing game development, royalty payments payable to third parties, cost of sales, rebates, returns and exchanges from gross monthly revenues generated from the Download Business, and an allocable share determined in the sole discretion of the chief accounting officer, of parent company general and administrative costs, including, legal, accounting, insurance, and public company costs. In the event that Sutton disputes the calculation of Net Monthly Revenues, the Company’s independent certified public accountants shall make such calculation which shall be binding, absent manifest error.

Sutton shall be responsible for the payment of all payroll taxes, Medicare and other taxes, and shall indemnify the Company with respect to the payment of all such amounts. Except as otherwise set forth herein, Sutton will not be entitled to payment of any bonus, vacation or other incentive compensation. Any tax, penalties or interest as a result thereof shall be the sole responsibility of Sutton who agrees to indemnify and hold harmless the Company with respect thereto

3. Consulting Services. From the period beginning on the Termination Date and ending twenty four (24) months thereafter (the “Term”), and as an ongoing condition of payment of the Monthly Payment amounts and other consideration provided for herein, Sutton agrees that he shall provide consulting and support services with respect to and in connection with the operation of the Company’s online and mobile downloadable digital games business, including new and existing titles (the “Download Business”), as reasonably requested by the Company (with no minimum time requirement to earn the Monthly Payment Amount) including, if requested, the promotion and management thereof and the introduction and launch of all new downloadable titles in process or developed in the future, and provide general business and consulting services to the Company to assist in all transitional needs and activities of the Company upon the reasonable request of the Company in support of management of the Company.

4. Sutton’s Release. In consideration for the payments and benefits described above and for other good and valuable consideration, Sutton hereby releases and forever discharges the Company and its Subsidiaries, as well as its affiliates and all of their respective directors, officers, employees, members, agents, and attorneys, of and from any and all manner of actions and causes of action, suits, debts, claims, and demands whatsoever, in law or equity, known or unknown, asserted or unasserted, which he ever had, now has, or hereafter may have on account of his employment with the Company, the termination of his employment with the Company, and/or any other fact, matter, incident, claim, injury, event, circumstance, happening, occurrence, and/or thing of any kind or nature which arose or occurred prior to the date when he executes this Agreement, including, but not limited to, any and all claims for wrongful termination; breach of any implied or express employment contract; unpaid compensation of any kind; breach of any fiduciary duty and/or duty of loyalty; breach of any implied covenant of good faith and fair dealing; negligent or intentional infliction of emotional distress; defamation; fraud; unlawful discrimination, harassment; or retaliation based upon age, race, sex, gender, sexual orientation, marital status, religion, national origin, medical condition, disability, handicap, or otherwise; any and all claims arising under arising under Title VII of the Civil Rights Act of 1964, as amended (“Title VII”); the Equal Pay Act of 1963, as amended (“EPA”); the Age Discrimination in Employment Act of 1967, as amended (“ADEA”); the Americans with Disabilities Act of 1990, as amended (“ADA”); the Family and Medical Leave Act, as amended (“FMLA”); the Employee Retirement Income Security Act of 1974, as amended ("ERISA"); the Sarbanes-Oxley Act of 2002, as amended (“SOX”); the Worker Adjustment and Retraining Notification Act of 1988, as amended (“WARN”); and/or any other federal, state, or local law(s) or regulation(s); any and all claims for damages of any nature, including compensatory, general, special, or punitive; and any and all claims for costs, fees, or other expenses, including attorneys' fees, incurred in any of these matters (the “Release”). The Company acknowledges, however, that Sutton does not release or waive any rights to contribution or indemnity under this Agreement to which he may otherwise be entitled. The Company also acknowledges that Sutton does not release or waive any claims, and that he retains any rights he may have, to any vested 401(k) monies (if any) or benefits (if any), or any other benefit entitlement that is vested as of the Termination Date pursuant to the terms of any Company-sponsored benefit plan governed by ERISA. Nothing contained herein shall release the Company from its obligations set forth in this Agreement or the Company’s obligation with respect to indemnification of Sutton as a former officer and/or director of the Company or for the advancement of expenses related thereto under applicable law. Sutton hereby represents there are no known claims known or threatened against the Company, other than have been previously disclosed to the Company.

5. Company Release. In exchange for the consideration provided for in this Agreement, the Company, its subsidiaries and affiliates irrevocably and unconditionally releases Sutton of and from all claims, demands, causes of actions, suits, debts, fees and liabilities of any kind whatsoever, which it had, now has or may have against Sutton, as of the date of this Agreement, in law or equity, known or unknown, asserted or unasserted by reason of any actual or alleged act, omission, transaction, practice, conduct, statement, occurrence, or any other matter. The Company represents that, as of the date of this Agreement, there are no known claims relating to Sutton. The Company agrees to indemnify Sutton against any future claims to the extent permitted under the Company’s bylaws, certificate of incorporation and federal or state law.

6. Confidential Information. Sutton understands and acknowledges that during the course of his employment by the Company and during the Term of this Agreement, he had access to Confidential Information (as defined below) of the Company. Sutton agrees that, at no time during the Term or a period of two (2) years immediately after the Term, will Sutton (a) use Confidential Information for any purpose other than in connection with services provided under this Agreement or in connection with the Retail Business or (b) disclose Confidential Information to any person or entity other than to the Company or persons or entities to whom disclosure has been authorized by the Company. As used herein, "Confidential Information" means all information of a technical or business nature relating to the Company or its affiliates, including, without limitation, trade secrets, inventions, drawings, file data, documentation, diagrams, specifications, know-how, processes, formulae, models, test results, marketing techniques and materials, marketing and development plans, price lists, pricing policies, business plans, information relating to customer or supplier identities, characteristics and agreements, financial information and projections, flow charts, software in various stages of development, source codes, object codes, research and development procedures and employee files and information; provided, however, that "Confidential Information" shall not include any information that (i) has entered the public domain through no action or failure to act of Sutton; (ii) was already lawfully in Sutton's possession without any obligation of confidentiality; (iii) subsequent to disclosure hereunder is obtained by Sutton on a non-confidential basis from a third party who has the right to disclose such information to Sutton; or (iv) is ordered to be or otherwise required to be disclosed by Sutton by a court of law or other governmental body; provided, however, that the Company is notified of such order or requirement and given a reasonable opportunity to intervene.

7. Zift Transaction. Promptly upon the execution hereof the parties shall negotiate in good faith the agreements related to the Zift Transaction and the Zift Transaction shall be closed on or before July 31, 2015. Sutton shall not pay any additional consideration in connection with the Zift Transaction. In connection with the Zift Transaction the Company shall grant to Zift an exclusive worldwide right to distribute the retail video games for a term of at least one year under all of the Company’s publishing licenses in exchange for a fee of 5% of the net revenue of such retail sales by Zift. The assets of Zift shall include $800,000 in working capital in the form of cash of which $400,000 shall be on deposit with Zift on the closing date and the remaining $400,000 shall be funded by the Company to Zift in 12 equal consecutive monthly installments of $33,333.33 each month on the first day of each month commencing August 1, 2015 (the ‘Deferred Payments”). The Company shall be indemnified against any assumed liabilities (See Exhibit B) and the Company shall have the full right and authority to withhold from the Deferred Payments, any and all assumed liabilities set forth on Exhibit B asserted against the Company (or any of its subsidiaries) at any time asserted against the Company, regardless of the merit or enforceability thereof. Any such withheld payment shall be paid to Sutton if the claim is paid by Zift or the money is ultimately found not to be owed.

8. Applicable Law and Dispute Resolution. Except as to matters preempted by ERISA or other laws of the United States of America, this Agreement shall be interpreted solely pursuant to the laws of the State of New York, exclusive of its conflicts of laws principles. Each of the parties hereto irrevocably submits to the exclusive jurisdiction of the courts of the State of New York, for the purposes of any suit, action, or other proceeding arising out of this Agreement or any transaction contemplated hereby. Any dispute arising out of or relating to this contract, including the breach, termination or validity thereof, shall be finally resolved by arbitration in accordance with the International Institute for Conflict Prevention and Resolution (“CPR”) Rules for Administered Arbitration (the “Administered Rules” or “Rules”) by three arbitrators, of whom each party shall designate one, with the third arbitrator to be appointed by CPR. The arbitration shall be governed by the Federal Arbitration Act, 9 U.S.C. §§ 1 et seq., and judgment upon the award rendered by the arbitrator(s) may be entered by any court having jurisdiction thereof. The place of the arbitration shall be New York, New York.

9. Non-Competition; Non-Solicitation; Non-Disparagement.

(i) Non-Compete. Sutton hereby covenants and agrees that Sutton will not, without the prior written consent of the Company, directly or indirectly, on her own behalf or in the service or on behalf of others, whether or not for compensation, engage in any business activity, or have any interest in any person, firm, corporation or business, through a subsidiary or parent entity or other entity (whether as a shareholder, agent, joint venturer, security holder, trustee, partner, consultant, creditor lending credit or money for the purpose of establishing or operating any such business, partner or otherwise) with any Competing Business in the Covered Area. For the purpose of this Section 8 (i) “Competing Business” means any mobile or digital downloadable gaming business and (ii) “Covered Area” means all geographical areas of the United States and foreign jurisdictions where Company then has offices and/or sells its products directly or indirectly through distributors and/or other sales agents. Notwithstanding the foregoing, Sutton may own shares of companies whose securities are publicly traded, so long as ownership of such securities do not constitute more than one percent (1%) of the outstanding securities of any such company.

(ii) Non-Solicitation and Non-Disparagement. Sutton further agrees that Sutton will not divert any business of the Competing Business of the Company and/or its affiliates or any customers or suppliers of the Company and/or the Company’s and/or its affiliates’ with respect to the Competing Business to any other person, entity or competitor, or induce or attempt to induce, directly or indirectly, any person to leave his or her employment with the Company and/or its affiliates. Sutton and the Company each agree that he and it shall not malign, defame, blame, or otherwise disparage the other, either publicly or privately regarding the past or future business or personal affairs of Sutton, the Company or any other officer, director or employee of the Company.

10. Voting of Securities. During the Term, Sutton hereby agrees that at every meeting of the shareholders of the Company called, and at every adjournment or postponement thereof, Sutton shall, or shall cause the holder of record on any applicable record date to, include all shares of the Company’s common stock beneficially owned by Sutton in any computation for purposes of establishing a quorum at any such meeting and vote such shares beneficially owned by Sutton in favor of any matter submitted to the Company’s shareholders for approval by the Company’s Board of Directors.

11. Entire Agreement. This Agreement may not be changed or altered, except by a writing signed by both parties. Until such time as this Agreement has been executed and subscribed by both parties hereto: (i) its terms and conditions and any discussions relating thereto, without any exception whatsoever, shall not be binding nor enforceable for any purpose upon any party; and (ii) no provision contained herein shall be construed as an inducement to act or to withhold an action, or be relied upon as such. This Agreement constitutes an integrated, written contract, expressing the entire agreement and understanding between the parties with respect to the subject matter hereof and supersedes any and all prior agreements and understandings, oral or written, between the parties.

12. Assignment. Sutton and the Company has not assigned or transferred any claim he or it is releasing, nor has he purported to do so. If any provision in this Agreement is found to be unenforceable, all other provisions will remain fully enforceable. This Agreement binds each parties heirs, administrators, representatives, executors, successors, and assigns, and will insure to the benefit of all Released Parties and Sutton and their respective heirs, administrators, representatives, executors, successors, and assigns.

13. Acknowledgement. Sutton acknowledges that he: (a) has carefully read this Agreement in its entirety; (b) has been advised to consult and has been provided with an opportunity to consult with legal counsel of his choosing in connection with this Agreement; (c) fully understands the significance of all of the terms and conditions of this Agreement and has discussed them with his independent legal counsel or has been provided with a reasonable opportunity to do so; (d) has had answered to his satisfaction any questions asked with regard to the meaning and significance of any of the provisions of this Agreement; (e) is signing this Agreement voluntarily and of his own free will and agrees to abide by all the terms and conditions contained herein; and (f) following his execution of this Agreement, he has seven (7) days in which to revoke his release and that, if he chooses not to so revoke, this Agreement shall become effective and enforceable on the eighth (8th) day following his execution of this Agreement (the “Effective Date”). To revoke the Release, Sutton understands that he must give a written revocation to the Company, within the seven (7)-day period following the date of execution of this Agreement. If the last day of the revocation period is a Saturday, Sunday, or legal holiday in the State of New York, then the revocation period shall not expire until the next following day which is not a Saturday, Sunday or legal holiday. If Sutton revokes the Release, this Agreement will not become effective or enforceable and Sutton acknowledges and agrees that he will not be entitled to any benefits hereunder, including in Section 2.

14. Notices. For the purposes of this Agreement, notices, demands and all other communications provided for in this Agreement shall be in writing and shall be delivered (i) personally, (ii) by first class mail, certified, return receipt requested, postage prepaid, (iii) by overnight courier, with acknowledged receipt, or (iv) by facsimile transmission followed by delivery by first class mail or by overnight courier, in the manner provided for in this Section, and properly addressed as follows:

| |

If to the Company: |

Majesco Entertainment Company

404I-T Hadley Road

S. Plainfield, NJ 07080

ATT: Trent Davis, Chairman

Fax:

|

| |

|

|

| |

With a copy to:

|

Thomson Hine LLP

335 Madison Avenue

12th Floor

New York, NY 10017

Fax: 212-344-6101

|

| |

|

|

| |

If to Sutton: Mr. Jesse Sutton

|

[_____] |

| |

|

|

| |

With a copy to:

|

Wachtel Missry LLP

One Dag Hammarskjold Plaze

885 Second Avenue

New York, NY 10017

Att: Scott Lesser

Fax: 212-909-9465

|

15. Counterparts. This Agreement may be executed in one or more counterparts, all of which shall be considered one and the same agreement, and shall become effective when one or more such counterparts have been signed by each of the parties and delivered to the other parties. In the event that any signature is delivered by facsimile transmission or by an e-mail which contains a portable document format (.pdf) file of an executed signature page, such signature page shall create a valid and binding obligation of the party executing (or on whose behalf such signature is executed) with the same force and effect as if such signature page were an original thereof.

13. Counsel Representation. The Parties hereto further agree that this Agreement has been carefully read and fully understood by them. Each Party hereby represents, warrants, and agrees that he was represented by counsel in connection with the Agreement, has had the opportunity to consult with counsel about the Agreement, has carefully read and considered the terms of this Agreement, and fully understands the same. Sutton represents, warrants and acknowledges that he has retained independent counsel and that counsel to the Company does not represent Sutton.

IN WITNESS HEREOF, the parties hereby enter into this Agreement and affix their signatures as of the date first above written.

| MAJESCO ENTERTAINMENT COMPANY |

| |

| By: /s/ Mohit Bhansali |

| Name: Mohit Bhansali |

| Title: Director |

| |

| /s/ Jesse Sutton |

| Jesse Sutton |

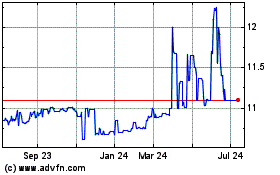

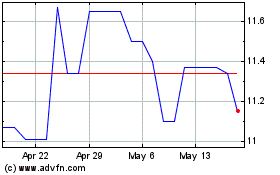

Corner Growth Acquisition (NASDAQ:COOL)

Historical Stock Chart

From Mar 2024 to Apr 2024

Corner Growth Acquisition (NASDAQ:COOL)

Historical Stock Chart

From Apr 2023 to Apr 2024