|

| | |

UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 |

FORM 8-K |

CURRENT REPORT |

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

| | |

Date of Report (Date of earliest event reported) July 23, 2015 |

| | |

AMERICAN NATIONAL BANKSHARES INC. |

(Exact name of registrant as specified in its charter) |

| | |

Virginia | 0-12820 | 54-1284688 |

(State or other jurisdiction of incorporation) | (Commission File Number) | (I.R.S. Employer Identification No.) |

| | |

| | |

| | |

| | |

Registrant’s telephone number, including area code: 434-792-5111 |

| | |

| | |

Not Applicable |

(Former name or former address, if changed since last report.) |

| | |

|

| | |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions: |

þ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) | |

o | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) | |

o | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) | |

o | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13a-4(c)) | |

Item 2.02 Results of Operations and Financial Condition

On July 23, 2015, American National Bankshares Inc. ("the Company") reports earnings for second quarter 2015.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits:

99.1 July 23, 2015 News Release

99.2 Quarterly Balance Sheets, Statements of Income, Net Interest Income Analysis and Selected Financial Data

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Date: July 24, 2015 /s/ William W. Traynham

Executive Vice President and Chief Financial Officer

|

| | | |

Date: | July 23, 2015 |

| |

Contact: | William W. Traynham, Chief Financial Officer |

| 434-773-2242 |

| traynhamw@amnb.com |

| | | |

Traded: | NASDAQ Global Select Market | Symbol: | AMNB |

AMERICAN NATIONAL BANKSHARES INC. REPORTS SECOND QUARTER 2015 EARNINGS

| |

• | Organic loan growth of $61.5 million (7.6%) over last four quarters |

| |

• | Completed integration of MainStreet BankShares, Inc. |

| |

• | Q2 2015 net income of $2.9 million and diluted EPS of $0.33 |

| |

• | Net interest margin of 3.69% for Q2 2015 |

| |

• | Average shareholders’ equity of $197 million is 12.85% of average assets |

Danville, VA -- American National Bankshares Inc. (“American National”) (NASDAQ: AMNB), parent company of American National Bank and Trust Company, today announced twelve month organic loan growth of 7.6%, the completion of the integration of MainStreet BankShares, Inc., and $2,880,000 net income for the second quarter 2015.

The net income of $2,880,000 compared to $3,233,000 for the second quarter of 2014, is a $353,000 or 10.9% decrease. Basic and diluted net income per common share was $0.33 for the 2015 quarter compared to $0.41 for the 2014 quarter. Net income for the second quarter of 2015 produced a return on average assets of 0.75%, a return on average equity of 5.86%, and a return on average tangible equity of 8.26%.

Net income for the first six months of 2015 was $6,395,000 compared to $6,683,000 for the comparable period of 2014, a $288,000 or 4.3% decrease. Basic and diluted net income per common share was $0.73 for the 2015 period compared to $0.85 for the 2014 period.

The 2015 quarter and six month period were negatively impacted by nonrecurring, merger related costs associated with the January acquisition of MainStreet

BankShares, Inc. (“MainStreet”). Merger related costs for the 2015 quarter were $1,502,000 and for the six month period $1,861,000.

Financial Performance and Overview

Jeffrey V. Haley, President and Chief Executive Officer, reported, “One major story for early 2015 continues to be our acquisition of MainStreet and its banking subsidiary, Franklin Community Bank, N.A. (“Franklin Community Bank”). This merger closed on January 1, 2015, and we completed the operational and technology aspects of the union in mid-May. We are extremely pleased with the integration progress made during the first half of this year and we are fortunate to have the employees and customers of Franklin Community Bank as part of our growing American National corporate family.

“The merger has had a positive impact on our balance sheet and we are also seeing organic balance sheet growth in our other markets.

“At June 30, 2015, American National had $982,905,000 in loans compared to $813,057,000 at June 30, 2014, an increase of $169,848,000 or 20.9%. Of this increase, $108,326,000 or 63.8% relates directly to the MainStreet acquisition.

“Our other major story for early 2015 is organic growth. Organic loan growth over the past year was $61,522,000 or 7.6%. We are very encouraged that a combination of active business development and gradually improving local market economic conditions are beginning to result in high quality growth.

“At June 30, 2015, American National had $1,234,018,000 in deposits compared to $1,035,800,000 at June 30, 2014, an increase of $198,218,000 or 19.1%. Of this increase, $125,320,000 or 63.2% relates directly to the MainStreet acquisition. The deposit growth was strong in all categories, but most notably in non-maturity (core) deposits. We are continuously working to grow core deposits and their affiliated relationships, but the challenge in this ongoing low rate environment is to do that in a cost effective and yet competitive manner. Our cost of interest bearing deposits for the second quarter was 0.50%, compared to 0.57% for the 2014 quarter.

“On the earnings side, our net income for the second quarter was $2,880,000, down from $3,233,000 in the 2014 quarter, a decrease of $353,000 or 10.9%.

“We had several drivers that impacted the 2015 quarter compared to the 2014 quarter.

“The merger with MainStreet had a significant and positive impact to operating results by adding substantially to earning assets.

“The provision for loan loss decreased by $50,000 during the quarter. This decrease was primarily related to improving economic conditions and continuing strong asset quality metrics, but was offset by loan growth during the quarter.

“Noninterest income was higher in the 2015 quarter by $558,000 or 20.7%, related mostly to the MainStreet merger.

“Noninterest expense was higher in the 2015 quarter by $3,277,000 or 39.2%, related mostly to the merger and to merger related, nonrecurring expenses. The nonrecurring merger costs were $1,502,000 for the quarter.”

Haley concluded, “The first half of 2015 has been busy and productive for American National. The Franklin Community Bank merger in January and operational conversion in May were major accomplishments and I want to thank all people that worked so hard and successfully to make them happen.

“On another front, we are extremely pleased to see the beginning of significant organic loan growth. This is our favorite leading indicator of improving business conditions.

“American National will continue to grow its balance sheet and maintain high asset quality. Asset quality is a fundamental value for us. But, at the same time, we are constantly seeking ways to better deploy our capital. Among those ways is our ongoing stock repurchase plan, which during the quarter bought almost 52,000 shares. These efforts will continue to manifest themselves through continuing consideration of future merger and acquisition opportunities, continuing timely and economical stock repurchase activity, and an ongoing review of our dividend policy.”

Capital

American National’s capital ratios remain strong and exceed all regulatory requirements.

For the quarter ended June 30, 2015, average shareholders’ equity was 12.85% of average assets, compared to 13.22% for the quarter ended June 30, 2014.

Book value per common share was $22.43 at June 30, 2015, compared to $21.95 at June 30, 2014.

Tangible book value per common share was $16.96 at June 30, 2015, compared to $16.65 at June 30, 2014.

Credit Quality Measurements

Non-performing assets ($3,772,000 of non-performing loans and $2,113,000 of other real estate owned) represented 0.39% of total assets at June 30, 2015, compared to 0.60% at June 30, 2014.

Annualized net charge offs to average loans was six basis points (0.06%) for the 2015 second quarter, compared to zero basis points (0.00%) for the same quarter in 2014.

The allowance for loan losses as a percentage of total loans was 1.30% at June 30, 2015 compared to 1.57% at June 30, 2014. The largest driver of this decrease was the merger with MainStreet, whose loans have been marked to fair value at the merger date and whose related allowance for loan loss was eliminated in the valuation process.

Other real estate owned was $2,113,000 at June 30, 2015, compared to $2,622,000 at June 30, 2014, a decrease of $509,000 or 19.4%.

Merger related financial impact

The fair value adjustments related to our two recent mergers have had a favorable impact on net interest income and income before income tax for American National. The adjustments are summarized below (dollars in thousands):

The MainStreet merger was effective January 1, 2015; therefore, no comparative 2014 information is presented.

Net Interest Income

Net interest income before provision for loan losses increased to $12,382,000 in the second quarter of 2015 from $10,351,000 in the second quarter of 2014, an increase of $2,031,000 or 19.6%.

For the 2015 quarter, the net interest margin was 3.69% compared to 3.68% for the same quarter in 2014, an increase of one basis point (0.01%).

Provision for loan losses

Provision expense for the second quarter of 2015 was $100,000 compared to $150,000 for the second quarter of 2014.

The need for provision expense in the 2015 quarter was driven primarily by an increase in loan volume of approximately $17 million. It was partially mitigated by improving economic conditions and continuing strong asset quality metrics.

Noninterest Income

Noninterest income totaled $3,258,000 in the second quarter of 2015, compared with $2,700,000 in the second quarter of 2014, an increase of $558,000 or 20.7%. Almost all income categories showed substantial increases, most of which were related to increased transaction volumes resulting from the MainStreet transaction.

Noninterest Expense

Noninterest expense totaled $11,642,000 in the second quarter of 2015, compared to $8,365,000 in the second quarter of 2014, an increase of $3,277,000 or 39.2%.

All expense categories were impacted by the MainStreet merger and the integration of Franklin Community Bank into American National’s operations.

However, the major driver of the increase was nonrecurring, merger related expenses, related to the MainStreet acquisition, which accounted for $1,502,000 or 45.8%

of the increase. The operational conversion of Franklin Community Bank was completed in mid-May and substantially all of the related technology costs have been recognized. Accordingly, management expects no substantial expense in this category in future periods.

About American National

As of January 1, 2015, with the closing of the acquisition of MainStreet BankShares, Inc., American National Bankshares Inc. is a multi-state bank holding company with total assets of approximately $1.5 billion. Headquartered in Danville, Virginia, American National is the parent company of American National Bank and Trust Company. American National Bank is a community bank serving southern and central Virginia and north central North Carolina with 27 banking offices and two loan production offices. American National Bank and Trust Company also manages an additional $767 million of trust, investment and brokerage assets in its Trust and Investment Services Division. Additional information about the company and the bank is available on the bank's website at www.amnb.com.

Shares of American National are traded on the NASDAQ Global Select Market under the symbol "AMNB."

Forward-Looking Statements

This press release contains forward-looking statements within the meaning of federal securities laws. Certain of the statements involve significant risks and uncertainties. The statements herein are based on certain assumptions and analyses by American National and are factors it believes are appropriate in the circumstances. Actual results could differ materially from those contained in or implied by such statements for a variety of reasons including, but not limited to: changes in interest rates; changes in accounting principles, policies or guidelines; significant changes in the economic scenario; significant changes in regulatory requirements; significant changes in securities markets; and changes regarding acquisitions and dispositions. Consequently, all forward-looking statements made herein are qualified by these cautionary statements and the cautionary language in American National's most recent Form 10-K report and other documents filed with the Securities and Exchange Commission. American National does not undertake to update forward-looking statements to reflect circumstances or events that occur after the date the forward-looking statements are made.

|

| | | | | | |

American National Bankshares Inc. and Subsidiaries |

Consolidated Balance Sheets |

(Dollars in thousands, except share and per share data) |

Unaudited |

| | | | |

| | June 30 |

ASSETS | | 2015 | | 2014 |

| | | | |

Cash and due from banks | | $ 24,548 |

| | $ 21,295 |

|

Interest-bearing deposits in other banks | | 50,758 |

| | 22,948 |

|

Federal funds sold | | 408 |

| | 0 |

|

| | | | |

Securities available for sale, at fair value | | 355,595 |

| | 349,719 |

|

Restricted stock, at cost | | 5,581 |

| | 4,998 |

|

Loans held for sale | | 2,720 |

| | 118 |

|

| | | | |

Loans | | 982,905 |

| | 813,057 |

|

Less allowance for loan losses | | (12,793) |

| | (12,763) |

|

Net Loans | | 970,112 |

| | 800,294 |

|

| | | | |

Premises and equipment, net | | 24,182 |

| | 23,083 |

|

Other real estate owned, net | | 2,113 |

| | 2,622 |

|

Goodwill | | 44,210 |

| | 39,043 |

|

Core deposit intangibles, net | | 3,283 |

| | 2,498 |

|

Bank owned life insurance | | 17,376 |

| | 14,945 |

|

Accrued interest receivable and other assets | | 23,470 |

| | 19,085 |

|

| | | | |

Total assets | | $ 1,524,356 |

| | $ 1,300,648 |

|

| | | | |

| | | | |

Liabilities | | | | |

Demand deposits -- noninterest-bearing | | $ 294,342 |

| | $ 228,588 |

|

Demand deposits -- interest-bearing | | 239,582 |

| | 189,700 |

|

Money market deposits | | 190,799 |

| | 165,090 |

|

Savings deposits | | 109,732 |

| | 88,539 |

|

Time deposits | | 399,563 |

| | 363,883 |

|

Total deposits | | 1,234,018 |

| | 1,035,800 |

|

| | | | |

Short-term borrowings: | | | | |

Customer repurchase agreements | | 50,123 |

| | 38,420 |

|

Other short-term borrowings | | 0 |

| | 12,000 |

|

Long-term borrowings | | 9,947 |

| | 9,924 |

|

Trust preferred capital notes | | 27,571 |

| | 27,470 |

|

Accrued interest payable and other liabilities | | 7,814 |

| | 4,951 |

|

Total liabilities | | 1,329,473 |

| | 1,128,565 |

|

| | | | |

Shareholders' equity | | | | |

Preferred stock, $5 par, 2,000,000 shares authorized, | | | | |

none outstanding | | — |

| | — |

|

Common stock, $1 par, 20,000,000 shares authorized, | | | | |

8,688,480 shares outstanding at June 30, 2015 and | | | | |

|

| | | | | | |

7,840,132 shares outstanding at June 30, 2014 | | 8,671 |

| | 7,840 |

|

Capital in excess of par value | | 76,826 |

| | 56,944 |

|

Retained earnings | | 106,984 |

| | 102,152 |

|

Accumulated other comprehensive income, net | | 2,402 |

| | 5,147 |

|

Total shareholders' equity | | 194,883 |

| | 172,083 |

|

| | | | |

Total liabilities and shareholders' equity | | $ 1,524,356 |

| | $ 1,300,648 |

|

|

| | | | | | | | | | |

American National Bankshares Inc. and Subsidiaries |

Consolidated Statements of Income |

(Dollars in thousands, except share and per share data) |

Unaudited |

| | | | | | | | |

| | Three Months Ended | | Six Months Ended |

| | June 30 | | June 30 |

| | 2015 | | 2014 | | 2015 | | 2014 |

Interest and Dividend Income: | | | | | | | | |

Interest and fees on loans | | $ 11,767 | | $ 9,687 |

| | $ 23,537 | | $ 19,534 |

|

Interest on federal funds sold | | 1 | | — |

| | 5 | | — |

|

Interest and dividends on securities: | | | | | | | | |

Taxable | | 994 | | 968 |

| | 1,969 | | 1,932 |

|

Tax-exempt | | 940 | | 1,016 |

| | 1,900 | | 2,051 |

|

Dividends | | 85 | | 74 |

| | 167 | | 149 |

|

Other interest income | | 50 | | 35 |

| | 98 | | 68 |

|

Total interest and dividend income | | 13,837 | | 11,780 |

| | 27,676 | | 23,734 |

|

| | | | | | | | |

Interest Expense: | | | | | | | | |

Interest on deposits | | 1,184 | | 1,161 |

| | 2,378 | | 2,390 |

|

Interest on short-term borrowings | | 2 | | 2 |

| | 5 | | 4 |

|

Interest on long-term borrowings | | 81 | | 81 |

| | 161 | | 161 |

|

Interest on trust preferred capital notes | | 188 | | 185 |

| | 372 | | 369 |

|

Total interest expense | | 1,455 | | 1,429 |

| | 2,916 | | 2,924 |

|

| | | | | | | | |

Net Interest Income | | 12,382 | | 10,351 |

| | 24,760 | | 20,810 |

|

Provision for loan losses | | 100 | | 150 |

| | 700 | | 150 |

|

| | | | | | | | |

Net Interest Income After Provision | | | | | | | | |

for Loan Losses | | 12,282 | | 10,201 |

| | 24,060 | | 20,660 |

|

| | | | | | | | |

Noninterest Income: | | | | | | | | |

Trust fees | | 1,005 | | 1,017 |

| | 1,957 | | 2,139 |

|

Service charges on deposit accounts | | 525 | | 431 |

| | 1,022 | | 844 |

|

Other fees and commissions | | 607 | | 493 |

| | 1,195 | | 937 |

|

Mortgage banking income | | 389 | | 275 |

| | 611 | | 538 |

|

Securities gains, net | | 237 | | 150 |

| | 547 | | 189 |

|

Other | | 495 | | 334 |

| | 1,082 | | 756 |

|

Total noninterest income | | 3,258 | | 2,700 |

| | 6,414 | | 5,403 |

|

| | | | | | | | |

Noninterest Expense: | | | | | | | | |

Salaries | | 4,308 | | 3,638 |

| | 8,455 | | 7,176 |

|

Employee benefits | | 1,111 | | 847 |

| | 2,186 | | 1,822 |

|

Occupancy and equipment | | 1,024 | | 910 |

| | 2,196 | | 1,846 |

|

FDIC assessment | | 195 | | 165 |

| | 380 | | 329 |

|

Bank franchise tax | | 220 | | 231 |

| | 455 | | 453 |

|

|

| | | | | | | | | | |

Core deposit intangible amortization | | 300 | | 330 |

| | 601 | | 661 |

|

Data processing | | 483 | | 345 |

| | 945 | | 693 |

|

Software | | 277 | | 235 |

| | 560 | | 497 |

|

Other real estate owned, net | | 133 | | (9) |

| | 186 | | 7 |

|

Merger related expenses | | 1,502 | | 0 |

| | 1,861 | | 0 |

|

Other | | 2,089 | | 1,673 |

| | 3,864 | | 3,304 |

|

Total noninterest expense | | 11,642 | | 8,365 |

| | 21,689 | | 16,788 |

|

| | | | | | | | |

Income Before Income Taxes | | 3,898 | | 4,536 |

| | 8,785 | | 9,275 |

|

Income Taxes | | 1,018 | | 1,303 |

| | 2,390 | | 2,592 |

|

Net Income | | $ 2,880 | | $ 3,233 |

| | $ 6,395 | | $ 6,683 |

|

| | | | | | | | |

Net Income Per Common Share: | | | | | | | | |

Basic | | $ 0.33 | | $ 0.41 |

| | $ 0.73 | | $ 0.85 |

|

Diluted | | $ 0.33 | | $ 0.41 |

| | $ 0.73 | | $ 0.85 |

|

Weighted Average Common Shares Outstanding: | | | | | | | |

Basic | | 8,707,504 | | 7,872,079 |

| | 8,713,528 | | 7,886,232 |

|

Diluted | | 8,715,934 | | 7,879,854 |

| | 8,722,266 | | 7,896,541 |

|

|

| | | | | | | | | | | | | | | | | | | | | | | | |

American National Bankshares Inc. and Subsidiaries | | | | | | | | | | |

Financial Highlights | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

(In thousands, except share, ratio and | | | | | | | | | | | |

nonfinancial data, unaudited) | 2nd Qtr | | 1st Qtr | | 2nd Qtr | | | YTD | | YTD | |

| | | | 2,015 | | 2,015 | | 2,014 | | | 2,015 | | 2,014 | |

EARNINGS | | | | | | | | | | | | | |

Interest income | | $ | 13,837 |

| | $ | 13,839 |

| | $ | 11,780 |

| | | $ | 27,676 |

| | $ | 23,734 |

| |

Interest expense | | 1,455 |

| | 1,461 |

| | 1,429 |

| | | 2,916 |

| | 2,924 |

| |

Net interest income | 12,382 |

| | 12,378 |

| | 10,351 |

| | | 24,760 |

| | 20,810 |

| |

Provision for loan losses | 100 |

| | 600 |

| | 150 |

| | | 700 |

| | 150 |

| |

Noninterest income | 3,258 |

| | 3,156 |

| | 2,700 |

| | | 6,414 |

| | 5,403 |

| |

Noninterest expense | 11,642 |

| | 10,047 |

| | 8,365 |

| | | 21,689 |

| | 16,788 |

| |

Income taxes | | 1,018 |

| | 1,372 |

| | 1,303 |

| | | 2,390 |

| | 2,592 |

| |

Net income | | 2,880 |

| | 3,515 |

| | 3,233 |

| | | 6,395 |

| | 6,683 |

| |

| | | | | | | | | | | | | | |

PER COMMON SHARE | | | | | | | | | | | |

Income per share - basic | $ | 0.33 |

| | $ | 0.40 |

| | $ | 0.41 |

| | | $ | 0.73 |

| | $ | 0.85 |

| |

Income per share - diluted | 0.33 |

| | 0.40 |

| | 0.41 |

| | | 0.73 |

| | 0.85 |

| |

Cash dividends paid | 0.23 |

| | 0.23 |

| | 0.23 |

| | | 0.46 |

| | 0.46 |

| |

Book value per share (a) | 22.43 |

| | 22.58 |

| | 21.95 |

| | | 22.43 |

| | 21.95 |

| |

Book value per share - tangible (a) (b) | 16.96 |

| | 17.09 |

| | 16.65 |

| | | 16.96 |

| | 16.65 |

| |

Closing market price | 23.81 |

| | 22.58 |

| | 21.73 |

| | | 23.81 |

| | 21.73 |

| |

| | | | | | | | | | | | | | |

FINANCIAL RATIOS | | | | | | | | | | | | |

Return on average assets | 0.75 |

| % | 0.93 |

| % | 1.00 |

| % | 0.84 |

| % | 1.03 |

| % |

Return on average equity | 5.86 |

| | 7.17 |

| | 7.53 |

| | | 6.51 |

| | 7.82 |

| |

Return on average tangible equity (c) | 8.26 |

| | 10.02 |

| | 10.67 |

| | | 9.14 |

| | 11.10 |

| |

Average equity to average assets | 12.85 |

| | 12.91 |

| | 13.22 |

| | | 12.88 |

| | 13.14 |

| |

Tangible equity to tangible assets (b) | 9.98 |

| | 9.98 |

| | 10.37 |

| | | 9.98 |

| | 10.37 |

| |

Net interest margin, taxable equivalent | 3.69 |

| | 3.73 |

| | 3.68 |

| | | 3.71 |

| | 3.69 |

| |

Efficiency ratio (d) | | 72.76 |

| | 63.90 |

| | 62.87 |

| | | 68.36 |

| | 62.34 |

| |

Effective tax rate | | 26.12 |

| | 28.07 |

| | 28.73 |

| | | 27.21 |

| | 27.95 |

| |

| | | | | | | | | | | | | | |

PERIOD-END BALANCES | | | | | | | | | | | |

Securities | | $ | 361,176 |

| | $ | 357,544 |

| | $ | 354,717 |

| | | $ | 361,176 |

| | $ | 354,717 |

| |

Loans held for sale | 2,720 |

| | 1,936 |

| | 118 |

| | | 2,720 |

| | 118 |

| |

Loans, net of unearned income | 982,905 |

| | 965,902 |

| | 813,057 |

| | | 982,905 |

| | 813,057 |

| |

Goodwill and other intangibles | 47,493 |

| | 47,793 |

| | 41,541 |

| | | 47,493 |

| | 41,541 |

| |

Assets | | | 1,524,356 |

| | 1,540,098 |

| | 1,300,648 |

| | | 1,524,356 |

| | 1,300,648 |

| |

Assets - tangible (b) | 1,476,863 |

| | 1,492,305 |

| | 1,259,107 |

| | | 1,476,863 |

| | 1,259,107 |

| |

Deposits | | 1,234,018 |

| | 1,242,675 |

| | 1,035,800 |

| | | 1,234,018 |

| | 1,035,800 |

| |

Customer repurchase agreements | 50,123 |

| | 53,664 |

| | 38,420 |

| | | 50,123 |

| | 38,420 |

| |

Other short-term borrowings | — |

| | — |

| | 12,000 |

| | | — |

| | 12,000 |

| |

Long-term borrowings | 37,518 |

| | 37,487 |

| | 37,394 |

| | | 37,518 |

| | 37,394 |

| |

Shareholders' equity | 194,883 |

| | 196,689 |

| | 172,083 |

| | | 194,883 |

| | 172,083 |

| |

Shareholders' equity - tangible (b) | 147,390 |

| | 148,896 |

| | 130,542 |

| | | 147,390 |

| | 130,542 |

| |

| | | | | | | | | | | | | | |

|

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

AVERAGE BALANCES | | | | | | | | | | | |

Securities | | $ | 349,813 |

| | $ | 345,800 |

| | $ | 347,726 |

| | | $ | 347,816 |

| | $ | 346,446 |

| |

Loans held for sale | 2,836 |

| | 939 |

| | 1,685 |

| | | 1,893 |

| | 1,858 |

| |

Loans, net of unearned income | 972,083 |

| | 954,882 |

| | 793,060 |

| | | 963,530 |

| | 790,752 |

| |

Interest-earning assets | 1,397,448 |

| | 1,382,817 |

| | 1,183,559 |

| | | 1,390,172 |

| | 1,185,172 |

| |

Goodwill and other intangibles | 47,682 |

| | 47,988 |

| | 41,738 |

| | | 47,834 |

| | 41,907 |

| |

Assets | | | 1,530,867 |

| | 1,518,449 |

| | 1,299,535 |

| | | 1,524,693 |

| | 1,301,078 |

| |

Assets - tangible (b) | 1,483,185 |

| | 1,470,461 |

| | 1,257,797 |

| | | 1,476,859 |

| | 1,259,171 |

| |

Interest-bearing deposits | 945,931 |

| | 938,064 |

| | 820,342 |

| | | 942,019 |

| | 825,258 |

| |

Deposits | | 1,236,626 |

| | 1,221,037 |

| | 1,043,479 |

| | | 1,228,874 |

| | 1,047,524 |

| |

Customer repurchase agreements | 51,417 |

| | 53,181 |

| | 40,720 |

| | | 52,294 |

| | 39,267 |

| |

Long-term borrowings | 37,499 |

| | 37,469 |

| | 37,376 |

| | | 37,484 |

| | 37,374 |

| |

Shareholders' equity | 196,663 |

| | 196,086 |

| | 171,784 |

| | | 196,376 |

| | 170,920 |

| |

Shareholders' equity - tangible (b) | 148,981 |

| | 148,098 |

| | 130,046 |

| | | 148,542 |

| | 129,013 |

| |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

|

| | | | | | | | | | | | | | | | | | | | | | | | |

American National Bankshares Inc. and Subsidiaries | | | | | | | | | | |

Financial Highlights | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

(In thousands, except share, ratio and | | | | | | | | | | | |

| | | | | | | | | | |

nonfinancial data, unaudited) | 2nd Qtr | | 1st Qtr | | 2nd Qtr | | | YTD | | YTD | |

| 2,015 | | 2,015 | | 2,014 | | | 2,015 | | 2,014 | |

CAPITAL | | | | | | | | | | | | | |

Weighted average shares outstanding - basic | 8,707,504 |

| | 8,723,633 |

| | 7,872,079 |

| | | 8,713,528 |

| | 7,886,232 |

| |

Weighted average shares outstanding - diluted | 8,715,934 |

| | 8,732,679 |

| | 7,879,854 |

| | | 8,722,266 |

| | 7,896,541 |

| |

| | | | | | | | | | | | | | |

ALLOWANCE FOR LOAN LOSSES | | | | | | | | | | | |

Beginning balance | $ | 12,844 |

| | $ | 12,427 |

| | $ | 12,614 |

| | | $ | 12,427 |

| | $ | 12,600 |

| |

Provision for loan losses | 100 |

| | 600 |

| | 150 |

| | | 700 |

| | 150 |

| |

Charge-offs | | (321 | ) | | (309 | ) | | (95 | ) | | | (630 | ) | | (168 | ) | |

Recoveries | | 170 |

| | 126 |

| | 94 |

| | | 296 |

| | 181 |

| |

Ending balance | | $ | 12,793 |

| | $ | 12,844 |

| | $ | 12,763 |

| | | $ | 12,793 |

| | $ | 12,763 |

| |

| | | | | | | | | | | | | | |

LOANS | | | | | | | | | | | | | |

Construction and land development | $ | 66,543 |

| | $ | 68,069 |

| | $ | 50,856 |

| | | $ | 66,543 |

| | $ | 50,856 |

| |

Commercial real estate | 432,315 |

| | 436,562 |

| | 366,722 |

| | | 432,315 |

| | 366,722 |

| |

Residential real estate | 220,778 |

| | 211,261 |

| | 175,387 |

| | | 220,778 |

| | 175,387 |

| |

Home equity | | 97,866 |

| | 97,811 |

| | 89,725 |

| | | 97,866 |

| | 89,725 |

| |

Commercial and industrial | 159,015 |

| | 146,280 |

| | 125,163 |

| | | 159,015 |

| | 125,163 |

| |

Consumer | | 6,388 |

| | 5,919 |

| | 5,204 |

| | | 6,388 |

| | 5,204 |

| |

Total | | | $ | 982,905 |

| | $ | 965,902 |

| | $ | 813,057 |

| | | $ | 982,905 |

| | $ | 813,057 |

| |

| | | | | | | | | | | | | | |

NONPERFORMING ASSETS AT PERIOD-END | | | | | | | | | | | |

Nonperforming loans: | | | | | | | | | | | |

90 days past due and accruing | $ | — |

| | $ | — |

| | $ | — |

| | | $ | — |

| | $ | — |

| |

Nonaccrual | | 3,772 |

| | 5,123 |

| | 5,224 |

| | | 3,772 |

| | 5,224 |

| |

Other real estate owned | 2,113 |

| | 2,653 |

| | 2,622 |

| | | 2,113 |

| | 2,622 |

| |

Nonperforming assets | $ | 5,885 |

| | $ | 7,776 |

| | $ | 7,846 |

| | | $ | 5,885 |

| | $ | 7,846 |

| |

| | | | | | | | | | | | | | |

ASSET QUALITY RATIOS | | | | | | | | | | | |

Allowance for loan losses to total loans | 1.30 |

| % | 1.33 |

| % | 1.57 |

| % | 1.30 |

| % | 1.57 |

| % |

Allowance for loan losses to | | | | | | | | | | | |

nonperforming loans | 339.16 |

| | 250.71 |

| | 244.31 |

| | | 339.16 |

| | 244.31 |

| |

Nonperforming assets to total assets | 0.39 |

| | 0.50 |

| | 0.60 |

| | | 0.39 |

| | 0.60 |

| |

Nonperforming loans to total loans | 0.38 |

| | 0.53 |

| | 0.64 |

| | | 0.38 |

| | 0.64 |

| |

Annualized net charge-offs (recoveries) | | | | | | | | | | | |

to average loans | 0.06 |

| | 0.08 |

| | — |

| | | 0.07 |

| | — |

| |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

OTHER DATA | | | | | | | | | | | | |

Fiduciary assets at period-end (e) (f) | $ | 509,289 |

| | $ | 502,779 |

| | $ | 450,352 |

| | | $ | 509,289 |

| | $ | 450,352 |

| |

Retail brokerage assets at period-end (e) (f) | $ | 257,306 |

| | $ | 244,725 |

| | $ | 197,625 |

| | | $ | 257,306 |

| | $ | 197,625 |

| |

Number full-time equivalent employees (g) | 322 |

| | 318 |

| | 291 |

| | | 322 |

| | 291 |

| |

Number of full service offices | 27 |

| | 27 |

| | 25 |

| | | 27 |

| | 25 |

| |

|

| | | | | | | | | | | | | | | | | | | | | | | | |

Number of loan production offices | 2 |

| | 2 |

| | 2 |

| | | 2 |

| | 2 |

| |

Number of ATM's | | 34 |

| | 34 |

| | 31 |

| | | 34 |

| | 31 |

| |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

Notes: | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

(a) - Unvested restricted stock of 17,761 shares are not included in the calculation. |

(b) - Excludes goodwill and other intangible assets. |

(c) - Excludes amortization expense, net of tax, of intangible assets. |

(d) - The efficiency ratio is calculated by dividing noninterest expense excluding gains or losses on the sale of OREO by net |

interest income including tax equivalent income on nontaxable loans and securities and excluding (i) gains or losses on |

securities and (ii) gains or losses on sale of premises and equipment. |

(e) - Market value. |

(f) - Assets are not owned by the Company and are not reflected in the consolidated balance sheet. |

(g) - Average for quarter. |

|

| | | | | | | | | | | | | | | | | | | | | |

| | | Net Interest Income Analysis |

| | | For the Three Months Ended June 30, 2015 and 2014 |

| | | (in thousands, except rates) |

| | | | | | | | | | | | | | | |

| | | | | | | | Interest | | | | | |

| | | | Average Balance | | Income/Expense | | Yield/Rate | |

| | | | | | | | | | | | | | | |

| | | | 2015 | | 2014 | | 2015 | | 2014 | | 2015 | | 2014 | |

Loans: | | | | | | | | | | | | | |

| Commercial | $ 155,752 |

| | $ 120,216 |

| | $ 1,760 |

| | $ 1,285 |

| | 4.53 |

| % | 4.29 |

| % |

| Real estate | 807,605 |

| | 669,537 |

| | 9,841 |

| | 8,325 |

| | 4.87 |

| | 4.97 |

| |

| Consumer | 11,562 |

| | 4,992 |

| | 205 |

| | 87 |

| | 7.11 |

| | 6.99 |

| |

| | Total loans | 974,919 |

| | 794,745 |

| | 11,806 |

| | 9,697 |

| | 4.85 |

| | 4.88 |

| |

| | | | | | | | | | | | | | | |

Securities: | | | | | | | | | | | | |

| Federal agencies & GSEs | 86,815 |

| | 79,284 |

| | 324 |

| | 227 |

| | 1.49 |

| | 1.15 |

| |

| Mortgage-backed & CMOs | 61,738 |

| | 62,356 |

| | 334 |

| | 368 |

| | 2.16 |

| | 2.36 |

| |

| State and municipal | 185,848 |

| | 190,821 |

| | 1,719 |

| | 1,866 |

| | 3.70 |

| | 3.91 |

| |

| Other | 15,412 |

| | 15,265 |

| | 125 |

| | 121 |

| | 3.24 |

| | 3.17 |

| |

| | Total securities | 349,813 |

| | 347,726 |

| | 2,502 |

| | 2,582 |

| | 2.86 |

| | 2.97 |

| |

| | | | | | | | | | | | | | | |

Federal funds sold | 6,480 |

| | — |

| | 2 |

| | — |

| | 0.12 |

| | — |

| |

Deposits in other banks | 66,236 |

| | 41,088 |

| | 50 |

| | 35 |

| | 0.30 |

| | 0.34 |

| |

| | | | | | | | | | | | | | | |

| Total interest-earning assets | 1,397,448 |

| | 1,183,559 |

| | 14,360 |

| | 12,314 |

| | 4.11 |

| | 4.16 |

| |

| | | | | | | | | | | | | | | |

Non-earning assets | 133,419 |

| | 115,976 |

| | | | | | | | | |

| | | | | | | | | | | | | | | |

| | Total assets | $1,530,867 |

| | $1,299,535 |

| | | | | | | | | |

| | | | | | | | | | | | | | | |

Deposits: | | | | | | | | | | | | |

| Demand | $ 237,102 |

| | $ 185,601 |

| | 22 |

| | 19 |

| | 0.04 |

| | 0.04 |

| |

| Money market | 195,578 |

| | 171,466 |

| | 61 |

| | 50 |

| | 0.13 |

| | 0.12 |

| |

| Savings | 109,397 |

| | 89,485 |

| | 14 |

| | 11 |

| | 0.05 |

| | 0.05 |

| |

| Time | | 403,854 |

| | 373,790 |

| | 1,087 |

| | 1,081 |

| | 1.08 |

| | 1.16 |

| |

| | Total deposits | 945,931 |

| | 820,342 |

| | 1,184 |

| | 1,161 |

| | 0.50 |

| | 0.57 |

| |

| | | | | | | | | | | | | | | |

Customer repurchase agreements | 51,417 |

| | 40,720 |

| | 2 | | 1 | | 0.02 |

| | 0.01 |

| |

Other short-term borrowings | — |

| | 571 |

| | — |

| | 1 | | — |

| | — |

| |

Long-term borrowings | 37,499 |

| | 37,376 |

| | 269 | | 266 | | 2.87 |

| | 2.85 |

| |

| Total interest-bearing | | | | | | | | | | | | |

| | liabilities | 1,034,847 |

| | 899,009 |

| | 1,455 |

| | 1,429 |

| | 0.56 |

| | 0.64 |

| |

| | | | | | | | | | | | | | | |

Noninterest bearing demand deposits | 290,695 |

| | 223,137 |

| | | | | | | | | |

Other liabilities | 8,662 |

| | 5,605 |

| | | | | | | | | |

Shareholders' equity | 196,663 |

| | 171,784 |

| | | | | | | | | |

| | Total liabilities and | | | | | | | | | | | | |

| | | shareholders' equity | $1,530,867 |

| | $1,299,535 |

| | | | | | | | | |

| | | | | | | | | | | | | | | |

|

| | | | | | | | | | | | | | | | | | | | | |

Interest rate spread | | | | | | | | | 3.55 |

| % | 3.52 |

| % |

Net interest margin | | | | | | | | | 3.69 |

| % | 3.68 |

| % |

| | | | | | | | | | | | | | | |

Net interest income (taxable equivalent basis) | | | | 12,905 |

| | 10,885 |

| | | | | |

Less: Taxable equivalent adjustment | | | | | 523 |

| | 534 |

| | | | | |

Net interest income | | | | | $12,382 |

| | $10,351 |

| | | | | |

|

| | | | | | | | | | | | | | | | | | | | | |

| | | Net Interest Income Analysis |

| | | For the Six Months Ended June 30, 2015 and 2014 |

| | | (in thousands, except rates) |

| | | | | | | | | | | | | | | |

| | | | | | | | Interest | | | | | |

| | | | Average Balance | | Income/Expense | | Yield/Rate | |

| | | | | | | | | | | | | | | |

| | | | 2015 | | 2014 | | 2015 | | 2014 | | 2015 | | 2014 | |

Loans: | | | | | | | | | | | | | |

| Commercial | $ 147,482 |

| | $ 120,460 |

| | $ 3,586 |

| | $ 2,757 |

| | 4.90 |

| % | 4.62 |

| % |

| Real estate | 804,507 |

| | 667,168 |

| | 19,560 |

| | 16,621 |

| | 4.86 |

| | 4.98 |

| |

| Consumer | 13,434 |

| | 4,982 |

| | 445 |

| | 176 |

| | 6.68 |

| | 7.12 |

| |

| | Total loans | 965,423 |

| | 792,610 |

| | 23,591 |

| | 19,554 |

| | 4.89 |

| | 4.94 |

| |

| | | | | | | | | | | | | | | |

Securities: | | | | | | | | | | | | |

| Federal agencies & GSEs | 80,866 |

| | 73,850 |

| | 569 |

| | 405 |

| | 1.41 |

| | 1.10 |

| |

| Mortgage-backed & CMOs | 63,637 |

| | 64,482 |

| | 712 |

| | 771 |

| | 2.24 |

| | 2.39 |

| |

| State and municipal | 188,020 |

| | 192,174 |

| | 3,482 |

| | 3,765 |

| | 3.70 |

| | 3.92 |

| |

| Other | | 15,293 |

| | 15,940 |

| | 248 |

| | 248 |

| | 3.24 |

| | 3.11 |

| |

| | Total securities | 347,816 |

| | 346,446 |

| | 5,011 |

| | 5,189 |

| | 2.88 |

| | 3.00 |

| |

| | | | | | | | | | | | | | | |

Federal funds sold | 10,508 |

| | — |

| | 6 |

| | — |

| | 0.12 |

| | — |

| |

Deposits in other banks | 66,425 |

| | 46,116 |

| | 98 |

| | 68 |

| | 0.30 |

| | 0.30 |

| |

| | | | | | | | | | | | | | | |

| Total interest-earning assets | 1,390,172 |

| | 1,185,172 |

| | 28,706 |

| | 24,811 |

| | 4.13 |

| | 4.19 |

| |

| | | | | | | | | | | | | | | |

Non-earning assets | 134,521 |

| | 115,906 |

| | | | | | | | | |

| | | | | | | | | | | | | | | |

| | Total assets | $1,524,693 |

| | $1,301,078 |

| | | | | | | | | |

| | | | | | | | | | | | | | | |

Deposits: | | | | | | | | | | | | |

| Demand | $ 224,955 |

| | $ 176,889 |

| | 40 |

| | 41 |

| | 0.04 |

| | 0.05 |

| |

| Money market | 199,236 |

| | 182,109 |

| | 132 |

| | 125 |

| | 0.13 |

| | 0.14 |

| |

| Savings | 108,545 |

| | 88,199 |

| | 26 |

| | 25 |

| | 0.05 |

| | 0.06 |

| |

| Time | | 409,283 |

| | 378,061 |

| | 2,180 |

| | 2,199 |

| | 1.07 |

| | 1.17 |

| |

| | Total deposits | 942,019 |

| | 825,258 |

| | 2,378 |

| | 2,390 |

| | 0.51 |

| | 0.58 |

| |

| | | | | | | | | | | | | | | |

Customer repurchase agreements | 52,294 |

| | 39,267 |

| | 5 | | 3 | | 0.02 |

| | 0.02 |

| |

Other short-term borrowings | — |

| | 287 |

| | — |

| | 1 | | — |

| | — |

| |

Long-term borrowings | 37,484 |

| | 37,374 |

| | 533 | | 530 | | 2.84 |

| | 2.84 |

| |

| Total interest-bearing | | | | | | | | | | | | |

| | liabilities | 1,031,797 |

| | 902,186 |

| | 2,916 |

| | 2,924 |

| | 0.57 |

| | 0.65 |

| |

| | | | | | | | | | | | | | | |

Noninterest bearing demand deposits | 286,855 |

| | 222,266 |

| | | | | | | | | |

Other liabilities | 9,665 |

| | 5,706 |

| | | | | | | | | |

Shareholders' equity | 196,376 |

| | 170,920 |

| | | | | | | | | |

| | Total liabilities and | | | | | | | | | | | | |

| | | shareholders' equity | $1,524,693 |

| | $1,301,078 |

| | | | | | | | | |

| | | | | | | | | | | | | | | |

|

| | | | | | | | | | | | | | | | | | | | | |

Interest rate spread | | | | | | | | | 3.56 |

| % | 3.54 |

| % |

Net interest margin | | | | | | | | | 3.71 |

| % | 3.69 |

| % |

| | | | | | | | | | | | | | | |

Net interest income (taxable equivalent basis) | | | | 25,790 |

| | 21,887 |

| | | | | |

Less: Taxable equivalent adjustment | | | | | 1,030 |

| | 1,077 |

| | | | | |

Net interest income | | | | | $24,760 |

| | $20,810 |

| | | | | |

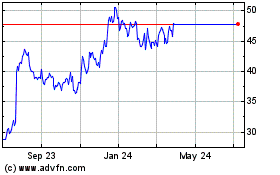

American National Banksh... (NASDAQ:AMNB)

Historical Stock Chart

From Mar 2024 to Apr 2024

American National Banksh... (NASDAQ:AMNB)

Historical Stock Chart

From Apr 2023 to Apr 2024